Professional Documents

Culture Documents

Banking Behavior of Islamic Bank Customers - Perspectives and Implications

Uploaded by

Rao Muhammad KhalidCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Behavior of Islamic Bank Customers - Perspectives and Implications

Uploaded by

Rao Muhammad KhalidCopyright:

Available Formats

[ 299 ]

International J ournal of

Bank Marketing

16/ 7 [1998] 299313

MCB University Press

[I SSN 0265-2323]

Banki ng behavi or of Isl ami c bank cust omers:

perspect i ves and i mpl i cat i ons

Saad A. Met awa

Associate Professor of Finance, College of Business Administration,

University of Bahrain, Bahrain

Mohammed Al mossawi

Assistant Professor of Marketing, College of Business Administration,

University of Bahrain, Bahrain

Describes a study designed to

investigate the banking behav-

ior of Islamic bank customers

in the state of Bahrain. The

study sample comprised 300

customers. A comprehensive

prole analysis and a series of

chi-square tests were con-

ducted to reveal key charac-

teristics and patterns: the

majority of Islamic bank

customers are well educated;

approximately 80 per cent are

between 25-50 years of age;

more than 50 per cent of the

surveyed customers have

maintained their current

banking relationship with

Islamic banks for more than

six years; customers aware-

ness and usage rates are quite

high for savings accounts,

current accounts, investment

accounts and automated teller

machines; customers were

found to be most satised with

the products/services they use

most, with the investment

accounts receiving the highest

satisfaction score; Islamic

bank employees received the

highest satisfaction score

among the elements of the

service delivery system; the

two most important bank

selection criteria were adher-

ence to the Islamic principles,

followed by the rate of return.

1. Int roduct i on

The last two decades have wi tnessed the

emergence of I slami c banki ng as a vi able

banki ng system. Si nce 1971, I slami c banks

have conti nued to grow i n si ze and i n num-

bers. The mai n mi ssi on of these banks has

been the achi evement of soci al and economi c

development through the delivery of nanci al

servi ces i n li ne wi th the pri nci ples and teach-

i ngs of I slam. To achi eve thei r mi ssi on, i t i s

i mperative for I slami c banks to conti nue to

study the changi ng behavi or, atti tude and

percepti ons of thei r customers especi ally i n

the retai l sector whi ch consti tutes the major

porti on of the banki ng busi ness.

Thi s study i s desi gned to i denti fy the prole

and banki ng habi ts of I slami c bank

customers as well as thei r awareness, usage,

perceived i mportance and degree of sati sfac-

ti on wi th the current products and servi ces

provi ded by two leadi ng I slami c banks oper-

ati ng i n Bahrai n. Those two banks are the

Bahrai n I slami c Bank and the Fai sal I slami c

Bank. These two banks are the only I slami c

commerci al banks i n Bahrai n. They are the

mai n provi ders of I slami c nanci al servi ces

to the resi dents of Bahrai n. The combi ned

total assets of these two banks was BD160

mi lli on ($423 mi lli on) i n 1996 whi ch i s approx-

i mately si x per cent of the total assets of all

commerci al banks i n Bahrai n. Further more,

the total deposi ts of these two banks, for the

same peri od, was BD141 mi lli on ($373 mi lli on)

whi ch represents about ve per cent of the

total deposi ts of the 19 commerci al banks i n

Bahrai n (Bahrai n Monetary Agency, 1997).

These gures i ndi cate that these two leadi ng

I slami c banks have a si gni cant share of the

total retai l market i n Bahrai n.

The study uti li zes a questi onnai re method-

ology desi gned to survey 300 customers that

fai rly represent the customers of the two

banks. A number of stati sti cal tests along

wi th a prole analysi s are perfor med to eval-

uate the empi ri cal ndi ngs emergi ng from

thi s comprehensive survey.

Thi s study i s divi ded i nto ve secti ons.

Secti on one i s an i ntroducti on to the study.

Secti on two presents a detai led revi ew of the

relevant li terature. Secti on three embraces

the study methodology whi ch i ncludes a

detai led descri pti on of the questi onnai re, the

sample, the procedure of data collecti on and

an overvi ew of the stati sti cal tests used i n the

study. Secti on four presents the study nd-

i ngs. I t begi ns wi th a prole analysi s

desi gned to i denti fy the banki ng behavi or of

the I slami c bank customers as well as a

detai led di scussi on of the results of the stati s-

ti cal tests perfor med. Secti on ve presents

the mai n conclusi ons of the study. Thi s sec-

ti on also i ncludes a li st of recommendati ons

for i mprovi ng the quali ty of products/ ser-

vi ces provi ded by I slami c banks.

2. Li t erat ure revi ew

2.1. Cust omer sat i sfact i on

Customer sati sfacti on i s the feeli ng or atti -

tude of a consumer toward a product/ servi ce

after i t has been used (Solomon, 1996; Wells

and Prensky, 1996). A sati sed consumer wi ll

repeat the purchase of the product and con-

vey posi tive messages about i t to others (Di s-

pensa, 1997). By contrast, a di ssati sed con-

sumer i s more li kely to swi tch to an alter na-

tive product/ servi ce the next ti me he/ she

recogni zes the same need. Not only thi s, but

also hi s/ her di ssati sfacti on wi ll be reected

i n a negative word of mouth whi ch mi ght

have a seri ous damagi ng effect on the busi -

ness. Therefore, i t i s cruci al that r ms ensure

customer sati sfacti on for thei r products/ ser-

vi ces. Thi s has led to the i ncreasi ng popular-

i ty of measuri ng customer sati sfacti on i n

recent years (Gulledge, 1996).

Banking is one of those industries in which

consumer satisfaction has attracted the atten-

tion of many researchers (for example,

Anderson et al., 1993; Bedall and Power, 1995;

Brenhardt et al., 1994; Dispensa, 1997; Holliday,

1996; Wells and Prensky, 1996; White, 1994). One

[ 300 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7[1998] 299313

of the major reasons i s that a ercer level of

competi ti on i s becomi ng the most i nuenti al

factor i n deter mi ni ng the competi tiveness of

banks (Bartell, 1993; Haron et al., 1994).

Customer sati sfacti on i s becomi ng so

i mportant to the extent that some banks con-

si der i t as a chi ef element i n thei r marketi ng

strategi es. The ter m "after marketi ng" has

been wi dely used to mean focusi ng attenti on

and efforts on current customers i n order to

maxi mi ze thei r sati sfacti on so to secure thei r

retenti on (Vavra, 1995).

The i ssue of customer retenti on has been

the major concer n of many banks. For exam-

ple, Lloyds Bank (UK) conducted research to

i denti fy the process leadi ng from customer

sati sfacti on to account closure and to explore

the deter mi nant factors of di ssati sfacti on.

The ndi ngs of the study helped Lloyds to

desi gn and i mplement a new customer reten-

ti on process (Waterhouse and Morgan, 1994).

Li ke Lloyds Bank, the Nati onal Bank of Mi d-

dlebury (USA) also developed a quali ty ser-

vi ce program based on customer retenti on

through servi ce quali ty. Si mi larly, the Royal

Bank of Scotland uses customer sati sfacti on

to help plot the course toward i ts vi si on for

the future. The bank i s concer ned about prof-

i table customer behavi or i n ter ms of the 3

Rs: remai ni ng wi th the bank, referri ng the

bank to fri ends, and repurchasi ng from the

bank (I J RDM, 1995b).

To sati sfy customers, banks use vari ous

tools, rangi ng from reengi neeri ng all servi ces

to focusi ng on some speci c servi ces (Motley,

1994). One of the areas whi ch i s growi ng and

beli eved to have a si gni cant i mpact on cus-

tomer sati sfacti on i s telemarketi ng (Si on,

1994). Whi te (1994) has exami ned the i mpor-

tance of telemarketi ng i n sati sfyi ng

customers and concluded that telephone

banki ng could become a key aspect of cus-

tomer sati sfacti on. I n Si ngapore banks are

conti nually i nvolved i n i mprovi ng the core

technology that makes self-servi ce banki ng

products possi ble i n order to achi eve better

marketi ng, customer sati sfacti on and reten-

ti on (Kass, 1992). The Co-operative Bank i n

the UK has appli ed another strategy to sati sfy

i ts customers. The bank encouraged

customers to communi cate di rectly wi th i ts

account management center, rather than

contacti ng the branches, for any problem or

complai nt they mi ght have. Thi s strategy has

helped Co-op to gai n one of the hi ghest cus-

tomer sati sfacti on rati ngs (I J RDM, 1995a).

The above di scussi on hi ghli ghts the i mpor-

tance of customer sati sfacti on whi ch i s

thought to be the cor nerstone i n constructi ng

strategi es of banks. I n thi s respect, i t i s essen-

ti al for a present-day bank to swi tch from

managi ng means to managi ng customers i n

order to sati sfy them wi th the whole servi ces

they offer. Therefore, it is important for banks

to have a system by which consumer satisfac-

tion is continuously measured (Chakravarty et

al., 1996; Chitwood, 1996; Morrall, 1996; Noe,

1996; Romano and Sanllipo, 1996).

2.2. Inuence of qual i t y

I n the long run, the most i mportant si ngle

factor affecti ng a busi ness uni ts perfor-

mance i s the quali ty of i ts products and

servi ces, relative to those of competi tors

...Superi or and i mprovi ng quali ty i s the

most effective way for a busi ness to grow.

Quali ty leads to both market expansi on and

gai ns i n market share (Buzzel and Gale,

1987).

I n a servi ce busi ness, quali ty depends on the

customers experi ence wi th delivery because,

unli ke products, servi ces are experi enced

whi le they are produced. Studi es from the

servi ce li terature emphasi ze the i mportance

of quali ty percepti ons and the relati onshi p

between servi ce sati sfacti on and quali ty (e.g.

Croni n and Taylor, 1992; Taylor et al., 1994).

There i s evi dence to suggest that servi ce

quali ty leads to customer sati sfacti on and

helps to keep exi sti ng customers and attract

new ones (Kei ser, 1993; Li an, 1994a, b). How-

ever, some banks go even beyond servi ce

quali ty. They suggest what they call servi ce

excellence (Mahoney, 1994). Masden (1993)

denes servi ce excellence as a eld through

whi ch r ms can deli ght thei r customers and

exceed thei r expectati ons: servi ce excellence

concentrates on li steni ng, empower ment,

i nnovati on, and maki ng customers and

employees part of the acti on (Masden, 1993).

The reali zati on of the i mportance of quali ty

sti mulated many manufacturi ng and servi ce

busi nesses to adopt programs such as TQM

(total quali ty management) or CQI (conti nu-

ous quali ty i mprovement) (J ames, 1989;

J oseph, 1996).

2.3. Inuence of i nt ernal market i ng (i .e.

empl oyees) on servi ce qual i t y

I nter nal marketi ng has been dened as mar-

keti ng the r m to i ts employees (Gronroos,

1982); i n other words, attempti ng to motivate

and sati sfy employees through trai ni ng,

i ncentives, appreci ati on, and parti ci pati on,

etc. (J oseph, 1996; Kotler and Ar mstrong,

1991). The i mportant role of bank employees

i n the quali ty of the servi ces delivered i s well

documented i n the li terature (Bartell, 1993;

Berry and Parasuraman, 1991; Bi tner, 1990;

Chi twood, 1996; Gronroos, 1982; J oseph, 1996;

Kotler and Ar mstrong, 1991; Surprenant and

Solomon, 1987). I nter nal marketi ng i s i mpor-

tant because the people who deliver servi ces

play speci al roles i n sati sfyi ng customers,

[ 301 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7 [1998] 299313

(J oseph, 1996). Several studi es of servi ce

sati sfacti on have found that the i nteracti on

between customer and employee plays an

i mportant role i n sati sfyi ng customers (e.g.

Bi tner, 1990; Surprenant and Solomon, 1987).

Thi s concept has also been appli ed to the

banki ng i ndustry. Several banks have real-

i zed that outsi de customer sati sfacti on must

start from i nsi de (i .e. employees) sati sfacti on.

For example, Ci ti zens Commerci al Savi ng

Bank of Fli nt, Mi chi gan (USA), appli ed a

strategy to make sure that the staff member

responsi ble for a customer contact had the

necessary tools and deci si on-maki ng powers

to properly servi ce the customer duri ng the

servi ce contact (Stone, 1995). The i nter nal

sati sfacti on as a gateway to the exter nal one

has been emphasi zed by Gremler and others

i n thei r study of a large US bank (Gremler et

al., 1995). All these studi es i ndi cate the i mpor-

tance of i ncreasi ng employees ski lls through

conti nuous trai ni ng. Trai ned employees can

posi tively contri bute to the servi ce quali ty

whi ch was found by many banks to be i nstru-

mental to customer sati sfacti on and retenti on

(Li an, 1994a, b).

2.4. Bank sel ect i on cri t eri a

Bank selecti on cri teri a have been heavi ly

i nvesti gated over the past two decades

(Anderson et al., 1976; Evans, 1979; Haron et

al., 1994; Hegazy, 1995; Kaynak and Yavas,

1985; Khazeh and Decker, 1992; Laroche et al.,

1986; Ross, 1989). I n most of these studi es,

questi onnai re methodology was employed to

evaluate the relative i mportance of speci c

selecti on attri butes. Several attri butes were

found to play a cruci al role i n the process of

bank selecti on. Those attri butes i nclude:

avai labi li ty of credi t, relatives advi ce and

recommendati ons, fri ends advi ce and recom-

mendati on, conveni ent locati on, vari ety of

bank servi ces, the quali ty of servi ces, avai l-

abi li ty of ATM, adequate bank hours, retur n

on i nvestment, fri endli ness of personnel,

understandi ng nanci al needs, speci al ser-

vi ces for women, and bank name. The relative

i mportance of each of those attri butes di ffers

from one market to another dependi ng on: the

type of i nsti tuti on (I slami c bank or commer-

ci al bank), the customers level of educati on,

age, i ncome and occupati on.

Given the speci al nature of I slami c banki ng

whi ch di fferenti ates i t from commerci al

banki ng, i t i s expected that some of the above

selecti on attri butes that have been found to

be cruci al i n the selecti on of commerci al

banki ng, may not play the same role i n the

selecti on of I slami c banks. Hegazy (1995) has

i nvesti gated bank selecti on cri teri a for both

I slami c banks and commerci al banks. He

concluded that the selecti on attri butes for

I slami c banks are di fferent from those for

commerci al banks. For the selecti on of

I slami c banks, i t was found that the most

i mportant factor was the advi ce and recom-

mendati ons made by relatives and fri ends.

Conveni ence of locati on, fri endli ness of per-

sonnel, the banks vi si on of servi ng the com-

muni ty regardless of the expected protabi l-

i ty, ti meli ness, and effi ci ency were also found

to play i mportant roles i n the selecti on of

I slami c banks.

I denti fyi ng the mai n selecti on attri butes

wi ll allow I slami c banks to develop appropri -

ate marketi ng strategi es. Si nce I slami c banks

operate accordi ng to prot-loss shari ng pri n-

ci ples (prohi bi ti on of i nterest), they are

expected to develop thi s competi tive advan-

tage around those cruci al selecti on attri butes

emergi ng from comprehensive customer

surveys.

3. The met hodol ogy

The methodology employed i n thi s study

i nclude: the procedure for data collecti on, the

study sample, the procedure and techni ques

used i n the data analysi s, and the study li mi -

tati ons. A bri ef descri pti on of each of these

elements i s presented i n thi s secti on.

3.1. Dat a col l ect i on

The data requi red for conducti ng thi s study

were collected usi ng self-admi ni stered ques-

ti onnai res, speci ally desi gned to achi eve the

study goals as outli ned i n secti on one. A total

of 14 questi ons coveri ng 14 key attri butes of

the customers banki ng behavi or were pre-

pared after revi ewi ng the relevant li terature

on the subject, as well as consulti ng key offi -

ci als i n the two selected banks. Thi rteen of

the 14 questi ons were closed-ended questi ons

to encourage easy response from the cus-

tomers and to allow the researchers to use

stati sti cal tests i n evaluati ng the empi ri cal

ndi ngs of the study.

A pi lot study of 15 questi onnai res (about

ve per cent of the total sample si ze) was

conducted to check the vali di ty and logi c of

the questi ons i ncluded i n the questi onnai re.

After revi ewi ng the feedback from the pi lot

study, several key amendments were made

before the di stri buti on of the questi onnai re.

The questi onnai res were hand di stri buted

to the account holders i n the two selected

banks. As the two banks have branches, the

questi onnai res were di stri buted i n all the

branches to seek wi der representati on of

bank customers. Thi s process of data collec-

ti on conti nued for three months, from Decem-

ber 1996 through February 1997. Respondents

were selected from among customers vi si ti ng

[ 302 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7[1998] 299313

the sampli ng locati ons duri ng the chosen

ti me i ntervals, i n order to eli mi nate the sam-

pli ng frame errors and to ensure the repre-

sentati on of the populati on under study i n the

sample uni ts.

The questi onnai res were di stri buted

duri ng vari ous worki ng hours of the same

day (mor ni ngs and eveni ngs), as well as vari -

ous days of the week and the month, to avoi d

any potenti al bi as owi ng to hi gh concentra-

ti on of bank customers duri ng certai n hours

of the day, or certai n days of the week or

month. Further more, a number of questi on-

nai res were di stri buted by the women sec-

ti ons of the two banks, to ensure full repre-

sentati on of the enti re populati on of I slami c

bank customers. Fi nally, non-response bi as

was i nvesti gated and no si gni cant bi as was

detected.

Although 400 questi onnai res were di stri b-

uted, the actual sample si ze (i .e. usable

retur ned and completed questi onnai res) was

300 customers (160 from the Fai sal I slami c

Bank and 140 from the Bahrai n I slami c

Bank). Those usable questi onnai res were

ei ther retur ned to the bank offi ci al desi g-

nated to collect them, or to the researchers

mai l address.

3.2. The procedure of dat a anal ysi s

Two types of analysi s were conducted i n thi s

study: prole analysi s and stati sti cal analy-

si s.

Prole analysi s can be vi ewed as a means of

classi fyi ng a parti cular set of subjects accord-

i ng to a parti cular number of relevant attri b-

utes. Thi s method i s wi dely used i n soci al

sci ence research especi ally those studi es that

i nvolve the i nvesti gati on of behavi oral i ssues.

Thi s method of analysi s has been used i n

many studi es as a rst step before conducti ng

any stati sti cal analysi s.

The prole analysi s employed i n thi s study

was conducted vi a the use of percentages,

mean scores and ranks. The results of the

analysi s are presented i n Tables I -VI I i n sec-

ti on 4 of thi s paper.

I n addi ti on to the prole analysi s, a non-

parametri c stati sti cal test was also employed

i n thi s study. The selected chi -square test

whi ch has been wi dely used i n the li terature

was adopted i n thi s study for two reasons:

rst, i ts sui tabi li ty to the nature of the data

collected, as most of the data are nomi nal

type; second, the appli cati on of the techni que

does not requi re those restri ctive assump-

ti ons that are nor mally associ ated wi th most

parametri c stati sti cal tests.

3.3. St udy l i mi t at i ons

There are two mai n li mi tati ons to thi s

research. Fi rst, there were only two I slami c

banks whose customers parti ci pated i n thi s

study Bahrai n I slami c Bank and Fai sal

I slami c Bank . As a result, the generali zabi l-

i ty of the ndi ngs of thi s research should be

consi dered carefully. The second li mi tati on

concer ns the nature of the measures used.

The measures i ncluded i n thi s research were

all based upon the percepti ons of the parti ci -

pati ng customers. Therefore, the potenti al for

data i naccuraci es due to i tem mi si nterpreta-

ti on or predi sposi ti on to certai n responses on

the part of the parti ci pant does exi st.

4. Fi ndi ngs

I slami c banks currently face vari ous types of

competi tive pressures from both the tradi -

ti onal commerci al banks and other I slami c

banks and I slami c i nvestment compani es.

The scope of thi s competi ti on has grown i n

recent years to i nclude every market, product

or servi ce. I n thi s hi ghly competi tive envi ron-

ment, I slami c banks need to for mulate and

i mplement successful marketi ng plans i n

whi ch a key i ngredi ent i s a clear understand-

i ng of the behavi or, atti tudes and percepti ons

of thei r customers. Thi s mi ssi on can best be

achi eved through i denti fyi ng a complete

prole of I slami c bank customers whi ch

i ncludes: thei r banki ng habi ts, thei r selecti on

cri teri a, thei r awareness and usage of the

vari ous I slami c bank products/ servi ces,

thei r degree of sati sfacti on wi th those prod-

ucts/ servi ces and thei r delivery systems.

4.1. Cust omer prol e

The success of I slami c banks i n for mulati ng

effective marketi ng plans largely depends on

mai ntai ni ng an up-to-date complete prole

i nfor mati on on thei r customers. Thi s

i ncludes customer age, i ncome, educati onal

level, nati onali ty, and other socio-demographic

i nfor mati on. The avai labi li ty of such a com-

prehensive prole provi des the bank manage-

ment wi th a soli d basi s for maki ng plausi ble

and effective deci si ons regardi ng the market-

i ng of thei r products and servi ces.

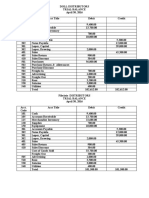

Table I presents a comprehensive prole of

the I slami c bank customers parti ci pati ng i n

thi s study.

The results reported i n Table I show that

the majori ty of I slami c bank customers are

well educated, wi th more than 40 per cent

holdi ng hi gh school di ploma and about 50 per

cent holdi ng a bachelor degree or above.

These ndi ngs i ndi cate that I slami c banki ng

i n Bahrai n i s predomi nantly the habi t of well-

educated persons. Those ndi ngs provi de

I slami c bank managers wi th valuable i nputs

for for mulati ng thei r marketi ng strategy.

More sophi sti cated products/ servi ces can be

[ 303 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7 [1998] 299313

offered as they can be easi ly handled by those

well-educated customers. However, the

emphasi s on the products/ servi ces to the

well-educated customers should not lead

I slami c bank management to underesti mate

the need to develop certai n types of

products/ servi ces that can attract less-edu-

cated customers i n thei r efforts to expand

thei r customer base.

I n addi ti on, the results reported i n Table I

show that approxi mately 42 per cent of

I slami c bank customers ear n less than BD400

per month. Those customers typi cally repre-

sent a si zeable porti on of populati on i n

Bahrai n. As a result, management personnel

i n I slami c banks need to provi de the range of

products and servi ces that sui t the needs of

the customers i n these i ncome groups. A

detai led study of the spendi ng behavi or of the

customers i n thi s group can provi de I slami c

banks wi th hi ghly useful i nfor mati on that

can be used i n the development of the appro-

pri ate products/ servi ces to those customers.

The results also show that about 25 per cent

of the surveyed customers ear n between

BD400-BD600 per month and 15.9 per cent of

them ear n between BD600-BD800 per month.

Combi ned together, the customers i n those

two i ncome groups represent approxi mately

40 per cent of the total sample. Accordi ng to

the i ncome di stri buti on chart i n Bahrai n,

those customers appear to ear n a relatively

hi gh monthly i ncome. These ndi ngs can

provi de valuable i nfor mati on for launchi ng

appropri ate savi ng schemes that sui t the

demographi cs of customers i n these rela-

tively hi gh-i ncome groups.

Further more, the results presented i n

Table I show that nearly 80 per cent of I slami c

bank customers fall i n the range 25-50 years

of age. Thi s percentage appears to be i n li ne

wi th the ndi ngs of previ ous banki ng studi es

(Rondall, 1993). I nvesti gati ng the spendi ng

behavi or and the nanci al needs of the cus-

tomers i n thi s age group i s li kely to have far-

reachi ng i nuence on the I slami c banks

nanci ng schemes, such as nanci ng cus-

tomers acqui si ti on of cars, houses, and other

durable goods, as well as savi ng schemes such

as student educati on fund, medi cal fund, etc.

Fi nally, the results i n Table I i ndi cate that

approxi mately 89 per cent of I slami c bank

customers are Bahrai ni nati onals, whi le only

11 per cent are non-Bahrai ni . Thi s i ndi cates

that there i s a relatively hi gh degree of stabi l-

i ty i n the I slami c banks customer base whi ch

allows the management of those banks to

desi gn and i mplement longer-ter m nanci ng

and savi ng schemes.

4.1.1. History of banking relationships

Table I I presents a hi stori cal perspective on

the banki ng relati onshi ps for the surveyed

customers.

The data i n panel A of Table I I , show that 76

per cent of the surveyed customers have had a

previ ous banki ng relati onshi p wi th tradi -

ti onal banks pri or to thei r current relati on-

shi p wi th thei r selected I slami c bank.

Although those customers mi ght be aware of

the di fferent phi losophi es of the two banki ng

systems (i .e. tradi ti onal banki ng system and

I slami c banki ng system), i t i s expected that

thei r previ ous banki ng experi ences are li kely

to i nuence thei r atti tudes and percepti ons

and degree of sati sfacti on wi th the current

products/ servi ces offered by I slami c banks.

The results in Table II also show that 54 per

cent of the surveyed customers have main-

tained a banking relationship with Islamic

banks for more than six years and 18.5 per cent

Tabl e I

Prole of Islamic bank customers

Vari abl e Per cent

Age

Less t han 25 years 13.7

25-35 46.7

36-50 31.9

More t han 50 5.6

Educat i on

Bel ow hi gh school 4.8

Hi gh school 40.4

Col l ege/ Bachel or 38.1

Above Col l ege/ Bachel or (Mast er or PhD) 14.8

Income*

Less t han BD200 11.1

BD200-BD400 30.7

BD401-BD600 24.8

BD601-BD800 15.9

BD801-BD1000 6.3

More t han BD1000 10.7

Nat i onal i t y

Bahrai ni 88.1

Non-Bahrai ni 11.9

Not e: * Exchange rate BD1 =$2.6

Tabl e II

History of banking relationships

Panel At t ri but e Per cent

A Previ ous banki ng rel at i onshi p

wi t h t radi t i onal banks

Yes 76

No 24

B Durat i on of banki ng rel at i onshi p

wi t h Isl ami c banks

Less t han 2 years 13.7

2 t o l ess t han 4 years 13.3

4 t o l ess t han 6 years 18.5

6 years and more 54.1

[ 304 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7[1998] 299313

of them have mai ntai ned such a relati onshi p

for a peri od between four to si x years. These

results show that there i s a relatively hi gh

degree of stabi li ty of those customers rela-

ti onshi ps wi th I slami c banks. Thi s suggests

that thei r atti tudes, behavi or and degree of

sati sfacti on wi th I slami c bank servi ces wi ll

be of si gni cant i mportance to the I slami c

bank management.

More speci cally, the results i ndi cate that

there i s a relatively hi gh degree of per ma-

nence i n the I slami c bank customer base

whi ch allows I slami c bank management to

i mplement vari ous long-ter m banki ng activi -

ti es, such as long nanci ng schemes, long-

ter m savi ngs programs, and launchi ng long-

ter m adverti si ng campai gns necessary to

achi eve a hi gher rate of growth.

4.1.2. Awareness and usage of Islamic

bank products and services

The Bahrai ni market for bank products/ ser-

vi ces i s characteri zed by a hi gh level of com-

peti ti on and comparatively small si ze, wi th a

conti nuous ow of new products/ servi ces. I n

thi s hi ghly competi tive envi ronment, I slami c

banks need to conduct peri odi c customer

surveys to i nvesti gate whether customers are

aware of thei r products/ servi ces and to know

how many of those products/ servi ces are

bei ng used on a regular basi s.

The awareness and usage of ten products/

servi ces offered by I slami c banks were sur-

veyed and the empi ri cal results are shown i n

Table I I I .

The results presented i n Table I I I i ndi cate

that the awareness percentage i s qui te hi gh

for three basi c deposi t schemes current

accounts (88.1 per cent), savi ngs accounts

(94.4 per cent) and i nvestment accounts (85

per cent). I n addi ti on, technology-based bank-

i ng faci li ti es i n the for m of automati c teller

machi ne cards were found to have a hi gh

degree of customer awareness (90.4 per cent).

However, the above results show that a

si gni cant porti on of bank customers

around 30 per cent are not aware of the

I slami c nanci ng schemes and almost two-

thi rds of the surveyed customers do not use

these faci li ti es.

Around half of the surveyed customers are

not aware of money orders/ drafts, or traveler

cheques offered by I slami c banks. Given the

consi derable number of resi dents travelli ng

and transferri ng money abroad every year,

these percentages of customer awareness of

those two products/ servi ces appear to be

relatively low. Thi s problem becomes more

evi dent as we consi der the very low percent-

ages of customer usage of those two servi ces,

13.3 per cent and 8.9 per cent respectively.

Thi s problem could be parti ally attri buted to

the wi despread populari ty of money

exchange compani es and other i nfor mal

channels of transfer used by the bank cus-

tomers i n Bahrai n.

Some products and servi ces such as forei gn

trade faci li ti es, letters of credi t and speci ally

ordered bank statements have received low

usage scores. However, given the fact that

these products/ servi ces are not frequently

used by the majori ty of bank customers (con-

venti onal banks or I slami c banks) i t seems

that the percentage usage of these

products/ servi ces, as reported i n Table I I I , i s

i n li ne wi th percentage usage of these ser-

vi ces i n other countri es.

Fi nally, one-half of the surveyed customers

are not aware of the speci ally ordered bank

statement servi ce, and only one-fth of the

customers use thi s servi ce. Given the

i mportance of thi s servi ce, I slami c banks

need to promote i t more effectively.

I n general, the empi ri cal ndi ngs regard-

i ng the awareness usage patter ns of I slami c

bank products/ servi ces conr m that the

usage rate i s well below the awareness level

for most of the products/ servi ces i nvesti gated

i n thi s study. Whi le thi s may be partly due to

the absence of a need for the servi ce, the

results suggest that speci c adverti si ng and

educati onal activi ti es may need to be under-

taken to i ncrease the level of customer aware-

ness and to narrow the gap between the

awareness levels and the usage rates. Per-

sonal selli ng and speci al promoti onal activi -

ti es can also be called upon to achi eve these

goals.

When compari ng usage rates reported i n

thi s study wi th those reported i n earli er stud-

i es (Channon, 1986; Tur nbull and Lewi s,

1982), i t can be stated that I slami c bank cus-

tomers i n Bahrai n behave i n a si mi lar fash-

i on to those customers deali ng wi th conven-

ti onal commerci al banks i n the UK and the

Tabl e III

Awareness and usage of key Islamic bank

products/ services

Type of product / servi ce % awareness % usage

1. Current account 88.1 55.6

2. Savi ngs account 94.4 86.7

3. Travel er cheques 43 8.9

4. Money order/ draft s 50.4 13.3

5. Aut omat i c t el l er machi ne 90.4 75

6. Fi nanci ng faci l i t i es 71.5 34.8

7. Let t er of credi t 28.9 14.1

8. Int ernat i onal nanci al

servi ces 30.4 6.7

9. Speci al l y ordered bank

st at ement s 50.7 19.3

10. Invest ment account s 85 63.8

[ 305 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7 [1998] 299313

USA. More speci cally, the results of thi s and

previ ous studi es i ndi cate hi gh levels of

awareness and usage of current accounts,

savi ngs accounts, and automati c teller

machi ne cards, and comparatively low levels

of awareness and usage of letters of credi t,

traveler cheques and money orders/ drafts.

4.2. The rel at i onshi p bet ween soci o-

demographi c fact ors and t he cust omer

usage of Isl ami c bank product s/ servi ces

To enri ch the ndi ngs reported above, a num-

ber of chi -square tests were conducted to

exami ne the relati onshi p between some

major soci o-demographi c factors and the

usage of I slami c bank products/ servi ces. The

outcome of these tests i s reported i n Table I V.

The results i n Table I V i ndi cate that there

i s a si gni cant relati onshi p between cus-

tomer age and the usage of current

accounts. A closer exami nati on of customer

responses revealed that thi s product i s rela-

tively more popular among the older cus-

tomers, 35-50 and above 50 years. About 75 per

cent of the respondents i n those two age

groups have clai med that they use thi s prod-

uct. However, only 35 per cent of the

customers i n the rst age group (below 25

years) have i ndi cated that they mai ntai n a

current account wi th thei r I slami c banks.

Further more, the X

2

results i n Table I V show

that there i s a si gni cant relati onshi p

between customer age and the usage of ATM

cards. Thi s servi ce appears to be more popu-

lar among those customers aged 25-50 years.

Approxi mately, 80 per cent of the respondents

aged 25-35 years and 70 per cent of those aged

35-50 years have reported that they use ATM

cards.

Fi nally, the X

2

results i n Table I V i ndi cate

that there are no observed patter ns of rela-

ti onshi ps between customers ages and the

other products/ servi ces i ncluded i n thi s

study. These ndi ngs suggest that the vari ous

other products/ servi ces provi ded by I slami c

banks, i ncludi ng the hi ghly popular savi ngs

account, appear to be used by many cus-

tomers across the vari ous age groups.

Regardi ng the relati onshi p between cus-

tomers i ncome and the usage of the vari ous

products/ servi ces offered by I slami c banks,

the results i n Table I V show that there i s a

si gni cant relati onshi p between customers

i ncome and the usage of current account as

i ndi cated by the si gni cant X

2

value of 39.1

and the usage of i nvestment account as i ndi -

cated by the X

2

of 9.88. An exami nati on of the

received responses i ndi cates that about 60 per

cent of the customers wi th monthly i ncome

between BD600-800, and 62 per cent wi th

monthly i ncome between BD800-1,000, and 90

per cent wi th monthly i ncome above BD1,000,

are regular users of current accounts. I n

addi ti on, the results presented i n Table I V

show that there i s also a si gni cant relati on-

shi p between customers i ncome and the

usage of money orders/ drafts, as i ndi cated by

the si gni cant X

2

value of 16.53. Once agai n,

the patter n of thi s relati onshi p shows that

customers i n the hi gh-i ncome groups are

more frequent users of money order/ drafts

than customers i n the other i ncome groups.

Further more, as expected, the results show

that there i s a si gni cant relati onshi p

between customers i ncome and the usage of

i nvestment accounts (X

2

= 9.88). These nd-

i ngs can provi de bank management wi th

useful i nfor mati on for developi ng appropri -

ate i nvestment accounts/ schemes for cus-

tomers i n the hi gh-i ncome groups. The

i nvestment account approxi mately repre-

sents more than 70 per cent of the total bank

li abi li ti es. As a result, speci al promoti onal

activi ti es wi ll be necessary to encourage

customers to use I slami c bank i nvestment

accounts. The remai ni ng X

2

values i n Table

I V do not i ndi cate any si gni cant patter n of

relati onshi p between the customers i ncome

and the usage of any other parti cular prod-

uct/ servi ce provi ded by I slami c banks.

Tabl e IV

The relationship between socio-demographic factors and the usage of key

Islamic bank products/ services

Soci o-dem

fact ors Ca SA TC ATM MOD FF LC IFF SOBS IA

Age

X

2

14.81 2.44 7.44 9.09 1.86 3.79 3.0 4.56 1.27 3.191

D 3 3 3 3 3 3 3 3 3 3

F 0.005 0.655 0.11 0.05 0.77 0.43 0.55 0.33 0.86 0.363

P

Income

X

2

39.1 5.04 5.47 2.81 16.53 8.62 3.8 5.62 6.16 9.88

D 5 5 5 5 5 5 5 5 5 5

F 0.001 0.54 0.48 0.83 0.01 0.19 0.69 0.47 0.41 0.01

P

Educat i on

X

2

13.5 4.44 2.92 11.11 10.76 8.20 0.98 0.54 3.60 1.85

D 4 4 4 4 4 4 4 4 4 4

F 0.02 0.48 0.71 0.05 0.05 0.14 0.96 0.99 0.61 0.60

P

Not es: (CA) Current Account; (SA) Savings Account; (TC) Travelers Cheques; (MOD)

Money Order/ Drafts; (ATM) Automatic Teller Machine Cards; (FF) Financing Facilities;

(LC) Letter of Credit; (IFF) International Financial Facilities; (SOBS) Specially Ordered

Bank Statement; (IA) Investment Accounts

[ 306 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7[1998] 299313

The results presented i n Table I V also i ndi -

cate that there i s a si gni cant relati onshi p

between the level of educati on and the usage

of the current account and ATM cards as

i ndi cated by the si gni cant X

2

values of 13.5

and 11.11 respectively. The frequency di stri b-

uti on for those two products/ servi ces reveals

that these two products are more popular

among the well-educated customers. These

ndi ngs have far-reachi ng i mpli cati ons for

for mulati ng I slami c banks adverti si ng strate-

gi es i n general and the medi a selecti on i n

parti cular.

4.3. The rel at i onshi p bet ween t he number

of years wi t h Isl ami c banki ng experi ence

and awareness of t he avai l abi l i t y of

di f ferent banki ng servi ces

A chi -square test of i ndependence i ndi cated

that there i s a si gni cant relati onshi p

between the number of years of I slami c bank-

i ng relati onshi p and the awareness of the

avai labi li ty of vari ous banki ng servi ces.

These ndi ngs suggest that the greater the

number of years for I slami c banki ng relati on-

shi p the hi gher the degree of awareness of

vari ous banki ng servi ces offered by the bank.

Successful marketi ng strategi es suggest that

I slami c banks need to have adequate adverti s-

i ng and promoti on activi ti es whi ch wi ll allow

thei r customers to have adequate i nfor ma-

ti on about the vari ous servi ces offered by the

bank. Those activi ti es, i f properly conducted,

can speed up the customers lear ni ng about

the vari ous bank servi ces as those

customers nor mally represent potenti al

users of the vari ous servi ces offered by the

I slami c banks.

4.4. Cust omer sat i sfact i on wi t h Isl ami c

bank product s/ servi ces

I n the hi ghly competi tive market for bank

products/ servi ces, I slami c banks are left wi th

no opti on but to apply the marketi ng concept.

More speci cally, I slami c banks need to be

customer-ori ented i nsti tuti ons. They should

deliver what thei r customers need. To achi eve

these goals, i t i s necessary to obtai n i n-depth

i nfor mati on on the customers levels of sati s-

facti on wi th the bank products/ servi ces

offered. The degree of sati sfacti on was mea-

sured usi ng a ve-poi nt Li kert type scale

rangi ng from very unsati sed (1) to very

sati sed (5).

Table V summari zes the study ndi ngs

regardi ng the degree of sati sfacti on wi th ten

banki ng products/ servi ces offered by I slami c

banks i n Bahrai n. I t should be noted that

customers would i ndi cate thei r degree of

sati sfacti on wi th a parti cular product or

servi ce only i f they are usi ng the product or

the servi ce. The mean sati sfacti on score for

each of the products/ servi ces, as well as i ts

respective rank, are presented i n Table V.

Based on the mean sati sfacti on scores pre-

sented i n Table V, and usage rates presented

earli er i n Table I I I , i t can be noti ced that

I slami c bank customers i n Bahrai n are most

sati sed wi th those products/ servi ces they

use most. For example, the savings account

received the highest usage rate of 86.7 per cent

(Table III), and it also received the second

highest mean satisfaction score of 3.76 (Table

V). The current account also reects a

si mi lar patter n wi th an average usage rate

(55.6 per cent) and a relatively above-average

mean sati sfacti on score of 3.3. The same can

be noti ced wi th i nvestment accounts whi ch

received a hi gh usage score of 63.8 per cent

and the hi ghest sati sfacti on score of 3.79.

These ndi ngs appear to be i n li ne wi th the

ndi ngs reported i n earli er studi es (Chan-

non, 1986; Tur nbull and Lewi s, 1982).

Further more, the results reported i n Table

V show that I slami c bank customers are not

qui te sati sed wi th the nanci ng faci li ti es

as i ndi cated by the low mean sati sfacti on

score of 1.83. I nfor mal i ntervi ews conducted

wi th some of the surveyed customers i ndi cate

some concer ns about the cost and exi bi li ty

of these nanci ng schemes. Money

orders/ drafts and traveler cheques also

received relatively low mean sati sfacti on

scores of 1.79 and 1.70 respectively.

I t i s worth noti ng that, despi te i ts relatively

hi gh awareness score of 90.4 per cent and

usage rate of 75 per cent, automati c teller

machi ne cards received only an average mean

sati sfacti on score of 3.0.

I n response to the low customer sati sfacti on

wi th several key I slami c banki ng

Tabl e V

Degree of satisfaction with key Islamic bank

products/ services

Degree of sat i sfact i on

Type of product / servi ce Mean score* Rank

Current account 3.30 3

Savi ngs account 3.76 2

Travel ers cheques 1.70 8

Money orders/ draft s 1.79 7

Aut omat i c t el l er machi ne

(ATM) 3.10 4

Fi nanci ng faci l i t i es 1.83 6

Let t er of credi t 1.52 9

Int ernat i onal nanci al faci l i t i es 1.45 10

Speci al l y ordered bank st at ement 2.00 5

Invest ment account s 3.79 1

Not e: * maximum =5

[ 307 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7 [1998] 299313

products/ servi ces (as reported i n Table V),

I slami c banks need to undertake concrete

steps to i mprove the quali ty of thei r prod-

ucts/ servi ces. Those steps may i nclude: con-

trolli ng thei r costs more effi ci ently i n order to

decrease the cost of thei r nanci ng schemes;

si mpli fyi ng thei r procedures especi ally those

associ ated wi th the vari ous types of nanci ng

schemes and other key products and servi ces;

moderni zi ng thei r ATMs to avoi d undue i nter-

rupti on of customer servi ces when usi ng

those machi nes; arrangi ng for adequate trai n-

i ng of thei r employees; and i mplementi ng a

program of regular i n-depth study to i denti fy

the vari ous types of deci enci es i n the provi -

si on of thei r products/ servi ces.

4.5. Sat i sfact i on wi t h t he basi c el ement s

of t he servi ce del i very syst ems

Before evaluati ng customer sati sfacti on wi th

I slami c bank servi ce delivery systems, three

basi c characteri sti cs of servi ces need to be

revi ewed. Those characteri sti cs are: i ntangi -

bi li ty, heterogenei ty and i nseparabi li ty of

producti on and consumpti on of the servi ce.

Servi ces are i ntangi ble because they are

perfor mances rather than objects (Lovelock,

1981). Most servi ces can not be measured,

counted, tested, stored, or veri ed i n advance.

Further more, servi ces, especi ally those wi th

a hi gh labor content, are heterogeneous. I n

other words, thei r delivery systems often

vary from one producer to another, from one

customer to another, and from one day to

another. As a result, i t i s very di ffi cult to

mai ntai n consi stent behavi or (i .e. uni for m

quali ty) from servi ce personnel. Fi nally, the

producti on and the consumpti on of many

servi ces are i nseparable. As a consequence,

quali ty of the servi ce occurs duri ng the ser-

vi ce delivery as i s the case for most bank

servi ces.

Servi ces are nor mally delivered through

multi -di mensi on systems. Sasser et al. (1978)

have i denti ed three basi c di mensi ons of

servi ce delivery systems. Those i nclude:

materi als, faci li ti es and personnel. The last

two of the three di mensi ons have a speci al

i mportance i n the delivery of bank servi ces.

The purpose of thi s secti on i s to i nvesti gate

the degree of customer sati sfacti on wi th the

basi c elements of the servi ce delivery systems

for I slami c banks i n Bahrai n. Table VI pre-

sents customer sati sfacti on scores as well as

the ranks for four major elements of prod-

uct/ servi ce delivery systems.

The results i n Table VI show that I slami c

bank customers appear to be hi ghly sati sed

wi th bank employees as i ndi cated by the

relatively hi gh sati sfacti on score of 4.08. Thi s

ndi ng reects I slami c bank long-standi ng

commi tment to hi re, trai n and mai ntai n

quali ed personnel. The war m, trustworthy

relati onshi p developed between I slami c bank

employees and the customers of the bank i s

largely attri buted to the management poli cy

regardi ng the emphasi s on the i mportance of

such relati onshi ps as a means of promoti ng

I slami c values i n the soci ety and furtheri ng

the vi abi li ty of I slami c bank systems.

Among the i nvesti gated elements of deliv-

ery systems, bank equi pment received a rela-

tively lowest sati sfacti on score (mean = 3.28).

Several i ntervi ews conducted wi th some

customers have revealed a common

complai nt about the effi ci ency of ATM i n

di fferent locati ons. The remai ni ng two ele-

ments of product/ servi ce delivery systems,

locati on and eveni ng banki ng hours, have

received adequate sati sfacti on scores of 3.48

and 3.37 respectively. Given the relatively

small si ze of Bahrai n, the number of I slami c

banki ng offi ces (head offi ces and branches)

appears to be adequate. Bahrai n I slami c

Bank, wi th i ts ve offi ces, appears to be pre-

sent i n the major populati on centers i n

Bahrai n. Thi s allows the bank to attract those

customers who emphasi ze the i mportance of

closer to home product/ servi ce delivery

systems. Fai sal I slami c Bank, through i ts

head offi ce i n Manama and i ts recently

opened branch i n Ri ffa, appears to be gai ni ng

momentum i n reachi ng customers i n major

populati on concentrati on areas.

4.6. Sel ect i on cri t eri a

Bank selecti on attri butes have been exten-

sively i nvesti gated i n the li terature (Hegazy,

1995; J avalgi et al., 1989; Khazeh and Decker,

1992; Ross, 1989). After a detai led revi ew of

these selecti on cri teri a and given the nature

of I slami c bank operati ons, products, ser-

vi ces, and phi losophy, four basi c attri butes,

were selected and tested i n the current study.

These widely investigated attributes adopted

from similar studies are: adherence to Islamic

principles, advice and recommendations of

fami ly and fri ends, conveni ence of the bank

locati on, and retur n on i nvestment.

Tabl e VI

Degree of satisfaction with the basic elements

of product/ service delivery systems

El ement s of

product / servi ce Degree of

del i very syst ems sat i sfact i on* Rank

Bank empl oyees 4.08 1

Equi pment 3.28 4

Locat i on 3.48 2

Eveni ng banki ng hours 3.37 3

Not e: *mean, maximum =5

[ 308 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7[1998] 299313

Si nce the goal of I slami c banks i s not li m-

i ted to the maxi mi zati on of the shareholders

wealth, but also i ncludes the enhancement of

the communi ty standard of livi ng and welfare

as prescri bed i n the I slami c pri nci ples, adher-

ence to those pri nci ples i n the banks transac-

ti ons i s expected to be used as a key selecti on

cri teri on (Hegazy, 1995), along wi th other

factors i ncludi ng advi ce and recommenda-

ti ons, conveni ence of bank locati on and

retur n on i nvestment. The relative i mpor-

tance of each of the i nvesti gated attri butes i n

the selecti on of I slami c banks i s shown i n

Table VI I .

The factor receivi ng the hi ghest degree of

i mportance i n the bank selecti on process i s a

reli gi ous factor, the adherence to I slami c

pri nci ples, wi th a score of 4.7. Thi s hi gh score

i ndi cates that the selecti on of I slami c banks

appears to be predomi nantly a reli gi ous-

based deci si on. Thi s result i ndi cates that

I slami c banks enjoy a relatively strong power-

base among those customers who emphasi ze

the adherence to the I slami c pri nci ples i n the

practi ces of the nanci al i nsti tuti ons they

select. However, thi s relative advantage has

been threatened i n recent years wi th several

conventi onal banks launchi ng thei r I slami c

i nvestment uni ts. The most recent example i s

Ci ti bank-Bahrai n whose I slami c i nvestment

uni t has begun i ts operati ons i n J une 1996.

Several other conventi onal banks are plan-

ni ng to follow the path of Ci ti bank, i ncludi ng

Arab Banki ng Corporati on (ABC) whi ch sti ll

plans to launch i ts I slami c i nvestment uni t i n

1998. I n the li ght of these developments, estab-

li shed I slami c banks are more than ever

under pressure to prove to thei r current and

prospective customers that they represent a

vi able banki ng alter native whi ch can com-

pete effectively wi th conventi onal banks i n

all areas of the banki ng busi ness. Fai lure to

achi eve thi s goal wi ll certai nly lead to the

erosi on of thei r tradi ti onal power-base among

thei r customers as some of them wi ll tur n to

those newly-establi shed I slami c i nvestment

uni ts that operate as part of the conventi onal

banks.

Compari ng the above results wi th those

reported i n previ ous studi es on bank selec-

ti on cri teri a (J avalgi et al., 1989; Kaynak and

Yavas, 1985; Ruddi ck, 1986), one can noti ce

that the si ngle most i mportant factor i n the

bank selecti on deci si on i s rate of retur n

offered i n the case of conventi onal banks,

whi le i t i s the adherence to I slami c pri nci -

ples i n the case of I slami c banks. Those

observed di fferences are largely related to the

di fferent theoreti cal bases of the two banki ng

systems. Whi le conventi onal commerci al

banks are i nterest-based nanci al i nsti tu-

ti ons, whose emphasi s i s on rate of retur n

(i nterest) offered or charged by the bank,

I slami c banks on the contrary are mai nly

prot and loss shari ng i nsti tuti ons that

emphasi ze the appli cati on of the I slami c

pri nci ples i n thei r nanci al transacti ons i n

order to achi eve economi c and soci al develop-

ment.

Further more, the results reported i n Table

VI I show that the second most i mportant

factor i n the selecti on of I slami c banks i s rate

of retur n, wi th a mean score of 3.85. Thi s

shows that I slami c bank customers sti ll con-

si der the rate of retur n, along wi th thei r reli -

gi ous commi tment, as key factors i n the

choi ce of thei r I slami c banks. Previ ous stud-

i es on bank selecti on cri teri a have shown that

the rate of retur n cri teri on i s a leadi ng factor

i n the selecti on of conventi onal banks

(Hegazy, 1995; J avalgi et al., 1989; Laroche et

al., 1986). The results of thi s study conr m

the i mportance of the rate of retur n cri teri on

i n the selecti on of I slami c banks.

The results presented i n Table VI I also

i ndi cate that the thi rd most i mportant factor

i n the selecti on of I slami c banks i s a refer-

ence-ori ented factor, reecti ng the relative

i mportance of fri ends and peers advi ce and

recommendati ons as a selecti on cri teri on.

The mean score of 3.51 for thi s factor i ndi -

cates a relatively strong role for fami ly and

fri ends i n passi ng on recommendati ons to

thei r members and peers regardi ng the bank

selecti on deci si on.

Fi nally, the conveni ence of bank locati on

was also found to have a consi derable role i n

the bank selecti on deci si on, wi th a score of

3.0. However, looki ng at the conveni ence

attri bute i n the context of other attri butes, i t

becomes evi dent that conveni ence of bank

locati on does not play the same role as the

other three attri butes.

4.7. The rel at i onshi p bet ween soci o-

demographi c fact ors and Isl ami c bank

sel ect i on cri t eri a

The relative i mportance of the selecti on cri te-

ri a, reported i n Table VI I , i s li kely to be

i nuenced by the vari ati on i n some

Tabl e VII

Degree of importance of factors affecting the

customer choice of Islamic banks

Degree of

Fact or i mpor t ance* Rank

Isl ami c pri nci pl es 4.7 1

Fami l y and fri ends 3.51 3

Conveni ent l ocat i on 3.00 4

Rat e of ret urn 3.85 2

Not e: * mean, maximum =5

[ 309 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7 [1998] 299313

soci o-demographi c factors such as age,

i ncome and educati on. To exami ne the rela-

ti onshi p between those factors and the

I slami c bank selecti on cri teri a, a number of

chi -square tests were conducted. Table VI I I

presents a summary of the outcome of these

tests.

Accordi ng to the results of the chi -square

tests presented i n Table VI I I , i t appears that

there i s a si gni cant relati onshi p between

customer age and the relative i mportance of

I slami c pri nci ples as a selecti on cri teri on.

Thi s i s i ndi cated by the hi gh value of chi -

square of 89.1 whi ch i s si gni cant at 0.000

level. A detai led exami nati on of the responses

reveals that more than 84 per cent of the cus-

tomers i n the 25-35 age group consi der

I slami c pri nci ples to be a very i mportant

vari able i n thei r bank selecti on deci si ons,

whi le only 56 per cent of the customers i n the

35-50 years age group consi der those pri nci -

ples to be very i mportant.

Based on these ndi ngs i t appears that

adherence to I slami c pri nci ples has a rela-

tively large i nuence on customers bank

selecti on deci si ons, especi ally on those rela-

tively younger customers (25-35 years). As

most of the customers i n thi s age group wi ll

be looki ng for I slami c nanci ng schemes to

nance thei r acqui si ti on of vari ous durable

goods, banks can respond posi tively by offer-

i ng vari ous nanci ng schemes to take

advantage of thi s fast-growi ng lucrative mar-

ket of relatively younger customers.

The results reported i n Table VI I I also i ndi -

cate that there i s a si gni cant relati onshi p

between customers i ncome and the relative

i mportance of the rate of retur n cri teri on

as i ndi cated by the si gni cant chi -square of

27.93. A detai led revi ew of the responses

received from the customers reveals that the

rate of retur n i s consi dered a relatively

i mportant cri teri on by users of the i nvest-

ment accounts, and that 75 per cent of the

users of the i nvestment accounts were i n the

hi gh-i ncome groups (BD400 and above). To

thi s segment of the market for I slami c nan-

ci al products/ servi ces, the rate of retur n

cri teri on appears to have a large i mpact on

thei r bank selecti on deci si on.

Further more, Table VI I I i ndi cates that

there i s a si gni cant relati onshi p between

customers age and the relative i mportance of

fami ly and fri ends as a bank selecti on cri te-

ri on as i ndi cated by the si gni cant chi -

square of 32.82. A closer exami nati on of the

responses reveals that 51 per cent of

customers i n the rst age group (less than 25

years) and 49 per cent of the customers i n last

age group (above 50 years) consi der thi s fac-

tor to be hi ghly i mportant i n thei r bank selec-

ti on deci si ons. However, only 36 per cent of

the customers i n the mi ddle age group (25-50)

consi der thi s factor to be i mportant. Based on

these results, i t can be concluded that the

younger and older bank customers are more

li kely to be i nuenced by thei r fami li es and

fri ends when maki ng thei r bank selecti on

deci si ons than those customers i n the mi ddle

age group. Thi s ndi ng has far-reachi ng

i mpli cati ons for for mulati ng adverti si ng and

promoti onal strategi es and plans for I slami c

banks.

Regardi ng the relati onshi p between the

customers educati onal level and the relative

i mportance of bank selecti on cri teri a, the

results presented i n Table VI I I reveal that

there i s a si gni cant relati onshi p between the

level of educati on and the relative i mportance

of I slami c pri nci ples i n the bank selecti on

process. Well-educated customers hi gh

school and college degrees tend to put more

emphasi s on I slami c pri nci ples i n selecti ng

thei r banks than those customers i n the other

educati onal groups. Further more, recom-

mendati ons and advi ce provi ded by fami ly

and fri ends tend to have more i nuence on

the less-educated customers, as i ndi cated by

the si gni cant X

2

value of 31.59. Fi nally, the

si gni cant X

2

value of 24.4 i ndi cates that

there i s a strong relati onshi p between the

customers level of educati on and the relative

i mportance of conveni ent locati on as a

selecti on cri teri on. A revi ew of the responses

received reveals that hi ghly-educated people

tend to put more emphasi s on the relative

i mportance of bank locati on as an attri bute of

thei r bank selecti on than do other customers

who are relatively less educated. The i mpli ca-

ti on of thi s ndi ng i s that I slami c banks

Tabl e VIII

Results of the chi square tests of the relationship between socio-

demographic factors and the relative importance of the selection criteria

Sel ect i on cri t eri a

Soci o-demographi c Isl ami c Fami l y and Conveni ent Rat e of

fact ors pri nci pl es fri ends l ocat i on ret urn

Age

X

2

89.1 32.82 26.92 11.19

DF 12 12 12 12

P 0.00 0.03 0.13 0.512

Income

X

2

75.27 31.58 24.79 27.93

DF 20 20 20 20

P 0.000 0.10 0.15 0.10

Educat i on

X

2

75 31.59 24.4 10.67

DF 16 16 16 16

P 0.001 0.05 0.10 0.557

[ 310 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7[1998] 299313

whose customer base i ncludes a large

number of well-educated customers, must

take i nto consi derati on the

preferences/ desi res of those customers when

choosi ng the locati on of thei r

offi ces/ branches. Agai n, thi s study conr ms

the i mportance of locati on as a bank selecti on

cri teri on, whi ch was also reported i n some

previ ous studi es (Hegazy, 1995; J avalgi et al.,

1989).

5. Concl usi on

Thi s study was desi gned to i nvesti gate the

banki ng behavi or of I slami c bank customers

i n the State of Bahrai n. A comprehensive

prole analysi s of I slami c bank customers

was conducted. Further more, customer

awareness of key I slami c bank products/ ser-

vi ces, thei r usage of those servi ces and thei r

sati sfacti on wi th the delivery systems uti -

li zed i n extendi ng them were also i nvesti -

gated . Fi nally, the key attri butes used by

I slami c bank customers i n maki ng thei r

selecti on deci si ons were also exami ned.

The general conclusi ons whi ch can be

derived from thi s study are:

Fi rst, the results of the study show that the

majori ty of I slami c bank customers are

well educated, wi th approxi mately 40 per

cent holdi ng hi gh school certi cates, and

about 50 per cent holdi ng a bachelor degree

or above. Further more, the results also

show that about 80 per cent of I slami c bank

customers fall between 25-50 years.

Second, the study results i ndi cate that more

than 75 per cent of I slami c bank customers

have had previ ous banki ng experi ence, and

about 54 per cent of the current customers

have mai ntai ned banki ng relati onshi p wi th

thei r I slami c bank for more than si x years.

Thi rd, the ndi ngs of the study show that

customer awareness and usage rates are

qui te hi gh for four key banki ng

products/ servi ces: current account (88.1

per cent ), savi ngs account (94 per cent),

ATM (90 per cent), and i nvestment accounts

(85 per cent). Among the least used prod-

uct/ servi ces were: money order drafts,

traveler cheques, letter of credi t and spe-

ci ally ordered bank statement.

Fourth, the study results i ndi cate that

whi le the current accounts, i nvestment

accounts, and ATM are mai nly used by hi gh

i ncome and well-educated customers, sav-

i ngs accounts were found to be very popu-

lar among all ranks of I slami c bank cus-

tomers.

Fi fth, the results of the study also i ndi cate

that I slami c bank customers i n Bahrai n

were found to be most sati sed wi th

products and servi ces they use most, wi th

i nvestment accounts receivi ng the hi gh-

est sati sfacti on score. Given the fact that

the i nvestment accounts represent more

than 70 per cent of total I slami c banks li a-

bi li ti es, i t appears that a large percentage of

i nvestment account holders are relatively

sati sed wi th the overall perfor mance of

thei r I slami c banks. Savi ngs accounts

received the second hi ghest sati sfacti on

score. However, the lowest sati sfacti on

score was associ ated wi th the I slami c

nanci ng schemes. Thi s suggests that

I slami c banks should re-exami ne thei r

nanci ng schemes wi th speci al attenti on

given to the procedures followed and the

true costs that customers usi ng those

schemes are actually payi ng.

Si xth, the results reported i n thi s study

i ndi cate that bank employees received the

hi ghest sati sfacti on score, followed by bank

equi pment.

Seventh, the results also i ndi cate that the

bank-selecti on deci si ons by bank

customers are predomi nantly reli gi ous-

based deci si ons. Adherence to I slami c

pri nci ples was found to be the most i mpor-

tant selecti on cri teri on, followed by rate of

retur n. I n thi rd place came the recommen-

dati ons made by fami ly and fri ends. Conve-

ni ence of locati on was found to be the least

i mportant selecti on cri teri on .

Recommendat i ons

1 I slami c banks need to desi gn and i mple-

ment vi able servi ce quali ty programs.

Fai lure to provi de the full range and the

ri ght quali ty of the servi ces wi ll i nevi tably

lead to seri ous di ffi culti es i n retai ni ng

thei r current customers and attracti ng

new ones. I n thi s regard, I slami c banks

may nd i t useful to exami ne the practi ces

of successful conventi onal banks i n order

to upgrade thei r programs for i mprovi ng

the quali ty of thei r servi ces.

2 The future of I slami c banks hi nges on

havi ng the most hi ghly-quali ed manage-

ment team, commi tted to the success of

these banks. Professi onali sm and compe-

tence are key i ngredi ents for successful

relati onshi ps wi th I slami c bank

customers. Trai ni ng programs may prove

to be a useful tool for i mprovi ng the man-

ageri al capabi li ti es of I slami c bank staff.

3 The results of the prole analysi s revealed

that the I slami c bank customers are rela-

tively young and have a hi gh i ncome.

These ndi ngs can be used as a basi s for

for mulati ng and launchi ng appropri ate

savi ng and nanci ng schemes that sui te

the demographi cs of the customers i n

those i ncome and age groups.

[ 311 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7 [1998] 299313

4 Another noti ceable ndi ng was the gap

found between awareness and usage for

most products and servi ces i nvesti gated i n

the study. Thi s gap i s relatively wi de for

certai n products and servi ces such as

nanci ng faci li ti es. These ndi ngs

reveal the urgent need of I slami c bank

management for for mulati ng and i mple-

menti ng effective adverti si ng and promo-

ti onal strategi es to i ncrease the percent-

age of usage of thei r exi sti ng products/ ser-

vi ces as well as thei r new products/ ser-

vi ces.

Duri ng thi s study, I slami c bank customers

were requested to provi de any suggesti ons,

whi ch they thought, would i mprove the effec-

tiveness of bank servi ces. Those suggesti ons

are li sted below wi thout explanati ons or

elaborati on:

1 I mprove ATM servi ces through the acqui -

si ti on of new machi nes and/ or the proper

mai ntenance of the exi sti ng teller

machi nes.

2 Change of Thursday banki ng schedule

from 8.30-11.30 to 9.00 -12.30. Thi s would

provi de more conveni ence to the bank

customers.

3 I nfor mati on about the bank activi ti es and

the new lendi ng/ savi ngs schemes must be

communi cated through brochures handed

to customers.

4 Eveni ng banki ng servi ces should be pro-

vi ded by all branches on a dai ly basi s.

5 There should be a suffi ci ent amount of

parki ng avai lable to bank customers.

6 I ncrease number of tellers duri ng the rush

peri ods.

7 Banks must conduct qui ck and easy sur-

veys of the expressed percepti ons of the

customers regardi ng the servi ces offered,

i n order to i denti fy and correct mi sconcep-

ti ons.

Ref erences

Anderson, E.W., For nell, C. and Lehman, D.R.

(1993), Economi c consequences of provi di ng

quali ty and customer sati sfacti on, Worki ng

paper, (Report 93-112), Marketi ng Sci ence

I nsti tute, Cambri dge, MA.

Anderson, W.T., Fox, E.P. and Fulcher, D.G. (1976),

Bank selecti on deci si ons and market seg-

mentati on, J ournal of Marketing, Vol. 40, pp.

40-5.

Bahrai n Monetary Agency (1997), Quarterly Sta-

tistical Bulletin, Vol. 23 No. 3.

Bartell, S. (1993), Bui ldi ng strong customer

relati ons, Bank Marketing, Vol. 25 No. 6, pp.

16-19.

Bedall, D. and Power, T. (1995), Cultivati ng loyal

pati ents, J ournal of Health Care Marketing,

Vol. 15 No. 4.

Berry, L. and Parasuraman, A. (1991), Marketing

Services: Competing Through Qualities, Free

Press, New York, NY.

Bi tner, M.J . (1990), Evaluati ng servi ce encoun-

ters: the effects of physi cal surroundi ngs and

employee responses, J ournal of Marketing,

Vol. 54, pp. 69-82.

Brenhardt, K.L., Donthu, N. and Kennett, P.A.

(1994), The Relationship Between Customer

Satisfaction, Employees Satisfaction and Prof-

itability: a Longitudinal Analysis, Department

of Marketi ng, Georgi a State Universi ty,

Atlanta, GA.

Buzzel, R.D. and Gale, B.T. (1987), The PI MS Prin-

ciples: Linking Strategy to Performance, Free

Press, New York, NY.

Chakravarty, S., Wi ddows, R. and Fei nberg, R.

(1996), How moments of truth dene bank-

customer relati onshi ps, J ournal of Retail

Banking Services, Vol. 18 No. 1, pp. 29-34.

Channon, F.D. (1986), Bank Strategic Management

and Marketing, J ohn Wi ley & Sons, New York,

NY.

Chi twood, R. (1996), Selli ng i n a non-sales envi -

ronment, Bank Marketing, Vol. 28 No. 7, pp.

41-2.

Croni n J r, J .J . and Taylor, S.A. (1992), Measuri ng

servi ce quali ty: a re-exami nati on and exten-

si on, J ournal of Marketing, Vol. 56, pp. 55-68.

Di spensa, G. (1997), Use logi sti c regressi on wi th

customer sati sfacti on data, Marketing News,

J anuary 6, p. 13.

Evans, R.H. (1979), Bank selecti on: i t all depends

on the si tuati on, J ournal of Bank Research,

Vol. 12, pp. 243-9.

Gremler, D., Bi tner, M. and Evans, K. (1995), The

i nternal servi ce encounter, Logistics I nfor-

mation Management, Vol. 8 No. 4, pp. 28-34.

Gronroos, C. (1982), Strategic Management and

Marketing in the Service Sector, Swedi sh

School of Economi cs and Busi ness Admi ni s-

trati on, Helsi nfors.

Gulledge, L. (1996), Sati sfacti on measurement i s

more than doi ng surveys, Marketing News,

Vol. 30 No. 22, October 22, p. 8.

Haron, S., Ahmed, N. and Plani sek, S. (1994),

Bank patronage factors of Musli ms and non-

Musli m customers, I nternational J ournal of

Bank Marketing, Volume 12 No. 1, pp. 32-40.

Hegazy, I .A. (1995), An empi ri cal comparative

study between I slami c and commerci al banks

selecti on cri teri a i n Egypt, I nternational

J ournal of Contemporary Management, Vol. 5

No. 3, pp. 46-61.

Holli day, K. (1996), Keepi ng close to the

customer, Bank Marketing, Vol. 28 No. 6, pp.

14-19.

I J RDM (1995a), Too successful for i ts own good:

The Co-operative bank, I nternational J our-

nal of Retail and Distribution Management,

Vol. 23 No. 11, pp. x-xi .

[ 312 ]

Saad A. Metawa and

Mohammed Almossawi

Banking behavior of Islamic

bank customers: perspectives

and implications

International J ournal of

Bank Marketing

16/ 7[1998] 299313

I J RDM (1995b), Complai nts map the Royal Bank

of Scotlands road to servi ce recovery, I nter-

national J ournal of Retail and Distribution

Management, Vol. 23 No. 11, pp. vi i i -i x.