Professional Documents

Culture Documents

A Study On WCM in Century

Uploaded by

Vivek KumarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Study On WCM in Century

Uploaded by

Vivek KumarCopyright:

Available Formats

1

CHAPTER 1

INTRODUCTION

The apparel and textile industry occupies a unique and important place in India.

One of the earliest industries to come into existence in the country, the sector accounts

for 14% of the total Industrial production, conduces to about 30% of the total exports and

is the second largest employment creator after agriculture.

The apparel and textile industry caters to one of the most basic requirements of

people and holds importance; maintaining the prolonged growth for improved quality of

life. The sector has a unique position as a self-reliant industry, from the production of raw

materials to the delivery of end products, with considerable value-addition at every stage

of processing. Over the years, the sector has proved to be a major contributor to nations'

economy.

Its immense potential for generation of employment opportunities in the

industrial, agricultural, organized and decentralized sectors & rural and urban areas,

especially for women and the disadvantaged is noteworthy.

1.1 COMPANY PROFILE

CENTURY APPARELS [P] LTD started with the aim of producing high quality

hosiery garments. The company was incorporated on 24

th

Dec 1989. The company started

its exporting activities from 1992. The founders of the company was Roopan David and

Neelam Roopan.

The quantity and timely delivery of the order attracted buyers around the globe.

Due to continuous hard work had achieved a turnover of around 75 crores per annum,

presently its exports to prestigious buyers from European countries. The Projected

2

average annual turnover for the next five years is Euro 20000000. The company has

three branches in Tirupur and one in Coimbatore.

CENTURY APPARELS is adopting a strict quality control method at the time of

purchasing quality yarn. The fabric is knitted with; the help of leading branded machines.

The company also entrust job work to quality knitters for all kinds of fabrics like jersey,

interlock, pique, jacquard engineering stripes etc.

CENTURY APPARELS has around 500 machineries and equipments. It

employed around 1000 employees. The main buyers are Cutter & Buck, Dockers,

Vantage, Espirit, LemonNOrange, Oliver, etc.The products produced in CENTURY

APPARELSs are Mens wear , Ladies wear, Childrens wear, Sports wear, Bermudas,

Pants, Shirts etc.,

3

The organization has its own building for carrying out the manufacturing process.

It also has own vehicles for transportation purpose. The organization provides the canteen

facility to the workers. It was started as small company. It has been developing with

technologies. The company has several departments such as production department,

purchase department, human resource department.

The production department starts their function from fabric to a garment. During

is it undertakes several functions such as knitting, dyeing and bleaching, compacting,

cutting, printing, embroidering, sewing, trimming and checking, ironing and packing.

After this the garment will be exported to foreign countries.

The company has latest equipments like Qwick track and other material

movement systems (from Malaysia and Sri Lanka) and air-cooling systems (from

Australia). Modern computerised sewing machines from Japan and ironing systems

from Italy. State of the art modern safe and healthy work place considered to be the best

in India. The company also has house printing (MHM Austria) and Embroidery (Tajima

Japan) along with Laser bridge (Proel Italy) and automatic spreading , CAD & cutting

(FK, Italy).

CERTIFICATIONS

Control union certification for manufacturing textile under EKO sustainable

textile standards.

GOTS standards for organic cotton by Control Union Certifications.

SA8000 certification approved by ITS.

SME Rating Agency of India Ltd (SMERA) rating of 3 in a scale of 1 to 8 for

financial management practices.

Government of India recognised Export house status.

Standards as per ILO norms and as per Factories Act.

SA8000 certification.

4

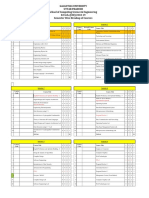

Chart 1.1 :ORGANIZATION CHART OF CENTURY APPARELS

Managing Director

General Manager

Administration Department

Finance Purchase Production Merchandising H R

Dept Dept Dept Dept Dept

Accounts Purchase Production Assistant Merchandiser H R

. Officer Supervisor Officer Officer

Cashier Assistant Supervisors Junior Merchandiser Clerks

Supervisor

Clerks Staffs & Workers

Employees

5

VISION AND MISSION

To be a bench mark in creating and delivering value to all our stakeholders.

To develop an ethical business model and strategy which is customer focussed ,

growth oriented, and adaptable for change

To develop strategic business partnerships and transform our supply chain into a

collaborative community of synchronized activities.

To empower all employees and motivate and train them through the best HR

practises, to develop team spirit and promote continuous learning .

To develop a pragmatic IT and communications network and make technology

and ERP the backbone of the organisation.

To synergize the above mentioned good business practises keeping in mind our

corporate social responsibility, and the values we stand for.

NAME OF AUTHORI TY DESI GNATI ON

MRS. NEELAM ROOPAN CEO

MR. ROOPAN DAVID MANAGING DIRECTOR

MR. ASHOK KUMAR GENERAL MANAGER

MR.MOHANRAJ HR MANAGER

MR. GURU KRISHNAN.M ACCOUNTS MANAGER

MR. MOHAN MERCHANDISING HEAD

MR.GUNA SEKARAN PRODUCTION MANAGER

MR.VIGNESH KUMAR PURCHASE MANAGER

6

Chart 1.2 MANUFACTURING PROCESS IN CENTURY APPARELS

YARN

KNITTING

DYING

CUTTING

PACKING

STITCHING

CHECKING

IRONING

7

1. KNITTING

Knitting is a method by which thread or yarn may be turned into cloth or other

fine crafts. Knitted fabric consists of consecutive loops, called stitches. As each row

progresses, a new loop is pulled through an existing loop. The active stitches are held on

a needle until another loop can be passed through them. This process eventually results in

a final product, often a garment. Knitting may be done by hand or by machine. There

exist numerous styles and methods of hand knitting.

Different yarns and knitting needles may be used to achieve different end

products by giving the final piece a different colour, texture, weight, and/or integrity.

Using needles of varying sharpness and thickness as well as different varieties of yarn

can also change the effect.

2. DYEING

Dyeing is the process of coloring textile material by immersing them in an

aqueous solution of dye called DYE LIQUOR. Normally the dye liquor consists of dye.

Water and auxiliary to improve the effectiveness on dyeing .

The theory of dyeing explains the interaction between dye, fiber, water and dye

auxiliary more specifically it explains.

Forces of repulsion which are developed between the dye molecule and water.

Forces of attraction which are developed between the dye molecule and fiber.

These forces are responsible for the dye molecule leaving the aqueous dye liquor

and entering and attaching themselves to the polymer of fiber.

3. CUTTING

Cutting is an important function since has greater effect on excessive

manufacturing cost than any other department concerned with actual production of

garment. They can be both internal cost those incurred in the cutting roll itself of the

malfunction in the cutting room .so proper care has to be taken while cutting the fabric.

While placing the pattern on the fabric lay, it should be done in such a way that

only the minimum amount of fabric is wasted. While cutting lay according to the pattern

pieces. It should be accurate and on the mark.

8

Finally while bundling the garments part that are out it should be bundling and

labeled accordingly which would make it easier for the sewing room to sort out those

pieces and start work. While cutting a particular 10to20%. We always cut more than the

order quantity. In case if there is any rejection of the garments due to certain detects, the

extra piece are used.

Use of pattern:

Pattern is prepared by the pattern maker in sampling room .It is

prepared for one of the buyer sampling pieces to take and preparing the front bodice,

bodies pack, yoke, sleeves cut, Collar, neck band ,pocket. The brow paper pattern is

prepared for all the size

Pattern layout:

Pattern are placed on the fabric departing upon economical pattern

placement. In the fabric layout two or three sizes will be marked.

4. SEWING

Sewing machine with greater technology guidance and confidence are

coming to industry with good quality. The thread is being source according to the same

/repaired color and contrast to the fabric. It is done and proper instructions of a

production needs. The whole garments is finished and monitored by the production head.

