Professional Documents

Culture Documents

Family Progression Matrix

Uploaded by

Pavan Krishnamurthy0 ratings0% found this document useful (0 votes)

60 views1 pagefamily business

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfamily business

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

60 views1 pageFamily Progression Matrix

Uploaded by

Pavan Krishnamurthyfamily business

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

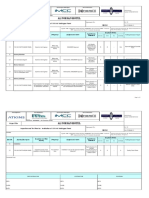

CORPORATE GOVERNANCE PROGRESSION MATRIX FOR

FOUNDER/FAMILY OWNED (UNLISTED) COMPANIES

Copyright 2007, International Finance Corporation

ATTRIBUTES

LEVEL 1

Understanding the need to

professionalize the Company

LEVEL 2

First concrete steps toward best

practices

LEVEL 3

Implementation of best

practices

LEVEL 4

Leadership

A.

COMMITMENT TO

CORPORATE GOVERNANCE

- The basic formalities of corporate

governance are in place including:

- Board of Directors;

- Annual Shareholders

meeting;

- Shareholders and

shareowners identified and

recorded.

- Board member or high-level

company executive explicitly charged

with responsibility for improving

corporate governance practices.

- Written policies established addressing

key elements in family firm governance:

- Succession planning;

- Human resources and family-

member employment;

- Family-member share ownership.

- Management/Board approves annual

calendar of corporate events.

- Corporate Governance policy

covers:

- Role of Board vis--vis

management;

- Long-term planning for

corporate governance of

company commensurate

with business plan.

- The Company has a written

code of Ethics, approved by the

Board.

- Applicable corporate governance,

accounting, auditing and internal

controls, and shareholder

information practices are equivalent

to those in place at best practice

public companies (i.e., little would

need to be done to qualify to make

a public offering).

- Company fully complies or

explains any deviations from all

applicable provisions of voluntary

code of best practices of the country

(some elements of which may be

applicable only to public

companies).

B.

STRUCTURE AND

FUNCTIONING OF THE

BOARD OF DIRECTORS

- Board of Directors constituted and

meets periodically.

- Board Meetings held according to a

regular schedule, agenda prepared in

advance, minutes prepared and approved.

- Non-family members (probably

company executives or ex-executives)

appointed to the Board and core

competency (skill mix) review of Board

conducted, or advisory Board of

independent professionals established and

consulted on a regular basis.

- Board composition

(competencies/skill mix)

adequate to oversight duties.

- Annual evaluation conducted.

- Audit Committee of non-

Executive Directors established.

- Directors independent of

management and owners

appointed to the Board (perhaps

graduated from the advisory

Board).

- Audit committee composed

entirely of independent directors.

- Nominating Committee

established.

- Compensation Committee

established.

C.

CONTROL ENVIRONMENT

AND PROCESSESS

- Adequate internal control systems are in

place and are periodically reviewed by

independent external auditors.

- Internal audit and internal control

systems are in accordance with highest

national standards.

- Internal audit and internal

control systems are consistent

with highest international

standards.

D.

TRANSPARENCY AND

DISCLOSURE

- Adequate accounting and auditing

systems in place including:

- Quarterly financial reports

prepared by internal accounting

and approved by the Board;

- Annual financial statements

audited by independent external

auditors and approved by

Shareholders Meeting.

- Accounting and reporting are performed

in accordance with the highest national

standards.

- The annual audit is performed by a

recognized independent external auditing

firm in accordance with the highest

national standards.

- Accounting, reporting and

auditing systems meet the highest

international standards.

E. SHAREHOLDERS - All shareholders kept informed of

company policy, strategy and results of

operations.

- Annual shareholders meetings held.

- Shareholders provided with all material

information and detailed agenda in

advance of shareholders meetings.

- Family council established (if

number of family members large

or substantial portion are not

working in the business).

- Company in position to quickly

implement all aspects of best

practice code with respect to

shareholders when company to go

public.

