Professional Documents

Culture Documents

Oldak V Credit Bureau of Napa County Inc Chase Receivables FDCPA Complaint PDF

Uploaded by

ghostgripOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Oldak V Credit Bureau of Napa County Inc Chase Receivables FDCPA Complaint PDF

Uploaded by

ghostgripCopyright:

Available Formats

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 1 of 16 PageID #: 1

UNITED STATES DISTRICT COURT

EASTERN DISTRICT OF NEW YORK

'

BO RUCH OLD AK on behalf of himself and

all other similarly situated consumers

CV

14

295

Plaintif,

SCA

N

LO

N

, M.J.

-against-

FILED

IN CLERK'S OFFICE

CREDIT BUREAU OF NAPA COUNTY, INC.

D/B/ A CHASE RECEIVABLES

U.S. DISTRICT COURT E.D.N.Y.

*

MAY oa 2014 *

Defendant.

LONG i$bANC OFFICE

CLASS ACTION COMPLAINT

Introduction

1. Plaintiff Boruch Oldak seeks redress fr the illegal practices of Credit Bureau Of Napa

County, Inc. d/b/a Chase Receivables in which it unlawfully engaged in the collection of

consumer debts in violation of the Fair Debt Collection Practices Act, 15 U.S.C. 1692,

et seq. ("FDCP A").

Parties

2. Plaintiff is a citizen of the State of New York who resides within this District.

3. Plaintiff is a consumer as that term is defned by Section 15 U.S.C. 1692(a)(3) of the

FDCPA.

4. The alleged debt that Defendant sought to collect fom the Plaintiff involves a consumer

debt.

5. Upon information and belief, Defendant's principal place of business is located within

Sonoma, Califrnia.

-1-

0

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 2 of 16 PageID #: 2

6. Defendant is regularly engaged, for proft, in the collection of debts allegedly owed by

consumers.

7. Defndant is a "debt collector" as that term is defined by the FDCPA, 15 U.S.C.

1692(a)(6).

Jurisdiction and Venue

8. This Court has fderal question jurisdiction under 15 U.S.C. !692k(d) and 28 U.S.C.

1331.

9. Venue 1s proper m this district pursuant to 28 U.S.C. 139l(b), as the acts and

transactions that give rise to this action occurred, in substantial part, within this district.

Allegations Particular to Boruch Oldak

10. Upon information and belief, on a date better known by Defendant, Defendant began to

attempt to collect an alleged consumer debt from the Plaintiff.

11. On or about November 27, 2013, Defendant sent the Plaintif collection letters seeking

to collect a balance allegedly incurred for personal purposes.

12. The said letters stated: "We apologize that a possible hardship or pitfll may have

prevented you from satisfing your obligation. It is with this in mind that we would like

to offer you a limited time offer opportunity to satisfy your outstanding debt."

13. The letters then went on to provide various limited time settlement offers with due dates

upon which those offers where required to be paid by.

14. Defndant stated the above language in order to create a sense of urgency in Plaintiff

and make him think that he was under a non-existent deadline.

15. Defndant's letters are misleading and deceptive in that its statements: "It is with this in

mind that we would like to offer you a limited time offer opportunity to satisf your

-2-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 3 of 16 PageID #: 3

outstanding debt," among other such statements, imply a time deadline.

16. Upon information and belief, there were no time deadlines; rather, Defndant made

these statements solely to create a flse sense of urgency by the Plaintiff.

17. At all times herein, Defendant's written communications to Plaintiff were flse,

deceptive, and misleading.

18. Defendant violated 15 U.S.C. 1692d of the FDCPA by harassing Plaintiff m

connection with the collection of an alleged debt.

19. Defndant violated 15 U.S.C. 1692e and 1692e(l 0) of the FDCPA by using false,

deceptive, or misleading representations or means in connection with the collection of a

debt.

20. Defendant violated 15 U. S.C. 1692f of the FDCPA by using unfir or unconscionable

means to collect or attempt to collect a debt.

21. Section l 692d provides that a debt collector "may not engage in any conduct the natural

consequence of which is to harass, oppress, or abuse any person in connection with the

collection of a debt." See 15 U.S.C. I 692d. The proper legal standard under ! 692d

takes into consideration the fact that "[ w ]hether a consumer is more or less likely to be

harassed, oppressed, or abused by certain debt collection practices does not relate solely

to the consumer's relative sophistication." Courts instead use a standard analogous to the

least sophisticated consumer standard, which requires "claims under l 692d should be

viewed from the perspective of a consumer whose circumstances makes him relatively

more susceptible to harassment, oppression, or abuse."

22. Sections l 692e and l 692e(l 0) prohibit the use of any flse representation or deceptive

means to collect or attempt to collect any debt or to obtain infrmation concering a

-3-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 4 of 16 PageID #: 4

consumer. This general prohibition is intended to cover the deceptive collection acts and

practices that do not ft the specific prohibitions given in the subsections of this section,

as it would be impossible fr Congress to foresee and list every type of deceptive

collection misbehavior.

23. In the context of settlement letters, many courts have held that settlement letters can be a

positive fr both debt collectors and consumers. Nevertheless, in keeping with the

statutory requirements, collection agencies may not be deceitfl in the presentation of

the settlement ofer.

1

In Goswami, the Fifh Circuit was presented with a letter fom the

defendant that stated that it could offer the plaintif a 30% discount as long as it

responded within the next 30 days, even though the defndant had authority to ofer the

discount for longer than the 30 days. Id. In reversing the district court's grant of

summary judgment in fvor of the defendant, the Fifth Circuit held that:

While we agree it is important to permit collection agencies

to offer settlement, that policy consideration does not remove

collection agencies' obligation under the FDCP A to deal in a

non- deceitfl maner. A collection agency may offer a

settlement; however, it may not be deceitful in the presentation

of that settlement ofer, as [defndant] was in this case ... [The

defndant's] deception is actionable under the FDCPA and is

not excused because it is part of a debt collector's settlement

ofer.

Id. at 495-95. Referring to the actual letter at issue in Goswami, the court determined

that fr the fllowing reasons, the defendant's letter was a violation of the FDCP A:

The statement in the collection letter is untrue and makes it

appear that [the original creditor's] offer of a 30% discount was

a one-time, take-it-or-leave-it ofer that would expire in thirty

days. The obvious purpose of the statement was to push [the

1 Campuzano-Burgos v. Midland Credit Management. Inc., 550 F.3d 294, 299 (3d Cir. 2008) citing Goswami v.

Am. Collections Enter., 377 F.3d 488, 496 (5th Cir.2004)).

