Professional Documents

Culture Documents

Fin 548 Answer Scheme

Uploaded by

Dayah AngelofluvOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fin 548 Answer Scheme

Uploaded by

Dayah AngelofluvCopyright:

Available Formats

APRIL 2009

QUESTION 4

ANSWER:-

A.) The agency was formed in November 1990, with a paid up capital of ! 10!. The formation of

A! is very important for the development of capital mar"et especially in the bond and debt

securities mar"et

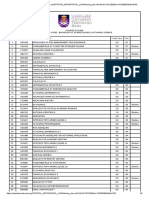

AT#N$ %&A'(%

) *rivate +ebt %ecurities atings

AT#N$ +(,#N#T#-N

AAA

The best .uality and offer the highest safety for timely payment of interest and

principal

AA /igh safety for timely payment of interest and principal

A

Ade.uate safety for timely payment of interest and principal. !ore susceptible

to changes in circumstances and economic conditions than debts in higher)

rated categories.

00A

!oderate safety for timely payment of interest and principal. 'ac"ing in

certain protective elements. &hanges in circumstances are more li"ely to lead

to wea"ened capacity to pay interest and principal than debts in higher)rated

categories

00

#nade.uate safety for timely payment of interest and principal. ,uture cannot

be considered as well assured

0

/igh ris" associated with timely payment of interest and principal Adverse

business or economic conditions would lead to lac" of ability on the part of the

issuer to pay interest or principal

0.) (1plain the difference between yield) to) maturity 23T!) and 3ield)to)call 23T&). 24!)

3ield)to)maturity 23T!) 5 The yield is the rate of return that the investor will get from the

purchase of bond at current mar"et price and held to maturity.

3ield)to)call 2 3T&) 5 The yield on a bond if it remains outstanding only until a specified call

date.

&.)

67 of convertible bond

m) 18years

c. ratio) 800 shares of common shares

c. price of convertible bond) m 990

!* of common shares) m :

+ividend ) 197

&-N;(%#-N ;A'<( = &.AT#- > !* -, &.%/A(%.

= 800 %hares >m:

= m 900

&-N;(%#-N *(!#<! 2!) = !.* -, &.0-N+ 5 &.;A'<(

= !990)!900

= !90

&-N;(%#-N *(!#<! 2 7) = ! 90

!900

= 107

*A30A&? *(#-+ = !90

2 !1000 > 67 ) 5 2 800 > 197)

= 6.@1 3(A%

QUESTION 5 (A.)

#. <N#T% 2800@)

NA; = T.Asset) T.liabilities

No.-f -utstanding

1.0A99 = 8:8,800 5 1@00

B

B = 88:,99@.AA units

##. ;A'<( 2 8009)

NA; = T.Asset) T.liabilities

No.-f -utstanding

1.0800 = 2 B C 1@00) )8100

800,000

80A,100 = B = C 1@00

B= ! 80:,:00

0.)

RETURN

SPECULATIVE STOCK

UNIT TRUST

T,BILLS

RISK

#n general, there is a positive relationship between ris" and return. #nvestment with high ris" tend to

give high e1pected return. ,or those with low ris", the return will also be low. ,rom the diagram,

we can see that instruments regarded as ris" free 2 for e1ample treasury bills) have very low return.

Dhile those which are very ris"y tend to be on the higher end of the spectrum and give high returns.

OCTOBER 2008

QUESTION 3

A.)

1.) #NT((%T AT( #%?) interest rate ris" or mar"et ris" is the uncertainty cause by the

changes in interest rate during the period in which a fi1ed income security 2 bond) is held.

The price of fi1ed) income securities is highly influenced by changes in interest rate. An

increase in interest rate can cause the price of the bond is decline and a decline in interest

can cause the price of the bond to increase. Dhen interest rate fall, new issues come to

mar"et with lower yields compared to e1isting securities. This ma"es the e1isting

securities to worth more. Thus, the price increases. -n the other hand, if the interest rate

increase, new issues come to mar"et with higher yields than e1isting securities. This will

ma"e the e1isting securities to worthless , thus the price drops.

8.) *<&/A%#N$ *-D( #%? ) The uncertainty caused by the changing in price levels in

the economy 2 inflation) will adversely affect the returns on the fi1ed income securities.

Dhen the consumer price inde1 2 &*#) increase, the fi1ed return from fi1ed income

securities will reduce purchasing power, for e1ample, less value of goods can be

purchased from the income.

4.) 0usinessE financial ris" ) is associated with how the company mi1 amount of debt and

e.uity used to finance the company. ,or the company that aggressively using financial

leverage to finance its investment e1pose to higher financial ris". +ebt financing e1pose

the company to pay fi1 interest payment to the lender. #nability to pay the fi1ed) interest

payment can cause business failure to the company.

