Professional Documents

Culture Documents

Tds

Uploaded by

Sahil SheikhCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds

Uploaded by

Sahil SheikhCopyright:

Available Formats

-:

I

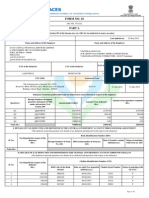

ITRACES

ITDS Reconciliation Analysis and Correction Enabling System

Government of Indi:a

Income TaxDepartment

Certificate Number: LAUYFSH Last Updated On: 23-0ct-2013

FORMNO.16A

[Seerule 31(1)(b)]

Certificate under Section 203 of the Income Tax Act, 1961 for tax deducted at source

Name and Address of Deduct or Name and Address ofDeductee

KONKAN RAILWAY CORPORA nON LIMITED

USBRL PROJ ECT OFFICE, KONKAN RAILW AY ASHOK KUMAR SAXENA

CORPORATIO, GEETA NAGAR TRINTHA, K 401, ANUPAM APARTMENTS,

REASI, REASI - 182311 EAST ARJ UN NAGAR, NEW DELHI - 110032 Delhi

J ammu &Kashmir

+(91)01991-245316 Note: Name and address is as present In PAN database of Income Tax Department.

990 J K(a1KONKANRAILWAY.GOV.IN

Apply for PAN change request to update details

PAN of Deductor TAN of Deduct or PAN of Deductee

AAACK3725H AMRKI0635C AARPS0039C

CIT(TDS) I; Assessment Year Period

.........

H

From To

The Commissioner oflncome Tax (TDS)

1

20l4"15

CR. Building, Sector 17. E, Himalaya Marg Chandigarh,i60017 ... 1 .

01-J ul-2013 30-Scp-2013

Summary oiPayment

Sr. No. Amount.Paid ICredited { i 2

i

.. Nature OfPayme?t~*\'

f

Date of Payment / Credit

".:.,\

I 56000.00

' "

194J

...

02-1ul-2013

2 4000.0,0 194J

' "

05-1ul-2013

Total {~ 60000.00

' .

.

"

:'

.... ;:~' ;:,' :>::;

SummaryofTax.Deducted iI~.?urce.!~ respectofDeductee

Receipt NumbetsofOriginal

Amount of Tax Deposited /

Quarterly Statements ofTDS Amount of Tax Deducted in

Quarter

Under sub-section (3) of Section respect ofDeductee {~

Remitted in respect of Deductee

200

{~

Q2 BRAXXCOD

..

6000.00 6000.00 ..

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENT.RAL GOVERNMENT ACCOUNT THROUGH BOOK ENTRY

(The deductor to provide payment-wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sr. No.

Tax Deposited in respect of

Deductee {~ Receipt Numbers of DDO Sequence Number in Book Date on which Tax Status of

Form24G Adjustment Mini Statement Deposited Booking*

Total {~

n, DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment-wise details of tax deducted and deposited with respect to the deductee)

Challan Identification Number (CIN)

Sr. No.

Tax Deposited in respect of

Deductee {~

BSR Code of the Bank Date on which Tax Challan Serial

Branch Deposited Number

Status of Booking*

1 5600.00 6320396 05-Aug-2013 90120 F

2 400.00 6320396 05-Aug-2013 90120 F

Total {~ 6000.00

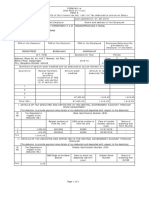

Verification

Page I of2

Certificate Number: LAUYFSH TAN of Deductor: AMRKI0635C

I MANGJ J ESH KUMAR ACHARI, son I daughter of KRISHNAN working in the capacity of.AAQ (designation), do hereby certify that a sum of (~~ [Rupees Six

Thousand Only] has been deducted and a sum of (~) liJ lJ lJ lJ lJ l [Rupees Six Thousand Only] has been deposited to the credit of the Central Government. I further

certify that the information given above is true, complete and correct and Is based on the books of account, documents, TDS statements, TDS deposited and other

available records.