-4-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 5 of 16 PageID #: 5

plaintiff] to make a rapid payment to take advantage of the

purported limited time offer.

24. Defndant's use of illusory and arbitrary deadlines were meant to deceive the Plaintif to

make a prompt payment.

25. Defndant claimed that its settlement ofers in the said letters were strictly contingent

upon payment being received in the amounts stated in the respective letters by the due

dates stated, but upon information and belief, Defendant's time deadlines are artifcial.

The Defendant intended to give the false impression that if the consumer does not pay

the settlement ofer by the deadline, then the consumer will have no frther chance to

settle their debt fr less than the full amount.

26. Upon infrmation and belief, the original creditor did not put any limitations on the time

within which Plaintiff could accept an ofer.

See. DeGeorge v. Fin. Recover Servs., 2012 U.S. Dist. LEXIS 140966, 19-20 (E.D. Pa.

Sept. 27, 2012) (Stating "while the safe harbor language may ensure that the consumer

will not perceive these letters as one-time ofers, plaintiff alleges that the 35-day

deadlines in the letters did not exist at all. Therefre, whether the least sophisticated

consumer would perceive the [collection] letters as "one-time, take-it-or-leave-it" offers

or as potentially renewable ofers, each letter still contained flse and misleading

information because, as alleged by plaintiff, no deadline existed at all.)

27. The inclusion of a deadline in a settlement ofer itself does not violate the FDCP A.

However, in order to act consistently with 1692e, the debt collector "may not be

deceitfl in the presentation of the settlement offer. "2

28. Where a debt collection letter contains an ofer to settle by a specified date and makes it

2 Campuzano, 550 F.3d at 299 (quoting Goswami v. Am. Collections Enter., 377 F.3d 488, 496 (5th Cir. 2004)).

-5-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 6 of 16 PageID #: 6

appear therein that such ofer is a "one-time, take-it-or-leave-it offer", when in fct the

debt holder is prepared to make other offers afer the expiration date, the letter contains a

false statement in violation of the FDCP A. 3 A letter that leaves a consumer with such a

false impression violates 1692e because an unsophisticated consumer may think that if

they don't pay by the deadline, they will have no further chance to settle their debt for

less than the fll amount.

See. DeGeorge v. Fin. Recovery Servs., 2012 U.S. Dist. LEXIS 140966, 19 (E.D. Pa.

Sept. 27, 2012) (The court stated "In Evory ... [T]he Seventh Circuit held that if a

collection letter contained the language, "We are not obligated to renew this offer", an

unsophisticated consumer would not be misled because "even the unsophisticated

consumer will realize that there is a renewal possibility but that it is not assured ... The

safe harbor language in Evory did not authorize debt collectors to present deadlines in

collection letters that were in fact non-existent. Therefre, I conclude that plaintiffs

allegations that the collection letters included flse deadlines -even if those deadlines

were presented as renewable offers -is sufficient to state a claim under 1692e" The

court noted "Moreover, I conclude that misrepresentations concering deadlines in a

collection letter constitute material misrepresentations. Therefre, plaintiff has stated a

claim under l 692e even if non-material, false representations do not violate the

FDCPA.")

29. Section 1692f of the FDCPA provides that a debt collector may not use "unfair or

unconscionable means to collect or attempt to collect any debt." 15 U .S.C. l 692f.

Section 1692f then goes on to enumerate eight particular practices which are unfair or

3 Dupuy v. Weitman. Weinberg & Reis Co., 442 F.Supp.2d 822. 828 (.D.Cal. 2006); [19] see also Goswami, 377

F.3d at 496.

-6-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 7 of 16 PageID #: 7

unconscionable. However, 1692f is not limited by this list of eight practices, and

prohibits all unfir or unconscionable conduct on the part of a debt collector. Reed v.

Pinnacle Credit Services, LLC, 2009 WL 2461852 (E.D. Pa. Aug. 11, 2009.) ("The list

of 1692f violations found in the subsections are non-exhaustive") (Interal citations

and quotations omitted).

30. A claim under FDCPA provision prohibiting debt collector from "using unfir or

unconscionable means to collect or attempt to collect any debt" should be viewed

through lens of the "least-sophisticated consumer."

31. The clear intention of the said letters is to pressure the Plaintif to come up with money

befre the illusory misleading deadlines run out.

32. Defendant, as a matter of patter and practice, mails letters, or causes the mailing of

letters, to debtors using language substantially similar or materially identical to that

utilized by Defendant in mailing the above-cited letters to the Plaintif.

33. The letters the Defendant mails, or causes to be mailed, are produced by Defndant's

concerted efforts and integrated or shared technologies including computer programs,

mailing houses, and electronic databases.

34. The said letters are standardized form letter.

35. Defndant's November 27, 2013 letters are in violation of 15 U.S.C. 1692d, 1692e,

1692e(l 0), and l 692f for engaging in deceptive, misleading, and unfir practices.

36. The said letters also stated in pertinent part as follows: "Pay via a Credit Card ($14.95

Chase Receivables processing fee where applicable.") and "Electronic Check Payments

can be done over the phone ($9.95 Chase Receivables processing fee where

applicable.")

-7-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 8 of 16 PageID #: 8

37. The notification and collection of the said processing fees is unlawful.

See e.g. Shami v. National Enter. Svs., 2010 WL 3824151 (E.D.N.Y. Sept.23, 2010)

(The court concluded that the complaint sufficiently pleaded a cause of action for

violation of 1692f(l) and 1692e(2). The complaint involved a collection letter

including the language "you can now pay by automated phone system . . . or on the

interet. Transaction fes will be charged if you use the automated phone system or the

interet to make payment on this account. You are not required to use the automated

phone system or the interet to make payment on this account."), McCutcheon v.

Finkelstein. Kern. Steinberg & Cunningham, 2012 WL 266893 (M.D. Tenn. Jan.30,

2012). (The plaintiff stated a viable FDCPA claim by alleging that the defendant

collected or attempted to collect a $4.24 payment processing fee not expressly

authorized by the agreement creating the debt.), Quinteros v. MB! Assocs., 2014 U.S.

