Professional Documents

Culture Documents

The Evolvable Enterprise Feb 2014 Tcm80-154437

Uploaded by

Mahammad KhadafiCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Evolvable Enterprise Feb 2014 Tcm80-154437

Uploaded by

Mahammad KhadafiCopyright:

Available Formats

The Evolvable

Enterprise

LESSONS FROM THE NEW TECHNOLOGY GIANTS

By Martin Reeves, Ron Nicol, Thijs Venema, and Georg Wittenburg

AT A GLANCE

Some of todays most dynamic companies compete in a fundamentally

distinct way: by leveraging evolvable algorithms. These algorithms,

which self-tune to acquired experience and changing circumstances,

allow these companies to balance broad, inexpensive, and fast explora-

tion of new opportunities with the exploitation of existing known ones,

helping the companies thrive under conditions of high uncertainty and

rapid change.

Evolvable Strategy and Organization

At a more basic level, such companies apply the same principles of

evolvability to both their strategy and their organization.

Evolvability Beyond High-Technology

Evolvable strategies are today largely confned to the high-tech arena,

but companies from other industries are beginning to apply them

as well.

The Evolvable Enterprise

2 | The Boston Consulting Group

Many leaders of big organizations, I think, dont believe that change is possi-

ble. But if you look at history, things do change; and if your business is static,

youre likely to have issues.

Larry Page, CEO and cofounder, Google

O

ver the past decade, business has witnessed the rise of a new

aristocracy: the new technology giants. Their growth has been stellar:

Google, Amazon.com, Facebook, and eBay, for example, all surpassed

$1 billion in annual sales within roughly 5 years of launch. Procter &

Gamble, by contrast, took more than 20 years to reach $1 million in yearly

sales and more than 100 years to pass the $1 billion mark.

Furthermore, many of these new leaders are highly profitable, with

margins often exceeding 25 percent. This is true of behemoths such as

Google (which had a margin of approximately 26 percent in 2012) as

well as smaller players such as Baidu (more than 40 percent). Few other

industries can match such margins: on average, margins of Fortune 500

companies are lower than 10 percent.

Evolvable Strategy

Is the emergence of these companies driven solely by the rise of a new

set of technologies? Unlikely. In fact, several of these companies com-

pete in a fundamentally new way. They leverage evolvable algorithms,

which self-tune to accumulated knowledge and changing circumstances.

These are the algorithms that, for example, select ads when a customer

books a flight online and create offers for similar flights and for related

destinations, hotels, and cars. The algorithms recommendations are

seamlessly updated when the customer researches alternatives. And the

algorithms learn from established patterns for future reference. In es-

sence, evolvable algorithms allow these companies to balance broad,

economical, and fast exploration of new opportunities with the exploita-

tion of existing known ones, helping the companies thrive under condi-

tions of high uncertainty and rapid change in their online businesses.

At a more fundamental level, these players apply the same principles of

evolvability recursively to both their strategy and their organization, areas

usually guided by managerial experience, intuition, and common sense.

Evolvable strategy is a better, more calibrated alternative: it allows organi-

zations to adapt to changing circumstances and avoid both frivolous ex-

ploration and insufficient exploitation of existing opportunities.

Consider three companies with seemingly diverse business models:

Google, Amazon, and Netflix. Their core evolvable algorithms perform

essentially the same tasks. They exploit proven winners by displaying

previously high-ranking search results, high click-through ads, and rec-

The Evolvable Enterprise

3 | The Boston Consulting Group

In many cases,

companies apply the

same evolvability

principles to their

organization and

strategy.

ommendations to blockbusters. Simultaneously, they explore a continu-

ous stream of new search entries, ads, and newly released movies for

which prospective popularity is unknowable.

Evolvable algorithms deal with such tradeoffs under uncertain and

changing conditions by doing the following:

Defning a very broad option space

Modeling expected payofs from options leveraging all available

information

Testing promising options quickly and cheaply

Rapidly updating option assessments in light of new information and

reallocating resources by scaling up, stopping, or repurposing invest-

ments

Quickly iterating the above steps in a self-tuning manner, thereby

overcoming the information complexity and speed constraints of

managerial decision making

Measuring outcomes and optimizing the algorithm itself in response

to changing circumstances

It is perhaps not surprising that, in many cases, these companies also

apply the same evolvability principles to their organization and strategy,

because their entire business needs to support rapid adaptive learning

to stay ahead of competitors that could, over time, replicate their core

algorithms.

