Professional Documents

Culture Documents

Feb. 2006 Mumbai

Uploaded by

srpvicky0 ratings0% found this document useful (0 votes)

24 views27 pagesHPCL is an integrated oil company that has experienced losses recently due to fluctuating international oil prices and domestic subsidies. It is taking several initiatives to address this, including capacity expansions, new pipelines, retail branding strategies, and rural fuel access programs. It is also exploring new businesses like exploration and production, natural gas, and aviation fuel to diversify. The Rangarajan Committee recommendations aim to reform fuel pricing, reduce subsidies, and increase oil company revenues if implemented.

Original Description:

h

Original Title

Namaste

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentHPCL is an integrated oil company that has experienced losses recently due to fluctuating international oil prices and domestic subsidies. It is taking several initiatives to address this, including capacity expansions, new pipelines, retail branding strategies, and rural fuel access programs. It is also exploring new businesses like exploration and production, natural gas, and aviation fuel to diversify. The Rangarajan Committee recommendations aim to reform fuel pricing, reduce subsidies, and increase oil company revenues if implemented.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

24 views27 pagesFeb. 2006 Mumbai

Uploaded by

srpvickyHPCL is an integrated oil company that has experienced losses recently due to fluctuating international oil prices and domestic subsidies. It is taking several initiatives to address this, including capacity expansions, new pipelines, retail branding strategies, and rural fuel access programs. It is also exploring new businesses like exploration and production, natural gas, and aviation fuel to diversify. The Rangarajan Committee recommendations aim to reform fuel pricing, reduce subsidies, and increase oil company revenues if implemented.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 27

1

Feb. 2006 Mumbai

2

Contents

Contents

HPCL A Profile

Current Scenario

Initiatives

3

HPCL

HPCL

-

-

An Overview

An Overview

A Fortune 500 company - 2005

Rank

Turnover 436

Profit 412

An Integrated downstream refining and marketing company

Crude Thruput : 13.94 MMT

Market Sales : 20.09 MMT

Pipeline Thruput : 6.05 MMT

Market Capitalization : Rs.110 Bn.

Shareholders : Over 1 Lac

4

Financial Highlights

Financial Highlights

5.3 4.5 4.4 GRM ($/Bbl)

84.41 77.43 66.79 Net Worth

12.77 19.04 15.37 Net Profit

646.90 563.33 526.98 Turnover

FY 05 FY 04 FY 03 Rs. Billion

5

Market Sales

Market Sales

10.5

2.3

6.0

0.8

10.9

2.5

5.8

0.9

7.9

1.9

3.9

0.8

0

5

10

15

20

FY 04 FY 05 A/D 05

Market Sales (MMT)

Retail LPG Direct Sales Exports

HPC Market Sale (in MMT) HPC Market Sale (in MMT)

19.5 20.1

14.4

16.9 % Overall

31.6 % Lubricants

25.3 % LPG

15.6 % Aviation

10.2 % Ind. & Cons.

21.5 % Retail

HPC Market Share

Market Share (Apr/Dec05) Market Share (Apr/Dec05)

6

Contents

Contents

HPCL A Profile

Current Scenario

Initiatives

7

Crude/ Product Price Mismatch

Crude/ Product Price Mismatch

Product Prices

Oil Prices

23.34

42.25

40.99

33.63

44.58

44.56

% Change

58.12 40.31 56.66 Brent Crude Oil ($/Bbl)

625.00 367.09 452.78 LPG ($/MT)

70.57 47.86 68.13 SKO (AG) ($/Bbl)

63.04 45.40 64.01 HSD (AG) ($/Bbl)

64.60 47.70 63.74 MS (Sing) ($/Bbl)

56.86 37.55 54.29 Indian Basket ($/Bbl)

Current Apr-Dec

04

Apr-Dec

05

8

International Price Trend

International Price Trend

78.39

60.54

59.79

49.47

43.38

32.37

64.95

71.78

61.36

53.81

36.88

42.79

65.42

60.23

53.68

30

35

40

45

50

55

60

65

70

75

80

A

p

r

-

0

4

J

u

l

-

0

4

O

c

t

-

0

4

J

a

n

-

0

5

A

p

r

-

0

5

J

u

l

-

0

5

O

c

t

-

0

5

J

a

n

-

0

6

Indian Basket of Crude Gas Oil (AG) Gasoline (Sing)