Place Reasi

Date 24-0ct-2013

Full Name: MANGUESH KUMAR ACHARI Designation: AAO

PAN of Deduetee: AARPS0039C Assessment Year: 2014-15

Signature of Person Responsible for Deduction of Tax

Notes:

I. Form 16A contains the latest transaction reported by the deductor in the TDS I TCS Statement. For further details please view your 26AS for same AYon the website httPs'lIwwwtdscpc

~

2. To update the PAN details inIncome Tax Department database, apply for 'PAN change request' through NSDL or UTITSL

Legend useq in Form 16A

* Status of Booking

P Provisional

F Final

o Overbooked

** Nature of Payment

Sectlon Code

.. Description

193 Interest on Securities

194 Dividends

194A Interest other than'Interest on securities'

194B Winning from lottery or crossword puzzle

194BB Winning fromhorse race

194C Payments to contractors and sub-contractors

194D Insurance commission

194E Payments to non-resident sportsmen or sports associations

I 94EE Payments in respect of deposits under National Savings Scheme

194F

Payments on account of repurchase of units by Mutual Fund or Unit Trust of

India

194G Commission, price, etc. on sale of lottery tickets

194H Commission or brokerage

1941 Rent

194J Fees for professional or technical services

194K

Income payable to aresident assessee in respect of units of aspecified mutual

fund or of the units of the Unit Trust of India

I94LA Payment of compensation on acquisition of cert~in immovable property

I 94LB Income by way ofInterest from Infrastructure Debt fund

Income by way of interest from specified company payable to anon-resident 194LC

have matched with the payment details

details of TDS I TCS booked in Government

withdetailsrnentioned inthe TDS ITCS statement but the

reduces claimed amount in the statement or

195 Other sums payable to ~non-resident

196A' Incom~in.respect of units of non-residents

196B Payments in respect of units to an offshore fund

196C

Income from foreign currency bonds or shares ofIndian company payable to

non-residents

196D ,,' incom~ of foreign institutional investors fromsecurities

206CA Collecti~n at source from alcoholic liquor for human consumption

206CB Collection at source fromtimber obtained under forest lease

206CC

Collection at source from timber obtained by any mode other than a forest

lease

206CD Collection at source from any other forest produce (not being tendu leaves)

206CE Collection at source from any scrap

206CF

Collection at source from contractors or licensee or lease relating to parking

lots

206CG Collection at source from contractors or licensee or lease relating to toll plaza

206CH

Collection at source fromcontractors or licensee or lease relating to mine or

quarry

206CI Collection at source from tendu Leaves

206CJ Collectio'o at source fromon sale of certain Minerals

.206CK Collection at source on c~sh case of Bullion and J ewellery

Page 2 of2

-

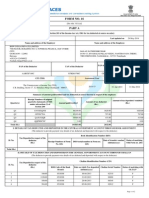

TRACES

Gcve-ome-c or. J odie

Income Tax Department

FORMNO.16A

[See rule 31(I )(b)]

Certificate under section 203 of the Income-tax Act, 1961 for tax deducted at source

Certificate No. HDYIJ YH Last updated on oI-Aug-20 13

Name and address of the deductor Name and address of the deductee

KONKAN RAILWAY CORPORATION LIMITED

USBRL - PROJ ECT OFFICE, J yotipuram Road,

ASHOK KUMAR SAXENA

Geeta Nagar Trintha - 182311

K 401. ANUPAM APARTMENTS.

Maharashtra

EASTAR.lUN NAGAR, NEW DELHI- 110032 Delhi

+(91)1991-245316

kmanguesh@gmail.colll

PAN of the deductor T AN of the deductor PAN of the deductee

AAACK3725H AMRKI0635C AARPS0039C

CIT (TDS) Assessment Year Period

From To

The Commissioner of Income Tax (TDS)

2014-15

C.R.

Building, Sector 17. E, Himalaya Marg Chandigarh - 160017

oI-Apr-20 13 30-.Iun-20 13

Summary of payment

Deductee Reference No.

Date of paymentl credit

SI. No. Amount paid/ credited Nature of payment** provided by the Deductor (if

any)

(dd/mm/yyyy)

I 50000.00 10-05-2013

2 52260.00 31-05-2013

Total (Rs.) 102260.00

Summary of tax deducted at source in respect of Deductee

Receipt Numbers of Original

Quarter

Quarterly Statements of TDS Amount of Tax Deducted in respect of Amount of Tax Deposited I Remitted in

Under sub-section (3) of Section Deductee respect of Deductee

200

QI BRBXXDVF 10226.00 10226.00 I

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJ USTMENT

(The deductor to provide payment-wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

SI. No.

