Professional Documents

Culture Documents

Analysis of Relationship of Adr and GDR Prices With The National and International Market

Uploaded by

Dr. Pabitra Kumar MishraOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Analysis of Relationship of Adr and GDR Prices With The National and International Market

Uploaded by

Dr. Pabitra Kumar MishraCopyright:

Available Formats

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management

gement Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

114

ANALYSIS OF RELATIONSHIP OF ADR AND GDR PRICES WITH THE

NATIONAL AND INTERNATIONAL MARKET

Sharmistha Ghosh, Assistant Professor

Department of Commerce, Shri Shikshayatan College, Kolkata

Abstract

The capital market of a country holds great significance with respect to its economic growth.

Capital markets in India as well as across the globe are progressively getting interconnected.

The new financial instrument for tapping the international markets may be termed as

Depository Receipts (DRs). A depositary receipt is a negotiable financial instrument issued by a

bank to represent a foreign company's publicly traded securities. It is a type of negotiable

(transferable) financial security that is traded on a local stock exchange but represents a

security, usually in the form of equity that is issued by a foreign publicly listed company.

Recently, Depository Receipts, especially, American Depository Receipts (ADR) and Global

Depository Receipts (GDR) have become a popular investment alternative for the investors in

India. ADR were first issued in 1927 and they account for the maximum number of trades in

comparison to GDRs. Both ADRs and GDRs help investors looking to tap a new investor base,

expand awareness, or raise capital. In this context, this paper aims at discussing the role of ADR

and GDRs issuance. It also showcases the different aspects of Depository Receipt issues along

with their relationship with the Indian and International securities market.

Key Words: Depository Receipts, American Depository Receipt, Global Depository Receipt,

Foreign Direct Investment, Regulation S.

Introduction

As the country grows and expands with the globalization of the economy, one important aspect

with regard to the investment opportunities available to investors is the introduction of

Depository Receipts (DRs) as an investment alternative. A DR is a tradable instrument that

represents an ownership interest in securities of a foreign issuer typically trading outside its

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

115

home market. Most common types of Depository Receipts are the American Depository

Receipts (ADRs) and Global Depository Receipts (GDRs). ADRs are issued by the United States

(US) in lieu of a non-US companys shares which are traded on the US exchange although the

companies itself are not listed on the US exchange. The DRs which are not listed on US

exchange but in other countrys exchanges most commonly in London or Luxembourg are

termed as Global depository Receipts (GDRs). A depositary receipt where the issuing bank is

European will sometimes be called a European Depositary Receipt (EDR). While by creating a

depositary receipts program, the companies are able to gain the flexibility and access they need

to achieve the companys strategic goals it also hold special appeal for investors because they

make investing in a company beyond the investors home borders easy and convenient. This

attribute fuels investor appetite, which in turn has driven explosive growth in the depositary

receipt market. So, from an investors point of view the ADR or GDR is essentially a certificate

issued by a bank that gives the owner rights over a foreign share. It can be listed on a stock

exchange and bought and sold just like a normal share. The holder of an ADR or GDR is entitled

to all benefits such as dividends and rights issues from the underlying shares but they are

sometimes though not always able to vote. Initially, most of the issues were done through

private placement route during the 1990s but afterwards the exchange traded ADRs were

introduced. In this respect this paper is organized as follows. Section 2 gives an overview of

depository receipts and their benefits. Section 3 draws an analysis of ADR and GDR prices and

studies their relation with the different market indices. Section 4 states the regulations

regarding ADR GDR issue and divestment of shares in India. And finally the last section is

devoted to conclusion and recommendations.

Overview of Depository Receipts

While depositary receipt (DR) programs can be structured in a variety of ways, there are two

basic options: American Depositary Receipt (ADR) programs, which give companies access to

the US capital markets, and Global Depositary Receipt (GDR) programs, which provide exposure

to the global markets outside the issuers home market and the institutional investor market in

the US.

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

116

Types of ADRs

Unsponsored Sponsored

Level I

Private placement

Level II

Level III

American Depository Receipts

American Depositary Receipts (ADRs) offer the issuing company access to the worlds largest

and most active capital market. Correspondingly, ADRs provide investors in the US with a

convenient way to directly invest in international companies while avoiding the risks

traditionally associated with securities held in other countries. ADRs are dollar-denominated

securities that trade, clear and settle like any other US security. Whether traded over-the-

counter or on one of the major US exchanges, ADRs are a mainstream and popular option for

investors. ADRs may be classified broadly into two: Unsponsored ADR and Sponsored ADR.

