Professional Documents

Culture Documents

UNVR

Uploaded by

Faizal WihudaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UNVR

Uploaded by

Faizal WihudaCopyright:

Available Formats

C

CO

OM

MP

PA

AN

NY

Y R

RE

EP

PO

OR

RT

T

UNVR

UNILEVER INDONESIA TBK.

Company Profile

PTUnileverIndonesiaTbk.wasestablishedonDecember5th,1933.UnileverIndonesiahas

growntobealeadingcompanyofHomeandPersonalCareaswellasFoodsandIceCream

productsinIndonesia.

The Company is engaged in the manufacturing, marketing and distribution of consumer

goods including soaps, detergents, margarine, dairy based foods, ice cream, cosmetic

products, tea based beverages and fruit juice. The Company commenced commercial

operationsin1933.

Unilever Indonesias portfolio includes many of the worlds best known and wellloved

brands,suchas:

Pepsodent,

Ponds,

Lux,

Lifebuoy,

Dove,

Sunsilk,

Clear,

Rexona,

Vaseline,

Rinso,

Molto,

Sunlight,

Walls,

BlueBand,

Royco,

Bangoandmanymore.

TheCompanysfactoriesarelocatedatJln.Jababeka9BlokD,Jln.JababekaRayaBlokO,

Jln. Jababeka V Blok V No. 1416, Jababeka Industrial Estate Cikarang, Bekasi, West Java,

andJln.RungkutIndustriIVNo.511,RungkutIndustrialEstate,Surabaya.

January 2014

Disclaimer:

The facts and opinions stated or expressed in this publication are for information purposes only and are not necessarily and must not be relied upon as being those of the publisher or

of the institutions for which the contributing authors work. Although every care has been taken to ensure the accuracy of the information contained within the publication it should not be

by any person relied upon as the basis for taking any action or making any decision. The Indonesia Stock Exchange cannot be held liable or otherwise responsible in anyway for any

advice action taken or decision made on the basis of the facts and opinions stated or expressed or stated within this publication.

UNVR Unilever Indonesia Tbk. [S]

COMPANY REPORT : JANUARY 2014

As of 30 January 2014

Main Board

Industry Sector : Consumer Goods Industry (5)

Industry Sub Sector : Cosmetics And Household (54)

146,162.904

Individual Index

:

Listed Shares

:

7,630,000,000

Market Capitalization : 217,836,500,000,000

5 | 217.8T | 5.02% | 28.63%

19 | 14.2T | 1.29% | 51.25%

COMPANY HISTORY

Established Date

: 05-Dec-1933

Listing Date

: 11-Jan-1982

Under Writer IPO :

PT Aseam Indonesia

PT Danareksa

PT Merchant Investment Corporation

Securities Administration Bureau :

PT Sharestar Indonesia

Beritasatu Plasa 7th Fl.

Jln. Jend. Gatot Subroto Kav. 35 - 36 Jakarta 12950

Phone : (021) 527-7966

Fax

: (021) 527-7967

BOARD OF COMMISSIONERS

1. Peter Frank ter Kulve

2. Bambang Subianto *)

3. Cyrillus Harinowo *)

4. Erry Firmansyah *)

5. Hikmahanto Juwana *)

*) Independent Commissioners

BOARD OF DIRECTORS

1. Maurits Daniel Rudolf Lalisang

2. Ainul Yaqin

3. Debora Herawati Sadrach

4. Enny Hartati

5. Tevilyan Yudhistira Rusli

6. Hadrianus Setiawan

7. Ira Noviarti

8. Ramakrishnan Raghuraman

9. Sancoyo Antarikso

10. Vishal Gupta

AUDIT COMMITTEE

1. Cyrillus Harinowo

2. Benny Redjo Setyono

3. Tjan Hong Tjhiang

CORPORATE SECRETARY

Sancoyo Antarikso

HEAD OFFICE

Graha Unilever

Jln. Jend. Gatot Subroto Kav. 15

Jakarta - 12930

Phone : (021) 526-2112

Fax

: (021) 526-4020

Homepage

Email

: www.unilever.com; www.unilever.co.id

: unvr.indonesia@unilever.com

SHAREHOLDERS (January 2014)