Tax deposited in respect of

Status of Matching

deductee (Rs.) Receipt Numbers of Form 000serial number in Form No. Date of Transfer

with Form No. 24G

No.24G 24G voucher (dd/mm/yyyy)

Total (Rs.)

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment-wise details of tax deducted and deposited with respect to the deductee)

Challan Identification Number (CIN)

SI. No.

Tax deposited in respect of the

deductee (Rs.)

BSR Code of the Bank Date on which tax deposited Challan Serial Number Status of matching with

Branch (dd/mm/yyyy) OLTAS*

I 5000.00 6320396 05-06-2013 90179 F

2 5226.00 6320396 05-06-2013 90179 F

Total (Rs.) 10226.00

Page I 01" 2

Certificate Number: I-IDYIJ YH TAl\' or Dcducrur-A \IRh:l06J 5C

Verillcation

I, MANGUESH KUMAR ACHARI, son I daughter of KRISHNAN working in the capacuy of M.Q (designalion) do hereby certify Ih.1 a sum of Rs. .!QllQJ illIRs. Im

Thousand Two Hundred and Twenty Six Only (in wo rd s)] has been deducted and H sum of Rs . .l.O..ll.6..J Ul]Rs. Ten ThQusand Two Hundred and Twenty Six Qoly] has

been deposited to the credit of the Central Government. I further certify thai the informario n given above is true, complete and correct and is based on the books of

account, documents, IDS statements, IDS deposited and other available records.

PAl\" or Dcductcc: AARPSOOJ 9C Assessment Year: 201"'-15

Place Reasi

oI-Aug-20 13

Full Name: MANGUESH KUMAR ACHARI

Date

Designation: AAO

(Signature of person responsible for deduction of tax)

Notes:

I. Fonn 16A contains the latest transaction reponed by the dcducror in the TDS I TCS Statement. For further details please view your 26AS for same AY on the website https'UwwwtdseQe gov.;n

2. To update the PAN details in Income Tax Dcpartrncm database, apply for 'PAN change request' through NSDL or UTITSL

3. In items 1and II, in column for tax deposited in rcpeci of dcductcc, furnish total amount ofTDS. surcharge (if applicable) and education cess (if applicable).

Legend used in Form 16A

* Status of matching with OLTAS

Legend Description Definition

U Unmatched

Deduetors have not deposited taxes or have furnishcd incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

P Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deduetors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

In case of non-government deductors, payment details ofTDS I TCS deposited in bank by deduct or have matched with the payment details

F Final mentioned in the TDS I TCS statement filed by the dcductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Payment details ofTDS I TCS deposited in bank by dcductor have matched with details mentioned in the TDS / TCS statement but the

0 Overbooked amount is over claimed in the statement. Final (F) credit will be reflected only when dcductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

** Nature of Payment

Section Code Description

193 Interest on Securities

194 Dividends

194A Interest other than 'Interest on securities'

1948 Winning from lottery or crossword puzzle

19488 Winning from horse race

194C Payments to contractors and sub-contractors

194D Insurance commission

194E Payments to non-resident sportsmen or sports associations

194EE Payments in respect of deposits under National Savings Scheme

194F

Payments on account ofrcpurehase of units by Mutual Fund or Unit Trust of

India

194G Commission, price, etc. on sale of lottery tickets

194H Commission or brokerage

1941 Rent

194J Fees for professional or technical services

194K

Income payable to a resident assessee in respect of units of a specified mutual

fund or of the units of the Unit Trust of India

194LA Payment of compensation on acquisition of certain immovable property

194LB Income by way of Interest from Infrastructure Debt fund

194LC Income by way of interest from specified company payable to a non-resident

Section Code Description

195 Other sums payable to a non-resident

196A Income in respect of units of non-residents

1968 Payments in respect of units to an offshore fund

196C

Income from foreign currency bonds or shares of Indian company payable to

non-residents

196D Ineomc of foreign institutional investors from securities

206CA Collection at source from alcoholic liquor for human consumption

206CB Collection at source from timber obtained under forest lease

206CC

Collection at source from timber obtained by any mode other than a forest

lease

206CD Collection at sourec from any other forest produce (not being tcndu leaves)