Sponsored ADR may be reclassified as Level I, Level II and Level III and the Private Placement

under Rule 144A (Fig: 1). The Unsponsored ADR program is one in which there is no deposit

agreement set up between a depositary bank and an issuer client. One or more depositary

banks create and issue ADRs due to market demand even without the issuing companys

participation.

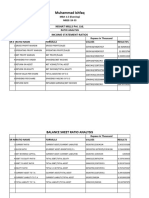

FIGURE: 1

DIFFERENT CATEGORIES OF ADR

Hence they are not required to be listed on any exchange. They are exempted from reporting

requirements of the SEC. The Sponsored ADRs are initiated by the issuer and it is established

jointly by an issuer and Depository. The Depository helps to provide shareholders

communication and other information to the ADR holders and it is through the Depository that

the ADR holders may exercise their voting rights. Under the Sponsored category, a Level I ADR

program is not listed on a stock exchange, but is available for retail investors to purchase and

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

117

trade in the over-the-counter market via NASDAQs Pink Sheets. A Level I program does not

create new capital in the US; rather, it gives the company an opportunity to develop or expand

its shareholder base by establishing a foothold in the US market. It maintains home market

accounting and disclosure standards. They use existing shares to satisfy investor demand and

liquidity. New DRs are created by issuing and canceling ordinary shares in the issuers home

market. These Level I ADRs are registered with the US Securities and Exchange Commission. A

Level II ADR uses existing shares to satisfy investor demand and liquidity. New ADRs are created

from deposits of ordinary shares in the issuers home market. Because these securities are

listed or quoted on a major US exchange, Level II ADRs reach a broader universe of potential

shareholders and gain increased visibility through reporting in the financial media. These are

more expensive than the Level I ADRs. Listed securities can be promoted and advertised, and

may be covered by analysts and the media. In addition, listed securities can be used to

structure incentives for an issuers US employees, or could be used to facilitate US mergers and

acquisitions. Level III ADRs are a public offering of new shares into the US markets. These

capital raisings have a high profile and are most expensive. They are followed closely by the

financial press and other media, often generating significant visibility for the issuer. Apart from

all these, the Rule 144A ADR is the unique one. It is the quickest, easiest, and most cost-

effective way to raise capital in the United States. New, restricted shares are created and then

privately placed with institutional investors. Rule 144A facilitates the resale of privately placed

securities to Qualified Institutional Buyers (QIBs) in the US. These do not need to conform to

the full SEC reporting and registration requirements.

Global Depository Receipts

The typical GDR structure offers DRs in Europe or other non-US markets pursuant to Regulation

S (Reg. S) promulgated under the US Securities Act of 1933. The predominant listing venues for

Reg. S GDRs are the London and Luxembourg Stock Exchanges, with GDRs having also been

listed on the Singapore Exchange, Frankfurt Stock Exchange and Nasdaq Dubai. Rule 144A GDRs

trade in the U.S. over-the-counter market. When GDRs are offered simultaneously in Reg. S and

Rule 144A form, but in separate and distinct tranches, they exist inside what is known as a

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

118

bifurcated GDR program. When the GDRs are offered simultaneously in Reg. S and Rule 144A

form, but not in separate and distinct tranches, they exist inside what is known as a unitary

GDR program. The ability of retail investors to purchase GDRs will depend on the type and

location of the listing. In general, however, GDR offerings are aimed at institutional investors

and depending on the exchange, they can then be purchased by retail investors in the

secondary market. GDRs are usually offered to institutional investors through a private offering,

in reliance on exemptions from registration under the Securities Act of 1933. These exemptions

are Regulation S (Reg. S) for non-U.S. investors, and Rule 144A for U.S. investors that are

Qualified Institutional Buyers (QIBs). The availability of these exemptions for GDR deals makes

them an efficient and cost-effective means of implementing a cross-border capital-raising

transaction. Due to the general flexibility afforded by GDRs, issuers from a variety of regions,

including Europe, the Middle East and Africa; Asia Pacific; and Latin America, have been utilizing

GDR programs to help meet their capital-raising needs on an increasing basis.

