Professional Documents

Culture Documents

Identity Theft Webquest

Uploaded by

api-256439588Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Identity Theft Webquest

Uploaded by

api-256439588Copyright:

Available Formats

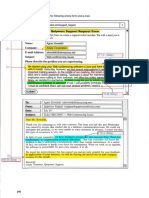

Identity Theft Webquest

Part I Use the Justice Departments website to learn more about identity theft.

http://www.justice.gov/criminal/fraud/websites/idtheft.html

1. What is identity theft?

when someone takes out lines of credit in your name

2. Define the following ways thieves might steal your identity

a. Shoulder Surfing

shoulder surfing" watching you from a nearby location as you punch in your telephone calling card

number or credit card number or listen in on your conversation if you give your credit-card number

over the telephone to a hotel or rental car company

b. Dumpster Diving

dumpster diving" going through your garbage cans or a communal dumpster or trash bin -- to

obtain copies of your checks, credit card or bank statements

c. Via the mail

If you receive applications for "preapproved" credit cards in the mail, but discard them without

tearing up the enclosed materials, criminals may retrieve them and try to activate the cards for their

use without your knowledge

d. Spam Emails

"spam" unsolicited E-mail that promises them some benefit but requests identifying data, without

realizing that in many cases, the requester has no intention of keeping his promise.

3. To avoid being a victim of identity theft, it is recommended that you SCAM what does this stand for?

stingy-check-ask- maintain

4. Explain what one part of SCAM means.

if something is wrong call the credit card company and ask if this is true

5. What groups do you need to contact when you find youre the victim of identity theft or fraud? [Hint - there are 7

specific bureaus/organizations + 2 more generic companies and institutions]

Federal trade commission, 1-877-ID THEFT, Consumer Response Center, local post office, fbi,

California Department of Consumer Affairs Federal Trade Commission - Fighting Back Against ID Theft

Part II For this assignment, you will read a story of one persons experience with identity theft and use the internet to

further your understanding of what happened to the person. Questions where you will need to research the answer

online are indicated as such.

Article -

http://www.protectmyid.com/images/education_center/pdf/060IdentityRecovery/050%20id%20recovery_one%20victi

ms%20story.pdf

6. Why was Joe Tremba confused when he received a collection letter about a past due credit card account?

because he did not sign up for it

7. What does it mean to be assigned to a collections agency? [Look up online]

that the credit card company pays someone to go after your money

8. How has this identity theft affected Joes life?

he cannot get a loan to buy a house

9. What does it mean to opt out of credit card offers that arrive in the mail? [Look this up online]

you cannot be sent credit card offers through the mail

10. How many people are victims of identity theft each year?

11.1 million

11. What is the average amount stolen according to the Javelin Identity Fraud Survey Report in 2010?

4,841

12. When must suspicious credit activity be reported so creditors can efficiently track fraudulent purchases?

within 30 dayas

13. What are the 3 big things you must look for when reviewing your credit report?

accounts that do not belong to you, personal information, outdated or incomplete infromation

14. What steps should be taken when you are the victim of identity theft?

notify the credit card company imediatly

15. What is a fraud alert with the FTC? [Look this up online]

If they detect any unusual account Activity they will notify you

You might also like

- I Want ThatDocument2 pagesI Want Thatapi-256439588No ratings yet

- Finding An ApartmentDocument4 pagesFinding An Apartmentapi-276122922No ratings yet

- Bank of AmericaDocument1 pageBank of Americaapi-256439588No ratings yet

- Journal 2Document1 pageJournal 2api-256439588No ratings yet

- Check Writing Sim 1Document13 pagesCheck Writing Sim 1api-256424511100% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Preventive MaintenanceDocument2 pagesPreventive Maintenancedoctor_mumairkNo ratings yet

- Location - : Manhattan, NyDocument15 pagesLocation - : Manhattan, NyMageshwarNo ratings yet

- Financial Reporting Standards SummaryDocument5 pagesFinancial Reporting Standards SummaryKsenia DroNo ratings yet

