Professional Documents

Culture Documents

Republic Vs Aquafresh Seafoods - CD

Uploaded by

Nolas Jay0 ratings0% found this document useful (0 votes)

34 views8 pages!espondent sold two parcels of land, including improvements thereon, located at Barrio anica,!o"as #it$. #&A received a report that the lots sold were undervalued for ta"ation purposes.

Original Description:

Original Title

30. Republic vs Aquafresh Seafoods - CD

Copyright

© © All Rights Reserved

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document!espondent sold two parcels of land, including improvements thereon, located at Barrio anica,!o"as #it$. #&A received a report that the lots sold were undervalued for ta"ation purposes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

34 views8 pagesRepublic Vs Aquafresh Seafoods - CD

Uploaded by

Nolas Jay!espondent sold two parcels of land, including improvements thereon, located at Barrio anica,!o"as #it$. #&A received a report that the lots sold were undervalued for ta"ation purposes.

Copyright:

© All Rights Reserved

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 8

CIR versus AQUAFRESH SEAFOODS

G.R. No. 170389

Octoer !0" !010

SECOND DI#ISION

FAC$S AS $O %E$I$IONER

On June 7, 1999, respondent Aquafresh Seafoods Inc. sold two parcels of

land, including improvements thereon, located at Barrio anica, !o"as #it$,

!espondent then filed a #apital %ains &a" !eturn'Application for #ertification

Authori(ing !egistration and paid the #apital %ains &a" )#%&* and the the

+ocumentar$ Stamp &a" )+S&* due from the said sale.

FAC$S AS $O RES%ONDEN$

&he )I!*, however, received a report that the lots sold were undervalued for

ta"ation purposes. &his prompted the Special Investigation +ivision )SI+* of

the I! to conduct an occular inspection over the properties. After the

investigation, the SI+ concluded that the su,-ect properties were commercial

with a (onal value of .hp/,000.00 per square meter.

On Septem,er 11, /000, )+irector Sacamos* sent two Assessment 2otices

apprising respondent of #%& and +S& deficiencies. On Octo,er 1, /000,

respondent sent a letter protesting the assessments which was denied.

!espondent filed a petition for review

3

,efore the #&A. !espondent asserted

that the su,-ect properties were classified as 4!!4 or residential and not

commercial. !espondent argued that since there was alread$ a pre5defined

(onal value for properties located in Barrio anica, the I! officials had no

,usiness re5classif$ing the su,-ect properties to commercial.

#&A promulgated a +ecision

6

ruling in favor of respondent, &he #&A En

Banc ruled that the 1991 !evised 7onal 8alues of !eal .roperties should

prevail. Said court relied on Section 9 ):* of the 2ational Internal !evenue

#ode )2I!#* which requires consultation from appraisers, from ,oth the

pu,lic and private sectors, in fi"ing the (onal valuation of properties.

ISSUE AS $O %E$I$IONER

1. .etitioner also contends that what it did in the instant case was not to

prescri,e the (onal value, ,ut merel$ classif$ the same as commercial

/. .etitioner, that its act of classif$ing the su,-ect properties ,ased on

actual use was proper.

ISSUE AS $O RES%ONDEN$

1. !espondent contends that I! officials had no ,usiness re5classif$ing

the su,-ect properties to commercial.

/. !espondent further argues that actual use of propert$ does not

determine its (onal value

RU&ING OF $HE SU%RE'E COUR$

1. As to the issue whether petitioner;s act of re5classif$ing the properties

were valid, the S# ruled in favor of respondent. .etitioner<s act of re5

classif$ing the su,-ect properties from residential to commercial cannot

,e done without first compl$ing with the procedures prescri,ed ,$ law.

.etitioner<s act of classif$ing the su,-ect properties involves a re5

classification and revision of the prescri,ed (onal values. .etitioner,

thus, cannot unilaterall$ change the (onal valuation of such properties

to 4commercial4 without first conducting a re5evaluation of the (onal

values which requires a prior consultation with competent appraisers

,oth from the pu,lic and private sectors.