5. STITCHING

There are three types of stitching machines. They are flat lock, over lock and

Singer.

The department breaks into different structures on fixing up a garments :

Allocation the materials to the proper line.

Sleeve binding

Neck binding

Shoulder joint ,lock stitch

Mogul joint

Size joint

Bottom folded stitch

9

Sleeve lock stitch

6. CHECKING

After all these processes are over, the garments come to the checking table and

checked by experienced hands. Extra threads are removed, damaged pieces are removed

by them and other mistakes are corrected through the re-stitching process.

Stain removing:

Stain removing is a part of checking process. At the time of checking if there is

any stain on the cloth it is removed. The steam is allowed on the so it is will help to

remove the stain from the cloth.

7. IRONING

The ironing section consists of the normal & steam ironing. There are ironing

masters and helpers. They iron the garment and send it to the packing section.

The main functions done in ironing are listed below:

He controls about measurement deviation.

Practical ironing knowledge is a must.

Garment folding technique

Packing ratio knowledge.

Cost control techniques.

8. PACKING

After the ironing process , Firstly they will attached the size tag and extra button

according to the specification of the buyer. Size label on the shirt and the size tag should

match. Next, at the same tag will be attached the different size label and the packing of

finished goods is done.

1.2 OBJECTIVES OF THE STUDY

The following are the main objectives of the study : -

To identify the financial strengths & weakness of the company.

10

Understand the Profitability of the company through the profit ratio.

To evaluate efficiency and liquidity of working capital management in

CENTURY APPARELS [P] LTD, Tirupur .

To examine the pattern of management of working capital and to analyze the

working capital trends.

To analyze receivable management in company.

To study the operating cycle of company.

To examine cash management practice in company

The following are the secondary objectives of the study :-

To look at possible remedial measures if any on the basis of which tied-up funds

in working capital could be used effectively and efficiently.

To suggest, if possible on the basis of conclusion some modification to meet the

situation.

1.3 NEED FOR THE STUDY

1.This projects is helpful in knowing the companies position of funds maintenance and

setting the standards for working capital inventory levels, current ratio level, quick ratio,

current asset turnover level & size of current liability etc.

2. This project is helpful to the managements for expanding the dualism & the project

viability & present availability of funds.

3. This project is also useful as it combines the present year data with the previous year

data and there by it show the trend analysis, i.e. increasing fund or decreasing fund.

4. The project is done as a whole entirely. It will give overall view of the organization

and it is useful in further expansion decision to be taken by management.

11

1.4 SCOPE & SIGNIFICANCE OF THE STUDY

The study is conducted at CENTURY APPARELS PVT. LTD for 2 months

duration. The study of W.C. management is purely based on secondary data and all the

information is available within the company itself in the form of records. To get proper

understanding of this concept, I have done the study of the balance sheets, profit and loss

A/Cs, cash accounts, trial balance, and cost sheets. I have also conducted the interviews

with employees of accounts and finance department and stores department. So, scope of

the study is limited up to the availability of official records and information provided by

the employees. The study is supposed to be related to the period of last five years.

1.5 LIMITATIONS OF THE STUDY

The following are the various limitations involved in the study : -

The study fully depends on financial data collected from the published financial

statement (Annual Report) of company. The data collected from above the

sources are not of detailed nature. Thus study incorporates all the limitations that

are inherent in the considered financial statement.

The study in limited 4 years (2007-2008) to (2010-2011) performance of the

company.

This study in conducted within a short period. During the limited period the study

may not be retailed, full fledged and utilization in all aspects.

We cannot do comparisons with other companies unless and until we have the

data of other companies on the same subject.

Only the printed data about the company will be available and not the backend

details.

Future plans of the company will not be disclosed to us.

Lastly, due to shortage of time it is not possible to cover all the factors and details

regarding the subject of study.

12

CHAPTER 2

REVIEW OF LITERATURE

2.1 THE RESEARCH DONE BY PASS C.L., PIKE R.H.

The research done by Pass C.L., Pike R.H., An overview of working capital

management and corporate financing,(1984) describes that over the past 40 years major

theoretical developments have occurred in the areas of longer-term investment and

financial decision making. Many of these new concepts and the related techniques are

now being employed successfully in industrial practice. By contrast, far less attention has

been paid to the area of short-term finance, in particular that of working capital

management. Such neglect might be acceptable were working capital considerations of

relatively little importance to the firm, but effective working capital management has a

crucial role to play in enhancing the profitability and growth of the firm. Indeed,

experience shows that inadequate planning and control of working capital is one of the

more common causes of business failure.

2.2 THE RESEARCH DONE BY HERRFELDT B

The research done by Herrfeldt B., How to Understand Working Capital Management

describes thatCash is king--so say the money managers who share the responsibility of

running this country's businesses. And with banks demanding more from their

prospective borrowers, greater emphasis has been placed on those accountable for so-

called working capital management. Working capital management refers to the

management of current or short-term assets and short-term liabilities. In essence, the

purpose of that function is to make certain that the company has enough assets to operate

its business. Here are things you should know about working capital management

13

2.3 THEORICAL BACKGROUND OF WORKING CAPITAL MANAGEMENT

Working capital occupies a peculiar position in the capital structure of a company. The

decision as to the adequacy of working capital is a complicated and yet a very important

decision.

Working capital is the life-blood of all types of enterprises, manufacturing and

trading both. It is constantly required to buy raw materials for payment of wages and

other day-to-day expenses. Without adequate working capital, manufacturing operations

will be crippled. For trading enterprises, the capacity to stock a variety of goods for sale

depends upon its working capital. It is a base on which all the activities of business

enterprise depend.

High working capital ratios often mean that too much money is tied up in

receivables and inventories. Typically, the knee-jerk reaction to this problem is to apply

the big squeeze by aggressively collecting receivables, ruthlessly delaying payments to

suppliers and cutting inventories across the board. But that only attacks the symptoms of

working capital issues, not the root causes. A more effective approach is to

fundamentally rethink and streamline key processes across the value chain. This will not

only free up cash but lead to significant cost reductions at the same time.

Excessive working capital is equally unprofitable. The extra working capital is not

utilized in business operations and earns no profit for the firm. It results in unnecessary

accumulation of inventories, leading to inventory mishandling, waste, theft etc. The

abundance of working capital would lead to waste and inefficiency

Shortage of working capital funds renders the firm unable to avail attractive credit

opportunities etc. The firm loses its reputation when it is not in a position to honor its

short term obligations. As a result, the firm faces tight credit terms. It stagnates growth.

Meaning Of Working Capital:-

In simple words working capital means that which is issued to carry out the day to

day operations of a business. Capital required for a business can be classified under two

main categories

Fixed capital

Working capital

14

Every business needs funds for two purposes, for its establishment and to carry on

its day to day operations. Long term funds are required to create production facilities

through purchase of fixed assets such as plant and machinery, land, building, furniture

etc. Investment in these assets represents that part of firm capital, which is blocked on a

permanent or fixed basis called fixed capital. Funds are also needed for short term

purposes i.e. for the purchase of raw material, payment of wages and other day to day

operations of business. These funds are known as working capital. In other words,

working capital refers to that firms Capital, which is required for short term assets or

current assets. Funds thus invested in current assets keep revolving last and being

constantly converted into cash and this cash flow is again converted into other current

assts. Hence it is known as circulating or short term capital.

15

CHAPTER 3

RESEARCH METHODOLOGY

Research Methodology is a purposeful, precise and systematic search for new

knowledge, skills, attitudes and values, or for the re-interpretation of existing knowledge,

skills, attitudes and values.