206CE Collection at source from any scrap

206CF

Collection at source from contractors or licensee or Icase relating to parkmg

lots

206CG Collection at source from contractors or licensee or lease relating 10 toll plaza

206CH

Collection at source from contractors' or licensee or lease relating 10 mine or

quarry

206CI Collection at source from tcndu Leaves

206CJ Collection at source from on sale of certain Minerals

206CK Collection at source on cash case of Bu!1ion and J cwcllcry

Page 2 of1

You might also like

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalNo ratings yet

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdNo ratings yet

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayNo ratings yet

- Rlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3Document2 pagesRlic App Ecommunication Pdfrecieptgenerator Mail PDF Files TDSC STMT 2011-12 q3 Ablpi5301a Form16a 2012-13 q3143688No ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohieNo ratings yet

- Form 16Document2 pagesForm 16SIVA100% (1)

- I. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryDocument34 pagesI. Details of Tax Deducted and Deposited in The Central Government Account Through Book EntryAjay PandeyNo ratings yet

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriNo ratings yet

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarNo ratings yet

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976No ratings yet

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajNo ratings yet

- 14374752Document2 pages14374752Anshul MehtaNo ratings yet

- Form16Document5 pagesForm16er_ved06No ratings yet

- PDFDocument5 pagesPDFdhanu1434No ratings yet

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- Form 16A NewDocument2 pagesForm 16A NewKovidh GoyalNo ratings yet

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryNo ratings yet

- Milton Form16Document4 pagesMilton Form16sundar1111No ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAnonymous glyBR9No ratings yet

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediNo ratings yet

- Chinnaduran Form16Document4 pagesChinnaduran Form16sundar1111No ratings yet

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavNo ratings yet

- Form No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceDocument2 pagesForm No. 16A: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at SourceAkshay DhawanNo ratings yet

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankNo ratings yet

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniNo ratings yet

- Chelladurai Form16Document4 pagesChelladurai Form16sundar1111No ratings yet

- Form16fy10 11Document3 pagesForm16fy10 11atishroyNo ratings yet

- Form 16: Jakson Engineers LimitedDocument5 pagesForm 16: Jakson Engineers LimitedAnit SinghNo ratings yet

- Voltas LimitedDocument16 pagesVoltas LimitedvedaNo ratings yet

- 0.00 Verification: TotalDocument4 pages0.00 Verification: TotalKesava KesNo ratings yet

- Form 16Document3 pagesForm 16Alla VijayNo ratings yet

- Aaacl4159l Q3 2024-25Document3 pagesAaacl4159l Q3 2024-25vbgrandvizagNo ratings yet

- Itr 62 Form 16Document4 pagesItr 62 Form 16Hardik ShahNo ratings yet

- 3657 Atmpa0825cDocument5 pages3657 Atmpa0825cnithinmamidala999No ratings yet

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978No ratings yet

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaNo ratings yet

- Form 16 ADocument23 pagesForm 16 Amlkhantwal8404No ratings yet

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarNo ratings yet

- Form No. 16: Finotax 1 of 3Document3 pagesForm No. 16: Finotax 1 of 3dugdugdugdugiNo ratings yet

- Form 16Document6 pagesForm 16anon_825378560No ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelNo ratings yet

- Ashokkumar Form 16Document4 pagesAshokkumar Form 16sundar1111No ratings yet

- Form 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument4 pagesForm 16: Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySyedNo ratings yet

- CTG FormDocument3 pagesCTG FormSamant LeoNo ratings yet

- (See Rule 37D) : Cit (TDS) Address City Pin Code . .Document2 pages(See Rule 37D) : Cit (TDS) Address City Pin Code . .Akshay RuikarNo ratings yet

- N/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesN/A AMRS16666G CGAPS6779N: Certificate Under Section 203 of The Income Tax-Act, 1961 For Tax Deducted at Source On SalaryZUHAIB ASHFAQNo ratings yet

- New Form 16 AY 11 12Document4 pagesNew Form 16 AY 11 12Sushma Kaza DuggarajuNo ratings yet

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978No ratings yet

- Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument3 pagesCertificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalarySvsSridharNo ratings yet