Fluctuations in

Crude Product cracks

9

Fluctuating Heavy / Light Crude Spread

Fluctuating Heavy / Light Crude Spread

30.00

35.00

40.00

45.00

50.00

55.00

60.00

65.00

A

p

r

-

0

4

M

a

y

-

0

4

J

u

n

-

0

4

J

u

l

-

0

4

A

u

g

-

0

4

S

e

p

-

0

4

O

c

t

-

0

4

N

o

v

-

0

4

D

e

c

-

0

4

J

a

n

-

0

5

F

e

b

-

0

5

M

a

r

-

0

5

A

p

r

-

0

5

M

a

y

-

0

5

J

u

n

-

0

5

J

u

l

-

0

5

A

u

g

-

0

5

S

e

p

-

0

5

O

c

t

-

0

5

N

o

v

-

0

5

D

e

c

-

0

5

J

a

n

-

0

6

F

e

b

-

0

6

Brent Dubai

US$ / Bbl

1.6

12.1

2.6

6.4

10

Gross Marketing Margins on MS & HSD

Gross Marketing Margins on MS & HSD

-5000

-4000

-3000

-2000

-1000

0

1000

2000

3000

4000

5000

A

p

r

-

0

4

J

u

n

-

0

4

A

u

g

-

0

4

O

c

t

-

0

4

D

e

c

-

0

4

F

e

b

-

0

5

A

p

r

-

0

5

J

u

n

-

0

5

A

u

g

-

0

5

O

c

t

-

0

5

D

e

c

-

0

5

F

e

b

-

0

6

MS Actual Margin

HSD Actual Margin

Normal Margin

Rs / KL

11

Current Subsidies on SKO (PDS) & LPG (Dom.)

Current Subsidies on SKO (PDS) & LPG (Dom.)

215.15 13.23 Subsidy absorbed by Oil Companies

22.58 0.82 Subsidy given by Govt.

237.73 14.04 Total Subsidy to Customer

Dom LPG

(Rs./Cyl)

PDS SKO

(Rs./Ltr)

12

HPCL Performance in Current Fiscal

HPCL Performance in Current Fiscal

Crude Thruput : 9.7 MMT

Market Sales : 14.4 MMT

Net Loss : Rs. 16.08 billion

Loss incurred for the first time

Negative Margins on MS & HSD

High subsidies on SKO & LPG

Changes in Duty structure impacting refining margins

13

Steps taken to reduce Industry losses

Steps taken to reduce Industry losses

Increase in Retail Selling Prices : In June 2005 & Sept. 2005

Loss sharing by Upstream companies : ~ Rs. 140 billion

Loss sharing by Refineries : ~ Rs. 54 billion

Likely to issue bonds in current fiscal towards the subsidy impact

Target value for the Industry: ~Rs. 115 billion

14

Rangarajan

Rangarajan

Committee on Pricing

Committee on Pricing

Recommendations of the Committee :

MS/HSD:

Reduction in Custom duty on MS & HSD -10% to 7.5%

Trade Parity Pricing for MS & HSD

Mix of Import Parity & Export Parity - 80:20

Specific Excise Duties on MS & HSD

Rs.14.75/Ltr on MS and Rs.5/Ltr on HSD

Retail pricing of MS & HSD to be fully market determined

Increase in RSP : MS - Rs.1.21/ Ltr, HSD - Rs.1.96/ Ltr

15

Rangarajan

Rangarajan

Committee on Pricing

Committee on Pricing

Recommendations of the Committee :

SKO/LPG:

SKO Subsidy to be limited to BPL families

LPG Subsidy to be phased out by 2007.

One time price increase of Rs.75/Cyl and gradual price increases

to remove subsidy.

Increase cess on ONGC/OIL crude to Rs.4800/MT

Cess to be used for subsidy on SKO & LPG

Govt. to bear total Subsidy on PDS SKO & Dom. LPG

16

Contents

Contents

HPCL A Profile

Current Scenario

Initiatives

17

Refinery Initiatives

Refinery Initiatives

Yield Improvements

Installing residue conversion facilities (Delayed Coker)

