Professional Documents

Culture Documents

IdP Debt Funds

Uploaded by

Kanishq BawejaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IdP Debt Funds

Uploaded by

Kanishq BawejaCopyright:

Available Formats

Contents

SUMMARY .......................................................................................................................... 3

INTRODUCTION TO THE SUBJECT ................................................................................ 4

CONCEPT: ........................................................................................................................ 4

Phases of the Industry ....................................................................................................... 4

Why Invest in Mutual Funds Advantages ...................................................................... 6

Increases the purchasing power of investors ..................................................................... 6

Disadvantages of Investing in Mutual Funds: ................................................................... 6

Types of risks .................................................................................................................... 7

Types of returns ................................................................................................................. 8

Types of Mutual Funds ......................................................................................................... 9

(I)Mutual Funds Classification based on Investment Objective: ...................................... 9

(II)Mutual Fund Investment Based on Constitution: ...................................................... 10

OBJECTIVE OF THE STUDY .......................................................................................... 11

METHODOLOGY .............................................................................................................. 12

SOURCES OF DATA ......................................................................................................... 13

COMPANIES SELECTED FOR ANALYSIS ................................................................... 14

RESEARCH INSTRUMENTS ....................................................................................... 14

LIMITATIONS OF THE REPORT: ............................................................................... 14

DEBT FUNDS .................................................................................................................... 16

How do debt funds make money? ................................................................................... 16

RISKS OF A DEBT MUTAUL FUND .......................................................................... 16

Why debt? ....................................................................................................................... 17

The options ...................................................................................................................... 17

Tax arbitrage ................................................................................................................... 17

Investment horizon .......................................................................................................... 18

Investing in debt funds still makes sense. Here's why: ................................................... 19

Current situation .............................................................................................................. 20

COMPARATIVE ANALYSIS OF HDFC FUND HOUSE (DEBT SCHEMES) .............. 21

HDFC Gilt Fund - Long Term Plan ................................................................................ 22

ANALYSIS OF HDFC Gilt Fund - Long Term Plan ..................................................... 25

HDFC Income Fund G ................................................................................................. 26

ANALYSIS OF HDFC INCOME FUND .................................................................... 31

HDFC MF Monthly Income Plan - Short Term Plan ...................................................... 32

ANALYSIS OF HDFC MONTHLY INCOME PLAN SHORT TERM .................. 36

HDFC MF Monthly Income Plan - Long Term Plan ...................................................... 37

ANALYSIS OF HDFC MF Monthly Income Plan - Long Term Plan ........................... 41

HDFC Q Interval Plan C Retail-G .................................................................................. 42

ANALYSIS OF Q Interval Plan C Retail-G ................................................................... 44

HDFC FMP 36M Jun 2007 Retail-G .............................................................................. 45

ANALYSIS HDFC FMP 36M Jun 2007 Retail-G .......................................................... 47

SNAPSHOT OF HDFC DEBT FUND SCHEMES ........................................................ 48

ANALYSIS FOR FUND SCHEMES OF HDFC MUTUAL FUND: ............................ 48

COMPARATIVE ANALYSIS OF SBI FUND HOUSE (DEBT SCHEMES) .................. 49

Magnum Gilt Long-term-G ............................................................................................. 50

ANALYSIS OF Magnum Gilt Long-term-G .................................................................. 53

Magnum Income-G ......................................................................................................... 54

ANALYSIS OF Magnum Income-G .............................................................................. 57

Magnum Income Plus Fund (Investment Plan) ............................................................... 58

ANALYSIS OF Magnum Income Plus Fund (Investment Plan) .................................... 63

Magnum NRI Investment Fund ....................................................................................... 64

ANALYSIS OF Magnum NRI Investment Fund ............................................................ 67

SBI Debt Fund Series 24 Months 1-G ............................................................................ 68

ANALYSIS OF SBI Debt Fund Series 24 Months 1-G .................................................. 71

SNAPSHOT OF SBI HDFC DEBT FUND SCHEMES ................................................ 72

ANALYSIS FOR FUND SCHEMES OF SBI MUTUAL FUND: ................................. 72

RECOMMENDATIONS .................................................................................................... 73

STEPS TO BE TAKEN BY SEBI .................................................................................. 73

Steps to be taken by AMCs ............................................................................................. 73

CONCLUSION ................................................................................................................... 74

LOOKING AHEAD ............................................................................................................ 76

BIBLOGRAPHY ................................................................................................................ 77

ANNEXURE ....................................................................................................................... 78

GLOSSARY .................................................................................................................... 79

SUMMARY

In the past few years Mutual Fund has emerged as a tool for ensuring ones financial well-being.

Mutual Funds have not only contributed to the India growth story but have also helped families tap

into the success of Indian Industry. As information and awareness is rising more and more people

are enjoying the benefits of investing in mutual funds.

The first part gives an insight about Mutual Fund industry and its various aspects, the Company

Profile, Objectives of the study, Research Methodology. One can have a brief knowledge about

Mutual Fund and its basics through the Project.

The project report in its later part presents data analysis. More importance is given to analyze why

debt funds are better? To realize the better performance of debt funds, comparison of two good

Fund Houses namely HDFC Mutual Fund SBI Mutual fund have been done in detailed keeping in

mind some important schemes. Schemes that have been analyzed in this project are many like Gilt

Short, Medium & Long, Debt Short Term, FMPs (Fixed Maturity Plan) etc. These schemes have

been analyzed taking into consideration main pillars of Debt Funds, i.e. Credit Quality, Liquidity,

Return, Average Maturity etc.

INTRODUCTION TO THE SUBJECT

CONCEPT:

A mutual fund is pool of money, which is collected from many investors and is invested by an

Asset Management Company to achieve some common objective of the investors.

The investment manager invests the money collected into assets that are defined by the stated

objective of the scheme. For example, an Equity fund would invest in Equity and Equity related

instruments and a Debt fund would invest in Bonds, Debentures, and Gilts etc. Further, a mutual

fund is just the connecting bridge or a financial intermediary that allows a group of investors to

pool their money together with a predetermined investment objective. The mutual fund will have a

fund manager who is responsible for investing the gathered money into specific securities (stocks

or bonds).

MUTUAL FUND OPERATION FLOW CHART

Phases of the Industry

PHASE YEAR PHASE KNOWN AS

Phase 1 1964-1987 Growth of UTI

Phase 2 1987-1993 Entry of Public Sector banks

Phase 3 1993-1996 Emergence of Private Funds

Phase 4 1996-1999 Growth and SEBI regulations

Phase 5 1999-2004 Emergence of a large and uniform industry

Phase 6 2004 onwards Consolidation and growth

The risk return trade-off indicates that if investor is willing to take higher risk then

correspondingly he can expect higher returns and vice versa if he pertains to lower risk

instruments, which would be satisfied by lower returns. For example, if an investors opt for bank

FD, which provide moderate return with minimal risk.

Thus investors choose mutual funds as their primary means of investing, as Mutual funds provide

professional management, diversification, convenience and liquidity. That doesnt mean mutual

fund investments risk free. This is because the money that is pooled in are not invested only in

debts funds which are less riskier but are also invested in the stock markets which involves a

higher risk but can expect higher returns. Hedge fund involves a very high risk since it is mostly

traded in the derivatives market which is considered very volatile.