Research methodology is a way to systematically solve the research problem. It

may be understood as a science of studying now research is done systematically. In that

various steps, those are generally adopted by a researcher in studying his problem along

with the logic behind them.

Data collection is important step in any project and success of any project will be

largely depend upon now much accurate you will be able to collect and how much time,

money and effort will be required to collect that necessary data, this is also important

step.

3.1 STATEMENT OF THE PROBLEM

Every business need fund for two purpose; one for the establishment and the other

to carry out the day to day operation. It needs some amount of working capital to meet

daily obligation. The need for working capital arises due to the time gap between the

production and realization cash from sales. Management of working capital is concerned

with the problem that arises in attempting to manage current asset, current liability and the

inter relationship that exist between them. Effective and efficient working capital

management of a firm has a great effect on its profitability, liquidity and the structural

health of organization.

In the management of working capital, the firm is faced with two key problems:

1. First, given the level of sales and the relevant cost considerations, what are the optimal

amounts of cash, accounts receivable and inventories that a firm should choose to

maintain?

16

2. Second, given these optimal amounts, what is the most economical way to finance

these working capital investments? To produce the best possible results, firms should

keep no unproductive assets and should finance with the cheapest available sources of

funds. Why? In general, it is quite advantageous for the firm to invest in short term assets

and to finance short-term liabilities.

Besides this followings are some other problem , a firm is facing. Through this study we

try to find answer for these problems.

1. What are root causes of working capital on business?

2. What are the major effects on accounts receivable?

3. What is the nature of relationship between working capital and capital employed

4. What steps should be taken to ensure that it effect on the profit of the firm will not

be negative?

5. How can working capital be managed?

6. What make up the working capital cycle?

7. How can debtors be controlled?

3.2 RESEARCH DESIGN:

Descriptive research procedure is used for describing the recent situations in the

organization and analytical research to analyze the results by using research tools.

Descriptive Research:

Descriptive research, also known as statistical research, describes data and

characteristics about the population or phenomenon being studied. Descriptive research

answers the questions who, what, where, when and how...

Although the data description is factual, accurate and systematic, the research

cannot describe what caused a situation. Thus, Descriptive research cannot be used to

create a causal relationship, where one variable affects another. In other words,

descriptive research can be said to have a low requirement for internal validity.

17

In short descriptive research deals with everything that can be counted and

studied. But there are always restrictions to that. Your research must have an impact to

the lives of the people around you. For example,finding the most frequent disease that

affects the children of a town. The reader of the research will know what to do to prevent

that disease thus, more people will live a healthy life.

3.3 DATA SOURCE & COLLECTION METHODS:

There are several ways of collecting the appropriate data which differ considerably

in context of money, cost, time and other sources at the disposable of the researcher.

There are two types of data:

Primary data

Secondary data

Primary data

Primary data are those which are collected afresh and for the first time, and thus

happen to be original in character. In case of descriptive research, researcher performs

survey whether sample survey or census survey, thus we obtain primary data either

through

Observation

Direct communication with respondent

Personal interview

Secondary Data:

Secondary data are those which have already been collected by someone else

and which have already been passed through the statistical process. The Secondary data

consist of reality available compendices already complied statistical statements.

18

Secondary data consists of not only published records and reports but also unpublished

records.

Here we done the analysis on basis of secondary data, which included-

Balance sheet of company

Profit and loss A/C of century apparels

Cost sheets, & Trail balance of five years

3.4 PURPOSE:

The purpose of this paper is to properly analysis of the working capital

management of Century Apparels, Tirupur over the period 2008-20011.

3.5 TOOLS USED:

I used the different tools to analyze the working capital management of

Century Apparels -

Analysis through Working capital ratios

Analysis through Schedule change in working capital

Analysis through Gross operating cycle & Net operating cycle

Analysis through Various components of working capital

19

CHAPTER 4

WORKING CAPITAL ANALYSIS

As we know working capital is the life blood and the centre of a business. Adequate

amount of working capital is very much essential for the smooth running of the business.

And the most important part is the efficient management of working capital in right time.

The liquidity position of the firm is totally effected by the management of working

capital. So, a study of changes in the uses and sources of working capital is necessary to

evaluate the efficiency with which the working capital is employed in a business. This

involves the need of working capital analysis.

The analysis of working capital can be conducted through a number of devices, such

as:

1. Ratio analysis. 2. Fund flow analysis. 3. Budgeting.

1. RATIO ANALYSIS

A ratio is a simple arithmetical expression one number to another. The technique of ratio

analysis can be employed for measuring short-term liquidity or working capital position

of a firm. The following ratios can be calculated for these purposes:

1. Current ratio. 2. Quick ratio

3. Absolute liquid ratio 4. Inventory turnover.

5. Receivables turnover. 6. Payable turnover ratio.

7. Working capital turnover ratio 8. Working capital leverage

9. Ratio of current liabilities to tangible net worth.

2. FUND FLOW ANALYSIS

Fund flow analysis is a technical device designated to the study the source from which

additional funds were derived and the use to which these sources were put. The fund flow

analysis consists of:

a. Preparing schedule of changes of working capital

b. Statement of sources and application of funds.

It is an effective management tool to study the changes in financial position (working

capital) business enterprise between beginning and ending of the financial dates.

20

3. WORKING CAPITAL BUDGETING

Budget is a financial or quantitative expression of business plans & policies to be pursued

in the future period of time. WC budget as a part of total budgeting process of a business

is prepared estimating future long term & short term WC capital needs & sources to

finance them & then comparing the budgeted figures with the actual performance for

calculating variances. The successful implementation of WC budget involves the

preparing of separate budgets for various elements of WC such as cash inventories and

receivables etc. The objectives of a WC budget is to ensure availability of funds as and

when needed and to ensure effective utilization of these resources.

KEY WORKING CAPITAL RATIOS

The following, easily calculated, ratios are important measures of working capital

utilization.

Table 4.1

Key Working Capital Ratios

Ratio Formulae Result Interpretation

Stock

Turnover

(in days)

Average Stock *

365/

Cost of Goods

Sold

= x days On average, you turn over the value of your entire

stock every x days. You may need to break this

down into product groups for effective stock

management.

Obsolete stock, slow moving lines will extend

overall stock turnover days. Faster production,

fewer product lines, just in time ordering will reduce

average days.

Receivables

Ratio

(in days)

Debtors * 365/

Sales

= x days It takes you on average x days to collect monies due

to you. If your official credit terms are 45 day and it

takes you 65 days.

One or more large or slow debts can drag out the

21

average days. Effective debtor management will

minimize the days.

Payables

Ratio

(in days)

Creditors * 365/

Cost of Sales (or

Purchases)

= x days On average, you pay your suppliers every x days. If

you negotiate better credit terms this will increase.

If you pay earlier, say, to get a discount this will

decline. If you simply defer paying your suppliers

(without agreement) this will also increase - but

your reputation, the quality of service and any

flexibility provided by your suppliers may suffer.

Current Ratio Total Current

Assets/

Total Current

Liabilities

= x times Current Assets are assets that you can readily turn

in to cash or will do so within 12 months in the

course of business. Current Liabilities are amount

you are due to pay within the coming 12 months.

For example, 1.5 times means that you should be

able to lay your hands on $1.50 for every $1.00 you

owe. Less than 1 times e.g. 0.75 means that you

could have liquidity problems and be under

pressure to generate sufficient cash to meet

oncoming demands.

Quick Ratio (Total Current

Assets -

Inventory)/

Total Current

Liabilities

= x times Similar to the Current Ratio but takes account of

the fact that it may take time to convert inventory

into cash.

Working

Capital Ratio

(Inventory +

Receivables -

Payables)/

Sales

As %

Sales

A high percentage means that working capital

needs are high relative to your sales.

