Professional Documents

Culture Documents

Goldfixing Timeline PDF

Uploaded by

Ovidiu Toma0 ratings0% found this document useful (0 votes)

48 views6 pages1660 1661 The East India Company secured exclusive trading rights to the east. In next 45 years they shipped almost 500,000 t.oz / 15. M.t from London to India. 1700 1696 / 7 The Great Recoinage in England shifted the balance of coins in circulation from silver to gold, by over-valuing gold.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1660 1661 The East India Company secured exclusive trading rights to the east. In next 45 years they shipped almost 500,000 t.oz / 15. M.t from London to India. 1700 1696 / 7 The Great Recoinage in England shifted the balance of coins in circulation from silver to gold, by over-valuing gold.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

48 views6 pagesGoldfixing Timeline PDF

Uploaded by

Ovidiu Toma1660 1661 The East India Company secured exclusive trading rights to the east. In next 45 years they shipped almost 500,000 t.oz / 15. M.t from London to India. 1700 1696 / 7 The Great Recoinage in England shifted the balance of coins in circulation from silver to gold, by over-valuing gold.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

London Gold Market: 1660-2014

Gold price: 4.05 per t.oz fine. 1660

1661 The East India Company secured exclusive

trading rights to the east. In next 45 years

they shipped almost 500,000 t.oz/15.5 m.t

from London to India.

The guinea, named after Guinea on Africa's

'gold coast', was first struck.

1663

1671 Moses Mocatta set up in London, founding

the firm that later became Mocatta &

Goldsmid, the oldest members of the market.

Nine generations of the family worked in the

bullion market. Mocatta first sent gold to

India via the East India Company in 1676.

Bank of England founded. 1674

Gold price: 4.35 per t.oz fine. 1700

1696/7 The Great Recoinage in England shifted the

balance of coins in circulation from silver to

gold, by over-valuing gold, thus paving the

way to an informal gold standard.

1702 Gold rush in Brazil led to opening of mint in

Rio de Janeiro making 'moedas de ouro',

most of which came to London over next sixty

years for reminting into guineas.

Sir Isaac Newton, as Master of the Mint, set

the historic gold price of 4.25 per troy ounce

fine (3.89 per standard ounce of 916 fine in

which guinea was minted). The price

effectively lasted two hundred years, placing

Britain on an unofficial gold standard.

The Bank opened its own Bullion Warehouse,

which became the crossroads for precious

metal for over a century.

Brazil's gold output peaked at 550,000

t.oz/17 m.t. Most of this came to London via

Lisbon.

Abraham Mocatta took Asher Goldsmid as

his partner. Lowndes London Directory

recorded: Mocatta & Goldsmid (Brokers),

Grigsby's Coffee House in 1783.

Bank of England opened an account for

Louise d'Or coins brought by French refugees

escaping the Revolution.

1717

1732

1760

1779

1789

1731 Mocatta appointed official broker in gold and

silver to the Bank of England.

1740 Bank of England's gold stock stood at

900,000 t.oz/28 m.t the first central bank

gold reserve.

1774/7 Major recoinage of guineas involving 5 million

t.oz/155.5 m.t. Mocatta bought 550,000

t.oz/17.1 m.t for the Bank's account in 1774

alone three-quarters of world output. The

rest came from old coin.

1785 Bank of England's Warehouse changed its

name to The Bullion Office.

1797 Bank of England's gold reserve, drained by

costs of the Napoleonic wars, was down to

235,000 t.oz (1 million) against note issue

liabilities of 15.5 million. Cash payment in

gold against bank notes was suspended on

20 February, and did not resume for twenty-

four years.

Nathan Mayer Rothschild opened his banking 1805

house in London and became closely

involved in secret shipments of gold and

silver to the Duke of Wellington's army in

Europe against Napoleon. Mocatta &

Goldsmid rounded up the gold, often bidding

over the market price.

Sharp & Kirkup, auctioneers since 1796,

started brokerage in gold and silver, but

refused Bank of England accreditation.

The Coinage Act made the gold standard

official, with the guinea replaced by the

sovereign, worth 1.00, weighing 0.25

t.oz/7.77 g at 916 fine. The first sovereigns

were issued in 1817.

Bank of England's Bullion Office opened to

'any sworn broker', because of the increase

in gold from Russia entering the Port of

London, thus ending Mocatta's exclusive

arrangement.

Australian gold discoveries in New South

Wales and Victoria pushed world output to

6.5 million t.oz/203 m.t by 1855. Most

Australian gold came to London, transforming

the market.

