Professional Documents

Culture Documents

IMT 58 Management Accounting M3

Uploaded by

solvedcare0 ratings0% found this document useful (0 votes)

480 views23 pagesFinancial accounting and management accounting are two major sub-systems of accounting information system. Both are concerned with revenues n expenses, assets and liabilities and cash flows. But the major difference between the two arises because they serve different audience.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial accounting and management accounting are two major sub-systems of accounting information system. Both are concerned with revenues n expenses, assets and liabilities and cash flows. But the major difference between the two arises because they serve different audience.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

480 views23 pagesIMT 58 Management Accounting M3

Uploaded by

solvedcareFinancial accounting and management accounting are two major sub-systems of accounting information system. Both are concerned with revenues n expenses, assets and liabilities and cash flows. But the major difference between the two arises because they serve different audience.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 23

Section-A

Q1. Distinguish between Management accounting and financial accounting.

Ans. Financial accounting and management accounting are two major sub-systems of accounting

information system. Both are concerned with revenues n expenses, assets and liabilities and cash

flows. But the major difference between the two arises because they serve different audience.

The main points of difference between the two are as follows:

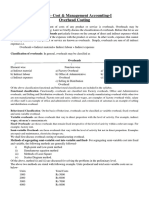

Basis Financial Accounting Management Accounting

1. External and

internal users

Financial accounting information

is mainly intended for external

users like investor, shareholders,

creditors, govt. authorities etc.

Management accounting

information is mainly meant for

internal users i.e. management.

2. Accounting

method

It is based on double entry systems

for recording business

transactions.

It is not base on double entry

system.

3. Statutory

requirements

Financial accounting is mandatory.

Under company law and tax laws,

financial accounting is obligatory

to satisfy various statutory

provisions.

Management accounting is

optional though its utility makes it

highly desirable to adopt it.

4. Analysis of

cost and profit

Financial accounting shows the

profit/loss of the business as a

whole. It does not show the cost

and profit for individual products,

processes or departments, etc.

Management accounting provides

detailed information about

individual products, plants,

departments or any other

responsibility centre.

5. Past and future

data

It is concerned with recording

transactions which have already

taken place, i.e. it represents past

or historical records.

It is future oriented and

concentrates on what is likely to

happen in future though it may

use past data for future

projections.

6. Periodic

and

continuous

recording

Financial reports, i.e. Profit and

loss account and Balance sheet are

prepared usually on a year to year

basis.

Management accounting reports

are prepared frequently, i.e. these

may be monthly, weekly or even

daily depending on managerial

requirements.

7. Accounting

standards

Companies are required to prepare

financial accounts according to

Accounting Standards issued by

the Institutes of Chartered

Accountants of India.

Management accounting is not

bound by accounting standards. It

may use any practice which

generates useful information

8. Types of

statements

prepared

Financial accounting prepares

general purpose statement Profit

and Loss Account and Balance

Sheet which are used by external

In management accounting special

purpose reports are prepared, e.g.,

performance report of sales

manager or any other department

users. manager which are used by top

level management.

9. Publication and

audit

Financial statements, i.e., P&L A/c

and Balance Sheet are published for

general public use and also sent to

shareholders. These are required to

be audited by the Chartered

Accountants.

Management accounting statements

are for internal use and thus neither

published for general public use

nor these are required to be audited

by the Chartered Accountants.

10. Monetary and

Non-Monetary

measurements

Financial accounting provides

information in terms of money only.

Management accounting may apply

monetary or non-monetary units of

measurements. For example:

information may be expressed in

terms of Rupees or units of

Quantity, machine hours, labour

hours, etc.

Q2. What are the methods by which semi variable cost can be split in its fixed and variable

elements?

Ans. Semi-variable costs are those costs which contain both fixed and variable components and

are thus partly affected by fluctuations in the level of activity, such as telephone bills, gas,

electricity, etc. Such costs can be depicted graphically as follows:

Activity Level

Methods of segregating Semi-variable costs into fixed and variable cost: The segregation of

semi-variable costs into fixed and variable costs can be carried out by using the following

methods:

Variable Cost

Total Cost

Fixed Cost

(a) Graphical Method: Under this method, the following steps are followed:

(i) A large number of observations regarding the total costs at different levels of output

are plotted on a graph with the output on the X-axis (ii) The total cost is plotted on the Y-

axis.

(iii) Then, by judgment, a line of best-fit, which passes through all or most of the

points is drawn

(iv) The points at which this line cuts the Y-axis indicates the total fixed cost

component in the total cost

(v) If a line is drawn at this point parallel to the X-axis, this indicate the fixed cost.

(vi) The variable cost, at any level of output, is derived by deducting this fixed cost

element from the total cost.

The following graph illustrates this:

Output (in units)

(b) High points and low points method: Under this method, the total cost at highest and

lowest volume is divide by the difference between the sales value at the highest and the

lowest volume. The quotient thus obtained gives us the rate of variable cost in relation to

sales value.

(c) Analytical method: Under this method, an experienced cost accountant tries to judge

empirically what portion of all the semi-variable cost would be variable and what would

be fixed. The degree of variability is ascertained for each item of semi-variable expenses.

For example, some semi-variable expenses may vary to the extent of 20% while others

may vary to the extent of 80%.

(d) Comparison by period or level of activity method: Under this method, the variable

overhead may be determined by comparing two levels of output with the amount of

expenses at those levels. Since the fixed element does not change, the variable element

may be ascertained with the help of a formula:

Change in the amount of expense

30

Semi-variable cost 20

( in rupees ) VariableCost

for this output

10 Fixed Cost

Change in quantity of output

(e) Least squared method: this is the best method to segregate semi-variable costs into its

fixed and variable components. This is a statistical method and is based on finding out a

line of best fit for a number of observations. The method uses linear equation y= mx+c,

where:

m represents the variable element of cost per unit

c represents the total fixed cost

y represents the total cost

x represents the volume of output.

The total cost is thus split into fixed and variable elements by solving this equation. By

using this method, the expenditure against an item is determined at various levels of

output and values of x and y are fitted in the above formula to find out the values of m

and c.

Q3. Medical aid co. manufactures a special product AID. The following particulars were

collected for the year 1998:

Monthly demand of AID 1,000 units

Cost of placing an order Rs. 100

Annual carrying cost per unit Rs 15

Normal usage 50 units per week.