Evolvable Organizations

Google, for example, embodies these key features in its organization and

strategy, exploring a broad range of options both close to and distant

from its core. Its efforts range from incrementally improving its core ad

products and making exploratory venture-capital investments through

Google Ventures to embarking on speculative projects such as Google

Glass. To prevent narrowing its options prematurely, Google requires

that project specs be no longer than one page, minimizing constraints

on changing course as projects progress.

And Google wouldnt be Google if the company didnt collect and lev-

erage all possible information for evaluating options. Google Ventures,

for instance, relies heavily on predictive analytics to calibrate invest-

ment decisions in an industry historically dominated by experience and

gut feel.

The Evolvable Enterprise

4 | The Boston Consulting Group

Almost all companies

face similar explora-

tion-exploitation

tradeofs in portfolio

management, R&D

strategy, and product

development.

Similarly, Google has developed ways of exploring options quickly and

frugally. To contain its risks and costs, the company launched Google

Glass among a select group of customers who pay to participate. Even if

Google Glass fails, participants will have enjoyed the thrill and cachet of

taking part in a high profile, visionary experiment.

Finally, Google calibrates exploration to avoid wasting resources on

low-value projects. The company continuously measures outcomes and,

on the basis of the results, rapidly reallocates resources among projects.

Over the past ten years, Google has both launched and killed roughly 10

to 15 products annuallywithout creating major customer or organiza-

tional resentment. Objective datarather than disputable gut feel

govern each decision. And consider Googles highly celebrated 20 per-

cent timetime employees can freely allocate to unofficial initiatives.

This is also calibrated: Google allows more time for exploratory and

speculative projects that require creativity than for existing product cat-

egories in which the direction is clear and broad exploration would be

superfluous.

Evolvability Beyond High-Tech Industries

So is self-tuning strategy reserved for technology whiz kids? Not at all.

Similar principles are being applied by more traditional businesses to

tackle tough operational challengessuch as dynamic pricing, securities

trading, and pharmaceutical clinical trialsthat entail decision making

in situations of high complexity, dynamism, and uncertainty.

Strategically, almost all companies face similar exploration-exploitation

tradeoffs in portfolio management, R&D strategy, and product develop-

ment. Few companies, however, outside of a handful of technology play-

ers, apply evolvability principles systematically to their strategy or or-

ganization. But companies in many industries now face increasingly un-

certain and dynamic environments and would benefit from doing so, be-

cause dynamism and uncertainty increase the value of acquiring new

knowledge. At the same time, however, exploring new areas without a

calibrated, balanced approach is costly and risky.

Evolvable strategy goes beyond simplistic exhortations for, say, increased

experimentation, flexibility, agility, simple rules, or leveraging of big

data. Lacking the integrated, self-adjusting mechanism that evolvable strat-

egy offers, such blanket prescriptions are ineffective and add cost and

complexity, as well as risk that is not calibrated to potential benefits and

a changing environment.

Evolvable strategy not only tells you to explore; it also ensures that you

know when, where, and how much to explore, and it self-tunes this guid-

ance to changing circumstances and knowledge.

The Evolvable Enterprise

5 | The Boston Consulting Group

Creating the Evolvable Organization

The whole is greater than the sum of the parts.

Aristotle

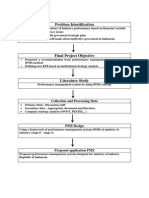

To create a self-calibrating, evolvable organization, companies need to

embed the algorithm of evolvable strategy into the software of their

organization. (See Exhibit 1.) To do this, companies need to do all of the

following:

Foster an exploratory mindset. Encourage risk taking, tolerate failure,

and challenge the status quo even when the company seems to

be successful. Set evolvable goals and methods that allow for

changing course as you learn more about environments and

investments.

Strengthen dynamic information management. Leverage a wide range of

information sources and develop predictive analytics to measure and

manage the exploration process.

Source: BCG analysis.