Samuel Montagu founded his bullion and

exchange business (today part of HSBC).

Germany went on the gold standard; most

other European nations followed suit.

1811

1816

1840

1851

1853

1871

1810 The House of Commons Select Committee

on the High Price of Bullion, which had risen

from the normal 3.89 for 916 gold to 4.50.

The evidence provided a unique insight into

the London market, as Aaron Asher

Goldsmid, Nathan Mayer Rothschild

(incognito as a 'continental merchant') and

gold refiner William Merle explained the

trade. The Committee concluded the Bank of

England had been printing too many notes as

they were no longer redeemable in gold.

1815 The gold price jumped to 5.35 for standard

gold after Napoleon escaped from Elba, but

after his defeat at Waterloo fell back under

4.00.

1821 Full resumption of cash payments in gold

against notes by the Bank of England.

1848 California gold rush brought a new dimension

to the gold market, with tripling of mine output

by 1850.

1852 Stewart Pixley set up as a bullion broker, the

first of four generations in the market, with

William Haggard as partner. The firm later

became Pixley & Abell.

1855 London market comprised: Brokers: Mocatta

& Goldsmid, Sharps & Wilkins, Pixley &

Haggard (shortly Abell), Samuel Montagu &

Co. Approved refiners: Johnson & Matthey,

Browne & Wingrove, Rothschild's Royal Mint

Refinery, H. L. Raphael's Refinery (1856).

'Good delivery' bars were of 200 t.oz, and the

Bank required a triple assay of each bar.

After 1871, 400 t.oz bars were also accepted.

1876 House of Commons Select Committee on

Depreciation of Silver took expert advice from

Mocatta, Pixley and Sharps on gold output

coin fabrication and central bank stocks.

Royal Commission on Gold & Silver

investigated changed relationship between the

metals. Samuel Montagu sat on the

Commission, Stewart Pixley and Sir Hector

Hay of Mocatta gave statistical briefings. The

Commission came out in favour of the gold

standard, as opposed to bimetallism.

Gold rush in Western Australia after

discoveries at Kalgoorlie.

Peak years of gold rush to the Yukon in

Canada, yielding 3.7 million t.oz/115 m.t.

At outbreak of World War I governments

limited gold flows and called in much

domestic coin, especially in Britain and

France. The gold standard was never officially

suspended, although in practical terms it was.

The Rand Refinery was opened in South

Africa, but the gold continued to be sold

through London.

Britain and many other nations came off the

gold standard, with the onset of the

depression. Sterling was devalued creating

price between 5.50 and 6.34.

On 31 January Roosevelt set a new fixed

price of $35 per t.oz. The US bought all gold

offered at that price.

1886

1893

1897/9

1914

1922

1931

1934

1886 Gold discoveries in the Witwatersrand in

South Africa. Output reached 3.8 million

t.oz/118.2 m.t by 1898. It came to London for

refining and sale.

1896 US presidential election had bimetallism as

the key issue, supported by William Jennings

Bryan. He was defeated and the US went on

the gold standard in 1900.

1900 Gold price: 4.25 t.oz fine/US $20.67.

1919 The Bank of England, determined to restore

London as the main gold market, reached an

agreement with the seven South African

mining houses to ship their gold to London for

refining, after which it would be sold through

N. M. Rothschild 'at the best price obtainable,

giving the London market and the Bullion

Brokers a chance to bid'. Thus, on 12

September 1919, the first gold fixing took

place; the price was fixed at 4.94 (US

$20.67) per t.oz fine a change from the

previous price for standard 916 gold. The

bids were made by telephone for the first few

days and it was then decided to hold a formal

meeting at Rothschild's offices in New Court,

St Swithins Lane.

1925 Britain went onto a gold bullion standard at

the old fixed rate of 4.25 t.oz fine, but with

minimum purchase of 400 ounces.

1933 The US came off the gold standard.

President Roosevelt stopped the convertibility

of dollars into gold and ordered US citizens to

hand in coin.

1939 London gold market closed on 3 September

on outbreak of World War II. Final fix 8.05.

Bretton Woods Agreement established new

international framework of fixed exchange

rates with gold exchanged for currencies

among central banks at $35.

London Gold Fixing resumed; opening price

12.42. Aim was to keep price equivalent to

$35.

Private buying exceeded mine supply,

making Gold Pool net sellers.

Federal Reserve in New York closed its 'gold

window' at which central banks had still been

able to trade dollars for gold at $35, ending

the gold exchange standard.

