Professional Documents

Culture Documents

Computek Pty LTD V CSARS SCA830112012ZASCA178 29 November 2012

Uploaded by

musvibaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Computek Pty LTD V CSARS SCA830112012ZASCA178 29 November 2012

Uploaded by

musvibaCopyright:

Available Formats

THE SUPREME COURT OF APPEAL OF SOUTH AFRICA

JUDGMENT

Reportable

Case no: 830/2011

In the matter between

H R COMPUTEK (PTY) LTD Appellant

and

THE COMMISSIONER FOR THE SOUTH AFRICAN

REVENUE SERVICE Respondent

Neutral citation: Computek v The Commissioner, SARS (830/2011)

[2012] ZASCA 178 (29 November 2012)

Bench: CLOETE, LEWIS, PONNAN and CACHALIA JJA and

ERASMUS AJA

Heard: 12 NOVEMBER 2012

Delivered: 29 NOVEMBER 2012

Summary: Value-Added Tax Act 89 of 1991 value-added tax

assessment of objection to appeal against disallowance of

objection taxpayer limited to the grounds stated in notice of

objection.

2

___________________________________________________________________

ORDER

___________________________________________________________________

On appeal from: Tax Court (Johannesburg) (Coppin J sitting as court of first

instance):

The appeal is dismissed with costs.

___________________________________________________________________

PONNAN JA (CLOETE, LEWIS, PONNAN and CACHALIA JJA and

ERASMUS AJA concurring)

[1] During October 2003 the respondent, the Commissioner for the South African

Revenue Services (SARS), conducted an audit in respect of the tax affairs of the

appellant, H R Computek (Pty) Ltd (formerly H R Computek CC) (the taxpayer). The

audit revealed that the taxpayer had under-declared and, in consequence, underpaid

value-added tax to SARS in terms of the Value-Added Tax Act 89 of 1991 (the VAT

Act). On 9 March 2004 SARS wrote to the taxpayer:

The Vat 201 returns submitted for the periods 03/2002 to 09/2003 inclusive, have been

revised to account for vat charged and not disclosed / declared on the appropriate Vat 201

returns. Additional tax equal to two hundred percent has been levied in terms of s 60 of the

Value Added Tax Act No. 89 of 1991 (herein referred to as the ACT).

The taxpayer was thus assessed to tax in the total sum of R4 040 377.28, being: (a)

R1 246 177.57 as to under-declared output tax (the capital amount); (b) R2 492

355.06 as to additional tax levied on the capital amount in terms of s 60 of the VAT

Act; (c) R124 617.75 as to a penalty levied on the capital amount in terms of section

39(1)(a)(i) of the VAT Act; and (d) R177 226.90 as to interest levied on the capital

amount in terms of s 39(1)(a)(ii) of the VAT Act. The revised assessment concluded

with these words:

Should you wish to lodge an objection, kindly do so in writing and clearly marked for the

attention of the writer. The objection must be received within 30 days of receipt of this notice.

You are obliged in terms of s 32 of the ACT to specify in detail the grounds for the objection.

[2] On 24 March 2004 Mr Harry Chakhala, who described himself as the sole

member of the taxpayer, filed a notice of objection with SARS. For ease of reference

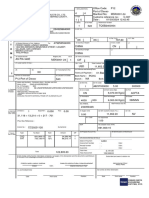

a copy of the relevant portion of the standard notice of objection form (ADR 1) as

duly completed by Mr Chakhala is reproduced here:

3

Assessment detail (Mark applicable tax type with an X)

Type of Tax: Income Tax/STCX VAT X PAYE/SDL/UIF Estate Duty Donations Tax Other X

If 'Other', please specify PROCEDURAL MATTERS

Nature of the amount in dispute Income Deduction Additional tax X Income Deduction Other X

Year of Assessment/Tax Period 20040309 Date of assessment/notice 20040304

Amount of tax in dispute in terms of the assessment/notice R 4040377.23

Grounds of objection

In the event of a discrepancy/dispute you are required to mark the nature of dispute with an X in the appropriate

box(es) to enable SARS to consider the objection.

Please note that you may select more than one box.