/. As to the issue whether actual use of the propert$ should determine

(onal values, the S# ruled in favor of respondent. :ven

assuming arguendo that the su,-ect properties were used for

commercial purposes, the same remains to ,e residential for (onal

value purposes. It appears that actual use is not considered for (onal

valuation, ,ut the predominant use of other classification of properties

located in the (one. Again, it is undisputed that the entire Barrio anica

has ,een classified as residential.

&he #&A En Banc held that petitioner failed to prove an$ amendment effected

on the 1991 !evised 7onal 8alues of !eal .roperties at the time of the sale of

the su,-ect properties.

=ence, herein petition, with petitioner raising the following issues for this

#ourt<s resolution, to wit>

I.

?=:&=:! O! 2O& &=: !:@AI!:B:2& OC #O2SAD&A&IO2 ?I&=

#OB.:&:2& A..!AIS:!S O&= C!OB &=: .!I8A&: A2+ .ADI#

S:#&O!S I2 +:&:!BI2I2% &=: CAI! BA!E:& 8ADA: OC &=:

SAJ:#& DO&S IS A..DI#AD: I2 &=: #AS: A& A!.

II.

?=:&=:! O! 2O& &=: #OA!& OC &AF A..:ADS EN

BANC #OBBI&&:+ %!A8: :!!O! I2 A..DGI2% &=: CAI! BA!E:&

8ADA: AS:+ O2 &=: 7O2AD 8ADAA&IO2 OC A !:SI+:2&IAD DA2+ AS

&AF AS: I2 &=: #OB.A&A&IO2 OC #A.I&AD %AI2S &AF A2+

+O#AB:2&A!G S&AB. &AF +:CI#I:2#I:S OC !:S.O2+:2&.

9

&he petition is not meritorious. &he issues ,eing interrelated, this #ourt shall

discuss the same in seriatim.

Ander Section /7)+*)1* of the 2I!# of 1997, a #%& of si" )9H* percent is

imposed on the gains presumed to have ,een reali(ed in the sale, e"change

or disposition of lands and'or ,uildings which are not activel$ used in the

,usiness of a corporation and which are treated as capital assets ,ased on

the gross selling price or fair marIet value as determined in accordance with

Section 9):* of the 2I!#, whichever is higher.

On the other hand, under Section 199 of the 2I!#, +S& is ,ased on the

consideration contracted to ,e paid or on its fair marIet value determined in

accordance with Section 9):* of the 2I!#, whichever is higher.

&hus, in determining the value of #%& and +S& arising from the sale of a

propert$, the power of the #I! to assess is su,-ect to Section 9):* of the

2I!#, which provides>

Section 9. Power of the Commissioner to Make Assessments and Prescribe

Additional Requirements for Tax Administration and Enforcement 5

" " " "

):* Authorit$ of the #ommissioner to .rescri,e !eal .ropert$ 8alues J &he

#ommissioner is here,$ authori(ed to divide the .hilippines into different

(ones or area and shall, upon co(su)t*t+o( ,+t- co./ete(t *//r*+sers

ot- 0ro. t-e /r+v*te *(1 /u)+c sectors, determine the fair marIet value

of real properties located in each (one or area. Cor purposes of computing

internal revenue ta", the value of the propert$ shall ,e, whichever is higher of>

)1* the fair marIet value as determined ,$ the #ommissionerK or

)/* the fair marIet value as shown in the schedule of values of the

.rovincial and #it$ Assessors.

?hile the #I! has the authorit$ to prescri,e real propert$ values and divide

the .hilippines into (ones, the law is clear that the same has to ,e done upon

consultation with competent appraisers ,oth from the pu,lic and private

sectors. It is undisputed that at the time of the sale of the su,-ect properties

found in Barrio anica, !o"as #it$, the same were classified as 4!!,4 or

residential, ,ased on the 1991 !evised 7onal 8alue of !eal .roperties.

.etitioner, thus, cannot unilaterall$ change the (onal valuation of such

properties to 4commercial4 without first conducting a re5evaluation of the (onal

values as mandated under Section 9):* of the 2I!#.