1. Unilever Indonesia Holding BV

2. Public (<5%)

6,484,877,500 :

1,145,122,500 :

DIVIDEND ANNOUNCEMENT

Bonus

Cash

Year

1989

1990

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2002

2003

2003

2004

2004

2005

2005

2005

2006

2006

2007

2007

2008

2008

2009

2009

2010

2010

2011

2011

2012

2012

2013

Shares

6:1

Dividend

600.00

470.00

780.00

810.00

860.00

920.00

1,010.00

1,110.00

1,320.00

25,000.00

690.00

1,150.00

400.00

500.00

50.00

80.00

70.00

60.00

80.00

60.00

120.00

80.00

125.00

90.00

167.00

95.00

220.00

100.00

299.00

100.00

344.00

250.00

296.00

300.00

334.00

330.00

Cum Date

from

11-Feb-03

16-Jul-03

17-Feb-04

15-Jul-04

02-Dec-04

04-Mar-05

08-Jul-05

05-Dec-05

22-Jun-06

29-Nov-06

22-Jun-07

28-Nov-07

26-Jun-08

26-Nov-08

26-Jun-09

25-Nov-09

28-Jun-10

26-Nov-10

27-Jun-11

06-Dec-11

27-Jun-12

10-Dec-12

28-Jun-13

02-Dec-13

Ex Date

27-Oct-89

27-Feb-91

20-Feb-92

21-Oct-93

03-Nov-94

06-Nov-95

04-Nov-96

03-Nov-97

18-Nov-98

03-Nov-99

28-Nov-00

19-Nov-01

13-Feb-03

17-Jul-03

18-Feb-04

16-Jul-04

03-Dec-04

07-Mar-05

11-Jul-05

06-Dec-05

23-Jun-06

30-Nov-06

25-Jun-07

29-Nov-07

27-Jun-08

27-Nov-08

29-Jun-06

26-Nov-09

29-Jun-10

29-Nov-10

28-Jun-11

07-Dec-11

28-Jun-12

11-Dec-12

01-Jul-13

03-Dec-13

Recording

Date

until

17-Feb-03

21-Jul-03

20-Feb-04

20-Jul-04

06-Dec-04

09-Mar-05

13-Jul-05

08-Dec-05

27-Jun-06

04-Dec-06

27-Jun-07

03-Dec-07

01-Jul-08

01-Dec-08

01-Jul-09

01-Dec-09

01-Jul-10

01-Dec-10

01-Jul-11

09-Dec-11

02-Jul-12

13-Dec-12

03-Jul-13

05-Dec-13

84.99%

15.01%

Payment

Date

26-Jun-90

04-Jul-91

20-Aug-93

29-Jul-94

28-Jul-95

26-Jul-96

27-Aug-97

07-Aug-98

27-Jul-99

20-Jul-00

01-Aug-01

22-Nov-02

04-Mar-03

04-Aug-03

05-Mar-04

03-Aug-04

17-Dec-04

24-Mar-05

27-Jul-05

21-Dec-05

11-Jul-06

18-Dec-06

11-Jul-07

14-Dec-07

11-Jul-08

15-Dec-08

14-Jul-09

15-Dec-09

13-Jul-10

15-Dec-10

13-Jul-11

15-Dec-11

13-Jul-12

20-Dec-12

16-Jul-13

12-Dec-13

F/I

I

I&F

I&F

I&F

I&F

I&F

I&F

I&F

I&F

I&F

I&F

I&F

I

F

I

F

I

I

I

I

F

I

F

I

F

I

F

I

F

I

F

I

F

I

F

I

ISSUED HISTORY

No.

1.

2.

3.

4.

Type of Listing

First Issue

Bonus Shares

Company Listing

Stock Split

Shares

9,200,000

2,251,225 T:

64,848,775

7,553,700,000 T:

Listing

Date

11-Jan-82

15-Dec-89 :

02-Jan-98

06-Nov-00 :

Trading

Date

11-Jan-82

22-Sep-93

02-Jan-98

03-Sep-03

UNVR Unilever Indonesia Tbk. [S]

Closing

Price*

Closing Price

Volume

(Mill. Sh)

36,000

40.0

31,500

35.0

27,000

30.0

22,500

25.0

18,000

20.0

13,500

15.0

9,000

10.0

4,500

5.0

Jan-10

Jan-11

Jan-12

Jan-13

Jan-14

Closing Price*, Jakarta Composite Index (IHSG) and

Consumer Goods Industry Index

January 2010 - January 2014

Freq.