:.) '#F<#+#T3 #%? ) The ris" being unable to sell the investment at a reasonable price in a

short period of time. The secondary mar"et plays an important role in providing li.uidity

to the investors. To be li.uid, there must be a lot of mar"et players and different types of

securities to suit different investors.

6.) &A'' #%? ) A ris" related calls features attached to the bond issued, called callable

bond. &allable bond is a type of bond that gives the right to the issuer to call the bond

before maturity date. #nvestors usually invest in bond for the fi1 income from the interest

rate. #f the bond were called before the maturity, the investors will receive the cash , thus

there is no more fi1ed income from this investment. Dith the cash in hand, investors have

to loo" for another alternative. The issuer usually calls the bond when interest rate drops.

#n the case, investor has to replace the investment with lower yields issue.

0.)

#. A bond with a par value of !1000, a coupon rate of @7 and is currently selling for !900.

!) 80,

*;)!1000,

&) @7,

!*)!900

3T!= &* C G *;)!*H

!

G *;C !*H

8

&*= & > *;

= @7 > !1000

= !@0

! @0 C G !1000) !900H

80

G !1000C !900 H

8

= 9.997

##. !) 80,

&) 0,

*;) !1000,

!*) !400

3T!= &* C G *;)!*H

!

G *;C !*H

8

&*= & > *;

= 0 > !1000

= !0

! 0 C G !1000) !400H

80

G !1000C !400 H

8

= 6.497

#nvestors should invest in 0ond 2 1) because the 3T! is higher. The 3T! is 9.99, which is

greater than the coupon rate of @7. To encourage the investor to buy the bond, the issuer must sell

the bond at a discount and provide a rate of return of 9.99 to investors

APRIL 2008

QUESTION 2

A.) 3T!= &* C G *;)!*H

!

G *;C !*H

8

3T! 2 0-N+ A)

&*= & > *;

= 0 > !1000

= !0

! 0 C G !1000) !909.10H

1

G !1000C !909.10 H

8

= 9.68 7

3T! 2 0-N+ 0 )

! 0 C G !1000) !@9@.80H

8

G !1000C !@9@.80 H

8

= 11.89 7

3T! 2 0-N+ &)

! 0 C G !1000) !A@6.00H

4

G !1000C !A@6.00H

8

=18.94 7

3T! 2 0-N+ &)

! 0 C G !1000) !A94.00H

:

G !1000C ! A94.00 H

8

= 9.:8 7

&hoose 0-N+ & because the 3T! is higher. The 3T! is 18.94, which is greater than the

coupon rate.

B.) 0-N+ *#&(

;0 = &* 2 *;#,A #, m ) C *; 2 *;#, #, m )

= 2 1000 > 10 7 ) 2 *;#,A 97, 1 ) C ! 1000 2 *;#,A 97, 1)

= !100 > 2 0.9869) C ! 986.98

= !1019.61

/*= 2 1000>10 7 >1) C 2 !1019.61 5!1000)

!1000

= 11.96 7

QUESTION

C.) &<(NT 3#('+

= 2 1000 > A 7 )

! 900

= @.67

&-N;(%#-N ;A'<(

= 100 > !@

= !@00

&-N;(%#-N *(!#<! 2 !)

=!900 5 ! @00

= !100

&-N;(%#-N *(!#<! 2 7)

= !100

!@00

= 1:.89 7

*A30A&? *(#-+

= !100

2 1000 >A7) 5 2 100>0.40)

= 4.44 3(A%.

APRIL 200!

QUESTION 3

A.) The relationship between bond prices and yields is when the mar"et interest rates

increases the bond prices will decline or sells at a discount. #f the mar"et value of the

bond is selling lower than the par value it is called a discount bond and when the mar"et

interest rates decline the bond prices will increase or sell at premium. #f the mar"et value

of the bond is selling above the par value, it is called a premium bond.

0.) &all ris" or prepayment ris" is the ris" that a bond will be I calledJ 2 retired) long before

its scheduled maturity date. #ssuers often prepay their bonds by calling them in for

prepayment. Dhen issuers call their bonds, the bondholders end up getting cashed out of

the deal and have to find another place for their investment funds and there is a problem.