LPG yield increased by 40% and MS by 25%

Quality up-gradation projects

Compliance of Euro III Emission control norms ~Rs. 35 billion

Upgradation of Lube Oil Base Stock for Grade II Lubricants

Oil Price Risk Management desk to be operational shortly

18

Refinery Initiatives

Refinery Initiatives

Capacity Additions and Expansions

Mumbai Refinery from 5.5 to 7.9 MMTPA

Visakh Refinery from 7.5 to 8.3 MMTPA

Plans to go up to ~12 MMTPA

New Grass Root refinery

Self sufficiency thru new refinery at Bhatinda in North

Possible participation of BP being discussed

Exploring feasibility of setting up of export oriented refinery at

East Coast

19

Pipelines

Pipelines

Existing Pipelines

Visakh Secunderabad 572 Kms 5.38 MMTPA

Mumbai Pune 161 Kms 3.67 MMTPA

Mangalore Bangalore (JV) 362 Kms 5.60 MMTPA

Pipeline Extension

Mumbai-Pune to Solapur 352 Kms 4.30 MMTPA

Target completion by Sep. 06 at a cost of Rs 3.35 billion

New Pipeline

Mundra Delhi 1048 Kms 5 MMTPA

Target completion by May 07 at a cost of Rs. 16.24 billion

20

Retail Branding

Retail Branding

First to introduce Branded Outlets

36 % Retail outlets converted to Club HP

50% sales thru Club HP outlets

12 Club HP helpline operational

60 % Club HP Outlets selling Power

12 % of total sale converted

Addl. margins of Rs. 120 million in

Apr/Dec 05

Targeted conversion of 18% with

addl. margin of Rs. 290 million

78 % Club HP Outlets selling Turbojet

8 % of total sale converted

Addl. margins of Rs. 76 million in

Apr/Dec 05

Targeted conversion of 15% with

addl. margins of Rs. 210 million

Outstanding

Vehicle

&

Customer

Care

21

Rural Strategy

Rural Strategy

First to set up branded Rural

Outlets : Hamara Pump

Providing quality product

At right price

Near the point of consumption

Tie-ups for Agri Inputs, Farming

Equipment & Micro Financing

Over 500 pumps in operation

M/s Heart king Agency, Masamchery,

Dist Kanjipuram,Tamil Nadu

22

Community Kitchens

Community Kitchens

1434 Rasoi Ghar as of Dec. 05

Responsible

Corporate

Citizen

23

Aviation Business : Fuelling the Growth

Aviation Business : Fuelling the Growth

ATF Growth Story

-2

8

18

28

38

48

HPC 3.8 0.8 23.3 47.8 25.3

BPC -1.1 1.6 9.2 4.8 12.7

IOC 0.9 3.1 7.4 12.0 14.6

FY 02 FY 03 FY 04 FY 05 A/D 05

G

r

o

w

t

h

(

%

)

HPC zooming

ahead of Ind.

Continuously achieving highest

growth rate in industry

Foreign airline customers base

expanded to 28 from 3 in FY 03

Widening ASF network for better

customer reach

2 new ASFsplanned

Only Indian company Only Indian company

Nominated by International Air

Transport Association (IATA)

on fuel suppliers advisory

committee

Among top 30 (Ranked 17

th

)

Companies adjudged as

'World's best jet fuel marketer'

in survey conducted by the

Armbrust Aviation group, USA

Having ISO 14001 certified

Aviation Facilities

24

Vertical Integration : Exploration & Production

Vertical Integration : Exploration & Production

Acquire E&P interests both in India and out of India

MOU with GAIL for overseas exploration opportunities

Participate in NELP VI on its own as well as thru collaborative

partners

Develop expertise of Prize Petroleum

J oint Venture for oil exploration and production

Awarded 1 Cambayonshore block under NELP IV in consortium with

GSPC

Service contract for development of 3 marginal onshore fields of ONGC

50% participating interest in mini oil producing field at Sanganpur,

Gujarat

25

New Businesses : Gas

New Businesses : Gas

Have presence in Natural Gas Market

MOU with GAIL for City Gas Distribution in the States of

Gujarat and Rajasthan

Joint Venture with GAIL for the distribution and

marketing of Green Fuels in AP and in MP

Possibility of Equity Participation in Shells LNG terminal at

Hazira

26

Distinctions :

Distinctions : Encouragement that propels us to greater heights

Excellent performance against

MOU for 14 years in succession

Forecourt Retailer of the year -

2005 (KSA Technopak- ICICI

Bank)

Most Respected company in

petroleum sector (Business

World)

Best Workplace practices (Asian

Forum on Corporate Social

Responsibility, Philippines)

Golden Peacock Innovation

Award for 2004 (Institute of

Directors)