Volume

Value

Day

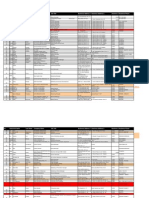

TRADING ACTIVITIES

Closing Price* and Trading Volume

Unilever Indonesia Tbk. [S]

January 2010 - January 2014

Month

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

High

11,750

11,700

13,200

14,000

16,550

18,900

17,350

17,150

17,250

19,200

17,500

17,000

Low

10,950

10,550

11,300

12,000

13,600

15,000

16,300

15,950

15,950

16,850

15,000

15,000

Close

11,300

11,500

12,150

13,850

15,600

17,000

16,950

16,100

16,850

17,450

15,000

16,500

(X)

5,909

4,558

7,296

6,233

10,001

12,810

14,001

12,188

11,202

10,736

17,104

15,223

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

Dec-11

16,650

16,200

16,950

15,650

15,300

15,350

15,900

17,400

17,750

16,500

18,400

19,000

13,800

14,100

15,250

14,900

14,650

14,600

14,700

15,000

14,000

15,250

15,450

17,100

15,050

16,200

15,300

15,300

14,700

14,900

15,600

16,900

16,500

15,650

18,200

18,800

16,428

11,599

15,300

17,329

10,563

9,679

12,108

20,492

17,471

17,533

12,590

13,898

48,440

27,234

59,981

57,709

43,392

28,109

41,466

63,871

46,683

56,126

43,802

40,609

732,617

412,351

967,698

878,710

648,620

419,148

628,166

1,043,194

763,768

897,769

722,503

732,748

21

18

23

20

21

20

21

19

20

21

22

21

Jan-12

Feb-12

Mar-12

Apr-12

May-12

Jun-12

Jul-12

Aug-12

Sep-12

Oct-12

Nov-12

Dec-12

24,450

20,050

20,200

20,750

22,450

25,500

25,250

27,350

28,500

26,300

26,950

26,400

18,200

17,500

18,600

18,750

19,700

20,000

22,350

23,800

25,100

25,250

25,600

20,100

19,600

19,250

20,000

19,850

20,550

22,900

24,250

27,100

26,050

26,050

26,350

20,850

16,752

17,028

14,713

14,599

16,221

15,235

16,534

13,551

20,640

15,755

13,272

50,609

38,440

31,412

27,939

31,656

45,658

37,485

35,057

24,914

43,814

45,467

46,071

143,941

761,415

606,182

543,448

615,568

965,430

842,684

828,065

635,793

1,177,790

1,176,959

1,207,920

3,196,599

21

21

21

20

21

21

22

19

20

22

20

18

Jan-13

Feb-13

Mar-13

Apr-13

May-13

Jun-13

Jul-13

Aug-13

Sep-13

Oct-13

Nov-13

Dec-13

23,150

23,300

23,100

26,250

34,500

31,550

34,600

32,350

33,300

37,350

30,800

27,300

20,900

21,650

21,700

22,150

24,800

25,550

26,000

26,600

30,100

29,600

25,700

25,100

22,050

22,850

22,800

26,250

30,500

30,750

31,800

31,200

30,150

30,000

26,600

26,000

23,609

17,807

16,433

15,906

21,913

34,773

24,938

25,112

28,077

26,976

27,121

22,404

61,636

44,383

50,808

50,732

57,502

62,429

45,612

39,989

50,371

54,142

53,564

36,810

1,347,431

1,001,564

1,147,414

1,178,848

1,657,707

1,795,607

1,435,491

1,191,169

1,587,564

1,698,290

1,502,119

963,138

21

20

19

22

22

19

23

17

21

21

20

19

Jan-14

28,775 25,800 28,550

44,445

49,313

1,352,166

20

(Thou. Sh.) (Million Rp)

30,857

347,247

17,150

192,747

41,522

500,726

31,299

397,505

45,746

686,004

45,361

755,493

48,902

818,405

41,934

696,369

49,461

826,348

46,924

819,428

70,085 1,158,321

45,919

729,446

20

19

22

21

19

22

22

21

17

21

21

20

245%

210%

179.5%

175%

158.4%

140%

105%

70%

71.6%

35%

-35%

Jan 10

Jan 11

Jan 12

Jan 13

Jan 14

SHARES TRADED

2010

2011

2012

Volume (Million Sh.)

