Professional Documents

Culture Documents

2927

Uploaded by

MilankaPalagankonaraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2927

Uploaded by

MilankaPalagankonaraCopyright:

Available Formats

Corporate Governance 2009

Published by Global Legal Group with contributions from:

A practical insight to cross-border corporate governance

www.ICLG.co.uk

The International Comparative Legal Guide to:

Advokatfirmaet Haavind AS

Al Tamimi & Company

ALRUD Law Firm

Anderson Mori & Tomotsune

Arnold Bloch Leibler

Ashurst LLP

Bae, Kim & Lee LLC

Basham, Ringe y Correa S.C.

BCM Hanby Wallace

Bernotas & Dominas Glimstedt

Cechov & Partners

Deneys Reitz Inc

Elvinger Hoss & Prussen

EMD Advocates

Garrigues

Gleiss Lutz

Kunz Schima Wallentin Rechtsanwlte OG

Law firm Miro Senica and attorneys

Lenz & Staehelin

Liepa, Skopina/ BORENIUS

Luiga Mody Hl Borenius

Michael Shine, Tamir & Co.

Osler, Hoskin & Harcourt LLP

Pachiu & Associates

Rnne & Lundgren

Roschier, Attorneys Ltd.

Santa Maria Studio Legale Associato

Schulte Roth & Zabel LLP

Siemiatkowski & Davies

Spasov & Bratanov Lawyers' Partnership

Vasil Kisil & Partners

Vieira de Almeida & Associados

Weinhold Legal, v.o.s.

Zhong Lun Law Firm

v

1

WWW.ICLG.CO.UK ICLG TO: CORPORATE GOVERNANCE 2009

Published and reproduced with kind permission by Global Legal Group Ltd, London

Chapter 1

Ashurst LLP

Directors Duties in the

Zone of Insolvency

Introduction

Corporate governance is concerned with supervision of the

management of a company and managing the risk, so that business

is carried out competently and with due care for the interests of all

stakeholders concerned. In the UK this regulation is undertaken

through various statutory provisions and the Financial Reporting

Councils Combined Code on Corporate Governance (Combined

Code) which relates to best practice.

Given the current unstable financial climate, corporate governance

issues will be particularly prominent in directors minds as they

balance the competing interests of their stakeholders. There is a

significant shift in directors duties when a company is faced with

the risk of insolvency. Directors need to be aware of these duties

and the related issues before the company becomes insolvent, as:

their responsibilities are very different from and more

extensive than those which apply to solvent companies;

many of them apply when a company is in financial trouble

but before it is insolvent in the technical sense;

directors who have not been faced with companies in

financial difficulties previously are likely to be unfamiliar

with them; and

failure to comply with them can lead to personal liability

and/or disqualification.

Who Do the Duties Apply to?

The duties apply to all directors. Section 250 of the Companies Act

2006 (2006 Act) defines a director as a person occupying the

position of a director by whatever name called. The common law

has imposed fiduciary duties on all directors, whatever their role,

and a duty of care and skill. Many of those duties have been

codified by the 2006 Act. Other statutes and regulations create

additional offences and many of them impose strict liability.

The common law fiduciary duty of the directors towards the

company was a duty to act honestly and in good faith in the best

interests of the company, and to use the powers granted to them for

the purposes for which they were conferred. Chapter 2 of Part 10

of the 2006 Act has codified certain of these duties.

Further, directors of listed companies must have regard to inter alia

the Listing Rules, Prospectus Rules, Disclosure and Transparency

Rules (DTRs) and the Combined Code. The Listing Rules,

Prospectus Rules, and the DTRs are regulated by the Financial

Services Authority (FSA) and create additional burdens which

are not faced by private companies. Although compliance with the

Combined Code is not mandatory, the Listing Rules prescribe that

officially listed companies must comply or explain how and why

they do not comply in their annual report. The Turnbull Guidance,

Smith Guidance and Higgs Report further supplement the

Combined Code with suggestions for good practice.

Codification of Directors Duties

The seven general duties of directors as codified by and set out in

sections 171 to 177 of the 2006 Act are:

to act within the powers conferred by the companys

constitution;

to promote the success of the company;

to exercise independent judgment;

to exercise reasonable care and skill;

to avoid conflicts of interest;

not to accept benefits from third parties; and

to declare interests in proposed transactions or arrangements.