- DH 0526Document12 pagesDH 0526The Delphos HeraldNo ratings yet

- Privacy & Big Data Infographics by SlidesgoDocument33 pagesPrivacy & Big Data Infographics by SlidesgoNadira WANo ratings yet

- Why The Irish Became Domestics and Italians and Jews Did NotDocument9 pagesWhy The Irish Became Domestics and Italians and Jews Did NotMeshel AlkorbiNo ratings yet

- Mono 83Document1,473 pagesMono 83lupibudiNo ratings yet

- TaclobanCity2017 Audit Report PDFDocument170 pagesTaclobanCity2017 Audit Report PDFJulPadayaoNo ratings yet

- Humility Bible StudyDocument5 pagesHumility Bible Studyprfsc13No ratings yet

- 30 - Tow Truck Regulation Working Document PDFDocument11 pages30 - Tow Truck Regulation Working Document PDFJoshNo ratings yet

- I I I I I I I: Quipwerx Support Request FormDocument2 pagesI I I I I I I: Quipwerx Support Request Form08. Ngọ Thị Hồng DuyênNo ratings yet

- UntitledDocument1,422 pagesUntitledKarinNo ratings yet

- Marketing PlanDocument18 pagesMarketing PlanPatricia Mae ObiasNo ratings yet

- CalendarDocument1 pageCalendarapi-277854872No ratings yet

- E - Commerce and IWTDocument4 pagesE - Commerce and IWTziddirazanNo ratings yet

- FAA Airworthiness Directive for Airbus AircraftDocument2 pagesFAA Airworthiness Directive for Airbus AircraftMohamad Hazwan Mohamad JanaiNo ratings yet

- Flow Concepts: Source: Managing Business Process Flows by Anupindi, Et AlDocument7 pagesFlow Concepts: Source: Managing Business Process Flows by Anupindi, Et AlKausik KskNo ratings yet

- SNETEL Brochure 2021Document6 pagesSNETEL Brochure 2021NamNo ratings yet

- Omoluabi Perspectives To Value and Chara PDFDocument11 pagesOmoluabi Perspectives To Value and Chara PDFJuan Daniel Botero JaramilloNo ratings yet

- Dukin DonutsDocument1 pageDukin DonutsAnantharaman KarthicNo ratings yet

- Benno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981Document198 pagesBenno Przybylski Righteousness in Matthew and His World of Thought Society For New Testament Studies Monograph Series 1981alenin1No ratings yet

- Apply For Cabin Crew (Airbus) at IndiGoDocument6 pagesApply For Cabin Crew (Airbus) at IndiGov.kisanNo ratings yet

- Delhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceDocument20 pagesDelhi Public School Mid-Term Exam for Class 5 Students Covering English, Math, ScienceFaaz MohammadNo ratings yet

- Dunn, David Christopher vs. Methodist Hospital (Court 189)Document1 pageDunn, David Christopher vs. Methodist Hospital (Court 189)kassi_marksNo ratings yet

- IBS AssignmentDocument4 pagesIBS AssignmentAnand KVNo ratings yet

- Literary Structure and Theology in The Book of RuthDocument8 pagesLiterary Structure and Theology in The Book of RuthDavid SalazarNo ratings yet

- Föreställningar Om Klass Och Kön I Arbetsförmedlingens Yrkesbeskrivningar?Document28 pagesFöreställningar Om Klass Och Kön I Arbetsförmedlingens Yrkesbeskrivningar?Filozófus ÖnjelöltNo ratings yet

- Regio v. ComelecDocument3 pagesRegio v. ComelecHudson CeeNo ratings yet

- Liberal Arts Program: Myanmar Institute of TheologyDocument6 pagesLiberal Arts Program: Myanmar Institute of TheologyNang Bu LamaNo ratings yet

- Preventing At-Risk Youth Through Community ParticipationDocument11 pagesPreventing At-Risk Youth Through Community ParticipationRhyolite LanceNo ratings yet