FIGURE: 2

DIFFERENT TYPES OF GDR ISSUE

Literature Review

Several research studies have been carried out in the area of Depository receipts issues both in

India and abroad. Chakrabarti (2003) stated that several factors are likely to influence the

dynamics of ADR prices and volume. Since ADRs are dollar-priced entitlements to foreign

shares, movements in their prices and returns are naturally expected to be affected by those in

TYPES OF GDR

REGULATION S

GDR

RULE 144A GDR

BOTH UNDER

REGULATION S

AND 144A GDR

BIFURCATED GDR

PROGRAM

UNITARY GDR

PROGRAM

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

119

the underlying shares and the relevant exchange rate. The host country (the US) market

becomes the natural candidate for such a factor, since American investors, who are obviously

affected by the movements in the US market, trade ADRs. Thus, the US market movements

constitute a usual suspect in the study of ADR prices and returns. He further empirically

investigated that how much of the variation in ADR prices may be explained by different

variables affecting them and found that ADR issuance often has a temporary positive effect on

the underlying stock price, but usually does not materially alter the stocks relationships with

the US and Indian markets. Saxena (2005) analyzed the trend in ADR premiums and the

movement in ADR premium levels over 2001-2005 period. He also analyzed the relation in

movement of ADR prices with the prices of underlying equity and concluded that ADR prices do

not move in lock-step with underlying equity prices. A study conducted by Bank of New York,

Mellon (2007) to provide an independent, robust analysis of the value and liquidity effects of

depositary receipts (DRs) established by companies from emerging markets analysed DR

programs of 628 firms covering the period 1980-2007. The study covered the BRIC countries of

Brazil, Russia, India and China along with Asia, Eastern Europe, Middle East countries and Africa.

It was shown empirically that DR programmes established by firms in emerging markets add

significant value and improve home-market liquidity to the benefit of both issuers and

investors. DRs additionally provide a strong signal of willing disclosure, greater transparency

and superior governance, particularly important from emerging, less-regulated markets.

Likewise, several research studies were carried out on various aspects of ADR/GDR issues but

not much work has been done in Indian context. The present study aims at fulfilling this

vaccum.

Objective of study

The paper aims to analyze the relationship between the ADR prices with their underlying equity

prices and the S&P 500 Index. It also tries to show the sensitivity of the underlying equity prices

to one of the Indian stock market index i.e. BSE Sensex. In addition, the paper draws the

relationship between the different Indian stock market Indices (CNX Nifty and BSE Sensex) to

the US stock market Index S&P 500.

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

120

Methodology

For the purpose of the study, secondary data was collected from different websites and data

was analyzed using SPSS software.

Analysis and findings

The first ADR in India was issued by Infosys Technologies in 1999. All Indian ADRs are sponsored

ones and belong to Level II and Level III category. It is found from the established literature and

data that India ranks the highest in issuance of Depository Receipts among various other

countries.

Table: 1

YEAR Total ADR/GDR Issues US $ Million

2000-01 831

2001-02 477

2002-03 600

2003-04 459

2004-05 613

2005-06 2552

2006-07 3776

2007-08 8769

2008-09 1162

2009-10 3328

2010-11 2049

2011-12 597

2012-13 187

Source: Handbook of Statistics, SEBI

Descriptive Statistics

N

Minimu

m

Maximu

m Mean

Std.

Deviation

ADRs:

ICICI BANK LTD. $

61

12.46

52.58

36.0643

9.91018

INFOSYS LTD. $ 61 24.20 76.08 49.4711 12.67124

REDIFF.COM $ 61 1.52 16.43 4.5189 2.93818

SESA STERLITE Ltd. $ 61 4.60 18.61 11.3843 4.18360

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

121

SIFY $ 61 .59 8.25 2.5241 1.42188

DR REDDYS LAB $ 61 8.02 39.24 26.9718 9.58850

HDFC BANK LTD. $ 61 26.28 184.37 86.9043 53.05657

TATA MOTORS LTD. $ 61 3.51 32.71 18.6751 7.93558

WIPRO $ 61 5.69 23.31 12.1041 4.34852

MTNL $ 61 .74 5.02 2.4016 1.22167

Valid N (listwise) 61

N

Minimu

m

Maximu

m Mean

Std.

Deviation

STOCKS :

ICICI BANK LTD. Rs.

61

328.10

1190.85

869.832

8

230.52454

INFOSYS LTD. Rs.

61 1117.85 3445.00

2397.58

93

568.85699

SESA STERLITE Ltd. Rs. 61 74.4 471.1 234.882 97.6354

DR REDDYS LAB Rs.

61 391.3 2215.4

1329.37

8

499.0046

HDFC BANK LTD. Rs. 61 177.0 703.7 429.104 150.2343

TATA MOTORS LTD.

Rs.