These duties apply at all times and not just when the company faces

financial difficulty. The new statutory statement of duties does not

cover all duties that directors might owe - other duties, such as the

important duty to consider creditors interests in times of threatened

insolvency, remain uncodified.

The codified duties apply to all directors, including shadow

directors and nominee directors. This in itself can cause difficulties

as obviously the possibility for conflict between a shareholders

requirements and the companys best interests can arise and may be

even more pronounced if the company is facing financial

difficulties.

Directors Duties in the Twilight Zone

In the insolvency world the twilight zone refers to the period

which starts when a solvent company becomes an insolvent one and

ends on the commencement of a formal insolvency process.

In normal circumstances, where the company is in good financial

health, the 2006 Act provides that the primary duty of directors is to

act in a way which would be most likely to promote the success of

the company with reference to the interests of its shareholders as a

whole. However, as previously referred to, this duty is qualified by

section 172(3) of the 2006 Act, which provides that it is subject to

any enactment or rule of law requiring directors, in certain

circumstances, to consider or act in the interests of creditors of the

company. When a company is insolvent the interests of the

shareholders are less important and the directors need to discharge

their duties by reference to the creditors of the company.

There is a significant shift in a directors responsibilities which

occurs when a company is in the zone of insolvency and before it

Rachel Mulligan

Andrew Edge

2

Ashurst LLP Directors Duties in the Zone of Insolvency

ICLG TO: CORPORATE GOVERNANCE 2009 WWW.ICLG.CO.UK

Published and reproduced with kind permission by Global Legal Group Ltd, London

is actually technically insolvent. This is a phrase which has not

been defined but that has been used by the courts. It is advisable

that directors regard the shift as occurring when it appears (or

should be apparent to them) that there is a greater than ordinary

business risk of their company failing.

The main problem is that it is not always clear for a director when

this switch or shift occurs. When the company is solvent there is no

reason for directors to consider the interests of creditors. However,

when insolvent, the directors must consider creditors in priority to

shareholders (West Mercia Safetywear Ltd [in Liquidation] v

Dodd [1988] BCLC 250). It is the period in between which causes

most difficulties - the so-called twilight zone.

The reference in section 172(3) is probably reference to the

concepts of wrongful trading and fraudulent trading pursuant to the

provisions of the Insolvency Act 1986 (IA 1986). When

applicable they qualify a directors duty to promote the success of

the company for the benefit of the members as the directors (as a

defence to wrongful trading claims) must show that they have taken

all steps to minimise loss to creditors and failing which may incur

personal liability.

Much is made of the personal liability of directors in the event that

they continue to permit a company in financial difficulties to trade.

However, provided that it can be shown that the director has taken

every reasonable or proper step which he ought to have taken, with

a view to minimising the potential loss to the companys creditors,

that personal liability ought not to be triggered.

Questions arise when a company is in trouble as to whether the

directors, in considering the interests of creditors, should also continue

to have regard to the various factors set out in section 172(1), or

whether they are only relevant when the directors are looking to

promote the success of the company for the benefit of its members.

For example, the directors of a company may decide to continue

trading for a period so as to improve returns for creditors but with

the ultimate aim of filing for insolvency. Although they would be

minimising the potential loss to creditors and possibly reducing the

likelihood of a wrongful trading action, there is always the

possibility that in continuing to trade they have made it harder for

the employees to find alternative work when the company

eventually enters insolvency. There has been no express guidance

on how directors should exercise their duties when approaching

insolvency so it has been assumed that the factors which need to be

considered when a company is trading solvently are not relevant.

However, as mentioned already, it is difficult for directors to know

exactly when creditors interests are to be preferred over the

interests of shareholders as there is no concrete timeline. This in

itself is a further potential conflict area for directors not really

addressed by the courts or legislation - but which more than likely

will be in the not so distant future.

Wrongful Trading (Section 214 IA 1986)

This is probably the most difficult legal problem which a director of

a company in financial difficulties might face. Fear of this liability

may often lead directors to put a company into formal insolvency

proceedings before strictly necessary.

