Professional Documents

Culture Documents

Some Notes On The Indian Economy in Crisis

Uploaded by

Abhishek GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Some Notes On The Indian Economy in Crisis

Uploaded by

Abhishek GuptaCopyright:

Available Formats

NOTES

june 14, 2014 vol xlIX no 24 EPW Economic & Political Weekly

108

Some Notes on the Indian

Economy in Crisis

Assessment and Prospects

A Vaidyanathan

There is no sign of recognition

among the political class and

policymakers of the implications

of the persistence of many

adverse trends in the Indian

economy and their underlying

causes. That the socio-economic

consequences of allowing present

trends to continue will be serious

is already manifest in widening

disparities between castes and

communities, classes, rural and

urban areas, and individuals.

Measures meant to counter this

have not been pursued seriously

and have had little effect on the

ground reality of persistent

inequality, slow growth, and an

unacceptably high incidence of

mass poverty and unemployment.

This article calls for a radical

retuning of policies aimed at

achieving inclusive economic

growth and a more egalitarian

distribution of income.

A Vaidyanathan (a.vaidyanathan053@gmail.

com) is a well-known economist who has

commented on the economy in the EPW for

many years.

T

he last two to three years have

witnessed a deterioration in prac-

tically all aspects of the countrys

economic performance.

After a decade of being in a healthy

state, Indias balance of payments has

worsened sharply in the last three years.

The current account decit (CAD) has

increased in absolute terms from an

average of $18 billion in 2006-08 to

nearly $55 billion and from less than 3%

to nearly 6% as a proportion of the gross

domestic product (GDP). The countrys

ability to nance the decit has declined.

Domestic wholesale price indices, which

increased at an average rate of 5% per

annum during 2000-10, have recorded

a progressive increase to double-digit

levels, and consumer prices are rising at

a faster rate.

GDP growth in the country, which

reached historically unprecedented levels

of 9% to 10% per annum during the last

decade, has come down to 5% and less in

the last two years.

The simultaneous deterioration of

performance on these key fronts has led

to a crisis of serious concern. This article

examines the causes and consequences

of this. We will explore the factors that

have contributed to deterioration in

each of these aspects, and comment on

the prospects for reviving the health and

growth momentum of the economy.

Balance of Payments

The surge in the CAD until 2012-13 was

accounted for by the widening trade

decit because export growth has been

increasingly outpaced by growth of

commodity imports, and there has been

no sustained or signicant rise in net in-

ows of non-factor services (mostly soft-

ware exports), remittances, and invisibles.

Commodity exports have maintained

a healthy rate of growth under a regime

of more or less constant and stable

exchange rates despite the recession in

developed countries. But this has been

slower than the surge in imports during

the last three years. The bulk of increase in

imports is accounted for by the growing

demand for crude oil and higher prices

for it; fertilisers; metals and minerals to

meet shortfalls in domestic production;

capital goods needed for capital formation;

electronics; and materials for export

industries. These items account for about

70% of the increase in the value of total

imports. The balance goes in meeting re-

quirements of imports for other domestic

production and consumption, including

gold. The rapid growth in import of gold,

which has risen nearly threefold since

2008-09, has emerged as a signicant

element in total imports, now compris-

ing nearly one-eighth of them. The CAD

grew from $16 billion in 2007-08 and

$28 billion in 2008-09 to $78 billion in

2011-12. It has since been brought down

to around 3% of GDP because of slower

growth and restrictions on gold imports.

In the pre-reform era, the CAD was

largely nanced by drawing down re-

serves, and using foreign aid and non-

resident Indian (NRI) deposits. Capital

inows were severely restricted. Heavy

reliance on commercial borrowings dur-

ing the 1980s culminated in a severe

payments crisis that triggered the liber-

alisation reforms of the 1990s. Since then,

restrictions on external capital ows

have been substantially relaxed to en-

courage foreign direct investment (FDI),

investments by foreign institutional in-

vestors (FII), and through commercial

borrowings. These measures, combined

with the abundant availability of cheap

funds in world nancial markets and the

relatively higher returns to investments

in stock markets, real estate, and bank

deposits in India, led to large inows of

foreign capital that were more than ade-

quate to cover the CAD. This helped the

country to increase its foreign exchange

reserves to $307 billion by 2007-08.

The situation has since changed dra-

matically due to a conjunction of external

NOTES

Economic & Political Weekly EPW june 14, 2014 vol xlIX no 24

109

and internal factors. The meltdown of

the world nancial system in 2008, fol-

lowed by deep and continuing recession

in the economies of developed coun-

tries, have had a signicant impact on

the Indian economy through shrinking

markets for exports, increases in world

market prices for key imports, and

declining capital inows. These factors

were compounded by the slowing down

of investment and growth rate of the

domestic economy; a rapid rise in the

CAD; persistently high rates of ination;

and concerns about the countrys ability

to nance the widening CAD and meet

impending large obligations for repayment

of external commercial borrowings

(ECBs). The decline in foreign reser ves

and sharp reduction in the rate of over-

all growth fuelled pessimism, indu cing

extreme volatility in both the stock market

and the exchange rate. The situation has

been contained by intervention of the

Reserve Bank of India (RBI) at the cost of

substantial depreciation of the rupee.

The underlying concerns about the future

prospects of both gro wth and balance of

payments remain.

The reduction in imports during the

last year will be reversed when growth

revives. Containing it within the com-

fort level of 3% to 3.5% level of GDP calls

for narrowing the difference between the

rates of growth of exports and imports.

The recent depreciation goes some way

to this, but its efcacy is likely to be

limited by several factors. While it obvi-

ously increases the protability of export

industries, the extent of the increase

varies depending partly on the extent to

which export production depends on

imported inputs, and the ability of entre-

preneurs to exploit the competitive ad-

vantage by increasing production and

aggressive marketing.

The impact on imports depends on the

extent to which their higher costs are

passed on to users, and on the price

sensitivity of domestic demand to prices.

In the case of oil, oil products, and ferti-

lisers, which are widely used by other

sectors in production but are supplied at

highly subsidised rates, only a small part

of the increase in import prices is passed

on to users. There are indications that this

will change in the near future. In these

cases, users have little incentive to econ-

omise on the use of these inputs. In some

cases, notably metals and coal, import

is determined by shortfalls in domestic

production. Removal of bottlenecks to

investment for expansion of capacity

and for underutilisation of available ca-

pacity would substantially reduce the

need for imports. The demand for gold is

price insensitive. Altogether, about a

third of total imports belong to the

above categories. The demand for the

rest, which have to bear the full impact

of higher import prices, can be expected

to dampen the growth of demand and

also induce greater import substitution.

Prospects of FDI

The reliance on unstable sources of nance

clearly needs to be reduced.

Direct investment in projects

in the country is obviously

preferable because it goes

with the acquisition of a

permanent stake in enter-

prises and contributes directly

to improvement of techno-

logy and production. Interest

in encouraging FDI increased

during the reform era and it

became a major element of

policy. Government attempts

to woo FDI have become a

highly contentious domestic

political issue. Faced with se-

vere opposition, the approach to libera-

lising the FDI policy has been cautious

and limited to a few selected spheres,

notably automobiles, telecom, nance,

real estate and software. The proportion

going into greeneld investments has

been relatively small compared to mergers

and acquisitions and for buying into the

equity of existing enterprises. With sig-

nicant exceptions such as automobiles,

components, and software (both capital

and technologically intensive), their fo-

cus has been on the domestic market.