22

4.1. RATIO ANALYSIS

Ratio analysis is a technique of analysis and interpretation of financial statements. It is

the process of establishing and interpreting various ratios for helping in making

decisions. It only means of better understanding of financial strengths and weaknesses of

a firm. The main emphasis has been on calculating the ratios related to a working capital

management.

LIQUIDITY RATIOS: -These are the ratios which measures the short term solvency or

financial position of a firm. In other words, it refers to the ability of a concern to meet its

current obligations as and when these become due. To measure the liquidity of a firm, the

following ratios can be calculated.

23

Table 4.2

Current Ratio Of Century Apparels

Chart 4.1: Current Ratio Of Century Apparels

ANALYSIS

The current ratio of the CENTURY APPARELS is above the standard and it guarantees

the payment of dues in time. The current ratio of the company has been considerably high

because they had made over investment in inventories, which is the main reason for the

high ratio of current assets. Inventories are high because of seasonal availability of raw

material. The overall position of current ratio for CENTURY APPARELS is satisfactory.

The current ratio of dye house has shown a remarkable increment from 5.26 in 2007-08

to 7.92 in 2008-09. Initially in 2007-08, the ratio was not satisfactory but it is quite

satisfactory for the years after 2010-11 and especially for the year 2008-09.

0

5

10

2008 2009 2010 2011

5.26

7.92

4.04

6.24

YEAR

CURRENT RATIO

CURRENT RATIO

YEAR CURRENT

ASSETS(in Rs)

CURRENT

LIABILITIES(in Rs)

CURRENT

RATIO

2008 72335450.22 13758132.09 5.26

2009 97761075.20 12343214.74 7.92

2010 141934492.00 35172584.20 4.04

2011 115612673.56 18528617.22 6.24

24

Table 4.3

Quick Ratio Of Century Apparels

YEAR LIQUID ASSETS

(in Rs)

CURRENT

LIABILITIES(in Rs)

LIQUID RATIO

2008 50693352.22 13758132.09 3.68

2009 56583851.20 12343124.74 4.58

2010 74081279.00 35172584.20 2.11

2011 71845029.56 18528617.22 3.88

Chart 4.2: Quick Ratio Of Century Apparels

Analysis

According to rule of thumb, it should be 1:1. For CENTURY APPARELS, the liquid

ratio present a uneven change over the past four years. It was 3.68 in 2007-08 and

increased to 4.58 in 2008-09 and then to 2.11 in 2009-10. The decrement in the ratio is

not satisfactory, however the ratio 2.11 in 2009-10 is more than the rule of thumb but it

should be quite more than the rule of thumb.

0

1

2

3

4

5

2008 2009 2010 2011

3.68

4.58

2.11

3.88

YEAR

LIQUID RATIO

LIQUID RATIO

25

Table 4.4

Working Capital Turnover Ratio Of Century Apparels

. YEAR SALES (in Rs) NET WORKING

CAPITAL (in Rs)

WCTR

2008 453662278.70 453662278.70 7.74

2009 503359979.46 85417950.46 5.89

2010 593474659.66 106761907.80 5.56

2011 703988634.61 97084056.34 7.25

Chart 4.3: Working capital Turnover Ratio Of Century Apparels

ANALYSIS

This ratio indicates the number of times the working capital is turned over in the course

of a year. A high working capital ratio indicates the effective utilization of working

capital and less working capital ratio indicates less utilization. For CENTURY

APPARELS, the ratio is quite same for the past five years. It is 7.74 in years 2007-08 and

in 2008-09 there was a slight change came over here and the ratio decreased to 5.89. And

in the next year in 2009-10 the ratio stand at 5.56. For CENTURY APPARELS, the ratio

is increasing once more in the very next year in 2010-11, it shows increment to 7.24, the

ratio of the company is satisfactory.

0

2

4

6

8

2008 2009 2010 2011

7.74

5.89

5.56

7.25

YEAR

WCTR

WCTR

26

Table 4.5

Stock Turnover Ratio Of Century Apparels

YEAR SALES (in Rs) AVERAGE

STOCK (in Rs)

STR or ITR

2008 453662278.70 24291109 18.68

2009 503359979.46 31409661 16.03

2010 593474659.66 23981268.5 24.75

2011 703988634.61 55810428.5 12.61

Chart 4.4: Stock Turnover Ratio Of Century Apparels

ANALYSIS: -

By analyzing the four-year data it seen, that it follows an uneven trend. We see that from

the year 2008 to 2009 the ratio is decreased in very nominal figures. In 2011 there is a

huge increase in inventory due to this, ratio the company maintains is very high in 2010

and the company is required to take measures to lower down this ratio as it affects the

working capital cycle of company and the flow of cash in the company. In 2011, we saw

company take measure to lower down its ratio which is good for company because a low

stock turnover ratio reveals undesirable accumulation of obsolete stock.

0

5

10

15

20

25

2008 2009 2010 2011

18.68

16.03

24.75

12.61

YEAR

STR or ITR

STR or ITR

27

Table 4.6

Debtors Turnover Ratio Of Century Apparels

YEAR CREDIT SALES

(in Rs)

AVERAGE

DEBTORS (in Rs)

DTR

2008 453662278.70 28677098.13 15.82

2009 503359979.46 27348823.87 18.41

2010 593474659.66 25923481.52 22.89

2011 703988634.61 32503373 21.66

Chart 4.5: Debtors Turnover Ratio Of Century Apparels

ANALYSIS

Generally a low debtors turnover ratio implies that it considered congenial for the

business as it implies better cash flow. The ratio indicates the time at which the debts are

collected on an average during the year. Needless to say that a high Debtors Turnover

Ratio implies a shorter collection period which indicates prompt payment made by the

customer. Now if we analyze the five year data we can say that it holds a good position

while receiving its money from its debtors. The ratios are in variation trend, which

implies that recovery position is good and company should maintain these positions.

0

5

10

15

20

25

2008 2009 2010 2011

15.82

18.41

22.89

21.66

YEAR

DTR

DTR

28

Table 4.7

Creditors Turnover Ratio Of Century Apparels

YEAR CREDIT PURCHASE

(in Rs)

AVERAGE CREDITORS

(in Rs)

CTR

2008 358037616.35 15724391.01 22.77

2009 421557817.32 10672311.95 39.50

2010 505412322.46 19426820.02 26.02

2011 567750535.58 20914713.21 27.15

Chart 4.6: Creditors Turnover Ratio Of Century Apparels

ANALYSIS

Actually, this ratio reveals the ability of the firm to avail the credit facility from the

suppliers throughout the year. Generally, a low creditors turnover ratio implies favorable

since the firm enjoys lengthy credit period. Now if we analyze the three years data we

find that in the year 2009 the ratio was very high which means that its position of

creditors that year was not good only in the year 2009, when we turn ahead the other

years creditors turnover ratio is in pretty good position. In the all four years it has

followed, a decreasing trend, which is very good, sign for the company. Therefore, we

can say it enjoys a very good credit facility from the suppliers.

0

10

20

30

40

2008 2009 2010 2011

22.77

39.5

26.02

27.15

YEAR

CTR

CTR

29

4.2 OPERATING CYCLE ANALYSIS

Operating cycle refers to the time period which starts from the raw material

purchases and ends with realization of receivable. So it is total time gap between raw

material purchases to total debtors collection. This is also known as working capital

cycle. Operating cycle is therefore expressed in terms of months or weeks or days. The

higher the operating cycle period, higher the working capital requirement. It comprises of

raw material conversion period, WIP conversion period, FG conversion period and

debtors conversion period and creditors period. The basic reason for calculating

operating cycle is to find out the means for reducing the duration of operating cycle

because if duration of operating cycle will be less than working capital requirement will

be less.