Minimum usage 25 units per weed

maximum usage 75 units per week re-order

usage 4 to 6 week

Compute from the above:

a. re-order quantity

b. re-order level

c. minimum level

d. maximum level

Ans. (i) Re-order quantity of units used = (2AS)/C

= (2*2600*100)/15 (See note below)

= 186 units (approx.)

Where A = Annual demand of input units

S = Cost of placing an order

C = Annual carrying cost per unit

(ii) Re-order level = Maximum re-order period*Maximum usage

= 6 weeks*75 units

= 450 units.

(iii) Minimum level = Re-order level (normal usage*average re-order period)

= 450 units (50 units* (4+6)/2)

= 450 units (50 units* 5 weeks)

= 450 units 250 units

= 200 units.

(iv)Maximum level=Re-order level+Re-order quantity(minimum usage*minimum order period)

= 450 units+186 units-(25 units*4weeks)

= 450 units+186 units-100 units

= 536 units.

Note:

A = Annual demand of input units for 12,000 units of Medical Aid Co.

= 52 weeks* normal usage of inputs per week

= 52 weeks*50 units of input per week

= 2600 units.

Q4. What do you understand by JIT?

Ans. Just In Time is an inventory strategy companies employ to increase efficiency and decrease

waste by receiving goods only as they are needed in the production process, thereby reducing

inventory costs. This method requires that producers are able to accurately forecast demand.

A good example would be a car manufacturer that operates with very low inventory levels,

relying on their supply chain to deliver the parts they need to build cars. The parts needed to

manufacture the cars do not arrive before nor after they are needed, rather do they arrive just as

they are needed.

JIT Purchasing

JIT purchasing refers to the technique of eliminating waste during the purchasing phase with the

help of the mutual understanding with good suppliers. The major elements of JIT purchasing

include locating, choosing and then developing mutual relations with the suppliers the number of

the suppliers should be limited and both the buyer and the supplier should possess mutual

dependence, having long term contracts which results in reduction of the lead time, aiming at

finding solutions to the problems by involving participation of the supplier at an earlier stage

during the decision making process.

JIT Manufacturing

JIT manufacturing refers to the technique of eliminating waste during the manufacturing process.

During the production of the products one important factor to be kept in mind is to fulfill or to

meet the customers requirement in context of the quality. JIT manufacturing aims at eliminating

all those factors or activities that act as a hindrance in the achievement of such goals of quality

maintenance.

Q5. Explain the term administrative overheads and briefly discuss three methods of

treatment thereof in cost accounts.

Ans. Administrative overhead is defined as the sum of those costs of general management and

of secretarial accounting and administrative services, which cannot be directly related to the

production , marketing , research or development functions of the enterprise.

It constitutes the expenses incurred in connection with the formulation of policy directing the

organization and controlling the operations of an undertaking.

ACCOUNTING TREATMENT OF ADMINISTRATIVE OVERHEADS: There are three

distinct methods of accounting of administrative overheads, which are discussed below :

(a) Apportioning administrative overheads between production and sales departments:

According to this method administrative overheads are apportioned over production and

sales departments. The reason for the apportionment of overhead expenses over these

departments, recognizes the fact that administrative overheads are incurred for the benefit

of both of these departments. Therefore each department should be charged with the

proportionate share of the same. When this method is adopted, administrative overheads

lose their identity and get merged with production and selling and distribution overheads.

Disadvantages:

(1) It is difficult to find suitable basis of administrative overhead apportionment over

production and sales departments.

(2) Lot of clerical work is involved in apportioning overheads.

(3) It is not justified to apportion total administrative overheads only over production and

sales departments when other equally important department like finance is also there.

(b) Charging to profit and loss account: According to this method administrative overheads

are charged to costing profit and loss account. The reason for charging to costing profit

and loss are firstly, the administrative overheads are concerned with the formulation of

policies and thus are not directly concerned with either the production or the selling and

distribution functions. Secondly, it is difficult to determine a suitable basis for

apportioning administrative overheads over production and sales departments. Lastly,

these overheads are the fixes costs. In view of these arguments, administrative overheads

should be charged to profit and loss account.

Disadvantages:

(1) Costs of products are understated as administrative overheads are not charged to costs.

(2) The exclusion of administrative overheads from cost of products is against sound

accounting principle.

(c) Treating administrative overheads as a separate addition to cost of production/sales:

This method considers administration as a separate function like production and sales

and, as such costs relating to formulating the policy, directing the organization and

controlling the operations are taken as a separate charge to the cost of the jobs or a

product, sold along with the cost of other functions. The basis which are generally used

for apportionment are:

(i) Works cost

(ii) Sales value or quantity

(iii) Gross profit on sales

(iv) Quantity produced

(v) Conversion cost, etc.

Section-B

Q1. How does ABC differ from the traditional costing approach?

Ans. Costing systems helps companies determine the cost of a product related to the revenue it

generates. Two common costing systems used in business are traditional costing and

activitybased costing. Traditional costing assigns manufacturing overhead based on the volume

of a cost driver, such as the amount of direct labor hours needed to produce an item. A cost driver

is a factor that causes cost to incur, such as machine hours, direct labor hours and direct material

hours. Activity-based costing allocates the costs of manufacturing a product according to the

activities needed to produce the item.

Basically, the traditional costing is used commonly by manufacturing companies to assign

manufacturing overheads to the units they produce. Using this, only the products are assigned an

overhead cost by the accountant. The downside of this method of costing is that it neglects to

consider the non-manufacturing costs like administration expenses which are associated with

production. Today, such method is considered outdated because a lot of the manufacturing

companies already use computers and machines for their production. Also business accounting

software is already being used widely. On the brighter side, the traditional costing is easy to use

especially for those companies that have one product.

On the other hand, the activity-based costing (ABC) is a more logical method of assigning

manufacturing overhead costs to products. Unlike traditional costing that simply assigns costs

based on the machine work hours, the ABC assigns costs first to the activities and processes that

cause the overhead. Then, these costs are assigned only to the products that require the activities.

Simply saying, the ABC is typically used as a supplemental costing system for businesses.

The following are the basic differences of the two methods of costing:

1. The traditional costing method focuses on structure rather than on processes while the

ABC is more on the activities than on structure.