Dist. LEXIS 27735 (E.D.N.Y. Feb. 27, 2014). (FDCPA violated by Collector's Fee to

process payments by credit card, or checks over phone.)

38. Defndant's processing fee demand is in violation of 15 U.S.C. 1692e(2) and

1692f(l ) for engaging in deceptive practices, by making a false representation that it was

entitled to receive compensation fr payment by credit card, or by collecting an amount

that was not authorized by contract or permitted by law.

AS AND FOR A FIRST CAUSE OF ACTION

Volations of the Fair Debt Collection Practices Act brought by Plaintion behal of himsel and the

members of a class, as against the Defendant.

39. Plaintiff re-states, re-alleges, and incorporates herein by reference, paragraphs one (1)

through thirty eight (38) as if set frth fully in this cause of action.

-8-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 9 of 16 PageID #: 9

40. This cause of action is brought on behalf of Plaintiff and the members of a class and a

subclass.

41. The class consists of all persons whom Defendant's records reflect resided in the State of

New York and who were sent a collection letter in substantially the same form letters as

the letters sent to the Plaintiff on or about November 27, 2013; and (a) the collection

letters were sent to a consumer seeking payment of a personal debt purportedly owed to

Montgomery Wards and Amerimark; and (b) the collection letters were not returned by

the postal service as undelivered; ( c) and the Plaintiff asserts that the letters contained

violations of 15 U.S.C. 1692d, 1692e 1692e(l 0), and 1692f for engaging in

deceptive, misleading, and unfair practices.

42. The subclass consists of all persons whom Defndant's records reflect resided in the

State of New York and who were sent a collection letter bearing the Defndant's

letterhead in substantially the same form as the letter sent to the Plaintiff on or about

November 27, 2013, sent within one year prior to the date of the within complaint; (a)

the collection letter was sent to a consumer seeking payment of a consumer debt

purportedly owed to Montgomery Wards and Amerimark; and (b) the collection letter

was not retured by the postal service as undelivered; ( c) and the Plaintiff asserts that

the letter contained violations of 15 U.S.C. 1692e(2) and 1692f(l ) for making a false

representation that it was entitled to receive compensation for payment by credit card.

43. Pursuant to Federal Rule of Civil Procedure 23, a class action is appropriate and

preferable in this case because:

(a) Based on the fact that form collection letters are at the heart of this litigation, the

class is so numerous that joinder of all members is impracticable.

-9-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 10 of 16 PageID #: 10

(b) There are questions of law and fact common to the class and these questions

predominate over any question(s) affecting only individual class members. The

principal question presented by this claim is whether the Defndant violated the

FDCPA.

( c) The only individual issue involves the identification of the consumers who

received such collection letters, (i.e. the class members). This is purely a matter

capable of ministerial determination from the records of the Defndant.

( d) The claims of the Plaintif are typical of those of the class members. All of the

respective class claims are based on substantially similar facts and legal theories.

(e) The Plaintiff will firly and adequately represent the class members' interests.

The Plaintif has retained counsel experienced in bringing class actions and

collection abuse claims. The Plaintiffs interests are consistent with those of the

members of the class.

44. A class action is superior for the fair and efcient adjudication of the class members'

claims. Congress specifcally envisions class actions as a principal means of enforcing

the FDCPA. 15 U.S.C. 1692(k). The members of the class are generally

unsophisticated individuals, whose rights will not be vindicated in the absence of a class

action. Prosecution of separate actions by individual members of the classes would

create the risk of inconsistent or varying adjudications resulting in the establishment of

inconsistent or varying standards fr the parties and would not be in the interest of

judicial economy.

45. If the fcts are discovered to be appropriate, the Plaintiff will seek to certify a class

pursuant to Rule 23(b)(3) of the Federal Rules of Civil Procedure.

-10-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 11 of 16 PageID #: 11

46. Collection attempts, such as those made by the Defendant are to be evaluated by the

objective standard of the hypothetical "least sophisticated consumer."

Volations of the Fair Debt Collection Practices Act

4 7. The Defendant's actions as set forth above in the within complaint violates the Fair Debt

Collection Practices Act.

48. Because the Defendant violated the Fair Debt Collection Practices Act, the Plaintif and

the members of the class are entitled to damages in accordance with the Fair Debt

Collection Practices Act.

WHEREFORE, Plaintiff, respectfully requests preliminary and permanent injunctive relief, and that

this Court enter judgment in his favor and against the Defndant and award damages as fllows:

(a) Statutory and actual damages provided under the FDCPA, 15 U.S.C. 1692(k);

And

(b) Attorey fees, litigation expenses and costs incurred in bringing this action; and

( c) Any other relief that this Court deems appropriate and just under the

circumstances.

-11-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 12 of 16 PageID #: 12

Dated: Cedarhurst, New York

May 6, 201

J. Fishbein, P.C. (AF-9508)

Attorey At Law

^llu1ncy 1hc 1a1n

483 Chestnut Street

Cedarhurst, New York 11516

Telephone (516) 791-4400

Facsimile (516) 791-4411

Plaintif requests trial by jury on all issues so triable.

-12-

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 13 of 16 PageID #: 13

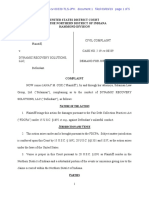

:EP-1Ct1 C!6:i123

PO !X .11:

CONCRC CA $(S4

|ll|KllIE ||`0\0|I`BI88'l`||I|8$

FEP3OAL& CONFllJENllAL

Adr:e: S.rViC .oq ues

#BWNFe <HROS216"1125

l!:ttffttttu!m |:l |fl1flu!ttlnt||.

S':RVCH Q1_Dli< 09483001!lY

AP! 01

5 W;:STM<NSTER "u

BROKLYN, v 1 '1&S'6

DmMRENABQ

A Prf.sionol Coll"tlon Agen

67-256-2510

Novornbr 27, 213

snd pymrs/Crrpnden To:

ChaGen 09483001-MV OM

Ch M A1ceivablea

12.7 B:ondwy

SonomCA 9476

of f'1d1in Yr AC. ..oJnt.

' , ' .. ..' ... """

. _,_ ... ' _.