OC = R + W + F + D C

Where,

R = raw material conversion period W = work in process period

F = finished goods conversion period D = debtor collection period

C = creditors payment period

30

Table 4.8

Raw Material Conversion Period (RMCP) Of Century Apparels

Raw Material Conversion Period (RMCP)

= Average Raw Material Stock X 365s

Average Raw Materials consumed during the year

PARTICULARS 2008 2009 2010 2011

Average raw

material stock

(in Rs)

13076062.5 20819151 33352213.5 33065118

Raw material

consumed

during the year

(in Rs)

218371.65 107464.04 213093.45 314166.03

RMCP 59.88 193.73 156.52 105.25

Chart 4.7:RMCP Of Century Apparels

0

50

100

150

200

2008 2009 2010 2011

59.88

193.73

156.52

105.25

N

O

.

O

F

D

A

Y

S

YEAR

RMCP

RMCP

31

Table 4.9

Work in Progress Conversion Period (WIPCP) Of Century Apparels

Work in Progress Conversion Period (WIPCP)

= Average stock in progress

Average Cost of Production

PARTICULARS 2008 2009 2010 2011

Average stock in

progress

4818821.5 5586013 8313099.5 7834151.50

Avg. Cost of

production

180015.22 194248.64 211273.02 190952.86

WICP 26.77 28.75 37.93 41.03

Chart 4.8:WICP Of Century Apparels

0

10

20

30

40

50

2008 2009 2010 2011

26.77

28.75

37.93

41.03

N

O

.

O

F

D

A

Y

S

YEAR

WICP

WICP

X365

32

Table 4.10

Finished Goods Conversion Period (FGCP) Of Century Apparels

Finished Goods Conversion Period (FGCP)

= Average finished goods inventory

Average Cost of goods sold

PARTICULARS 2008 2009 2010 2011

Average

finished goods

inventory

6396225 5004497 13149905.5 14911159

Cost of goods

sold

1260173 1398222.17 1648540.72 1955523.98

FGCP 5.08 3.58 7.98 7.63

Chart 4.9:FGCP Of Century Apparels

0

1

2

3

4

5

6

7

8

2008 2009 2010 2011

5.08

3.58

7.98

7.63

N

O

.

O

F

D

A

Y

S

YEAR

FGCP

FGCP

X 360

X 360

X 365

33

Table 4.11

Debtors Conversion Period (DCP) Of Century Apparels

Debtors Conversion Period (DCP)

= Days in year company operating

Debtors Turnover

PARTICULARS

2008 2009 2010 2011

Days in year

company

operating

360 360 360 360

Debtors turnover 15.82 18.41 22.89 21.66

DCP 22.76 19.55 15.72 16.62

Chart 4.10: DCP Of Century Apparels

0

5

10

15

20

25

2008 2009 2010 2011

22.76

19.55

15.72

16.62

N

O

.

O

F

D

A

Y

S

YEAR

DCP

DCP

34

Table 4.12

Credit Conversion Period (CCP) Of Century Apparels

Credit Conversion Period (CCP)

= Days in year company operating

Creditors turnover

PARTICULARS

2008 2009 2010 2011

Days in year

company

operating

360 360 360 360

Creditors

turnover

22.77 39.50 26.02 27.15

Avg. consumption

period OR CCP

15.81 9.11 13.84 13.26

Chart 4.11:CCP Of Century Apparels

0

2

4

6

8

10

12

14

16

2008 2009 2010 2011

15.81

9.11

13.84

13.26

N

O

.

O

F

D

A

Y

S

YEAR

Avg. consumption period OR CCP

Avg. consumption period OR

CCP

35

Table 4.13

GROSS OPERATING CYCLE FOR CENTURY APPARELS:

(in Days)

YEAR RMCP WICP FGCP DCP GOC

2008 59.88 26.77 5.08 22.76 114.49

2009 193.73 28.75 3.58 19.55 245.61

2010 156.52 37.93 7.98 15.72 217.84

2011 105.25 41.03 7.63 16.62 170.53

Chart 4.12:GOC Of Century Apparels

0

50

100

150

200

250

2008 2009 2010 2011

114.49

245.61

217.84

170.53

N

O

.

O

F

D

A

Y

S

YEAR

GOC

GOC

36

Table 4.14

NET OPERATING CYCLE FOR CENTURY APPARELS: -

(In DAYS)

YEAR GOC CCP OR APP NOC

2008 114.49 15.81 98.68

2009 245.61 9.11 236.5

2010 217.84 13.84 204.31

2011 170.53 13.26 157.27

Chart 4.13:NOC Of Century Apparels

0

50

100

150

200

250

2008 2009 2010 2011

98.68

236.5

204.31

157.27

N

O

.

O

F

D

A

Y

S

YEAR

NOC

NOC

37

ANALYSIS

It claimed that gross operating cycle of CENTURY APPARELS is increasing in year

2008-09 and in the year 2009-10 it decreasing up to certain extent. In year 2007-08, it is

114.49 days is increased to 245.91 days in the year 2008-09. The main reason of

increasing gross operating cycle in 2008-09 is due to more availability of raw material in

the stores. In 2008-09, it is on the highest point of 245.61 days. In year 2008-09 the

company purchased a bulk of raw material due to market variations the GOC is

increased. However, when we came to year 2009-10 the GOC for CENTURY

APPARELS has shown a significant decrement of 204.31 days from the year 2008-09 to

245.61. When in next year 2010-11, it came out to be 170.53 days. The GOP for

satisfactory as it Varies as the market requirements and changes in form of meet the

customers requirements largely.

But when we came to the NOC of CENTURY APPARELS it we can see that Creditors

payment period OR Average payment period of CENTURY APPARELS is on a average

of 15 days in each (4) four years so does not make more effect on GOC. Therefore, it is

somehow near of the GOC.

That is why the companys NOC 98.68, 236.5, 204.31, and 157.27 in the years 2008,

2009, 2010 and 2011. Therefore, we can say that there is a significant change in the NOC

of the CENTURY APPARELS.

38

4.3 ANALYSIS ON THE BASIS OF SCHEDULE OF CHANGES IN WORKING

CAPITAL

Table 4.15

ANALYSIS OF CHANGES IN WORKING CAPITAL FROM 2007-08 TO 2008-09

(in Rs)

PARTICULARS 2007-08 2008-09 INCREASE DECREASE

CURRENT ASSETS:

Inventories 21642098 41177224 19535126

S. debtors 30359548.69 24338099.04 6021449.65

Cash & Bank Balances 3407307.32 2297697.88 1109609.44

Loans & Advances 16926496.21 32127724.16 15201227.95

Total current assets (A) 72335450.22 99940745.08

CURRENT

LIABILITIES:

S. creditors 11585162.05 9759461.84 1825700.21

Advance from customers 100000 100000

Provisions 2072970.04 2483662.9 410692.86

Total current liabilities

(B)

13758132.09 12343124.74

Working capital (A-B) 58577318.13 87597620.34 36562054.16 7541751.95

Net Increase in working

capital

29020302.21 29020302.21

87597620.34 87597620.34 36562054.16 36562054.16

39

Table 4.16

ANALYSIS OF CHANGES IN WORKING CAPITAL FROM 2008-09 TO 2009-10

(in Rs)

PARTICULARS 2008-09 2009-10 INCREASE DECREASE

CURRENT ASSETS:

Inventories 41177224 67853213 26675989

S. debtors 24338099.04 27508864 3170764.96

Cash & Bank Balances 2297697.88 3665403.6 1367705.72

Loans & Advances 32127724.16 42907011.4 10779287.24

Total current assets (A) 99940745.08 141934492

CURRENT

LIABILITIES:

S. creditors 9759461.84 29094178.2 19334716.36

Advance from customers 100000 2539050 2439050

Provisions 2483662.9 3539356 1055693.1

Total current liabilities

(B)