2. Traditional costing method is already obsolete especially with the changing technology

trends such as the introduction of the business accounting software.

3. The ABC provides more accurate costs of products.

4. Whereas the traditional costing method has increasingly become obsolete, the ABC

became a rising method since 1981.

Q2. What is service costing? Describe the type of industries in which such a system would

be suitable.

Ans. Service costing is a cost accounting method concerned with establishing the costs of

services rendered.

Despite this definition, we should note immediately that even though we may be dealing with

services that are intangible, the cost accounting methods we use are essentially the same as if we

were making cars, biscuits or televisions.

When we set up a service cost accounting system, therefore, we would need to keep in mind the

fact that the progression, for example, of a cheque through the banking system, can be treated as

items of raw material passing through a production process. Similarly, we should readily

appreciate that the provision of a transport service has much in common, from the cost

accounting point of view, with the manufacture of the lorry or van that is being used to provide

the service.

Specific Examples:

Transport

Hotels

Tourism

Solicitors

Education

Retail distribution

financial services

Service costing is also applied within a manufacturing setting. For example, a manufacturer

might wish to calculate the costs of the following services:

Transport

Catering

Computing and IT

Accounting

Human resources

Q3. Calculate the cost of each process and total cost production from the data given below:

Process x Process Y Process Z

Materials 2,250 750 300

Labour 1,200 3,000 900

Direct Expenses:

Fuel 300 200 400

Carriage 200 300 100

Work overhead 1,890 2,580 1,875

The indirect expenses Rs. 1,275 should be apportioned on the basis of wages.

Ans.

Particulars Process X Process Y Process Z

Materials 2250 750 300

Labour 1200 3000 900

Fuel 300 200 400

Carriage 200 300 100

Work Overhead 1890 2580 1875

Indirect Expenses 300 750 225

Total Cost 6140 7580 3800

Total cost of production = Total Cost of Process (X+Y+Z)

= Rs. 6140+7580+3800

= Rs. 17520

Q4. What are the advantages of variable costing?

Ans. Variable costing is a managerial accounting cost concept. Under this method manufacturing

overhead is incurred in the period that a product is produced. It is a costing method that includes only

variable manufacturing costs--direct materials, direct labor, and variable manufacturing overhead--in

unit product costs.

Advantages of variable costing system:

1. Variable costing provides a better understanding of the effect of fixed costs on the net profits

because total fixed cost for the period is shown on the income statement.

2. Various methods of controlling costs such as standard costing system and flexible budgets have

close relation with the variable costing system. Understanding variable costing system makes the

use of those methods easy.

3. Companies using variable costing system prepare income statement in contribution margin

format that provides necessary information for cost volume profit (CVP) analysis. This data

cannot be directly obtained from a traditional income statement prepared under absorption

costing system.

4. The net operating income figure produced by variable costing is usually close to the flow of cash.

It is useful for businesses with a problem of cash flows.

5. Under absorption costing system, income of different periods changes with the change of

inventory levels. Sometime income and sales move in opposite directions. But it does not happen

under variable costing.

Q5. What do you mean by break-even analysis and explain its uses and applications? Ans.

Break even analysis is an analysis to determine the point at which revenue received equals the

costs associated with receiving the revenue. Break-even analysis calculates what is known as a

margin of safety, the amount that revenues exceed the break-even point. This is the amount that

revenues can fall while still staying above the break-even point.

Break-even analysis is a supply-side analysis; that is, it only analyzes the costs of the sales. It

does not analyze how demand may be affected at different price levels.

Finding break even point of a product or service is an essential tool in choosing the best price per

unit of a product and also helping to determine projected sales. Break even analysis can used for

a number of different applications. Its basic function is to determine when a product or service

will be profitable. This analysis can be applied to many other applications to determine a future

forecast in sales, set a unit price and to target the best strategic options for the company.

Once the break-even figures are determined, the company can then use this information for other

financial projections. The most common break even analysis applications and uses are:

1. Determining the point of profitability

Many things should be considered when finding the break even point for a product's profitability.

A company's goal is to be profitable as quickly as possible, so it is more effective for a company

to run the numbers through a set of break even points to determine where the company will have

the optimal chance of making a profit. Harvard business school provides a break even analysis

toolkit that includes information and analysis tools to determine the break even point of any

product or service. Business Tools provides a guide and calculator to perform basic break even

analysis.

2. Finding the break even point for unit pricing

Performing break even analysis can also lead to the numbers that will help determine a set price

per unit. This is calculated by leaving the cost per unit as the variable in a break even analysis

equation. The most effective unit price will bring quick profitability to the company without the

company spending too much for production and marketing of the product.

Bradley University provides information on all of the equations to determine break even analysis,

including determining the break even cost, break even number of units and for setting the unit

price. Bean Counter explains the relationships between cost, volume and profits in break even

analysis.

3. Using the analysis information to choose the best company strategy

Another use for break even analysis is to use the information from the analysis to help determine

the company's financial strategy. If a company's profitability is determined by the success of one

or more products, using the break even point for each product will provide a timeline for the

company. This can be used to choose a better overall financial strategy that fits the projected

costs and profits.

The Weatherhead School of Management provides information on break even analysis and how

to use this analysis to help make strategic decisions. All Business provides a guide to use break

even analysis for making business decisions and choosing the best strategies.

Section-C

Q1. Explain advantages and limitations of budgeting.

Ans. Advantages Of Budgeting:

1. Reinforce the management process of planning ahead. In fact, budget compel the

managers to think and anticipate of future challenges, formulate strategies, etc. so as to

achieve the desired companys goals

2. A budget is in reality a set of plan. This plan is created by all the relevant managers to

create a course of action for future action.

3. Create a basis for Performance Evaluation of Managers performance. Incentives are

based on how much have been achieved against the budgeted figures. Hence, if budgets

are set up realistically will assist to motive manager and employees positively.

4. Aid in resource planning and allocation, key or scarce resources or capital expenditure

are carefully review during the establishment of the budgets.

5. Promote continuous improvement. In the budgeting stage, non-value adding activities

shall be eliminated, new or enhanced processes are designed to increase productivity, etc.