The case law relating to wrongful trading demonstrates that the

courts will typically find directors liable for wrongful trading where

the directors closed their eyes to the reality of the companys

position, and carried on trading long after it should have been

obvious to them that the company was insolvent and that there was

no way out for it (Re Continental Assurance Limited [2001]

BPIR 733).

What is the Standard Required of a Director?

The court will ask the following questions:

(a) during the time that person was a director and before the

commencement of the winding up of the company, did he

know or ought he to have known that there was no

reasonable prospect of the company avoiding an insolvent

liquidation (section 214(2) IA 1986)? If not, then there is no

wrongful trading by that person;

(b) if yes, following the time he did become aware (or ought to

have become aware) that there was no reasonable prospect

that the company would avoid going into an insolvent

liquidation, did he take all reasonable and proper steps with

a view to minimising the potential loss to the companys

creditors? If yes, then the court will not make an order

against that person (section 214(3) IA 1986).

Objective and Subjective Tests

Section 214(4) of the IA 1986 states that the facts which a director

of a company ought to know or ascertain, the conclusions he ought

to reach and the steps which he ought to take are those which would

have been known, ascertained, reached or taken by a reasonably

diligent person having both:

a) the general knowledge, skill and experience that may

reasonably be expected of a person carrying out the same

functions as are carried out by that director in relation to the

company (i.e., an objective test); and

b) the general knowledge, skill and experience that that director

has (i.e., a subjective test).

The court will look at the function carried out by the director in

question when deciding these questions.

What Order Can the Court Make?

The courts discretion in relation to section 214 is very wide. The

main consequence of a finding of wrongful trading is that the

director may be required to make a personal contribution to the

assets of the insolvent company. In addition to personal liability

where a director engages in wrongful trading, he may be

disqualified by a court order for a period between two and fifteen

years (see below).

Fraudulent Trading (Section 213 IA 1986)

Under the IA 1986 a liquidator can apply to court to obtain a

contribution from any person (including, but not limited to a

director) who knowingly continues to carry on the companys

business with the intention of defrauding creditors with the

knowledge that there is no reasonable prospect of the company

being able to pay its creditors (fraudulent trading). Fraudulent

trading is also a criminal offence pursuant to the CA 2006.

Whilst the use of the word fraud suggests a high level of

misconduct, in Re Powdrill & anor v Watson & anor (1995 2

WLR 312) it was suggested that fraudulent trading would

encompass trading either knowing or being reckless as to whether

creditors would be paid.

As fraudulent trading will almost certainly be wrongful trading as

well, it is unlikely that claims will be made for fraudulent trading

when a claim for wrongful trading can be made more easily. The

primary advantage of section 213 is that it can be used against non-

directors.

Recent case law suggests that fraudulent trading claims could become

WWW.ICLG.CO.UK

3

Ashurst LLP Directors Duties in the Zone of Insolvency

ICLG TO: CORPORATE GOVERNANCE 2009

Published and reproduced with kind permission by Global Legal Group Ltd, London

increasingly important and of wider application. These indicate that a

participant need only know the elements of a transaction which

transgress the ordinary standards of behaviour (Barlow Clowes

International Ltd [in liquidation] and anor - v - Eurotrust

International Limited and anor [2006] 1 All ER 333).

Preferences (Section 239 IA 1986)

Where a company has at a relevant time given a preference to a

person (being a creditor, surety or guarantor for any of the

companys debts or liabilities), a liquidator (or an administrator)

may apply to the court for an order restoring the position to what it

would have been had the preference not occurred.

A preference takes place if the company does something to put a

surety, creditor or guarantor in a better position than it would have

been in the event of the company entering insolvent liquidation.

The company must be influenced by the desire to achieve this result

(there can be no preference without their desire and, in practice, this

is difficult to show).

The transaction must have taken place within six months (or two

years in the case of connected persons) before the onset of

insolvency and the company must be insolvent at the time or as a

result of the preference. The desire element is presumed if the

preference is given to a connected person.

A director who authorises a preference may be subject to

disqualification under the Company Directors Disqualification Act

1986 (CDDA) and/or may be required to contribute to any shortfall.

