Professional Documents

Culture Documents

Kone

Uploaded by

mansie139Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Kone

Uploaded by

mansie139Copyright:

Available Formats

Executive Summary

The Strategic Problem is that Kone is currently facing a precarious financial situation in an industry that competes

on price rather than differentiation. The Strategic Alternatives are: (1) Price Skimming Strategy (2) Penetration

Pricing Strategy (3) Neutral Market Pricing Strategy. The Strategic Recommendation is to follow a neutral market

pricing strategy with a recommended price of DM 76,500 to create an economic value for the product and generate

DM 10,628,769 (Exhibit 4) in next 5 years with a 50% retention rate. (Exhibit 3)

Situation Analysis:

Category: Germany is a critical market because of its large size (15,500 total units annually) and its global reputation

as a technology leader. Although, the elevator market in Germany is a highly saturated market and a slump in

construction led to a demand fall of about 15%. With high buying power, contractors consistently used the bid

process to pressure contractors for price reductions (Exhibit 7). As the selling process is largely dependent on bidding,

it is inevitable that the industry competes on competitive pricing. The market attractiveness is high due to low

entry barriers, simple and established technology and high profit margin in service industry. Competition: Schindlers

market share is the highest in the German market, at 19.4% followed by Otis, Thyssen and KONE, other mid-sized

held approximately 46% of the German elevator market. The competitive advantage for large players is that they

provided 24-hour service and had onsite sales and manufacturing facilities. Most of the selling was based on bidding

thus, Kones lower market share points to its competitive advantage being medium-low as it doesnt have a better

priced product. Company: Although Kone Aufzug has access to the entire demand for elevators in the German

market through the bidding process, the market share in PH, PT and PU are only 9.1%, 2.7% and 0.46% (Exhibit 6).

As the country with the largest market, Germany is ironically Kones weakest market in comparison to France (14%),

U.K (20%) and the Netherlands (40%). Customer/Consumer: Customers are price sensitive due to market

saturation. There are also quality, efficiency, and service oriented customers. Property developers, general contractors

and architects are our customers where property dealers are concerned about price while general contractors whose

top 4 constitute 20% of market, are highly fragmented in nature & influence the sale of the product using competitive

bidding process. Architects select elevators cosmetic options only. COI: Our COI are the contractors and architects

who make the final purchase decision 90% of the time. Context: There is a need for legal approval for Monospace to

be installed in every state throughout the country and also Government does not subsidize the elevator industry.

Key Takeaways: (1) Kone has significant market share in PH over the rest. This has important implications since the

introduction of Monospace could potentially cannibalize sales of PH. (2) In order to mitigate product risks, consumers

will usually sample a product before purchase. Unfortunately, in the elevator industry where investments made are

rather substantial, there is no chance to experience a ride in the elevator before purchase. The installation of a

MonoSpace in the Kone office will give potential buyers a chance to experience a MonoSpace, reduce perceived

product risks that they may have and create a greater incentive to purchase MonoSpace.

Strategic Alternatives: (1) Price Skimming Strategy: This approach would entail pricing near the very top of

the price window and retaining most of the economic benefit created by Monospace.

Pros: -Emphasizes profit margins

-Higher price conveys benefits and reinforces the message that Monospace is a revolutionary product in the market.

-Does not upset other current players in the market and minimizes their reaction

-Gives KONE the most room to maneuver & change future pricing (it is easier to lower prices than to increase them)

Cons: -Price may be too high since not all benefits are enjoyed by all the decision makers

-Total economic value of Monospace will not be enjoyed until later due to present machine room designs.

-Harder to sell benefits of the product to the customer since they receive a smaller portion of their value

-Need a very skilled, experienced sales force that can carefully market the high value of each of these benefits

(2) Penetration Pricing Strategy: This means pricing near the bottom of the price window and giving the customer

most of the economic value created by Monospace.

Pros: -Easier to sell benefits to the customer

-Volume play that will likely increase revenue results in Germany

Cons: -Will incite a far greater reaction from stronger competitors in the segment

-May make it harder to position the rest of the product line in the future

-May cannibalize sales of its low rise PH product

(3) Neutral Market Pricing Strategy: A market strategy that prices near the middle of a value map.