12343124.74 35172584.2

Working capital (A-B) 87597620.34 106761907.8 41993746.92 22829459.46

Net Increase in working

capital

19164287.46 19164287.46

106761907.8 106761907.8 41993746.92 41993746.92

40

Table 4.17

ANALYSIS OF CHANGES IN WORKING CAPITAL FROM 2009-10 TO 2010-11

(in Rs)

PARTICULARS 2009-10 2010-11 INCREASE DECREASE

CURRENT ASSETS:

Inventories 67853213 43767644 24085569

S. debtors 27508864 37497882 9989018

Cash & Bank Balances 3665403.6 6891449.29 3226045.69

Loans & Advances 42907011.4 27455698.27 15451313.13

Total current assets (A) 141934492 115612673.6

CURRENT

LIABILITIES:

S. creditors 29094178.2 12735248.22 16358929.98

Advance from customers 2539050 822054 1716996

Provisions 3539356 4971315 1431959

Total current liabilities

(B)

35172584.2 18528617.22

Working capital (A-B) 106761907.8 97084056.34 31290989.67 40968841.13

Net Decrease in working

capital

9677851.46 9677851.46

106761907.8 106761907.8 40968841.13 40968841.13

41

ANALYSIS

FOR YEARS 2007-08 AND 2008-09:

As we have a look on the schedule of changes in working capital for the Century

Apparels over the years 2007-08 and 2008-09, we find that, among current assets,

inventories, loans and advances have shown increment from year 2007-08 to year 2008-

09. The sundry debtors and cash & bank balances have decreased in the same years.

Among the current liabilities, the sundry creditors and other liabilities have decreased and

provisions were increased. Therefore, the overall net working capital has increased.

FOR YEARS 2008-09 AND 2009-10:

As we have a look on the schedule of changes in working capital for the Century

Apparels over the years 2008-09 and 2009-10, we find that all the current assets such as

inventories, loans and advances, sundry debtors and cash & bank balances have shown

increment from year 2008-09 to year 2009-10. All the current liabilities were increased

from 2008-09 to 2009-10. The overall net working capital has increased but it is less

compared to previous year's net working capital increment.

FOR YEARS 2009-10 AND 2010-11:

Among the current assets, debtors and cash & bank balances have increased and

inventories and loans & advances have shown decrement. The total current assets have

increased. Among the current liabilities, sundry creditors and other liabilities have

decreased which made a positive effect on networking capital and it increases, on the

other hand, the provision increased which not directly but overall made a good effect on

company.

42

4.4 ANALYSIS OF VARIOUS COMPONENTS OF WORKING CAPITAL

Table 4.18

Position of inventory in Century Apparels: - (in Rs)

PARTICULARS

2007-08 2008-09 2009-10 2010-11

Raw material 12230900 29407402 37297025 28833211

W.I.P 4901850 6270176 9756023 5912280

Finished goods 4509348 5499646 20800165 9022153

TOTAL 21642098 41177224 67853213 43767644

Chart 4.14: Position of inventory in Century Apparels

INTERPRETATION: By analyzing the 4 years data we see that the inventories are

increased/decreased year by year. We can look increasing pattern in inventories. We can

see that inventories are grown in 08-09 and 09-10 respectively from previous year in

figures it increases up to19535126 in 2009 and in the year 2010 it increases to 26675989

in comparison of 2009. By this growth we can say that the company is growing. A

company uses inventory when they have demand in market and Century Apparels is

having a demand in industry market. That is biggest reason for increase in Inventories.

From other point of view we can say that the liquidity of firm is blocked in inventories

but to stock is very good due to uncertainty of availability of raw material in time.

0

10000000

20000000

30000000

40000000

50000000

60000000

70000000

2008 2009 2010 2011

21642098

41177224

67853213

43767644

A

M

O

U

N

T

(

i

n

R

s

)

YEAR

STOCK

43

SUNDRY DEBTORS ANALYSIS

Debtors or an account receivable is an important component of working capital and fall

under Current assets. Debtors will arise only when credit sales made.

Table 4.19

Position of Sundry Debtors in Century Apparels

(in Rs)

PARTICULARS

2007-08 2008-09 2009-10 2010-11

DEBTS O/S

FOR A PERIOD

OF SIX

MONTHS

85124.00 118028.00 203547.00 0.00

OTHER

DEBTS

30274424.69 22040401.16 27305317.00 37497882.00

TOTAL 30359548.69 22158429.16 27508864.00 37497882.00

Chart 4.15: Position of Sundry Debtors in Century Apparels

0

5000000

10000000

15000000

20000000

25000000

30000000

35000000

40000000

2008 2009 2010 2011

30359548.69

22158429.16

27508864

37497882

A

M

O

U

N

T

(

i

n

R

s

)

YEAR

DEBTORS

44

INTERPRETATION

In the table and figure, we see that there are continuous variations in the debtors of

Century Apparels in four successive years. A simple logic is that debtors increase only

when sales increase and if sales increases it is good sign for growth. We can see that in

the year 2008-09 the Debtors are at minimum level. Moreover, in next two years in 2010

& 2011 the debtors are continuously increasing. We can say that it is a good sign as well

as negative also. Company policy of debtors is very good but a risk of bad debts is always

present in high debtors. When sales are increasing with a great speed the profit also

increases. If company decreases the Debtors, they can use the money in many investment

plans. So, this variation is good from the firm prospect

45

CASH AND BANK BALANCE ANALYSIS

Cash called the liquid asset and vital current assets; it is an important component of

Working capital. In a narrow sense, cash includes notes, bank draft, cheque etc.

Table 4.20

Position of Cash and Bank Balance in Century Apparels: -

(in Rs)

PARTICULARS

2007-08 2008-09 2009-10 2010-11

Cash & Bank 3407307.32 2297697.88 3665403.60 6891449.29

TOTAL 3407307.32 2297697.88 3665403.60 6891449.29

Chart 4.16: Position of Cash and Bank Balance in Century Apparels

0

1000000

2000000

3000000

4000000

5000000

6000000

7000000

2008 2009 2010 2011

3407307.32

2297697.88

3665403.6

6891449.29

A

M

O

U

N

T

(

i

n

R

s

)

YEAR

CASH & BANK

46

INTERPRETATION

If we analyze the above table and chart we find that it follows an increasing trend. In the

year 2008, it had maintained a huge amount of cash and bank balance which has

decreases in the year 2009. Although companys cash position in the year 2008, 2009 &

2010 was not sound so, this is not a very good sign for company. The analysis shows that

the fix deposits of company are rapidly fallen in the year in 08- 09 respectively from

year 2008 that is why company is have minimum balance in 2009 in comparison of all.

Through analysis, we got that company is utilizing the fixed cash for exploding the

Projects that is good for growth.

47

LOANS AND ADVANCES ANALYSIS

Loans and Advances here refers to any to amount given to different parties, company,

employees For a specific period of time and in return they will be liable to make timely

repayment of that Amount in addition to interest on that loan.

Table 4.21

Position of Loan and Advance in Century Apparels: -

(in Rs)

PARTICULARS

2007-08 2008-09 2009-10 2010-11

LOANS &

ADVANCES

16926496.21 32127724.16 42907011.40 27455698.27

TOTAL 16926496.21 32127724.16 42907011.40 27455698.27

Chart 4.17: Position of Loan and Advance in Century Apparels

0

5000000

10000000

15000000

20000000

25000000

30000000

35000000

40000000

45000000

2008 2009 2010 2011

16926496.21

32127724.16

42907011.4

27455698.27

A

m

o

u

n

t

(

i

n

R

s

)

YEAR

LOANS & ADVANCES

48

INTERPRETATION

If we analyze the table and the chart we can see that it follows an increasing trend which

is a Good sign for the company. We can see that the increase of loans and advances are

increases year by year except the year 2011. In the year 2010 there is more than Rs 4

crore given as loan, due to this a lot of amount was blocked. But it used for expansion of

business. The increasing pattern shows that company is giving advances for the

expansion of plants and Machinery which is good sign for better production. Although

companys cash is blocked but This is good that company is doing modernization of plan

competitors in market.