0ecause bonds are nearly always called for prepayment after interest rates have ta"en a

big fall. Thus, the investors have to replace a high)yielding bond with a much lower

yielding issue. ,rom the bondholderKs perspective, a called bond means not only a

disruption in cash flow but also a sharply reduced rate of return

C.) CAPITAL "AINS# PV- $P

m1000)m9A4.0@ = ! 14A.94

! 1000) !186.@9 = !9@:.81

&hoose bond which have Lero coupon because (rnie can gains more profit

TOTAL RETURN# CP ( PVI%A I, & ) ' PV ( P VI% I, &)

&) @.67

!) 80

#) 97

&*)! @6

=!@6 > 2 *;#,A 97, 80) C 1000 2 *;#, 97, 80)

= !@6 2 9.1896) C 1@9.:4

= !9A4.0@

&) 07

!) 86

#) 97

&*) !0

==!0 > 2 *;#,A 97, 86) C 1000 2 *;#, 97, 86)

= !0 2 9.9886) C 116.9A@9

= !186.@9

0ond which have the shorter period offers a lot more price volatility which 80 year. #t means

if (rnie want to reduce e1posure to capital loss or more to the point, to lower the price

volatility in bond holdings, then Must choose the shorten maturities.

QUESTION

T(E CONCEPT O% UNIT TRUST

A unit trust is one of the investment alternatives that are available in our economy. #t is an

investment scheme, which pools money from many investors who share the same financial

obMectives. An investors can participate in unit trust investment by buying certain number of

units of the unit trust fund which is freely traded. An authoriLed agent is responsible of the

units. A full time manager them invests the pooled money in shares or other authoriLed

securities on their behalf.

T)PE O% UNIT TRUST IN $ALA)SIA

#n !alaysia, there are seven types of unit trust that are classified according to different

categories based on the following criteriaN)

1.) $*+*,-.*& I&/012 %3&4-) !alaysian domiciled unit trust which mainly invest in

!alaysian e.uities and on a regular basis. Appro1imately half of the total returns

achieved are distributed to unit trust)holder in the form of income. #ncome funds are less

volatile. #t is an investment in high dividend yield companies or in the money mar"ets.

Thus, dividend payment is of primary importance and is consistent even during an

economic downturn.

8.) $*+*,-.*& "50678 %3&4-) The fund invested in stoc"s of smaller and emerging

companies with better growth potential. !alaysian domiciled unit trust, mainly invest in

!alaysia e.uities and on a regular basis, where more than half of the returns are in the

form of capital gains 2 increase unit price or bonus units)

4.) $*+*,-.* B*+*&/24 %3&4-) !alaysia domiciled unit trust, which will only invest up to a

ma1imum of A07 in !alaysian e.uities and the balance in fi1ed interest securities. #t is

an investment in stoc"s with good growth potential and high earning yield. A reasonable

dividend payout and capital appreciation can be e1pected.

:.) %052.9& $*&*924 $*+*,-.*& E:3.7, %3&4-- ,oreign domiciled unit trust, which

mainly invest in !alaysian e.uities.

6.) $*+*,-.*& I-+*1./ %3&4-) !alaysian domiciled unit trust, which mainly invest in

!alaysian e.uities e1cluding Inon halal stoc"J and interest)bearing money mar"et

instruments. These funds are investment in IhalalJ stoc"s based on #slamic principles of

the %yariah 'aws.

A.) $*+*,-.*& B0&4 %3&4-) !alaysian domiciled unit trust, which mainly invest in fi1ed

interest securities. 0ond funds are primarily invested in high yielding government

securities, corporate bonds, and loan stoc"s. They tend to be more conservatively

managed than e.uity funds and less subMect to fluctuation. Their obMective is to preserve

capital while producing a moderate income.

@.) E*-7 A-.*& %3&4-) (ast Asian e.uities are foreign domiciled unit trusts, which mainly

invest in a selection in (ast Asian or Asian countries including !alaysia.

A;VANTA"ES O% INVESTIN" IN T(E $ALA)SIAN UNIT TRUST %UN;S, QUATE;

AN; UNQUATE;

1.) ;IVERSI%ICATION 5 The investors , especially with small capital outlay, can diversify the

ris" as the funds are invested in a wide range of securities and across different assets classes

such as stoc"s, bonds, money mar"et instruments and or cash

8.) VARIET)) The investors have various investments to choose from to suit their needs and

obMectives.

4.) PRO%ESSIONAL $ANA"E$ENT) ,or an average investor, the unit trust is one of the

few avenues of investment where they can obtain professional management of his investment

at a reasonable service charge. The portfolio management process of a unit trust management

company involves an investment committee which sets an investment policies and strategies

while the fund manager provides research, analysis of assets allocation and stoc"s

recommendations

:.) EASE O% TRANSACTION) The investors can easily invest, redeem, split, transfer or merge

the units they have.