Pros: - Price is adequate to create customer demand

-Will create a positive position in future

-No strong retaliation attacks

Cons: -May not provide big profit margins

-Its success depends on Kones future position

-Require an adequate mix of volume play and skilled sales force

Strategic Recommendation is to pursue a neutral market pricing strategy that targets geared traction elevators

customers in the low-to-mid rise residential market. A neutral pricing strategy that prices Monospace in between the

PT and PU levels on the value map (Exhibit 5) seems to strike the right balance between immediate sales and future

positioning. It allows time to grow the ecosystem while increasing chances for a successful German launch; it

maintains current revenues from existing hydraulic markets by minimizing cannibalization. This price level preserves

the current discrete product segments and leaves KONE well placed with respect to margins, product positioning, and

flexibility for future expansion. Using the pricing model and assuming that switching costs and other negative

differentiation values are close to zero, we get a total differentiation value of 33,000 DM (Exhibit 4). Because we are

not the market leader, we recommend that KONE give the consumer at least 50% of the economic value (V) created

by the Monospace product. Kones superior technology and the above exercise leave us with a price

recommendation of DM 76,500, which sits between the PU and PT price range.

Tactical Marketing Plan: Target audience: Communication of the benefits to each decision maker must be

customized and focused on their individual benefits. It is important that these constituencies are not grouped

together, and they must be presented material specific to their needs. Marketing Kit: As a result, we recommend a

combination of sales-visits, targeted seminars, a media kit that includes a video CD, and advertisements in

subscription based monthly trade journals. This can make KONE to develop a stronger foothold with a promotion cost

of DM 264,200 (Exhibit 1). Pilot projects/Live demonstrations: Because this is a new technology, it is important

to have several installations around the country for demonstration purposes. These installations must be designed so

that architects can appreciate the freedom they will have, owners can quantify the savings, and for contractors to

experience the ease of installation. Supplier power concerns: Customers may have concerns about price gouging

once they have designed their buildings for MonoSpace. Other concerns could arise over switching costs if KONE were

to decide to suddenly discontinue the product line. KONE can demonstrate its commitment by offering contracts that

offer price guarantees once building designs are finalized and penalty clauses if the MonoSpace line is discontinued.

New technology: With any innovation, concerns about reliability may arise. KONE can offer customers warranties or

bundles with a 1-year service contract included free of charge (KONEs estimated cost for maintenance is DM 2,100

per year). Furthermore, KONE can emphasize its leadership position in other markets and its history in delivering

reliable innovative product to reassure customers. Maintenance and Distribution: KONE must also undertake the

proper capacity planning and build-up to guarantee capacity needs on both the new equipment and service side can

be met. With the aforementioned plan, Kone would be able to generate a profit of DM 3,499,575 in the next year at a

3% annual growth rate with a potential profit of DM 10,628,769 with a 9% growth rate in the next 5 years

considering a 50% retention rate. Long-Term Plan: Kone must continue to invest in technology development to

both expand the capabilities of the EcoDisc technology and drive down costs. KONE should consider increasing its

R&D expenditures (1.5% of revenues) to close the spending gap with the market leaders. This will enable KONE to

maintain its technology lead and extend a high end EcoDisc solution higher up the price/performance line. Cost

reductions will also enable KONE to sell cost competitive low-end EcoDisc solutions closer to the PH segment. In the

future as this product line gains breadth, further market segmentation can transition MonoSpace products into a far-

reaching product line that completely spans the low to medium range segments. In addition, as it grows its

technological and organization capabilities, KONE should devise entry plans in the fast growing markets in Asia.