Why Invest in Mutual Funds Advantages

Increases the purchasing power of investors

Risk reduction through diversification

Reduction of risk

Money would be managed by professionals at low costs

Reduction of transaction costs due to economies of operation at a large scale

Liquidity (Fast redemption)

Convenience of investing the money and tracking the performance of money

Flexibility to change investment objectives

Safety of regulatory environment by SEBI made the industry very transparent

Mutual funds offer a whole range of industries / sectors to choose from.

Disadvantages of Investing in Mutual Funds:

No control over Cost in the Hands of an Investor

No tailor-made Portfolios

Managing a Portfolio Funds

Difficulty in selecting a Suitable Fund Scheme

Types of risks

All investments involve some form of risk. Mentioned below are the common types of risks. An

investor would do well to evaluate them against potential rewards while selecting an investment.

Market Risk: At times, the prices or yields of all the securities in a particular market, rise

or fall due to broad outside influences. When this happens, the stock prices of both an

outstanding, highly profitable company and a fledgling corporation may be affected. This

change in price is due to "market risk". It is also known as systematic risk and interest

rate risk.

Inflation Risk: Sometimes referred to as "loss of purchasing power." There would be

no such risk if the interest of the bond is linked to the rate of inflation.

Credit Risk: In short, how stable is the company or entity to which one lends his/her

money while investing? How certain are you that it will be able to pay the interest you are

promised, or repay your principal when the investment matures?

Interest Rate Risk: Changing interest rates affect both Equities and bonds in many ways.

Investors are reminded that "predicting" which way rates will go, is rarely successful. A

diversified portfolio can help in offsetting these changes.

Exchange risk: A number of companies generate revenues in foreign currencies and may

have investments or expenses also denominated in foreign currencies. Changes in

exchange rates may, therefore, have a positive or negative impact on companies which in

turn would have an effect on the investment of the fund.

Investment Risks: In sartorial fund schemes, investments will be predominantly in

Equities of select companies in the particular sectors. Accordingly, the NAV of the

schemes are linked to the equity performance of such companies and may be more volatile

than a more diversified portfolio of Equities.

Types of returns

There are three ways, where the total returns provided by mutual funds can be enjoyed by

investors:

1. Income is earned from dividends on stocks and interest on bonds. A fund pays out nearly

all income it receives over the year to fund owners in the form of a distribution.

2. If the fund sells securities that have increased in price, the fund has a capital gain. Most

funds also pass on these gains to investors in a distribution.

3. If fund holdings increase in price but are not sold by the fund manager, the fund's shares

increase in price. You can then sell your mutual fund shares for a profit. Funds will also

usually give you a choice either to receive a check for distributions or to reinvest the

earnings and get more shares.

Types of Mutual Funds

(I)Mutual Funds Classification based on Investment Objective:

1) Equity Oriented

a) General Purpose: The investment objectives of general-purpose. Equity schemes do not

restrict these funds from investing only in specific industries or sectors. Hence these funds

have a diversified portfolio of companies spread across a vast spectrum of industries.

b) Sector Specific: These schemes restrict their investing to one or more pre-defined sectors,

e.g. technology sector. More risky since it is concentrated only one sector.

c) Special schemes:

i) Index schemes: The primary purpose of an Index is to serve as a measure of the

performance of the market as a whole, or a specific sector of the market. An Index also

serves as a relevant benchmark to evaluate the performance of Mutual Funds.

ii) Tax saving schemes: Tax-saving schemes offer tax rebates to the investors under tax

laws prescribed from time to time. Under Sec.88 of the Income Tax Act, contributions

made to any Equity Linked Savings Scheme (ELSS) are eligible for rebate.

2) Debt Based

The objective of these Funds is to invest in debt papers. Government authorities, private

companies, banks and financial institutions are some of the major issuers of debt papers. By

investing in debt instruments, these funds ensure low risk and provide stable income to the

investors.

a. Income Schemes: Income schemes invest in long- and medium-term instruments like

corporate bonds, debentures, fixed deposits

b. Liquid Income Schemes: Liquid Income Schemes are similar to the Income schemes but have

a shorter maturity period.

c. Money Market Schemes: These schemes invest in short term instruments such as commercial

paper ("CP"), certificates of deposit ("CD"), treasury bills ("T-Bill") and overnight money

("Call"). Since they invest in short-term maturities they are least volatile.

d. Gilt Funds: Investment is done in Government securities. Less credit risky, since Government

Debt is generally credit risk free. Choosing between a between gilt and an income fund would

depend upon the risk appetite of any investor.

3) Hybrid Scheme

These schemes are commonly known as balanced schemes and invest in both equities as well as

debt. By investing in a mix of this nature, balanced schemes seek to attain the objective of income

and moderate capital appreciation and are ideal for investors with a conservative, long-term

orientation.

(II)Mutual Fund Investment Based on Constitution:

Open-ended schemes: An open-end fund is one that is available for subscription all

through the year. These do not have a fixed maturity. Investors can conveniently buy and

sell units at Net Asset Value ("NAV") related prices. The key feature of open-end schemes

is liquidity.

Close-ended schemes: Close-ended schemes have fixed maturity periods. Investors can

buy into these funds during the period when these funds are open in the initial issue. After

that, such schemes cannot issue new units except in case of bonus or rights issue.

However, after the initial issue, you can buy or sell units of the scheme on the stock

exchanges where they are listed.

Interval schemes: These schemes combine the features of open-ended and closed-ended

schemes. They may be traded on the stock exchange or may be open for sale or

redemption during pre-determined intervals at NAV based prices.

OBJECTIVE OF THE STUDY

The mutual fund industry in India has come a full circle from being an open competitive market to

nationalization.

The objective behind taking this project was:

To gain knowledge about Mutual Fund Industry with special focus on Debt Fund

Analyze the performance of Debt Funds by comparing with Critical parameters.

To know how effective debt schemes funds and their performance is in comparison with

various benchmark indices

To look at the debt fund as a separate sector and therefore know its benefits and limitations

To analyze the Debt Fund trend

To get a holistic picture of the Mutual Fund Industry in India, analyze its trends and

market potential

Apart from having theoretical knowledge of Mutual Fund as a subject there was a need to know

more things beyond academics syllabus. The same was possible only by taking live project like

this.

Hence, the project for Debt Fund Analysis was selected under the guidance of Core faculty guide.

METHODOLOGY

Market research calls for developing the research plan for gathering the required information. The

aim of the research was to find out How Mutual Funds work with a special focus on Debt Fund

Schemes. Two different debt fund house were analyzed to get a clear picture out of this project.

The following method is adopted for carrying out the research:

SOURCES OF DATA

Secondary data is taken into consideration for this project. Primary data could not be collected as

people are not aware much about Debt Fund Schemes. As compare to Equity funds debt funds are

not popular.

Although the secondary data has been used to compare critical parameter like return till date,

NAV, Current Sharpe Ratio & Expense ratio etc., care has been taken not to take outdated

secondary data.

