Professional Documents

Culture Documents

Capital Anirudh Dutta 2014

Uploaded by

Anirudh Dutta0 ratings0% found this document useful (0 votes)

39 views3 pagesBP

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBP

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

39 views3 pagesCapital Anirudh Dutta 2014

Uploaded by

Anirudh DuttaBP

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

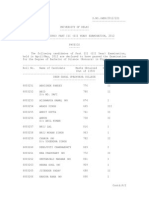

GOLDMAN SACHS

1) COMPANY AND GROUP OVERVIEW

The Goldman Sachs Group, Inc. (Goldman Sachs) is global investment banking, securities and investment

management firm that provides a range of financial services to a substantial and diversified client base

that includes corporations, financial institutions, governments and high-net-worth individuals. Through

affiliates GS Capital Partners, GS Mezzanine Partners, and others, Goldman Sachs is also one of the

largest private equity investors in the world.

2) MANAGEMENT TEAM

Lloyd Blankfein :- Chairman of the Board, CEO

Gary Cohn :- President, COO

Mark Schwartz :- Vice-Chairman, Head Asia-Pacific

Michael Sherwood :- Vice Chairman, Co-CEO

John Weinberg :- Vice Chairman

Harvey Schwartz :- CFO, Executive Vice President

3) AREAS OF OPERATIONS

Goldman Sachs operates in four segments: Investment Banking, Institutional Client Services, Investing &

Lending and Investment Management. As of December 2012, it had offices in over 30 countries,

including offices in all major financial centers worldwide.

4) MAJOR CLIENTS/ DEALS

The clientele of Goldman Sachs include major corporations, financial institutions and governments.

Some of the major deals

Apples $17 billion debt offering this inaugural issuance played a key role in the companys $100

billion capital return program and was the largest-ever corporate debt offering at the time.

Vodafones sale of the U.S. group which owns its 45 percent interest in Verizon Wireless to Verizon

Communications Inc. for a total consideration of $130 billion, as well as Vodafones $11.5 billion

acquisition of Kabel Deutschland

Softbanks $21.6 billion acquisition of a majority stake in Sprint

LinkedIns $1.4 billion follow-on equity offering

5) KEY DEVELOPMENTS

Goldman Sachs Group Inc. and Bain Capital Partners agree to $121 million settlements in LBO

antitrust violations case.

Blackstone Group and Goldman Sachs merchant banking division to acquire Ipreo from KKR.

Goldman Sachs Group and Goldman Sachs Australia Group cease to be substantial shareholder in

Australand Assets Trust.

Goldman Sachs investigated in New York currency trading probe-Reuters

CITIBANK

1) COMPANY AND GROUP OVERVIEW

Citibank is the consumer banking division of financial services multinational Citigroup. Founded in 1812,

Citigroup was the third largest bank holding company in the United States in 2010 by total assets, after

Bank of America and JPMorgan Chase.

2) MANAGEMENT TEAM

Michael Corbat :- CEO, Citigroup

Jerry Bailey:- CFO

Mark Mason:- CEO, Citi Private Bank

Eric W. Aboaf:- Treasurer, Citi

Pramit Jhaveri:- Chief Country Officer

Vikram Subrahmanyam:- Managing Director & Head - Operations & Technology, South Asia

3) AREAS OF OPERATIONS

Citi offers consumers and institutions a broad range of financial products and services, including

consumer banking and credit, corporate and investment banking, securities brokerage, and wealth

management.

Citi's franchise in India includes businesses such as equity brokerage, equities distribution, private

banking (Citi Private Bank) and alternate investments and private equity (CVCI).

4) MAJOR CLIENTS/ DEALS

The clientele Citibank include major corporations, individuals and governments. Some of the major deals

Citigroup to Sell Spanish Consumer Bank to Banco Popular

Taiwan's Zhen Ding Technology to issue $300 mln convertible bonds source ( Citibank joint

coordinators on the deal)

BRIEF-Ryanair launches 850 mln euros euro bond issue

5) KEY DEVELOPMENTS

Citigroup Reports First Quarter 2014 Earnings per Share of $1.23; $1.30 Excluding CVA/DVA and

Tax Item

Citigroup Announces Expiration and Final Tender Results of Offers to Purchase Nine Series of

Outstanding Notes.

Citigroup Announces $2 Billion Redemption of Trust Preferred Securities.

Citi Second Quarter 2014 Fixed Income Investor Review.

Citi Second Quarter 2014 Earnings Review

DHABHA BUSINESS PLAN

The initial capital investment into the Dabha will be Rs 40000. This initial capital will include kitchen

ware, gas cylinder supply, tables & chairs, requisite permission fee, initial grocery.