You might also like

- Corporate Governance - Effective Performance Evaluation of the BoardFrom EverandCorporate Governance - Effective Performance Evaluation of the BoardNo ratings yet

- Internal and External Institutions and Influences of Corporate GovernanceDocument39 pagesInternal and External Institutions and Influences of Corporate GovernanceLovely PasatiempoNo ratings yet

- Rangkuman OJK Rules Audit Committee, Remuneration and Nomination CommitteDocument24 pagesRangkuman OJK Rules Audit Committee, Remuneration and Nomination CommitteYuniar Nawang WulanNo ratings yet

- Wipro Corporate Governance Guidelines April09Document24 pagesWipro Corporate Governance Guidelines April09Devang Amit GhediaNo ratings yet

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"From Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"No ratings yet

- Code of Corporate Governance: Faiza Rehman MBA-4 (M) ID#5539Document23 pagesCode of Corporate Governance: Faiza Rehman MBA-4 (M) ID#5539Fahad AliNo ratings yet

- Comprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeFrom EverandComprehensive Manual of Internal Audit Practice and Guide: The Most Practical Guide to Internal Auditing PracticeRating: 5 out of 5 stars5/5 (1)

- F8 PresentationDocument232 pagesF8 PresentationDorian CaruanaNo ratings yet

- Auditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlFrom EverandAuditing Information Systems and Controls: The Only Thing Worse Than No Control Is the Illusion of ControlNo ratings yet

- Internal Auditing Role in Corporate GovernanceDocument23 pagesInternal Auditing Role in Corporate GovernanceNor Syahra AjinimNo ratings yet

- Globant S.A. - Corporate Governance GuidelinesDocument4 pagesGlobant S.A. - Corporate Governance Guidelineszerocinco5berto xdebertoNo ratings yet

- Corporate Governance - ITCDocument31 pagesCorporate Governance - ITCRutika VyasNo ratings yet

- Audit Committee Charter (MEGA SOFT LTD.)Document5 pagesAudit Committee Charter (MEGA SOFT LTD.)rohitgupta_arsenalNo ratings yet

- Topic 2 - The Regulatory Environment and Corporate GovernaceDocument28 pagesTopic 2 - The Regulatory Environment and Corporate GovernaceSandile Henry DlaminiNo ratings yet

- SEC Code of Corporate Governance 2016 (Outline)Document12 pagesSEC Code of Corporate Governance 2016 (Outline)Regine A. Ansong67% (3)

- Name: Priyanka Iyer Roll No.: 24 Sub.: Business Ethics and Corporate Governance Topic: Wipro and Its GovernanceDocument4 pagesName: Priyanka Iyer Roll No.: 24 Sub.: Business Ethics and Corporate Governance Topic: Wipro and Its GovernanceAmol GadeNo ratings yet

- Lecture 10Document42 pagesLecture 10Humaira RaoNo ratings yet

- Audit Committee CharterDocument6 pagesAudit Committee CharterDayarayan CanadaNo ratings yet

- What is corporate governance? Key principles and guidelines in IndiaDocument29 pagesWhat is corporate governance? Key principles and guidelines in IndiaPoonam SharmaNo ratings yet

- Corporate Law and Corporate GovernanceDocument42 pagesCorporate Law and Corporate GovernanceNooria YaqubNo ratings yet

- Code On Corporate GovernanceDocument63 pagesCode On Corporate GovernanceVishwas JorwalNo ratings yet

- Fatima Fertilizer Annual ReportDocument106 pagesFatima Fertilizer Annual ReportMuhammad Imran Umer100% (1)

- Effective boardsDocument3 pagesEffective boardsHajra ZANo ratings yet

- Topic 2 - The Regulatory Environment and Corporate GovernaceDocument28 pagesTopic 2 - The Regulatory Environment and Corporate GovernaceSandile Henry DlaminiNo ratings yet

- Boards and Directors: Key RequirementsDocument5 pagesBoards and Directors: Key RequirementsFeeding_the_SelfNo ratings yet

- Cadbury Committee Report and Oecd Report On Corporate GovernanceDocument5 pagesCadbury Committee Report and Oecd Report On Corporate GovernanceVrushti Parmar100% (1)

- Chapter 5 Corporate GovernanceDocument9 pagesChapter 5 Corporate GovernanceJamal ArshadNo ratings yet

- Audit Committee ResponsibilitiesDocument8 pagesAudit Committee ResponsibilitiesJuan Pascual CosareNo ratings yet

- Corporate Governance Code Improves PerformanceDocument29 pagesCorporate Governance Code Improves PerformanceHemant SolankiNo ratings yet

- NOTESDocument6 pagesNOTESSOPHIA GRACE NIDUAZANo ratings yet

- Cadbury ReportDocument16 pagesCadbury ReportToral Shah100% (1)

- Board of DirectorsDocument30 pagesBoard of DirectorsDavid Kimani100% (1)

- Corporate Governance FundamentalsDocument9 pagesCorporate Governance FundamentalsjdjdbNo ratings yet