Transactions at an Undervalue (Section 238

IA 1986)

A transaction at an undervalue occurs where a company has at a

relevant time (being two years ending with the onset of

insolvency) made a gift to a person or entered into a transaction

where the company receives no consideration or the consideration

received is significantly less in money or moneys worth than the

consideration given by the company.

The company must be insolvent at the time or become insolvent as

a result of the transaction.

The court may order that the company be put in the position that it

would have been in had the transaction not taken place. Often a

director will be joined to the proceedings if he was guilty of

misfeasance in permitting the company to enter into the transaction.

Furthermore, a director who authorises a transaction at an

undervalue may be subject to disqualification under the CDDA in

addition to personal liability.

Disqualification

The CDDA was brought into force with a view to raising standards.

Pursuant to the CDDA, a director may be disqualified from acting

as a director of a company whether directly or indirectly or in any

way being concerned or taking part in the promotion, formation or

management of a company unless he has the leave of the court.

Where a person has been a director of a company which has become

insolvent (either whilst he was a director or subsequently) and the

court finds that his conduct as a director makes him unfit to be

concerned in the management of a company, the court is obliged to

make a disqualification order for between two and 15 years.

A directors conduct will make him or her unfit to be concerned in

the management of a company if the court is satisfied that the

director has been guilty of a serious failure, whether deliberately or

due to incompetence, to perform his or her duties. The court will

have regard to:

any misfeasance or breach of duty by the director;

non-payment of crown debts such as PAYE, National

Insurance contributions and VAT;

the extent of the directors responsibility for the failure by

the company to supply goods or services which have been

paid for;

failure to keep proper books of account and/or to make

statutory returns;

misapplication of the companys funds or property;

trading with a succession of phoenix companies and/or

using a prohibited name;

drawing excessive remuneration; and

the directors responsibility for the company entering into

any preferences or transactions at an undervalue.

It is worth noting that over the years, and possibly as a result of the

growing body of corporate governance guidelines, the number of

disqualification cases before the court has increased dramatically.

On average, for every 10 companies that end up in a formal

insolvency, one director is disqualified.

Announcement Obligations for Directors of

Public Companies

Where a companys shares are listed on the UK Listing Authoritys

Official List, directors additionally have to consider the impact of

the DTRs and the Financial Services and Markets Act 2000

(FSMA) - particularly with reference to those provisions on

misleading the market.

Pursuant to the DTRs, companies which issue securities are under

an obligation to provide to the FSA inter alia any information

which the FSA considers appropriate to protect investors or to

ensure smooth operation of the market.

Directors of such companies are required to notify a Regulatory

Information Service (RIS) as soon as possible where there is a

change in the companys financial condition and when a substantial

movement in the price of its listed securities is likely. This clearly

applies to the situation where directors of listed companies are

aware of a high risk of insolvency.

Directors face difficulties in such circumstances. This obligation

will more than likely cause conflicts with directors first instincts to

protect the companys financial position until a decision has been

reached whether or not to trade on or to implement some form of

rescue. They have information which may cause the share price to

plunge, thus possibly inflicting substantial losses on shareholders.

Making a disclosure may seem inconsistent with a directors duty to

take every step to minimise potential losses to creditors within the

wrongful trading test.

DTR 2 (Disclosure and control of inside information by issuers)

requires an issuer admitted to trading on a regulated market (which

includes the main market of the London Stock Exchange, but not

AIM) to disclose via a RIS any inside information relating to it as

soon as possible (AIM has a separate disclosure regime which is

outside the scope of this paper ). However, DTR 2.5 (Delaying

disclosure of inside information) permits an issuer to delay the

disclosure of inside information in certain limited circumstances.

A recent amendment to DTR 2 recognises that an issuer which

receives liquidity support from the Bank of England or another

central bank may have a legitimate interest in delaying the public

disclosure of this fact.

4

Ashurst LLP Directors Duties in the Zone of Insolvency

ICLG TO: CORPORATE GOVERNANCE 2009 WWW.ICLG.CO.UK

Published and reproduced with kind permission by Global Legal Group Ltd, London

If a company does fail to comply with the disclosure requirements

the UKLA may suspend the trading of its shares.