Exhibit 1 | Create a Self-Calibrating, Evolvable

Organization

Strategy principle

Organizational

embodiment Example

Defne a broad option

space

Foster an exploratory

mindset

In-Q-Tel makes mi-

nority venture-capital

investments that chal-

lenge the intelligence

communitys status

quo thinking

Evaluate options, leverag-

ing all information

Strengthen information

management

Alibaba leverages

data to explore new ser-

vicessuch as Alipay and

Alibaba Cloud

Computingand

afliate stores

Explore quickly and

frugally

Build an experimen-

tation engine

Amazon.com conducts

A/B testing of diferent

versions of its website

Continually reallocate

resources

Develop a process for

the fexible allocation of

resources

Facebook shifed focus

in 2012 toward the mobile

channel. Within a year,

almost half of the com-

panys ad revenues came

from mobile users

Iterate quickly

Increase the strategy-

process clock speed

Google launches, evalu-

ates, and kills 10 to 15

products each year

Monitor efectiveness

and optimize the algo-

rithm

Tune the algorithm

Netfix is choosing to

cannibalize DVD sales by

promoting lower-margin,

high-growth streaming

The Evolvable Enterprise

6 | The Boston Consulting Group

Some high-tech

companies excel at

evolvable strategy,

and now companies

from beyond that

realm are beginning

to follow.

Build an experimentation engine. Use rapid (virtual) testing at a

limited scale and minimize the cost of failure. Maximize information

extraction from each test and share and leverage the results widely.

Be fexible in resource acquisition and allocation. Share resources,

source externally, and ensure that project leaders will not be penal-

ized for projects that must be aborted. Modularize the organization

and continually reallocate resources.

Increase strategic clock speed. Shorten planning cycles and feedback

loops. Simplify approval processes and reduce hierarchy.

Continually tune your algorithm. Measure the ft between the uncer-

tainty and dynamism of the environment and the parameters of your

experimentation engine. Fine-tune your model accordingly.

Combined, these interventions create the integrated, information-

enabled learning systems of the type that leading technology compa-

nies use to thrive in an increasingly complex world. Conversely, focusing

on or omitting individual lines of code will cause a bug that renders the

entire system ineffective.

Some high-tech companies excel at evolvable strategy, and now compa-

nies from beyond that realm are beginning to follow. Shell, for example,

explores options broadly with its external ideation competitions. Wal-

Mart continually experiments with store plans and leverages deep ana-

lytics to measure outcomes. The 3M Company experiments virtually to

speed up innovation. We predict that creating evolvable organizations

and strategies will become increasingly important to all enterprises.

Learning to Avoid the Traps

Success in the past always becomes enshrined in the present by the overvalu-

ation of the policies and attitudes that accompanied that success.

Bruce Henderson, founder, The Boston Consulting Group

It is not surprising that evolvable strategy and organization are unfamil-

iar, challenging to implement, hard to replicate, and, hence, valuable

from a competitive standpoint. When embracing evolvability, organiza-

tions need to avoid the following common traps that can cause them to

veer either toward too little or, alternatively, toward too much explora-

tion.

Focus Trap. A company pursues only focused exploitation of familiar

options when a change in circumstances or uncertainty demands

broader exploration. We can demonstrate, using algorithms similar to

those employed by Netfix, Google, and Amazon, that such focused

The Evolvable Enterprise

7 | The Boston Consulting Group

strategies are suboptimal under high uncertainty or dynamism. (See

the sidebar Modeling the Exploration-Exploitation Tradeof.)

Pessimism Trap. Uncertainty leads a company to explore insufciently

and to assume that if the value of something cannot be quantifed or

is currently unknown, it is not actually there.

Excessive-Exploration Trap. This is the fip side of excessive focus or

pessimism. Even in highly dynamic environments, continual experi-

mentation can lead to diminishing returns, given the (opportunity)

cost of exploration and the need to recoup exploration investments

with periods of exploitation. (See Exhibit 2.)

Resource Inertia. A company whose organizational incentives and

processes are geared toward reinforcing existing strategies, beliefs,

and power structures may be inclined to allocate insufcient resourc-

es to exploration.

Cannonball Trap. Making only big bets (cannonballs), a com-

pany increases risk and limits the total number of exploratory

bets (bullets) it can make and the speed at which they generate

learnings.

Fixed-Formula Trap. A company spends a fxed share of resources (for

example, a specifed percentage of sales) on exploration, leading it to

We modeled the impact of balancing exploration and exploitation with

diferent strategies in diferent environments, using an algorithm

similar to that used by, for example, Google and Netfix (a so-called

multiarmed bandit algorithm). We considered a scenario with 30

options and ran hundreds of rounds of exploration-versus-exploitation

tradeofs, updating the algorithm for every piece of new information

obtained.

The model included a range of business environments that varied

with respect to the dynamism and uncertainty of the rewards

associated with each scenario. Furthermore, we tested a range of

strategies in each environment, which allowed us to explore the

efectiveness of a variety of approaches.