49

CURRENT LIABILITIES ANALYSIS

Current liabilities are any liabilities that are incurred by the firm on a short term basis or

current Liabilities that has to be paid by the firm within one year.

Table 4.22

Position of Current liabilities in Century Apparels: -

(in Rs)

PARTICULARS 2008 2009 2010 2011

SUNDRY

CREDITORS

11585162 9759462 29094178 12735248

ADVANCE FROM

CUSTOMERS/DLRS

100000 100000 2539050 822054

TOTAL 11685162 9859462 31633228 13557302

Chart 4.18: Position of Current Liabilities in Century Apparels

0

5000000

10000000

15000000

20000000

25000000

30000000

35000000

2008 2009 2010 2011

11685162

9859462

31633228

13557302

A

M

O

U

N

T

(

i

n

R

s

)

YEAR

CURRENT LIABILITIES

50

INTERPRETATION

If we analyze the above table then we can see that it follow an uneven trend in the sundry

creditors and other liabilities. In 2009 current liabilities is decreased compared to 2008 .

In 09-10 it was increased because of growth in other liabilities. This is done because in

the year 2011 company purchased a bulk of raw material due to market variations. When

company has minimum liabilities it creates a better goodwill in market. High current

liabilities indicate that company is using credit facilities by creditors.

51

PROVISIONS ANALYSIS

Table 4.23

Position of Provisions in Century Apparels: -

(in Rs)

PARTICULARS 2008 2009 2010 2011

PROVISIONS 2072970 2483663 3539356 4971315

TOTAL 2072970 2483663 3539356 4971315

Chart 4.19: Position of Provisions in Century Apparels

INTERPRETATION

From the above table we can see that provision shows a growing trend and the huge

amount is being kept in these provisions. Though the profits of the company are

increased, income tax is also increased. Therefore, there is a great need of maintaining

proper provisions, which is good that company is creating in time. The provisions are

increasing as the tax increases. Although company is paying more income tax that is why

because company also earning more. This is good sign for Company.

0

500000

1000000

1500000

2000000

2500000

3000000

3500000

4000000

4500000

5000000

2008 2009 2010 2011

2072970

2483663

3539356

4971315

A

M

O

U

N

T

(

i

n

R

s

)

YEAR

PROVISIONS

52

CHAPTER 5

FINDINGS, CONCLUSION AND SUGGESTIONS

5.1 FINDINGS

Due to seasonal availability of raw material is purchased in bulk .So the most part

of current assets is covered by inventories.

Liquidity ratios of Century Apparels are too high because of maintaining more

inventory stock of raw material.

Raw material is purchased by corporate office in bulk to get the advantages of

bulk purchasing.

The cost of raw material fluctuates depending upon the availability of crop in the

particular season, so it effect the finished product price.

The operating cycle of Century Apparels is very high due to the high raw

material conversion period because raw material is a seasonal product.

For filling its fund requirement Century Apparels depends upon the ICICI bank

and Axis Bank .

It holds the cash only for transaction purpose. Corporate office holds the cash for

major receipts & payments.

EOQ technique is not followed by Century Apparels for purchasing Yarn because

cotton is a seasonal product. Also EOQ is not followed in stores.

5.2 CONCLUSION

By conducting the study about working capital management, I found out that

working capital management of CENTURY APPARELS is good. CENTURY

APPARELS has sufficient funds to meet its current obligation every time, which

is due to sufficient profits and efficient management of CENTURY APPARELS.

53

Raw material for all the units of CENTURY APPARELS purchased by corporate

office in bulk, which is a major problem for the company as it increases the

inventory cost.

Company is cash rich but as there are expansion and diversification plans under

the pipeline, company is not utilizing these funds. For meeting the working capital

needs and capacity expansion needs, it has borrowed from banks.

Lack of advertisement can be considered to be a weak point for the CENTURY

APPARELS.

The amount of stock is increasing per year, which is a good sign, as it would help

them in the tough competition coming ahead.

Firm profitability can be increase by shortening accounts receivables and

inventory periods.

5.3 SUGGESTIONS

Management should make the proper use of inventory control techniques like

fixation of minimum, maximum and ordering levels for all the items for less

blockage of money.

The company should also adopt proper inventory control like ABC analysis etc.

This inventory system can make the inventory management more result oriented.

The EOQ should also follow in stores.

The company should train its work force properly, which would enable the

company to utilize its resources properly and in the interim help in minimizing

wastage, and hence result in the expansion of its market share.

Due to competition, prices are market driven and for earning more margin

company should give the more concentration on cost reduction by improving its

efficiency.

The investments of surplus funds made by the corporate office and the units are

not generally involved while taking decisions with regard to structure of

investment of surplus funds. The corporate office should involve the units to

better ascertain the future requirements of funds and accordingly the investments

made in different securities.

54

The company is losing its overseas customers due to decrease in exports so; the

sufficient amount of exports should the maintained.

Companys Average debtor collection period of company is 19 days. Therefore, it

would be the one of the positive point for company and company should maintain

it for future.

55

BIBILIOGRAPHY

WEBSITES:-

http://www.centuryapparel.com/

http://www.centuryapparel.com/evolution.php

http://www.centuryapparel.com/strengths.php

http://www.studyfinance.com/lessons/workcap/

http://en.wikipedia.org/wiki/Working_capital

http://papers.ssrn.com/sol3/papers.cfm?abstract_id=931591&rec=1&am

p;amp;srcabs=966188

http://www.emeraldinsight.com/Insight/ViewContentServlet?contentType=Articl

e&S.Sename=/published/emeraldfulltextarticle/pdf/2910030202.pdf

BOOKS AND JOURNALS

Anand, M. 2001. Working Capital performance of corporate India: An empirical

survey, Management & Accounting Research, Vol. 4(4), pp. 35-65

Berryman, J. 1983. Small Business Failure and Bankruptcy: A survey of the Literature,

European Small Business Journal, 1(4), pp47-59

Bhattacharya, H. 2001. Working Capital Management: Strategies and Techniques,

Prentice Hall, New Delhi.

Grablowsky, B. J. 1976. Mismanagement of Accounts Receivable by Small Business,

Journal of Small Business, 14, pp.23-28

Grablowsky, B. J. 1984. Financial Management of Inventory, Journal of Small

Business Management, July, pp. 59-65

Shields, Patricia and Hassan Tajalli. 2006. Intermediate Theory: The Successful Student

Scholarship. Journal of Public Affairs Education. Vol. 12, No. 3. Pp. 313-334.