6. Budgeting is the best time for all level of manager to co-ordinate together so as to plan

ahead, promotes teamwork, process improvement and goal congruency between the

company and the employees.

7. Delegation of duties, authority limit and responsibility are more properly segregated as

budgets are set up. With budgets, top management feel that they are in control of the

various business activities of the company.

Disadvantages of Budgeting:

1. De-motivation of employees as they feel that the budgeted figures are way too high to

achieve

2. Budgetary slack or padding the budgets as managers will intentionally blow up their

budget figures for fear of top managements reprimanding them

3. A budget tends to emphasize on results and the real reasons are being ignored

4. Unrealistic budgets can lead managers to make decisions that might be detrimental to

the company. A good example of over-ambitious sales budget will lead to disastrous

impact like giving steep discount to increase volume,etc.

5. No matter how well prepared a budget might be, it will never be able to reflect truly the

reality/complexities faced by the company

6. There is a need to revise/update the budget which at the time was based on a certain set

of circumstances/best information.

7. Budgets if not properly buy in by all relevant parties will not get the full cooperation

hence it might lead to the motto: Planning to fail.

Q2. What are transfer prices? What are different types of transfer prices? Ans. Transfer

price is the price at which divisions of a company transact with each other. Transactions may

include the trade of supplies or labor between departments. Transfer prices are used when

individual entities of a larger multi-entity firm are treated and measured as separately run entities.

Different Types of Transfer Prices

1. Market-based Transfer Price

Market conditions which are appropriate for adoption

Are generally appropriate in a perfect market, where there is homogeneous product with only

one price for both sellers and buyers and no buying or selling costs.

In a perfect market, Selling Division (SD) will be operating at full capacity and can sell

whatever quantity of intermediate product it can produce in the external market. In this situation,

internal transfers will result in a need to sacrifice external sales. The benefit forgone that is the

contribution lost (opportunity cost) from sacrificing external sales should be included in the

transfer price. Thus in this situation TP=MP will be consistent with the general TP rule.

TP = MC+OC = MP

In a perfect market, the minimum TP is also the maximum TP. Thus, both SD and BD will

be happy with a transfer price set as the market price

The adoption of market-based transfer price in a perfectly competitive market meet the

criteria of a good transfer price, that is it will promote goal congruent decisions, preserve

divisional autonomy and provide an equitable basis for performance evaluation.

Limitations:

(i) As a result of product differentiation, they may be no comparable product or a single market

price.

(ii) Market price may vary because of over-supply or under-supply, promotions, or product

dumping by foreign competitors.

2. Full-cost based Transfer Price

Market conditions which are appropriate for adoption

In an imperfect market, it may be unwise to always set transfer price exactly at the variable

costs of production, as such prices do not provide for the replacement of fixed assets.

The Supply Division (SD) will want to base the transfer price on total absorption cost to

ensure that it will provide a contribution to cover the fixed overheads.

Full-cost based transfer price is widely used because managers require an estimate of long-

run marginal cost for decision-making. However, traditional absorption costing systems tend to

provide poor estimates of long-run marginal cost for decision-making. ABC will provide better

estimates of long run MC.

Limitations:

(i) It can lead buying division (BD) to make sub-optimal decisions because BD regards the

transfer price (which includes the fixed costs) as a wholly variable cost.

3. Negotiated Transfer Price

Market conditions which are appropriate for adoption

In an imperfect market (different selling costs for internal and external sales, differential

market prices), transfer prices set at the prevailing or planned market price are not optimal i.e.

will not induce SD and BD to adopt optimal output level. Central/corporate management

intervention is necessary in order to ensure that optimal output levels are set but this process may

undermine divisional autonomy.

In this situation, it is more appropriate to adopt negotiated transfer prices. If both managers

had been provided with all the information and were educated to use information correctly, it is

likely that a negotiated solution would have emerged which would have been acceptable to both

the divisions and the group.

When there is unused capacity, the transfer price range for negotiations generally lied

between the minimum price at which SD is willing to sell (its marginal cost) and the maximum

price BD is willing to pay (the external supplier price net off any external purchase related costs).

Limitations:

(i) Can lead to sub-optimal decisions

(ii) Time-consuming

(iii) Strongly influenced by the bargaining skills and power of the divisional managers(iv)

Inappropriate in certain circumstances (e.g. no market for the intermediate product or an

imperfect market exists as the SD will have a bargaining disadvantage).

Q3. Define expense centre. What is the suitability of the measure of performance in an

expense centre?

Ans. Expense centers are responsibility centers for which inputs, or expenses are measured in

monetary terms, but for which outputs are not measured in monetary terms. There are two

general types of expense centers:

1. Engineered expense centers are expense centers in which all or most costs are

engineered costs. Engineered costs are elements of cost for which the right or proper

amount of costs that should be incurred can be estimated with a reasonable degree of

reliability. Cost incurred in a factory for direct labor, direct material, components,

supplies, and utilities are examples.

2. Discretionary expense centers are expense centers in which all, or most, costs are

discretionary. Discretionary costs/managed costs are those for which no such engineered

estimate is feasible the amount of costs incurred depends on managements judgment

about the amount that is appropriate under the circumstances.

Performance measures

1. Minimize total cost for a selected level of output.

2. Maximize total output for a given budget.

In several cases, the output (revenue) of a responsibility centre cannot be reliably measured in

financial terms such as legal departments, accounting department, public relation departments,

personnel departments, etc. Each of these centers/divisions has a conceptually identifiable output.

Their output cannot be expressed in monetary terms. The only measurable performance is there

efficiency in the use of inputs. If production centre is producing one single product, then its

performance can be measured in efficiency & effectiveness. The output cannot be expressed in

monetary terms but cost per unit would be efficiency of department. An expense centre can also

be suitably employed to measure performance if the responsibility of the departmental manager

is to produce a stated quantity of outputs at the lowest feasible cost.

Q4. Differentiate between sunk and avoidable costs. What is the relevance of such a

distinction for short-run decisions?