Further details of these simulations will be published in a forth-

coming in-depth report on the evolvable enterprise.

MODELING THE EXPLORATION-

EXPLOITATION TRADEOFF

The Evolvable Enterprise

8 | The Boston Consulting Group

explore insufciently (or too much) whenever environmental dyna-

mism increases (or decreases).

Individual-Practices Trap. Although a company mimics the individual

practices (for example, experimentation, metrics, and personnel

policies) of companies that master evolvable strategy, it fails to

create an integrated learning algorithm.

An overly focused strategy underperforms

in dynamic environments

Excessive exploration reduces rewards

Time

Reward

Focused exploitation

Moderate exploratory strategy

Reward

Time

Nearly continuous exploration

Moderate exploratory strategy

Initial

stability Options dynamically change

Exploitation is

stuck with a

suboptimal option

Continuous

exploration fails

to exploit winners

Initial

stability Options dynamically change

Source: BCG analysis.

Exhibit 2 | Dynamic Environments Need Calibrated

Exploration

The Evolvable Enterprise

9 | The Boston Consulting Group

Stand Still, Fall Behind, or Leapfrog

If you stand still, you fall behind.

Mark Twain, U.S. author and humorist

From telegraph operators to more recently fallen giants such as Eastman

Kodak, economic history is littered with companies that failed to adapt

their strategic approach to environmental change. We are currently fac-

ing such a shift in technology, and the lesson is the same: move and

catch the wave or fall behind. Success in todays fast-changing, uncer-

tain, data-rich business environments requires continuous adaptation of

strategy and organization in a self-tuning manner.

Creating an evolvable enterprise goes beyond catching up: it presents an

opportunity to leapfrog competition, go beyond managerial common

sense, and leverage new, previously underutilized or misunderstood

tools to create and reinforce advantage in a systematic, calibrated, and

continuous manner.

About the Authors

Martin Reeves is a senior partner and managing director in the New York ofce of

The Boston Consulting Group, the director of the BCG Strategy Institute, and a BCG

Fellow. You may contact him by e-mail at reeves.martin@bcg.com.

Ron Nicol is a senior partner and managing director in the frms Dallas ofce. You

may contact him by e-mail at nicol.ron@bcg.com.

Thijs Venema is a consultant in BCGs New York ofce and an ambassador to the

BCG Strategy Institute. You may contact him by e-mail at venema.thijs@bcg.com.

Georg Wittenburg is a consultant in the frms New York ofce and an ambassador

to the BCG Strategy Institute. You may contact him by e-mail at wittenburg.georg

@bcg.com.

The Boston Consulting Group (BCG) is a global management consulting frm and the

worlds leading advisor on business strategy. We partner with clients from the private,

public, and not-for-proft sectors in all regions to identify their highest-value opportu-

nities, address their most critical challenges, and transform their enterprises. Our cus-

tomized approach combines deep in sight into the dynamics of companies and mar-

kets with close collaboration at all levels of the client organization. This ensures that

our clients achieve sustainable compet itive advantage, build more capable organiza-

tions, and secure lasting results. Founded in 1963, BCG is a private company with 81

ofces in 45 countries. For more information, please visit bcg.com.

To fnd the latest BCG content and register to receive e-alerts on this topic or others,

please visit bcgperspectives.com.

Follow bcg.perspectives on Facebook and Twitter.

The Boston Consulting Group, Inc. 2014. All rights reserved.

#484 2/14

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Andi Muhammad Rasbin-CGK-WKTZKF-UPG-FLIGHT - ORIGINATING PDFDocument2 pagesAndi Muhammad Rasbin-CGK-WKTZKF-UPG-FLIGHT - ORIGINATING PDFfathur rahmanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Mid Test Report FormatDocument5 pagesMid Test Report FormatMahammad KhadafiNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Jurnal Submit FinalDocument17 pagesJurnal Submit FinalMahammad Khadafi100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Problem Identification: Collection and Processing DataDocument2 pagesProblem Identification: Collection and Processing DataMahammad KhadafiNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- JS 3 - KhadafiDocument8 pagesJS 3 - KhadafiMahammad KhadafiNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Microwave & Food Processing TechnologyDocument2 pagesMicrowave & Food Processing TechnologyMahammad KhadafiNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Bat Sample QuestionsfgdfgDocument36 pagesBat Sample Questionsfgdfglefter_ioanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Registration Form MPC 2014Document5 pagesRegistration Form MPC 2014Mahammad KhadafiNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- 587537833Document83 pages587537833Mahammad KhadafiNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Higher Growth Through The Blue Ocean StrategyDocument11 pagesHigher Growth Through The Blue Ocean StrategyMahammad KhadafiNo ratings yet