61 136.35 1306.30

528.840

2

361.12928

WIPRO Rs. 61 207.4 706.8 425.366 116.3902

MTNL Rs. 61 17.3 104.2 53.865 26.0023

Valid N (listwise) 61

N

Minimu

m

Maximu

m Mean Std. Deviation

INDICES:

S & P BSE SENSEX

61

8891.61

0

20509.0

90

16597.9

26

3011.808

CNX NIFTY

61 2802.3 6134.5

4990.10

5

893.3480

S & P 500

61 735.09 1630.74

1215.39

18

210.70744

Valid N (listwise) 61

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

122

It is observed that HDFC Bank ADR is having the highest average price among the others with

the highest standard deviation as well. While in the domestic market Infosys ltd. shares has the

highest mean price. In case of indices, S&P 500 has the lowest deviation from its mean.

The correlation between the ADR prices and the underlying stock prices of these companies

was studied (Table 6, also Refer to Annexure 1) and it was found that all the eight companies of

the sample showed significant correlation in their ADR prices and their underlying stocks except

that of HDFC Bank Ltd. which shows a negative correlation and Tata Motors which showed a

considerably lesser correlation of 40% only. This suggests that the ADR prices move in tandem

with their underlying stocks in the Indian market.

Summarized result (1)

ADR NAME

CORRELATION WITH

UNDERLYING EQUITY

CORRELATION WITH S & P

500

ICICI BANK LTD. $ 0.961 0.619

INFOSYS LTD. $ 0.939 0.378

REDIFF.COM $ - 0.306

SESA STERLITE Ltd. $

0.898 -0.142

SIFY $ - 0.361

DR REDDYS LAB $ 0.964 0.76

HDFC BANK LTD. $ -0.274 -0.285

TATA MOTORS LTD. $

0.403 0.788

WIPRO $ 0.942 -0.184

MTNL $ 0.92 -0.669

A correlation analysis was also done between the ADR prices and S&P 500 index (Table 7, also

refer to Annexure 2) and it was observed that the ADR prices and their correlation with the S&P

500 Index is not so significant in case of the sample companies except that of Tata Motors Ltd.,

Dr. Reddys Lab and ICICI Bank Ltd. On the contrary, the underlying stocks of these companies

being traded on BSE (Table 8, also Refer to Annexure 3) showed more or less a significant

correlation with the S&P BSE Sensex (except MTNL stock which showed a negative correlation).

But an analysis of the S&P500 Index with the S&P BSE Sensex and CNX Nifty (Table 9) showed a

greater degree of correlation between them. This suggests over the given time period the

Indian Market and the US market was sufficiently correlated which may be due to the high

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

123

correlation between the ADR prices and their underlying stock prices because the underlying

securities prices showed a greater degree of sensitivity to the S&P BSE Sensex.

Summarized Result (2)

Correlation between CNX Nifty and S&P 500 and SENSEX and S&P 500

Correlations

S & P

500

CNX

NIFTY

S & P 500 Pearson

Correlation

1 .776(**)

Sig. (2-tailed) .000

N 61 61

CNX

NIFTY

Pearson

Correlation

.776(**) 1

Sig. (2-tailed) .000

N 61 61

** Correlation is significant at the 0.01 level (2-tailed).

STOCK CORRELATION WITH S& P BSE

SENSEX

ICICI BANK LTD.

Rs. 0.979

INFOSYS LTD. Rs. 0.884

SESA STERLITE

Ltd. Rs. 0.485

DR REDDYS LAB

Rs. 0.877

HDFC BANK LTD.

Rs. 0.812

TATA MOTORS

LTD. Rs. 0.495

WIPRO Rs. 0.413

MTNL Rs. -0.506

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

124

Correlations

S & P BSE

SENSEX

S & P

500

S & P BSE SENSEX Pearson

Correlation

1 .736(**)

Sig. (2-tailed) .000

N 61 61

S & P 500 Pearson

Correlation

.736(**) 1

Sig. (2-tailed) .000

N 61 61

** Correlation is significant at the 0.01 level (2-tailed).

Conclusion and Recommendations

ADR and GDR have emerged as an innovative instrument of investment. The relation between

the different ADR prices, their stock market indices, the change or trend in the underlying

stocks were examined which may provide with the general idea about the status of trading in

these instruments in the domestic market and the US market as well. It may also be concluded

that for a developing country like India, these depository receipts have enabled the investors as

well as the companies to tap the global market and become an international player. Although

the ADRs are a derivative of underlying equity, yet there may exist a significant difference in the

ADR prices compared to the price of underlying equity (i.e. the ADR premium). So before going

for investing in such avenues it is a must to note the trend in their prices and the prices of their

underlying securities also. Moreover, the introduction or permission for two way fungibility

scheme for the DR issues has paved the way for arbitraging opportunity in a more realistic way.

Hence, we can look forward to the companies and investors for more participation in such

issues in the years to come.