Ans. A relevant cost (also called avoidable cost or differential cost) is a cost that differs

between alternatives being considered. In order for a cost to be a relevant cost it must be:

Future

Cash Flow

Incremental

It is often important for businesses to distinguish between relevant and irrelevant costs when

analyzing alternatives because erroneously considering irrelevant costs can lead to unsound

business decisions. Also, ignoring irrelevant data in analysis can save time and effort. For

example: A construction firm is in the middle of constructing an office building, having spent $1

million on it so far. It requires an additional $0.5 million to complete construction. Because of a

downturn in the real estate market, the finished building will not fetch its original intended price,

and is expected to sell for only $1.2 million. If, in deciding whether or not to continue

construction, the $1 million sunk cost were incorrectly included in the analysis, the firm may

conclude that it should abandon the project because it would be spending $1.5 million for a

return of $1.2 million. However, the $1 million is an irrelevant cost, and should be excluded.

Continuing the construction actually involves spending $0.5 million for a return of $1.2 million,

which makes it the correct course of action.

Whereas a sunk cost is a retrospective (past) cost that has already been incurred and cannot be

recovered. Sunk costs are sometimes contrasted with prospective costs, which are future costs

that may be incurred or changed if an action is taken. Both retrospective and prospective costs

may be either fixed (continuous for as long as the business is in operation and unaffected by

output volume) or variable (dependent on volume) costs. For example, if a firm sinks $1 million

on an enterprise software installation that cost is "sunk" because it was a one-time expense and

cannot be recovered once spent. A "fixed" cost would be monthly payments made as part of a

service contract or licensing deal with the company that set up the software. The upfront

irretrievable payment for the installation should not be deemed a "fixed" cost, with its cost

spread out over time. Sunk costs should be kept separate. The "variable costs" for this project

might include data centre power usage, etc.

Short-run decision making involves choosing among alternatives and tends to be short-run in

nature with an immediate end in view. Sound short-run decision making results in decisions that

achieve an immediate objective and serve the overall strategic goals of the organization.

The costs which should be used for decision making are often referred to as "relevant costs".

CIMA defines relevant costs as 'costs appropriate to aiding the making of specific management

decisions'.

To affect a decision a cost must be:

a) Future: Past costs are irrelevant, as we cannot affect them by current decisions and they are

common to all alternatives that we may choose.

b) Incremental: ' Meaning, expenditure which will be incurred or avoided as a result of making a

decision. Any costs which would be incurred whether or not the decision is made are not said

to be incremental to the decision.

c) Cash flow: Expenses such as depreciation are not cash flows and are therefore not relevant.

Similarly, the book value of existing equipment is irrelevant, but the disposal value is relevant.

Other terms:

d) Common costs: Costs which will be identical for all alternatives are irrelevant, e.g. rent or

rates on a factory would be incurred whatever products are produced.

e) Sunk costs: Another name for past costs, which are always irrelevant, e.g. dedicated fixed

assets, development costs already incurred.

f) Committed costs: A future cash outflow that will be incurred anyway, whatever decision is

taken now, e.g. contracts already entered into which cannot be altered.

Q5. The details regarding composition and the weekly wage rate of labour force engaged on

a job scheduled to be completed in 30 weeks are as follows:

Standard Actual

Category of No. of Weekly wage No. of Weekly wage

Workers Laborers Rate Laborers Rate

Skilled 75 60 70 70

Semi-skilled 45 40 30 50

Unskilled 60 30 80 20

The work is actually completed in 32 weeks. Calculate the various labour cost variances.

Ans. Basic calculations:

Category

of workers

Standard Actual

Weeks (no.

of

workers*

No. of

weeks)

Rate (In

Rupees)

Amount (In

Rupees)

Weeks (no.

of

workers*

No. of

weeks)

Rate (In

Rupees)

Amount (In

Rupees)

Skilled 75*30=

2250

60 135000 70*32=

2240

70 156800

Semi-

skilled

45*30=

1350

40 54000 30*32=

960

50 48000

Unskilled 60*30=

1800

30 54000 80*32=

2560

20 51200

Total 5400 243000 5760 256000

Calculation of variances:

(i) Labour cost variance = Standard cost Actual cost

= Rs.243000-Rs.256000

= Rs.13000 (A)

(ii) Labour rate variance = (Standard rate Actual rate) * Actual time

Skilled = (60-70)*2240 = Rs.22400 (A)

Semi-skilled = (40-50)*960 = Rs. 9600 (A)

Unskilled = (30-20)*2560 = Rs. 25600 (F)

Total Labour rate variance = Rs.6400 (A)

(iii) Labour efficiency variance = (Standard time Actual time) * Standard rate

Skilled = (2250-2240)*60 = Rs.600 (F)

Semi-skilled = (1350-960)*40 = Rs. 15600 (F)

Unskilled = (1800-2560)*30 = Rs. 22800 (A)

Total Labour efficiency variance = Rs.6600 (A)

(iv) Labour mix variance = (Revised standard time Actual time) * Standard rate

Skilled = (2400-2240)*60 = Rs.9600 (F)

Semi-skilled = (1400-960)*40 = Rs. 19200 (F)

Unskilled = (1920-2560)*30 = Rs. 19200 (A)

Total Labour mix variance = Rs.9600 (F)

Revised standard time calculated as under:

Revised standard time = Standard time of grade * Total Actual time

Total standard time

Skilled = 2250 *5760 = 2400 weeks

5400

Semi-skilled = 1350 * 5760 = 1440 weeks

5400

Unskilled = 1800 * 5760 = 1920 weeks

5400

(v) Labour revised efficiency variance = (Std. time Revised Std. time) * Standard rate

Skilled = (2250-2400)*60 = Rs.9000 (A)

Semi-skilled = (1350-1440)*40 = Rs. 3600 (A)

Unskilled = (1800-1920)*30 = Rs. 3600 (A)

Total Labour revised efficiency variance = Rs.16200 (A)

Check:

(i) Labour cost variance = Labour rate variance + Labour efficiency variance

Rs. 13000(A) = Rs. 6400(A) + Rs. 6600(A)

(ii) Labour efficiency variance=Labour mix variance+Labour revised efficiency

variance

Rs. 6600(A) = Rs. 9600(F) + Rs. 16200(A)

Case Study1

A Ltd. furnishes the following data relating to the year 2008:

1

st

half of the year 2

nd

half of the year

Sales (Rs.) 45,000 50,000

Total cost (Rs.) 40,000 43,000

Assuming that there is no change in prices and variable cost and that the fixed expenses are

incurred equally in the two half year period, calculate:

1. P/V Ratio

2. Fixed expenses

3. Break even sales

4. Percentage of margin of safety to total sales.

Ans. Profit = Sales- Total cost

Profit (1

st

half of the year) = 45000-40000 = Rs.5000

Profit (2

nd

half of the year) = 50000-43000 = Rs.7000

(i) P/V Ratio = Difference in Profit

Difference in Sales

= 2000

5000

= 40%

PV Ratio will remain same for each half year.