Secondary source is the data obtained from published / unpublished sources. This constitutes the

chief material on the basis of which research work is carried out. The secondary data used, in this

report has been obtained from Valueresearchonline, Indiainfoline, Research Database, Google and

other search engine websites. Secondary data has also helped to get a complete information about

the two different fund house.

COMPANIES SELECTED FOR ANALYSIS

The Mutual Fund house selected for analysis are HDFC and SBI Mutual Fund, which are

performing well in the market, and different concepts in this project can be easily understood and

explored.

RESEARCH INSTRUMENTS

Initially common research instrument such as different types of graphs, Ratios etc. are used to

study the parameters affecting the debt schemes.

LIMITATIONS OF THE REPORT:

Time Constraint

Study is based on historical and current data

Detailed information related for future of debt fund was not completely

available

No primary data could be collected by actually visiting the people due

to lack of knowledge of Debt Funds.

DEBT

FUND

ANALYSIS

DEBT FUNDS

Investments goals vary from person to person. While somebody wants security, others

might give more weight age to returns alone. Somebody might want to plan for his childs

education while somebody might be saving for proverbial rainy days or even life after

retirement. With objectives defying any range, it is obvious that the products required will

vary as well.

How do debt funds make money?

In three ways precisely

Through the interest they get on the bonds they hold,

Through gains made by marking the portfolio to market values(assuming that bond values

rise)

Through trading gains, i.e., by actively churning the portfolio

RISKS OF A DEBT MUTAUL FUND

Broadly, there can be two risks in a debt fund:

1. Credit Risk: The money in debt funds is invested in interest-bearing instruments of banks,

companies and Govt. such as bonds, FDs, GSecs etc. Therefore if a particular company or

a bank defaults, then it will affect the returns. However, considering the fact that a

particular scheme would invest in many companies/banks, a default by a few will not

impact the returns much. Moreover, MFs invest mainly in top-rated instruments, where the

risk of default is very low. So overall this is not a very big risk, unless of course there is a

mass default or a MF invests in low-rated instruments.

2. Interest Rate Risk: The interest rate and the bond price have an inverse relationship. If

interest rates rise, bond prices will fall. Accordingly the NAV, which is calculated from

the bond prices, will also fall. But if interest rates fall, bond prices and consequently the

NAV will rise. And the longer is the maturity of a particular bond, the more it falls/rises.

Why debt?

Ideally, investments in the equity markets are fraught with uncertainties and volatility. And hence,

these factors nullify a constant flow of returns, which debt schemes, to a certain extent, guarantee.

And this being true of the current market scenario, there is a growing shift towards debt schemes.

Hence, in order to secure the hard-earned money, the investment is protected through proper asset

allocation of 60:40 between debt and equity. And this also depends upon the investors goals and

risk-taking capacity.

However, to consolidate a portfolio, one has to focus on retaining the income generated through

equity, considering their high-risk nature. And this way, one can reduce the equity component and

increase the debt exposure gradually. Investing in debt funds will give a steady income without

destroying the capital.

The options

Debt funds have a fairly wide range of schemes offering something for all types of investors.

Liquid fund, Liquid plus funds, Short term income funds, GILT funds, income funds and

hybrid funds are some of the more popular categories.

For long term investors, income funds provide the best opportunity to gain from interest rate

movements. Liquid funds can be used for very short term surpluses. Fixed maturity plans have

been gaining in popularity as they minimize the interest rate risk and offer reasonable returns to

debt investors.

Tax arbitrage

A potent reason behind investing in debt funds is the tax benefit. Specifically, this is termed as tax

arbitrage. Investing in debt attracts tax but in a different manner. Opting for dividend option in

liquid/money market schemes attracts net dividend distribution tax of 28.325% and the remaining

debt schemes (like gilt, income/bonds) attract 14.16% tax in the hands of mutual funds. Any

investment, be it in fixed deposit schemes of any bank or in debt funds have to be looked beyond

the rate offered on the investment. For the purpose of determining the attractiveness of the

investment, effective return, that is, post-tax returns should be given more weight. Dividends from

debt mutual funds are taxed at a rate lower than highest marginal tax rate. The long term capital

gains can also be paid after indexation benefit.

Investment horizon

As an investor one should invest taking a holistic view and have debt funds as part of overall

portfolio. Beauty is, debt is one category where there is some option for every investment

horizon. Investors can select a fund on the basis of respective investment horizon. For example,

an investor with an overnight investment horizon may choose a liquid fund where one may choose

a hybrid fund for investment horizon of 18 months or higher. Generally speaking, there is a linear

relationship between investment horizon and returns other things remaining the same.

Investing in debt funds still makes sense. Here's why:

Debt funds offer benefits, which pure debt investments (like bonds and deposits) don't. If

there were to be a further decline in interest rates, and one has directly invested in debt

instruments, it would not mean much. One would hardly trade the securities that they hold

since all one would want to collect is the promised interest at the end of the term. But a

debt fund can post a better return by marking the bonds in its portfolio to their rising

market value, and by actively trading them.

The era of tax concessions is ending. With lower interest rates already acting as a

dampener, small saving schemes appear to be at a disadvantage compared to debt funds.

Unlike the case of direct investments in bonds, higher returns in debt funds need not

necessarily mean higher risks. Several debt funds have achieved great returns from a

steady income stream and aggressive duration management (that is managing bonds'

tenure in the portfolio), without their risk going up. In short, exceptional returns in debt

funds need not mean higher risks. In pure debt instruments, higher return is certainly the

result of the issuer taking higher risks.

Unlike retail investors, debt fund managers do not rely only on the rating of credit rating

agencies while evaluating bonds. The market has a way of downgrading a bond even

before the bond is actually downgraded by a rating agency.

Debt fund managers can factor in a possible industrial recovery in their strategies.

A debt fund manager can move a substantial chunk of the corpus into corporate bonds and

reap higher returns because of spread contraction. As individual investors, simply don't

have the means to make such moves.

Current situation

While not too long ago, liquid and liquid plus funds faced a major crisis due to the sudden

redemption pressure, things have improved now. The debt market is smooth and offers investors a

safe place to keep money, provided no more panic situations arise. After the Reserve Bank of India

(RBI) cut cash reserve ratios and opened a separate window for mutual funds to borrow against

certificates of deposit, the debt market overload eased up considerably. Investors have burnt their

fingers before in the equity market and are now focusing solely on wealth preservation. The debt

market is looking the most attractive currently and investors are still keen on keeping a sizeable

portion of their portfolio invested in debt.

In India, unlike abroad, one cannot invest in debt instruments as a retail investor and that means

the mutual fund route is what investors must use. This has in such times been a blessing in disguise

for investors as the risks they could face have been considerably reduced. As such, amongst all the

risks mentioned the two most prominent ones that one should take care against are interest rate

risks and credit risks.

COMPARATIVE ANALYSIS OF HDFC FUND HOUSE (DEBT

SCHEMES)

WHY HDFC MUTUAL FUND?

HDFC Mutual Fund is one of the largest mutual funds and well-established fund house in the

country with consistent and above average fund performance across categories since its

incorporation on December 10, 1999. The single most important factor that drives HDFC Mutual

Fund is its belief to give the investor the chance to profitably invest in the financial market,

without constantly worrying about the market swings. To realize this belief, HDFC Mutual Fund

has set up the infrastructure required to conduct all the fundamental research and back it up with

effective analysis.