6.) LIQUI;IT)- The investment can be cashed at any time, thus allowing the investors the

fle1ibility to enter and e1it the mar"et at their discretion. The unit trust manager is obligated to

buy bac" any units redeemed by the investors. All the investors have to do is fill in redemption

or repurchase form and submit it to the management company. The unit will be redeemed and

the proceeds will be paid to the investors within 1business days.

APRIL 2008

QUESTION !

A.) A stoc" mar"et inde1 is used to measure the performance of the aggregated shares or the

entire stoc" mar"et. A well) formulated stoc" mar"et inde1 also can be used as a leading

indicator of the economic performance and as a useful summary measure of current

e1pectation of future outloo" economy. #t is also a sensitive barometer of a short) run political

and economic developments as well as a monitor of long) term structural changes in an

economy.

The inde1 movements illustrate mar"et sentiment. They are use by investors to measure

whether the mar"et going)up or down active or sluggish. The movement in the &# for the in

allows investors to describe the mar"et has having a bull or bear run. There are numerous

inde1es, the investors used them to compare which sectors outperform or underperform and

in what direction.

/owever, this does not mean investors can reap hefty profit by loo"ing at the inde1es.

Trac"ing the inde1es is Must one of the processes in ma"ing investment decision.

B.) The difference between a premium bond and discount bond is premium bond is one that sells

for more than its par value and it occurs when interest rates drop below the coupon rate and

discount bond is sells for less than par value , its occurs when mar"et rates are greater than the

coupon rate.

T(REE %ACTORS:-

1.) INTEREST RATE RISK) #s the number one source of ris" to fi1ed income investors

because itKs the maMor cause of price volatility in the bond mar"et. ,or bond, interest rate

ris" translates into mar"et ris". The behavior of interest rates affects all bonds and cuts

across all sector of the mar"et. Dhen mar"et interest rates rise, bond prices fall. As

interest rates become more volatile, so do bond prices.

8.) COUPON RATE) &oupon rate is a rate of interest payment for every bond issued.

0onds with lower coupons have a lots of price volatility and are more responsive to

changes in mar"et interest rate.

4.) $ATURIT) TER$- #s a limited life of bond. 0onds with longer maturities have a lots

of price volatility and the largest change in price occurs when the bond has the greatest

number of years to maturity.

&.) "ROWT( %UN;- The fund obMective is to have faster growth rate in term of investment

wealth. This can be seen its net asset value growth over time. This type of fund possesses

diversified portfolio of common stoc"s in the hope of achieving large capital gains for their

unit holders.

D.) AGGRESSIVE GROWTH FUND- This ,undOs investment obMective is to see" long)term

aggressive growth of capital. Aggressive $rowth ,und see"s to achieve its obMective by being

fully invested 2967 or more of net assets) in e.uity mutual funds whose obMective is growth or

capital appreciation. This ,und almost never ta"es a temporary defensive position, although it

has the ability to do so if !anagement determines that e1treme circumstances e1ist.

OCTOBER 200!

QUESTION2

A.) &losed)end company is one of the investment companies. The word I closed)endJ means

that the company has a limitation in its basic capitaliLation. The companies will use

leverage by selling senior securities such as bonds and preferred stoc". The companies

will proceed from the stoc" sale to purchase land, e.uipment, and inventory from the other

firms. &ompanies shares are traded and organiLed e1changes. Dhen investors buy

shares in a closed) end investment company, they must buy them from another person or

company. The buyers pays the nominal commission on such a purchase. The shares of

a closed)end company can be sold above or below the net asset value of the shares. The

reason that the closed) end investment companies sell at a discount are the investors

attitude concerning the abilities of the fundKs management , lac" of sales effort 2 bro"ers

earn less commission on closed)ended fund shares than an open)ended fund shares)

B.) &apital raisers consist of companies needing funds selling securities to the public through

investment ban"ers acting as intermediary between the company and investors. The

securities are purchased by the investors who provide funds to the companies. An

#N;(%T!(NT 0AN?(% is a firm that act as middleman or intermediary between the

investors and the capital raisers . They are the consultant to the corporate clients on

matters pertaining to the sale of new securities and fund raising. #nvestment ban"ers also

act as underwriters on the new issue of shares. The responsibility of an underwriter is to

guarantee the subscription of new shares issued by a company. The shares that are not

subscribed in the offer for sale are ta"en up by the underwriter. The #N;(%T!(NT

0AN?( appointed by a company usually act as a financial consultant to the company

planning on the new issues. The investment ban"er prepares a preliminary prospectus

called red herring which is similar to prospectus e1cept that it does not contain the actual

price of the shares. -nce the relevant authorities such as the %ecurities &ommission

approves the preliminary prospectus, a final prospectus is issued through ban"s and

bro"erage firms to be distributed to the public.