Value (Billion Rp)

Frequency (Thou. X)

Days

515

7,928

127

245

557

8,847

175

247

552

12,558

225

246

608

16,506

285

244

49

1,352

44

20

19,200

10,550

16,500

16,500

19,000

13,800

18,800

18,800

28,500

17,500

20,850

20,850

37,350

20,900

26,000

26,000

28,775

25,800

28,550

28,550

34.45

16.22

38.97

32.87

19.75

40.09

36.37

19.15

36.00

39.94

23.95

39.53

Price (Rupiah)

High

Low

Close

Close*

37.17

PER (X)

16.41

PER Industry (X)

31.12

PBV (X)

* Adjusted price after corporate action

2013 Jan-14

UNVR Unilever Indonesia Tbk. [S]

Financial Data and Ratios

Book End : December

Public Accountant : Tanudiredja, Wibisana & Rekan (Member of PricewaterhouseCoopers Global Network)

BALANCE SHEET

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

858,322

317,759

336,143

229,690

261,202

TOTAL ASSETS AND LIABILITIES (Bill. Rp)

(Million Rp except Par Value)

Cash & Cash Equivalents

Assets

Receivables

1,345,255

1,752,633

2,188,280

2,261,941

3,279,694

Inventories

1,340,036

1,574,060

1,812,821

2,061,899

2,084,331

Current Assets

3,598,793

3,748,130

4,446,219

5,035,962

5,862,939

68,371

4,148,778

5,314,311

6,283,479

6,874,177

50,377

75,705

70,456

69,271

8,701,262 10,482,312 11,984,979

7,485,249

Fixed Assets

Other Assets

Total Assets

55,058

7,484,990

Current Liabilities

Long Term Liabilities

Total Liabilities

10,000

7,500

5,000

16.25%

20.47%

14.34%

-37.54%

2,500

3,454,869

4,402,940

6,474,594

7,535,896

8,419,442

321,546

249,469

326,781

480,718

674,076

3,776,415

4,652,409

6,801,375

8,016,614

9,093,518

23.20%

46.19%

17.87%

13.43%

Growth (%)

Growth (%)

Liabilities

12,500

2009

2010

2011

2012

2013

TOTAL EQUITY (Bill. Rp)

Authorized Capital

76,300

76,300

76,300

76,300

76,300

Paid up Capital

76,300

76,300

76,300

76,300

76,300

7,630

7,630

7,630

7,630

7,630

10

10

10

10

10

Retained Earnings

3,530,519

3,873,119

3,504,268

4,933,326

4,082,370

Total Equity

3,702,819

4,045,419

3,680,937

3,968,365

4,254,670

9.25%

-9.01%

7.81%

7.21%

Dec-10

Dec-11

Dec-12

Dec-13

Paid up Capital (Shares)

Par Value

4,255

4,045

4,255

3,703

3,968

3,681

3,387

2,519

Growth (%)

INCOME STATEMENTS

Total Revenues

Dec-09

1,651

783

18,246,872 19,690,239 23,469,218 27,303,248 30,757,435

7.91%

Growth (%)

19.19%

16.34%

12.65%

-85

2009

2010

2011

2013

9,485,274 11,462,805 13,414,122 14,978,947

Cost of Revenues

9,200,878

Gross Profit

9,045,994 10,204,965 12,006,413 13,889,126 15,778,488

Expenses (Income)

4,831,103

5,662,340

6,431,614

7,391,019

8,614,043

Operating Profit

4,214,891

4,542,625

5,574,799

6,498,107

7,164,445

7.78%

22.72%

16.56%

10.25%

TOTAL REVENUES (Bill. Rp)