You might also like

- Kone CaseDocument6 pagesKone CaseSachin SuryavanshiNo ratings yet

- Kone ElevatorsDocument2 pagesKone Elevatorslordavenger0% (1)

- Kone MonospaceDocument11 pagesKone MonospacekarsocoolNo ratings yet

- KONE's Marketing Plan for MonoSpace Launch in GermanyDocument5 pagesKONE's Marketing Plan for MonoSpace Launch in GermanyGoenka Vicky100% (1)

- KONE's Neutral Pricing Strategy for Launching MonoSpace in GermanyDocument17 pagesKONE's Neutral Pricing Strategy for Launching MonoSpace in Germanyjunk_987654100% (2)

- Kone Case AnalysisDocument4 pagesKone Case AnalysisUmesh SonawaneNo ratings yet

- Marketing PlanDocument21 pagesMarketing PlanBianca van Niekerk100% (1)

- Assignment 1 - B2B MarketingDocument4 pagesAssignment 1 - B2B MarketingNik100% (1)

- Launch KONE MonoSpace in GermanyDocument10 pagesLaunch KONE MonoSpace in GermanynewboyinNo ratings yet

- Kone Case AnalysisDocument7 pagesKone Case AnalysisPaskalis Sergius Noeng0% (2)

- Kone Case AnalysisDocument6 pagesKone Case AnalysisNikit Tyagi50% (2)

- Mono Space 2Document12 pagesMono Space 2Cheryl Kang100% (1)

- Kone Case StudyDocument10 pagesKone Case StudyTarun GargNo ratings yet

- KONE Case Analysis - 18021141055Document6 pagesKONE Case Analysis - 18021141055meghanaNo ratings yet

- KOneDocument13 pagesKOnevijaygopal2100% (2)

- Kone Case Write-up AnalysisDocument7 pagesKone Case Write-up AnalysisAnwesha RoyNo ratings yet

- Kone Case AnalysisDocument4 pagesKone Case AnalysisKshitij GuptaNo ratings yet

- CH Dell ComputersDocument5 pagesCH Dell ComputersKANIKA GORAYANo ratings yet

- LoctiteDocument19 pagesLoctiteAbhi_The_RockstarNo ratings yet

- Mother Dairy PresentationDocument5 pagesMother Dairy PresentationAKANSHANo ratings yet

- MGEC Session10 SeqandRepGamesDocument61 pagesMGEC Session10 SeqandRepGamesjohn abacusNo ratings yet

- Kone: The Monospace Launch in GermanyDocument13 pagesKone: The Monospace Launch in GermanyBimal SahooNo ratings yet

- Philips Lighting CAB Eden GardensDocument5 pagesPhilips Lighting CAB Eden GardensVinayNo ratings yet

- PGP12101 B Akula Padma Priya DADocument20 pagesPGP12101 B Akula Padma Priya DApadma priya akulaNo ratings yet

- HCL Beanstalk Case StudyDocument15 pagesHCL Beanstalk Case Studydebarpan100% (1)

- Otis LineDocument2 pagesOtis LineKesav ViswanathNo ratings yet

- RCF's Supply Chain Management StrategiesDocument24 pagesRCF's Supply Chain Management Strategiesmalik_samnani100% (1)

- Porter's 5 Forces Analysis of Toyota's Automotive Industry PositionDocument9 pagesPorter's 5 Forces Analysis of Toyota's Automotive Industry PositionBiju MathewsNo ratings yet

- Group 10 - Siemens CerberusEco in ChinaDocument9 pagesGroup 10 - Siemens CerberusEco in Chinaronitr209No ratings yet

- KONEDocument14 pagesKONEAlok PokharnaNo ratings yet

- Group D7: Giridaran - Moksh - Mithila - Revant - Rhythym - SwapnilDocument6 pagesGroup D7: Giridaran - Moksh - Mithila - Revant - Rhythym - Swapnilrev1202No ratings yet

- Tale of Two Companies, Case SummaryDocument3 pagesTale of Two Companies, Case Summaryshershah hassan0% (1)

- Case MethodDocument10 pagesCase MethodEka Moses MarpaungNo ratings yet

- Business Strategy Case Study - DoCoMoDocument18 pagesBusiness Strategy Case Study - DoCoMoRobinHood TiwariNo ratings yet

- SchindlerDocument7 pagesSchindlerShaina DewanNo ratings yet

- Kone MonospaceDocument13 pagesKone MonospaceAnshul Anand0% (1)

- Ceba-Geigy Pharmaceuticals - Pharma International AnalysisDocument20 pagesCeba-Geigy Pharmaceuticals - Pharma International AnalysisRashmi KethaNo ratings yet