C.) )OUN" INVESTORS ( &26 .&<2-712&7) ) The early stages of an industry often are

characteriLed by a new technology or product. At this stage, it is difficult to predict which

firms will emerge as industry leader. +uring this start up stages, the industry e1periences

modest sales growth and very small or negative profit margins. The mar"et for the

industryKs product or services during this time is small and the firm involves maMor

development cost. Therefore, there is considerable ris" in selecting one firm within the

industry.

$.44+2-*924 .&<2-705- 5 +uring this rapid growth stage, a mar"et develops for the

product or services and demand becoming substantial. The limited number of firms in the

industry face little competition. The profit margins are very high as the sale grow at an

increasing rate as the industry attempts to meet e1cess demand.

RETIRE; INVESTORS ( OL; INVEST$ENT)) The success in the stage8 has

satisfied most of the demand for the industry goods or services. Thus future sales growth

may be above normal but it no longer accelerates. apid growth of sales and higher

profit margins attract competitors to the industry, which cause an increase in supply and

lower prices such that profit margins begin to decline to normal levels.

QUESTION 3

A.) ;0= &* 2 *;#,A #,n) C *; 2 *;#,A #, n)

= 21000 > 107) 2 *;#,A 187, 86) C 10002 *;#,A 187, 86)

= 1000 2 @.9:41) C 1000 2 0.0699)

= @9:.41 C 69.9

= ! 9:4.11

3T!= 3T!= &* C G *;)!*H

!

G *;C !*H

8

&*= & > *;

= 107 > !1000

= !100

! 100 C G !1000) !980H

6

G !1000C !980 H

8

= 18.09 7

Dhen re.uired rate of return 2 ?) = &oupon interest rate, bond will sell at par.

Dhen re.uired rate of return 2 ?) P &oupon interest rate, bond will sell at discount

Dhen re.uired rate of return 2?) Q &oupon interest rate, bond will sell at premium.

0.) BUSINESS ASSESS$ENT- #nvolves assessing the companyKs ability to overcome

challenges and threats, growth ,potential, level of profitability and cost compared to industry,

research, and development capability, mar"eting strategies

%INANCIAL ANAL)SIS) At this point, A! will focus on the different data. #t involve in)

depth ratio analysis and also the e1pected cash flows.

$ANA"E$ENT EVALUATION) The .uality of management is also being assessed

because it is believe the credit strength will also depend on managementKs ability to anticipate

change and react timely. A! loo" for managementKs capability of formulating policies

appropriate to the state of economy.

&.) =ERO COUPON BON; also "nown as original discount bond is sold at a large discount

from par. Thus the investors return comes from the gain in value that is par value minus

purchase price. The main attraction to investors to buy these bonds would be the low prices

and they would receive full face value at maturity. ,irms can raise large capitals at minimum

cost because they donKt pay interest or pay only little interest.

You might also like

- ELC501Document5 pagesELC501Roy HodgsonNo ratings yet

- FIN 542 - Answer Scheme OCT 2009Document8 pagesFIN 542 - Answer Scheme OCT 2009Rafiedah OmarNo ratings yet

- TAX Treatment For TAX267 and TAX317 Budget 2019Document5 pagesTAX Treatment For TAX267 and TAX317 Budget 2019nonameNo ratings yet

- Family's Financial Planning RecommendationsDocument10 pagesFamily's Financial Planning RecommendationsMUHAMMAD NUR IMAN NOR AZLI100% (1)

- EXAMPLE BS and CF and Ratio QuestionDocument4 pagesEXAMPLE BS and CF and Ratio QuestionhaziqNo ratings yet

- Internship Log Book Template LATESTDocument29 pagesInternship Log Book Template LATESTNabila HusnaNo ratings yet

- Determinants of Firm Productivity in Financial DistressDocument5 pagesDeterminants of Firm Productivity in Financial DistressSaufi RazaliNo ratings yet

- Individual Assignment March 2021Document1 pageIndividual Assignment March 2021Muhammad RusydiNo ratings yet

- Inflation Only ECO120Document7 pagesInflation Only ECO120Nxnx Celup100% (1)

- Malaysian Employment Laws HRM581/582: Course InformationDocument7 pagesMalaysian Employment Laws HRM581/582: Course InformationAziraNo ratings yet

- Eco211 210 164 219Document10 pagesEco211 210 164 219Ana MuslimahNo ratings yet

- Fin645 Final AssessmentDocument3 pagesFin645 Final Assessmentmark50% (2)

- Chapter 2 - Bank Negara Malaysia (BNM)Document44 pagesChapter 2 - Bank Negara Malaysia (BNM)Nur HazirahNo ratings yet