Overall, the scale of inows has been

relatively small.

Ination

Persistent high rates of ination are an-

other major cause for concern. Analyses

and discussions of causes and remedies

of ination in academia, policy, and

political forums are based on the ofcial

wholesale and consumer price indices.

By these indices, ination has signi-

cantly increased since 2004-05 com-

pared to the previous decade the aver-

age rate of increase in the wholesale

price index (WPI) during the decade

ending 2004-05 was around 5% per an-

num, while in the subsequent seven

years it averaged 6.6%. Moreover, while

there was no signicant trend in the

rate in the earlier period, it has

increased signicantly after that from

8% in 2006-07 to a peak of 17% in 2009-

10. Though it has since dipped, it still

remains at 9% to 10%. There are signi-

cant differences both in the rate and

pattern of price increases across sectors

(Table 1).

Changes in the indices for several key

sectors do not reect the state of balance

between supply and demand in the

domestic market. They are inuenced to

a signicant extent by direct govern-

ment intervention in the market through

administered prices as well as the effect

of changes in the world market. The

prices of several key inputs (energy,

fertilisers, and rail transport) are deter-

mined administratively and not through

the market. Ideally, these should be xed

at levels that enable the total revenue

to cover the overall costs of producing

and distributing them for various uses,

allowing for discrimination between

uses on the basis of social and strategic

considerations. Costs have varied around

a strong rising secular trend. But govern-

ments have followed a conscious policy

of not charging prices to end-users to

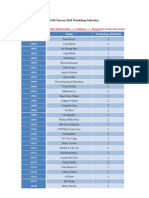

Table 1: Recent Trends in Wholesale Price Index

Overall Indices of WPI, 2004-05 =100 Ratio of Food/

Food Manufactures Fuel Minerals Manufactures

Average

1994-2005 to

2004-05 5.0 5.0 4.0

2005-06 104.5 105 115 102 114 1.01

2006-07 111.4 116 137 108 121 1.08

2007-08 116.6 126 153 118 121 1.07

2008-09 126 135 187 120 135 1.13

2009-10 130.8 155 203 123 132 1.26

2010-11 143.3 180 253 130 148 1.40

2011-12 156.1 193 321 140 169 1.38

Average

2004-05 to

2011-12 6.6 10 16.7 5.1 7.9

Source: Based on estimates of averages for months for various years in

Economic Survey 2012-13; 1993-2005 estimates based on series with 1983-84 as

base; those for 2005-11 based on 1993-94 base.

NOTES

june 14, 2014 vol xlIX no 24 EPW Economic & Political Weekly

110

ensure full cost recovery. In many cases,

issue prices have been unchanged or

even reduced to prevent causing hard-

ship to users, especially socially and

economically vulnerable people. Because

of this, the ofcial price index tends to

suppress the true extent of inationary

pressures in the economy.

A striking feature is a sharp break in

the trend behaviour of agricultural prices

relative to those of manufactures before

and after 2004-05. During the decade

before 2004-05, they rose at an average

rate of 5% per annum, roughly at the

same rate as the overall index and slightly

more than that of manufactures. Their

ratio does not show any signicant

trend. But in the subsequent seven years,

while the overall index rose by 6.6% per

annum on an average and that of manu-

factures rose by 5% per annum, the

index for agriculture increased by 10%

per annum. Since then, and especially

during the last ve years, the ratio of

agricultural to manufacturing prices has

shown a sustained rise.

Besides well-known deciencies such

as the coverage and reliability of prices,

especially of products in the unorga nised

sector, the ofcial WPI does not adequately

capture the impact of major changes in

patterns of production and consump-

tion; the introduction of nume rous new

products; and changes in their quality.

Over time, especially during the last two

decades, the proportion of private con-

sumption expenditure spent on food has

steadily declined even as the proportion

devoted to non-food items has grown

rapidly. Among non-food items, the share

of services has grown much faster than

of manufactures. These patterns are

evident in both rural and urban areas,

more markedly so in the latter.

In the case of agriculture, we have

a situation in which the governments

policy of raising the minimum support

price (MSP) for staple crops and accumu-

lating larger stocks of foodgrains has

had a signicant impact on open market

prices. But prices of non-MSP crops

(which include practically all fruits, veg-

etables and animal products) are left

wholly to the market. The production of

all crops being signicantly dependent

on rainfall, they are inherently volatile.

The trend growth rate of output (overall)

has remained more or less constant

throughout, even as accelerated urbani-

sation, worsening income distribution, and

changing consumption patterns have led

to a slower growth in demand for food

despite much higher growth of incomes.

The relative constancy of food to non-

food prices during the 1980s and 1990s

suggests that the growth of overall food

supply was in a rough balance with

decelerating demand growth. The sub-

sequent sharp increase in food to non-

food prices points to a major change with

aggregate supply growth falling increas-

ingly short of the slower pace of demand

growth. The increase in prices of non-

cereal food is far more marked than for

cereals, which points to an increasing

shortfall of supplies relative to demand

for animal products, vegetables and fruits.

The possibilities of coping with this grow-

ing imbalance through imports to contain

domestic prices is limited because of

balance of payment constraints, and the

non-availability of perishables on the

scale needed to meet the overall demand.

Under these conditions, in the absence

of a signicant turnaround in domestic

agricultural growth, for which the pros-

pects are far from promising, sluggish

agriculture can become an important

structural source of food ination.

Ination Control Mechanisms

Under these circumstances, control of

ination is handled at the macroeconomic

level through appropriate conventional

scal, foreign exchange, and monetary

policies. The rst two are the responsi-

bility of the central government. Main-

taining reasonable price stability and

ensuring the stability of the nancial

system are the central mandate of the RBI.

Monetary policy is meant to be decided

and implemented by the RBI as an auto-

nomous and professional organisation.

As all three components of macroeconomic

management are closely interrelated,

coordination between them to ensure

mutual consistency is important. While,

by law, the RBI board is free to decide

on matters falling within in its domain,

the necessity for coordination requires

consultation and discussions with the

central government. There are inbuilt

mechanisms, both formal and informal,

to facilitate the process and arrive at a

consensus. These mechanisms have

worked fairly well so far. In the process,

the RBI is exposed to covert and overt

pressures from the government and

business interests, but has managed to

assert and retain its autonomy.

The ability of the RBI to full its

mandate is severely constrained by the

governments scal decit, which is both

chronic and frequently beyond prudent

limits. The inability of the government

to control the decit forces the RBI to

carry the brunt of responsibility for

ination control by regulating the volume

and terms of credit overall and for

different sectors, and at the same time

ensuring stability of the nancial system.

The bank seeks to achieve these objec-

tives primarily by adjusting the rates of

interest permissible on different types

of deposits; the repo and reverse repo

rates for RBI lending to banks; and the

provisioning norms for different kinds

of loans depending on the emerging

trends in the economy.