- Wipro TechnologiesDocument12 pagesWipro TechnologiesVivek SinhaNo ratings yet

- Ingersoll-Rand (A) : Managing Multiple Channels: 1985Document5 pagesIngersoll-Rand (A) : Managing Multiple Channels: 1985miteshgajjarNo ratings yet

- Tata Daewoo Deal1Document5 pagesTata Daewoo Deal1Ashwinikumar KulkarniNo ratings yet

- MBM Project Interim SubmissionDocument4 pagesMBM Project Interim SubmissionSonaliCaffreyNo ratings yet

- 300 - Prachet PrakashDocument3 pages300 - Prachet PrakashSAURABH RANGARINo ratings yet

- Tyler Abrasives Global Pricing Case StudyDocument7 pagesTyler Abrasives Global Pricing Case StudyTejas ShahNo ratings yet

- Written Case Format AnalysisDocument4 pagesWritten Case Format AnalysisKalpesh Hotchandani0% (1)

- Assignment B2B MarketingDocument5 pagesAssignment B2B MarketingNitam BaroNo ratings yet

- Group5 - B 3rd CaseDocument2 pagesGroup5 - B 3rd CaseRisheek SaiNo ratings yet

- Finland and Nokia: Creating The World's Most Competitive Economy, HBS Case Number: 9-702-427Document1 pageFinland and Nokia: Creating The World's Most Competitive Economy, HBS Case Number: 9-702-427HarrisNo ratings yet

- Integrated L & SCM Case StudyDocument21 pagesIntegrated L & SCM Case Studyrahul_thorat01No ratings yet

- Ingersoll Rand Sec B Group 1Document8 pagesIngersoll Rand Sec B Group 1biakNo ratings yet

- Merloni Elettrodomestici Spa: The Transit Point ExperimentDocument23 pagesMerloni Elettrodomestici Spa: The Transit Point ExperimenthehehuhuNo ratings yet

- Competition in The Craft Beer Industry in 2018Document8 pagesCompetition in The Craft Beer Industry in 2018Himanshu MaanNo ratings yet

- Le Petit Chef Case AnalysisDocument2 pagesLe Petit Chef Case AnalysisAdisorn SribuaNo ratings yet

- DMB2B Assignment Shreya 2018PGP355Document5 pagesDMB2B Assignment Shreya 2018PGP355SHREYA PGP 2018-20 BatchNo ratings yet

- Strategic Inflection Points in The Telecom IndustryDocument15 pagesStrategic Inflection Points in The Telecom IndustryUdita Dasgupta BiswasNo ratings yet

- KoneDocument3 pagesKoneMalini RajashekaranNo ratings yet

- Case Analysis Kone MonospaceDocument2 pagesCase Analysis Kone Monospacesameerrd100% (1)

- Kone PDFDocument3 pagesKone PDFShilanand Vaibhav50% (2)

- KoneDocument3 pagesKoneAnkita Gupta100% (1)

- Business MarketingDocument17 pagesBusiness MarketingSyed D Kings'No ratings yet

- KONE ElevatorDocument2 pagesKONE ElevatorvelusnNo ratings yet

- Berk/DeMarzo Corporate Finance Annuity Spreadsheet InstructionsDocument1 pageBerk/DeMarzo Corporate Finance Annuity Spreadsheet Instructionsmansie139No ratings yet

- CHP 1Document18 pagesCHP 1mansie139No ratings yet

- Crucibles of Leadership - BennisDocument7 pagesCrucibles of Leadership - Bennismansie139No ratings yet

- Business Math - CPA-1Document1 pageBusiness Math - CPA-1mansie139No ratings yet

- Pro-Free Trade: Fanghzou Liu Kareem Ameen Mariana Francisco Abhishek Yadev Mohammed PariyaDocument11 pagesPro-Free Trade: Fanghzou Liu Kareem Ameen Mariana Francisco Abhishek Yadev Mohammed Pariyamansie139No ratings yet

- Hult Elective Catalog 2014 MIB 20140204Document248 pagesHult Elective Catalog 2014 MIB 20140204mansie139No ratings yet