30,757

30,757

Growth (%)

2012

27,303

23,469

24,483

33,699

-3,982

-31,342

-5,637

Income before Tax

4,248,590

4,538,643

5,574,799

6,466,765

7,158,808

Tax

1,205,236

1,153,995

1,410,495

-1,627,620

1,806,183

Profit for the period

3,043,354

3,384,648

4,164,304

4,839,145

5,352,625

11.21%

23.04%

16.21%

10.61%

Other Income (Expenses)

Growth (%)

18,247

19,690

18,208

11,934

5,659

Period Attributable

3,043,354

3,386,970

4,163,369

4,839,277

5,352,625

Comprehensive Income

3,044,107

3,384,648

4,164,304

4,839,145

5,352,625

3,386,970

4,163,369

4,839,277

5,352,625

Comprehensive Attributable

Dec-09

Dec-10

Dec-11

Dec-12

Dec-13

Current Ratio (%)

104.17

85.13

68.67

66.83

69.64

Dividend (Rp)

399.00

444.00

546.00

634.00

330.00

EPS (Rp)

398.87

443.90

545.66

634.24

701.52

BV (Rp)

485.30

530.20

482.43

520.10

557.62

DAR (X)

0.50

0.53

0.65

0.67

1.21

RATIOS

-615

2009

2010

2011

2012

2013

PROFIT FOR THE PERIOD (Bill. Rp)

5,353

4,839

5,353

4,164

4,261

3,043

3,385

3,169

1.02

1.15

1.85

2.02

2.14

ROA (%)

40.66

38.90

39.73

40.38

71.51

ROE (%)

82.19

83.67

113.13

121.94

125.81

GPM (%)

49.58

51.83

51.16

50.87

51.30

OPM (%)

23.10

23.07

23.75

23.80

23.29

NPM (%)

16.68

17.19

17.74

17.72

17.40

100.03

100.02

100.06

99.96

47.04

3.61

2.69

2.90

3.04

1.27

DER(X)

Payout Ratio (%)

Yield (%)

2,077

985

-107

2009

2010

2011

2012

2013

You might also like

- B SDocument36 pagesB SkeithguruNo ratings yet

- Corporate Governance BMFM 33132 Title: Successful of Ecoworld CompanyDocument16 pagesCorporate Governance BMFM 33132 Title: Successful of Ecoworld CompanyJoeaan TanNo ratings yet

- List Sponsor FullDocument17 pagesList Sponsor FullRaja Mochamad Eka Toar100% (2)

- Petronas Annual Report 2003 - EditorialDocument57 pagesPetronas Annual Report 2003 - EditorialsantoshNo ratings yet

- Alumni FtsDocument31 pagesAlumni Ftsk03mNo ratings yet

- Eep306 Assessment 1 FeedbackDocument2 pagesEep306 Assessment 1 Feedbackapi-354631612No ratings yet

- Matahari Putra Prima TBK.: February 2016Document4 pagesMatahari Putra Prima TBK.: February 2016Arnold StevenNo ratings yet

- UnileverDocument11 pagesUnileverMuhammad Abin Sholahuddin UlumNo ratings yet

- MDS Unilever Kel4Document26 pagesMDS Unilever Kel4Alvian Guntur100% (1)

- SMCBDocument4 pagesSMCBRisris RismayaniNo ratings yet

- Name: Jesica Maria Erlisa Purba Sri Zuraily Class: 4 EgcDocument2 pagesName: Jesica Maria Erlisa Purba Sri Zuraily Class: 4 EgcJapen Lachardo SamosirNo ratings yet

- Icbp PDFDocument4 pagesIcbp PDFHijrah Saputra BimaNo ratings yet

- U.P. Stock Exchange Limited History and OverviewDocument44 pagesU.P. Stock Exchange Limited History and OverviewViresh YadavNo ratings yet

- PT RAJAWALI NUSANTARA INDONESIA Company ProfileDocument10 pagesPT RAJAWALI NUSANTARA INDONESIA Company ProfileRizal SaputraNo ratings yet