.etitioner argues, however, that the requirement of consultation with

competent appraisers is mandator$ onl$ when it is prescri,ing real propert$

values J that is when a formulation or change is made in the schedule of

(onal values. .etitioner also contends that what it did in the instant case was

not to prescri,e the (onal value, ,ut merel$ classif$ the same as commercial

and appl$ the corresponding (onal value for such classification ,ased on the

e"isting schedule of (onal values in !o"as #it$.

10

?e disagree.

&o this #ourt<s mind, petitioner<s act of re5classif$ing the su,-ect properties

from residential to commercial cannot ,e done without first compl$ing with the

procedures prescri,ed ,$ law. It ,ears to stress that ADD the properties

inBarrio anica were classified as residential, under the 1991 !evised 7onal

8alues of !eal .roperties. &hus, petitioner<s act of classif$ing the su,-ect

properties involves a re5classification and revision of the prescri,ed (onal

values.

In addition, !evenue Bemorandum 2o. 1L599 provides for the procedures on

the esta,lishment of the (onal values of real properties, vi(.>

)1* &he su,mission or review ,$ the !evenue +istrict Offices Su,5

&echnical #ommittee of the schedule of recommended (onal values to

the &#!.8K

)/* &he evaluation ,$ &#!.8 of the su,mitted schedule of

recommended (onal values of real propertiesK

)3* :"cept in cases of correction or ad-ustment, the &#!.8 finali(es

the schedule and su,mits the same to the :"ecutive #ommittee on

!eal .ropert$ 8aluation ):#!.8*K

)3* Apon approval of the schedule of (onal values ,$ the :#!.8, the

same is em,odied in a +epartment Order for implementation and

signed ,$ the Secretar$ of Cinance. &hereafter, the schedule taIes

effect )11* da$s after its pu,lication in the Official %a(ette or in an$

newspaper of general circulation.

.etitioner failed to prove that it had complied with !evenue Bemorandum 2o.

1L599 and that a revision of the 1991 !evised 7onal 8alues of !eal

.roperties was made prior to the sale of the su,-ect properties. &hus,

notwithstanding petitioner<s disagreement to the classification of the su,-ect

properties, the same must ,e followed for purposes of computing the #%&

and +S&. It ,ears stressing, and as o,served ,$ the #&A En Banc, that the

1991 !evised 7onal 8alues of !eal .roperties was drafted ,$ petitioner, I!

personnel, representatives from the +epartment of Cinance, 2ational &a"

!esearch #enter, Institute of .hilippine !eal :state Appraisers and .hilippine

Association of !ealtors oard, which dul$ satisfied the requirement of

consultation with pu,lic and private appraisers.

11

.etitioner contends, nevertheless, that its act of classif$ing the su,-ect

properties ,ased on actual use was in accordance with guidelines num,er 15,

and / as set forth in 4#ertain %uidelines in the Implementation of 7onal

8aluation of !eal .roperties for !+O 7/ !o"as #it$4 )7onal 8aluation

%uidelines*.

1/

Section 1 ),* of the 7onal 8aluation %uidelines reads>

1. No 2o(*) v*)ue -*s ee( /rescr+e1 for a particular classification of real

propert$.

?here in the approved schedule of (onal values for a particular ,aranga$ 5

" " " "

,* No 2o(*) v*)ue -*s ee( /rescr+e1 for a particular classification of real

propert$ in one ,aranga$, the (onal value prescri,ed for the same

classification of real propert$ located in an ad-acent ,aranga$ of similar

conditions shall ,e used.

Section 1 ),* does not appl$ to the case at ,ar for the simple reason that said

proviso operates onl$ when 4no (onal valuation has ,een prescri,ed.4 &he

properties located in Barrio anica, !o"as #it$ were alread$ su,-ect to a

(onal valuation, a fact which even petitioner has admitted in its petition, thus>

It must ,e noted that under the schedule of (onal values, aranga$ anica,

where the su,-ect lots are situated, has a single classification onl$ J that of a

residential area. Accordingl$, it has a prescri,ed (onal value of .hp910.00

per square meter.

