Professional Documents

Culture Documents

File 3

Uploaded by

api-247402233Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

File 3

Uploaded by

api-247402233Copyright:

Available Formats

Teens

Set

lesson

Teens

on school

fundin$

Teen leadership

rcffi

li;',"i";f;

makes visit construc-

as part

of tour

BYDANARASMUSSEN

SnffWriter

drasmussen@tdnpublishing.

com

Troy Supt. Tom Dunn and

Treasurer Don Pence frelded

questions

about school fund-

ing Thursday from members

of Teen Leadership Troy.

Dunn asked the teens how

much they thought it cost to

operate the schools on a dailv

basis and the answers hL

received ranged from

$Z

mil-

lion to

$40 million. with the

latter being the closest to the

actual amount. The operating

expenses for the 2005-2000

school year came to almost

$Se million, according to

Pence.

Dunn explained to the stu-

dents that operating expenses

are for the day-to-day ele-

ments of running a school,

from teachers salaries to util-

ities. Operating expenses

tion under

way at the

high school

or Concord

and Forest

Elementary

schools

because

those are

being paid

for by a per-

manent improvement levy

the residents of Trov voted

for.

One student asked whv the

schools were renovated and

not rebuilt. Dunn said the

state came in and looked at

all the schools and said thev

should all be demolished ani

the district should build new

ones, but a new high school

alone would've cost between

$30-$40 million.

"We did a survey of our

community members and

asked them what they'd sup-

port," Dunn said. "People like

I See TEENS on

page

A2

I CONTINUED FROM A1

our schools. We take good

care of them because we set

money aside for them. People

don't want to see us knocking

down the schools and building

new ones.tt

Sonia Gupta, L6, asked

why the schools are collecting

revenue generated by proper-

ty taxes when that source of

funding was determined to be

unconstitutional by the

Supreme Court. She suggest-

ed schools become funded by

an income tax instead. Pence

explained the reason behind

the current method Troy

schools employ for funding.

"With tax structure the

way it was, if we'd gone to an

income tax we'd have shifted

the burden

(of

funding the

schools) onto individuals,"

Pence said. "Tax laws have

changed so dramatically since

then that now

(an

income tax)

makes sense."

The income tax would

make sense now for schools

because of House Bill 66,

which eliminates the tangible

personal property tax busi-

nesses have had to pay in the

past.

Pence told the students

about this forgiveness oftaxes

on businesses and told them

that with that tax break the

schools will lose 29 percent of

the funding they received

from tangible personal prop-

erty taxes over the next five

years.

The state of Ohio said they

will make up the difference

until 2010 and then schools

across Ohio will have to find

other means to make up for

the loss.

Pence said the legislature

has to come'up with another

way to fund schools without

using property tax, but they

have yet to do so.

The reason the Supreme

Court declared the way

schools are funded to be

unconstitutional is because of

its inequity and inadequacy,

according to Pence.

Districts that are consid-

ered high weaith have more

money to spend per pupil.

In Troy,

$7,634

is spent on

each student, according to

Pence. Areas in southeast

Ohio spend much less per stu-

dent. In Beachwood City, a

suburb of Cleveland, $18,686

is spent on each student,

Pence said.

"People living in southeast

Ohio said

just

because we live

down here doesn't mean we

shouldn't get the same educa-

tion

(as

students do in other

regions)," Dunn said.

"Education ought to be equal

across the board."

Dunn and Pence made a

point to tell the teens that

schools do try to provide the

best education and opportuni-

ties they can for students.

"It's no different than what

your parents do," Dunn said.

"Parents look at what their

kids want and then they see

how much money they have

and then see what they can

afford. It's all about money. If

we could afford it, we would

get the things we want for you

that we wish we could afford."

Dururu

You might also like

- Where to Send Your Child: Private, Public or Home School? Volume 1From EverandWhere to Send Your Child: Private, Public or Home School? Volume 1No ratings yet

- Peggy M. Venable Testimony Texas Public Education EfficiencyDocument20 pagesPeggy M. Venable Testimony Texas Public Education EfficiencyeduefficiencyNo ratings yet

- Young MailingDocument4 pagesYoung MailingValerie DaleNo ratings yet

- ArgumentativeDocument6 pagesArgumentativeDennis Nani AmayaNo ratings yet

- Barack Obama On EducationDocument5 pagesBarack Obama On Educationnadir_hNo ratings yet

- Educate NY Platform 2018Document24 pagesEducate NY Platform 2018Nick ReismanNo ratings yet