- List of Merger Accounting Company: Salaki-SalakiDocument5 pagesList of Merger Accounting Company: Salaki-SalakiMeta SilvyaniNo ratings yet

- Financial Report PT. IndofoodDocument4 pagesFinancial Report PT. IndofoodkuninganNo ratings yet

- Assignment of Introduction To BusinessDocument21 pagesAssignment of Introduction To Businessfeblustrum13No ratings yet

- 56 BBNI Bank Negara Indonesia TBKDocument4 pages56 BBNI Bank Negara Indonesia TBKDjohan HarijonoNo ratings yet

- No Salutation First Name Last Name Company Name Job Title Business Address 1 Business Address 2 Business Zip Code Business PhoneDocument48 pagesNo Salutation First Name Last Name Company Name Job Title Business Address 1 Business Address 2 Business Zip Code Business PhoneAulia Agustin Salim92% (13)

- VI Good ManDocument5 pagesVI Good ManWong RushenNo ratings yet

- Company Profile: Gedung Graha ReksoDocument5 pagesCompany Profile: Gedung Graha ReksoFiqiNo ratings yet

- Business: "Form of Business Ownership"Document5 pagesBusiness: "Form of Business Ownership"Laila SafitriNo ratings yet

- Hasil Try Out 1 XII 2014Document12 pagesHasil Try Out 1 XII 2014dediNo ratings yet

- Skript Presentation UnileverDocument4 pagesSkript Presentation UnileverMUHAMMAD RIZQULLAH NAUFALNo ratings yet

- Company Analysis PT UnileverDocument20 pagesCompany Analysis PT UnileverRifeNo ratings yet

- Curiculum VitaeDocument2 pagesCuriculum Vitaecharli dimarzioNo ratings yet

- PTK Reg01 - Group 6 ReportDocument33 pagesPTK Reg01 - Group 6 ReportRidho MahendraNo ratings yet

- List of Registered Venture Capital Corporations As at 31 October 2011Document21 pagesList of Registered Venture Capital Corporations As at 31 October 2011AtiQah AnnUarNo ratings yet

- Jadwal Responsi Praktikum Analisa Inti Batuan: No. Perusahaan Hari Sesi Jam Asisten KoorDocument1 pageJadwal Responsi Praktikum Analisa Inti Batuan: No. Perusahaan Hari Sesi Jam Asisten KoorViko FintaruNo ratings yet

- 2Document4 pages2Syahrul AlimiNo ratings yet

- Semen Gresik (Persero) TBK.: January 2012Document4 pagesSemen Gresik (Persero) TBK.: January 2012davidwijaya1986No ratings yet

- COMPRO PROMARINDO BaruDocument12 pagesCOMPRO PROMARINDO BaruARIF ALMAGHFURNo ratings yet

- CV ProfesionalDocument2 pagesCV ProfesionalRicky NovliskyNo ratings yet

- Top 10 chemical companies in IndonesiaDocument20 pagesTop 10 chemical companies in IndonesiaYozuaTWYozuaNo ratings yet

- Data Corporate - Proposal Corporate JRPDocument113 pagesData Corporate - Proposal Corporate JRPDiana Ang Alraniry100% (1)

- Indofood CBP Sukses Makmur Tbk.Document4 pagesIndofood CBP Sukses Makmur Tbk.Asterina AnggrainiNo ratings yet

- Ujikom Fo - Guest in House - Ea - Room Status - UpdateDocument67 pagesUjikom Fo - Guest in House - Ea - Room Status - Updatedani mulyanaNo ratings yet

- Steering a Middle Course: From Activist to Secretary General of GolkarFrom EverandSteering a Middle Course: From Activist to Secretary General of GolkarNo ratings yet

- Luhut Binsar PanjaitanDocument8 pagesLuhut Binsar Panjaitanferi lukmanNo ratings yet

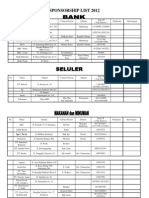

- Sponsorship ListDocument11 pagesSponsorship ListDwinita Ayuni Larasati0% (1)