The Debt based Funds offered by this house are:

HDFC GILT FUND - LONG TERM PLAN

HDFC INCOME FUND - G

HDFC MF MONTHLY INCOME PLAN - SHORT TERM PLAN

HDFC MF MONTHLY INCOME PLAN - LONG TERM PLAN

HDFC Q INTERVAL PLAN C RETAIL-G

HDFC Gilt Fund - Long Term Plan

INVESTMENT OBJECTIVE: Is to generate credit risk free returns through investments in

sovereign securities issued by the Central Government and/or a State Government. The scheme is

a dedicated gilt scheme which seeks to generate reasonable returns with investments in

government securities, securities guaranteed by GoI with medium to long term residual maturities.

SNAPSHOTS

PERFORMANCE

ANALYSIS OF HDFC Gilt Fund - Long Term Plan

This fund has been rated 3 Star, this indicates Average performance of this fund in the same

category.

Average maturity of this fund is 11.73 years. Fund style of this fund is also marked as high for

Interest rate sensitivity.

Its benchmarking is done with the index which comprises securities maturing late than seven

years. So it can be said that benchmarking is done correctly.

Credit quality is high for this fund, it can be determined that there will be less possibility in its

default risk. Default risk is less since the investment of this fund is done AAA rated schemes.

Sharpe ratio is 0.47, that means the fund have generated 0.47 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 0.65

Beta of this fund is 0.66, it is less than 1 and it signifies that this fund is conservative fund,

means it is moving slowly than the market.

HDFC Income Fund G

INVESTMENT OBJECTIVE: The primary objective of the Scheme is to optimize returns while

maintaining a balance of safety, yield and liquidity from a portfolio of debt and money market

instruments.

SNAPSHOTS

ANALYSIS OF HDFC INCOME FUND

This fund has been rated 2 Star, this indicates below average performance of this fund in the

same category.

Average maturity of this fund is 9.27 years that can be considered as shorter. Fund style is

rated as high for Interest rate sensitivity.

Its benchmarking is done with the index which track the return on a composite portfolio that

includes call instrument, commercial paper, government securities as also the AAA and AA

related instruments. So it can be said that benchmarking is done correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Default risk is less since the investment of this fund is done AAA

rated schemes.

Sharpe ratio is 0.75, that means the fund have generated 0.75 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 1.00

Standard Deviation is 7.76.

Beta of this Fund is 0.94, it is less than 1, it signifies that this fund is conservative fund, means

it is moving slowly than the market.

HDFC MF Monthly Income Plan - Short Term Plan

INVESTMENT OBJECTIVE: The primary objective of Scheme is to generate regular returns

through investment primarily in Debt and Money Market Instruments. The secondary objective of

the Scheme is to generate long-term capital appreciation by investing a portion of the Scheme's

assets in equity and equity related instruments. However, there can be no assurance that the

investment objective of the Scheme will be achieved.

This aims to generate regular returns through investment primarily in debt and money market

instruments. It will also invest inequity and equity related securities to generate long-term capital

appreciation.

SNAPSHOT

ANALYSIS OF HDFC MONTHLY INCOME PLAN SHORT TERM

This fund has been rated 2 Star, this indicates below average performance of this fund in the

same category.

Average maturity of this fund is 2.29 years that can be considered as very short period, so this

scheme is sensitive to market interest rate change. Fund style for this is also rated as medium

for Interest rate sensitivity.

Its benchmarking is done with the index which track the return on a MIP portfolio that

includes both equity held in various companies as well as debt market instruments. Since

benchmarking is in line with this schemes objective it can be said that benchmarking is done

correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Default risk is less since the investment of this fund is done AAA

& AA rated schemes.

Sharpe ratio is -0.73 that means the fund have generated -0.73 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 2.23

Standard Deviation is 5. 68

Beta of this fund is 0.52 which is less than 1. This signifies that this fund is conservative fund,

means it is moving slowly than the market.

HDFC MF Monthly Income Plan - Long Term Plan

INVESTMENT OBJECTIVE: The primary objective of Scheme is to generate regular returns

through investment primarily in Debt and Money Market Instruments. The secondary objective of

the Scheme is to generate long-term capital appreciation by investing a portion of the Scheme`s

assets in equity and equity related instruments. However, there can be no assurance that the

investment objective of the Scheme will be achieved.

SNAPSHOTS

PERFORMANCE

ANALYSIS OF HDFC MF Monthly Income Plan - Long Term Plan

This fund has been rated 3 Star, this indicates average performance of this fund in the same

category.

Average maturity of this fund is 5.95 years, Fund style for this fund is also rated as high for

Interest rate sensitivity.

Its benchmarking is done with the index which track the return on a MIP portfolio that

includes both equity held in various companies as well as debt market instruments. Since

benchmarking is in line with this schemes objective it can be said that benchmarking is done

correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Default risk is less since the investment of this fund is done AAA

rated schemes.

Sharpe ratio is -0.61 that means the fund have generated -0.61 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 1.74

Standard Deviation is 9.54

Beta of this fund is 0.89, which is less than 1. That signifies that this fund is conservative fund,

means it is moving slowly than the market.

HDFC Q Interval Plan C Retail-G

ANALYSIS OF Q Interval Plan C Retail-G

Its benchmarking is done with the index which track the returns on a portfolio that includes

call instruments and commercial paper instruments. Since benchmarking is in line with this

schemes objective it can be said that benchmarking is done correctly.

Sharpe ratio is 5.82 that means the fund have generated 5.82 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 0.03

Standard Deviation is 0.66

Beta of this fund is -0.02, which is less than 0, that means there is inverse relationship between

fund and market.

HDFC FMP 36M J un 2007 Retail-G

ANALYSIS HDFC FMP 36M J un 2007 Retail-G

Its benchmarking is done with the index which track the return on a short term portfolio that

include call instruments, commercial papers, government securities as also the AAA and AA

rated instruments. it can be said that benchmarking is done correctly.

Sharpe ratio is 0.72 that means the fund have generated 0.72 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 0.58

Standard Deviation is 4.43

Beta of this fund is -0.11 which is less than 0, this signifies that there is inverse relation

between fund and market.

SNAPSHOT OF HDFC DEBT FUND SCHEMES

ANALYSIS FOR FUND SCHEMES OF HDFC MUTUAL FUND:

Credit Quality for most of the funds has been rated as High. That indicates that there

will be less possibility of default risk. Less default risk will be there since the schemes into

which they are investing are AAA or AA rated.

Sharpe Ratio, as the rule says higher the Sharpe ratio better is the fund. Above all the

funds only HDFC Q Interval plan (Retail G) has got the outstanding ratio. This particular

fund has been able to generate returns by taking less risk compare to other funds. It can

also be said that this fund has performed well considering its riskiness. Rest all can be

categorized as Good. Further to analysis, negative Sharpe ratio cannot be compared with

others.