Award for Innovative Brand

Strategies (DAKS Awards for

Brand Excellence)

Performance

Professionalism Innovation

27

Changing face of Retail Marketing

Changing face of Retail Marketing

Thank You

Outstanding Contribution

Petro Retailing Business

- DEW Journal

Most Respected Company

- Business World

Forecourt Retailer

-KSA Technopak / ICICI Bank

You might also like

- Rolling Stock 2Document128 pagesRolling Stock 2Ren Bautista67% (3)

- FormulasDocument9 pagesFormulasShankar JhaNo ratings yet

- GoMechanic OrderBill NullDocument7 pagesGoMechanic OrderBill NullsrpvickyNo ratings yet

- Channel Conflict-Lubricant Markets-Petroleum IndustryDocument12 pagesChannel Conflict-Lubricant Markets-Petroleum IndustryNikhil100% (1)

- Refrigerant Dryers F-HS SerieDocument8 pagesRefrigerant Dryers F-HS SerieVictor BarretoNo ratings yet

- IPPDocument4 pagesIPPCrisel MaligligNo ratings yet

- Equity Note - Padma Oil Company LTDDocument2 pagesEquity Note - Padma Oil Company LTDMd Saiful Islam KhanNo ratings yet

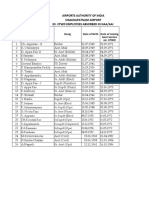

- Airports Authority of India Visakhapatnam Airport Ex. CPWD Employees Absorbed in Naa/AaiDocument2 pagesAirports Authority of India Visakhapatnam Airport Ex. CPWD Employees Absorbed in Naa/AaisrpvickyNo ratings yet

- Power T&D Reliance PDFDocument63 pagesPower T&D Reliance PDFRonak JajooNo ratings yet

- Approved Harmonized National RD Agenda 2017-2022Document58 pagesApproved Harmonized National RD Agenda 2017-2022Joemel BautistaNo ratings yet

- Pump Applications Using VFDS: Are Vfds Worth It For Pump Applications? Have They Been Oversold To The Market?Document29 pagesPump Applications Using VFDS: Are Vfds Worth It For Pump Applications? Have They Been Oversold To The Market?123sam456No ratings yet

- Transformer Testing - DV Power ProductsDocument61 pagesTransformer Testing - DV Power ProductsbaoHVLABNo ratings yet

- Financial Statement Analysis of OGDCLDocument33 pagesFinancial Statement Analysis of OGDCLRehan Yousaf100% (15)

- BPDocument7 pagesBPyagrwlNo ratings yet

- Supply Chain Process of HPCLDocument27 pagesSupply Chain Process of HPCLAvinaba HazraNo ratings yet

- BPCL Organization StructureDocument34 pagesBPCL Organization StructureAroop Sanyal50% (10)

- Zonergy CatalogDocument19 pagesZonergy CatalogSuban Tasir0% (1)

- Naveen PatnaikDocument248 pagesNaveen PatnaiksrpvickyNo ratings yet

- NTPC Mckinsey 7s FrameworkDocument27 pagesNTPC Mckinsey 7s Frameworkkanchan20667% (3)

- Analysis October 07Document22 pagesAnalysis October 07Vaibhav KumarNo ratings yet

- Gail (India) Firstcall 150914Document14 pagesGail (India) Firstcall 150914rohitkhanna1180No ratings yet

- B K BakhshiDocument21 pagesB K Bakhshirahulmehta631No ratings yet

- Oil India Ongc ComparisionDocument35 pagesOil India Ongc ComparisionAlakshendra Pratap TheophilusNo ratings yet

- Aegis Logistics LTD 110313Document30 pagesAegis Logistics LTD 110313shahavNo ratings yet

- Revenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.ChawalaDocument7 pagesRevenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.Chawalakrishan_28No ratings yet

- Annual Report 2012-13Document126 pagesAnnual Report 2012-13KarolinafischerNo ratings yet

- Vishwa Vishwani Institute of Systems and MangementDocument30 pagesVishwa Vishwani Institute of Systems and MangementNishant ShindeNo ratings yet

- Term Paper OF Corporate Law: Topic: - Gail IndiaDocument14 pagesTerm Paper OF Corporate Law: Topic: - Gail India9646231712No ratings yet

- Media Release 200706Document12 pagesMedia Release 200706Pradeep SharmaNo ratings yet