- Keeping Indonesia Safe from the COVID-19 Pandemic: Lessons Learnt from the National Economic Recovery ProgrammeFrom EverandKeeping Indonesia Safe from the COVID-19 Pandemic: Lessons Learnt from the National Economic Recovery ProgrammeNo ratings yet

- New Club Establishment ProposalDocument4 pagesNew Club Establishment ProposalAliph HamzahNo ratings yet

- List of Translators and Interpreters in Indonesia: Prepared by British Embassy JakartaDocument23 pagesList of Translators and Interpreters in Indonesia: Prepared by British Embassy JakartayusufNo ratings yet

- Data Base Media Partner (Recovered)Document10 pagesData Base Media Partner (Recovered)Rubensio ArigeniNo ratings yet

- Data Base Media PartnerDocument9 pagesData Base Media PartnerShoji Meguro100% (1)

- Company ProfileDocument10 pagesCompany ProfileMuhammad ArifinNo ratings yet

- Major State-Owned EPC (Refer To P.69)Document101 pagesMajor State-Owned EPC (Refer To P.69)depzz27No ratings yet

- Aisa Lalal DDJDKD Kjbfjkbfjkbasj Jasbch jkhCUISDocument1 pageAisa Lalal DDJDKD Kjbfjkbfjkbasj Jasbch jkhCUISsigeledekNo ratings yet

- Wisnu CV 1Document4 pagesWisnu CV 1As'ad KhaliilNo ratings yet

- Orchid Plant Management at Joseph Orchids CompanyDocument55 pagesOrchid Plant Management at Joseph Orchids CompanyMuhammad Dandy SatriaNo ratings yet

- PT.PINDO DELI PULP AND PAPER MILLS PROFILEDocument6 pagesPT.PINDO DELI PULP AND PAPER MILLS PROFILEDewi LarasatiNo ratings yet

- Matahari Department Store TBK.: August 2018Document4 pagesMatahari Department Store TBK.: August 2018Ana SafitriNo ratings yet

- List Potential MarketDocument5 pagesList Potential MarketRidwan FauzanNo ratings yet

- DOAPAULINO CV - March2024Document15 pagesDOAPAULINO CV - March2024Paulino doaNo ratings yet

- Conflict or ConsentDocument429 pagesConflict or ConsentOlenka MuhammadNo ratings yet

- Business QuizDocument24 pagesBusiness QuizTamil Vasanth MNo ratings yet

- Curriculum VitaeDocument1 pageCurriculum VitaeAgoenk KertawijayaNo ratings yet

- List of Translators and Interpreters in IndonesiaDocument22 pagesList of Translators and Interpreters in IndonesiaFikka AnastasiaNo ratings yet

- BING4102 - Satriyo LaksonoDocument4 pagesBING4102 - Satriyo LaksonoSocial KuNo ratings yet

- InggrisDocument1 pageInggrisUlvi Wahidatul KhoiriyahNo ratings yet

- Tolak AnginDocument9 pagesTolak AnginFariz AlNo ratings yet

- Land and Development in Indonesia: Searching for the People's SovereigntyFrom EverandLand and Development in Indonesia: Searching for the People's SovereigntyNo ratings yet

- Appraisal-Form PSDocument8 pagesAppraisal-Form PSFaizal WihudaNo ratings yet

- Employee Engagement The Key To Improving PerformanceDocument8 pagesEmployee Engagement The Key To Improving PerformanceFaizal WihudaNo ratings yet

- Empowering Leadership and Innovative Work BehaviourDocument1 pageEmpowering Leadership and Innovative Work BehaviourFaizal WihudaNo ratings yet

- Bal Etal 2013 JMSDocument28 pagesBal Etal 2013 JMSFaizal WihudaNo ratings yet

- As02 2Document26 pagesAs02 2Caberawit Bandd Jayapura EntertainerNo ratings yet

- Robinson Et AlDocument1 pageRobinson Et AlFaizal WihudaNo ratings yet

- Warr Inceglu 2012Document22 pagesWarr Inceglu 2012Faizal Wihuda100% (1)

- Alternative Disclosure and Performance Measurement of Islamic BanksDocument51 pagesAlternative Disclosure and Performance Measurement of Islamic BanksDr. Shahul Hameed bin Mohamed Ibrahim100% (9)