Expense Ratio, as the rule says lower the Expense ratio better is the fund. Above all the

funds lowest Expense ratio is observed in HDFC Q Interval plan (Retail G) has got the

lowest ratio. Rest all can be categorized as Pretty Ok, except HDFC MF Monthly plan

Short term plan which is more than 2%.

Shorter the average maturity more sensitive is the fund to market rate changes. HDFC MF

Monthly Income Plan Short term plan is more sensitive to market rate changes compared

to other schemes.

Considering funds 5 years return every fund is in line with the performance of the return

of its respective category. Except HDFC MF Monthly Income Plan Long term which has

outperformed than its respective category.

Four funds have been observed as Conservative Funds and for remaining two there is an

inverse relationship between market and fund.

COMPARATIVE ANALYSIS OF SBI FUND HOUSE (DEBT

SCHEMES)

Proven Skills in Wealth Generation.

SBI Mutual Fund is Indias largest bank sponsored mutual fund and has an enviable track record in

judicious investments and consistent wealth creation. The fund traces its lineage to SBI - Indias

largest banking enterprise. The institution has grown immensely since its inception and today it is

India's largest bank, patronized by over 80% of the top corporate houses of the country.

SBI Mutual Fund is a joint venture between the State Bank of India and Socit Gnrale Asset

Management, one of the worlds leading fund management companies that manages over

US$ 500 Billion worldwide. In twenty years of operation, the fund has launched 38 schemes and

successfully redeemed fifteen of them. In the process it has rewarded its investors handsomely

with consistent returns.

A total of over 5.4 million investors have reposed their faith in the wealth generation expertise of

the Mutual Fund. Schemes of the Mutual fund have consistently outperformed benchmark indices

and have emerged as the preferred investment for millions of investors and HNIs.

Today, the fund manages over Rs. 27,076.63 crores of assets and has a diverse profile of investors

actively parking their investments across 36 active schemes. The fund serves this vast family of

investors by reaching out to them through network of over 130 points of acceptance, 28 investor

service centers, 46 investor service desks and 56 district organizers.

SBI Mutual is the first bank-sponsored fund to launch an offshore fund Resurgent India

Opportunities Fund.

DEBT FUNDS OFFERED BY SBI

MAGNUM GILT LONG-TERM-G

MAGNUM INCOME-G

MAGNUM INCOME PLUS FUND (INVESTMENT PLAN)

MAGNUM NRI INVESTMENT FUND

SBI DEBT FUND SERIES 24 MONTHS 1-G

Magnum Gilt Long-term-G

INVESTMENT OBJECTIVE: To provide the investors with returns generated through

investments in government securities issued by the Central Government and / or a State

Government. It will normally maintain an average maturity of more than three years.

ANALYSIS OF Magnum Gilt Long-term-G

This fund has been rated 2 Star, this indicates below average performance of this fund in the

same category.

Average maturity of this fund is 8.09 years. Fund style of this is also rated as high for Interest

rate sensitivity.

Its benchmarking is done with the index which comprises securities maturing later than seven

years. Since benchmarking is in line with this schemes objective it can be said that

benchmarking is done correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Default risk is less since the investment of this fund is done GoI

schemes.

Sharpe ratio is 0.11 that means the fund have generated 0.11 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 1.38.

Standard Deviation is 11.16

Beta of this fund is 0.60, which is less than 1. This signifies that this fund is conservative fund,

means it is moving slowly than the market.

Magnum Income-G

INVESTMENT OBJECTIVE: The objective of the scheme is to provide the investors an

opportunity to earn, in accordance with their requirements, through capital gains or through regular

dividends, returns that would be higher than the returns offered by comparable investment avenues

through investment in debt & money market securities.

ANALYSIS OF Magnum Income-G

This fund has been rated 1 Star, this indicates poor performance, of this fund in the same

category.

Average maturity of this fund is 8.02 years. Fund style of this is also marked as high for

Interest rate sensitivity, that means they are sensitive to market interest rate change.

Its benchmarking is done with the index which track the return on a composite portfolio that

includes call instruments, commercial paper, government securities as also the AAA and AA

rated instruments. Since benchmarking is in line with this schemes objective it can be said

that benchmarking is done correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Default risk is less since the investment of this fund is done AAA

rated schemes.

Sharpe ratio is -0.20 that means the fund have generated -0.20 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 1.52

Standard Deviation is 7.49

Beta of this is 0.96, which is less than 1. That means this fund is conservative fund, means it is

moving slowly than the market.

Magnum Income Plus Fund (Investment Plan)

INVESTMENT OBJECTIVE: The investment objective of the scheme will be to provide

attractive returns to the Magnum holders / Unit holders either through periodic dividends or

through capital appreciation through an actively managed portfolio of debt, equity and money

market instruments. Income may be generated through the receipt of coupon payments, the

amortization of the discount on the debt instruments, receipt of dividends or purchase and sale of

securities in the underlying portfolio. The scheme aims to invest at least 80 per cent of its corpus in

investment grade debt instruments and money market instruments and the balance in equity and

equity related instruments. The stocks would be selected from the BSE 100 index only.

ANALYSIS OF Magnum Income Plus Fund (Investment Plan)

Average maturity is 1.27 years. Fund style of this is rated as medium for Interest rate

sensitivity.

Its benchmarking is done with the index which track the return on a MIP portfolio that

includes both equity held in various companies as well as debt market instruments. Since

benchmarking is in line with this schemes objective it can be said that benchmarking is done

correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Less default risk since the investment of this fund is done AAA

rated schemes.

Sharpe ratio is -0.74 that means the fund have generated -0.74 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 1. 30

Standard Deviation is 6.88

Beta of this fund is 0.70, which is less than 1. This signifies that this fund is conservative fund,

means it is moving slowly than the market.

Magnum NRI Investment Fund

INVESTMENT OBJECTIVE: The investment objective of the scheme will be to provide

attractive returns to the Magnum holders either through periodic dividends or through capital

appreciation through an actively managed portfolio of debt, equity and money market instruments.

Income may be generated through the receipt of coupon payments, the amortization of the discount

on the debt instruments, receipt of dividends or purchase and sale of securities in the underlying

portfolio. The scheme would invest only in investment grade debt instruments like government

securities, corporate bonds and debentures and money market instruments. The average maturity of

the scheme would normally not exceed 3 years. This would be ideal for investors with an

investment horizon of more than one year.

ANALYSIS OF Magnum NRI Investment Fund

Average maturity of this fund is 0.01 years. Fund style of this fund is marked as low for

Interest rate sensitivity.

Its benchmarking is done with the index which track the return on a composite portfolio that

includes call instrument, commercial paper, government securities as also the AAA and AA

related instruments. So it can be said that benchmarking is done correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Less default risk since the investment of this fund is done AAA

rated schemes.

Sharpe ratio is -4.88 that means the fund have generated -4.88 percentage point of return above

the risk free return for each point of standard deviation.

Expense ratio is 1.12

Standard Deviation is 1.36

Beta of this fund is 0.05, which is less than 1. That means this fund is highly conservative

fund, means it is moving very slowly than the market.