- Portfolio 3Document5 pagesPortfolio 3api-617566886No ratings yet

- The Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)Document35 pagesThe Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)National Education Policy CenterNo ratings yet

- Input On Fees Sought: Fraternity Likely To Be Punished After KeggerDocument18 pagesInput On Fees Sought: Fraternity Likely To Be Punished After KeggerThe University Daily KansanNo ratings yet

- Concerned Citizens Smithton School: Our Opposition Is Based OnDocument1 pageConcerned Citizens Smithton School: Our Opposition Is Based Oncc4ssNo ratings yet

- Description: Tags: HawaiiDocument1 pageDescription: Tags: Hawaiianon-765014No ratings yet

- Human Capital EconomicsDocument17 pagesHuman Capital Economicsapi-352490158No ratings yet

- 30 Common Misconceptions About Public Education - and The Facts That Set The Record StraightDocument8 pages30 Common Misconceptions About Public Education - and The Facts That Set The Record StraightMarc LiflandNo ratings yet

- April 22 Parent Leader MeetingDocument2 pagesApril 22 Parent Leader Meetingapi-251362692No ratings yet

- UFT Press Release - Jan 5Document3 pagesUFT Press Release - Jan 5Dan FletcherNo ratings yet

- Elizabeth A. Harris: in Connecticut, A Wealth Gap Divides Neighboring SchoolsDocument5 pagesElizabeth A. Harris: in Connecticut, A Wealth Gap Divides Neighboring SchoolsConnCANNo ratings yet

- Commission Remarks 072909Document3 pagesCommission Remarks 072909Education Policy Center100% (2)

- Position Argument or ProposalDocument5 pagesPosition Argument or Proposalapi-253026182No ratings yet

- Octorara Administration Office: Thomas L. Newcome II, Ed.DDocument5 pagesOctorara Administration Office: Thomas L. Newcome II, Ed.DOctorara_ReportNo ratings yet

- Final Tuition Story - Kassandra DarnellDocument4 pagesFinal Tuition Story - Kassandra Darnellapi-407259664No ratings yet

- Budget Operations InterviewDocument18 pagesBudget Operations Interviewapi-313210230No ratings yet

- Current Issue and DilemmasDocument18 pagesCurrent Issue and Dilemmasveronica alvezNo ratings yet

- RCL Post-Deliberation ReportDocument7 pagesRCL Post-Deliberation Reportapi-666094650No ratings yet

- Mike Dewine Paolo Demaria:, Governor, Superintendent of Public InstructionDocument5 pagesMike Dewine Paolo Demaria:, Governor, Superintendent of Public Instructionmsdyer923No ratings yet

- Press ReleaseDocument2 pagesPress ReleaseAlanRupeNo ratings yet

- Education Is Not Only A Human Need Its A Human RightDocument4 pagesEducation Is Not Only A Human Need Its A Human RightDamon K JonesNo ratings yet

- Proposition A - EtallentDocument9 pagesProposition A - Etallentapi-469171353No ratings yet

- Funds Dedicated To Relief: What Is Recreation'?Document20 pagesFunds Dedicated To Relief: What Is Recreation'?elauwitNo ratings yet

- Project 1Document7 pagesProject 1api-309791804No ratings yet

- CarmelpushforfundingDocument5 pagesCarmelpushforfundingapi-307114516No ratings yet

- Cusd Press Release Re Ballot Proposition e 03-13-14Document3 pagesCusd Press Release Re Ballot Proposition e 03-13-14api-214709308No ratings yet

- Research ReportDocument15 pagesResearch ReportQurat ul ainNo ratings yet

- The Arizona Scholarship Tax Credit: Giving Parents Choices, Saving Taxpayers Money, Cato Policy Analysis No. 414Document27 pagesThe Arizona Scholarship Tax Credit: Giving Parents Choices, Saving Taxpayers Money, Cato Policy Analysis No. 414Cato InstituteNo ratings yet

- Commercialized EducationDocument2 pagesCommercialized EducationDuc DaoNo ratings yet

- NewsDocument14 pagesNewsskywriter36No ratings yet

- Weston Reading FreepDocument8 pagesWeston Reading Freepapi-134134588No ratings yet

- Press Release N-20, 2011-12 (Partnering With Parents Policy Speech 10 26 11)Document10 pagesPress Release N-20, 2011-12 (Partnering With Parents Policy Speech 10 26 11)GothamSchools.orgNo ratings yet