Since Dabha is situated just outside a college (which has 4 other surrounding colleges) , I have afoot-fall

estimate of 150 people per day. Taking the average price of each dish to be 35, the per month revenue is

roughly Rs 157500.

Grocery 50000

Gas Cylinder Supply 1100X15 =16500

1 cook 8000

1 helper 4000

2 waiter 5000X2=10000

Coal supply for tandoor 4000

MCD rent 20000

Depreciation of utensils etc @10% 3000

Advertisement 5000

TOTAL EXPENDITURE 120500

Thus the money left after all expenditures is Rs 37000. After two months of operations, without any

unforeseen expenditure, I will break even.

After a year of operation I intend to grow @ 10%

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Chapter 1 problem 3 exercisesDocument18 pagesChapter 1 problem 3 exercisesAlarich CatayocNo ratings yet

- Production TheoryDocument72 pagesProduction TheoryAnirudh Dutta100% (1)

- PGP I - 2014-16 - Sectionwise Email IdsDocument9 pagesPGP I - 2014-16 - Sectionwise Email IdsAnirudh DuttaNo ratings yet

- IFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMDocument9 pagesIFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMAnirudh DuttaNo ratings yet

- FDRM 1Document16 pagesFDRM 1Anirudh DuttaNo ratings yet

- In 2013Document3 pagesIn 2013Anirudh DuttaNo ratings yet

- IFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMDocument9 pagesIFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMAnirudh DuttaNo ratings yet

- MaDocument20 pagesMaAnirudh DuttaNo ratings yet

- Dubai Port Visit ReportDocument1 pageDubai Port Visit ReportAnirudh DuttaNo ratings yet

- IFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMDocument9 pagesIFRS VS U.S. GAAP: The Point Form Revision Version: by Darren Degraaf, CFA, CMA, PRMAnirudh DuttaNo ratings yet

- Teacher and Health Worker Absence in Developing CountriesDocument31 pagesTeacher and Health Worker Absence in Developing CountriesAnirudh DuttaNo ratings yet

- Verify if Put Call parity holds in NSE Option ChainDocument6 pagesVerify if Put Call parity holds in NSE Option ChainAnirudh DuttaNo ratings yet

- BSC H PH PT IIIDocument41 pagesBSC H PH PT IIIAnirudh DuttaNo ratings yet

- BM Session 1Document94 pagesBM Session 1Anirudh DuttaNo ratings yet

- Time Value of MoneyDocument22 pagesTime Value of MoneyAnirudh DuttaNo ratings yet

- The Change LeaderDocument2 pagesThe Change LeaderAnirudh DuttaNo ratings yet

- Determinants of Demand Determinants of SupplyDocument2 pagesDeterminants of Demand Determinants of SupplyAnirudh DuttaNo ratings yet

- Introduction to Financial Accounting ConceptsDocument37 pagesIntroduction to Financial Accounting ConceptsAnirudh DuttaNo ratings yet

- MalpuaDocument2 pagesMalpuaanandkavi10No ratings yet

- CSR 16 20633848971471875000Document3 pagesCSR 16 20633848971471875000pallavi111No ratings yet

- Dhabha Business PlanDocument1 pageDhabha Business PlanAnirudh DuttaNo ratings yet

- 1 s2.0 S0038109810002929 MainDocument3 pages1 s2.0 S0038109810002929 MainAnirudh DuttaNo ratings yet

- Auto Pay Your Monthly Landline/broadband Bill Payment. Give Us A Standing Instruction On Your Credit Card in 3 Simple StepsDocument1 pageAuto Pay Your Monthly Landline/broadband Bill Payment. Give Us A Standing Instruction On Your Credit Card in 3 Simple StepsAnirudh DuttaNo ratings yet

- English Entrance Paper Pattern - ACJDocument2 pagesEnglish Entrance Paper Pattern - ACJSrikant RaoNo ratings yet

- Lecture 10Document33 pagesLecture 10ankara271828No ratings yet

- Quasi CrystalsDocument4 pagesQuasi CrystalsAnirudh DuttaNo ratings yet

- Vodafone Transfer of Ownership HFL FormDocument1 pageVodafone Transfer of Ownership HFL FormAnirudh DuttaNo ratings yet

- PHL744 Problem Set III Relativity Preliminaries and Dirac Equation in 2 DimensionsDocument2 pagesPHL744 Problem Set III Relativity Preliminaries and Dirac Equation in 2 DimensionsAnirudh DuttaNo ratings yet