13

.etitioner, however, also relies on Section / )a* of the 7onal 8aluation

%uidelines, to -ustif$ its action. Said section states>

/. .redominant Ase of .ropert$.

a* All real properties, regardless of actual use, located in a street',aranga$

(one, the use of which are predominantl$ commercial shall ,e classified as

4#ommercial4 for purposes of (onal valuation.

In I! !uling 2o. 0615/001, issued on Septem,er 1L, /001, the I! tacIled

the application of a provision which is identical to Section / )a* of the 7onal

8aluation %uidelines. I! !uling 2o. 0615/001 involved a request ,$

the!glesia Ni Cristo that the re5computation of #%& and +S& ,ased on the

predominant use of the real properties located at Bindanao Avenue, @ue(on

#it$, ,e set aside. In said case, the !glesia ni Cristo paid the #%& and +S&

,ased on the (onal value of residential lots in @ue(on #it$. &he !evenue

+istrict Officer, however, ordered a re5computation of the #%& and +S&

,ased on the ground that the real propert$ is located in a predominantl$

commercial area and must ,e classified as commercial for purposes of (onal

valuation. &he I! ruled in favor of!glesia ni Cristo stating that 4#ertain

%uidelines in the Implementation of 7onal 8aluation of !eal .roperties for

!+O 2o. 3L, appl$ing the predominant use of propert$ as the ,asis for the

computation of the #apital %ains and +ocumentar$ Stamp &a"es, s-*))

*//)3 o()3 ,-e( t-e re*) /ro/ert3 +s )oc*te1 +( *( *re* or 2o(e ,-ere

t-e /ro/ert+es *re (ot 3et c)*ss+0+e1 *(1 t-e+r res/ect+ve 2o(*) v*)u*t+o(

*re (ot 3et 1eter.+(e1.4 &he pertinent portion of I! !uling 2o. 0615/001

reads>

In repl$, please ,e informed that this Office finds $our request meritorious.

&he num,er / guideline laid down in #ertain %uidelines in the implementation

of 7onal valuation of !eal .roperties for !+O 2o. 3L5 2orth @ue(on #it$ """

does not appl$ to this case.

2um,er / of the #:!&AI2 %AI+:DI2:S I2 &=: IB.D:B:2&A&IO2 OC

7O2AD 8ADAA&IO2 OC !:AD .!O.:!&I:S CO! !+ 2O. 3L J 2O!&=

@A:7O2 #I&G4 provides>

4!. .!:+OBI2A2& AS: OC .!O.:!&G>

ADD !:AD .!O.:!&I:S !:%A!+D:SS OC A#&AAD AS:, DO#A&:+ I2 A

S&!::&'A!A2%AG 7O2:, &=: AS: OC ?=I#= A!: .!:+OBI2A2&DG

#OBB:!#IAD S=ADD : #DASSICI:+ AS <#OBB:!I#IAD<CO!

.A!.OS:S OC 7O2AD 8ADAA&IO2.4

It +s t-e co(s+1ere1 o/+(+o( o0 t-+s O00+ce t-*t t-e 5u+1e)+(e *//)+es ,-e(

t-e re*) /ro/ert3 +s )oc*te1 +( *( *re* or 2o(e ,-ere t-e /ro/ert+es *re

(ot 3et c)*ss+0+e1 *(1 t-e+r res/ect+ve 2o(*) v*)u*t+o( *re (ot 3et

1eter.+(e1.