SBI Debt Fund Series 24 Months 1-G

Investment Objective: The objective of the scheme will be to provide regular income,

liquidity and returns to the investors through investments in a portfolio comprising of debt

instruments such as Government Securities, AAA/AA+ Bonds and Money Market instruments.

Income may be generated through the receipt of coupon payments, the amortization of the discount

on the debt payments, or purchase and sale of securities in the underlying portfolio.

ANALYSIS OF SBI Debt Fund Series 24 Months 1-G

Average maturity of this fund is 0.63 which can be considered as very short. Therefore, fund

style of this fund is also marked as low for Interest rate sensitivity.

Its benchmarking is done with the index which track the return on a composite portfolio that

includes call instrument, commercial paper, government securities as also the AAA and AA

related instruments. So it can be said that benchmarking is done correctly.

Credit quality is high for this fund, that means it can be determined that there will be less

possibility in its default risk. Less default risk since the investment of this fund is done AA

rated schemes.

Expense ratio is 0.60

SNAPSHOT OF SBI HDFC DEBT FUND SCHEMES

ANALYSIS FOR FUND SCHEMES OF SBI MUTUAL FUND:

Credit Quality for all the funds has been rated as High. That indicates that there will be

less possibility of default risk. Less default risk will be there since the schemes into which

they are investing are AAA or AA rated.

Sharpe Ratio, as the rule says higher the Sharpe ratio better is the fund. Above all the

funds none of the funds Sharpe ratio is outstanding or pretty good. It can also be

interpreted that none of the fund have been able to generate returns by taking less risk

compare to other funds. Considering the risk attached to the funds have not performed

well. Further to analysis, negative Sharpe ratio cannot be compared with others.

Expense Ratio, as the rule says lower the Expense ratio better is the fund. Above all the

funds lowest Expense ratio is observed in SBI Debt Fund series 24 months has got the

lowest ratio.

Shorter the average maturity more sensitive is the fund to market rate changes. NRI

Investment fund has got the shortest average maturity. Compare to SBI Debt Fund series

rest schemes are less sensitive to market rate.

Considering funds 5 years return not every fund of SBI is in line with the performance of

the return given by its respective category. Returns given by NRI investment plan and

return given by its category is having maximum difference.

Three funds have been observed as Conservative Funds and only one fund is having an

inverse relationship with.

RECOMMENDATIONS

There is great scope for the growth of the mutual funds in India. Mutual funds have to compete

with bank deposits and government securities for a share of consumer savings. This requires the

regulator and the AMC to increase the creditability of mutual funds and develop a trust among the

average retail investors.

Mutual Fund can penetrate rural India like the Indian Insurance Industry with simple and limited

products.

SEBI should allow the mutual fund to launch commodity mutual funds

Emphasis on better corporate governance

Trying to curb the late trading practices

Introduction of financial planners who can provide need based advice

The following steps should be taken by SEBI and AMC

STEPS TO BE TAKEN BY SEBI

Increase accountability among different players

Give the board of trustees the right to choose the fund manager of their own choice. This will

make them more accountable and aware as to what the AMC is doing.

Benchmark the performance of funds with peers as well as with specific indices.

Restriction on who can be appointed as a sub brokers

Implementation of international accounting principles across the mutual fund industry will help

promote fairness and stability of the sector,

Steps to be taken by AMCs

Make mutual offer documents more comprehensible by making disclosures more simple and

relevant, and fund structure more distinctive to the common people

Make disclosure regarding the MF expense more transparent especially distributor expenses

which form a major chunk of entry loads.

Make Fund managers accountable to unit holders. This can be done by organizing Annual

General Meetings of Unit holders where performance of the fund would be reviewed.

CONCLUSION

Savings form an important part of the economy of any nation. With savings invested in various

options available to the people, the money acts as the driver for growth of the country. Indians

have predominantly favored assured and guaranteed returns from their investments. Hence the

tendency to save in Bank FDs, NSCs, PPFs, Post Office schemes and such other products!

Indian financial scene too presents multiple avenues to the investors. Though certainly not the best

or deepest of markets in the world, it has ignited the growth rate in mutual fund industry to provide

reasonable options for an ordinary man to invest his savings. And because MFs are not allowed to

offer assured/guaranteed returns - which means there is some uncertainty of returns - debt mutual

funds have not enjoyed the kind of popularity they could have.

Though still at a nascent stage, Indian MF industry offers plethora of schemes and serves broadly

all type of investors. The range of products includes Equity , Debt, Liquid, Gilt and Balanced

Funds.

Coming to the mutual fund space, if debt schemes are to attract the investors then they can act

favorable in softening interest rate scenario.

There is no doubt that debt funds will continue to be frontrunners of growth in the mutual fund

industry but investors should not underestimate the risks involved there.

There was a time when fixed maturity plans (FMPs) were corporate Indias favorite debt

investment. But new regulations have taken liquidity out of the picture, putting their future in

doubt. Two major regulatory changes have affected FMPs. First, market regulator Securities and

Exchange Board of India (Sebi) has forbidden redemptions at net asset value (NAV) by new

closed-end funds, instead mandating that these funds be listed on a stock exchange as a way of

providing exit. The practice of announcing indicative yields and portfolios has also been

disallowed. While the indicative yield rule isnt a major dampener, the lack of NAV-based

liquidation is a big issue. It wont be surprising if FMPs die out eventually. The old ones will be

redeemed and no new ones will be launched. That would be a pity. Except for the liquidity

problem, FMPs have many desirable characteristics. Its also possible that as the economic

situation settles down, liquidity shortcomings will seem to matter less and shorter-duration FMPs

will make a comeback as a viable investment.

With equity markets in the doldrums, mutual funds are increasingly turning to debt instruments.

Several mutual funds have diverted a large portion of their portfolios into debt schemes.

LOOKING AHEAD

Though the last credit policy announced by the RBI did not make any changes in key interest rates,

there is a buzz regarding a further hike in cash reserve ratio (CRR), which can put further pressure

on banks. There are mixed reactions by fund managers over the trend of interest rates. In this

situation, where interest rates could remain stable or can decline a little, selecting a lucrative debt

fund is difficult. Investors with a time period of one to three years can go for FMPs. They can stay

away from investing in gilts for some time, looking at the uncertainty in interest rates in the near

future.

Debt funds offer tremendous scope for most investors. One can get liquidity, and most

importantly, a regular flow of income. However, it has a risk attached as compared to fixed

deposits. But considering the benefit of tax arbitrage and the imposition of penalty on withdrawal

before maturity in fixed deposits, liquid funds are a better option, though returns in both fixed

deposits and liquid funds are more or less the same. On the other hand, FMPs are relatively less

risky than income funds as they have fixed maturity, which gives fixed returns according to the

time period selected.

With FMPs dying and liquid funds set to be commoditized, it looks as if things are going to be

difficult for debt funds. However, there are many positives on the horizon.

Fundamentally, debt funds are simple products, or at least they ought to be. Unlike the complex

world of equity analysis, all debt instruments can be reduced to five simple characteristics. Five

pillars are credit quality, returns, maturity, liquidity and tax.. Moreover, it is also easy for investors

to map their own expectations and requirements on the basis of these five parameters.. As long as

an investor can define his own needs, it should be a simple matter to choose the debt fund that is

the best fit for his needs.