American citizens again permitted to own

gold after 42 years. Comex 1 kilo contract

launched. US Treasury began five years of

gold sales.

Record London fixing at $850 on 21 January

ended an inflationary decade of oil price

shocks, the freezing of Iran's assets and the

Soviet invasion of Afghanistan, which sent

investors into gold. Average price for the year

was $614.63.

The longest fixing, 2 hours 26 minutes, took

place on 23 March, when a Middle East bank

came into the fix offering at least 450,000

t.oz/14 m.t. The price dropped over $20

during the fix.

1944

1954

1965

1971

1975

1980

1990

1949 US gold reserves peaked at 707 million

t.oz/21,990 m.t; equal to 75% of world

stocks.

1961 Gold Pool of US and main European central

banks set up to defend $35 price, by selling

at fixing to contain it.

1968 Collapse of Gold Pool and defence of $35

price, after devaluation of sterling and

pressure on dollar over Vietnam setbacks

sent speculators into gold. The pool lost

almost 64 million t.oz/2,000 m.t. London

market closed for two weeks; when it

reopened the fix was in dollars, not sterling,

and an afternoon fix was added for New

York's benefit. Gold price floated freely, but

central banks still exchanged at $35.

1974 Hong Kong gold market liberalised. London

market members soon opened trading rooms.

1976 IMF began four-year series of gold auctions.

1987 The London Bullion Market Association

founded to represent the interests of the

members of the wholesale bullion market.

1993 Republic National Bank buys the fixing seat

from Mase Westpac.

The fixing members now are:

N.M. Rothschild, Midland Montagu, Kleinwort

Benson (Sharps Pixley), Standard Chartered

Bank (Mocatta) and Republic National Bank.

Deutsche Bank buys Sharps Pixley from 1994

Kleinwort Benson.

The fixing members now are:

Deutsche Bank, N.M. Rothschild, Midland

Montagu, Standard Chartered Bank and

Republic National Bank.

2004

2000

1997

2008

Bank of Nova Scotia buys the fixing seat from

Standard Chartered Bank.

The fixing members now are:

Deutsche Bank, N.M. Rothschild, Midland

Montagu, Bank of Nova Scotia Mocatta and

Republic National Bank

Following the takeover of Republic National

Bank by HSBC, the institution now has two fixing

seats. HSBC sells one of these to Credit Suisse.

The fixing members now are:

Deutsche Bank, N.M. Rothschild, HSBC, Bank

of Nova Scotia Mocatta and Credit Suisse

8th March the European central bank Gold

Agreement is extended for a further 5 years with

the total maximum allowed to be sold by the

signatories over the period increased from 2,000

tonnes to 2,500 tonnes. The period to run from

27th September until 26th September 2009.

Barclays buys the fixing seat from N.M.

Rothschild & Sons.

The fixing members now are:

Barclays, Deutsche Bank, HSBC, Bank of Nova

Scotia Mocatta and Societe Generale.

The Gold Fixing becomes phone based only and

it is determined that the Chair would rotate

annually amongst the 5 members on 1st May

each year.

Gold fixes above $850 for the first time and

surpasses the record set in January 1980 on the

morning of 3rd January when it fixes at $865.35.

In April the International Monetary Fund

announces that it will be selling 403.3 tonnes of

gold to create an endowment.

1999 The Euro was launched, with the European

Central Bank holding 15% of its reserves in

gold.

In line with the birth of the new currency, the

first official gold fixing rate in Euros was

provided on 4th January 1999 bringing to 3

currencies (USD, GBP and EUR) that are the

official benchmarks for the twice daily Fixings.

The Swiss National Bank and the Bank of

England announce plans to sell roughly half of

their respective countries official stocks of gold.

17th September, golds PM fixing of $255.10 is

the lowest for 20 years.

The European central bank Gold Agreement is

announced with the 15 signatories committed

to selling no more than 400 tonnes of gold per

annum between them with an absolute cap of

2,000 tonnes of gold over the 5 year period of

the Accord (from 27th September 1999 until

26th September 2004)

The Midland Montagu name for membership of

the gold fixing is retired and is replaced by

HSBC

The fixing members now are:

Deutsche Bank, N.M. Rothschild, HSBC, Bank

of Nova Scotia Mocatta and Republic National

Bank

2002 Societe Generale buys Credit Suisses fixing

seat.

The fixing members now are:

Deutsche Bank, N.M. Rothschild, HSBC, Bank

of Nova Scotia Mocatta and Societe Generale

2007 From 1st October the discretionary balance

between gold offered for sale and that wanting

to be bought on the Fixing was doubled from

25 bars of gold to 50 bars.