References

1. Chakraborti, R. (2003). An Empirical Study of Exchange Traded ADRs from India,

Money and Finance, ICRA Bulletin.

2. Fenn, G.W., (2000). Speed of issuance and adequacy of disclosure in the Rule 144A

high-yield debt market, Journal of Financial Economics 56, 383405.

SAMZODHANA SAMZODHANA SAMZODHANA SAMZODHANA Journal of Management Research Journal of Management Research Journal of Management Research Journal of Management Research

Vol 2 Vol 2 Vol 2 Vol 2, ,, , I II Issue 1 ssue 1 ssue 1 ssue 1 March March March March 2014 2014 2014 2014

www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in www.eecmbajournal.in

125

3. Jayaraman, N., Shastri, K., Tandon, K., (1993). The impact of international cross listings

on risk and return: The evidence from American depositary receipts, Journal of Banking

and Finance, vol. 17, pp. 91-104.

4. Jitendranathan, T., T.R. Nirmalanandan and Tandon, K. (2000). Barriers to international

investing and market segmentation: Evidence from Indian GDR market, Pacific-Basin

Finance Journal, vol. 8, pp. 399-417.

5. Kadapakkam, P., Misra, L., Tse, Y., (2003). International Price Discovery for Emerging

Market Stocks: Evidence from Indian GDRs, Review of Quantitative Finance and

Accounting, September 2003, pp. 179199.

6. Karolyi, A, (1998), What Happens to Stocks that List Shares Abroad? A Survey of

Evidence and its Managerial Implications, NYU Salomon Brothers Center Monograph

series, 7, #1.

7. Miller, D.P., (1999). The market reaction to international cross-listings: Evidence from

depositary receipts, Journal of Financial Economics, vol. 51,103,123.

8. Moel, A., (2000). The Role of ADRs in the Development of Emerging Markets, Working

Paper. Harvard Business School.

9. Pinegar, J.M. and R. Ravichandran, (2002). Global and local information asymmetries,

illiquidity and SEC Rule 144A/Regulation S: The case of Indian GDRs, Journal of Banking

and Finance, vol. 26, pp. 1645-1673.

10. Saxena, S. (2006). Premia in the Indian ADR Market- An Analysis of Trend and Causes,

available at http:// www.

11. Eaton.T, Nofsinger.J, and Weaver, D. (2007). Disclosure and the cost of equity in

international cross-listing, Review of Quantitative Finance and Accounting, Volume 29,

Number 1, pp 1-24.

You might also like

- Summary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoFrom EverandSummary of Philip J. Romero & Tucker Balch's What Hedge Funds Really DoNo ratings yet

- If (3,4,5)Document8 pagesIf (3,4,5)gopika premarajanNo ratings yet

- A Practical Approach to the Study of Indian Capital MarketsFrom EverandA Practical Approach to the Study of Indian Capital MarketsNo ratings yet

- International Swaps and Derivatives Association (ISDA)Document5 pagesInternational Swaps and Derivatives Association (ISDA)Anonymous f5qGAcZYNo ratings yet

- INVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)From EverandINVESTING IN STOCKS: Building Wealth and Financial Freedom through Stock Market Investments (2023 Guide for Beginners)No ratings yet

- GDR Global Depository ReceiptsDocument28 pagesGDR Global Depository Receiptssrk_pk_sunnyNo ratings yet

- Mutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingFrom EverandMutual Funds - The Mutual Fund Retirement Plan For Long - Term Wealth BuildingNo ratings yet

- ADR and GDRDocument22 pagesADR and GDRsaini_randeep2No ratings yet

- International Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCEFrom EverandInternational Trade Finance: A NOVICE'S GUIDE TO GLOBAL COMMERCENo ratings yet

- Adr GDR IdrDocument27 pagesAdr GDR IdrMohit Batra100% (1)

- Hemant Sachan - IFMDocument12 pagesHemant Sachan - IFMHemant SachanNo ratings yet

- SMO Unit-Iv Adr, Fdi, GDR, Fii, Euro IssueDocument6 pagesSMO Unit-Iv Adr, Fdi, GDR, Fii, Euro IssueSANGITA ACHARYANo ratings yet

- Depository Receipts PrimerDocument5 pagesDepository Receipts PrimerAstrologer GuruNo ratings yet

- Chapter 3Document21 pagesChapter 3Manjunath BVNo ratings yet

- (Deutsche Bank) Depositary Receipts HandbookDocument22 pages(Deutsche Bank) Depositary Receipts Handbook00aaNo ratings yet

- American Depositary Receipts - Rule 144A Depositary ReceiptsDocument9 pagesAmerican Depositary Receipts - Rule 144A Depositary Receiptsquynh4290No ratings yet