BIBLOGRAPHY

www.nse.com

www.unittrustofindia.com

www.indiainfoline.com

www.amfiindia.com

www.debtonline.com

www.mutualfundsindia.com

www.google.com

www.finmin.nic.in

www.valueresearchonline.com

www.itfsl.co.in

www.investopedia.com

www.myiris.comwww.moneycontrol.com

AMFI Book

Mutual Fund by Akhilesh (Based On AMFI (Advisorys Module)

Mutual Fund Industry Products & Services by Indian Institute of Banking & Finance

ANNEXURE

GLOSSARY

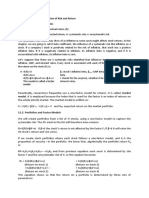

PERFORMANCE MEASURES OF MUTUAL FUNDS

Mutual Fund industry today, with about 34 players and more than five hundred schemes, is one of

the most preferred investment avenues in India. However, with a plethora of schemes to choose

from, the retail investor faces problems in selecting funds. Factors such as investment strategy and

management style are qualitative, but the funds record is an important indicator too. Though past

performance alone cannot be indicative of future performance, it is frankly, the only quantitative

way to judge how good a fund is at present. Therefore, there is a need to correctly assess the past

performance of different mutual funds. There must be some performance indicator that will reveal

the quality of stock selection of various AMCs.

Return alone should not be considered as the basis of measurement of the performance of a mutual

fund scheme, it should also include the risk taken by the fund manager because different funds will

have different levels of risk attached to them. The most important and widely used measures of

performance are:

THE TREYNOR MEASURE: The Treynor ratio sometimes called Reward to Variability

Ratio also relates return to risk; but systematic risk instead of total risk is used. The higher

the ratio the better the performance under analysis.

Treynors Index (Ti) = (Ri-Rf) / Bi

Where T= Treynor ratio, r = Portfolio return, rf= Risk-free rate, b= Portfolio beta

THE SHARPE MEASURE: The Sharpe also known as Reward to Volatility Ratio

indicates the excess return per unit of risk associated with the excess return. The higher the

ratio the better performance.

Sharpe Index (Si) = (Ri-Rf)/Si

Where S=Sharpe ratio, r=Portfolio return, rf= Risk free rate, v=Portfolio volatility

JENSON MODEL: Jensons model proposes another risk adjusted performance measure.

This measure involves evaluation of the returns that the fund has generated vs. the returns

actually expected out of the fund given the level of its systematic risk. The surplus

between the two returns is called Alpha.

Ri = Rf + Bi (Rm-Rf)

FAMA MODEL: The Eugene Fama Model is an extension of Jenson model. This model

compares the performance, measured in terms of returns, of a fund with the required return

commensurate with the total risk associated with it. The difference between these two is

taken as a measure of the performance of the fund and is called net selectivity.

Required return can be calculated as: Ri = Rf + Si/Sm*(Rm-Rf)

Where, Sm = standard deviation of market returns.

Fama Model that considers the entire risks associated with fund are suitable for small

investors, as the ordinary investor lacks the necessary skill and resources to diversify...

EXPENSE RATIO: Expense ratio is the ratio of total expenses of the fund to the average

net assets of the fund. Expense ratio states how much you pay a fund in percentage term

every year to manage your money. Since this is charged regularly (every year), a high

expense ratio over the long-term may eat into our returns massively through power of

compounding.

Expenses ratio = Total expenses / Avg net assets * 100

PORTFOLIO TURNOVER: Every mutual fund has a portfolio turnover rate. The

turnover rate is basically the percentage of the portfolio that is bought and sold to

exchange for other stocks. This number helps one determine how much you will have to

pay in taxes for that mutual fund. For example, if the mutual fund has a low turnover rate,

you will probably pay less in taxes. If it has a high turnover rate, you will probably pay

more in taxes. Higher portfolio turnover generally results in higher costs such as brokerage

costs, stamp duty and custodian charges. In case of higher portfolio turnover, the scheme

will try to endeavor to cover these costs by way of higher gain from the increased

turnover.

PORTFOLIO P/E RATIO: Importance of portfolio P/E ratio in case of mutual funds is

rather less as portfolio consists of a number of stocks in different sectors. Every sector has

different P/E and every individual security has a different P/E ratio and it calculates the

weighted average with respect to weight of the security in the portfolio.

Otherwise also a portfolio composition changes almost every day. As portfolio turnover

rate increases it becomes more and more immaterial to find out the importance of P/E with

respect to mutual funds.

P/E (price-to-earnings) ratio of a stock tells us how much the investors will pay for one

rupee of a companys earnings. High P/E indicates higher expectations of investors from a

particular stock. But the P/E ratio of a fund is the weighted average of the P/E of all stocks

in its portfolio.

PORTFOLIO P/B RATIO: Portfolio P/B ratio indicates at what price market is willing

to pay for a portfolio with respect to its book value and again it is the average of P/B ratio

of different individual securities which are present in the portfolio.

A higher P/B ratio indicates that market values a particular security higher than its book

value and that may be for a variety of reasons but the other side of it indicates that a

security is not trading at correct valuation level and it is deliberately increased by

speculators.

P/B (price-to-book value) ratio compares the market value of a stock to its book value. A

high P/B value indicates an overvalued stock and a low P/B indicates an undervalued

stock. A low P/B of a stock could also mean that something is fundamentally wrong with

the company. For a fund, the P/B ratio is calculated like the P/E ratio, by taking the

weighted average P/B of all stocks in a funds portfolio.

A funds P/E and P/B ratios do not take the cash component into account. So, they are not as

relevant for funds as they are for stocks. Yet they can be used to understand the broad nature of a

funds portfolio within a category. The growth funds in a category will have a relatively higher P/E

and P/B than the value funds.

BETA

Beta = Covariance (Index, Stock) / Variance (Index)

If Beta =1, than fund will move precisely in line with the market.

Beta < 1, than it means that it is a conservative fund, i.e. it is moving slowly than the

market.

Beta > 1, it means that fund is moving aggressively in the market.

Beta < 0, it means that there is an inverse relationship between fund and market.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Midland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5Document13 pagesMidland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5killer dramaNo ratings yet

- Active Portfolio Management: NoteDocument31 pagesActive Portfolio Management: NoteNitiNo ratings yet

- Capital Asset Pricing ModelDocument34 pagesCapital Asset Pricing ModelasifanisNo ratings yet

- Saa SDocument5 pagesSaa SKanishq BawejaNo ratings yet

- Chapter 5 AnswerDocument16 pagesChapter 5 AnswerLogeswary VijayakumarNo ratings yet

- Chapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinDocument21 pagesChapter 7 Portfolio Theory: Prepared By: Wael Shams EL-DinmaheraldamatiNo ratings yet

- Portfolio Management in Kotak SecuritesDocument92 pagesPortfolio Management in Kotak SecuritesGunda Abhishek0% (1)

- 298 - Lakme Fashion Week - Associate SponsorDocument47 pages298 - Lakme Fashion Week - Associate SponsorKanishq BawejaNo ratings yet

- Powering India: The Road To 2017Document13 pagesPowering India: The Road To 2017Rajnish SinghNo ratings yet

- EOI Cancellation Form Gurugram V1Document1 pageEOI Cancellation Form Gurugram V1Kanishq BawejaNo ratings yet

- Dalmia Bharat Sugar: Uniquely positioned to capitalise on industry recoveryDocument158 pagesDalmia Bharat Sugar: Uniquely positioned to capitalise on industry recoveryArul DassNo ratings yet

- Casuse List Principal Bench 14.06.2018Document5 pagesCasuse List Principal Bench 14.06.2018Kanishq BawejaNo ratings yet

- Title of The Dissertation (Maximum 25 Word) Name of The StudentDocument1 pageTitle of The Dissertation (Maximum 25 Word) Name of The StudentKanishq BawejaNo ratings yet

- Promotional Plan For The MBA ProgramDocument14 pagesPromotional Plan For The MBA ProgramKanishq BawejaNo ratings yet

- (Case Study) SiemensDocument4 pages(Case Study) Siemenspithawalla_purvi20860% (1)

- Summer Internship Nasir FinalDocument10 pagesSummer Internship Nasir FinalKanishq BawejaNo ratings yet

- Marketing Through Spirituality A Case ofDocument10 pagesMarketing Through Spirituality A Case ofVirag GadaNo ratings yet

- Synopsis FormatDocument2 pagesSynopsis FormatKanishq BawejaNo ratings yet

- Case Analysis OBDocument7 pagesCase Analysis OBKanishq BawejaNo ratings yet

- BigDataforDevelopment GlobalPulseMay2012Document47 pagesBigDataforDevelopment GlobalPulseMay2012Kanishq BawejaNo ratings yet

- Garg Brothers & Co. Case: Managing Foreign Exchange Risk Using DerivativesDocument12 pagesGarg Brothers & Co. Case: Managing Foreign Exchange Risk Using DerivativesKanishq BawejaNo ratings yet

- Gravity Model of Trade (India-Germany) : Year Indian 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969Document6 pagesGravity Model of Trade (India-Germany) : Year Indian 1960 1961 1962 1963 1964 1965 1966 1967 1968 1969Kanishq BawejaNo ratings yet

- Erp BPRDocument8 pagesErp BPRKanishq BawejaNo ratings yet

- IM&F AssignmentDocument1 pageIM&F AssignmentKanishq BawejaNo ratings yet

- Paytm RechargeDocument2 pagesPaytm RechargeKanishq BawejaNo ratings yet

- Big DataDocument19 pagesBig DataKanishq BawejaNo ratings yet

- Germany LogisticsDocument13 pagesGermany LogisticsKanishq BawejaNo ratings yet

- SMT Maruti SuzukiDocument26 pagesSMT Maruti SuzukiKanishq BawejaNo ratings yet

- PerformanceDocument11 pagesPerformanceKanishq BawejaNo ratings yet

- Globalization ReportDocument4 pagesGlobalization ReportKanishq BawejaNo ratings yet

- Garg Brothers & Co. Case: Managing Foreign Exchange Risk Using DerivativesDocument12 pagesGarg Brothers & Co. Case: Managing Foreign Exchange Risk Using DerivativesKanishq BawejaNo ratings yet

- Strategic Differentiation of Internationalization in The Mobile Telecommunications Industry: Case StudiesDocument11 pagesStrategic Differentiation of Internationalization in The Mobile Telecommunications Industry: Case StudiesKanishq BawejaNo ratings yet

- Summer Internship Nasir FinalDocument10 pagesSummer Internship Nasir FinalKanishq BawejaNo ratings yet

- Quasi ContractsDocument12 pagesQuasi ContractsKanishq BawejaNo ratings yet

- Guidelines Fill SOPDocument1 pageGuidelines Fill SOPKanishq BawejaNo ratings yet

- Big DataDocument19 pagesBig DataKanishq BawejaNo ratings yet

- Problem Stock ValuationDocument5 pagesProblem Stock ValuationbajujuNo ratings yet

- Paper14 Strategic Financial ManagementDocument34 pagesPaper14 Strategic Financial ManagementKumar SAPNo ratings yet

- REVISED FINAMA Reviewer With AnswersDocument25 pagesREVISED FINAMA Reviewer With AnswersYander Marl Bautista100% (1)

- The Big Market DelusionalDocument19 pagesThe Big Market DelusionalSg SubramaniamNo ratings yet

- Icaew FMDocument12 pagesIcaew FMcima2k15No ratings yet

- Ifm-Chapter 3 - Risk and Return 2 (Slide)Document50 pagesIfm-Chapter 3 - Risk and Return 2 (Slide)minhhien222No ratings yet

- FFM15, CH 08 (Risk), Chapter Model, 2-08-18Document16 pagesFFM15, CH 08 (Risk), Chapter Model, 2-08-18ALFINA BUDI RAHMADANINo ratings yet

- Corporate Finance Test Questions and AnswersDocument6 pagesCorporate Finance Test Questions and AnswersAnanditaKarNo ratings yet

- Case Study SPBLDocument18 pagesCase Study SPBLMonirul IslamNo ratings yet

- Measuring Portfolio Factor Exposures A Practical GuideDocument3 pagesMeasuring Portfolio Factor Exposures A Practical GuideAY6061No ratings yet

- RFLR v5 n1Document68 pagesRFLR v5 n1navycruise100% (1)

- Fin PracticaDocument14 pagesFin PracticaChristian Diegho Vacadiez Laporta100% (1)

- Financial Engineering and Structured FinanceDocument88 pagesFinancial Engineering and Structured Financevarun_kakkar76No ratings yet

- IE00B18GC888Document4 pagesIE00B18GC888a28hzNo ratings yet

- 13 Portofolio Risk and Return Part IIDocument6 pages13 Portofolio Risk and Return Part IIAditya NugrohoNo ratings yet

- Chapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisDocument32 pagesChapter5-Capitalization - Discount Rates (NACVA, 2003) - National Association of Certified Valuation AnalysisMichael SmithNo ratings yet

- Assignment of WiproDocument6 pagesAssignment of WiproIsha IshNo ratings yet

- AFM REVISION VIDEO LINKS May 2024Document2 pagesAFM REVISION VIDEO LINKS May 2024chogle911No ratings yet

- CAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - StudentsDocument4 pagesCAPM - Theory, Advantages, and Disadvantages - F9 Financial Management - ACCA Qualification - StudentsWaqas RashidNo ratings yet

- Chapter 11Document33 pagesChapter 11pranav sarawagiNo ratings yet

- Analyzing Risk and Return of Assets X and YDocument2 pagesAnalyzing Risk and Return of Assets X and YJuan Antonio0% (1)

- Financial Management - Grinblatt and TitmanDocument68 pagesFinancial Management - Grinblatt and TitmanLuis Daniel Malavé RojasNo ratings yet

- Overview Factor Investing, FidelityDocument8 pagesOverview Factor Investing, FidelitychaltrikNo ratings yet

- Resume of Chapter 12 An Alternative View of Risk and ReturnDocument2 pagesResume of Chapter 12 An Alternative View of Risk and ReturnAimé RandrianantenainaNo ratings yet