- Oil and Petroleum Industry AnalysisDocument26 pagesOil and Petroleum Industry AnalysisSaurav DemtaNo ratings yet

- Cs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentDocument5 pagesCs Sandeep Kumar Raina b54 Roll No 27 08 - Cs - Week4 - s9 10 - Application AssignmentsandeeprainaNo ratings yet

- Antique - Kirloskar Pneumatic Initiation - 180821Document20 pagesAntique - Kirloskar Pneumatic Initiation - 180821darshanmaldeNo ratings yet

- Reliance Industries Limited Key Corporate HighlightsDocument32 pagesReliance Industries Limited Key Corporate HighlightsMadava HegdeNo ratings yet

- About HPCL 2018Document14 pagesAbout HPCL 2018rqnNo ratings yet

- BYCO Petroleum LimitedDocument8 pagesBYCO Petroleum Limitedhamza dosaniNo ratings yet

- POManagement PROJECT (IOC, BHARAT PETROLEUM)Document14 pagesPOManagement PROJECT (IOC, BHARAT PETROLEUM)Khushi ShahNo ratings yet

- Hindustan Petroleum Corporation LimitedDocument11 pagesHindustan Petroleum Corporation Limitedshabila_momin4976No ratings yet

- HPCL - Religare - 23rd AugustDocument10 pagesHPCL - Religare - 23rd AugustanjugaduNo ratings yet

- Oil - Downstream - Update - Jan 15Document37 pagesOil - Downstream - Update - Jan 15satish_xpNo ratings yet

- Indo German Carbons - R - 22052018Document7 pagesIndo German Carbons - R - 22052018Vinu VaviNo ratings yet

- Overview of Energy Scenario WRT India: USA China Russian... Japan India Germany CanadaDocument7 pagesOverview of Energy Scenario WRT India: USA China Russian... Japan India Germany CanadaAnirban PahariNo ratings yet

- Oil & Gas Industry FINALDocument21 pagesOil & Gas Industry FINALAshutosh KashyapNo ratings yet

- FileDocument4 pagesFileLeandroNo ratings yet

- Press 25jul23 ResultsDocument5 pagesPress 25jul23 ResultsNagendranNo ratings yet

- Pakistan State Oil Introduction of The OrganizationDocument32 pagesPakistan State Oil Introduction of The OrganizationTAS_ALPHANo ratings yet

- Letter To Shareowners: Annual Report 2015-16 Reliance Industries LimitedDocument4 pagesLetter To Shareowners: Annual Report 2015-16 Reliance Industries Limitedramakanta mishraNo ratings yet

- Micro Economics ReportDocument10 pagesMicro Economics ReportAbhiroop MukherjeeNo ratings yet

- Oil and Gas Sector NewDocument24 pagesOil and Gas Sector NewApoorva PuranikNo ratings yet

- Financial Analysis: Petronet LNG LTDDocument19 pagesFinancial Analysis: Petronet LNG LTDVivek AntilNo ratings yet

- Final ProjectDocument47 pagesFinal ProjectKshitij MishraNo ratings yet

- PSODocument21 pagesPSOAsad Mazhar100% (1)

- Business Plan: OF BiodieselDocument12 pagesBusiness Plan: OF BiodieselNainesh PandareNo ratings yet

- Castrol India LTDDocument18 pagesCastrol India LTDSakshi BajajNo ratings yet

- Balmer Lawrie Co Ltd-FinalDocument18 pagesBalmer Lawrie Co Ltd-FinalAyush AhujaNo ratings yet

- AnnualReport2004-05 HPCLDocument204 pagesAnnualReport2004-05 HPCLAshita RanjanNo ratings yet

- Assessing Market Potential of CNG Engine Oil FOR Gulf Oil Corporation Limited BY Neha 203Document68 pagesAssessing Market Potential of CNG Engine Oil FOR Gulf Oil Corporation Limited BY Neha 203Abhinav SaraswatNo ratings yet

- BPCLDocument7 pagesBPCLSanjeedeep Mishra , 315No ratings yet

- Oinl 14 2 24 PLDocument6 pagesOinl 14 2 24 PLSanjeedeep Mishra , 315No ratings yet

- Grasim Q1FY05 Results PresentationDocument46 pagesGrasim Q1FY05 Results PresentationDebalina BanerjeeNo ratings yet