2011 It becomes a requirement that organisations

wishing to reproduce or utilise gold fixing data

will be required to purchase a license from The

London Gold Market Fixing Limited.

Gold sets its all time nominal record fixing of

$1896.50 on the morning of 5th September

although it did trade higher than this in the

market later that day.

Banco de Mexico announces that it has

2012

purchased nearly 100 tonnes of gold and Bank

of Thailand adds over 50 tonnes to its

reserves.

In April China announces that its gold

reserves have increased by 454 tonnes to

1,054 tonnes.

Gold fixes above $1000 for the first time on

the afternoon of 8th September with a fixing of

$1000.75

The financial crisis delays the IMFs sales

plan but the selling of 403.3 tonnes is

restarted on 18th September.

The European central bank Gold Agreement

is extended for a further 5 years with the total

maximum allowed to be sold by the

signatories over the period once more capped

at 2,000 tonnes.

3rd November, The IMF announces that it has

sold 200 tonnes of gold to the Reserve Bank

of India.

Banco Central do Brasil buys 33.6 tonnes of

gold.

2009

2010 Further central bank buying of gold is seen

throughout the year with Saudi Arabia (180

tonnes), Bangladesh (10 tonnes) and

Thailand (15.6 tonnes) all announcing

increases to their gold reserves. Russia

continues to accumulate gold from its

domestic production.

AngloGold Ashanti announces that it has

closed out its hedgebook. This is widely

considered to be the last of the large hedged

positions remaining amongst gold mining

companies.

2013 The Central Bank of Russia has increased the

amount of gold in its reserves from 458 tonnes

in 1998 to 996.4 tonnes in August: mainly

from buying domestic gold production.

The Central Bank of Turkey has increased the

amount of gold in its reserves from 117 tonnes

in 1998 to 441.5 tonnes in August: mainly due

to their policy of allowing gold from

commercial banks to be used as part of their

posting of reserve requirements.

The website for The London Gold Market

Fixing Limited is revamped and launched.

Deutsche Bank resigns as a member. 2014

You might also like

- Kryvyi RihDocument35 pagesKryvyi RihOvidiu TomaNo ratings yet

- Changing The Location of The Cash Register ProcedureDocument2 pagesChanging The Location of The Cash Register ProcedureOvidiu TomaNo ratings yet

- Jcms 2009Document15 pagesJcms 2009Ovidiu TomaNo ratings yet

- Othp 05Document37 pagesOthp 05Ovidiu TomaNo ratings yet

- XML ModelingDocument124 pagesXML Modelingmmkaleem1964No ratings yet

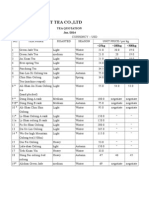

- Quotation 2013 Tea New DecDocument5 pagesQuotation 2013 Tea New DecOvidiu TomaNo ratings yet

- Blooming Tea CatalogueDocument6 pagesBlooming Tea CatalogueOvidiu TomaNo ratings yet

- AM Katalog-Dlouhe-En OSTRAVA PDFDocument37 pagesAM Katalog-Dlouhe-En OSTRAVA PDFdanielagrigoreNo ratings yet

- Ingineria programării. Laboratoare – Referinţe SEODocument2 pagesIngineria programării. Laboratoare – Referinţe SEOOvidiu TomaNo ratings yet

- Steel Rebar Industry ProfileDocument34 pagesSteel Rebar Industry ProfileOvidiu TomaNo ratings yet

- Offer - Nordic MerchantsDocument2 pagesOffer - Nordic MerchantsOvidiu TomaNo ratings yet

- FEES Exec MBA Bucharest 2013-2014 EarlyBird20 1Document1 pageFEES Exec MBA Bucharest 2013-2014 EarlyBird20 1Ovidiu TomaNo ratings yet

- Professor Ph.D. Alexandru Lupa S at His 65-th Anniversary: Eugen DR AghiciDocument18 pagesProfessor Ph.D. Alexandru Lupa S at His 65-th Anniversary: Eugen DR AghiciOvidiu TomaNo ratings yet

- 12 Week Body Sculpting WorkoutDocument383 pages12 Week Body Sculpting WorkoutJames Gilreath100% (5)

- Manual BIP1300 Eng WMDocument35 pagesManual BIP1300 Eng WMOvidiu TomaNo ratings yet