But the scope for using these instru-

ments is constrained partly by the need

to balance concerns about containing

ination without hurting growth, and

that the demand for credit from large

sections (especially agriculture, a wide

range of intermediate goods, imports,

and the public sector) is not sensitive to

interest rates on loans. The room for ma-

noeuvre is constrained by mandatory

targets of lending at concessional rates

for priority sectors, and that large unor-

ganised segments of the economy are

beyond the reach of banks and institu-

tions over which the RBI has control.

Going forward, it is clear that the ef-

cacy of monetary policy for ination

management and maintaining stability

of the nancial system is severely limited

unless combined with appropriate scal

and foreign exchange policies. The ex-

change rate has been kept reasonably

stable for much of the last decade along

with signicant accretion to reserves

thanks to substantial inows of foreign

funds. But recent volatility of these

ows in response to disturbances in the

world markets and their impact on the

exchange rate of the rupee and on

NOTES

Economic & Political Weekly EPW june 14, 2014 vol xlIX no 24

111

domestic economic growth gives cause

for concern. On the scal front, the gov-

ernment has been unable to control the

burgeoning scal decit and its adverse

impact on ination, public sector devel-

opment outlays, and growth.

Subsidies

The persistently high and rising scal

decit touched a high of 6.5% in 2009-10

and is around 3% to 4% now. This has

severely impaired the governments ca-

pacity to maintain the holy trinity in bal-

ance and led to rampant ination. The

major part of the scal decit is because

of the conscious state policy of supplying

a wide range of goods to different sections

of the population at prices well below

their cost.

Much the larger part of subsidies and

their rapid growth currently is for energy,

water, fertilisers, and other intermediate

products used in the process of production.

The supply of these products and their

costs of production and distribution are

determined by world market conditions

for some resources, and constrained by

the level and efciency of investments

for expanding domestic capacity. In the

absence of independent and effective

regulatory authorities, the pricing of these

products is subject to political pressures

to keep them low despite supply con-

straints and rising costs. This results in a

chronic cycle of excess demand and con-

icts over access to, including illegal

appropriation of, available supplies. Subsi-

dies on these inputs not only cut deep

into the resources available for growth, but

also cause enormous collateral damage to

sustainable development. Subsidisation

of commercial energy for domestic use

and private motorised transport, which

is mostly concentrated among middle

and upper-income groups, can hardly be

justied in the interests of social equity.

Supply at low prices encourages faster

growth of demand for imports and, if

world markets for oil continue to be tight,

sustained pressure on public authorities

to not increase prices.

These tendencies cannot be corrected

by appropriate adjustments in prices in

the face of concerted user pressure for

keeping prices low and the political

class propensity to succumb to it. This

has caused distortions in the patterns

and efciency of use throughout the

system, posing serious threats to sus-

tainability of growth with equity. The

undesirable consequences of these policies

are best illustrated by the effect of water

and fertiliser pricing policies.

The expansion of irrigation, increased

fertiliser use, and introduction of improved

varieties with a genetically higher yield

potential have been the key factors that

have contributed to the growth of agri-

cultural production. Each individually

and in combination contribute to increased

production by more intensive cropping,

a shift to higher-yielding crop patterns,

and higher yields of individual crops.

Their combined impact is to increase

the overall productivity of land and

return to cultivation compared to rain-

fed farming. But there are strict diminish-

ing returns to increasing their quantum.

The optimum results depend on how

much inputs are applied, in what combi-

nation, and when. Individual farmers

neither have the knowledge nor the

means to determine and observe this.

Their tendency is to focus on getting

more water to irrigate larger areas as

the main precondition for increasing

productivity. The large difference in

yields between irrigated and rain-fed

land gives rise to a strong demand for

expansion of irrigation facilities.

The government has responded to

these pressures by undertaking massive

investments for constructing large-scale

surface irrigation works; infrastructure

for expansion of groundwater irrigation;

and by keeping water charges and energy

for pumping groundwater very low.

Under these circumstances, farmers focus

is on somehow getting access to water

and not its optimal management. Nor are

administrative agencies of the govern-

ment responsible for water management.

On the contrary, their pricing policies

seriously erode incentives for prudent

and efcient use of both water and ferti-

lisers. As a consequence, the yield im-

pact of irrigation both per unit of land

and, more so per unit of water use, are

much below that demonstrated under

controlled research conditions.

Low water rates have led to the demand

for water outstripping the increase in

available supplies, and increasing conicts

between uses and users. In many areas,

over exploitation of groundwater has led

to a progressive lowering of the water

table. In surface irrigated areas, overuse

of water has resulted in increased water-

logging and salinity and degradation of

land. Large-scale leaching of nutrients

into water sources due to excessive and

imprudent use of fertilisers has become

a major reason for pollution and qualita-

tive deterioration of water sources, mak-

ing them unt for potable and agricul-

tural uses.

Rationalisation and reduction of sub-

sidies is essential to reduce, if not elimi-

nate, dysfunctional subsidies, which do

not contribute to reducing inequalities

and/or have adverse effects on the

efcient and sustainable use of resources.

This will release resources available to

the exchequer for growth of output and

employment in a manner that is inclu-

sive and equitable. Many of the existing

subsidies do not help mitigate socio-

economic inequalities, tend to benet

the better-off segments, and are ineffec-

tive from the viewpoints of efciency,

equity, and sustainability.

Sustaining rapid economic growth

under conditions of reasonably stable

domestic price levels and the CAD

depends, at present, on reducing the scal

decit. That a high level of explicit and

implicit subsidies is being borne by the

budget is a major reason for the persist-

ence of high levels of budget decits.

Reducing the burden of subsidies is

therefore both necessary and urgent for

restoring the economy to a higher but

stable growth trajectory. That there is

ample scope for this should be apparent

from the foregoing discussion. But it is

also obvious that any attempt to exploit

this potential will face strong opposi-

tion from varied and widespread inter-

ests that have been beneciaries of the

existing system.

This calls for a strategy that focuses

initially on rationalisation of the existing

subsidy regime so that larger revenues

can be generated without raising rates.

Thus more resources can be released for

productive investment. This is possible

because a considerable amount of revenue

is foregone because of the pervasive

NOTES

june 14, 2014 vol xlIX no 24 EPW Economic & Political Weekly

112

under-assessment of dues and under-

recovery of assessed dues. The potential

for this is quite substantial in the case of

water and electricity.

Steps are also necessary to narrow the

differential between issue prices and

costs. But this has to be done in a phased

manner by setting targets for raising

prices by specied degrees over the

medium and long term. In doing so, it is

necessary that this done transparently and

on the basis of clearly stated principles.

The changes must be based on a credible

professional analysis documenting the

loss of efciency and the inequities of

the present system, and the consequenc-

es of not taking corrective action. An es-

sential condition is to assure users that

they will not bear the burden of high

costs due to mismanagement and/or

corruption; that the increases will be

phased in moderate steps and in a pro-

gressive manner; and that it will nd

ways (through differential and discrimi-

natory changes) to reduce the impact on

poor and vulnerable segments.