Provide detailed grounds upon which the objection is made on a separate page(s) together, with any

supporting documentation attached thereto.

Processing-related objections Factual and interpretative disputes

There is a miscalculation on the assessment in that an X Additional tax in the amount of R 2492355.70

amount(s) was taken into account/not taken into account imposed must be remitted to an amount of

to determine the liability for tax. R _________

Penalty imposed for the late rendition of a tax return must X Interest in the amount of R 177 266.90 imposed

be remitted. must be remitted.

Penalty for late payment of tax must be remitted.

X Penalty for underestimation of provisional tax must be remitted. An amount of R claimed as a

deduction but which has been disallowed

must be allowed.

X Interest on underpayment of provisional tax must be remitted in

X I do not agree with a notice/decision issued by SARS which in An amount of R included as

terms of legislation, is subject to objection on appeal. income by SARS must not be so included .

X Other (please elaborate). Refer to attachments X Other (please elaborate). Refer to attachments

[3] In an addendum to ADR 1 Mr Chakhala described the grounds of objection

as:

'1 Unfair application of procedural matters by SARS Special Investigations.

2 Excessive add tax of 200% plus penalties and interest charges.

3. Interference of SARS Special Investigation officer into the affairs of the businesses

including HR & Associates without any form of negotiations or consultations.

4 Reparations of damages caused by SARS interference and actions in the said

businesses in order to put things right.

4

5 SARS contraventions of its own SARS CHARTER and SARS SSMO and Dispute

Resolution processes.'

One of the attachments to which Mr Chakhala refers next to the tick box other at the

foot of ADR 1 is a three page letter written by him on behalf of the taxpayer. Whilst it

touches on a range of issues, its primary focus was the conduct of one of the special

investigators in the employ of SARS. To the extent here relevant it reads:

'Uncontested VAT Assessment value of R1 246 177.69 was presented to the said business

on the 10

th

March 2004. It was noted that the said businesses have 30 days period to lodge

an objection to the evaluation of the assessment. However during the same meeting, we

were informed that SARS would immediately take the cash balances amounting to R821

115.22 (65.9% of the capital amount) from the said businesses accounts. We did not contest

this decision though the businesses have been denied adequate resources for re-

establishing meaning operations.'

[4] On 28 July 2004 SARS informed the taxpayer that its objection had been

disallowed. As the first reason given for disallowing the objection SARS stated:

'No objection to the quantum of additional vat output raised suggesting your

acceptance of these figures. Revised additional vat assessments raised on the basis

of vat invoices issued and payments received for services rendered.

On 7 October 2004 Dr W A A Gouws, a chartered accountant, wrote a letter to SARS

on behalf of the taxpayer. After referring to a meeting of the previous morning and

various discussions that had taken place, paragraph two of that letter records:

'I would like to note that we are in agreement with your turnover figures.

The difference between your figures and those of the VAT returns relate to different

methods of accounting for VAT liabilities.

A further letter in this matter will be addressed to you.

On 22 January 2007 the appellant filed a notice of appeal (form ADR 2) in respect of

SARS' disallowance of its objection. It advanced the following grounds of appeal:

'1 Unfair imposition of 200% additional tax.

2 Unfair imposition and incorrect penalty.

3 Unfair imposition and incorrect interest charge.

4 Unfair tax procedural matters.'

[5] In the statement of the grounds of assessment delivered on 17 February 2011

in terms of rule 10 of the tax rules (made in terms of s 107A of the Income Tax Act

58 of 1962 (the Income Tax Act)) SARS contended:

5

When the objection (Notice of Objection and the letter of the grounds of Objection)

and the appeal (Notice of Appeal and the letter of the grounds of Appeal) [are

considered], it is clear that the Appellant does not dispute liability for the capital

amount.

The only amounts of the assessment that the Appellant objected to and appealed

against were the levying of additional tax at 200%, interest and penalty.

In response on 15 March 2011 the taxpayer filed a rule 11 statement, which for the

first time asserted that in calculating its VAT liability SARS had included the turnover

figures of a related entity, HR & Associates, of which Mr Chakhala was also the

'managing member'.

[6] At a pre-trial conference held during July 2011 the parties agreed:

'2.1 . . . that the following preliminary point must be argued and determined by the Court

before the trial on main issues commences.