- ACCA Paper F8 - : Audit and Assurance (INT)Document232 pagesACCA Paper F8 - : Audit and Assurance (INT)sohail merchantNo ratings yet

- Germic 1Document41 pagesGermic 1BENILDA CAMASONo ratings yet

- Ethical Aspects of SFMDocument21 pagesEthical Aspects of SFMKaneNo ratings yet

- Corporate Governance Definition and ModelsDocument65 pagesCorporate Governance Definition and ModelssubhidraNo ratings yet

- Acca P1Document26 pagesAcca P1dabianNo ratings yet

- Corporate Goverance in IndiaDocument43 pagesCorporate Goverance in IndiaParandeep ChawlaNo ratings yet

- Corporate Governance GuidelinesDocument10 pagesCorporate Governance GuidelinesAjad AliNo ratings yet

- Audit Committee CharterDocument39 pagesAudit Committee CharterozlemNo ratings yet

- Cadbury Committee ReportDocument8 pagesCadbury Committee ReportArunjeet Singh Rainu100% (1)

- Lecture 4-Auditing & Corporate GovernanceDocument19 pagesLecture 4-Auditing & Corporate GovernanceNatalia NaveedNo ratings yet

- Corp Gov - TybmsDocument46 pagesCorp Gov - TybmsNurdayantiNo ratings yet

- Week 5, Corporate GovernanceDocument25 pagesWeek 5, Corporate GovernanceShaheer BaigNo ratings yet

- Assurance Course OutlineDocument27 pagesAssurance Course OutlineShiza KhanNo ratings yet

- MBA Business Law Session 8 Reading. 1Document11 pagesMBA Business Law Session 8 Reading. 1Aniket MishraNo ratings yet

- Corporate Governance: "Satyam Vada Dharmam Chara"Document26 pagesCorporate Governance: "Satyam Vada Dharmam Chara"Durga Prasad DashNo ratings yet

- MBA I - 428 Business Ethics Unit - Iv: Corporate Governance MeaningDocument6 pagesMBA I - 428 Business Ethics Unit - Iv: Corporate Governance MeaningJebin JamesNo ratings yet

- Business Ethics Unit-5Document10 pagesBusiness Ethics Unit-5Ajilal KadakkalNo ratings yet

- 4.1. Audit Committee Charter Sample 8Document4 pages4.1. Audit Committee Charter Sample 8Mohamed El-najjarNo ratings yet

- ABC Board Manual V3Document36 pagesABC Board Manual V3Faisal HashmiNo ratings yet

- Cadbury Committee ReportDocument2 pagesCadbury Committee ReportBitha AnojNo ratings yet

- Audit Compliance Committee CharterDocument6 pagesAudit Compliance Committee CharterAli Mohammed AbdellahNo ratings yet

- Audit Committee Charter - PDFDocument5 pagesAudit Committee Charter - PDFMuhammad31No ratings yet

- Internal Auditing: An Essential Governance FunctionDocument18 pagesInternal Auditing: An Essential Governance FunctionShilongo OliviaNo ratings yet

- Board of Directors' Key Responsibilities and Effective FunctioningDocument61 pagesBoard of Directors' Key Responsibilities and Effective FunctioningVij88888No ratings yet

- Corporate Governance PolicyDocument4 pagesCorporate Governance PolicySuriyaNo ratings yet

- Mission StatementsDocument2 pagesMission StatementsPavan KrishnamurthyNo ratings yet

- Guide evaluate OPD vendor capabilitiesDocument15 pagesGuide evaluate OPD vendor capabilitiesPavan KrishnamurthyNo ratings yet

- Entrepreneurial Competency PDFDocument12 pagesEntrepreneurial Competency PDFShiela OchoaNo ratings yet

- EntrepreneurshipDocument42 pagesEntrepreneurshipPavan KrishnamurthyNo ratings yet

- 20questionsabout Cod Eof ConductDocument28 pages20questionsabout Cod Eof ConductPavan KrishnamurthyNo ratings yet

- Creating A Common Purpose 6x9Document100 pagesCreating A Common Purpose 6x9Pavan KrishnamurthyNo ratings yet

- VC Presentation PavanDocument21 pagesVC Presentation PavanPavan KrishnamurthyNo ratings yet

- Workingvalues EraDocument7 pagesWorkingvalues EraPavan KrishnamurthyNo ratings yet

- Ancient Indian CookeryDocument47 pagesAncient Indian CookeryPavan KrishnamurthyNo ratings yet