The ultimate objective is a radical

restructuring of the institutional arrange-

ments for developing and managing

these programmes. It must be insulated

from government/political interference

except for laying down the basic policy

framework, and run by autonomous pro-

fessional managers, subject to independ-

ent audit. Decisions on pricing must be

subject to review and approval by inde-

pendent regulatory agencies.

Growth

The performance of the economy during

the last two decades in terms of overall

growth and structural transformation

is obviously both unprecedented and

impressive. During much of the last

decade, the economy maintained a high

rate of growth of domestic output and

investment. Foreign trade and capital

inows at relatively low rates of ination

from 2000-01 to 2007-08 received a major

shock in the wake of the meltdown of

the nancial system in 2008 and the

recession in developed countries. Indias

growth rate dipped sharply in 2008-09.

Though it recovered in the next two

years to a level comparable to the levels

reached in mid-decade, the impact of

the continuing world recession, and the

rise in oil and commodity prices has

since led to a slowing down of domestic

growth rates in most key sectors.

The trend rate of increase in agriculture

continues to uctuate around the long-

term historical trend of 2.5% per annum,

and industrial growth has averaged

around 7% per annum since 2008-09,

compared to more than 9% per annum

earlier. The overall growth of tertiary

sector GDP increased progressively from

less than 7% in 2001-02 to more than

11% in 2005-06, but fell to 9% in 2011-12.

The growth rates of transport, commu-

nications, construction, and business

services the sunrise sectors that

drove growth over this period have

also slowed down. There are, however,

concerns about the sustainability of the

nature and pace of volatility of sectoral

growth rates, with robustness of growth

based so heavily on the tertiary sector

and the increased vulnerability of the

economy to the external economic envi-

ronment. The social and political conse-

quences of inequalities and the growing

power of big corporations (domestic and

foreign) in the economy and polity, and

the pursuit of a pattern of growth un-

mindful of its environmental consequences

and sustainability are additional sources

of concern.

Agriculture

Except for liberalisation of foreign trade

in farm products, there has been no sig-

nicant change in the strategy for pro-

moting agricultural growth during the

last two decades. The domestic agricul-

tural development strategy continued to

focus on increasing public investments

in irrigation and land improvement;

research to develop varieties and tech-

niques to raise the yield of crops and

livestock; providing key material inputs

at subsidised prices; and substantial

increases in farm support prices. The

overall impact has been limited because

of the adjustments mandated by the

World Trade Organisation (WTO).

The scale of resources devoted to

various components of development

programmes has grown manifold with-

out making much of a difference to the

growth of output. This is largely due to

technological, institutional, and economic

constraints. The expansion of irrigation

has slowed down despite massive invest-

ments by both the public and private

sectors. In the public sector, problems

caused by inordinate delays in imple-

mentation and uncontrolled cost escala-

tions of surface water works have been

aggravated. Private investment, mostly

for exploiting groundwater, goes increas-

ingly into deepening wells and installing

more powerful pumps. Programmes for

soil conservation and land improve-

ment, which are critical for raising the

productivity of rain-fed lands, are inad-

equate both in scale and effectiveness.

Progress in improvement of crop varieties

and agronomic practices has been uneven

across regions and crops, and more so

between rain-fed and irrigated crops.

The functioning of public systems re-

sponsible for the management and regu-

lation of common pool resources, research,

and input supply have deteriorated. But

there is no sign of recognition among the

political class and policymakers of the

implications of the persistence of these

trends and their underlying causes. The

prospects of any signicant improve-

ment in terms of sustained growth rates

of farm output overall, and of its ability

to meet rapidly diversifying patterns of

consumption are therefore very dim.

That the socio-economic consequences

of allowing pre sent trends to continue

will be serious is already manifest in

widening disparities between rain-fed

and irrigated tracts, and between rural

and urban areas.

There are growing social tensions and

agrarian distress in the rural economy;

and signs of growing disinclination among

the newer generation of large and even

medium farm households to continue in

agriculture. These problems are likely to

accentuate as the gap between the agri-

cultural and non-agricultural sectors

continues to widen. With the long-term

trend growth of agriculture being only

slightly more than population growth,

and signs of greater volatility during the

last decade, droughts and natural cala-

mities can have a disproportionately

large impact on shortfalls, which in turn

would adversely affect the ability to

manage the new food security programme

NOTES

Economic & Political Weekly EPW june 14, 2014 vol xlIX no 24

113

and ensure reasonable price stability of

non-cereal food items.

Secondary Sector

The performance of secondary sectors

during the reform period has been quite

uneven. The pace of increase in GDP from

mining, manufacturing, and utilities

during the last two decades has been

faster than in the previous two decades.

However, closer scrutiny of the trajecto-

ries of changes in different sub-sectors

over the period shows considerable un-

evenness. Growth in mining and utilities

during the reform period turned out to

be much slower than earlier, with no

sign of sustained improvement over the

period. The progressive increase in rates

of capital formation following liberali-

sation was reected in the faster and

quickening growth of construction

activity and in the slight rise (from 6.8%

to 7.8%) in its share in GDP over the

period. Given that the main focus of re-

forms was on freeing industry from the

earlier regime of direct controls, freer

markets and more scope and opportunity

for the private sector should have had a

big impact on production and invest-

ment in this sector. But this expectation

has been belied.

Manufacturing output during the last

two decades did increase 3.7 times com-

pared to 2.6 times in the earlier two

decades. However, this was only mar-

ginally higher than the overall GDP

growth rate. The share of manufactur-

ing in total GDP rose, but marginally

from 15% to less than 16% over the pe-

riod. Moreover, even the limited liber-

alisation reforms initiated during the

1980s had a sizeable impact in the latter

half of that decade. The rate of increase

in manufacturing GDP in the reform

period turns out to be only marginally

higher than that during the second half

of the 1980s. Nor is there any indication

of a sustained quickening in the pace of

growth over the last two decades. Dur-

ing this period, manufacturing output

more or less kept pace with the overall

economy. There was no signicant in-

crease in the share of this sector in total

GDP or its increment (Table 2).

The rate of increase in manufacturing

GDP in the reform period turns out to

be only marginally higher than during

the second half of the 1980s. Nor is there

any indication of a sustained quickening

in the pace of growth over the last

two decades.

This is widely attributed to tardy im-

plementation of programmes to expand

infrastructural support; lukewarm re-

sponses to efforts to attract FDI; delays

in land acquisition and getting environ-

mental clearances for major projects;

concerns about the scope, pace, and

social impact of liberalisation; and the

quality of entrepreneurial response to

emerging opportunities.

Given that India was and still is a low-

income country, one would expect do-

mestic consumer demand for manufac-

tures relative to incomes to be relatively

high. However, according to national in-

come estimates, private consumption of

manufactured goods has grown roughly

at the same rate as aggregate consump-

tion expenditure. The available data

from consumer surveys suggest that per

capita expenditure on manufactures in

urban areas is around twice the level

reported in rural areas. Given the rapid

pace of urbanisation, overall consumer

demand for manufactures must have risen

faster than total private consumption

expenditure. This tendency would be re-

inforced by rising per capita incomes and

worsening income distribution between

(and within) rural and urban areas. While

the reasons for this discrepancy need to

be investigated, it is worth noting that

national income estimates are based

on inadequate data on physical output of

manufactures and their disposition,

especially in the unorganised sector.