(ii) Fixed Expenses = (Sales*P/V Ratio) - Profit

Fixed expenses (1

st

half of the year) = (45000*40%) 5000

= Rs. 13000

Fixed expenses (2nd half of the year) = (50000*40%) 7000

= Rs. 13000

Total Fixed Expenses = Rs. 13000+ Rs.13000

= Rs. 26000

(iii) Break even sales = Fixed Cost

P/V Ratio

Break even sales (1

st

half of the year) = 13000

40%

= Rs.32500

Break even sales (2

nd

half of the year) = 13000

40%

= Rs.32500

Total Break even sales = Rs. 32500+ Rs.32500

= Rs. 65000

(iv) Percentage of margin of safety to total sales = Total Profit

P/V Ratio

(1

st

half of the year) = 5000

40%

= Rs.12500

(2

nd

half of the year) = 7000

40%

= Rs. 17500

Total Percentage of margin of safety to total sales = Rs.12500+Rs.17500

= Rs. 30000

Case Study2

Goodluck Ltd. is currently operating at 75% of its capacity. In the past two years, the level

of operations were 5f5% and 65% respectively. Presently, the production is 75,000 units.

The company is planning for 85% capacity level during 2013 2014. The cost details are

as follows:

55% 65% 75%

Rs. Rs. Rs.

Direct Materials 11,00,000 13,00,000 15,00,000

Direct labour 5,50,000 6,50,000 7,50,000

factory overheads 2,00,000 2,00,000 2,00,000

Selling overheads 3,10,000 3,30,000 3,50,000

Administrative overheads 3,20,000 3,60,000 4,00,000

-------------- --------------- ---------------

24,40,000 28,00,000 31,60,000

-------------- --------------- ----------------

Profit is estimated @ 20% on sales.

The following increases in costs are expected during the year.

In percentage

Direct material 8

Direct labour 5

Variable selling overheads 8

Fixed factory overheads 10

Fixed selling overheads 15

Administrative overheads 10

Required: Prepare flexible budget for the period 20X120X2 at 85% level of capacity. Also

ascertain profit and contribution.

Ans. Flexible budget for the period 20X1-20X2 at 85% level of capacity:

Particulars Amount (Rs.)

Direct Material (20*108%*85000) 1836000

Direct Labour (10*105%*85000) 8925000

Factory Overheads (200000*110%) 220000

Selling Overheads

Fixed (200000*115%) 230000

Variable (2*108%*85000) 183600

Administration Overheads

Fixed (100000*110%) 110000

Variable (4*110%*85000) 374000

Total Cost 11878600

Profit (25% of Total Cost) 26969659

Sales 14848250

Contribution = Fixed cost + Profit

= Direct material + Direct Lobour + Factory overheads + Fixed Selling Cost +

Fixed Administration Cost + Profit

= 1836000+ 8925000+ 220000+ 230000+ 110000 + 2969650

= Rs. 14290650

You might also like

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Ipcc Cost Accounting RTP Nov2011Document209 pagesIpcc Cost Accounting RTP Nov2011Rakesh VermaNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- CA Final AMA Theory Complete R6R7GKB0 PDFDocument143 pagesCA Final AMA Theory Complete R6R7GKB0 PDFjjNo ratings yet

- Practical BEP QuestionsDocument16 pagesPractical BEP QuestionsSanyam GoelNo ratings yet

- Job and Batch CostingDocument7 pagesJob and Batch CostingDeepak R GoradNo ratings yet

- Cost-Volume-Profit AnalysisDocument50 pagesCost-Volume-Profit AnalysisMarkiesha StuartNo ratings yet

- Ilide - Info Review Qs PRDocument93 pagesIlide - Info Review Qs PRMobashir KabirNo ratings yet

- Understand Support Department Cost Allocation MethodsDocument27 pagesUnderstand Support Department Cost Allocation Methodsluckystar251095No ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- Marginal CostingDocument13 pagesMarginal CostingKUNAL GOSAVINo ratings yet

- CA Ipcc Costing Suggested Answers For Nov 20161Document12 pagesCA Ipcc Costing Suggested Answers For Nov 20161Sai Kumar SandralaNo ratings yet

- 46793bosinter p8 Seca cp5 PDFDocument42 pages46793bosinter p8 Seca cp5 PDFIsavic AlsinaNo ratings yet

- Analysis of VariancesDocument40 pagesAnalysis of VariancesSameer MalhotraNo ratings yet

- Jaiib Accounting Module C and Module DDocument340 pagesJaiib Accounting Module C and Module DAkanksha MNo ratings yet

- CVP Question 6Document1 pageCVP Question 6Humphrey OsaigbeNo ratings yet

- Cost EstimationDocument5 pagesCost EstimationSenelwa AnayaNo ratings yet

- CIMA Process Costing Sum and AnswersDocument4 pagesCIMA Process Costing Sum and AnswersLasantha PradeepNo ratings yet

- Hca16ge Ch06 SMDocument76 pagesHca16ge Ch06 SMAmanda GuanNo ratings yet

- 68957Document9 pages68957Mehar WaliaNo ratings yet

- SEM-II-Cost & Management Accounting-I Overhead CostingDocument8 pagesSEM-II-Cost & Management Accounting-I Overhead CostingTanishq KambojNo ratings yet

- Standard (I Unit Produced) ParticularsDocument11 pagesStandard (I Unit Produced) ParticularsForam Raval100% (1)

- Graded Illustrations on Capital Budgeting TechniquesDocument57 pagesGraded Illustrations on Capital Budgeting TechniquesVishesh GuptaNo ratings yet

- ValuationDocument23 pagesValuationishaNo ratings yet

- ADL 56 Cost & Management Accounting 2V3Document20 pagesADL 56 Cost & Management Accounting 2V3Deepesh100% (1)