Ofre Hours:

=~

,

......

.

"" - ,., ..... , ' ". , ,, .... , ,

CREDITOR: AMERft'ARK ^ D,.S

CRBITOR ACCT#: 411001(259010 04A

DR LEONARD'S * OMS PLASE OA,,BETEEN

Mordy-Frlday 8:00am t< 6:30m PST

Satrday 7m 1 2:3QmPST

Dear SOPUOLAK,

ACCT: 094030

\

AMOUNT0UE.297 83

This 1&1tar I; t inform,ouof a speclal oNerto resolve your o.eaeoacoJnt wlfh rtllent We apologize tkat R possible hatds'ip

or pfall may hav" prsventd you frm satostin1 your oll1gat1on t 1$ wilh lh1 in mind that we woul lik< t olr you a limilld limo

oner opor[n|gIl sam[your oulmnding <bt We are preon1ing four cpuons that Will enabie you Il avood {nrcollection

activity bing tken againtl you.

Pleas8Iteat iou may bavesddionl oulstnd1ng account that do not qca\Ior\|ioer.

OPTION 1: A ootlomnt of OFF of your current bzlance, 8YD ONLY PY1M, in OE PAYMENTthat m"st be

reeive 6th" 00|t8on or before @Q 15t. 213.

OPION 2: A "ttlomn1 of 40 Off of your :ctsatba|ance, 8OYD OLY PY51W in ONE PAYET lhat must be

recei< ir!biot|:eon or before D@@

M$\

OPTION s A W1tlemon1 oI3OF0I you1 current balznoe,BOYD QNLYMNbTQPAYMTOF$10.24EC the

tt pymeot muot Ile re..1ved on or belore DQ@0 1W, Q|} and l second b JNUMY 1294.

OPTON 4 Monllly pymenl Ian on M balance

IJ are htere:tF lr tking advantage of ore 0Ithsso ter1ifio oppartn1t1as or ft you havo onyqukons,youMUSTcontaot cur

as soon possible at 87/255-2510 (toll leo). Whenyou all, ]'e<W let iour "P"n1at1ve know that you Haveracall

the CHASLReoeivablas Opl1on |e0crand tell us whether you would '|ket tke a0vnVgeof the SEIT,EMEWTOPION or the

|AYMFNTQto.

I= we do not hasr from you, we are frce to ass1e lat l'OU do no! |n!ed Ioreo'vycut obl!gat101 on a volontary bsis a1d we

w11 recmmefd tat our cfenf procea wrT frtercollotiin ec(\)q

SIncee\,

49

CHaseRehrables

1 Sed U& a checkMakall chco pyable te AMERIMARK -OMS

and senc lo the paymont addroa abovo.

2. Pat via a Crooil Card ($15Chse Ruco|,Ioa prooeslng '00

whereuppIab|o}

3 Py via Waern l.lion

4. Fay via te web VMW.ohsre.c'mlpaym&lhod.php PIN# 55576.'

5. Carl Is at 1ha n1mt.r !huwn above and one of our represan1atrvos

.iii be happy t assist yoo!

S. Eleclron( Check Paymnls can b. doni ovar the phooe ($9.95

Chase Rece|tab|procesing fee where appl1cabl}

, $l'tlng lis iptlon cnabIe0y0uto mer payment :4 hoursadty,

7 da weok and ;ou do not heed to pk t a genmIve.

TIS I: AN ATPT m COltfCT A DEB, AND ArY INFOAMATOfl (TAINED WILL BE USE FOi IHAl PPPE

TH IS OOMMUNICATON IS FROM A COLECTiON AO ENCY.

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 14 of 16 PageID #: 14

Nc 'trk O|t,0o;anmentof Consumr Afairi licene numbBr 101682

11A credir may GU& you t culleI on thi debt. Even i tbs creitr win5 and obttn! a JUdgmft ngainat ou, :t;t and

federl lw. prevent cQrtaln 'ex&mpf mn6/S 6ombeing tken t satqtht dgmont lrcotne thatyou recelv& from thE

'olfo\ing sources my be 'e)empt frm collftion

1. Supplemntf soYrt |ncomo.(6Sl),

2. Scolal securlq;

3. Pblic asolatance(welfare};

I Spousal supporl. mintenane (a|'mony)or chil support;

5. Unemplymonl oonafls:

a. D|>b|||qbenofl,

7. Wrk0|6'cpneuLonbnf.,

8. Fu|kot prJat pensins;

. Vetirans' bnaf. and

10. Federal student loan. foderal student grant, and featt! \Jork study funds."

AGCT f

Q94S3rffl '11001C325901C C4A

?F!NCIAL

291. 83 2$7.$3

T:t.l . . . T . > :97' e3

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 15 of 16 PageID #: 15

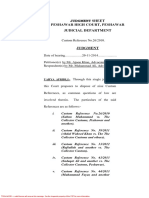

OEFi1011 C.l311257

PO OX 15

CONCORC CA !4

MfB fBI|'BM'WlWll|'lI'll

PESONAL & CCNF!DE' tl

Ad<resi Selce Req1.m:to

#BlZF #HR46"41211"57H

l1i1ll111ll11l1l1tlnltf1lltl111lu11llJ.,l,,l11lnill,_r!,I

tRUCJ D O!.DAK og401s.5-MY

5 WESHtN!STER RO <PT D1

B"OOKL YN. NY 1'2lSS18

CNMW

A P"1inal Collootion Ag1oy

e726B .510

November2T1 201a

Sn pymnNom spmTo:

ChHl 094181 SMY OM

ChHe R"!vable

1247 B"dwoy

Sonoma, CA S64N

, ,, . . , .... ,, ,, , , . ,,,, , ,,, '""" . , ... ......... ' " .............

- . ""' "' . .. . . . ' ' "" ... . .. , . ' , ... . '"""'"'

Ofue Handing Your Acrunt

OH7t1

PL!S IFE

Monday-Fmayi

OOam to620

mPST

Saturday 7am to 2:30p< PST

Dor SUCHD OLDAK,

GREDlTDP MONTDOMF3YWARDS OMS

CR!DITOR ACCT#: <10304549290

GRADPOINTE - DMS

ACC'09461<15

AMOUNT DUE: 340.13

Thls I0ris t Tkrm\'OY of a 8ial0I|crIoresolve ycuroverdue accunt with our client. Weapo|qIzem0Ia passiblQ htdship

crptlal; n-y have proven la you kmtr\your ItonIlwtl th|sInmltnat\wm/|mb e yo a ml

ofer opportunity to .1 .. ty yout oul1andng debt We are presanling folJr options lhat wi!! onabl you to avoid further clle:ion

ac0wqcingtkon againt ycu.