With rising rates of capital formation,

the demand for machinery, cement, and

construction material used for investment

has increased faster than total national

income. Exports of manufactures have

also recorded unprecedented growth

during the last two decades. Overall, the

aggregate domestic demand for manu-

factures has grown rapidly. The full

impact of the growth of aggregate demand

for manufactures was, however, not been

realised by domestic industry because

an increasing pro portion of it (especially

of capital goods) is met by imports. The

recent sharp reduction in industrial

growth to near stagnation levels reects

a slowdown of investment, exports, and

domestic consumer demand.

Exports of manufactures, which were

relatively small and did not increase much

during the 1970s and 1980s, recorded a

phenomenal expansion in the last two

decades. The performance has, however,

been neither consistent nor comparable

to the record of several other developing

countries, including China.

Tertiary Sector

The tertiary sector consists of a mixed

bag of diverse activities with widely

varying growth. Several segments (per-

sonal services, entertainment, real estate

services, and rentals) have grown much

slower than aggregate GDP, and largely

cater for private consumption. Public ad-

ministration and defence have grown

roughly at the same rate as overall GDP.

Activities that cater for domestic demand

and have grown somewhat faster than

average include trade, transport, educa-

tion, and medical services provided by

both the private and public sectors.

The growth of trading activity is related

to the expansion in the total volume of

commodities being produced and the

proportion that is traded in domestic

and international markets.

Expansion of transport reects the

growth of freight trafc (which is a func-

tion of commodity production) and the

rapid increase in private demand for

travel by all modes.

The rapid expansion in demand for

education and health services being met

by the public sector and increasingly by

the private sector is reected in the rela-

tively rapid growth of GDP generated by

these sectors.

Together, all these activities accounted

for the bulk (85%) of tertiary sector GDP

Table 2: Trends in Secondary Sector GDP during

the Reform and Pre-reform Periods

1988-90 1998-2000 2008-10 1990-2010

Mining 429 675 1,039 142

Manufacture 1,919 3,409 7,167 274

R 1,125 2,100 4,894 335

UR 813 1,314 2,273 180

EGW 251 504 874 248

Construction 873 1,468 3,574 309

R: registered, UR: unregistered, EGW: electricity gas and

water. Estimates in rupees billion at constant 2004-05

prices, based on the Central Statistical Offices national

accounts statistics.

NOTES

june 14, 2014 vol xlIX no 24 EPW Economic & Political Weekly

114

in 1988-90. Their output has now quad-

rupled to account for nearly 70% of its

increment over the period.

Given the economic slowdown in deve-

loped countries, the rapid growth of IT

services is unlikely to be sustained, as

also the growth in telecom and domestic

business services. On this basis, and

given the modest growth of agriculture

and industry, the overall growth rate

may be around 7% per annum.

Inequality

Concern over the persistence of social

and economic inequality, and the need

for purposive action to reduce it has

been a continuing feature of public and

political discourse in India. These con-

cerns have been heightened by the wide-

spread impression that these inequali-

ties have increased in the era of liberali-

sation. Inequalities exist across several

dimensions between castes and com-

munities, classes, rural and urban areas,

individuals, and in terms of income,

wealth, consumption levels, and living

standards. Data from household con-

sumption surveys conducted by the

National Sample Survey (NSS) give some

idea of trends in inequality in private

consumption expenditures in rural and

urban India, across states and social

groups, in the post-reform period.

They show that at the all-India level,

overall per capital consumption expendi-

ture was consistently higher in urban areas

than in rural areas, and the disparity

has been growing progressively since

the early 1970s. This trend has been more

remarked in the reform period (1987-88

to 2009-10). Interpersonal inequality in

the distribution of consumption meas-

ured by the gini coefcient is consid-

erable and persistent in both rural and

urban areas. Inequality in urban areas

is consistently higher than in rural areas.

Over the last two decades, the extent of

inequality has not shown any sustained

trend in rural areas, but it shows a sus-

tained rising trend in urban areas. The

rural-urban difference has also widened

progressively, especially in the reform

period. With urban pre-capital private

consumption expenditure (PCE) being

higher and increasing faster than in rural

areas, inequality in the d istribution of

private consumption for the population as

whole is increasing (Table 3).

Trends estimated from household

consumption surveys are apt to under-

state the degree of inequality because

NSS estimates of total PCE are consist-

ently lower than national accounts sta-

tistics (NAS) estimates and the differ-

ence progressively widened from about

36% in 1987-88 to 50% in 2009-10. This

points to an increasing underestimation

bias in NSS estimates of private consump-

tion. The downward bias in NSS estimates

reects the unwillingness and inability

of households to give complete and accu-

rate information on their consumption

expenditures. Field experience suggests

that this is more pronounced among

upper-income households, especially in

urban areas. If allowance is made for

these differences, the NSS estimates of

inequality (gini coefcient) substantially

understate the true extent of inequality

and upward trends in it. It is, however,

difcult to pin down the extent of this

downward bias in NSS estimates.

Incomes generated in the process of

economic activity consist of two compo-

nents wages and salaries paid to hired

labour or imputed for labour provided by

the self-employed and employers, and

income from real and nan-

cial assets owned by entities.

Inequalities in the former

reect differences in the ex-

tent and quality of employ-

ment, and the rates at which

workers of different catego-

ries and skills are remuner-

ated. Unskilled casual wage

labour is paid the least;

workers with full time, reg-

ular employment get more;

and wages increase with

the level of education and

experience (Table 4).

For the economy as a whole, average

wage rates of casual wage labour are

consistently low in rural areas, followed

by urban areas. The average for all

workers with regular employment is

much higher. During the post-reform

period, both the level of employment

and average wage rates of both casual

and regular workers have increased sig-

nicantly. Casual labour wages have in-

creased signicantly and at a faster rate

in rural areas. Urban wage rates for reg-

ular workers are also consistently higher

than in rural areas and the rate of increase

is higher. Therefore the rural-urban dif-

ferential is progressively widening. This

rising wage trend has gone with a sus-

tained rise in both the level and the de-

gree of diversication of employment

during the reform period. Over the last

two decades, the entire increase in the

labour force has found employment in

non-agricultural activities and involun-

tary unemployment rates are low.

However the rate of increase varies

hugely across different categories of

employment in a manner that increases

inequality in wage incomes at the point

of generation. At the bottom of the pile

are casual wage labourers, who consti-

tute more than a quarter of the total

Table 3: Trends in Pre-capital Private Consumption and Its Inequality in Rural and Urban India

1972-73 1977-78 1983 1987-88 1993-94 1999-2000 2004-05 2009-10

Mean PCE Rural 44.2 68.9 112.3 158.1 286.1 486.1 558.8 927

Urban 63.3 96.1 165.8 250 464.3 854.9 1052.4 178.5

U/R 1.43 1.4 1.48 1.58 1.62 1.75 1.88 1.92

Gini coefficient of PCE Rural .302 .337 .298 .291 .281 .28 .297 .27

Urban .341 .345 .330 .352 .340 .343 .373 .381

U/R 1.13 1.02 1.11 1.21 1.21 1.23 1.26 1.41

Estimates are at current prices. After adjusting for differences in the rate of inflation (consumer price index for agricultural

labourers, or CPIAL, for rural, and index for non-manual workers in urban areas), the rural-urban gap in mean consumption

shows a sharper rise since the late 1980s.

Source: Rattanchand (2006).

Table 4: Average Earnings of Different Categories of Hired Labour

1987-88 1999-2000 2009-10

Casual rural manual Rs per day 11.2 45 102

Casual urban manual Rs per day 17.9 63 132

Regular RM Rs per day 34.9 127 249

Regular UM Rs per day 34.9 170 377

Factory workers Rs per day 53 193 411

Factory workers 000 Rs/year 15.8 57 125

Government employees 000 Rs/year 20.1 113*

Central PSUs 000 Rs/year 32.5 168 610

Banks 000 Rs/year 48.3 403*

ICT companies 000 Rs/year 5,300**

BPOs 000 Rs/year 1,000-1,200**

Source: * Figure reported in Arijit Ghosh (2003): Determinants of Executive

Compensation in Emerging Evidence from Indias Economy, IGIDR, Mumbai.

** Reported in Surendra Pratap (2010): Challenges for Organising the BPO

Workers in India, Asia Monitor Resource Centre, Hong Kong.

NOTES

Economic & Political Weekly EPW june 14, 2014 vol xlIX no 24

115

workforce. Their average wage rates

and total earnings per year are the

lowest and remain so despite signicant

increases over time. Overall, their rela-

tive position has worsened compared to

regular workers.

The advent of IT, communications,

and specialised business services gener-

ated demand for personnel with high

levels of technical and professional

training, which commanded a world-

wide market. This led to salary levels

getting aligned with international rates,

which are far higher than in domestic

sectors. That the growing demand could

not be fully met with available supplies

of personnel led to a rapid increase in

emolument levels. This phenomenon

had a spillover effect on other organised

enterprises. The available evidence sug-

gests that this affected salaries at the

professional/managerial levels more

than others. For instance, in the factory

sector of industry, the average emoluments

of employees other than process workers

are invariably higher than the average

for workers in both non-corporate and

corporate establishments. Interestingly,

the disparity between the two has in-

creased during the last two decades, the

tendency being much pronounced in

the private corporate sector.

The cumulative effect of these trends

is to increase the inequality in the distri-

bution of wage and salary incomes among

workers. This tendency is likely to be

further aggravated by the progressive

increase in the proportion of organised-

sector workforce hired on a contract or

temporary basis. Given the importance

of these phenomena, it is surprising that

so little attention is given to ensuring

reliable and sufciently detailed data on

the composition of employment and the

basis and levels of remuneration of

different classes of employees in different

sectors and types of enterprises.

Non-wage incomes consisting of the

incomes of the self-employed and em-

ployers of unincorporated enterprises

and the prots of the organised sector

have also grown. The former has increased

at roughly the same rate as wages and

salaries of hired labour. Little is known

about the degree of inequality in its

distribution within that class. But the

distribution of prots of other enterprises,

especially corporate enterprises, is heavily

skewed in favour of the higher income

classes. The higher the proportion of

prots earned by the private sector

(operating surplus in national income

terminology), the higher the overall ine-

quality in income distribution. During

the last decade, prot incomes have

grown far faster than total wage and

mixed incomes. The increase in their

share in total private incomes from

14.7% in 1993-94 to 19.4% in 2009-10

must have led to a signicant increase in

overall inequality (Table 5).

Strategy for Reducing Inequality

Reducing, if not eliminating, socio-

economic inequalities gured prominently

in both political and policy rhetoric in

the early part of the post- Independence

era. For nearly two decades, inequalities

in income and wealth were sought to be

reduced through land reforms; encour-

aging cooperative forms of production;

nationalising key sectors; progressively

increasing the proportion of income and

wealth generated by the public sector;

and progressive taxation. But none of

them was pursued seriously and at any

rate had little effect on the ground reality

of persistent inequality, slow growth,

and an unacceptably high incidence of

mass poverty and unemployment.

The 1950s and 1960s were marked by

growing concern over the slow pace of

improvement in average living stand-

ards and in basic social amenities; per

capita incomes; the persistence of high

levels of unemployment and underem-

ployment, especially among poor seg-

ments of the population; declining real

wages; and indications of increasing

concentrations of incomes and wealth.

Efforts to achieve faster growth being

unsuccessful, attempts to cope with grow-

ing restlessness veered towards ways of

directly ameliorating the conditions of

the poor and the unemployed, who con-

stituted a large majority of the electorate.

The idea of an employment guarantee

scheme mooted during this phase was

rapidly expanded as an important part

of national strategy. Indira Gandhi used

this along with bank nationalisation and

abolition of privy purses as socialistic

measures to win elections. Ever since,

the idea of anti-poverty programmes

has come to be widely accepted and

pursued by practically all political par-

ties. Expanding the scope

and differentiated packag-

ing of its elements to garner

wider support has become

an endemic feature of elec-

toral strategy in this era of

competitive politics.

These trends have con-

tinued in the post-reform

era in an even more intensi-

ed form. With sharp in-

creases in the growth of

both overall and average per capita GDP

during this period, the entire increase in

the labour force has been absorbed out-

side agriculture at rising real wage rates.

Thus the incidence of poverty has de-

clined appreciably. While pro-reformers

saw this as justifying liberalisation and

carrying it further, those opposed high-

lighted the slow pace of improvement in

living standards of the rural population,

largely reecting the persistent slow

growth of agriculture; the aggravation

of inequalities in living standards be-

tween rural and urban areas; and the

unsatisfactory access to and quality of

basic social amenities.

National Pro-poor Programmes

The scope, scale, and range of national

programmes for employment guarantee,

universal basic education and health-

care, rural infrastructure, security and

pensions for the poor, aged, and dis-

abled, and public housing have been

widened. This restructuring as well as

the passage of legislation on the right to

work, education, health, and food were

made with the concurrence of the states

by the National Development Council.

Table 5: Growth of Non-Wage and Non-Self-Employed

Incomes in India

1993-94 2009-10

Total PSUs Private Total PSUs Private

NDP 6,990 1,629 939 54,490 11,115 12,400

Employee

compensation 2,390 1,107 433 34,868 9,056 3,600

Mixed incomes 3,548 24,178

Operating surplus 1,028 522 506 10,690 2,159 8,740

% of NDP 14.7 31.5 53.8 20 19.4 70

PSU = public sector enterprises; Private = enterprises in the organised

private sector.

Source: National accounts estimates; all figures are in billions of rupees at

current prices.

NOTES

june 14, 2014 vol xlIX no 24 EPW Economic & Political Weekly

116

The programmes are wholly funded by

the centre. While the responsibility for

implementation rests with the states,

they are expected to observe central

government guidelines on implementa-

tion and monitoring.

The outlays on these agship pro-

grammes have tripled over the last dec-

ade from Rs 92 billion in 1999-2000 to

Rs 280 billion in 2009-10. In addition,

the revamped food security programme

has vastly expanded the scope and scale

of subsidised public distribution of

foodgrains. This led to a signicant shift

in public sector plan allocations the

share of social services in total public

sector plan outlay increased from 24% in

1990-2001 to 54% in 2009-10.

Central government outlays on these

revamped and expanded agship pro-

grammes is projected to grow manifold

over the next decade. It is possible,

though very unlikely, that the result of

the 2014 elections will lead to a drastic

departure from these programmes or a

signicant reversal of recent trends in

outlays. Both the scale of these pro-

grammes and the rationale for the

strategy underlying them will continue

to be centres of controversy.

Criticism of poverty alleviation pro-

grammes as the main if not the only

cause of the scal crisis and erosion of

resources available for development is

highly misleading. This is based on a

comparison of the expenditures on these

programmes with the scal decit re-

ported in the central budget, which is

but a small fraction of numerous explicit

and implicit subsidies provided in the

production/distribution of various goods

and services by/through central and

state governments. In 2009-10, central

government outlays on agship pro-

grammes accounted for only half the

amount of explicit subsidies reported in

the budget. This proportion would be

much smaller when implicit non-merit

subsidies on account of non-departmental

enterprises (such as water and electricity)

and other handouts by state governments

are taken into account. Reducing these

subsidies will make a far bigger contri-

bution to the scal situation and release

more resources for capacity augmenting

investments than trimming pro-poor

programmes. It will contribute to reduc-

ing the current bias in the distribution of

costs and benets between classes, and

have a hugely benecial impact in terms

of efcient and sustainable use of re-

sources. But public discussion and debate

on reform of pricing and deciencies of

governance is quite limited. The need

for a signicant increase in rates and

measures to improve efciency of pro-

duction and distribution hardly gures in

it. This is not surprising because, if

seriously pursued, these measures will

adversely affect the middle and upper

classes in whose favour the current

system is heavily biased.

This is not to suggest the current

strategy and programmes for achieving

greater equity are all well conceived,

implemented effectively, and have the

desired impact. They are a mixed bag.

Of these, the employment guarantee and

the food security programmes are the

largest in terms of coverage and claims

on public funds. The rationale for the

former and its achievements in terms of

additional employment generated for

the rural poor and its impact on their

NEW

Pp xiv + 538 Rs 745

ISBN 978-81-250-5131-2

2013

Higher Education in India

In Search of Equality, Quality and Quantity

Edited by

JANDHYALA B G TILAK

India has a large network of universities and colleges with a massive geographical reach and the facilities for higher

education have been expanding rapidly in recent years. The story of higher education in India has seen many challenges

over the decades and has not been without its share of problems, the most serious being a very high degree of inequity.

Drawn from writings spanning almost four decades in the EPW, the articles in this volume discuss, among other things,

issues of inclusiveness, the impact of reservation, problems of mediocrity, shortage of funds, dwindling numbers of

faculty, and unemployment of the educated young.

Authors: Andr Bteille Shiv Visvanathan Suma Chitnis Satish Deshpande K Sundaram Rakesh Basant, Gitanjali Sen Jayati Ghosh

Thomas E Weisskopf Lloyd I Rudolph, Susanne Hoeber Rudolph A M Shah Errol DSouza G D Sharma, M D Apte Glynn L Wood

D P Chaudhri, Potluri Rao R Gopinathan Nair, D Ajit D T Lakdawala, K R Shah Chitra Sivakumar Amrik Singh Jandhyala B G Tilak Anindita

Chakrabarti, Rama Joglekar Karuna Chanana Saumen Chattopadhyay Samuel Paul Deepak Nayyar V M Dandekar M Anandakrishnan

Thomas Joseph

Orient Blackswan Pvt Ltd

www.orientblackswan.com

Mumbai

Chennai

New Delhi

Kolkata

Bangalore

Bhubaneshwar

Ernakulam

Guwahati

Jaipur

Lucknow

Patna

Chandigarh

Hyderabad

Contact: info@orientblackswan.com

NOTES

Economic & Political Weekly EPW june 14, 2014 vol xlIX no 24

117

bargaining power in the rural labour

market are widely recognised. So are its

main weaknesses it is unevenly spread

across the country; all the poor are not

covered and all those covered are not

poor; the works undertaken are of poor

quality and do not signicantly augment

durable and productive social assets;

and the programme is marked by signi-

cant leakages and corruption. There are

widespread complaints that the pro-

gramme has not only raised wage rates,

but also adversely affected the availability

of labour for normal economic activities

and reduced the quality of work. But

these aspects have not been rigorously

examined and documented.

The rationale for a food security

programme focusing exclusively on the

highly subsided supply of foodgrains

(including the not so poor) and its ef-

cacy in raising food intake and quality

to nutritionally satisfactory levels is also

questionable. Past experience shows that

among the poorest segments of the popu-

lation, even in regions with a well-

functioning public distribution system

(PDS), the actual intake of grains re-

mains well below nutritional norms and

has remained stagnant despite increas-

es in incomes and subsidies of various

kinds. The huge difference between the

price at which grains will be supplied to

beneciaries and prevailing market

rates gives tremendous scope for leak-

ages and corruption. Direct cash trans-

fers to PDS traders not an easy task can

take care of leakages but not provide

a rbitrage opportunities for beneciaries.

General eco-development programmes

(like rural and agricultural development,

education, and health) seek to ensure a

sustained increase in income and employ-

ment in rural areas and to enable the

socially and economically underprivi-

leged to take advantage of employment

and income opportunities. Measures to

narrow differences in the average dura-

tion and quality of education, and afr-

mative action to enable underprivi-

leged segments acquire higher skills,

and access capital to engage in entre-

preneurial opportunities are necessary

to make a signicant and sustained

reduction in inequality of income and

opportunity.

In the areas of agricultural and rural

development, social services, social pro-

tection, and employment guarantee, the

responsibility for planning and imple-

menting programmes rests entirely with

the states. Several of the elements of the

present national programmes in these

elds were originally pioneered at the

state level. These programmes have over

time become increasingly important in

determining the scale, content, and

nancing of states plans in domains over

which they are supposed to have domi-

nant, if not exclusive, authority. The

Planning Commission is given the autho-

rity to work out the operational details,

procedures and scale of overall funding;

the distribution between the states; and

the guidelines that they have to follow.

This arrangement has led to a situation

in which states role in devising strate-

gies and nancing programmes in areas

of their core responsibility has been

largely replaced by centrally-sponsored

national programmes.

Problems and Solutions

The design and guidelines of these pro-

grammes have been rightly criticised for

adopting a one size ts all approach,

with the guidelines allowing little room

for the exible adaptation of programmes

to local conditions. However states chose

to acquiesce in the arrangement because

it opened up a large and increasing

source of funds, thereby giving them

greater freedom to use their own re-

sources to pursue other priorities.

States have not paid serious attention

to building effective implementation

mechanisms to ensure that the selection

of beneciaries is fair, and that the

various physical works at the ground

level meet a minimum standard. Elected

panchayats are the appropriate agencies to

handle these tasks with account ability.