2.1.1 Whether or not the Appellant objected to the capital portion (i.e. dispute

amount minus additional tax, penalties and interest) in its Notice of Objection

(ADR 1 form) read with the letter of Grounds of Objection attached to the

Notice of Objection. (If the Court finds that the Appellant did not object to the

capital amount, the Appellant will not be entitled to raise the capital amount as

an issue on trial, without leave to amend. Conversely, if the Court finds that

the Appellant objected to the capital amount, the Appellant will be entitled to

raise the capital amount as an issue on trial).

[7] The Johannesburg Tax Court presided over by Coppin J decided the

preliminary point against the taxpayer, but granted leave to it to appeal to this court.

[8] The taxpayer has sought, on appeal, to assail the conclusion of the tax court:

'. . . that the notice of objection and the letter accompanying it does not cover the

issue which the appellant now wishes to raise, namely, that the capital amount levied

for VAT is wrong'. In my view, for the reasons that follow, the conclusion of the tax

court is unassailable. In its notice of objection read together with the letter that

accompanied it (both dated 24 March 2004), it is quite clear that the taxpayer did not

object to the capital amount. That Mr Chakhala could quite easily have done by

ticking the first box which reads: There is a miscalculation on the assessment in that

an amount(s) was taken into account/not taken into account to determine the liability

for tax. The letter, far from objecting to the revised capital assessment, goes so far

6

as to refer to the capital assessment of R1 246 177.60 as being uncontested. In

disallowing the objection SARS made it clear to the taxpayer that it had not objected

to the quantum of additional VAT output raised. In the face of that, the taxpayer

intimated through Dr Gouws, that it was in agreement with SARS' turnover figures.

That was followed by its notice of appeal where once again no mention is made of a

challenge to the revised capital assessment.

[9] The provisions of s 107A of the Income Tax Act and any rules made under

that Act apply to objections and appeals (ss 32 (2)) and 33(4) respectively of the

VAT Act). Rule 4 states that the notice of objection must be in a form prescribed by

the Commissioner of SARS and must be in writing specifying in detail the grounds

upon which it is made. That had earlier been brought to the attention of the taxpayer

by SARS in its revised VAT assessment notice. The thrust of the taxpayers case

before us was that in referring to the globular amount of R 4 040 377 as being the

amount of tax in dispute in terms of the assessment the taxpayer had by necessary

implication raised an objection to the capital assessment, which was but one

component of that globular sum. But that, as I shall show, misconceives the inquiry.

[10] Section 32 of the VAT Act identifies the subject matter in respect of which a

taxpayer may object. It includes an assessment made upon a taxpayer in terms of s

31. 'Assessment' is not defined in the VAT Act. But it is in the Income Tax Act. As

Harms DP put it (First South African Holdings (Pty) Ltd v Commissioner for South

African Revenue Service 73 SATC 221 para 15) an assessment -

is a determination by the Commissioner of one or more matters (compare ITC 1077 28

SATC 33 at 38 per Corbett J). This appears from the definition of the word in s 1 of the

Income Tax Act:

assessment means the determination by the Commissioner, by way of a notice of

assessment (including a notice of assessment in electronic form) served in a manner

contemplated in section 106 (2)

(a) of an amount upon which any tax leviable under this Act is chargeable; or

(b) of the amount of any such tax; or

(c) of any loss ranking for set-off; or

(d) of any assessed capital loss determined in terms of paragraph 9 of the Eighth

Schedule,

7

and for the purposes of Part III of Chapter III includes any determination by the

Commissioner in respect of any of the rebates referred to in section 6 and any decision of

the Commissioner which is in terms of this Act subject to objection and appeal.

That definition does not countenance an objection to a globular amount. The capital

amount was an assessment to tax in terms of s 31 of the VAT Act with which the

taxpayer was dissatisfied and to which it ought to have objected pursuant to the

provisions of s 32(1)(b). That it did not do.