Directors also need to have regard to FSMA provisions relating to

misleading statements and practices which impose criminal

penalties. Under section 397(2) of FSMA any person (not only a

director) who:

(a) makes a statement, promise or forecast which he knows to be

misleading, false or deceptive in a material particular;

(b) dishonestly conceals any material facts whether in

connection with a statement, promise or forecast made by

him or otherwise; or

(c) recklessly makes (dishonestly or otherwise) a statement,

promise or forecast which is misleading, false or deceptive in

a material particular,

is guilty of an offence if he makes the statement, promise or forecast

or conceals the facts for the purpose of inducing, or is reckless as to

whether it may induce another person (whether or not the person to

whom the statement, promise or forecast is made):

(a) to enter or offer to enter into, or to refrain from entering or

offering to enter into a relevant agreement; or

(b) to exercise, or refrain from exercising, any rights conferred

by a relevant investment.

Under section 397, an offence can be committed if a person makes

a false or misleading statement recklessly, even though they do

not realise that it is false or misleading. However, the omission of

a material fact can involve an offence only if the fact was concealed

dishonestly. Under section 397(3) of FSMA, it is also an offence

to act or engage in conduct which creates a false or misleading

impression as to the market in, or price or value of, any relevant

investments if the act or conduct is carried out for the purpose of

creating that impression and thereby inducing another person to

acquire, dispose of, subscribe or underwrite those investments or to

refrain from doing so.

A person guilty of an offence under section 397 is liable to a fine

and/or imprisonment for up to seven years.

It can be seen that directors of listed companies have a more

difficult time in relation to their responsibilities, having to balance

the timing of any necessary announcements against the need to

protect the business of the company, creditors and the share value

of the company.

Serious Loss of Capital

Section 142 of the Companies Act 1985 (to become section 656 CA

2006 with effect from 1 October 2009) provides that directors of

public companies should convene a general meeting where the net

assets of the company are half or less of its called up share

capital, within 28 days of one of them becoming aware of the

position. A failure to convene such a meeting, where necessary, can

leave directors open to a fine of up to 5,000 each.

How Can Directors Protect Themselves?

It is not possible to exempt a director from liability for negligence,

default, breach of duty or breach of trust, but shareholders can ratify

conduct by a director amounting to any of these by ordinary

resolution (unless otherwise stated in the companys articles). The

votes of the director (if he is also a shareholder) and his connected

persons are disregarded in such a resolution.

Acompany can include, and normally does include, an indemnity in

favour of directors within its articles in respect of any liabilities,

costs, charges and expenses incurred in the execution and discharge

of their duties. This includes liability incurred in defending any

civil or criminal proceedings relating to anything done, omitted or

alleged to be done or omitted by a director as an officer or employee

of the company.

Section 232 of the 2006 Act prevents a director from obtaining an

indemnity from the company against wrongful trading liability,

although a third party could give an indemnity. Whether liability is

covered by insurance cover will depend upon the terms of the

policy.

A company can purchase D&O insurance or a qualifying third party

indemnity provision (QTPIP) for its directors against any such

liability. However, the director cannot be covered by an indemnity

or a QTPIP in respect of:

fines imposed in criminal proceedings;

penalties imposed in respect of non-compliance with

regulatory requirements;

the defence costs of criminal proceedings where the director

is convicted;

the defence costs of civil proceedings successfully brought

against the director by the company or an associated

company; and

the costs of any unsuccessful applications brought by the

director for relief.

With ever-increasing standards being required to ensure compliance

with corporate governance guidelines, it seems that professionally

qualified directors may be more regularly in the firing line from

office-holders and the Secretary of State particularly if they have the

requisite deep pockets and/or are backed by D&O insurance

policies.

The decision to indemnify a director may be taken by the companys

board and shareholder approval is not required, although where

there is a potential conflict of interests, it may be prudent for

shareholder approval to be obtained.

No indemnity or insurance is available in respect of fraudulent

trading.

As far as directors of listed companies are concerned, they should

further ensure that they make the appropriate disclosures regarding

going concern status and liquidity risk. The difficult economic

conditions will mean that directors have to consider seriously

whether using the going concern basis of accounting is reasonable.

Conclusion

It is critical that directors still have regard to corporate governance

principles and their duties in times of financial difficulty. Regular

board meetings should be held so that commercial decisions are

recorded in company minutes. It is also important that directors

have up to date financial and legal information available to them at

board meetings to enable them to make informed decisions.