- Jarvis University Ju Is A Private Multiprogram U S University WithDocument2 pagesJarvis University Ju Is A Private Multiprogram U S University Withtrilocksp SinghNo ratings yet

- NO. Name Matric No.: Department of Building Universiti Teknologi Mara (Perak)Document5 pagesNO. Name Matric No.: Department of Building Universiti Teknologi Mara (Perak)Che Wan Nur SyazlyanaNo ratings yet

- Guidelines To Article Analysis Elc501Document10 pagesGuidelines To Article Analysis Elc501Akmal RahimNo ratings yet

- Elc231 Mid Sem Test June2020 Set1 PDFDocument6 pagesElc231 Mid Sem Test June2020 Set1 PDFNURUL AIN IZZATI BINTI MUHAMAD ZAILAN SOVILINUSNo ratings yet

- Test 1 Maf653 Oct2017 QnADocument7 pagesTest 1 Maf653 Oct2017 QnAFakhrul Haziq Md FarisNo ratings yet

- Case Study Assignment Eco415 ( (Macroeconomics)Document4 pagesCase Study Assignment Eco415 ( (Macroeconomics)Dayat HidayatNo ratings yet

- ASSIGNMNENT2 APril 2020Document7 pagesASSIGNMNENT2 APril 2020maslindaNo ratings yet

- Course INTERMEDIATE MICROECONOMICS PDFDocument7 pagesCourse INTERMEDIATE MICROECONOMICS PDFnorshaheeraNo ratings yet

- Satyam and Welli MultiDocument7 pagesSatyam and Welli Multilyj1017No ratings yet

- Fin 533 Chapter 6 Past Year QuestionDocument2 pagesFin 533 Chapter 6 Past Year QuestionWAN NORSYAMILANo ratings yet

- Fin430 - Dec2019Document6 pagesFin430 - Dec2019nurinsabyhahNo ratings yet

- Topic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityDocument7 pagesTopic: Effect of Covid19 Toward Bank Islam Malaysia Berhad (BIMB) ProfitabilityLuqmanulhakim JohariNo ratings yet

- Report For Assignment Chapter 6 (Bankruptcy Among Young People in Malaysia)Document10 pagesReport For Assignment Chapter 6 (Bankruptcy Among Young People in Malaysia)Aida KarimNo ratings yet

- Eco - 162 - Teaching - Materials - Topic 1 - 3Document53 pagesEco - 162 - Teaching - Materials - Topic 1 - 3Atiqah RazakNo ratings yet

- Tax317 Group Project SSTDocument23 pagesTax317 Group Project SSTNik Syarizal Nik MahadhirNo ratings yet

- Solution Maf653 - Dec 2019 - StudentDocument7 pagesSolution Maf653 - Dec 2019 - Studentdini ffNo ratings yet

- Ind Assignment Fin242 Saiyidah Aisyah Kba1193gDocument15 pagesInd Assignment Fin242 Saiyidah Aisyah Kba1193gsaiyidah AisyahNo ratings yet

- Ads560 Group Assignment-Timor Leste CrisisDocument18 pagesAds560 Group Assignment-Timor Leste CrisisFatin AqilahNo ratings yet

- Project Report ECO261Document7 pagesProject Report ECO261Amy Joe100% (1)

- Bachelor of Business Administration (Hons) Marketing essay on Malaysia's minimum wage orderDocument6 pagesBachelor of Business Administration (Hons) Marketing essay on Malaysia's minimum wage orderWAN NUR'MUNIFAH MAHMOODNo ratings yet

- Role Play 20204 - Fin242Document2 pagesRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNo ratings yet

- Solution Maf603 - Jun 2018Document9 pagesSolution Maf603 - Jun 2018anis izzatiNo ratings yet

- INS200Document4 pagesINS200Miszz Bella Natallya'zNo ratings yet

- MGT538 Test Aug 21Document5 pagesMGT538 Test Aug 21Ash NadiaNo ratings yet

- 5 FIN555 2 Format Assignment 1 Chap 11-16 2022 PJJDocument11 pages5 FIN555 2 Format Assignment 1 Chap 11-16 2022 PJJAzrul IkhwanNo ratings yet

- Eco 415 Apr07Document5 pagesEco 415 Apr07myraNo ratings yet

- MKT 537/536 Oct 2007Document8 pagesMKT 537/536 Oct 2007myraNo ratings yet

- Field Report Pac671 Template (New) - Cover Page - TocDocument2 pagesField Report Pac671 Template (New) - Cover Page - TocAiman FaezNo ratings yet

- Fin552 Final Assessment 2021Document3 pagesFin552 Final Assessment 2021amirul baharudinNo ratings yet