[11] What then is the effect of the conclusion that the taxpayer did not object to the

capital assessment? In Matla Coal Ltd v Commissioner for Inland Revenue1987 (1)

SA 108 (A) Corbett JA held (at 125C-J):

Section 81(3) of the Act provides that every objection shall be in writing and shall specify in

detail the grounds upon which it is made. And in terms of s 83(7)(b) the appellant in an

appeal against the disallowance of his objection is limited to the grounds stated in his notice

of objection. This limitation is for the benefit of the Commissioner and may be waived

by him . . .

. . .

It is naturally important that the provisions of s 83(7)(b) be adhered to, for otherwise the

Commissioner may be prejudiced by an appellant shifting the grounds of his objection to the

assessment in issue. At the same time I do not think that in interpreting and applying

s83(7)(b) the Court should be unduly technical or rigid in its approach. It should look at the

substance of the objection and the issue as to whether it covers the point which the

appellant wishes to advance on appeal must be adjudged on the particular facts of the case.

Here, although we do not have a similar statutory provision to that encountered in

Matla Coal, I can conceive of no reason why the principle that is established there

should not apply with equal force to an objection and appeal under the VAT Act. The

rationale for such a principle is explained by Cloete JA (Commissioner, South African

Revenue Service v Brummeria Renaissance (Pty) Ltd & others 2007 (6) SA 601

(SCA) para 26) thus:

. . . It is obviously in the public interest that the Commissioner should collect tax that is

payable by a taxpayer. But it is also in the public interest that disputes should come to an

end interest reipublicae ut sit finis litium; and it would be unfair to an honest taxpayer if the

Commissioner were to be allowed to continue to change the basis upon which the taxpayer

were assessed until the Commissioner got it right memories fade; witnesses become

unavailable; documents are lost. That is why s 79(1) seeks to achieve a balance: it allows

the Commissioner three years to collect the tax, which the Legislature regarded as a fair

period of time; but it does not protect a taxpayer guilty of fraud, misrepresentation or non-

8

disclosure. If either of the Commissioner's arguments were to be upheld, this balance would

be unfairly tilted against the honest taxpayer.'

[12] It follows that not having raised an objection to the capital assessment in its

notice of objection, the taxpayer was precluded from raising it on appeal before the

tax court. That that must be so finds support in rule 6(3)(a), which provides:

'(3) In the taxpayer's notice of appeal in terms of subrule (2), he or she

(a) must indicate in respect of which of the grounds specified in his or her objection in

terms of rule 4 he or she is appealing.'

Thus when the taxpayer challenged the capital amount for the first time in its rule 11

statement, it effectively raised a new objection directed at an individual assessed

amount that had not previously been objected to. It remains to add that in terms of

s 32(5) of the VAT Act as no objection had been lodged against SARS assessment

that the taxpayer was liable to SARS for additional VAT output tax in the sum of

R1 246 177.60, that assessment became final and conclusive in April 2007. And as a

period of three years has elapsed (s 31A), the taxpayer cannot now lawfully require

SARS to revisit its assessment even if it was wrong to have included the turnover of

a related entity in calculating the taxpayers VAT liability (First South African

Holdings para17-18). It follows that the taxpayers appeal must fail.

[13] That leaves costs: SARS sought the costs of two counsel on appeal. In my

view the matter was devoid of any factual or legal complexity. There was thus no

warrant for the employment of two counsel by SARS. In those circumstances it

would be unjustified to mulct the taxpayer with those costs and I would accordingly

only allow the costs of one counsel.

[14] In the result the appeal is dismissed with costs.

_________________

V M PONNAN

JUDGE OF APPEAL

9

APPEARANCES:

For Appellant: B G Savvas

Instructed by:

Venn & Muller Attorneys

Pretoria

Honey Attorneys

Bloemfontein

For Respondent: V Ngalwana

N Nxumalo

Instructed by:

Advocate L Haskins

Legal Representative for SARS

Pretoria

The State Attorney

Bloemfontein

You might also like

- ADR1 - Notice of ObjectionDocument1 pageADR1 - Notice of ObjectionKerrynNo ratings yet

- CIR VDocument9 pagesCIR VKristiana LeañoNo ratings yet

- RR 22-2020 (Notice of Discrepancy) PDFDocument3 pagesRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolNo ratings yet