Flose nqte thatyoumy have addllinf outstanding aooul that do not quaIfr this ofot.

OPTIO : AsetofWF< your imnt balhoe, 6OY OLYPAY#170.D7 in OE FATTtat mus! e

receivG m lhlzoHooon or|oregJN @

0P!ON 2: A sett!omnl of QM of your urrent lalM. SY [Y FA$0.M in OE FAYMOTIb6tmstbe

rseoived in Ihsofe onor befre @OBER81e[2013.

OP!ON 3: A ttloment fWOFof )our cur(ntbnlonoe, 8OYOLYMMDFOETOF$110.GH !he

Irs!pymnt mat be reoetV on or b"be g;$,@l s th, oeoonr by gU 1M_204.

OPT!ON 4. vo-|aDaymtitp|anoo I|ool! nc

!f you am ruImIeiotking adva.,lage of one ot lh !Grf!fo opportvnilias or if yoq have ny queston;, yoy MUST cont.ct out

o!ioe as son a pooib!e at 377-256-251 o (IcI|Irn} Whan you ca|l,p!as lat your rerasantat1ve !mo mat you have reeied

l OReeIvblOptioll Ltr ond te!I iS wh"her you wol lik to tke advan1age o|theSETTLEME\TOPTION or the

PAMENTOpUon

If e do ot her fm you we aro fre k as&ume Ih8tYQl do not intend t rebyour obligatfh on a voh.ntaty baSI$ and vie

\'lil re1:orrend that 0rc|clceedwth furlher co1sct|oIiacliv.

Sfnc&re!y,

0hH8Il

Yhl I 1 pm.

1. Sen us a aeo-Mke al chock payable fo MOTOMFPY

WNDS UYS and sond k N0 payman! ddraes ae.

2. Fsy vio a OtitCard. (514.95 Ch Racelvable proesing fo

.are applicabIe}

3. Pay vi Wetn Unin

4. Py vi !e Wl .woo)e, pFW# :7" .

5. Gal! us a1 te numer shown above and one of our rerosenta1es

will be hnppy t assist youi

s 8ootronio CInck Paymnru can be 0o ovar lhe phcne ($9.85

ChsseReeivables proc . slng ewhe1pplteable)

8e ez)ll opuon enablesyou :maka a povment 24 hours a oay,

7 da v'ee . ap ycu do not n IQ t a rentative.

THl5 lS lN ATbWFTO COLLECTA DEl, AND ANY INFORMATION OSTlNED WI,, B USED FOR TAT PURPOSE

TIS COMMLt>llCATION I6 FHOYA COIlcCTONA3NDY.

Case 1:14-cv-02950-FB-VMS Document 1 Filed 05/08/14 Page 16 of 16 PageID #: 16

Ngw York Clq0orwen:ol Consum Ahirs licenco -ea:1 Ote2

''A o:edormy sue e1 collect or1 thls dabt. Een If the edlkr win$ ant: obtin: a jdqmeuIag|na:yoil. stt srd

feera law. prvnt crt|n'mg

monsya fom bairig takai 10 eat.f) tat Judgmunt lnoms that you reoeivefom to

ftlO\ng $UrC05 my b 'Colla1ion;

1. Suppte.1el m|lqincomo. (6SI),

2 Sooi!I 8vt'I/,

3. Pubrw ailance (we0ro);

4, Spousar euprort, main1"nance {alimny} orchild upport:

5. UnelcymenIbanafit;

e. Disabtl|qboneri;

7, Wlrkers' compen9tion benett:

a. Publi or p1lvate pea|chs

9 Ve'ran.1 benefit: and

10. Fro|ta4eo!loan& federel sludent grart, and |ederJVfOrk study futida 1

C9'f!S:5

PFINIPAt

JLO.l 340. !3

Tota . . . - -> 340l.

You might also like

- Weiss V Credit Bureau of Napa County Inc Chase Receivables FDCPA Complaint PDFDocument14 pagesWeiss V Credit Bureau of Napa County Inc Chase Receivables FDCPA Complaint PDFghostgripNo ratings yet

- Class Action ComplaintDocument18 pagesClass Action ComplaintSamuel RichardsonNo ratings yet

- Nego DigestDocument6 pagesNego DigestLau NunezNo ratings yet

- 2016-05-31 11th Cir Holds Failure To Disclose Disputes Must Be in Writing Violates FDCPADocument3 pages2016-05-31 11th Cir Holds Failure To Disclose Disputes Must Be in Writing Violates FDCPAD. BushNo ratings yet

- 2017-04-12 2nd Cir Holds Payoff Statement Stating Amount Due May Include Estimated Fees Costs Violates FDCPADocument2 pages2017-04-12 2nd Cir Holds Payoff Statement Stating Amount Due May Include Estimated Fees Costs Violates FDCPAdbush1034No ratings yet

- Debtor Creditor Answer TemplateDocument3 pagesDebtor Creditor Answer TemplatecanunobiNo ratings yet

- Tan V MendezDocument12 pagesTan V MendezCastle CastellanoNo ratings yet

- United States Court of Appeals, Second Circuit.: No. 759. Docket 34693Document4 pagesUnited States Court of Appeals, Second Circuit.: No. 759. Docket 34693Scribd Government DocsNo ratings yet

- Template FDCPA SuiteDocument9 pagesTemplate FDCPA Suite:Ankh-Heru:El©®™100% (2)

- Elizabeth Brown, On Behalf of Herself and All Others Similarly Situated, Formerly Known As Elizabeth Schenck v. Card Service Center Cardholder Management Services, 464 F.3d 450, 3rd Cir. (2006)Document8 pagesElizabeth Brown, On Behalf of Herself and All Others Similarly Situated, Formerly Known As Elizabeth Schenck v. Card Service Center Cardholder Management Services, 464 F.3d 450, 3rd Cir. (2006)Scribd Government DocsNo ratings yet

- 06 Sycip, Jr. V Court of Appeals (G.R. No. 125059 - March 17, 2000)Document3 pages06 Sycip, Jr. V Court of Appeals (G.R. No. 125059 - March 17, 2000)teepeeNo ratings yet

- Lambert V RSB Equity Group FDCPA Complaint PDFDocument4 pagesLambert V RSB Equity Group FDCPA Complaint PDFghostgrip100% (2)

- Leos Investment Limited V Turyakira and Another (Civil Suit No 8 of 2020) 2022 UGHCLD 39 (3 March 2022)Document5 pagesLeos Investment Limited V Turyakira and Another (Civil Suit No 8 of 2020) 2022 UGHCLD 39 (3 March 2022)evasakankwatsa900No ratings yet

- Strict vs Liberal Construction of Bouncing Checks LawDocument3 pagesStrict vs Liberal Construction of Bouncing Checks Law01123813No ratings yet

- Joseph Szczurek v. Professional Management Inc, 3rd Cir. (2015)Document9 pagesJoseph Szczurek v. Professional Management Inc, 3rd Cir. (2015)Scribd Government DocsNo ratings yet

- Skolsky V Chase Receivables Inc FDCPA TCPA Napa Complaint PDFDocument6 pagesSkolsky V Chase Receivables Inc FDCPA TCPA Napa Complaint PDFghostgripNo ratings yet

- Shally FinalsDocument15 pagesShally Finalsmy yNo ratings yet

- Biolsi V Jefferson Capital Systems LLC FDCPA Complaint Debt CollectionDocument8 pagesBiolsi V Jefferson Capital Systems LLC FDCPA Complaint Debt CollectionghostgripNo ratings yet

- AZK Services LTD V Crane Bank LTD (Civil Suit No 334 of 2016) 2018 UGCommC 63 (7 August 2018)Document8 pagesAZK Services LTD V Crane Bank LTD (Civil Suit No 334 of 2016) 2018 UGCommC 63 (7 August 2018)bonifacentandaNo ratings yet

- Special CasesDocument7 pagesSpecial CasesJunelyn T. EllaNo ratings yet

- BOURFF Vs Ruben LublinDocument3 pagesBOURFF Vs Ruben Lublindbush2778No ratings yet

- Security Bank and Trust Co. Inc. v. CuencaDocument18 pagesSecurity Bank and Trust Co. Inc. v. CuencaShairaCamilleGarciaNo ratings yet

- Special CasesDocument34 pagesSpecial CasesJunelyn T. EllaNo ratings yet

- Oblicon Chapter2 DigestDocument57 pagesOblicon Chapter2 DigestEzekiel Japhet Cedillo EsguerraNo ratings yet

- Supreme Court Rules on Bounced Check CaseDocument3 pagesSupreme Court Rules on Bounced Check CaseLA AINo ratings yet

- 17 Condonation or RemissionDocument8 pages17 Condonation or RemissionJong PerrarenNo ratings yet

- Everett Houck v. Local Federal Savings and Loan, Inc., A Corporation, 996 F.2d 311, 10th Cir. (1993)Document7 pagesEverett Houck v. Local Federal Savings and Loan, Inc., A Corporation, 996 F.2d 311, 10th Cir. (1993)Scribd Government DocsNo ratings yet

- MWSS V DawayDocument4 pagesMWSS V Dawayab_munsayac3434No ratings yet

- Security Bank & Trust Company v. Cuenca, G.R. No. 138544, October 3, 2000Document19 pagesSecurity Bank & Trust Company v. Cuenca, G.R. No. 138544, October 3, 2000Tris LeeNo ratings yet

- SPOUSES POON v. PRIME SAVINGSDocument3 pagesSPOUSES POON v. PRIME SAVINGSJohn Ray PerezNo ratings yet

- Baptiste V NACS National Attorney Collection Services FDCPA ComplaintDocument13 pagesBaptiste V NACS National Attorney Collection Services FDCPA ComplaintghostgripNo ratings yet

- Roman Catholic Church of Malolos v. IAC land lease disputeDocument7 pagesRoman Catholic Church of Malolos v. IAC land lease disputeThameenah ArahNo ratings yet

- Civil Law - Secured Transactions - Simple Loan - Relation Between Bank and DepositorDocument10 pagesCivil Law - Secured Transactions - Simple Loan - Relation Between Bank and DepositorEmelie Marie DiezNo ratings yet

- Florentina A. Lozano, Petitioner, vs. The Honorable Antonio M. MARTINEZ, in His Capacity As Presiding Judge, Regional Trial Court, NationalDocument8 pagesFlorentina A. Lozano, Petitioner, vs. The Honorable Antonio M. MARTINEZ, in His Capacity As Presiding Judge, Regional Trial Court, NationalEdward Kenneth KungNo ratings yet

- Deposit Case DigestsDocument6 pagesDeposit Case DigestsKim EcarmaNo ratings yet

- Rosario vs. Co: Criminal Case for BP 22 Violation Not Suspended by SEC PetitionDocument2 pagesRosario vs. Co: Criminal Case for BP 22 Violation Not Suspended by SEC PetitionMaribeth G. TumaliuanNo ratings yet

- 118297-2000-Security Bank and Trust Co. Inc. v. CuencaDocument17 pages118297-2000-Security Bank and Trust Co. Inc. v. Cuencaaspiringlawyer1234No ratings yet

- Letter of Credit DigestDocument6 pagesLetter of Credit Digestjongreyes100% (1)

- 118297-2000-Security Bank and Trust Co. Inc. v. Cuenca-2Document17 pages118297-2000-Security Bank and Trust Co. Inc. v. Cuenca-2Saima RodeuNo ratings yet

- United States Court of Appeals, Ninth CircuitDocument7 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsNo ratings yet

- Marbucco Corp. v. Suffolk Construction, 165 F.3d 103, 1st Cir. (1999)Document5 pagesMarbucco Corp. v. Suffolk Construction, 165 F.3d 103, 1st Cir. (1999)Scribd Government DocsNo ratings yet

- Midland Credit Management, Inc. COMPLAINT - Doc - 0Document6 pagesMidland Credit Management, Inc. COMPLAINT - Doc - 0Samuel RichardsonNo ratings yet

- G.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsDocument3 pagesG.R. No. 109172 August 19, 1994 Trans-Pacific Industrial Supplies, Inc., Petitioner, The COURT OF APPEALS and ASSOCIATED BANK, RespondentsOnana100% (2)

- Pervez V Fair Collections and Outsourcing FDCPA TCPA Complaint Oak Park Place Apartments Debt CollectorDocument7 pagesPervez V Fair Collections and Outsourcing FDCPA TCPA Complaint Oak Park Place Apartments Debt CollectorghostgripNo ratings yet

- Opinion Langley v. Statebridge Company LLCDocument6 pagesOpinion Langley v. Statebridge Company LLCAdam DeutschNo ratings yet

- Nego Cases 15-17 (Digested)Document3 pagesNego Cases 15-17 (Digested)Supply ICPONo ratings yet

- NIL Cases 4Document34 pagesNIL Cases 4SpidermanNo ratings yet

- United States District Court For The Northern District of Indiana Hammond DivisionDocument5 pagesUnited States District Court For The Northern District of Indiana Hammond DivisionTamika BathilyNo ratings yet

- RCBC VS CaDocument2 pagesRCBC VS CaJan Rhoneil SantillanaNo ratings yet

- LBP Vs Monet's Export & MFG Corp 161865 J. Ynares-Santiago First Division DecisionDocument9 pagesLBP Vs Monet's Export & MFG Corp 161865 J. Ynares-Santiago First Division DecisionjonbelzaNo ratings yet

- Lund V Diversified Adjustment Service, Inc. (DAS) FDCPA ComplaintDocument5 pagesLund V Diversified Adjustment Service, Inc. (DAS) FDCPA ComplaintghostgripNo ratings yet

- Fair Debt Collection ICLEDocument24 pagesFair Debt Collection ICLEPWOODSLAWNo ratings yet

- DLSU COLLEGE OF LAW COMMERCIAL LAW REVIEWDocument3 pagesDLSU COLLEGE OF LAW COMMERCIAL LAW REVIEWArjuna Guevara75% (4)

- Doctrines of Strict Compliance and AutonDocument11 pagesDoctrines of Strict Compliance and AutonVaibhav GuptaNo ratings yet

- Foster Frosty Foods, Inc. v. Commissioner of Internal Revenue, 332 F.2d 230, 10th Cir. (1964)Document5 pagesFoster Frosty Foods, Inc. v. Commissioner of Internal Revenue, 332 F.2d 230, 10th Cir. (1964)Scribd Government DocsNo ratings yet

- Dino Vs Judal LootDocument3 pagesDino Vs Judal LootJohnNicoRamosLuceroNo ratings yet

- NATELCO v. CA contract reformation prescriptionDocument46 pagesNATELCO v. CA contract reformation prescriptionEugene Albert Olarte JavillonarNo ratings yet

- Oblicon Case Digest 8Document19 pagesOblicon Case Digest 8LAWRENCE EDWARD SORIANONo ratings yet

- Joe Six Pack VodDocument12 pagesJoe Six Pack VodTeresa ReneeNo ratings yet

- Unilever Hellman's Survey Questions - Hampton CreekDocument14 pagesUnilever Hellman's Survey Questions - Hampton CreekghostgripNo ratings yet

- Presqriber V Practice Fusion Motion To DismissDocument19 pagesPresqriber V Practice Fusion Motion To DismissghostgripNo ratings yet

- Urspringer V Pizza Luce ADA Discrimination ComplaintDocument10 pagesUrspringer V Pizza Luce ADA Discrimination ComplaintghostgripNo ratings yet

- Nicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerDocument3 pagesNicolai V NCO Financial Systems Inc Rule 68 Offer of Judgment Erstad RiemerghostgripNo ratings yet

- Presqriber LLC V Practice Fusion Inc Motion To DismissDocument2 pagesPresqriber LLC V Practice Fusion Inc Motion To DismissghostgripNo ratings yet

- Reflections of A Career Prosecutor James BackstromDocument6 pagesReflections of A Career Prosecutor James BackstromghostgripNo ratings yet

- Pratt V NCO Financial Systems FDCPA Complaint MinnesotaDocument6 pagesPratt V NCO Financial Systems FDCPA Complaint MinnesotaghostgripNo ratings yet

- Presqriber v. Medical Information Technology, Inc. D/b/a MeditechDocument7 pagesPresqriber v. Medical Information Technology, Inc. D/b/a MeditechPriorSmartNo ratings yet

- Mitchell V Chase Receivables Inc FDCPADocument5 pagesMitchell V Chase Receivables Inc FDCPAghostgripNo ratings yet

- Declaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoDocument13 pagesDeclaration of Ryu Yokoi Hellman's - Unilever V Hampton Creek Just MayoghostgripNo ratings yet

- Minneapolis Police Officers Federation Contract 2012Document121 pagesMinneapolis Police Officers Federation Contract 2012ghostgrip100% (1)

- Scheffler V NCO Financial Systems Inc FDCPA ComplaintDocument5 pagesScheffler V NCO Financial Systems Inc FDCPA ComplaintghostgripNo ratings yet

- Jay Clifton Kolls DPPA ExhibitsDocument14 pagesJay Clifton Kolls DPPA Exhibitsghostgrip100% (1)

- Acosta V Credit Bureau of Napa County Chase ReceivablesDocument13 pagesAcosta V Credit Bureau of Napa County Chase ReceivablesghostgripNo ratings yet

- Chase Receivables Collection Agency NoticeDocument2 pagesChase Receivables Collection Agency NoticeghostgripNo ratings yet

- Chase Receivables Chase Payment CenterDocument2 pagesChase Receivables Chase Payment CenterghostgripNo ratings yet

- Dobson Chase Receivables Robert ArleoDocument2 pagesDobson Chase Receivables Robert ArleoghostgripNo ratings yet

- Hellmans V Just Mayo - Declaration of Michael MazisDocument14 pagesHellmans V Just Mayo - Declaration of Michael MazisghostgripNo ratings yet

- Declaration of Michael J Wood Chase ReceivablesDocument3 pagesDeclaration of Michael J Wood Chase ReceivablesghostgripNo ratings yet

- Motion For Class Certification Acosta V Credit Bureau of Napa CountyDocument6 pagesMotion For Class Certification Acosta V Credit Bureau of Napa CountyghostgripNo ratings yet

- Mitchell V Chase Receivables Inc FDCPADocument5 pagesMitchell V Chase Receivables Inc FDCPAghostgripNo ratings yet

- Diabate V University of Minnesota ComplaintDocument9 pagesDiabate V University of Minnesota ComplaintghostgripNo ratings yet

- Grazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaDocument209 pagesGrazzini-Rucki V Knutson Amended Appendix ECF 17-2 13-CV-02477 Michelle MacDonald MinnesotaghostgripNo ratings yet

- Bien V Stellar Recovery Inc Complaint Caller ID SpoofingDocument15 pagesBien V Stellar Recovery Inc Complaint Caller ID SpoofingghostgripNo ratings yet

- Conopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintDocument17 pagesConopco Unilever Hellman's V Hampton Creek Just Mayo ComplaintghostgripNo ratings yet

- Grazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald MinnesotaDocument72 pagesGrazzini-Rucki V Knutson Amended Complaint ECF 17 13-CV-02477 Michelle MacDonald Minnesotaghostgrip100% (1)

- Grazzini-Rucki V Knutson Feb 18 Letter ECF 43-1 13-CV-02477 Michelle MacDonald MinnesotaDocument3 pagesGrazzini-Rucki V Knutson Feb 18 Letter ECF 43-1 13-CV-02477 Michelle MacDonald MinnesotaghostgripNo ratings yet

- Jay Clifton Kolls V City of Edina Withdrawal of CounselDocument1 pageJay Clifton Kolls V City of Edina Withdrawal of CounselghostgripNo ratings yet

- Grazzini-Rucki V Knutson Order ECF 44 13-CV-02477 Michelle MacDonald MinnesotaDocument34 pagesGrazzini-Rucki V Knutson Order ECF 44 13-CV-02477 Michelle MacDonald MinnesotaghostgripNo ratings yet

- Michelle MacDonald Complaint Criminal Contempt Dakota CountyDocument3 pagesMichelle MacDonald Complaint Criminal Contempt Dakota CountyghostgripNo ratings yet

- CBAA vs. Camp John Hay Development CorporationDocument3 pagesCBAA vs. Camp John Hay Development CorporationRossette AnaNo ratings yet

- CODE OF CIVIL PROCEDURE INDEXDocument7 pagesCODE OF CIVIL PROCEDURE INDEXimachieverNo ratings yet

- Civil Procedure Code (Act 5 of 1908)Document242 pagesCivil Procedure Code (Act 5 of 1908)nups50% (2)

- Roberts vs. LeonidasDocument4 pagesRoberts vs. LeonidasJoana Arilyn CastroNo ratings yet

- Sps. de La Cruz vs. Sps. CapcoDocument2 pagesSps. de La Cruz vs. Sps. CapcoSarah GantoNo ratings yet

- Lico v. Comelec, 771 Scra 596 (2015)Document5 pagesLico v. Comelec, 771 Scra 596 (2015)Ralph LorenzoNo ratings yet

- Arbitration March 2010Document211 pagesArbitration March 2010Muhammad IqbalNo ratings yet

- Fredco Manufacturing vs. Harvard UniversityDocument2 pagesFredco Manufacturing vs. Harvard UniversityLizzette Dela PenaNo ratings yet

- CIVIL PROCEDURE CODE REVIEW AND REVISIONDocument13 pagesCIVIL PROCEDURE CODE REVIEW AND REVISIONSudhanshuNo ratings yet

- Akbayan-Youth v. ComelecDocument2 pagesAkbayan-Youth v. ComelecRaymond Roque100% (1)

- Remedial Law Transcription - BrondialDocument152 pagesRemedial Law Transcription - BrondialFritzTarronas100% (2)

- Record On AppealDocument11 pagesRecord On Appealacie600No ratings yet

- Supreme Court rules on extending benefits of earlier judgmentDocument13 pagesSupreme Court rules on extending benefits of earlier judgmentBhawna PalNo ratings yet

- Adverse PossessionDocument3 pagesAdverse PossessionKarofio 'Seijuro' MuriithiNo ratings yet

- Marcos II v. CA (1997)Document3 pagesMarcos II v. CA (1997)Ice ElorchaNo ratings yet

- Republic of The Philippines v. Maria Lourdes P. A. Sereno, G.R. No. 237428 FactsDocument7 pagesRepublic of The Philippines v. Maria Lourdes P. A. Sereno, G.R. No. 237428 FactsDennis Aran Tupaz AbrilNo ratings yet

- Peshawar High Court judgment on customs references involving vehicle confiscationDocument39 pagesPeshawar High Court judgment on customs references involving vehicle confiscationA8nanbaigNo ratings yet

- Vette Industrial Sales Vs ChengDocument3 pagesVette Industrial Sales Vs ChengAllenMarkLuperaNo ratings yet

- Understanding Evidence RulesDocument117 pagesUnderstanding Evidence Rulesroa yuson100% (2)

- Jardine Manila Finance vs. CA Full CaseDocument5 pagesJardine Manila Finance vs. CA Full CaseanalynNo ratings yet

- 12 de Castro V TanDocument2 pages12 de Castro V TanRoseanne MateoNo ratings yet

- Res-000110 HTMLDocument3 pagesRes-000110 HTMLMalibog AkoNo ratings yet

- TN Basic Service RulesDocument30 pagesTN Basic Service RulesKrishna MoorthyNo ratings yet

- Mushtaq Anjum Amendment 1Document4 pagesMushtaq Anjum Amendment 1muhammad_awan_49No ratings yet

- Kaltim Vs KPC IcsidDocument60 pagesKaltim Vs KPC IcsidAgung CahyonoNo ratings yet

- Dr. Omkar Nath SirDocument12 pagesDr. Omkar Nath SirS RAVI RANJANNo ratings yet

- United States Court of Appeals, Third CircuitDocument5 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Muhammad Masroor Zaman,: No. & Date EvenDocument3 pagesMuhammad Masroor Zaman,: No. & Date EvenasifmalikNo ratings yet

- Ongsuco vs. MalonesDocument10 pagesOngsuco vs. MalonesAngelo LopezNo ratings yet

- Floreza vs. EvangelistaDocument3 pagesFloreza vs. EvangelistaMj BrionesNo ratings yet