- ASSESSMENT LAW 299 EditedDocument1 pageASSESSMENT LAW 299 Editedsyahiir syauqiiNo ratings yet

- International Economics: Specialization and TradeDocument42 pagesInternational Economics: Specialization and TradeAwang AizatNo ratings yet

- Based On Current Trends of Volume and PriceDocument11 pagesBased On Current Trends of Volume and PriceHendra SetiawanNo ratings yet

- Elc550 Annotated BibliographyDocument2 pagesElc550 Annotated BibliographyAllisya NasirNo ratings yet

- Wage Reduction & Business Solutions During CovidDocument13 pagesWage Reduction & Business Solutions During Covidliyana nazifaNo ratings yet

- ISF 1101 Islamic Finance Profit Computation ExamplesDocument5 pagesISF 1101 Islamic Finance Profit Computation ExamplesPrashant VishwakarmaNo ratings yet

- Ins510 Group Project ReportDocument17 pagesIns510 Group Project Reportradia amalin99No ratings yet

- Fin 242 FullDocument5 pagesFin 242 FullIzzaty AffrinaNo ratings yet

- FIN420 Individual Assignment 20214Document3 pagesFIN420 Individual Assignment 20214Admin & Accounts AssistantNo ratings yet

- Most Preferred Cafeteria Among UiTM Tapah StudentsDocument13 pagesMost Preferred Cafeteria Among UiTM Tapah StudentsAmir Haseri100% (1)

- Study PlanDocument2 pagesStudy PlanDanial FahimNo ratings yet

- ECO415 - Demand Theory and ElasticityDocument38 pagesECO415 - Demand Theory and Elasticitykimi9090No ratings yet

- Market Manipulation Convictions UpheldDocument8 pagesMarket Manipulation Convictions UpheldMohamad SaniyNo ratings yet

- ACC 106 Chapter 1Document13 pagesACC 106 Chapter 1Firdaus Yahaya100% (4)

- University Name Gujarat University Course Name MBA-Financial Services Semester 4Document11 pagesUniversity Name Gujarat University Course Name MBA-Financial Services Semester 4patelshreyasNo ratings yet

- Danforth & Donnalley Laundry Products Case StudyDocument5 pagesDanforth & Donnalley Laundry Products Case StudyLovely SueNo ratings yet

- Case 03 - The Lazy Mower - SolutionDocument7 pagesCase 03 - The Lazy Mower - SolutionDũngPham67% (3)

- Calculate repricing gap impact of 1% rate changeDocument8 pagesCalculate repricing gap impact of 1% rate changeCristina BoboacăNo ratings yet

- 3 Chemlab Expt 12 Characterization of Nucleic AcidsDocument8 pages3 Chemlab Expt 12 Characterization of Nucleic AcidsAssumpta Minette BurgosNo ratings yet

- Bio MoleculesDocument35 pagesBio MoleculeskailashNo ratings yet

- Form 57ADocument2 pagesForm 57AAbdunnajar Mahamud83% (6)

- AlkynesDocument8 pagesAlkynesFaye BogbogNo ratings yet

- Investment: Presented By: Prof. Eduardus Tandelilin, CWMDocument8 pagesInvestment: Presented By: Prof. Eduardus Tandelilin, CWMIwan SetiawanNo ratings yet

- Guide On The Use of The Design & Build / Turnkey Conditions of ContractDocument3 pagesGuide On The Use of The Design & Build / Turnkey Conditions of ContractupdazNo ratings yet

- 01 MeetingDocument113 pages01 MeetingslumbaNo ratings yet

- Types of CapitalDocument24 pagesTypes of CapitalAnkita N VyasNo ratings yet

- Synthesis and Characterization of Acrylated EpoxidizedDocument10 pagesSynthesis and Characterization of Acrylated EpoxidizedCalin MihaelaNo ratings yet

- CLS Aipmt 16 17 XI Che Study Package 3 SET 2 Chapter 11Document21 pagesCLS Aipmt 16 17 XI Che Study Package 3 SET 2 Chapter 11kalloli100% (1)

- Alcohol Oxidation NotesDocument11 pagesAlcohol Oxidation Notesapi-281589298No ratings yet

- 4 - Rate Laws and Stoichiometry - StuDocument62 pages4 - Rate Laws and Stoichiometry - StuTiệp MatícNo ratings yet

- CPF in Singapore - A Cap Market Boost or DragDocument26 pagesCPF in Singapore - A Cap Market Boost or DragNing LuoNo ratings yet

- AP Chemistry Study GuideDocument11 pagesAP Chemistry Study Guidesarah2941No ratings yet

- ESG 332 Test 1 Review SheetDocument12 pagesESG 332 Test 1 Review SheetAshish JohnsonNo ratings yet