- Rev CTA 8835 8790 Chevron Holdings Inc vs. CIRDocument20 pagesRev CTA 8835 8790 Chevron Holdings Inc vs. CIRJerome Delos ReyesNo ratings yet

- 164479-2010-Tambunting Pawnshop Inc. v. Commissioner Of20180923-5466-G66v6dDocument7 pages164479-2010-Tambunting Pawnshop Inc. v. Commissioner Of20180923-5466-G66v6dNika RojasNo ratings yet

- Topic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Document2 pagesTopic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Joshua Erik MadriaNo ratings yet

- Petitioner Respondents Sabino R. Padilla The Solicitor GeneralDocument9 pagesPetitioner Respondents Sabino R. Padilla The Solicitor GeneralKarl Michael OdroniaNo ratings yet

- TAX2601 SummaryDocument14 pagesTAX2601 SummaryGhairunisa Harris50% (2)

- Leonen Qa Taxation LawDocument12 pagesLeonen Qa Taxation LawHarriz Dela CruzNo ratings yet

- SC Tax Decision2Document45 pagesSC Tax Decision2Jasreel DomasingNo ratings yet

- Tax Cases 0307.odtDocument190 pagesTax Cases 0307.odtAnne Zsarina AvenidoNo ratings yet

- Gross Income CasesDocument80 pagesGross Income CasesapperdapperNo ratings yet

- Bir Ruling No. Dac168 519-08Document12 pagesBir Ruling No. Dac168 519-08Jasreel DomasingNo ratings yet

- Reply On PANDocument6 pagesReply On PANPaul Casaje89% (18)

- Allowable DeductionsDocument118 pagesAllowable DeductionsPrincess Hazel GriñoNo ratings yet

- Tambunting Pawnshop Vs CIRDocument9 pagesTambunting Pawnshop Vs CIRbraindead_91No ratings yet

- G.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.Document156 pagesG.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.roa yusonNo ratings yet

- G.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.Document9 pagesG.R. No. 184823 October 6, 2010 Commissioner OF Internal REVENUE, Petitioner, Aichi Forging Company of Asia, Inc., Respondent. Del Castillo, J.Mike HamedNo ratings yet

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument17 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityGeorge Mitchell S. GuerreroNo ratings yet

- (CTA-EB), in C.T.A. EB No. 90, Affirming The October 26, 2004 Decision of The CTA-First DivisionDocument65 pages(CTA-EB), in C.T.A. EB No. 90, Affirming The October 26, 2004 Decision of The CTA-First DivisionAl Marvin SantosNo ratings yet

- CIR V IsabellaDocument6 pagesCIR V IsabellaChristine JacintoNo ratings yet

- Tax Cases CompletedDocument310 pagesTax Cases CompletedAnjanette MangalindanNo ratings yet

- 50 - (G.R. NO. 172231. February 12, 2007)Document7 pages50 - (G.R. NO. 172231. February 12, 2007)alda hobisNo ratings yet

- G.R. No. 172231Document25 pagesG.R. No. 172231Fymgem AlbertoNo ratings yet

- 209890-2017-Opulent Landowners Inc. v. Commissioner of PDFDocument29 pages209890-2017-Opulent Landowners Inc. v. Commissioner of PDFJobar BuenaguaNo ratings yet

- LIFEBLOODDocument47 pagesLIFEBLOODBREL GOSIMATNo ratings yet

- GR No. 179085 Tambunting V CIR (Good Faith)Document14 pagesGR No. 179085 Tambunting V CIR (Good Faith)Jerwin DaveNo ratings yet

- VAT CasesDocument32 pagesVAT CasesJasmine Leona Monteclaro SyNo ratings yet

- 7 Tambunting Pawnshop v. Commissioner of Internal RevenueDocument4 pages7 Tambunting Pawnshop v. Commissioner of Internal RevenueChristian Edward CoronadoNo ratings yet

- Judicial Decisions CasesDocument17 pagesJudicial Decisions CasesLori-Anne Luis DulasNo ratings yet

- Petitioner Vs Vs Respondent: Second DivisionDocument8 pagesPetitioner Vs Vs Respondent: Second DivisionIsabella GamuloNo ratings yet