- Architecture FirmDocument23 pagesArchitecture Firmdolar buhaNo ratings yet

- Chapter 2 Islamic Civilization4Document104 pagesChapter 2 Islamic Civilization4Anas ShamsudinNo ratings yet

- United States v. Hernandez-Maldonado, 1st Cir. (2015)Document9 pagesUnited States v. Hernandez-Maldonado, 1st Cir. (2015)Scribd Government DocsNo ratings yet

- Informative Speech OutlineDocument5 pagesInformative Speech OutlineMd. Farhadul Ibne FahimNo ratings yet

- Malayan Law Journal Reports 1995 Volume 3 CaseDocument22 pagesMalayan Law Journal Reports 1995 Volume 3 CaseChin Kuen YeiNo ratings yet

- Sabbia Food MenuDocument2 pagesSabbia Food MenuNell CaseyNo ratings yet

- True or FalseDocument3 pagesTrue or FalseRB AbacaNo ratings yet

- Second Letter To DOJ Re Victims 9.8.23 FinalDocument3 pagesSecond Letter To DOJ Re Victims 9.8.23 FinalBreitbart NewsNo ratings yet

- Konosuba! Volume:7Document359 pagesKonosuba! Volume:7SaadAmirNo ratings yet

- Effective Team Performance - FinalDocument30 pagesEffective Team Performance - FinalKarthigeyan K KarunakaranNo ratings yet

- Christ The Redemers Secondary SchoolDocument36 pagesChrist The Redemers Secondary Schoolisrael_tmjesNo ratings yet

- Rubric for Evaluating Doodle NotesDocument1 pageRubric for Evaluating Doodle NotesMa. Socorro HilarioNo ratings yet

- TallerDocument102 pagesTallerMarie RodriguezNo ratings yet

- ACC WagesDocument4 pagesACC WagesAshish NandaNo ratings yet

- New Wordpad DocumentDocument2 pagesNew Wordpad DocumentJia JehangirNo ratings yet

- 3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Document436 pages3.1.bauer Martin-Resistance To New Technology Nuclear Power, Information Technology and Biotechnology 1995Anonymous 2o0az0zOJNo ratings yet

- Cover Letter For Post of Business Process Improvement CoordinatorDocument3 pagesCover Letter For Post of Business Process Improvement Coordinatorsandeep salgadoNo ratings yet

- (Cooperative) BOD and Secretary CertificateDocument3 pages(Cooperative) BOD and Secretary Certificateresh lee100% (1)

- ChildBook Mother Is Gold Father Is Glass Gender An - Lorelle D Semley PDFDocument257 pagesChildBook Mother Is Gold Father Is Glass Gender An - Lorelle D Semley PDFTristan Pan100% (1)

- MGT420Document3 pagesMGT420Ummu Sarafilza ZamriNo ratings yet

- Irregular verbs guideDocument159 pagesIrregular verbs guideIrina PadureanuNo ratings yet

- Final Activity 4 Theology 1. JOB Does Faith in God Eliminate Trials?Document3 pagesFinal Activity 4 Theology 1. JOB Does Faith in God Eliminate Trials?Anna May BatasNo ratings yet

- AIS 10B TimetableDocument1 pageAIS 10B TimetableAhmed FadlallahNo ratings yet

- 11 Days Banner Advertising Plan for Prothom AloDocument4 pages11 Days Banner Advertising Plan for Prothom AloC. M. Omar FaruqNo ratings yet

- Surface Chemistry Literature List: Literature On The SubjectDocument5 pagesSurface Chemistry Literature List: Literature On The SubjectMasih SuryanaNo ratings yet

- 2011 Grade Exam ResultDocument19 pages2011 Grade Exam ResultsgbulohcomNo ratings yet

- 1) Anuj Garg Vs Hotel Association of India: Article 15Document26 pages1) Anuj Garg Vs Hotel Association of India: Article 15UriahNo ratings yet

- How K P Pinpoint Events Prasna PDFDocument129 pagesHow K P Pinpoint Events Prasna PDFRavindra ChandelNo ratings yet