- Curriculum Vitae - Ovidiu Toma (Einstein) - enDocument3 pagesCurriculum Vitae - Ovidiu Toma (Einstein) - enOvidiu TomaNo ratings yet

- Cookbook (Saas - Framework - ComDocument312 pagesCookbook (Saas - Framework - ComClara SimondNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Eu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enDocument3 pagesEu Priips Blackrock Ics Euro Government Liquidity Fund Premier Acc t0 Eur Ie00b41n0724 enAllanNo ratings yet

- Graham Number and Warren Buffett PortfolioDocument2 pagesGraham Number and Warren Buffett PortfoliobogatishankarNo ratings yet

- The Importance of Preschool and Child Care For Working MothersDocument7 pagesThe Importance of Preschool and Child Care For Working MothersCenter for American Progress100% (2)

- Direct Selling Association 0912 BoardbookDocument78 pagesDirect Selling Association 0912 BoardbookBill KeepNo ratings yet

- FI-Bank Statement Exercise v1.0Document3 pagesFI-Bank Statement Exercise v1.0marie3xNo ratings yet

- Princess Rapunzel - English Short Stories For Kids.Document4 pagesPrincess Rapunzel - English Short Stories For Kids.Rajiv PawarNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 9 - QuestionsDocument2 pagesACF 103 - Fundamentals of Finance Tutorial 9 - QuestionsRiri FahraniNo ratings yet

- Trade DiscountDocument26 pagesTrade DiscountALMA ACUNANo ratings yet

- Smart Contracts UnderstandingDocument1 pageSmart Contracts UnderstandingCao Ngoc Anh100% (2)

- Mock Exam Level II 2004 Final AnsDocument33 pagesMock Exam Level II 2004 Final Ansapi-3703582No ratings yet

- SDM NotesDocument8 pagesSDM NotesgautamcsnitpNo ratings yet

- Project Profile On Hybrid Solar InverterDocument11 pagesProject Profile On Hybrid Solar InvertersuryanathNo ratings yet

- Portfolio Evaluation and Investment Decision MakingDocument15 pagesPortfolio Evaluation and Investment Decision Makingdollu mehtaNo ratings yet

- HARVARD SUMMER SCHOOL ECON COURSEDocument4 pagesHARVARD SUMMER SCHOOL ECON COURSEArnaud St-GermainNo ratings yet

- Shaping The Future Alignment Tool 5559 PDFDocument39 pagesShaping The Future Alignment Tool 5559 PDFMyOdysseyNo ratings yet

- Definition of Business FinanceDocument2 pagesDefinition of Business Financerahulravi4uNo ratings yet

- QSD Booklet201309Document20 pagesQSD Booklet201309jasminetsoNo ratings yet

- Janet - Rothenberg - Pack - Growth and Convergence in Metropolitan AmericaDocument257 pagesJanet - Rothenberg - Pack - Growth and Convergence in Metropolitan AmericaJesús TreviñoNo ratings yet

- IB ReadingDocument4 pagesIB ReadingDan RussellNo ratings yet

- Capital Market Corporate ProfileDocument40 pagesCapital Market Corporate ProfilePinank TurakhiaNo ratings yet

- LOAN STUDYDocument78 pagesLOAN STUDYkanuj kohli50% (2)

- (Cambodia - 1996) Law On Organization and Functioning of The National Bank of CambodiaDocument73 pages(Cambodia - 1996) Law On Organization and Functioning of The National Bank of Cambodiaរ័ត្នវិសាល (Rathvisal)No ratings yet

- Swot Analysis of Sbi MFDocument3 pagesSwot Analysis of Sbi MFKrishna Prasad Gadde33% (6)

- Preethi QuestionnaireDocument5 pagesPreethi Questionnairetamil selviNo ratings yet

- Investor Satisfaction Analysis of Financial and Real Investments in GoaDocument9 pagesInvestor Satisfaction Analysis of Financial and Real Investments in GoaAsh SalviNo ratings yet

- Guidelines SebiDocument19 pagesGuidelines SebiDylan WilcoxNo ratings yet

- Demat Account: VerificationDocument10 pagesDemat Account: VerificationMahesh TejaniNo ratings yet

- Principles of Accounts: Paper 7110/01 Multiple ChoiceDocument5 pagesPrinciples of Accounts: Paper 7110/01 Multiple ChoiceNanda SinghNo ratings yet

- Raising The Capital Your Business NeedsDocument19 pagesRaising The Capital Your Business NeedsScott CooneyNo ratings yet

- Open InterestDocument9 pagesOpen InterestAmbikesh ChauhanNo ratings yet