- Cta 3D CV 10304 J 2023apr27 AssDocument8 pagesCta 3D CV 10304 J 2023apr27 AssErlinda SantiagoNo ratings yet

- C.T.A. Eb Case No. 853. August 22, 2013Document28 pagesC.T.A. Eb Case No. 853. August 22, 2013Edu ParungaoNo ratings yet

- Solicitors Accounts Lecture 4 HandoutDocument10 pagesSolicitors Accounts Lecture 4 HandoutJames C. RickerbyNo ratings yet

- G.R. No. 187485 CIR v. San Roque Power CorporationDocument24 pagesG.R. No. 187485 CIR v. San Roque Power CorporationPaul Joshua SubaNo ratings yet

- 02 - BPI Savings v. CTADocument4 pages02 - BPI Savings v. CTAPhilip UyNo ratings yet

- CIR vs. Cebu Holdings, Inc.Document5 pagesCIR vs. Cebu Holdings, Inc.Mitch Arcones-GabineteNo ratings yet

- Liquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119Document3 pagesLiquigaz Philippines Corp. Vs CIR, CTA EB Nos. 1117 and 1119brendamanganaanNo ratings yet

- Commissioner vs. Ironcon BuilderDocument5 pagesCommissioner vs. Ironcon Buildermyles15No ratings yet

- CIR v. Isabela Cultural Corporation, G.R. No. 172231, 2007Document5 pagesCIR v. Isabela Cultural Corporation, G.R. No. 172231, 2007JMae MagatNo ratings yet

- RCBC Vs CIRDocument2 pagesRCBC Vs CIRAnneNo ratings yet

- 1maple v. CIRDocument26 pages1maple v. CIRaudreydql5No ratings yet

- Tenant Advisory: 20 Day of The Month Following The Close of The Taxable QuarterDocument1 pageTenant Advisory: 20 Day of The Month Following The Close of The Taxable QuarterJanetNo ratings yet

- Cta Eb CV 01767 D 2019aug09 AssDocument18 pagesCta Eb CV 01767 D 2019aug09 AssChristel BravoNo ratings yet

- 1.what Are RFD-01 and RFD-01A & Steps To Apply For GST Refund?Document20 pages1.what Are RFD-01 and RFD-01A & Steps To Apply For GST Refund?Ravi JhaNo ratings yet

- Upreme QI:ourt: L/epublic of Tbe TlbilippineDocument26 pagesUpreme QI:ourt: L/epublic of Tbe Tlbilippinejemybanez81No ratings yet

- 4taganito Mining Corp. v. Commissioner Of20211122-11-Tr743sDocument13 pages4taganito Mining Corp. v. Commissioner Of20211122-11-Tr743sMARIA LOURDES NITA FAUSTONo ratings yet

- CTA 2D CV 08462 D 2013SEP23 REF-doosanDocument12 pagesCTA 2D CV 08462 D 2013SEP23 REF-doosanChel-chan NiemNo ratings yet

- BIR RULING (DA - (C-168) 519-08) - Liquidated DamagesDocument8 pagesBIR RULING (DA - (C-168) 519-08) - Liquidated Damagesjohn allen MarillaNo ratings yet

- Deloitte Africa Tax and LegalDocument2 pagesDeloitte Africa Tax and LegalCalvin kamothoNo ratings yet

- CIR vs. AichiDocument21 pagesCIR vs. AichijerrymanalangNo ratings yet

- Bpifamily VcaDocument5 pagesBpifamily VcanixyaNo ratings yet

- Republic of The Philippines Court of Appeals Quezon: TAX CityDocument27 pagesRepublic of The Philippines Court of Appeals Quezon: TAX CitydoookaNo ratings yet

- Bureau of Internal RevenueDocument13 pagesBureau of Internal Revenuenathalie velasquezNo ratings yet

- RR 2-98 Section 2.57 (B) - CWTDocument3 pagesRR 2-98 Section 2.57 (B) - CWTZenaida LatorreNo ratings yet

- CIR Vs Isabele CulturalDocument13 pagesCIR Vs Isabele CulturalmifajNo ratings yet

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Mike's Homemade Pizza Recipe - AllrecipesDocument4 pagesMike's Homemade Pizza Recipe - AllrecipesmusvibaNo ratings yet