- Depository Receipts in India: With A Special Reference To Indian Depository ReceiptsDocument18 pagesDepository Receipts in India: With A Special Reference To Indian Depository Receiptsnikhil rajpurohitNo ratings yet

- What Is Euro Issue?Document22 pagesWhat Is Euro Issue?Jay PandyaNo ratings yet

- Global Depositary Receipts: Himanshu Ahire 13 Executive Full Time PGDM (2009-2010) Trimester 4Document22 pagesGlobal Depositary Receipts: Himanshu Ahire 13 Executive Full Time PGDM (2009-2010) Trimester 4rbharat87No ratings yet

- GDR - Global Depository ReceiptsDocument22 pagesGDR - Global Depository Receiptshahire0% (1)

- Adr GDRDocument28 pagesAdr GDRAnupam JyotiNo ratings yet

- ADR Wipro Meenakshi 2212376Document14 pagesADR Wipro Meenakshi 2212376sharmameenakshi11No ratings yet

- ADR and GDR (International Finance)Document37 pagesADR and GDR (International Finance)Philippa DmelloNo ratings yet

- Adr, GDR, Idr PDFDocument27 pagesAdr, GDR, Idr PDFmohit0% (1)

- DEC 2022 - International FinanceDocument10 pagesDEC 2022 - International FinanceindrakumarNo ratings yet

- Market For Depository ReceiptsDocument16 pagesMarket For Depository ReceiptsShivangi MahajanNo ratings yet

- Adr & GDRDocument14 pagesAdr & GDRMANSI JOSHINo ratings yet

- CH 6 DRsDocument25 pagesCH 6 DRsNamrata NeopaneyNo ratings yet

- Adr GDR IdrDocument19 pagesAdr GDR IdrRachit MadhukarNo ratings yet

- Ways To Raise Finance From International MarketDocument7 pagesWays To Raise Finance From International Marketankitonway100% (1)

- Law MantraDocument20 pagesLaw MantraSakshi JhaNo ratings yet

- Adr - GDRDocument81 pagesAdr - GDRPankaj ChauhanNo ratings yet

- Global Markets: Topic: ADR's, GDR's & FCCB'sDocument10 pagesGlobal Markets: Topic: ADR's, GDR's & FCCB'sRachna JayaraghavNo ratings yet

- American Depositary ReceiptDocument7 pagesAmerican Depositary ReceiptarmailgmNo ratings yet

- Master of Business Administration 42Document7 pagesMaster of Business Administration 42ali_rahim1988No ratings yet

- American Depository Receipt Global Depository Receipt European Depository ReceiptDocument6 pagesAmerican Depository Receipt Global Depository Receipt European Depository ReceiptJohn RizviNo ratings yet

- Pallavithakur28064 AssignmentDocument12 pagesPallavithakur28064 AssignmentNoob DaddyNo ratings yet

- SAPM - Notes-1 PDFDocument9 pagesSAPM - Notes-1 PDFSanjay YadavNo ratings yet

- Depository ReceiptsDocument38 pagesDepository ReceiptsUdit SethiNo ratings yet

- The University of Economics Ho Chi Minh City The International School of Business (Ueh - Isb)Document17 pagesThe University of Economics Ho Chi Minh City The International School of Business (Ueh - Isb)Trần Ngọc LanNo ratings yet

- Sources of International FinancingDocument6 pagesSources of International FinancingSabha Pathy100% (2)

- ADR and GDR and IDRDocument3 pagesADR and GDR and IDRVarun IsraniNo ratings yet

- ADR&GDRDocument4 pagesADR&GDRdaksha pathakNo ratings yet

- Depository Receipts: IDR and Its Legal Framework: GNLU-MA-AV-0417-02Document9 pagesDepository Receipts: IDR and Its Legal Framework: GNLU-MA-AV-0417-02Falguni MathewsNo ratings yet

- ProjectDocument30 pagesProjectSunilPandeyNo ratings yet

- Unit-6 International Sources of FinanceDocument12 pagesUnit-6 International Sources of FinanceShefali TailorNo ratings yet

- Adr, GDR and Idr: Presented By: Group 4Document30 pagesAdr, GDR and Idr: Presented By: Group 4Govind VaishnavNo ratings yet

- American Depository Receipts (Adr) & Global Depository Receipts (GDR)Document6 pagesAmerican Depository Receipts (Adr) & Global Depository Receipts (GDR)Sanjeet MohantyNo ratings yet

- Financial Management Report - C2Document15 pagesFinancial Management Report - C2NairaNo ratings yet