- 05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFDocument22 pages05 AC212 Lecture 5-Marginal Costing and Absorption Costing PDFsengpisalNo ratings yet

- AMA Suggested Telegram Canotes PDFDocument427 pagesAMA Suggested Telegram Canotes PDFAnmol AgalNo ratings yet

- Target CostingDocument9 pagesTarget CostingRahul PandeyNo ratings yet

- BEP N CVP AnalysisDocument49 pagesBEP N CVP AnalysisJamaeca Ann MalsiNo ratings yet

- Makerere University College of Business and Management Studies Master of Business AdministrationDocument15 pagesMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidNo ratings yet

- Marginal Costing and Cost-Volume-Profit Analysis (CVP)Document65 pagesMarginal Costing and Cost-Volume-Profit Analysis (CVP)Puneesh VikramNo ratings yet

- Marginal Costing Numericals PDFDocument7 pagesMarginal Costing Numericals PDFSubham PalNo ratings yet

- I. Product Costs and Service Costs: Absorption CostingDocument12 pagesI. Product Costs and Service Costs: Absorption CostingLinyVatNo ratings yet

- InventoryDocument46 pagesInventoryAnkit SharmaNo ratings yet

- Cost Accounting UNIT I Theroy (1) New PDFDocument18 pagesCost Accounting UNIT I Theroy (1) New PDFyogeshNo ratings yet

- Joint Products & by Products: Solutions To Assignment ProblemsDocument5 pagesJoint Products & by Products: Solutions To Assignment ProblemsXNo ratings yet

- Gross Profit AnalysisDocument5 pagesGross Profit AnalysisInayat Ur RehmanNo ratings yet

- JOB, BATCH AND SERVICE COSTING-lesson 11Document22 pagesJOB, BATCH AND SERVICE COSTING-lesson 11Kj NayeeNo ratings yet

- Cost Accounting MCQs and ProblemsDocument5 pagesCost Accounting MCQs and ProblemsEnbathamizhanNo ratings yet

- MTP1 May2022 - Paper 5 Advanced AccountingDocument24 pagesMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantNo ratings yet

- Costing System at Plastim CorporationDocument10 pagesCosting System at Plastim CorporationKumar SunnyNo ratings yet

- Leverage PPTDocument13 pagesLeverage PPTamdNo ratings yet

- Cost Accounting, Job Costing & Batch CostingDocument10 pagesCost Accounting, Job Costing & Batch Costing✬ SHANZA MALIK ✬No ratings yet

- Marginal Costing PDFDocument26 pagesMarginal Costing PDFMasumiNo ratings yet

- Chapter 4Document45 pagesChapter 4Yanjing Liu67% (3)

- Cost 2021-MayDocument8 pagesCost 2021-MayDAVID I MUSHINo ratings yet

- Cost Accounting Fundamentals for Manufacturing BusinessesDocument21 pagesCost Accounting Fundamentals for Manufacturing Businessesabdullah_0o0No ratings yet

- Vdocuments - MX - Chapter 5 578590693cc3a PDFDocument43 pagesVdocuments - MX - Chapter 5 578590693cc3a PDFAmrita TamangNo ratings yet

- Amendment Mat BookDocument99 pagesAmendment Mat BookSomsindhu NagNo ratings yet

- LKAS 19 2021 UploadDocument31 pagesLKAS 19 2021 Uploadpriyantha dasanayake100% (1)

- Horngren Ima15 Im 07Document19 pagesHorngren Ima15 Im 07Ahmed AlhawyNo ratings yet

- Assignment-2 CmaDocument8 pagesAssignment-2 CmaAYESHA BOITAINo ratings yet

- CVP Multiple Product DiscussionDocument5 pagesCVP Multiple Product DiscussionheyheyNo ratings yet

- ABC Costing Guide for Managerial Accounting ToolsDocument3 pagesABC Costing Guide for Managerial Accounting Toolssouayeh wejdenNo ratings yet

- Cost AccountingDocument28 pagesCost Accountingrenjithrkn12No ratings yet

- Project Appraisal 1Document23 pagesProject Appraisal 1Fareha RiazNo ratings yet

- AmalagamationDocument3 pagesAmalagamationPavan ReddyNo ratings yet

- Working Capital MGTDocument14 pagesWorking Capital MGTrupaliNo ratings yet

- 340 - Resource - 10 (F) Learning CurveDocument19 pages340 - Resource - 10 (F) Learning Curvebaby0310100% (2)

- ADL 12 Business Laws V6Document1 pageADL 12 Business Laws V6solvedcareNo ratings yet

- Advertising & Sales Promotion V5Document7 pagesAdvertising & Sales Promotion V5solvedcareNo ratings yet

- Accounting For Managers V5Document14 pagesAccounting For Managers V5solvedcareNo ratings yet

- Advertising & Sales Management V4Document12 pagesAdvertising & Sales Management V4solvedcareNo ratings yet

- Business Statistics V2Document20 pagesBusiness Statistics V2solvedcareNo ratings yet

- Process Analysis & Theory of Constraints V2Document8 pagesProcess Analysis & Theory of Constraints V2solvedcareNo ratings yet

- Principles and Practice of Management V4Document9 pagesPrinciples and Practice of Management V4solvedcareNo ratings yet

- Financial Management V5Document11 pagesFinancial Management V5solvedcareNo ratings yet

- Management in Action Social Economic Ethical Issues V1Document9 pagesManagement in Action Social Economic Ethical Issues V1solvedcareNo ratings yet

- Production and Operations Management V5Document9 pagesProduction and Operations Management V5solvedcareNo ratings yet

- Marketing of Services V4Document9 pagesMarketing of Services V4solvedcareNo ratings yet

- Customer Relationship Management V3Document8 pagesCustomer Relationship Management V3solvedcareNo ratings yet

- ADL 09 Human Resource Managment V5Document9 pagesADL 09 Human Resource Managment V5solvedcareNo ratings yet

- Service Operation Management V2Document5 pagesService Operation Management V2solvedcareNo ratings yet

- Distribution & Logistics Management V3Document5 pagesDistribution & Logistics Management V3solvedcareNo ratings yet

- ADL 74 System Analysis and Design V3Document6 pagesADL 74 System Analysis and Design V3solvedcareNo ratings yet

- Product & Brand Management V2Document6 pagesProduct & Brand Management V2solvedcareNo ratings yet