I( t-e +(st*(t c*se" -o,ever" t-e c)*ss+0+c*t+o( *(1 v*)u*t+o( o0 t-e

/ro/ert+es )oc*te1 +( '+(1*(*o Ave(ue" 6*5o(5 6*(t*3" -*ve *)re*13

ee( 1eter.+(e1. Ander +epartment of Cinance Order 2o. 95/000, the

properties along Bindanao Avenue had alread$ ,een classified as residential

and commercial. &he (onal valuation thereof had alread$ ,een determined. "

" " $-ere0ore" t-e Reve(ue D+str+ct O00+cer o0 RDO No. 38 -*s (o

1+scret+o( to 1eter.+(e t-e c)*ss+0+c*t+o( or v*)u*t+o( o0 t-e /ro/ert+es

)oc*te1 +( t-e /ert+(e(t *re*. &he computation of the capital gains and

documentar$ stamp ta"es shall ,e ,ased on the (onal of residential

properties located at Bindanao Avenue, ago anta$, @ue(on #it$.

16

"a##$hil

ased on the foregoing, this #ourt need not ,ela,our on the applica,ilit$ of

Section / )a*, as the I! itself has alread$ ruled that the same shall appl$

onl$ when the real propert$ is located in an area or (one where the properties

are not $et classified and their respective (onal valuation are not $et

determined. As mentioned earlier, the su,-ect properties were alread$ part of

the 1991 !evised 7onal 8alue of !eal .roperties which classified the same

as residential with a (onal value of .hp910.00 per square meterK thus,

Section / )a* clearl$ has no application.

&his #ourt agrees with the o,servation of the #&A that 4(onal valuation was

esta,lished with the o,-ective of having an Mefficient ta" administration ,$

minimi(ing the use of discretion in the determination of the ta" ,ased on the

part of the administrator on one hand and the ta"pa$er on the other

hand.;4

11

7onal value is determined for the purpose of esta,lishing a more

realistic ,asis for real propert$ valuation. Since internal revenue ta"es, such

as #%& and +S&, are assessed on the ,asis of valuation, the (onal valuation

e"isting at the time of the sale should ,e taIen into account.

19

If petitioner feels that the properties in Barrio anica should also ,e classified

as commercial, then petitioner should worI for its revision in accordance with

!evenue Bemorandum Order 2o. 1L599. &he ,urden was on petitioner to

prove that the classification and (onal valuation in Barrio anica have ,een

revised in accordance with the prevailing memorandum. In the a,sence of

proof to the contrar$, the 1991 !evised 7onal 8alues of !eal .roperties must

,e followed.

Dastl$, this #ourt taIes note of the wording of Section / ),* of the 7onal

8aluation %uidelines, to wit>

/. .redominant Ase of .ropert$.

,* &he predominant use of other classification of properties located in a

street',aranga$ (one, re5*r1)ess o0 *ctu*) use shall ,e considered for

purposes of (onal valuation.

ased thereon, this #ourt rules that even assuming arguendo that the su,-ect

properties were used for commercial purposes, the same remains to ,e

residential for (onal value purposes. It appears that actual use is not

considered for (onal valuation, ,ut the predominant use of other classification

of properties located in the (one. Again, it is undisputed that the

entire Barrio anica has ,een classified as residential.

7HEREFORE, premises considered, the petition is denied. &he 2ovem,er 9,

/001 +ecision of the #ourt of &a" Appeals En Banc, in #&A5:.. 2o. 77, is

here,$ AFFIR'ED.

SO O!+:!:+.

DIOSDADO '. %ERA&$A

Associate Justice

?: #O2#A!>

You might also like

- Am - 14 11 350 RTC - 2017 PDFDocument24 pagesAm - 14 11 350 RTC - 2017 PDFNolas JayNo ratings yet

- Small ClaimsDocument66 pagesSmall ClaimsarloNo ratings yet

- Affidavit of Loss Cellphone SIM CardDocument1 pageAffidavit of Loss Cellphone SIM CardNolas JayNo ratings yet

- Small ClaimsDocument66 pagesSmall ClaimsarloNo ratings yet

- 2015 Rem Q & ADocument12 pages2015 Rem Q & ANolas JayNo ratings yet

- GR 198209 2017 PDFDocument9 pagesGR 198209 2017 PDFNolas JayNo ratings yet

- GR 192345 2017 PDFDocument24 pagesGR 192345 2017 PDFNolas JayNo ratings yet

- 2014 Rem Q & ADocument14 pages2014 Rem Q & ANolas JayNo ratings yet

- Police Raid Violated Search Warrant RequirementDocument15 pagesPolice Raid Violated Search Warrant RequirementCarlo Landicho100% (1)