- Cliffe Dekker Hofmeyr - Special-Edition-Budget-Speech-Alert-26-February-2020Document21 pagesCliffe Dekker Hofmeyr - Special-Edition-Budget-Speech-Alert-26-February-2020musvibaNo ratings yet

- Agric Grade 6 - 2020Document35 pagesAgric Grade 6 - 2020musviba80% (5)

- Traveller Health Questionnaire - Screening Within South AfricaDocument1 pageTraveller Health Questionnaire - Screening Within South AfricaSreenivas PogakulaNo ratings yet

- Classic Vanilla Cupcakes Recipe - Get CrackingDocument2 pagesClassic Vanilla Cupcakes Recipe - Get CrackingmusvibaNo ratings yet

- Mike's Homemade Pizza Recipe - AllrecipesDocument4 pagesMike's Homemade Pizza Recipe - AllrecipesmusvibaNo ratings yet

- CBZ Bank Mortgage Finance Product OfferingDocument15 pagesCBZ Bank Mortgage Finance Product OfferingmusvibaNo ratings yet

- SARS Year Assessment Accounts Accepted Other Than Last Day FebruaryDocument16 pagesSARS Year Assessment Accounts Accepted Other Than Last Day FebruarymusvibaNo ratings yet

- Cassimjee V Minister of Finance (45511) (2012) ZASCA 101 (1 June 2012)Document13 pagesCassimjee V Minister of Finance (45511) (2012) ZASCA 101 (1 June 2012)musvibaNo ratings yet

- Special Edition Budget Speech Alert 2019 20 February 2019Document23 pagesSpecial Edition Budget Speech Alert 2019 20 February 2019musvibaNo ratings yet

- Unisa Interpretation of Statutes Study MaterialDocument127 pagesUnisa Interpretation of Statutes Study Materialmusviba100% (2)

- South African Tax Guide 2019/202019 - 2020 - Tax - GuideDocument58 pagesSouth African Tax Guide 2019/202019 - 2020 - Tax - GuidemusvibaNo ratings yet

- South African Budget Tax Guide 2019/2020Document21 pagesSouth African Budget Tax Guide 2019/2020musvibaNo ratings yet

- South Africa Income Tax - Exemptions PBODocument8 pagesSouth Africa Income Tax - Exemptions PBOmusvibaNo ratings yet

- Guide For Value Added Tax Via EFiling - External GuideDocument39 pagesGuide For Value Added Tax Via EFiling - External GuidemusvibaNo ratings yet

- South Africa Income Tax - Provisional Tax ExtimatesDocument3 pagesSouth Africa Income Tax - Provisional Tax ExtimatesmusvibaNo ratings yet

- PNM Financial Services Tax Guide 2014-2015Document53 pagesPNM Financial Services Tax Guide 2014-2015musvibaNo ratings yet

- Csars V Tradehold LTD (13211) (2012) Zasca 61 (8 May 2012)Document14 pagesCsars V Tradehold LTD (13211) (2012) Zasca 61 (8 May 2012)musvibaNo ratings yet

- CSARS V Plasmaview Technologies (Pty) LTD (64709) (2010)Document16 pagesCSARS V Plasmaview Technologies (Pty) LTD (64709) (2010)musvibaNo ratings yet

- Commissioner For SARS V de Beers (5032011) (2012) ZASCA 103 (1 June 2012)Document26 pagesCommissioner For SARS V de Beers (5032011) (2012) ZASCA 103 (1 June 2012)musvibaNo ratings yet

- Notes To Annual Financial Statements - Module 8Document63 pagesNotes To Annual Financial Statements - Module 8musvibaNo ratings yet

- The Employment Tax Incentive - CalculationsDocument4 pagesThe Employment Tax Incentive - CalculationsmusvibaNo ratings yet

- ArmgoldHarmony Freegold Joint Venture V CSARS (7032011) (2012) ZASCA 152 (1 October 2012)Document18 pagesArmgoldHarmony Freegold Joint Venture V CSARS (7032011) (2012) ZASCA 152 (1 October 2012)musvibaNo ratings yet