- Byco PetroleumDocument5 pagesByco PetroleumRana Muhammad TalhaNo ratings yet

- ProjectDocument67 pagesProjectKrittika Mitra50% (2)

- The Future of Asian RefiningDocument4 pagesThe Future of Asian Refiningponmanikandan1No ratings yet

- IOCL Broker (Motilal Oswal) Report.Document8 pagesIOCL Broker (Motilal Oswal) Report.Utkarsh PrasadNo ratings yet

- Kanoria Chemicals & Industries LTD: Key Financial IndicatorsDocument4 pagesKanoria Chemicals & Industries LTD: Key Financial IndicatorsPradeep MunnaNo ratings yet

- of BPCL JaipurDocument15 pagesof BPCL JaipurRaman Kumar JhaNo ratings yet

- Abc Limited: Lump-Sum Turnkey ProjectsDocument5 pagesAbc Limited: Lump-Sum Turnkey ProjectsVikash Kumar SharmaNo ratings yet

- Organics Stock IdeaDocument7 pagesOrganics Stock IdeaMohit KanjwaniNo ratings yet

- Fra Assignment 1Document11 pagesFra Assignment 1Ruchi SambhariaNo ratings yet

- Sector 2: Oil & Gas Company 1: BPCL General OverviewDocument5 pagesSector 2: Oil & Gas Company 1: BPCL General Overviewxilox67632No ratings yet

- Q1 FY21 Adversely Impacted by COVID 1 9Document4 pagesQ1 FY21 Adversely Impacted by COVID 1 9Esha ChaudharyNo ratings yet

- Financial Statement AnalysisDocument15 pagesFinancial Statement AnalysissambaviNo ratings yet

- The Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesFrom EverandThe Korea Emissions Trading Scheme: Challenges and Emerging OpportunitiesNo ratings yet

- Solar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitFrom EverandSolar Powered Agro Industrial Project of Cassava Based Bioethanol Processing UnitNo ratings yet

- Medical Certificate of Sickness and Fitness: S. Devanya - Whose SignatureDocument10 pagesMedical Certificate of Sickness and Fitness: S. Devanya - Whose SignaturesrpvickyNo ratings yet

- Format of Shift TimingsDocument2 pagesFormat of Shift TimingssrpvickyNo ratings yet

- GeM Comparitive StatementDocument6 pagesGeM Comparitive StatementsrpvickyNo ratings yet

- DGM (EC) - 23-SupplDocument2 pagesDGM (EC) - 23-SupplsrpvickyNo ratings yet

- Format FR 56J - ProbityDocument1 pageFormat FR 56J - ProbitysrpvickyNo ratings yet

- February TC 2022Document1 pageFebruary TC 2022srpvickyNo ratings yet

- Feedback Form - RTC RHQ SR - ON LINE - MODIFIEDDocument1 pageFeedback Form - RTC RHQ SR - ON LINE - MODIFIEDsrpvickyNo ratings yet

- Medical BillDocument8 pagesMedical BillsrpvickyNo ratings yet

- VEG Sunday Monday Tuesday Wednesday Thurseday Friday SaturedayDocument3 pagesVEG Sunday Monday Tuesday Wednesday Thurseday Friday SaturedaysrpvickyNo ratings yet

- Export MarketDocument39 pagesExport MarketsrpvickyNo ratings yet

- Interview QuestionDocument2 pagesInterview QuestionsrpvickyNo ratings yet

- Difference Between NPS and EPSDocument78 pagesDifference Between NPS and EPSsrpvickyNo ratings yet

- KPIDocument6 pagesKPIsrpvickyNo ratings yet

- Total Quality ManagementDocument15 pagesTotal Quality ManagementsrpvickyNo ratings yet

- TO DT: 17/11/2015 The Officer in Charge Cossiporre Branch EsicDocument2 pagesTO DT: 17/11/2015 The Officer in Charge Cossiporre Branch EsicsrpvickyNo ratings yet

- Form-I: Application For Registration of Establishment Employing Building WorkersDocument1 pageForm-I: Application For Registration of Establishment Employing Building WorkerssrpvickyNo ratings yet

- S. No. Roll No Application No Candidate Name Category Disability Domain SAIL MT 2015 - To Be Called List For GD & InterviewDocument3 pagesS. No. Roll No Application No Candidate Name Category Disability Domain SAIL MT 2015 - To Be Called List For GD & InterviewsrpvickyNo ratings yet