- Introduction To Object Oriented Programming & C++ V2Document9 pagesIntroduction To Object Oriented Programming & C++ V2solvedcareNo ratings yet

- Security Analysis and Portfolio Management V3Document6 pagesSecurity Analysis and Portfolio Management V3solvedcareNo ratings yet

- Consumer Behavior V4Document6 pagesConsumer Behavior V4solvedcareNo ratings yet

- Popular Fiction V1Document5 pagesPopular Fiction V1solvedcare0% (1)

- Web Enabled Business Process V1Document5 pagesWeb Enabled Business Process V1solvedcareNo ratings yet

- Modern English Poetry V1Document5 pagesModern English Poetry V1solvedcareNo ratings yet

- Compensation Management V2Document6 pagesCompensation Management V2solvedcareNo ratings yet

- Innovation in Business & Entreprise V1Document11 pagesInnovation in Business & Entreprise V1solvedcareNo ratings yet

- Compensation & Reward Management V3Document6 pagesCompensation & Reward Management V3solvedcareNo ratings yet

- Compensation Management V2Document6 pagesCompensation Management V2solvedcareNo ratings yet

- Evaluating Business Opportunities V1Document7 pagesEvaluating Business Opportunities V1solvedcareNo ratings yet

- Management of Financial Institutions V4Document6 pagesManagement of Financial Institutions V4solvedcareNo ratings yet

- Corporate Tax Planning V2Document6 pagesCorporate Tax Planning V2solvedcareNo ratings yet

- Standard Chartered BackgroundDocument6 pagesStandard Chartered BackgroundAwesum Allen MukiNo ratings yet

- PDF. Art Appre - Module 1Document36 pagesPDF. Art Appre - Module 1marvin fajardoNo ratings yet

- Boeing 7E7 - UV6426-XLS-ENGDocument85 pagesBoeing 7E7 - UV6426-XLS-ENGjk kumarNo ratings yet

- The Beatles - Allan Kozinn Cap 8Document24 pagesThe Beatles - Allan Kozinn Cap 8Keka LopesNo ratings yet

- Subject Object Schede PDFDocument28 pagesSubject Object Schede PDFanushhhkaNo ratings yet

- Hbet1103 Introduction To General LinguisticsDocument11 pagesHbet1103 Introduction To General LinguisticsNasidah NasahaNo ratings yet

- Design and Implementation of Land and Property Ownership Management System in Urban AreasDocument82 pagesDesign and Implementation of Land and Property Ownership Management System in Urban AreasugochukwuNo ratings yet

- Corporate Process Management (CPM) & Control-EsDocument458 pagesCorporate Process Management (CPM) & Control-EsKent LysellNo ratings yet

- Respiration NotesDocument2 pagesRespiration NotesBriana TaylorNo ratings yet

- HSG Anh 9 Thanh Thuy 2 (2018-2019) .Document8 pagesHSG Anh 9 Thanh Thuy 2 (2018-2019) .Huệ MẫnNo ratings yet

- Topic 8 - Managing Early Growth of The New VentureDocument11 pagesTopic 8 - Managing Early Growth of The New VentureMohamad Amirul Azry Chow100% (3)

- Talking About Your Home, Furniture and Your Personal Belongings - Third TemDocument4 pagesTalking About Your Home, Furniture and Your Personal Belongings - Third TemTony Cañate100% (1)

- The Ten Commandments For Network MarketersDocument3 pagesThe Ten Commandments For Network MarketersJustin Lloyd Narciso PachecoNo ratings yet

- I Could Easily FallDocument3 pagesI Could Easily FallBenji100% (1)

- Drainage Pipe Unit Price AnalysisDocument9 pagesDrainage Pipe Unit Price Analysis朱叶凡No ratings yet

- Siege by Roxane Orgill Chapter SamplerDocument28 pagesSiege by Roxane Orgill Chapter SamplerCandlewick PressNo ratings yet

- Modulo InglesDocument8 pagesModulo InglesJames Mosquera GarciaNo ratings yet

- Recommendation Letter - One Young WorldDocument2 pagesRecommendation Letter - One Young WorldNabeel K. AdeniNo ratings yet

- Text Detection and Recognition in Raw Image Dataset of Seven Segment Digital Energy Meter DisplayDocument11 pagesText Detection and Recognition in Raw Image Dataset of Seven Segment Digital Energy Meter DisplaykkarthiksNo ratings yet

- Effects of Violence On Transgender PeopleDocument8 pagesEffects of Violence On Transgender PeopleAdel Farouk Vargas Espinosa-EfferettNo ratings yet

- Checklist For HR Audit Policy and ProceduresDocument3 pagesChecklist For HR Audit Policy and ProcedureskrovvidiprasadaraoNo ratings yet

- Chapter 018Document12 pagesChapter 018api-281340024No ratings yet

- Concept of Intestate SuccessionDocument9 pagesConcept of Intestate SuccessionBodhiratan BartheNo ratings yet

- Lana Del Rey NewestDocument11 pagesLana Del Rey NewestDorohy Warner MoriNo ratings yet

- Lesson 3 Lymphatic System and Body DefensesDocument10 pagesLesson 3 Lymphatic System and Body DefensesJulio De GuzmanNo ratings yet

- School Communication Flow ChartsDocument7 pagesSchool Communication Flow ChartsSarah Jane Lagura ReleNo ratings yet

- Mech Course HandbookDocument20 pagesMech Course Handbookbrody lubkeyNo ratings yet

- PersonalDevelopment Q1 Module 2Document7 pagesPersonalDevelopment Q1 Module 2Stephanie DilloNo ratings yet

- Court Rules on Debt Collection Case and Abuse of Rights ClaimDocument3 pagesCourt Rules on Debt Collection Case and Abuse of Rights ClaimCesar CoNo ratings yet

- Understanding key abdominal anatomy termsDocument125 pagesUnderstanding key abdominal anatomy termscassandroskomplexNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- Basic Accounting: Service Business Study GuideFrom EverandBasic Accounting: Service Business Study GuideRating: 5 out of 5 stars5/5 (2)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesFrom EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesRating: 4.5 out of 5 stars4.5/5 (30)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungFrom EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungRating: 4 out of 5 stars4/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet