Professional Documents

Culture Documents

Stock Recommendation 20012014

Uploaded by

Bawonda IsaiahOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Recommendation 20012014

Uploaded by

Bawonda IsaiahCopyright:

Available Formats

EQUITY | INVESTMENT GUIDE | STOCK RECOMMENDATION

1

www.meristemng.com

Disclosure and Analyst certification on page 10

MARKET P REVIEW

For the week commencing January 20, 2014

Whilst the current market mood can best be described as

calm given the magnitude of gains and losses recorded since

the beginning of the year, the imminent market catalyst will

be expected 2013FY corporate actions.

In our view, market sentiments will move largely in favour of

stocks with expected attractive dividend yields. Also,

investors demand will likely tilt in favour of stocks with

attractive fundamentals.

Given our considerations above, we expect the market to

close the week on a positive note albeit marginal.

0.27

MARKET REVIEW

For the week ended January 17, 2014

Equities market remained calm through the previous week as

price movements in either directions stayed marginal. The All-

Share-Index closed the week 0.65%higher.

JAPAUL, DNMEYER and NSLTECH were the highest gaining

stocks with respective returns of 17.24%, 9.93%and 9.09%.

On the flip side, JBERGER, CILEASING and FO lost 9.95%, 8.33%

and 6.74%respectively WoW.

The overall market mood in the week was positive with

market breadth at 1.31x (46 advancers against 35 decliners).

Our market mood indicator settled at 0.27.

0

1,000

2,000

15,000.00

20,000.00

25,000.00

30,000.00

35,000.00

40,000.00

45,000.00

Millions

Volume [RHS] Index [pts]

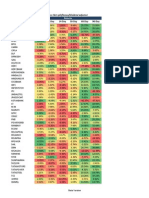

NSEASI & Meristem Research - Sectoral Indices [Return Profile]

WtD MtD QtD YtD

NSEASI 0.65% 1.02% 10.97% 1.02%

MERI-PENNY 20 0.13% -1.05% 20.61% -1.05%

MERI-BNK 3.35% -0.34% 11.37% -0.34%

MERI-INS -1.82% 0.66% 12.90% 0.66%

MERI OILG 1.46% 0.86% 14.02% 0.86%

MERI-CMG 0.59% -0.87% 2.75% -0.87%

MERI-IND -0.08% 4.39% 19.66% 4.39%

MERI-CONG 4.43% 51.40% 4.43% 96.65%

MERI-SERV 0.00% 16.67% -2.40% 33.55%

Cur. Week Prev. Week

NSEASI 41,751.55 41,480.62

Market Cap [NGN'tr] 13.483

Market Cap [USD 'bn] 84.135

Volume Traded [bn] 1.51 1.72

Value Traded [bn] 18.33 22.39

Most Traded Value Most Traded Volume

OANDO 2,173,647,392 TRANSCORP 147,966,544

ZENITHBANK 1,908,683,104 FCMB 99,173,093

WAPCO 1,286,710,573 UNITYBNK 81,746,729

FLOURMILL 1,273,667,036 OANDO 80,992,620

NEM 1,062,219,664 ZENITHBANK 79,211,839

Highest Gainers % Highest Losers %

JAPAULOIL 17.24% JBERGER -9.95%

DNMEYER 9.93% CILEASING -8.33%

ZENITHBANK 8.23% FO -6.74%

UPL 7.77% ASHAKACEM -5.95%

VITAFOAM 6.97% IHS -5.66%

STOCK RECOMMENDATION JANUARY 21, 2014

THE WEEK THAT WAS (A REVIEW)

EQUITY | INVESTMENT GUIDE | STOCKRECOMMENDATION

Tuesday, 21 January 2014

www.meristemng.com

Disclosure and Analyst certification on page 10

Tickers 2014 TP

Closing

Price

Up/Down

Potential Wtd % Ytd %

Trailing

P/E

Trailing

P/BV

Trailing

Div.

Yield

Forward

P/E

Forward

P/BV

Forward

Div. Yield Ratings

Financial Services

Banks

ACCESS 9.51 9.57 -0.63% -0.31% 2.92 5.94 x 0.91 x 8.6% 5.84 x 0.96 x 7.2% HOLD

DIAMONDBNK 8.60 7.92 8.59% 2.19% 6.67 -0.12 x 0.95 x 0.0% 4.02 x 0.72 x 2.4% HOLD

ETI 19.76 17.40 13.56% 2.35% 7.16 29.38 x 1.85 x 0.0% 4.25 x 0.83 x 3.6% HOLD

FCMB 5.64 4.00 41.00% 2.83% 8.94 4.23 x 0.53 x 0.0% 4.71 x 0.44 x 0.0% BUY

FIDELITYBK 3.32 2.54 30.71% -3.42% -5.20 3.74 x 0.44 x 8.2% 3.74 x 0.42 x 9.4% BUY

FBNH 19.84 16.10 23.23% 4.21% -3.07 6.00 x 1.21 x 6.3% 4.41 x 1.01 x 10.1% BUY

GUARANTY 34.41 28.50 20.74% 0.71% 4.52 9.28 x 2.82 x 5.5% 7.20 x 2.59 x 6.6% BUY

SKYEBANK 6.06 4.40 37.73% -3.51% 0.00 4.44 x 0.58 x 11.4% 3.19 x 0.60 x 14.3% BUY

STANBIC 17.56 22.00 -20.18% 2.33% 3.14 14.33 x 2.34 x 0.0% 8.80 x 1.34 x 7.0% SELL

STERLNBANK 2.51 2.42 3.72% -1.63% -3.60 3.85 x 0.78 x 8.3% 5.76 x 0.55 x 9.9% HOLD

UBA 8.17 8.93 -8.51% -0.78% 0.34 5.25 x 1.42 x 5.6% 3.50 x 0.90 x 7.3% HOLD

UBN 8.60 10.00 -14.00% -0.99% 8.00 24.88 x 0.86 x 0.0% 6.90 x 0.87 x 0.0% SELL

UNITYBNK 0.72 0.50 44.00% 0.00% 0.00 2.79 x 0.37 x 0.0% 10.00 x 0.50 x 0.0% BUY

WEMABANK 0.52 1.14 -54.39% -5.00% -4.10 -9.48 x 310.98 x 0.0% 19.00 x 1.56 x 0.0% SELL

ZENITHBANK 29.61 25.11 17.92% 8.23% -9.27 7.60 x 1.62 x 6.4% 6.34 x 1.47 x 8.0% HOLD

Insurance

AIICO 0.90 0.87 3.45% -2.25% 2.38 4.57 x 0.52 x 9.3% 4.14 x 0.46 x 5.7% HOLD

CONTINSURE 1.38 1.20 15.00% 0.84% -4.07 7.35 x 0.90 x 8.5% 6.00 x 0.84 x 8.3% HOLD

HMARKINS 0.63 0.50 26.00% 0.00% 0.00 9.40 x 0.70 x 0.0% 5.56 x 0.61 x 6.0% BUY

CUSTODYINS 3.53 2.40 47.08% 1.69% 17.79 17.76 x 1.10 x 5.3% 4.44 x 0.86 x 8.8% BUY

MANSARD 2.50 2.37 5.49% -5.20% -3.27 13.50 x 1.60 x 4.6% 10.77 x 1.56 x 5.9% HOLD

UNITYKAP 0.80 0.50 60.00% 0.00% 0.00 4.29 x 0.74 x 4.0% 5.00 x 0.69 x 20.0% BUY

Consumer Goods

Brewery

GUINNESS 283.79 237.80 19.34% 0.34% -0.21 27.45 x 8.55 x 3.0% 22.25 x 7.39 x 2.9% HOLD

INTBREW 17.38 29.00 -40.08% -1.69% 4.53 48.33 x 9.54 x 0.0% -36.25 x 38.67 x 0.0% SELL

NB 171.52 165.20 3.83% 0.12% -1.01 31.77 x 78.59 x 1.8% 20.15 x 6.99 x 2.7% HOLD

EQUITY | INVESTMENT GUIDE | STOCKRECOMMENDATION

Tuesday, 21 January 2014

www.meristemng.com

Disclosure and Analyst certification on page 10

Tickers 2014 TP

Closing

Price

Up/Down

Potential Wtd % Ytd %

Trailing

P/E

Trailing

P/BV

Trailing

Div.

Yield

Forward

P/E

Forward

P/BV

Forward

Div. Yield Ratings

Food and Beverages

7UP 68.11 71.40 -4.61% 0.00% 0.00 12.66 x 3.26 x 3.1% 11.89 x 4.44 x 3.1% HOLD

CADBURY 41.44 59.01 -29.77% 0.00% -1.25 26.51 x 8.80 x 0.9% 184.41 x 7.96 x 1.6% SELL

DANGSUGAR 8.45 12.23 -30.89% 0.91% 2.56 11.74 x 3.04 x 4.2% 9.78 x 2.57 x 8.3% SELL

HONYFLOUR 3.62 3.94 -8.23% 1.29% 4.90 10.99 x 1.68 x 0.0% 8.21 x 1.52 x 4.1% HOLD

FLOURMILL 101.77 88.00 15.64% -1.19% 1.15 26.59 x 2.35 x 2.3% 20.95 x 2.36 x 2.3% HOLD

NASCON 7.34 14.00 -47.55% 0.00% -6.60 13.27 x 5.11 x 6.4% 43.75 x 4.85 x 5.9% SELL

NESTLE 1,182.52 1,165.00 1.50% 0.43% -3.75 41.11 x 30.07 x 1.7% 32.26 x 19.85 x 2.9% HOLD

Personal / Household Products

PZ 27.16 38.15 -28.80% 3.11% 1.49 28.47 x 3.26 x 1.5% 71.98 x 3.53 x 2.2% SELL

UNILEVER 44.45 53.58 -17.04% 1.09% 0.37 36.36 x 27.07 x 2.6% 35.48 x 20.22 x 2.6% SELL

VITAFOAM 6.53 5.22 25.00% 6.97% 10.41 7.32 x 1.28 x 0.0% 6.96 x 1.13 x 6.7% BUY

Conglomerates

AGLEVENT 1.78 1.73 2.89% 1.76% 4.71 -37.85 x 0.37 x 0.0% 7.52 x 0.42 x 8.1% HOLD

UACN 39.66 70.00 -43.34% 4.48% 2.99 10.85 x 1.80 x 1.9% 25.00 x 1.85 x 4.0% SELL

Healthcare

MAYBAKER 2.43 2.25 8.00% -5.06% -4.08 50.85 x 0.69 x 0.0% 16.92 x 0.68 x 1.3% HOLD

FIDSON 3.53 2.80 26.07% -0.36% -3.58 20.42 x 0.79 x 4.5% 7.53 x 0.86 x 7.9% BUY

GLAXOSMITH 70.45 68.05 3.53% 0.07% 0.00 22.17 x 6.00 x 1.9% 18.53 x 4.60 x 2.1% HOLD

Construction/Real Estate

JBERGER 59.03 65.10 -9.32% -9.95% -9.95 9.37 x 5.49 x 0.0% 964.44 x 359.47 x 0.0% HOLD

Industrial Goods

Cement

ASHAKACEM 21.32 19.91 7.08% -5.95% -4.72 18.89 x 0.88 x 2.1% 9.62 x 0.82 x 0.9% HOLD

CCNN 11.64 10.87 7.08% -1.09% -8.77 9.73 x 1.61 x 0.0% 7.99 x 1.36 x 3.0% HOLD

DANGCEM 262.63 230.00 14.19% 0.00% 2.75 20.76 x 8.25 x 1.3% 16.37 x 5.57 x 2.4% HOLD

WAPCO 128.91 115.00 12.10% 0.00% 0.00 16.95 x 4.35 x 1.0% 10.99 x 2.96 x 2.2% HOLD

EQUITY | INVESTMENT GUIDE | STOCKRECOMMENDATION

Tuesday, 21 January 2014

www.meristemng.com

Disclosure and Analyst certification on page 10

Tickers 2014 TP

Closing

Price

Up/Down

Potential Wtd % Ytd %

Trailing

P/E

Trailing

P/BV

Trailing

Div.

Yield

Forward

P/E

Forward

P/BV

Forward

Div. Yield Ratings

Chemical and Paints

CAP 57.90 48.00 20.63% -1.80% -0.93 23.25 x 19.98 x 5.2% 16.33 x 13.56 x 4.1% BUY

BERGER 9.84 8.65 13.76% 2.37% 8.13 9.50 x 1.09 x 8.1% 8.16 x 0.98 x 7.6% HOLD

Oil andGas

MRS 56.83 54.44 4.39% 10.00% 75.88 52.38 x 0.72 x 0.0% 20.37 x 0.74 x 1.0% HOLD

CONOIL 55.84 52.40 6.56% 0.00% -22.86 19.51 x 2.19 x 2.0% 11.99 x 2.16 x 4.3% HOLD

ETERNA 5.40 5.23 3.25% 0.58% 15.96 7.49 x 0.96 x 0.0% 581.11 x 85.74 x 0.0% HOLD

FO 66.77 83.00 -19.55% -6.74% -15.59 58.06 x 9.71 x 0.0% 22.12 x 7.08 x 1.1% SELL

MOBIL 148.96 120.21 23.92% 2.48% 1.38 10.08 x 6.72 x 4.2% 11.12 x 4.61 x 5.0% BUY

OANDO 18.61 25.60 -27.30% -2.77% 10.10 20.67 x 1.08 x 2.8% 16.39 x 1.82 x 2.1% SELL

TOTAL 200.79 180.00 11.55% 2.59% 5.88 13.95 x 4.46 x 5.6% 11.46 x 4.88 x 6.2% HOLD

Services

NAHCO 6.81 6.05 12.56% 0.00% -2.42 14.13 x 1.55 x 4.1% 12.60 x 1.61 x 4.1% HOLD

AIRSERVICE 4.24 3.55 19.44% 5.97% 10.94 5.91 x 1.16 x 7.0% 4.93 x 0.84 x 7.9% HOLD

Agriculture

OKOMUOIL 33.35 44.25 -24.63% 0.57% 0.89 14.61 x 1.62 x 7.9% 12.36 x 1.57 x 5.9% SELL

PRESCO 37.26 41.06 -9.25% 2.65% 6.65 16.33 x 2.39 x 2.4% 11.73 x 1.97 x 2.4% HOLD

EQUITY | INVESTMENT GUIDE | STOCK RECOMMENDATION

5

www.meristemng.com

Disclosure and Analyst certification on page 10

Contact Information

Brokerage Services

gbadunolasokunbi@meristemng.com (+234 803 361 6176)

Tel: +234 1 271 7350-5

Investment Banking/Corporate Finance

adejumokeawolumate@meristemng.com (+234 806 273 2560)

michaelogun@meristemng.com (+234 805 521 1605)

Wealth Management

sulaimanadedokun@meristemwealth.com (+234 803 301 3331)

damilolahassan@meristemng.com (+234 803 613 9123)

Tel: +234 01 738 9948

Registrars

muboolasoko@meristemregistrars.com (+234 803 324 7996)

www.meristemregistrars.com

Tel: +234 01 892 0491 2

Trustees

yinkaadegbola@meristemng.com (+234 0803 717 9556)

Tel: +234 01 448 5990

Group Business Development

olabelgore@meristemng.com (+234 806 022 0899)

Client Services

tounomonaiye@meristemng.com (+234 805 846 0048)

Investment Advisory

ifeomaogalue@meristemng.com (+234 802 394 2967)

Investment Research

kemiakinde@meristemng.com (+234 809 18309487)

saheedbashir@meristemng.com (+234 07046121928)

research@meristemng.com 01-2953135

Corporate websites: www.meristemng.com www.meristemwealth.com www.meristemregistrars.com

Meristem Research can also be accessed on the following platforms:

Meristem Research portal: meristem.com.ng/rhub FactSet: www.factset.com

Bloomberg: MERI <GO>

Reuters: www.thomsonreuters.com

Capital IQ: www.capitaliq.com

ISI Emerging Markets: www.securities.com/ch.html?pc=NG

EQUITY | INVESTMENT GUIDE | STOCK RECOMMENDATION

6

www.meristemng.com

Disclosure and Analyst certification on page 10

Analysts Certification and Disclaimer

This research report has been prepared by the research analyst(s), whose name(s) appear(s) on the cover of this report.

Each research analyst hereby certifies, with respect to each security or issuer covers in this research that:

(1) all of the views expressed in this report accurately reflect his or her personal views about any and all of the subject

securities or issuers (the Issuer); and

(2) no part of any of the research analysts compensation was, is, or will be directly or indirectly related to the specific

recommendations or views expressed by the research analyst(s) in this report. Research analysts compensation is

determined based upon activities and services intended to benefit the investor clients of Meristem Securities Limited (the

Firm). Like all of the Firms employees, research analysts receive compensation that is impacted by overall Firm

profitability, which includes revenues from other business units within the Firm.

(3) each research analyst and/or persons connected with any research analyst may have interacted with sales and trading

personnel, or similar, for the purpose of gathering, synthesizing and interpreting non-material non-public or material

public market information.

As at the date of this report, any ratings, forecasts, estimates, opinions or views herein constitute a judgment, and are not

connected to research analysts compensations. In the case of non-currency of the date of this report, the views and

contents may not reflect the research analysts current thinking. This document has been produced independently of the

Issuer. While all reasonable care has been taken to ensure that the facts stated herein are accurate and that the ratings,

forecasts, estimates, opinions and views contained herein are fair and reasonable, neither the research analysts, the Issuer,

nor any of its directors, officers or employees, shall be in any way responsible for the contents hereof, and no reliance

should be placed on the accuracy, fairness or completeness of the information contained in this document. No person

accepts any liability whatsoever for any loss howsoever arising from any use of this document or its contents or

otherwise arising in connection therewith.

Important Disclosure

Analysts Compensation: The equity research analysts responsible for the preparation of this report receive

compensation based upon various factors, including the quality and accuracy of research, client feedback, competitive

factors, and overall firm revenues, which include revenues from, among other business units, Investment Banking.

Legal entity disclosures: Meristem Securities Limited is a member of The Nigerian Stock Exchange and is authorized

and regulated by the Securities and Exchange Commission to conduct investment business in Nigeria.

Investment Ratings

Fair Value Estimate

We estimate stocks fair value by computing a weighted average of projected prices derived from discounted cash flow

and relative valuation methodologies. The choice of relative valuation methodology (ies) usually depends on the firms

peculiar business model and what in the opinion of our analyst is considered as a key driver of the stocks value from a

firm specific as well as an industry perspective. However, we attach the most weight to discounted cash flow valuation

methodology.

Ratings Specification

BUY: Fair value of the stock is above the current market price by at least 20 percent

HOLD: Fair value of the stock ranges between -10 percent and 20percent from the current market price.

SELL: Fair value of the stock is more than 10 percent below the current market price.

Copyright 2013 Meristem Securities Limited. All rights reserved. This report or any portion hereof may not be reprinted,

sold or redistributed without the written consent of Meristem Securities Limited.

124, Norman Williams Street, South West, Ikoyi, Lagos, Nigeria

Email: research@meristemng.com, website: www.meristemng.com

You might also like

- Portfolio Optimization: BSRM Brac Beximco GP RAKDocument27 pagesPortfolio Optimization: BSRM Brac Beximco GP RAKFarsia Binte AlamNo ratings yet

- Tata Motors ForetradersDocument18 pagesTata Motors Foretradersguptaasoham24No ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Port. de InvDocument7 pagesPort. de InvAdrian Duran ValenciaNo ratings yet

- Jindal Steel Ratio AnalysisDocument1 pageJindal Steel Ratio Analysismir danish anwarNo ratings yet

- New Statement UnfinishedDocument2 pagesNew Statement UnfinishedAhsan RasheedNo ratings yet

- Portfolio Data For TableauDocument4 pagesPortfolio Data For TableauSai PavanNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Summary BenchmarkDocument28 pagesSummary BenchmarkADNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Ratio Analysis TamoDocument1 pageRatio Analysis Tamomir danish anwarNo ratings yet

- Empresas de EnergiaDocument2 pagesEmpresas de EnergiaBruno Henrique CardosoNo ratings yet

- Pi Daily Strategy 24112023 SumDocument7 pagesPi Daily Strategy 24112023 SumPateera Chananti PhoomwanitNo ratings yet

- ProjectDocument14 pagesProjectSameer BhattaraiNo ratings yet

- Administración Financiera Ii: Flavio Bueno Juan Pablo Carrión Sara Collaguazo Creistina GarciaDocument7 pagesAdministración Financiera Ii: Flavio Bueno Juan Pablo Carrión Sara Collaguazo Creistina Garciaflavio buenoNo ratings yet

- Planilha (Aulas Iniciais) Curso Avançado de ExcelDocument8 pagesPlanilha (Aulas Iniciais) Curso Avançado de ExcelluanaNo ratings yet

- Technidex: Stock Futures IndexDocument3 pagesTechnidex: Stock Futures IndexRaya DuraiNo ratings yet

- Currency (Yearly) TrendDocument3 pagesCurrency (Yearly) Trendismun nadhifahNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Nifty Beat 02 Nov 2010Document1 pageNifty Beat 02 Nov 2010FountainheadNo ratings yet

- 40 StocksDocument50 pages40 StocksTridib SarkerNo ratings yet

- Daily FNO Overview: Retail ResearchDocument5 pagesDaily FNO Overview: Retail ResearchjaimaaganNo ratings yet

- Hot-Accounts Google FinanceDocument5 pagesHot-Accounts Google Financerbp_1973No ratings yet

- Yahoo! Finance SpreadsheetDocument7 pagesYahoo! Finance SpreadsheetAnonymous 5lDTxtNo ratings yet

- Yahoo! Finance SpreadsheetDocument9 pagesYahoo! Finance Spreadsheetsandip_exlNo ratings yet

- Financail Statement Ratios Tata Motors RNo 89-90-91 SecBDocument8 pagesFinancail Statement Ratios Tata Motors RNo 89-90-91 SecBchirag100% (1)

- ITC Financial ModelDocument150 pagesITC Financial ModelKaushik JainNo ratings yet

- JSW SteelDocument34 pagesJSW SteelShashank PatelNo ratings yet

- 唯品会估值模型Document21 pages唯品会估值模型Yiang QinNo ratings yet

- Equity and Liabilities: Description Mar-21 Mar-20 Mar-19 Mar-18 Mar-17 Share Capital Total ReservesDocument102 pagesEquity and Liabilities: Description Mar-21 Mar-20 Mar-19 Mar-18 Mar-17 Share Capital Total Reservesaditya jainNo ratings yet

- Charting Filter - 02242018Document115 pagesCharting Filter - 02242018Titus Keith CaddauanNo ratings yet

- Perf LS FundDocument4 pagesPerf LS Fundkren24No ratings yet

- Private Banks Fundamentals: Siddesh Naik Abhishek RanjanDocument19 pagesPrivate Banks Fundamentals: Siddesh Naik Abhishek RanjanAbhishekNo ratings yet

- ITC Financial ModelDocument24 pagesITC Financial ModelKaushik JainNo ratings yet

- Macy's, Inc. Financial HealthDocument2 pagesMacy's, Inc. Financial Healthjoia.dej1234No ratings yet

- Roic Revenue Growth: Appendix 1: Key Business DriversDocument7 pagesRoic Revenue Growth: Appendix 1: Key Business DriversPeter LiNo ratings yet

- Quadro de Desempenho - Gestão Icatu SegurosDocument2 pagesQuadro de Desempenho - Gestão Icatu SegurosWendel Gustavo Das NevesNo ratings yet

- Financial Statements For BYCO Income StatementDocument3 pagesFinancial Statements For BYCO Income Statementmohammad bilalNo ratings yet

- Oksidasi - XrayDocument3 pagesOksidasi - XrayIntania Anzhal SasyabilNo ratings yet

- Miscellaneous FA SoftwareDocument5 pagesMiscellaneous FA SoftwareArnold Roger CurryNo ratings yet

- Modal Mass 30 Modes Combined TowerDocument4 pagesModal Mass 30 Modes Combined TowerAbel BerhanemeskelNo ratings yet

- Year Nominal Return Inflation Real Rate of Return VarianceDocument14 pagesYear Nominal Return Inflation Real Rate of Return VarianceKunal NakumNo ratings yet

- Corporate Finance - PresentationDocument14 pagesCorporate Finance - Presentationguruprasadkudva83% (6)

- Tamzidul Islam Portfolio Optimization MidtermDocument24 pagesTamzidul Islam Portfolio Optimization MidtermTamzidul IslamNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- FM 1-1Document25 pagesFM 1-1Utkarsh BalamwarNo ratings yet

- Bullish Price & Top Volumes (19 Jan 2010)Document2 pagesBullish Price & Top Volumes (19 Jan 2010)g3murtuluNo ratings yet

- Equity Portfolio ConstructionDocument15 pagesEquity Portfolio ConstructionSuyash PurohitNo ratings yet

- The ValuEngine Weekly Is An Investor Education Newsletter Focused OnDocument10 pagesThe ValuEngine Weekly Is An Investor Education Newsletter Focused OnValuEngine.comNo ratings yet

- PiñerazoDocument8 pagesPiñerazomatiasNo ratings yet

- Bahan Prediksi Closing April 2019-1Document12 pagesBahan Prediksi Closing April 2019-1NazarNo ratings yet

- Development Sales Lacking: Wheelock Properties (S)Document7 pagesDevelopment Sales Lacking: Wheelock Properties (S)Theng RogerNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Business Sustainability in Asia: Compliance, Performance, and Integrated Reporting and AssuranceFrom EverandBusiness Sustainability in Asia: Compliance, Performance, and Integrated Reporting and AssuranceNo ratings yet

- Pricing with Confidence: Ten Rules for Increasing Profits and Staying Ahead of InflationFrom EverandPricing with Confidence: Ten Rules for Increasing Profits and Staying Ahead of InflationNo ratings yet

- Positive Alpha Generation: Designing Sound Investment ProcessesFrom EverandPositive Alpha Generation: Designing Sound Investment ProcessesNo ratings yet

- The New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade ManagementFrom EverandThe New Trading for a Living: Psychology, Discipline, Trading Tools and Systems, Risk Control, Trade ManagementRating: 4 out of 5 stars4/5 (45)

- eWBB2.1 M2000 V200R012 and V200R013 Product Description 01 (20120930) - 1Document31 pageseWBB2.1 M2000 V200R012 and V200R013 Product Description 01 (20120930) - 1Bawonda IsaiahNo ratings yet

- 2 - Introduction To EthernetDocument9 pages2 - Introduction To EthernetBawonda IsaiahNo ratings yet

- Mapinfo TutorialDocument63 pagesMapinfo TutorialProsenjit SinghNo ratings yet

- Ahead of MPC 16012014Document11 pagesAhead of MPC 16012014Bawonda IsaiahNo ratings yet

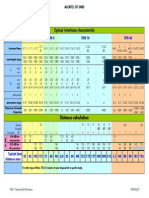

- Optical Interfaces Characteristic: Distance CalculationDocument1 pageOptical Interfaces Characteristic: Distance CalculationBawonda IsaiahNo ratings yet

- Who Is Buying What: NigeriaDocument5 pagesWho Is Buying What: NigeriaBawonda IsaiahNo ratings yet

- 01-07 Chapter 7 Troubleshooting Pointer JustificationDocument14 pages01-07 Chapter 7 Troubleshooting Pointer JustificationBawonda IsaiahNo ratings yet

- 2013 Prophecies by Pastor EDocument2 pages2013 Prophecies by Pastor EBawonda IsaiahNo ratings yet

- The SUN Exclusive: Buhari Bares It All: Home About Us Paper Ad Rate Online Ad Rates Contact UsDocument58 pagesThe SUN Exclusive: Buhari Bares It All: Home About Us Paper Ad Rate Online Ad Rates Contact UsBawonda IsaiahNo ratings yet

- Mathematical Explorations With MATLABDocument321 pagesMathematical Explorations With MATLABBawonda IsaiahNo ratings yet

- Table 5: Data Services KpisDocument2 pagesTable 5: Data Services KpisBawonda IsaiahNo ratings yet

- EE Assign 2Document19 pagesEE Assign 2Bawonda Isaiah100% (3)

- 60 Monthly Topics Spiritual ThemeDocument4 pages60 Monthly Topics Spiritual ThemeBawonda Isaiah100% (1)

- Corporate Benefit Trigger 08072013Document5 pagesCorporate Benefit Trigger 08072013Bawonda IsaiahNo ratings yet

- Work OrderDocument14 pagesWork OrderBawonda IsaiahNo ratings yet

- Table 5: Data Services KpisDocument2 pagesTable 5: Data Services KpisBawonda IsaiahNo ratings yet

- Chapter 3-Magnetic MethodsDocument74 pagesChapter 3-Magnetic MethodsReza WardanaNo ratings yet

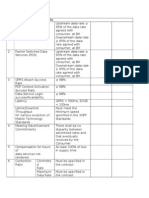

- YES NO Short Stay Visa For Professional VisitDocument1 pageYES NO Short Stay Visa For Professional VisitBawonda IsaiahNo ratings yet

- Praise and WorshipDocument2 pagesPraise and WorshipBawonda IsaiahNo ratings yet

- 15th January, 2013: QuotationDocument2 pages15th January, 2013: QuotationBawonda IsaiahNo ratings yet

- EE Assign 2Document19 pagesEE Assign 2Bawonda Isaiah100% (3)

- First Floor PlanDocument1 pageFirst Floor PlanBawonda IsaiahNo ratings yet

- Work OrderDocument14 pagesWork OrderBawonda IsaiahNo ratings yet

- The Problem: 2.1 Elementary QuantitiesDocument3 pagesThe Problem: 2.1 Elementary QuantitiesBawonda IsaiahNo ratings yet

- Last Words of Famous PeopleDocument4 pagesLast Words of Famous PeopleBawonda IsaiahNo ratings yet

- TouchingDocument1 pageTouchingBawonda IsaiahNo ratings yet

- The Mindset of The WorldDocument5 pagesThe Mindset of The WorldBawonda IsaiahNo ratings yet

- Last Words of Famous PeopleDocument4 pagesLast Words of Famous PeopleBawonda IsaiahNo ratings yet

- A Hard Saying 3-20-05Document5 pagesA Hard Saying 3-20-05Bawonda IsaiahNo ratings yet

- Stockholder's EquityDocument8 pagesStockholder's EquityKaila stinerNo ratings yet

- CMA2 P2 Practice Questions PDFDocument12 pagesCMA2 P2 Practice Questions PDFMostafa Hassan100% (1)

- Identify The Letter of The Choice That Best Completes The Statement or Answers The QuestionDocument10 pagesIdentify The Letter of The Choice That Best Completes The Statement or Answers The QuestionAngelo Payawal100% (1)

- Tidewater IncDocument135 pagesTidewater Incad9292No ratings yet

- Piper Jaffray On BAGL 8.14Document4 pagesPiper Jaffray On BAGL 8.14lehighsolutionsNo ratings yet

- Bwff1013 Foundations of Finance Quiz #3Document8 pagesBwff1013 Foundations of Finance Quiz #3tivaashiniNo ratings yet

- Test Bank CH 3Document32 pagesTest Bank CH 3rathaloz777100% (4)

- ACCT 3312 - Chap 17 Practice QuestionsDocument5 pagesACCT 3312 - Chap 17 Practice QuestionsVernon Dwanye LewisNo ratings yet

- Tax-Efficient Investing For High Earners: Sponsored byDocument16 pagesTax-Efficient Investing For High Earners: Sponsored byIDB12345678No ratings yet

- Bookmarks Jan 18Document69 pagesBookmarks Jan 18tpowell55No ratings yet

- Finance Module 9 Introduction To InvestmentsDocument5 pagesFinance Module 9 Introduction To InvestmentsKJ JonesNo ratings yet

- Herd Behavior and Equity Market LiquidityDocument10 pagesHerd Behavior and Equity Market Liquiditysuman souravNo ratings yet

- Quiz 3Document33 pagesQuiz 3Arup DeyNo ratings yet

- Final Thesis - Mansi Khanna-104-127Document24 pagesFinal Thesis - Mansi Khanna-104-127Stanzin LundupNo ratings yet

- How To Recognize Great Performing Stocks: Your Guide To Spot The Double Bottom Chart PatternDocument16 pagesHow To Recognize Great Performing Stocks: Your Guide To Spot The Double Bottom Chart PatternKoteswara Rao CherukuriNo ratings yet

- PSA FCA Proposed Merger Presentation Dec 18 19Document27 pagesPSA FCA Proposed Merger Presentation Dec 18 19Fiat500USA0% (1)

- Ibbl Midaraba Bond Final Report 20.08.06Document8 pagesIbbl Midaraba Bond Final Report 20.08.06Miran shah chowdhury100% (2)

- SAP MM Presentstion-FinalDocument80 pagesSAP MM Presentstion-Finalsamirjoshi73100% (2)

- Apex Mining Co Inc - Conso AFS As of 12.13.14Document100 pagesApex Mining Co Inc - Conso AFS As of 12.13.14Ashley Ibe GuevarraNo ratings yet

- Bloomberg FunctionsDocument1 pageBloomberg FunctionsMatthew McKeanNo ratings yet

- OB Case Study Jack StackDocument12 pagesOB Case Study Jack StackPratik Sharma100% (1)

- Investing in GoldDocument19 pagesInvesting in Goldviny137100% (2)

- Fu Shou Yuan ProspectusDocument566 pagesFu Shou Yuan ProspectuskaywuNo ratings yet

- Tesla SEC Filing Q2 2020Document171 pagesTesla SEC Filing Q2 2020Joey KlenderNo ratings yet

- Test BankDocument14 pagesTest BankJi YuNo ratings yet

- FR Ind As 102Document56 pagesFR Ind As 102Dheeraj TurpunatiNo ratings yet

- BUSINESS COMBINATION - PTDocument13 pagesBUSINESS COMBINATION - PTSchool FilesNo ratings yet

- Citigroup LBO PDFDocument32 pagesCitigroup LBO PDFP WinNo ratings yet

- A Project Report ON Working Capital Management Icici Bank LTDDocument64 pagesA Project Report ON Working Capital Management Icici Bank LTDMukesh Prabhakar67% (3)

- Pre RemovalExamination20192ndSemDocument13 pagesPre RemovalExamination20192ndSemLay Ann AlmarezNo ratings yet