- American Depositary Receipts Basics: (Page 1 of 4)Document4 pagesAmerican Depositary Receipts Basics: (Page 1 of 4)garvitdaveNo ratings yet

- American Depository ReceiptsDocument38 pagesAmerican Depository ReceiptsD Attitude KidNo ratings yet

- Forex ADR AND GDRDocument14 pagesForex ADR AND GDRBanti guptaNo ratings yet

- International Finance Ch3Document5 pagesInternational Finance Ch3Farheen AkramNo ratings yet

- ADR N GDRDocument7 pagesADR N GDRShoaib_456No ratings yet

- Presentation By: Chaitra Datta Deepak Gayatri Hanumanth Harish Irfan ImranDocument39 pagesPresentation By: Chaitra Datta Deepak Gayatri Hanumanth Harish Irfan Imranaliaabid2012No ratings yet

- Adr and GDR NotesDocument3 pagesAdr and GDR NotesMAGESH KUMARNo ratings yet

- ADR's and GDR'S: Submitted by Raja Kumar Naik (32) Venkata Ashok (44) Vicky KumarDocument17 pagesADR's and GDR'S: Submitted by Raja Kumar Naik (32) Venkata Ashok (44) Vicky KumarAshok VenkataNo ratings yet

- Content: Definition: Global Depository Receipt (GDR) Procedure For Issue of GDR in A CompanyDocument29 pagesContent: Definition: Global Depository Receipt (GDR) Procedure For Issue of GDR in A CompanyVirendra JhaNo ratings yet

- Adr & GDRDocument6 pagesAdr & GDRJaikishan BiswalNo ratings yet

- Sourcing Equity GloballyDocument27 pagesSourcing Equity GloballySpidy BondNo ratings yet

- Ournal of Nvironmental Anagement and Ourism: Issue 6 (30) Fall 2018 ISSN 2068 - 7729 Journal DOIDocument17 pagesOurnal of Nvironmental Anagement and Ourism: Issue 6 (30) Fall 2018 ISSN 2068 - 7729 Journal DOIDr. Pabitra Kumar MishraNo ratings yet

- Revisiting Feldstein-Horioka Puzzle: Evidence From SAARC EconomiesDocument21 pagesRevisiting Feldstein-Horioka Puzzle: Evidence From SAARC EconomiesDr. Pabitra Kumar MishraNo ratings yet

- Tourism-Energy-Environment-Growth Nexus: Evidence From IndiaDocument12 pagesTourism-Energy-Environment-Growth Nexus: Evidence From IndiaDr. Pabitra Kumar MishraNo ratings yet

- Corona Pandemic and Stock Market Behaviour: Empirical Insights From Selected Asian CountriesDocument25 pagesCorona Pandemic and Stock Market Behaviour: Empirical Insights From Selected Asian CountriesDr. Pabitra Kumar MishraNo ratings yet

- Do Women's Advancement and Gender Parity Promote Economic Growth? Evidence From 30 Asian CountriesDocument22 pagesDo Women's Advancement and Gender Parity Promote Economic Growth? Evidence From 30 Asian CountriesDr. Pabitra Kumar MishraNo ratings yet

- Management Convergence: (An International Journal of Management)Document13 pagesManagement Convergence: (An International Journal of Management)Dr. Pabitra Kumar MishraNo ratings yet

- Poverty in Multidimensional Perspective: Policy Insights From Selected North Indian DistrictsDocument28 pagesPoverty in Multidimensional Perspective: Policy Insights From Selected North Indian DistrictsDr. Pabitra Kumar MishraNo ratings yet

- Surplus Agricultural Labour and The Development of A Dual EconomyDocument27 pagesSurplus Agricultural Labour and The Development of A Dual EconomyDr. Pabitra Kumar MishraNo ratings yet

- Industrial Development and Policy: Revisiting Schumpeter in The 21st CenturyDocument19 pagesIndustrial Development and Policy: Revisiting Schumpeter in The 21st CenturyDr. Pabitra Kumar MishraNo ratings yet

- Kkhsou PDFDocument8 pagesKkhsou PDFDr. Pabitra Kumar MishraNo ratings yet

- Unit 1: Definition, Scope and Importance of PhilosophyDocument12 pagesUnit 1: Definition, Scope and Importance of PhilosophyDr. Pabitra Kumar MishraNo ratings yet

- 3 PS BirthalDocument12 pages3 PS BirthalDr. Pabitra Kumar MishraNo ratings yet

- Mefe 8 11Document9 pagesMefe 8 11Dr. Pabitra Kumar MishraNo ratings yet

- Food InflationDocument32 pagesFood InflationDr. Pabitra Kumar MishraNo ratings yet