56

ANNEXURES

BALANCE SHEET AS AT CENTURY APPARELS PVT LTD

PARTICULARS 2010-11 2009-10 2008-09 2007-08

SOURCES OF

FUNDS

SHARE CAPITAL 19901000 19901000 19901000 19901000

RESERVE AND

SURPLUS

345519708.1 29625231.23 15253956.78 21829295.54

LOAN FUNDS

SECURED LOANS 72686105.58 88539002.13 94535519.74 55323395.23

DEFERED TAX

LIABILITY

3383097 3449412 3080483 662332

UNSECURED

LOANS

43486673 46947616 28872233 15703501

TOTAL 173976583.7 188462261 171643192.5 113419524

APPLICATION OF

FUNDS

FIXED ASSETS

A: GROSS BLOCK 178453951.9 172240571.2 164888412.7 126570061.8

B: less

DEPRICIATION

101561424.6 90540217.62 78663170.62 71729938.62

C: NET BLOCK 76892527.31 81700353.56 86225242.06 54840123.14

D:CURRENT

ASSETS

INVENTORY 43767644 67853213 41177224 21642098

SUNDRY DEBTORS 37497882 27508864 24338099.04 30359548.69

CASH IN HAND &

BANK

6891449.29 3665403.6 2297697.88 3407307.32

LOANS AND

ADVANCES

27455698.27 42907011.4 32127724.16 16926496.21

E:CURRENT

LIABILITIES

SUNDRY

CREDITORS

12735248.22 29094178.2 9759461.84 11585162.05

ADVANCE FROM

CUSTOMERS/DLRS

822054 2539050 100000 100000

PROVISIONS 4971315 3539356 2483662.9 2072970.04

(D-E)NET

CURRENT ASSETS

970s84056.34

106761907.8 85417950.46 58577318.13

MISCELLANEOUS

EXPENSES

--------- --------- -------- 2082.5

TOTAL 173976583.7 188462261 171643192.5 113419524

57

PROFIT & LOSS ACCOUNT AS AT CENTURY APPARELS PVT LTD

PARTICULARS 2010-11 2009-11 2008-09 2007-08

(A) INCOME

1: NET SALES 703988634.6

1

593474659.6

6

503359979.4

6

453662278.7

0

2: OTHER INCOME 436106.42 3913796.87 172310.00 13234.00

TOTAL 704424741.0

3

597388456.5

3

503532289.4

6

453675512.7

0

(B) EXPENSES

1:RAW

MATERIAL,FINISHE

D GOODS & WORK

IN PROGRESS

591836104.5

8

478736333.4

6

402022691.3

2

36335638.35

2:MANUFACTURING

EXPENSES

68743029.05 76058287.24 69929616.64 64805480.37

3:SALARY & OTHER

EMP.BENEFITS

4115744.00 3845617.00 3348712.00 3336648.00

4: ADMINISTRATIVE

EXPENSES

3232698.41 3229712.90 3352674.68 2742302.31

5: SELLING

EXPENSES

4646428.28 4114634.84 3276473.48 3183784.89

6: FINANCIAL

EXPENSES

13455947.36 13038713.28 7292587.41 6731948.84

7: OTHER EXPENSES 446187.51 324537.36 731402.50 38487.59

8:DEPRICIATION 11021207.00 11877047.00 6933232.00 7349223.00

TOTAL 697497346.1

9

591224883.0

8

496887390.0

3

451523513.3

5

PROFIT BEFORE

TAX

6927394.84 6163573.45 6644899.43 2151999.35

DEFERRED TAX -66315.00 368929.00 2418151.00 662332.00

PROVISION FOR FBT 99521.00 90342.00 56529.41 0.00

PROVISION FOR

TAXATION

1999712.00 1333028.00 745557.78 446425.00

PROFIT AFTER TAX 4894476.84 4371274.45 3424661.24 1043242.35

PROFIT AS PER

LAST YEAR

BALANCE SHEET

18406627.98 14035353.53 10610692.29 9567449.94

CARRIED TO

CURRENT YEAR

BALANCE SHEET

23301104.82 18406627.98 14035353.53 10610692.29

You might also like

- Project Front PagesDocument9 pagesProject Front PagesVivek KumarNo ratings yet

- HR Interview Question and AnswerDocument5 pagesHR Interview Question and AnswerKumar SukhiNo ratings yet

- Scope and LimitationDocument5 pagesScope and LimitationVivek Kumar50% (4)

- Assurance Brochure Credit Risk Basel Platform Assurance Framework 01 2011Document2 pagesAssurance Brochure Credit Risk Basel Platform Assurance Framework 01 2011Vivek KumarNo ratings yet

- Customs ActDocument88 pagesCustoms ActVivek KumarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Importance of Skill Based Education-2994Document5 pagesImportance of Skill Based Education-2994João Neto0% (1)

- 8 A - 1615864446 - 1605148379 - 1579835163 - Topic - 8.A.EffectiveSchoolsDocument9 pages8 A - 1615864446 - 1605148379 - 1579835163 - Topic - 8.A.EffectiveSchoolsYasodhara ArawwawelaNo ratings yet

- 19 Dark PPT TemplateDocument15 pages19 Dark PPT TemplateKurt W. DelleraNo ratings yet

- Acting White 2011 SohnDocument18 pagesActing White 2011 SohnrceglieNo ratings yet

- MH5-C Prospekt PDFDocument16 pagesMH5-C Prospekt PDFvatasaNo ratings yet

- Test Bank For Psychology 6th Edition Don HockenburyDocument18 pagesTest Bank For Psychology 6th Edition Don HockenburyKaitlynMorganarwp100% (42)

- SG110CX: Multi-MPPT String Inverter For SystemDocument2 pagesSG110CX: Multi-MPPT String Inverter For SystemKatherine SmithNo ratings yet

- COK - Training PlanDocument22 pagesCOK - Training PlanralphNo ratings yet

- CATaclysm Preview ReleaseDocument52 pagesCATaclysm Preview ReleaseGhaderalNo ratings yet

- Simran's ResumeDocument1 pageSimran's ResumesimranNo ratings yet

- ICMApprovedCentres - Ghana PDFDocument8 pagesICMApprovedCentres - Ghana PDFPrince Kelly100% (2)

- Vitamins - CyanocobalaminDocument12 pagesVitamins - CyanocobalaminK PrashasthaNo ratings yet

- AMICO Bar Grating CatalogDocument57 pagesAMICO Bar Grating CatalogAdnanNo ratings yet

- Introduction CompilerDocument47 pagesIntroduction CompilerHarshit SinghNo ratings yet

- Sundar Pichai PDFDocument6 pagesSundar Pichai PDFHimanshi Patle100% (1)

- Jul - Dec 09Document8 pagesJul - Dec 09dmaizulNo ratings yet

- Word CountDocument3 pagesWord CountLeo LonardelliNo ratings yet

- Derivational and Inflectional Morpheme in English LanguageDocument11 pagesDerivational and Inflectional Morpheme in English LanguageEdificator BroNo ratings yet

- SilmaDocument12 pagesSilmanobleconsultantsNo ratings yet

- 02 Object Modeling TechniqueDocument50 pages02 Object Modeling TechniqueMuhammad Romadhon Batukarang EsdNo ratings yet

- SP-Chapter 14 PresentationDocument83 pagesSP-Chapter 14 PresentationLoiDa FloresNo ratings yet

- EMD Question Bank II 2Document4 pagesEMD Question Bank II 2Soham MisalNo ratings yet

- Alaba Adeyemi AdediwuraDocument12 pagesAlaba Adeyemi AdediwuraSchahyda ArleyNo ratings yet

- Trina 440W Vertex-S+ DatasheetDocument2 pagesTrina 440W Vertex-S+ DatasheetBrad MannNo ratings yet

- DB Lecture Note All in ONEDocument85 pagesDB Lecture Note All in ONEyonasante2121No ratings yet

- Ultra ConductorsDocument28 pagesUltra ConductorsAnu Kp50% (8)

- Evidence Prove DiscriminationDocument5 pagesEvidence Prove DiscriminationRenzo JimenezNo ratings yet

- Ch-10 Human Eye Notes FinalDocument27 pagesCh-10 Human Eye Notes Finalkilemas494No ratings yet

- Department of Education: Template No. 1 Teacher'S Report On The Results of The Regional Mid-Year AssessmentDocument3 pagesDepartment of Education: Template No. 1 Teacher'S Report On The Results of The Regional Mid-Year Assessmentkathrine cadalsoNo ratings yet

- Galgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesDocument2 pagesGalgotias University Uttar Pradesh School of Computing Science & Engineering B.Tech. (CSE) 2018-19 Semester Wise Breakup of CoursesRohit Singh BhatiNo ratings yet