- What's The Latest?: Greece Debt Crisis Alexis Tsipras International Monetary FundDocument6 pagesWhat's The Latest?: Greece Debt Crisis Alexis Tsipras International Monetary FundsrpvickyNo ratings yet

- Frequently Asked Questions On Labour LawsDocument52 pagesFrequently Asked Questions On Labour LawssrpvickyNo ratings yet

- OLA Sandeep Ranjan Pattnaik: Total FareDocument1 pageOLA Sandeep Ranjan Pattnaik: Total FaresrpvickyNo ratings yet

- Scholarship Renewal FormDocument1 pageScholarship Renewal FormsrpvickyNo ratings yet

- Annamalai UniversityGvn Infotech KolkataDocument1 pageAnnamalai UniversityGvn Infotech KolkatasrpvickyNo ratings yet

- RINL MT Challan RpQcjcgQWIq N8mhXh8Ipg2Document1 pageRINL MT Challan RpQcjcgQWIq N8mhXh8Ipg2srpvickyNo ratings yet

- Without RefiningDocument1 pageWithout RefiningsrpvickyNo ratings yet

- Objective of ResearchDocument3 pagesObjective of ResearchsrpvickyNo ratings yet

- Prasentation On SHCILDocument18 pagesPrasentation On SHCILsrpvicky0% (1)

- E BA O2 ISM Qualification Kit Edf 2018 12 LRDocument80 pagesE BA O2 ISM Qualification Kit Edf 2018 12 LRUtun DedeNo ratings yet

- Head TankDocument1 pageHead TankAndrzej KozłowskiNo ratings yet

- Pakistan Strategy - CPEC A Big Impetus For Growth and InvestmentDocument9 pagesPakistan Strategy - CPEC A Big Impetus For Growth and InvestmentAyeshaJangdaNo ratings yet

- EnergyNext Vol 03 Issue 8 Aug 2013Document68 pagesEnergyNext Vol 03 Issue 8 Aug 2013IndiaNextNo ratings yet

- DFRBPCLBinaKotaPipeProj Aug07Document186 pagesDFRBPCLBinaKotaPipeProj Aug07M Ahmed LatifNo ratings yet

- Coal Facts 2008: West Virginia Coal AssociationDocument40 pagesCoal Facts 2008: West Virginia Coal AssociationKyle LangsleyNo ratings yet

- 4 - Refrigerant Pumping - Monika Witt Presentation PDFDocument90 pages4 - Refrigerant Pumping - Monika Witt Presentation PDFme641sivaNo ratings yet

- 965983-150LR Boiler ParkerDocument213 pages965983-150LR Boiler ParkerJuan PerazaNo ratings yet

- Metrosil IntroductionDocument2 pagesMetrosil Introductionian.rowley4051No ratings yet

- Sevair Synthetic 46Document2 pagesSevair Synthetic 46johan marinNo ratings yet

- SENATE HEARING, 113TH CONGRESS - S. Hrg. 113-720 NOMINATIONS OF THE 113TH CONGRESS - SECOND SESSIONDocument874 pagesSENATE HEARING, 113TH CONGRESS - S. Hrg. 113-720 NOMINATIONS OF THE 113TH CONGRESS - SECOND SESSIONScribd Government DocsNo ratings yet

- Reliance InfrastructureDocument15 pagesReliance InfrastructurePrasannaKumar93No ratings yet

- Unit Merinyu Elektrik: Application For Certificate of CompetencyDocument4 pagesUnit Merinyu Elektrik: Application For Certificate of CompetencySaff MdNo ratings yet

- Sample Greenaura IGBC AP NOTESDocument2 pagesSample Greenaura IGBC AP NOTESMayank SharmaNo ratings yet

- Methanol To GasolineDocument9 pagesMethanol To GasolinehhvgNo ratings yet

- Petronas Group of Companies 2021Document7 pagesPetronas Group of Companies 2021Loges WarryNo ratings yet

- Vortex Tube Steam Jet RefrigerationDocument14 pagesVortex Tube Steam Jet RefrigerationDInesh KumarNo ratings yet

- PCP0902 tcm24-2645Document20 pagesPCP0902 tcm24-2645duybac_carimax1979No ratings yet

- Daud CV PersonnelDocument4 pagesDaud CV Personneldaud.exptb100% (1)

- Catalog ContactoareDocument204 pagesCatalog ContactoareRadu LupuNo ratings yet