- Kapalabhati PranayamaDocument9 pagesKapalabhati PranayamaPavan KrishnamurthyNo ratings yet

- Seminarski Rad - My Favourite FilmDocument11 pagesSeminarski Rad - My Favourite FilmMartin StarčevićNo ratings yet

- Dalai Lama FraudDocument6 pagesDalai Lama FraudbanglanealNo ratings yet

- Marc II Marketing, Inc. vs. Joson, G.R. No. 171993, 12 December 2011Document25 pagesMarc II Marketing, Inc. vs. Joson, G.R. No. 171993, 12 December 2011Regienald BryantNo ratings yet

- Cronicle of Spain PDFDocument232 pagesCronicle of Spain PDFAlbiHellsingNo ratings yet

- Itp Installation of 11kv HV Switchgear Rev.00Document2 pagesItp Installation of 11kv HV Switchgear Rev.00syed fazluddin100% (1)

- 35 - Motion For More Definite StatementDocument18 pages35 - Motion For More Definite StatementRipoff Report100% (1)

- Larceny in The Heart-DraftDocument159 pagesLarceny in The Heart-DraftChalcedon Foundation100% (1)

- Guidelines For The Writing of An M.Phil/Ph.D. ThesisDocument2 pagesGuidelines For The Writing of An M.Phil/Ph.D. ThesisMuneer MemonNo ratings yet

- Midterm Examination in Capital MarketsDocument3 pagesMidterm Examination in Capital MarketsNekki Joy LangcuyanNo ratings yet

- 17Mb221 Industrial Relations and Labour LawsDocument2 pages17Mb221 Industrial Relations and Labour LawsshubhamNo ratings yet

- TranscriptDocument10 pagesTranscriptAnonymous 4pbJ6NtNo ratings yet

- Entering and Leaving The Traffic Separation SchemeDocument2 pagesEntering and Leaving The Traffic Separation SchemeAjay KumarNo ratings yet

- Full Download Understanding Human Sexuality 13th Edition Hyde Test BankDocument13 pagesFull Download Understanding Human Sexuality 13th Edition Hyde Test Bankjosiah78vcra100% (29)

- Training Design SKMTDocument4 pagesTraining Design SKMTKelvin Jay Cabreros Lapada67% (9)

- Work Permit ProcedureDocument13 pagesWork Permit ProcedureMohamed ElsaneeNo ratings yet

- UL E483162Cajas EVTDocument2 pagesUL E483162Cajas EVTYeison Alberto Murillo Guzman0% (1)

- File No. AI 22Document8 pagesFile No. AI 22Lori BazanNo ratings yet

- Iso 16750 4 2010 en PDFDocument8 pagesIso 16750 4 2010 en PDFvignesh100% (1)

- Camshaft Precision Color, Florian Ion PETRESCUDocument88 pagesCamshaft Precision Color, Florian Ion PETRESCUPetrescu FlorianNo ratings yet

- Notes Labor RevDocument4 pagesNotes Labor RevCharmagneNo ratings yet

- Guimba, Nueva EcijaDocument2 pagesGuimba, Nueva EcijaSunStar Philippine NewsNo ratings yet

- Role of Jamaat Islami in Shaping Pakistan PoliticsDocument15 pagesRole of Jamaat Islami in Shaping Pakistan PoliticsEmranRanjhaNo ratings yet

- Class Program: Division of Agusan Del Norte Santigo National High SchoolDocument1 pageClass Program: Division of Agusan Del Norte Santigo National High SchoolIAN CLEO B.TIAPENo ratings yet

- Manila Banking Co. vs. University of BaguioDocument2 pagesManila Banking Co. vs. University of BaguioMarianne Andres100% (2)

- LAW OF EVIDENCEDocument7 pagesLAW OF EVIDENCERajithha KassiNo ratings yet

- Bulletin No 18 August 16 2019 - PassDocument770 pagesBulletin No 18 August 16 2019 - PassNithyashree T100% (1)

- Korea Technologies Co, Ltd. v. LermaDocument1 pageKorea Technologies Co, Ltd. v. Lermadwight yuNo ratings yet

- CEILLI Trial Ques EnglishDocument15 pagesCEILLI Trial Ques EnglishUSCNo ratings yet

- FNDWRRDocument2 pagesFNDWRRCameron WrightNo ratings yet

- MOA Establishes 50-Hectare Model Agroforestry FarmDocument8 pagesMOA Establishes 50-Hectare Model Agroforestry FarmENRO NRRGNo ratings yet