- The First Five Yearly Plans Had Been Laid Down in 1951Document2 pagesThe First Five Yearly Plans Had Been Laid Down in 1951Anirudh DuttaNo ratings yet

- Phl567 Tut 1Document1 pagePhl567 Tut 1Anirudh DuttaNo ratings yet

- 5 Principles of Event PlanningDocument2 pages5 Principles of Event PlanningJe ĻenaNo ratings yet

- Franz Damayo FSDocument29 pagesFranz Damayo FSFranz Julius Adriane DamayoNo ratings yet

- Leadership and Decision Making Presentation HCS 475Document14 pagesLeadership and Decision Making Presentation HCS 475Tamekia Hatter0% (1)

- TQM DEFINITION AND PRINCIPLESDocument6 pagesTQM DEFINITION AND PRINCIPLESIsabel Victoria GarciaNo ratings yet

- Topic Iv: Occupational Safety & Health Management System (OSHMS)Document71 pagesTopic Iv: Occupational Safety & Health Management System (OSHMS)Itsa BellaNo ratings yet

- CA Final - Paper 3 - Advanced Auditing and Professional EthicsDocument12 pagesCA Final - Paper 3 - Advanced Auditing and Professional EthicsAyushi GuptaNo ratings yet

- Labsii Lak 182 Muddee 17 Bara 2006 PDF Final ADocument32 pagesLabsii Lak 182 Muddee 17 Bara 2006 PDF Final AAssefa GaredewNo ratings yet

- 3 The Importance of Operations ManagementDocument35 pages3 The Importance of Operations ManagementAYAME MALINAO BSA19No ratings yet

- Maithili AmbavaneDocument62 pagesMaithili Ambavanerushikesh2096No ratings yet

- Coffee Shop ThesisDocument6 pagesCoffee Shop Thesiskimberlywilliamslittlerock100% (2)

- Parties & Their Role in Project FinanceDocument15 pagesParties & Their Role in Project FinanceBlesson PerumalNo ratings yet

- Managers Checklist New Empl IntegrationDocument3 pagesManagers Checklist New Empl IntegrationRajeshNo ratings yet

- Comparison of Mission Statements Mission Accomplished Bicon Shanta BiotechDocument32 pagesComparison of Mission Statements Mission Accomplished Bicon Shanta BiotechRachael SookramNo ratings yet

- Dana's HandbagsDocument2 pagesDana's HandbagsJustin MandelNo ratings yet

- Ebook Sap OmDocument39 pagesEbook Sap OmmarcosoliversilvaNo ratings yet

- Event Guide: CGT Asset Disposal and Other EventsDocument8 pagesEvent Guide: CGT Asset Disposal and Other EventsVMRONo ratings yet

- Chase Lesson 3 PDFDocument4 pagesChase Lesson 3 PDFstraywolf0No ratings yet

- ISO 14001 2015 Checklist 13 August 2018Document1 pageISO 14001 2015 Checklist 13 August 2018Belajar K3LNo ratings yet

- Unit 3-Strategy Formulation and Strategic Choices: Group MemberDocument12 pagesUnit 3-Strategy Formulation and Strategic Choices: Group MemberBaken D DhungyelNo ratings yet

- Lokakarya 0Document14 pagesLokakarya 0Edelweiss HenriNo ratings yet

- 1ST AssDocument5 pages1ST AssMary Jescho Vidal AmpilNo ratings yet

- Advertising objectives to inform, persuade and remind customersDocument2 pagesAdvertising objectives to inform, persuade and remind customersashwinibhosale37No ratings yet

- Cips November 2014 Examination TimetableDocument1 pageCips November 2014 Examination TimetableajayikayodeNo ratings yet

- Xacc280 Chapter 2Document46 pagesXacc280 Chapter 2jdcirbo100% (1)

- Partnership: Characteristics Elements of PartnershipDocument2 pagesPartnership: Characteristics Elements of PartnershipMarinella RamosNo ratings yet

- 1625426853empresas Que Emitiram Vistos de Trabalho Na Irlanda - Jul 2021Document76 pages1625426853empresas Que Emitiram Vistos de Trabalho Na Irlanda - Jul 2021Marina Fenato Mariani XuNo ratings yet

- Mago V SunDocument8 pagesMago V SunMatthew Evan EstevesNo ratings yet

- Pooya, A., Mehran, A.K. and Ghouzhdi, S.G., 2020.Document19 pagesPooya, A., Mehran, A.K. and Ghouzhdi, S.G., 2020.Eduardo CastañedaNo ratings yet

- Resume Amit KR Singh NewDocument3 pagesResume Amit KR Singh NewCharlie GuptaNo ratings yet