But the upper tiers of the political class

and bureaucracy are loathe to empower

panchayats. Instead, they have every-

where taken control over what schemes

are to be taken up where, who gets con-

tracts, and who will receive benets.

The scope and design of these pro-

grammes, and institutional arrangements

for their implementation, leave much scope

for improvement. Despite considerable

simplication and rationalisation, c entrally-

sponsored schemes are still far too

n umerous and rely on central govern-

ment directives, funding, and oversight,

all of which are neither conducive to

e fciency not effective in ensuring ac-

countability. The necessary corrective

measures include the following.

Shifting the locus of effective authority

and responsibility for deciding and im-

plementing all local development works

from the state government bureaucracy

to the appropriate tiers of elected local

governments at the district and sub-

district levels.

Ensuring that funds allocated in the

national and state plans for such works

are placed at the disposal of elected lo-

cal bodies, leaving them free, subject to

general guidelines regarding prudent

use of resources, to decide their priori-

ties and their implementation.

Vesting elected local bodies at differ-

ent levels with accountability for the ob-

servance of rules and outcomes of ex-

penditures.

Switching from nancial audit to inde-

pendent social audit of realised out-

comes relative to the targets decided by

elected bodies.

Combining audits with inbuilt mecha-

nisms (of which periodic elections are

most important) as well as external in-

ducements (by making the scale and

composition of future funding commit-

ments contingent on past and current

performance) to make elected local gov-

ernments function in a transparent and

efcient manner.

Conclusions

My understanding of the evolving crisis

and its denouement are clearly at odds

with the optimism of many observers.

Besides the various internal and exter-

nal constraints (economic, political, and

institutional), we have to reckon with

the effect of over-exploitation of key

natural resources (especially water and

forests); the indiscriminate manner in

which further expansion of land, forests,

and minerals are sought to be promoted

in the interests of rapid growth; and the

cavalier way in which ecological, envi-

ronmental, and social concerns are

ignored and dismissed.

You might also like

- Environment and BiodiversityDocument11 pagesEnvironment and BiodiversityAbhishek GuptaNo ratings yet

- Polity Prelim Civil ServicesDocument75 pagesPolity Prelim Civil ServicesAbhishek GuptaNo ratings yet

- Vision Ias: GENERAL STUDIES (Test Code: 420)Document68 pagesVision Ias: GENERAL STUDIES (Test Code: 420)Abhishek GuptaNo ratings yet

- IPCC (2013) AR5WG1 Summary For Policy Makers (SPM)Document28 pagesIPCC (2013) AR5WG1 Summary For Policy Makers (SPM)HeavenL77No ratings yet

- Disaster Management WWW - Visionias.inDocument20 pagesDisaster Management WWW - Visionias.inAbhishek GuptaNo ratings yet

- Known Unknowns of RTIDocument7 pagesKnown Unknowns of RTIRajatBhatiaNo ratings yet

- Honours and Numbers: Commentry On Bloated Egos and Academic Dishonesty of A Topmost Indian ScientistDocument3 pagesHonours and Numbers: Commentry On Bloated Egos and Academic Dishonesty of A Topmost Indian ScientistDr Abhas MitraNo ratings yet

- DoubleDigit Inclusive GrowthDocument6 pagesDoubleDigit Inclusive Growthchoudhary2k8No ratings yet

- GIS Taiwan 2011 Workshop SelectionsDocument2 pagesGIS Taiwan 2011 Workshop SelectionsAbhishek GuptaNo ratings yet

- Representation of The People Act, 1951Document67 pagesRepresentation of The People Act, 1951kewal1829No ratings yet

- Gender Issues For The Fourteenth Finance CommissionDocument3 pagesGender Issues For The Fourteenth Finance CommissionAbhishek GuptaNo ratings yet

- E-Commerce Across EuropeDocument10 pagesE-Commerce Across EuropeAbhishek GuptaNo ratings yet

- China - Maritime Silk RoadDocument4 pagesChina - Maritime Silk RoadAbhishek GuptaNo ratings yet

- Luring You To: Case StudyDocument4 pagesLuring You To: Case StudyAbhishek GuptaNo ratings yet

- GBC 2011 - Case StudyDocument19 pagesGBC 2011 - Case StudyRahul RoonwalNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Imp Remittance - Status - and - Contribution - To - GDP - of - NepalDocument15 pagesImp Remittance - Status - and - Contribution - To - GDP - of - Nepalratna hari prajapatiNo ratings yet

- The Amounts and The Effects of Money LaunderingDocument187 pagesThe Amounts and The Effects of Money LaunderingPetros ArvanitisNo ratings yet

- Macro Economics Aspects of BudgetDocument44 pagesMacro Economics Aspects of Budget6882535No ratings yet

- Name: Maria Guadalupe Papacetzi Andrade Number: Course: ProfessorDocument3 pagesName: Maria Guadalupe Papacetzi Andrade Number: Course: Professorlupita andradeNo ratings yet

- Economics 1 Bridging Study Guide Part 3Document118 pagesEconomics 1 Bridging Study Guide Part 3Roger LinNo ratings yet

- Third National Development Plan - NDP Iii - 2020-25 PDFDocument267 pagesThird National Development Plan - NDP Iii - 2020-25 PDFKizito DrazuaNo ratings yet

- Outcomes of Democracy Shobhit NirwanDocument9 pagesOutcomes of Democracy Shobhit NirwanRohit Kumar100% (1)

- Emerging Business Travel Trends in India: Opportunities for GrowthDocument52 pagesEmerging Business Travel Trends in India: Opportunities for GrowthBhakti RaneNo ratings yet

- Organization Management Answer Sheet Week 5-6Document23 pagesOrganization Management Answer Sheet Week 5-6Maestro MertzNo ratings yet

- P FM Credit Policy BriefDocument16 pagesP FM Credit Policy Briefviktor6No ratings yet

- Corruption and Development in Africa: Challenges For Political and Economic ChangeDocument7 pagesCorruption and Development in Africa: Challenges For Political and Economic ChangeANTENEHNo ratings yet

- The Electrotechnical Industry Regional Value Chain in Southern Africa A Case For South Africa and Zambia 2018Document55 pagesThe Electrotechnical Industry Regional Value Chain in Southern Africa A Case For South Africa and Zambia 2018Amelie BrouNo ratings yet

- Cobecon Term Paper - CappsDocument7 pagesCobecon Term Paper - CappsLara Ysabelle CappsNo ratings yet

- CIE BusDocument138 pagesCIE BusKelvin Kaung Si ThuNo ratings yet

- Awareness of Mutual Fund and Its ScopeDocument64 pagesAwareness of Mutual Fund and Its ScopeLakshman Kota100% (1)

- KUMBI Proposal Final1Document31 pagesKUMBI Proposal Final1Kasim MergaNo ratings yet

- Indian Dairy Dairy Products Industry - June 2020Document13 pagesIndian Dairy Dairy Products Industry - June 2020Sivakumar SelvarajNo ratings yet

- Australian Blueprint Critical TechnologyDocument32 pagesAustralian Blueprint Critical TechnologyTom BurtonNo ratings yet

- Insurance Company in EthiopiaDocument98 pagesInsurance Company in Ethiopiajonegetachew100% (4)