- Buku Bung FadjroelDocument400 pagesBuku Bung FadjroelBambang Eko WidyantoNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Buku Bung FadjroelDocument400 pagesBuku Bung FadjroelBambang Eko WidyantoNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- ACCOUNTING REPORT PHD 803Document45 pagesACCOUNTING REPORT PHD 803Meanne SolinapNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Success Stories of Five Enterpreneurs in PakistanDocument11 pagesSuccess Stories of Five Enterpreneurs in PakistanMuzahir Hussain Joyia100% (1)

- Indivdual Workweek Accomplishment ReportDocument4 pagesIndivdual Workweek Accomplishment ReportBuena EstanilNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Culture and Compensation For SRF LimitedDocument5 pagesCulture and Compensation For SRF Limitedrugvedraje0% (1)

- How To Become A For-Profit Social Enterprise (FOPSE)Document12 pagesHow To Become A For-Profit Social Enterprise (FOPSE)FreeBalanceGRP100% (1)

- Kenneth Arrow EconDocument4 pagesKenneth Arrow EconRay Patrick BascoNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- 03laborsupply PracticeDocument31 pages03laborsupply PracticeCesarNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Baankii HojiiGamtaa OromiyaaDocument4 pagesBaankii HojiiGamtaa Oromiyaamamo kebabowNo ratings yet

- Entrep Pretest 2022-2023Document3 pagesEntrep Pretest 2022-2023kate escarilloNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- 260CT Revision NotesDocument30 pages260CT Revision NotesSalman Fazal100% (4)

- OFFICE MANAGEMENT-noteDocument53 pagesOFFICE MANAGEMENT-notereem mazeeNo ratings yet

- Case StudyDocument8 pagesCase StudyKothapalle Inthiyaz0% (1)

- Inventory ManagementDocument21 pagesInventory ManagementSrinivas MantripragadaNo ratings yet

- Fuzzy-Logic Based Target Classification Using DroolsDocument4 pagesFuzzy-Logic Based Target Classification Using Droolseditorijsaa100% (1)

- 207.1 SyllabusDocument8 pages207.1 SyllabusCecilia PasanaNo ratings yet

- It Is Important To Understand The Difference Between Wages and SalariesDocument41 pagesIt Is Important To Understand The Difference Between Wages and SalariesBaban SandhuNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- JJM StrategyDocument3 pagesJJM Strategyvkisho5845No ratings yet

- Post Graduate Diploma in Business Administration b6011 Marketing Management InstructionsDocument2 pagesPost Graduate Diploma in Business Administration b6011 Marketing Management InstructionsvishsanthNo ratings yet

- Study Id54247 Global Footwear MarketDocument52 pagesStudy Id54247 Global Footwear MarketTanvi Khandelwal (Ms.)No ratings yet

- Inoper2 q2Document9 pagesInoper2 q2api-353305207100% (1)

- 104 Law of ContractDocument23 pages104 Law of Contractbhatt.net.inNo ratings yet

- BAT 4M Chapt 1 All SolutionsDocument78 pagesBAT 4M Chapt 1 All Solutionstasfia_khaledNo ratings yet

- HRM in IDBI BankDocument75 pagesHRM in IDBI BankAkshayBorgharkar80% (5)

- Havells Initiating Coverage 27 Apr 2011Document23 pagesHavells Initiating Coverage 27 Apr 2011ananth999No ratings yet

- A1-Cash and Cash Equivalents - 041210Document28 pagesA1-Cash and Cash Equivalents - 041210MRinaldiAuliaNo ratings yet

- Dalberg - 130214 ADB IB Workshop - Introduction To IB Models - VFDocument33 pagesDalberg - 130214 ADB IB Workshop - Introduction To IB Models - VFADBPovertyNo ratings yet

- E-Logistics and E-Supply Chain Management: Applications For Evolving BusinessDocument21 pagesE-Logistics and E-Supply Chain Management: Applications For Evolving BusinessRUCHI RATANNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 10 Plus Purchase Not in TallyDocument14 pages10 Plus Purchase Not in TallyAAKARNo ratings yet

- A Project Report (1) OutlookDocument52 pagesA Project Report (1) OutlookVersha Singh80% (5)