- SuccessionDocument3 pagesSuccessionNolas JayNo ratings yet

- Almario V AgnoDocument9 pagesAlmario V AgnoMino GensonNo ratings yet

- State LandDocument9 pagesState LandNolas JayNo ratings yet

- SystraDocument13 pagesSystraNolas JayNo ratings yet

- FilinvestDocument36 pagesFilinvestNolas JayNo ratings yet

- Cyanamid V CADocument17 pagesCyanamid V CANolas JayNo ratings yet

- ManilabankDocument9 pagesManilabankNolas JayNo ratings yet

- CIR V PhilamgenDocument8 pagesCIR V PhilamgenNolas JayNo ratings yet

- Cir Vs Primetown Property G.R. No. 184823 October 6, 2010Document2 pagesCir Vs Primetown Property G.R. No. 184823 October 6, 2010Nolas JayNo ratings yet

- Street Law RapeDocument10 pagesStreet Law RapeNolas JayNo ratings yet

- Billofrights DiscussionDocument3 pagesBillofrights DiscussionNolas JayNo ratings yet

- 01 - Philippine First Insurance Co., Inc. v. Maria Carmen Hartigan, Et. Al., 7 SCRA 252Document8 pages01 - Philippine First Insurance Co., Inc. v. Maria Carmen Hartigan, Et. Al., 7 SCRA 252Alexylle Garsula de ConcepcionNo ratings yet

- Freedom of Information and Access To Government Records Around The World.Document40 pagesFreedom of Information and Access To Government Records Around The World.Nolas JayNo ratings yet

- Selection and Acquisition of MultimediaDocument8 pagesSelection and Acquisition of MultimediaNolas JayNo ratings yet

- Establishing a Sustainable Social Enterprise for WomenDocument21 pagesEstablishing a Sustainable Social Enterprise for WomenNolas JayNo ratings yet

- CIR Vs Metro Star Superama - CDDocument2 pagesCIR Vs Metro Star Superama - CDNolas JayNo ratings yet

- Standard For Special LibrariesDocument5 pagesStandard For Special LibrariesNolas JayNo ratings yet

- Fitness by Design Vs CIR - CDDocument2 pagesFitness by Design Vs CIR - CDNolas Jay100% (1)

- CIR Vs Hambrecht & Quis Phils - CDDocument2 pagesCIR Vs Hambrecht & Quis Phils - CDNolas JayNo ratings yet

- Chamber of Real Estate vs Romulo: SC Rules on MCIT, CWT ConstitutionalityDocument2 pagesChamber of Real Estate vs Romulo: SC Rules on MCIT, CWT ConstitutionalityNolas Jay100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Covenant For Quiet EnjoymentDocument2 pagesCovenant For Quiet EnjoymentJensenNo ratings yet

- LAWS3113 - Equitable Property InterestsDocument4 pagesLAWS3113 - Equitable Property InterestsEleanor FooteNo ratings yet

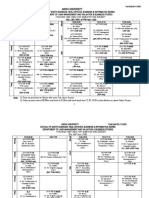

- Ardhi University: Mr. Kafullah/Ms. Jenesta Lecture R-62Document14 pagesArdhi University: Mr. Kafullah/Ms. Jenesta Lecture R-62Betson EsromNo ratings yet

- 7 Steps Simple Steps Blueprint Investing For WomenDocument16 pages7 Steps Simple Steps Blueprint Investing For WomenN'Gandjo Wassa CisseNo ratings yet

- Court Case Over Inherited Land Dispute Among RelativesDocument8 pagesCourt Case Over Inherited Land Dispute Among Relativesp95No ratings yet

- Corporate Properties Study Benton Harbor/St. Joseph Part IIDocument112 pagesCorporate Properties Study Benton Harbor/St. Joseph Part IIProtectJKPNo ratings yet