Particular attention should be paid to monitoring compliance with

financial covenants in any arrangements with lenders.

In order to satisfy their legal obligations, directors should keep the

companys position under constant review when in the zone of

insolvency (in most cases on a day-to-day basis) to ensure that there

remains a reasonable prospect of the company avoiding an insolvent

liquidation and that action taken in relation to the company is not

contrary to the best interests of the creditors. Directors should,

therefore, follow the guidelines below:

hold regular board meetings as soon as possible upon them

becoming aware that the company may be in financial

difficulties (and at least every week thereafter). Ideally no

other business would be tabled at the meeting, to permit

complete focus on the issue of whether the business is viable

WWW.ICLG.CO.UK

5

Ashurst LLP Directors Duties in the Zone of Insolvency

ICLG TO: CORPORATE GOVERNANCE 2009

Published and reproduced with kind permission by Global Legal Group Ltd, London

and to keep under review the prospect of avoiding insolvent

liquidation. Note that for a group of companies, the directors

should hold separate board meetings for each affected

company and must be careful only to consider the interests of

the relevant company (not its parent or sister companies) at

the relevant meeting;

carefully minute their discussions and conclusions as to why

there is a reasonable prospect of the company avoiding an

insolvent liquidation and, in particular, as to why the

company should continue to trade;

hold early discussions with auditors as regards potential

disclosures;

make sure that they have available all information necessary

to enable them to take an accurate and informed view as to

the financial position (including cashflows) and prospects of

the company. This information should cover not just the

immediate future but also as far into the future as is required

to enable an informed assessment of whether or not the

company will ultimately survive;

in particular the company will need accurate information as

to the make-up of its present (and future) creditors;

the minutes will assist as evidence of whether or not the

directors have taken steps to minimise potential loss to

creditors for the purpose of avoiding wrongful trading

liability;

ensure that there is a proper distribution of responsibility and

delegation within the company;

keep any new commitments to a minimum and consider ways

in which exposure can be reduced;

pay cash wherever possible;

take appropriate professional advice on remedial measures

including taking specialist insolvency advice as soon as

practicable;

consider whether it is possible to inform potential new

creditors of the companys financial difficulties so that they

can make an informed decision whether or not to trade with

the company; and

consider trading through an administration or requesting the

bank to appoint an administrative receiver (if it is able to do

so).

Andrew Edge

Ashurst LLP

Broadwalk House

5 Appold Street

London EC2A 2HA

United Kingdom

Tel: +44 20 7638 1111

Fax: +44 20 7638 1112

Email: Andrew.Edge@ ashurst.com

URL: www.ashurst.com

Andrew Edge is a partner in the corporate department in London,

specialising in mergers and acquisitions and corporate finance. He

has particular expertise in the healthcare sector. Andrew was

seconded to Ashursts Frankfurt office, from January 2002 to May

2005. In the past year he has acted for United Company Rusal, the

worlds largest aluminium company, on its acquisition of a 25 per

cent. state in Norilsk Nickel, and for Protherics plc, on its acquisition

by BTG plc, to form the UKs largest quoted biopharmaceutical

company.

Rachel Mulligan

Ashurst LLP

Broadwalk House

5 Appold Street

London EC2A 2HA

United Kingdom

Tel: +44 20 7638 1111

Fax: +44 20 7638 1112

Email: Rachel.Mulligan@ ashurst.com

URL: www.ashurst.com

Rachel Mulligan is a professional development lawyer in the

corporate department in London, specialising in restructuring and

insolvency. Rachel is a member of the professional development

team and, as such, her role is supporting and developing technical

excellence within the firm. Rachel works on internal and client-

facing documents, is involved in training and also helps generally on

technical legal matters, all across a wide-range of restructuring

related areas. Rachel is also a regular contributor to Corporate

Rescue and Recovery journal.

With over 200 partners and 800 lawyers in 12 countries, Ashurst LLP is an elite law firm advising corporates and

financial institutions. Our core business is built around our finance and corporate capabilities, combined with strong

commercial, competition, employment, litigation, real estate, regulatory and tax practices.