- 1 - Form 16Document5 pages1 - Form 16premsccNo ratings yet

- Thirumoorthy Form16Document4 pagesThirumoorthy Form16sundar1111No ratings yet

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiNo ratings yet

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiNo ratings yet

- Babu Form 16Document4 pagesBabu Form 16sundar1111No ratings yet

- Anspg5953f 2018-19Document3 pagesAnspg5953f 2018-19virajv1No ratings yet

- Role of DDO in GovtDocument27 pagesRole of DDO in GovtPratik ViholNo ratings yet

- Law Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16Document3 pagesLaw Incometaxindia Gov in Dittaxmann Incometaxrules PDF Itr62form16api-247505461No ratings yet

- Cyber CrimeDocument9 pagesCyber CrimeSahil SheikhNo ratings yet

- An Overview of AmulDocument6 pagesAn Overview of AmulSahil SheikhNo ratings yet

- Marketing Management AssignmentDocument5 pagesMarketing Management AssignmentSahil SheikhNo ratings yet

- Material Handling: Shaikh Shahid, Mba (Evening) 2020, Roll No: - 22 Assignment: - POMDocument8 pagesMaterial Handling: Shaikh Shahid, Mba (Evening) 2020, Roll No: - 22 Assignment: - POMSahil SheikhNo ratings yet

- T&C For Desktop SystemDocument2 pagesT&C For Desktop SystemSahil SheikhNo ratings yet

- StressDocument2 pagesStressSahil SheikhNo ratings yet

- Union Public Service Commission: Dholpur House, Shahjahan Road, New Delhi-110 069Document2 pagesUnion Public Service Commission: Dholpur House, Shahjahan Road, New Delhi-110 069Sahil SheikhNo ratings yet

- 15.01.2018 Sub: Repair of HP Deskjet Ink Advantage 3525e PrinterDocument1 page15.01.2018 Sub: Repair of HP Deskjet Ink Advantage 3525e PrinterSahil SheikhNo ratings yet

- Cyber CrimeDocument9 pagesCyber CrimeSahil SheikhNo ratings yet

- Konkan Railway IT PolicyDocument4 pagesKonkan Railway IT PolicySahil SheikhNo ratings yet

- Konkan Railway IT PolicyDocument4 pagesKonkan Railway IT PolicySahil SheikhNo ratings yet

- Difference Between GSM and CDMA - GSM Vs CDMADocument4 pagesDifference Between GSM and CDMA - GSM Vs CDMASahil SheikhNo ratings yet

- Data Sheet c78-610061Document16 pagesData Sheet c78-610061raythn57No ratings yet

- KRCL Joint Measurement ReportDocument6 pagesKRCL Joint Measurement ReportSahil SheikhNo ratings yet

- Incredible India - UploadDocument20 pagesIncredible India - UploadSahil SheikhNo ratings yet

- Test 1&solDocument21 pagesTest 1&solSahil SheikhNo ratings yet

- 88829221Document1 page88829221Sahil SheikhNo ratings yet

- IES 2014 Test.6&solDocument17 pagesIES 2014 Test.6&solSahil SheikhNo ratings yet

- Test 4&solDocument22 pagesTest 4&solSahil SheikhNo ratings yet

- Test 4&solDocument22 pagesTest 4&solSahil SheikhNo ratings yet

- New Doc 3Document1 pageNew Doc 3Sahil SheikhNo ratings yet

- Union Public Service Commission: Dholpur House, Shahjahan Road, New Delhi-110 069Document2 pagesUnion Public Service Commission: Dholpur House, Shahjahan Road, New Delhi-110 069Sahil SheikhNo ratings yet

- Electronics Engineering Formula SheetsDocument44 pagesElectronics Engineering Formula SheetsInstitute of Engineering Studies (IES)88% (8)

- Test1 14 1Document14 pagesTest1 14 1Priyanka ChauhanNo ratings yet

- Delhi Govt. Min Wages CircularDocument4 pagesDelhi Govt. Min Wages CircularVijay JoshiNo ratings yet

- Konkan Railway Corporation LTD.: A/C HeadDocument1 pageKonkan Railway Corporation LTD.: A/C HeadSahil SheikhNo ratings yet