- Public Education 2015Document6 pagesPublic Education 2015Christopher KindredNo ratings yet

- Fiscal Analysis of A $500 Federal Education Tax Credit To Help Millions, Save Billions, Cato Policy Analysis No. 398Document16 pagesFiscal Analysis of A $500 Federal Education Tax Credit To Help Millions, Save Billions, Cato Policy Analysis No. 398Cato InstituteNo ratings yet

- College TuititonDocument5 pagesCollege Tuititonapi-331216185No ratings yet

- Students Are Digital Natives: Cheaper Trash CollectionDocument24 pagesStudents Are Digital Natives: Cheaper Trash CollectionelauwitNo ratings yet

- Argumentative EssayDocument6 pagesArgumentative EssayKendall O'NeillNo ratings yet

- Grade 11 Sample Performance Task 478946 7Document13 pagesGrade 11 Sample Performance Task 478946 7api-235457167No ratings yet

- Strike On Education FinalDocument7 pagesStrike On Education Finalapi-437161177No ratings yet

- Issues in EducationDocument5 pagesIssues in Educationapi-515950929No ratings yet

- Argument PaperDocument5 pagesArgument Paperapi-272061879No ratings yet

- Charter Schools DissertationDocument4 pagesCharter Schools DissertationHowToFindSomeoneToWriteMyPaperNaperville100% (1)

- Document 179Document3 pagesDocument 179Anthony PorterNo ratings yet

- Essay 2 Noah WoodwardDocument4 pagesEssay 2 Noah Woodwardapi-665541249No ratings yet

- 06ML031512CDocument1 page06ML031512CErin PihlajaNo ratings yet

- Round Rock Isd Homework PolicyDocument6 pagesRound Rock Isd Homework Policyptrmpezod100% (1)

- Betsy LetterDocument5 pagesBetsy LetterThe Washington Post100% (1)

- DeVos Letter To McConnellDocument5 pagesDeVos Letter To McConnellMary Margaret OlohanNo ratings yet

- Assessments Standards by Lonnie Tucker, CHE, CSW & Ms. Donna Wells, BS, PCWSDocument38 pagesAssessments Standards by Lonnie Tucker, CHE, CSW & Ms. Donna Wells, BS, PCWSLakotaAdvocatesNo ratings yet

- Donating The Voucher: An Alternative Tax Treatment of Private School EnrollmentDocument2 pagesDonating The Voucher: An Alternative Tax Treatment of Private School EnrollmentCato InstituteNo ratings yet

- PALSS Update - March 19Document4 pagesPALSS Update - March 19jenbrogNo ratings yet

- The AFT responds to criticism of its charter school reportDocument3 pagesThe AFT responds to criticism of its charter school reportfastchennaiNo ratings yet

- The Education Invasion: How Common Core Fights Parents for Control of American KidsFrom EverandThe Education Invasion: How Common Core Fights Parents for Control of American KidsNo ratings yet

- Remember MerrittDocument1 pageRemember Merrittapi-247402233No ratings yet

- Bank RobbedDocument1 pageBank Robbedapi-247402233No ratings yet

- OverdoseDocument1 pageOverdoseapi-247402233No ratings yet

- File 9Document1 pageFile 9api-247402233No ratings yet

- File10 0001Document1 pageFile10 0001api-247402233No ratings yet

- File 10Document1 pageFile 10api-247402233No ratings yet

- File 8Document1 pageFile 8api-247402233No ratings yet

- File 11Document1 pageFile 11api-247402233No ratings yet

- File 5Document1 pageFile 5api-247402233No ratings yet

- File 7Document1 pageFile 7api-247402233No ratings yet

- File 6Document1 pageFile 6api-247402233No ratings yet

- File3 0001Document1 pageFile3 0001api-247402233No ratings yet

- File 2Document1 pageFile 2api-247402233No ratings yet

- TDN Homeless SeriesDocument21 pagesTDN Homeless Seriesapi-247402233No ratings yet

- Private Copy of Vishwajit Mishra (Vishwajit - Mishra@hec - Edu) Copy and Sharing ProhibitedDocument8 pagesPrivate Copy of Vishwajit Mishra (Vishwajit - Mishra@hec - Edu) Copy and Sharing ProhibitedVISHWAJIT MISHRANo ratings yet

- Final Year Project - Developing A Plastic Bottle Solar CollectorDocument78 pagesFinal Year Project - Developing A Plastic Bottle Solar CollectorLegendaryN0% (1)