We have designed and built our business to meet our clients needs around the world, where the changing corporate

and regulatory environment is increasing the complexity of the business landscape and the need for timely and well-

judged responses. We deliver the innovative, commercially-driven advice that ambitious organisations need to succeed.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Syndicate Bank ProjectDocument86 pagesSyndicate Bank Projectmohammed saleem50% (4)

- Huerta Alba Resort V CADocument2 pagesHuerta Alba Resort V CAsinisteredgirl100% (1)

- Viking Form 2 ADVDocument36 pagesViking Form 2 ADVSOeNo ratings yet

- Tqs Finals Operations-AuditDocument46 pagesTqs Finals Operations-AuditCristel TannaganNo ratings yet

- Kipley Pereles' Resume - ConcordiaDocument2 pagesKipley Pereles' Resume - ConcordiaKipley_Pereles_5949No ratings yet

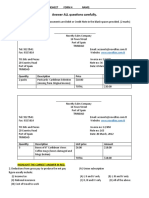

- Learning Exercises Bsa 3101 Corporate LiquidationDocument2 pagesLearning Exercises Bsa 3101 Corporate LiquidationRachel Mae FajardoNo ratings yet

- KCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Document24 pagesKCNXBPW /O/Bpw) Ns ) BPW: (") Lem /J) Lem Apm' F LN N Iytbmsv Is MSV)Avani Raju Baai0% (1)

- Case For L.CDocument17 pagesCase For L.CChu Minh LanNo ratings yet

- Project Proposal by Nigah-E-Nazar FatimiDocument8 pagesProject Proposal by Nigah-E-Nazar Fatiminazarfcma5523100% (3)

- Marginal Costing and Cost Volume Profit AnalysisDocument5 pagesMarginal Costing and Cost Volume Profit AnalysisAbu Aalif RayyanNo ratings yet

- Hba O1Document3 pagesHba O1rahul100% (1)

- Smart ConsensusDocument1 pageSmart ConsensusKarthikKrishnanNo ratings yet

- CBRE Releases Q4 2017 Quarterly Report Highlights Ho Chi Minh City MarketDocument5 pagesCBRE Releases Q4 2017 Quarterly Report Highlights Ho Chi Minh City Marketvl coderNo ratings yet

- Ar 2019 # Samindo-4 PDFDocument271 pagesAr 2019 # Samindo-4 PDFpradityo88100% (1)

- 2017 WOCCU International Operating PrinciplesDocument2 pages2017 WOCCU International Operating PrinciplesEllalaNo ratings yet

- CLS 12Document27 pagesCLS 12aarchi goyalNo ratings yet

- Aptitude Test - Accounts ExecutiveDocument8 pagesAptitude Test - Accounts ExecutiveHARCHARAN SINGH RANOTRANo ratings yet

- Chapter 10Document8 pagesChapter 10Nguyên NguyễnNo ratings yet

- Form 43Document1 pageForm 43ShobhnaNo ratings yet

- Quiz 2Document9 pagesQuiz 2yuvita prasadNo ratings yet

- Assignment Fiscal Policy in The PhilippinesDocument16 pagesAssignment Fiscal Policy in The PhilippinesOliver SantosNo ratings yet

- Nego Digest Week 2Document13 pagesNego Digest Week 2Rufino Gerard MorenoNo ratings yet

- Chit Fund CompaniesDocument179 pagesChit Fund CompaniesMIKE4U4No ratings yet

- MAINDocument80 pagesMAINNagireddy KalluriNo ratings yet

- NFRS 5Document14 pagesNFRS 5abhilekh2055No ratings yet

- Master Thesis Maarten VD WaterDocument92 pagesMaster Thesis Maarten VD WaterkennemerNo ratings yet

- Module 4 PDFDocument19 pagesModule 4 PDFRAJASAHEB DUTTANo ratings yet

- Real Estate Principles Legal Equitable "Exclusive Equity"Document92 pagesReal Estate Principles Legal Equitable "Exclusive Equity"Ven Geancia100% (1)

- PEFINDO Report Plus: DashboardDocument32 pagesPEFINDO Report Plus: DashboardIjazNo ratings yet

- T03 - Home Office & BranchDocument3 pagesT03 - Home Office & BranchChristian YuNo ratings yet