- HPCL PDFDocument7 pagesHPCL PDFSahilJainNo ratings yet

- Limited: Prime BankDocument1 pageLimited: Prime BankHabib MiaNo ratings yet

- Dividend Theory Chap 17Document18 pagesDividend Theory Chap 17Nihar KuchrooNo ratings yet

- BQSPS0080B 2019 PDFDocument4 pagesBQSPS0080B 2019 PDFsaiNo ratings yet

- NumericalReasoningTest2 SolutionsDocument32 pagesNumericalReasoningTest2 SolutionsMuhammad Waseem100% (1)

- Jsis A 242 Feb 14 ExamDocument4 pagesJsis A 242 Feb 14 Examapi-532751872No ratings yet

- AwbDocument1 pageAwbAnonymous RCM8aHgrPNo ratings yet

- Mwakyusa Bupe Final E-Thesis (Master Copy) PDFDocument326 pagesMwakyusa Bupe Final E-Thesis (Master Copy) PDFRajendra LamsalNo ratings yet

- Summer Internship Project Report On: "Study On Model Dairy Plant"Document62 pagesSummer Internship Project Report On: "Study On Model Dairy Plant"Apoorva singh SengerNo ratings yet

- Procurement Statement of WorkDocument4 pagesProcurement Statement of WorkAryaan RevsNo ratings yet

- HOA - REG.0002 Articles of Incorporation Regular HOA PDFDocument5 pagesHOA - REG.0002 Articles of Incorporation Regular HOA PDFMelita LagumbayNo ratings yet

- Company Details 2.8Document3 pagesCompany Details 2.8Prakash KumarNo ratings yet

- Tourism in Jammu & Kashmir: Submitted By: Rajat Singh Submitted To: Prof.M Y KhanDocument8 pagesTourism in Jammu & Kashmir: Submitted By: Rajat Singh Submitted To: Prof.M Y KhanRAJAT SINGH MBA-2017No ratings yet

- Cbip Manual CapitalizationDocument2 pagesCbip Manual CapitalizationMahidhar Talapaneni100% (1)

- Ngos in PakistanDocument13 pagesNgos in Pakistanapi-339753830100% (1)

- Impact of Foreign Direct Investment On Indian EconomyDocument8 pagesImpact of Foreign Direct Investment On Indian Economysatyendra raiNo ratings yet

- Globalization Is Changing: Jude Brian Mordeno BSTM 401ADocument4 pagesGlobalization Is Changing: Jude Brian Mordeno BSTM 401AAnon MousNo ratings yet

- Lecture 5 - Competitive StrategyDocument17 pagesLecture 5 - Competitive StrategySachin kumarNo ratings yet

- E - Challan Government of Haryana E - Challan Government of HaryanaDocument1 pageE - Challan Government of Haryana E - Challan Government of HaryanaAmit KumarNo ratings yet

- Advantages and Problems of PrivatisationDocument4 pagesAdvantages and Problems of PrivatisationShahriar HasanNo ratings yet

- Philippine Bank vs. NLRC Case DigestDocument1 pagePhilippine Bank vs. NLRC Case Digestunbeatable38No ratings yet

- App ADocument37 pagesApp AadeepcdmaNo ratings yet

- Travel Green Guide 2009Document185 pagesTravel Green Guide 2009Yunran100% (1)

- The Impact of Globalisation On Technology in Developing CountryDocument5 pagesThe Impact of Globalisation On Technology in Developing CountryMinh Nguyên LêNo ratings yet

- Category Management GTDocument2 pagesCategory Management GTArun MaithaniNo ratings yet

- P3 - Basic Revision Q & A Selected TopicsDocument96 pagesP3 - Basic Revision Q & A Selected TopicsZin Tha100% (1)

- Security Seal 4-MALAYSIADocument124 pagesSecurity Seal 4-MALAYSIAEkin Elias100% (1)

- Latin America Confronts The Great Depression: Brazil and ArgentinaDocument24 pagesLatin America Confronts The Great Depression: Brazil and ArgentinaEnriqueNo ratings yet

- Microeconomics Test 1Document14 pagesMicroeconomics Test 1Hunter Brown100% (1)

- Beston Global AssignmentDocument13 pagesBeston Global AssignmentTayyaba TariqNo ratings yet