- How Sovereign Credit Quality May Affect Other RatingsDocument9 pagesHow Sovereign Credit Quality May Affect Other RatingsxanasadjoNo ratings yet

- STEM - Gen Chem 1 and 2 CGDocument18 pagesSTEM - Gen Chem 1 and 2 CGWichel AnnNo ratings yet

- Lyceum of The Philippines University-Cavite Engineering Economy April 15, 2020 WedDocument5 pagesLyceum of The Philippines University-Cavite Engineering Economy April 15, 2020 WedKenneth Rodriguez HerminadoNo ratings yet

- Indemnity BondDocument1 pageIndemnity BondaggarwalbhaveshNo ratings yet

- ARE - CDS Exam GuideDocument22 pagesARE - CDS Exam GuideiamarrNo ratings yet

- F321 Module 3 Practice 3 AnswersDocument4 pagesF321 Module 3 Practice 3 Answerscoughsyrup123No ratings yet

- Biological Molecules Revision NotesDocument49 pagesBiological Molecules Revision NotesAyaz Nasih88% (8)

- Linkage IsomersDocument61 pagesLinkage IsomersMonica NC67% (3)

- Bond Prices and Long-Term LiabilitiesDocument1 pageBond Prices and Long-Term LiabilitiesLenneth MonesNo ratings yet

- Covalent Vs Non CovalentDocument3 pagesCovalent Vs Non CovalentezajihaNo ratings yet

- Duration Problems: Problem 1Document6 pagesDuration Problems: Problem 1SanjeevNo ratings yet

- Chapter 11 - Cost of CapitalDocument18 pagesChapter 11 - Cost of CapitalTajrian RahmanNo ratings yet

- ChemTri Reviewer Comprehensive Chemistry Orbital Bonding ReviewDocument6 pagesChemTri Reviewer Comprehensive Chemistry Orbital Bonding ReviewRovick TubisNo ratings yet

- C-01: Solid StatesDocument25 pagesC-01: Solid StatesAbhishek KukretiNo ratings yet

- Tactical Asset Allocation Alpha and The Greatest Trick The Devil Ever PulledDocument8 pagesTactical Asset Allocation Alpha and The Greatest Trick The Devil Ever PulledGestaltUNo ratings yet

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)From EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Rating: 4.5 out of 5 stars4.5/5 (4)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorFrom EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorNo ratings yet

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- Mastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsFrom EverandMastering Private Equity: Transformation via Venture Capital, Minority Investments and BuyoutsNo ratings yet

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityFrom EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityRating: 4.5 out of 5 stars4.5/5 (4)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- Add Then Multiply: How small businesses can think like big businesses and achieve exponential growthFrom EverandAdd Then Multiply: How small businesses can think like big businesses and achieve exponential growthNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Angel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000From EverandAngel: How to Invest in Technology Startups-Timeless Advice from an Angel Investor Who Turned $100,000 into $100,000,000Rating: 4.5 out of 5 stars4.5/5 (86)

- Joy of Agility: How to Solve Problems and Succeed SoonerFrom EverandJoy of Agility: How to Solve Problems and Succeed SoonerRating: 4 out of 5 stars4/5 (1)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- LLC or Corporation?: Choose the Right Form for Your BusinessFrom EverandLLC or Corporation?: Choose the Right Form for Your BusinessRating: 3.5 out of 5 stars3.5/5 (4)

- Financial Risk Management: A Simple IntroductionFrom EverandFinancial Risk Management: A Simple IntroductionRating: 4.5 out of 5 stars4.5/5 (7)

- Investment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionFrom EverandInvestment Valuation: Tools and Techniques for Determining the Value of any Asset, University EditionRating: 5 out of 5 stars5/5 (1)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Key Performance Indicators: Developing, Implementing, and Using Winning KPIsFrom EverandKey Performance Indicators: Developing, Implementing, and Using Winning KPIsNo ratings yet

- Getting a Job in Private Equity: Behind the Scenes Insight into How Private Equity Funds HireFrom EverandGetting a Job in Private Equity: Behind the Scenes Insight into How Private Equity Funds HireNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionFrom EverandThe Business of Venture Capital: The Art of Raising a Fund, Structuring Investments, Portfolio Management, and Exits, 3rd EditionRating: 5 out of 5 stars5/5 (3)

- The Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupFrom EverandThe Fundraising Strategy Playbook: An Entrepreneur's Guide To Pitching, Raising Venture Capital, and Financing a StartupNo ratings yet

- Will Work for Pie: Building Your Startup Using Equity Instead of CashFrom EverandWill Work for Pie: Building Your Startup Using Equity Instead of CashNo ratings yet