- 02 - AbapDocument139 pages02 - Abapdina cordovaNo ratings yet

- Moi University: School of Business and EconomicsDocument5 pagesMoi University: School of Business and EconomicsMARION KERUBONo ratings yet

- Solved Problems: EEE 241 Computer ProgrammingDocument11 pagesSolved Problems: EEE 241 Computer ProgrammingŞemsettin karakuşNo ratings yet

- Black Box Components and FunctionsDocument9 pagesBlack Box Components and FunctionsSaifNo ratings yet

- Flex VPNDocument3 pagesFlex VPNAnonymous nFOywQZNo ratings yet

- Civil Boq AiiapDocument170 pagesCivil Boq AiiapMuhammad ArslanNo ratings yet

- MCQs on Defence Audit Code Chapter 9 and 10Document2 pagesMCQs on Defence Audit Code Chapter 9 and 10Rustam SalamNo ratings yet

- 6 Acop v. OmbudsmanDocument1 page6 Acop v. OmbudsmanChester Santos SoniegaNo ratings yet

- Lessee Information StatementDocument1 pageLessee Information Statementmja.carilloNo ratings yet

- Rdbms Manual 0Document111 pagesRdbms Manual 0sridharanchandran0% (1)

- Dues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Document52 pagesDues+&+Bylaws+Committee+Packet ICPI John@bestadmix Com Tholyfield@Greefield JasonNo ratings yet

- Danielle Smith: To Whom It May ConcernDocument2 pagesDanielle Smith: To Whom It May ConcernDanielle SmithNo ratings yet

- BIM and AM to digitally transform critical water utility assetsDocument20 pagesBIM and AM to digitally transform critical water utility assetsJUAN EYAEL MEDRANO CARRILONo ratings yet

- DX DiagDocument31 pagesDX DiagJose Trix CamposNo ratings yet

- Tutorial 2 EOPDocument3 pagesTutorial 2 EOPammarNo ratings yet

- Merging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - ColaboratoryDocument16 pagesMerging - Scaled - 1D - & - Trying - Different - CLassification - ML - Models - .Ipynb - Colaboratorygirishcherry12100% (1)

- Motor Controllers AC Semiconductor Motor Controller Types RSE 22 .. - B, RSE 4. .. - B, RSE 60 .. - BDocument4 pagesMotor Controllers AC Semiconductor Motor Controller Types RSE 22 .. - B, RSE 4. .. - B, RSE 60 .. - BAbdul Aziz KhanNo ratings yet

- Daftar Pustaka Marketing ResearchDocument2 pagesDaftar Pustaka Marketing ResearchRiyan SaputraNo ratings yet

- University of Cebu-Main Campus Entrepreneurship 100 Chapter 11 QuizDocument3 pagesUniversity of Cebu-Main Campus Entrepreneurship 100 Chapter 11 QuizAnmer Layaog BatiancilaNo ratings yet

- Medhat CVDocument2 pagesMedhat CVSemsem MakNo ratings yet

- How To Google Like A Pro-10 Tips For More Effective GooglingDocument10 pagesHow To Google Like A Pro-10 Tips For More Effective GooglingMinh Dang HoangNo ratings yet

- Culture GuideDocument44 pagesCulture GuideLeonardo TamburusNo ratings yet

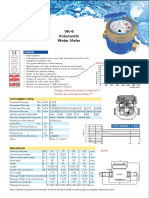

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- EPA - Regulatory Impact AnalysisDocument822 pagesEPA - Regulatory Impact AnalysisSugarcaneBlogNo ratings yet

- Request For Information (Rfi) : Luxury Villa at Isola Dana-09 Island - Pearl QatarDocument1 pageRequest For Information (Rfi) : Luxury Villa at Isola Dana-09 Island - Pearl QatarRahmat KhanNo ratings yet

- Restructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)Document126 pagesRestructuring The Circular Economy Into The Resource Based Economy (Michaux, 2021)CliffhangerNo ratings yet

- G.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsDocument56 pagesG.R. No. 122039 May 31, 2000 VICENTE CALALAS, Petitioner, Court of Appeals, Eliza Jujeurche Sunga and Francisco Salva, RespondentsJayson AbabaNo ratings yet

- 110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive ExamsDocument42 pages110 TOP Single Phase Induction Motors - Electrical Engineering Multiple Choice Questions and Answers - MCQs Preparation For Engineering Competitive Examsvijay_marathe01No ratings yet