- Eveready V CSARS (195/11) (2012) ZASCA 36 (29 MARCH 2012)Document12 pagesEveready V CSARS (195/11) (2012) ZASCA 36 (29 MARCH 2012)musvibaNo ratings yet

- Arasco - Vat - SD - BBP - V1.2Document12 pagesArasco - Vat - SD - BBP - V1.2Anonymous hCDnyHWjTNo ratings yet

- Bureau of Internal RevenueDocument3 pagesBureau of Internal RevenueHanabishi RekkaNo ratings yet

- Construction Irrigation Business PlanDocument27 pagesConstruction Irrigation Business Planberhe dargoNo ratings yet

- GSTandAustralianTaxes PDFDocument104 pagesGSTandAustralianTaxes PDFLefter Telos ZakaNo ratings yet

- LGC - QFCS-Web Application Form 2020 V1 PDFDocument6 pagesLGC - QFCS-Web Application Form 2020 V1 PDFLeslie Liliana Palomino SalazarNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument4 pagesApplication For Registration: Kawanihan NG Rentas InternasCarl PedreraNo ratings yet

- Economic CrimeDocument388 pagesEconomic CrimeAlejandra Arredondo RuizNo ratings yet

- Garri Processing Business Plan SampleDocument3 pagesGarri Processing Business Plan SampleMokween100% (10)

- This Study Resource Was: Problem 1Document7 pagesThis Study Resource Was: Problem 1?????No ratings yet

- Oxford Brookes University: Research and Analysis ProjectDocument37 pagesOxford Brookes University: Research and Analysis ProjectAaryanNo ratings yet

- 127.CIR Vs PLDTDocument9 pages127.CIR Vs PLDTClyde KitongNo ratings yet

- Important SAP SD-Cin TablesDocument3 pagesImportant SAP SD-Cin Tablesdeepak1155No ratings yet

- Financial Accounting 2 Semester Level 1Document3 pagesFinancial Accounting 2 Semester Level 1Folegwe FolegweNo ratings yet

- SUMMER TRAINING REPORT - CameyDocument99 pagesSUMMER TRAINING REPORT - CameycameyNo ratings yet

- Standard Data 2020-21 Final PDFDocument368 pagesStandard Data 2020-21 Final PDFBammidiVivek100% (2)

- Excise TaxDocument14 pagesExcise TaxRoma Sabrina GenoguinNo ratings yet

- Module 6Document13 pagesModule 6Keara Jermain RellenteNo ratings yet

- AIDC Submission To The Zondo Commission of InquiryDocument20 pagesAIDC Submission To The Zondo Commission of InquirySizweNo ratings yet

- GST PPT TaxguruDocument30 pagesGST PPT TaxgurupraveerNo ratings yet

- Form PDF 202892500120121Document55 pagesForm PDF 202892500120121SRINIVAS MNo ratings yet

- CV of Md. Mizanur Rahman OpuDocument4 pagesCV of Md. Mizanur Rahman OpuMizanur Rahman OpuNo ratings yet

- Invoice 9935766161Document1 pageInvoice 9935766161Banvari GurjarNo ratings yet

- PE RO Price Circular Wef 18th May 2022Document201 pagesPE RO Price Circular Wef 18th May 2022Mohit MohataNo ratings yet

- CusdecFinalSAD TQSB2400004Document5 pagesCusdecFinalSAD TQSB2400004BSCA DepartmentNo ratings yet

- Compost 58000002480Document13 pagesCompost 58000002480prasadNo ratings yet

- Purisima vs. Lazatin 811 SCRA 205Document39 pagesPurisima vs. Lazatin 811 SCRA 205BernsNo ratings yet

- A Guide On Tax Incentives /exemptions Available To The Uganda InvestorsDocument57 pagesA Guide On Tax Incentives /exemptions Available To The Uganda InvestorsGODFREY JATHONo ratings yet

- GR 198146 DigestDocument3 pagesGR 198146 Digestceilo coboNo ratings yet

- Supplier Information FormDocument23 pagesSupplier Information FormStephen KasinaNo ratings yet

- Chart of Accounts QBDocument8 pagesChart of Accounts QBTelle SirchNo ratings yet