- Class 5 WorksheetDocument2 pagesClass 5 Worksheetmansie139No ratings yet

- 04 A SCM Mod E 2014 v1Document38 pages04 A SCM Mod E 2014 v1mansie139No ratings yet

- TutorialActivity 3Document7 pagesTutorialActivity 3Adarsh AchoyburNo ratings yet

- 6021-P3-Lembar KerjaDocument48 pages6021-P3-Lembar KerjaikhwanNo ratings yet

- Informative FinalDocument7 pagesInformative FinalJefry GhazalehNo ratings yet

- Bajaj Chetak PLCDocument13 pagesBajaj Chetak PLCVinay Tripathi0% (1)

- Seminar Assignments Multiple Choice Questions City Size Growth PDFDocument4 pagesSeminar Assignments Multiple Choice Questions City Size Growth PDFminlwintheinNo ratings yet

- Data 73Document4 pagesData 73Abhijit BarmanNo ratings yet

- Case Digest FinalDocument13 pagesCase Digest FinalAngelo Igharas Infante60% (5)

- Reference BikashDocument15 pagesReference Bikashroman0% (1)

- Social ResponsibilityDocument2 pagesSocial ResponsibilityAneeq Raheem100% (1)

- Blackout 30Document4 pagesBlackout 30amitv091No ratings yet

- Part 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetDocument50 pagesPart 1: Foundations of Entrepreneurship: Chapter 1: The Entrepreneurial MindsetMary Rose De TorresNo ratings yet

- MK-101 Sec-F Group-4 Executive SummaryDocument16 pagesMK-101 Sec-F Group-4 Executive SummarySantosh Rajan Iyer0% (1)

- Energy Audit and Energy SavingDocument21 pagesEnergy Audit and Energy SavingPrafulla Mandlekar100% (2)

- ReidtaylorDocument326 pagesReidtayloralankriti12345No ratings yet

- As of December 2, 2010: MHA Handbook v3.0 1Document170 pagesAs of December 2, 2010: MHA Handbook v3.0 1jadlao8000dNo ratings yet

- Legal NoticeDocument7 pagesLegal NoticeRishyak BanavaraNo ratings yet

- Top 10 Mistakes (FOREX TRADING)Document12 pagesTop 10 Mistakes (FOREX TRADING)Marie Chris Abragan YañezNo ratings yet

- Income from House PropertyDocument5 pagesIncome from House PropertyKaustubh BasuNo ratings yet

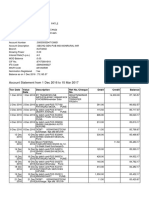

- Account statement showing transactions from Dec 2016 to Feb 2017Document4 pagesAccount statement showing transactions from Dec 2016 to Feb 2017AnuAnuNo ratings yet

- Bichar BigyanDocument25 pagesBichar Bigyanrajendra434383% (12)

- Final Exam - Module 2: Smooth Chin Device CompanyDocument16 pagesFinal Exam - Module 2: Smooth Chin Device CompanyMuhinda Fredrick0% (1)

- Marketing Plan - NikeDocument32 pagesMarketing Plan - NikeHendra WijayaNo ratings yet

- (Sample) Circular Flow of Incom & ExpenditureDocument12 pages(Sample) Circular Flow of Incom & ExpenditureDiveshDuttNo ratings yet

- We Are All ImmigrantsDocument106 pagesWe Are All ImmigrantsHerman Legal Group, LLCNo ratings yet

- Case Study 2 (Indigo) PDFDocument3 pagesCase Study 2 (Indigo) PDFDebasish SahooNo ratings yet

- Tourism MarketingDocument27 pagesTourism MarketingJade Lyn LopezNo ratings yet

- GASODOR S-FreeDocument7 pagesGASODOR S-FreeDavid Jesus Mejias LlanosNo ratings yet

- October Month Progress ReportDocument12 pagesOctober Month Progress ReportShashi PrakashNo ratings yet

- Capital Budgeting Project Instruction RubricDocument3 pagesCapital Budgeting Project Instruction RubricSunil Kumar0% (1)

- D) Indirect Taxes and SubsidiesDocument7 pagesD) Indirect Taxes and SubsidiesnatlyhNo ratings yet