- Course: Objective: To Introduce To Students in The Real Estate Brokerage Practice by EquippingDocument2 pagesCourse: Objective: To Introduce To Students in The Real Estate Brokerage Practice by EquippingJosue Sandigan Biolon SecorinNo ratings yet

- Deed of Simple Mortgage Deed: Mr. - , Son of Mr. - , Aged About - YearsDocument5 pagesDeed of Simple Mortgage Deed: Mr. - , Son of Mr. - , Aged About - YearsJai GaneshNo ratings yet

- Updated listings of foreclosed properties in Laguna, Cavite, Parañaque & moreDocument2 pagesUpdated listings of foreclosed properties in Laguna, Cavite, Parañaque & moreArnulfo Pecundo Jr.No ratings yet

- G.R. No. 200274. April 20, 2016. Melecio Domingo, Petitioner, vs. Spouses Genaro MOLINA and ELENA B. MOLINA, Substituted by ESTER MOLINA, RespondentsDocument17 pagesG.R. No. 200274. April 20, 2016. Melecio Domingo, Petitioner, vs. Spouses Genaro MOLINA and ELENA B. MOLINA, Substituted by ESTER MOLINA, RespondentsLalaNo ratings yet

- Estate Tax Case Decided by Court of Tax AppealsDocument7 pagesEstate Tax Case Decided by Court of Tax AppealsYsabel SantosNo ratings yet

- Carolina (Carlina) Vda. de Figuracion, Et Al. vs. Emilia Figuracion-GerillaDocument3 pagesCarolina (Carlina) Vda. de Figuracion, Et Al. vs. Emilia Figuracion-GerillaMichelle Montenegro - AraujoNo ratings yet

- Discovery JT FoxxDocument10 pagesDiscovery JT Foxxrifishman1No ratings yet

- Privy Council Decisions on Gibraltar Property DebtDocument17 pagesPrivy Council Decisions on Gibraltar Property DebtChen ShiLunNo ratings yet

- Assignment in LEGAL COMMDocument3 pagesAssignment in LEGAL COMMSai PastranaNo ratings yet

- Conditional Deed of Sale 1Document3 pagesConditional Deed of Sale 1John Paul Pagala AbatNo ratings yet

- BBGreater JKT Landed Residential H22011Document10 pagesBBGreater JKT Landed Residential H22011JarjitUpinIpinJarjitNo ratings yet

- Web SurveyorDocument3 pagesWeb SurveyorChittagong Port AgentNo ratings yet

- Briar's Keep SampleDocument5 pagesBriar's Keep SamplePaige MNo ratings yet

- Vested Interests ExplainedDocument18 pagesVested Interests ExplainedAhmed Hasan MosaibNo ratings yet

- India Mumbai Industrial H1 2021Document2 pagesIndia Mumbai Industrial H1 2021mudit methaNo ratings yet

- Mangaser vs. UgayDocument16 pagesMangaser vs. UgayFbarrsNo ratings yet

- City of Cebu Versus Hers of Candido RubiDocument1 pageCity of Cebu Versus Hers of Candido RubiJemson Ivan WalcienNo ratings yet

- User Guide Pointv70Document537 pagesUser Guide Pointv70Nye LavalleNo ratings yet

- Loan and Mortgage FraudDocument15 pagesLoan and Mortgage FraudHan Win100% (1)

- Squatters Rights Oklahoma - Difference Between Trespasser and SquatterDocument12 pagesSquatters Rights Oklahoma - Difference Between Trespasser and Squatterscott nachatiloNo ratings yet

- Land Titles and Deeds Memory AidDocument12 pagesLand Titles and Deeds Memory AidSarah CadioganNo ratings yet

- Deed of Sale of A Real PropertyDocument6 pagesDeed of Sale of A Real Propertyoshin saysonNo ratings yet

- Vedant BaseDocument6 pagesVedant BasePanda ponnuNo ratings yet

- Property Law Notes Lecture Notes Lectures 1 10Document39 pagesProperty Law Notes Lecture Notes Lectures 1 10RjRajora100% (1)