- Demonetization Whether The Stated Objectives Have Been Met With or Not: An Analysis of Success of The Move in The Present and The Future ProspectiveDocument9 pagesDemonetization Whether The Stated Objectives Have Been Met With or Not: An Analysis of Success of The Move in The Present and The Future ProspectiveDr. Pabitra Kumar MishraNo ratings yet

- Community Perception On Implementation of Environmental Taxation For Sustainable Development in NigeriaDocument9 pagesCommunity Perception On Implementation of Environmental Taxation For Sustainable Development in NigeriaDr. Pabitra Kumar MishraNo ratings yet

- NET NotificationDocument43 pagesNET NotificationDr. Pabitra Kumar MishraNo ratings yet

- 09 Chapter 3Document67 pages09 Chapter 3Dr. Pabitra Kumar MishraNo ratings yet

- IITM Placement BrochureDocument45 pagesIITM Placement BrochureDr. Pabitra Kumar MishraNo ratings yet

- Department of Management Studies Indian Institute of Science, Bangalore, INDIADocument29 pagesDepartment of Management Studies Indian Institute of Science, Bangalore, INDIADr. Pabitra Kumar MishraNo ratings yet

- PseDocument3 pagesPseAsh1No ratings yet

- Stock Exchange Online Share Trading at Nirmal BangDocument111 pagesStock Exchange Online Share Trading at Nirmal Bangpreet100% (1)

- Corporation AccountingDocument71 pagesCorporation AccountingUmar Zahid100% (1)

- Testing Ben Graham NCAV Strategy in LondonDocument16 pagesTesting Ben Graham NCAV Strategy in LondonAdvanced Security AnalysisNo ratings yet

- Overview of Indian Securities Market: Chapter-1Document100 pagesOverview of Indian Securities Market: Chapter-1tamangargNo ratings yet

- Peter Lynch 8 Growth StocksDocument6 pagesPeter Lynch 8 Growth Stockssrikrishnak100% (2)

- FM Assignment - EVA and DuPont Analysis For CompaniesDocument10 pagesFM Assignment - EVA and DuPont Analysis For Companiesamitbharadwaj7No ratings yet

- CAI MCQ Booklet v2 FinalDocument51 pagesCAI MCQ Booklet v2 FinalSanket ChouguleNo ratings yet

- Leveraged BuyoutDocument11 pagesLeveraged BuyoutDeekshith NNo ratings yet

- StocksDocument6 pagesStocksChristine AltamarinoNo ratings yet

- 7 Steps To Understanding The Stock Market Ebook v6Document32 pages7 Steps To Understanding The Stock Market Ebook v6Afsal Mohamed Kani 004No ratings yet

- Pengaruh Pendidikan Kewirausahaan Terhadap Minat Berwirausaha Mahasiswa Akuntansi Universitas Islam Malang Moh. HarisDocument11 pagesPengaruh Pendidikan Kewirausahaan Terhadap Minat Berwirausaha Mahasiswa Akuntansi Universitas Islam Malang Moh. Hariskharis maulanaNo ratings yet

- Soal Tambahan Chap 8Document3 pagesSoal Tambahan Chap 8Tarisya PermatasariNo ratings yet

- Ratio Analysis and Excel TemplatesDocument4 pagesRatio Analysis and Excel Templatesmartain maxNo ratings yet

- Financial Management 2-UumDocument48 pagesFinancial Management 2-UumjameshsurunaNo ratings yet

- Afs ProjectDocument37 pagesAfs ProjectNuman RoxNo ratings yet

- Stock Valuation: Div PP R PDocument7 pagesStock Valuation: Div PP R PLeanne TehNo ratings yet

- 409A Training 2023Document41 pages409A Training 2023Chulbul PandeyNo ratings yet

- International Bond and Equity Market ExerciseDocument5 pagesInternational Bond and Equity Market ExerciseSylvia GynNo ratings yet

- Stock Market English 1Document5 pagesStock Market English 1Moustapha DjitteNo ratings yet

- List of Index Funds in India 2024 Download ExcelDocument8 pagesList of Index Funds in India 2024 Download ExcelMana PlanetNo ratings yet

- Bus 262 Business Finance Student Final Part HW Corona 2020Document4 pagesBus 262 Business Finance Student Final Part HW Corona 2020Olatowode OluwatosinNo ratings yet

- 115 - Indian Stock Market - Sumit DwivediDocument23 pages115 - Indian Stock Market - Sumit DwivedishobikhanNo ratings yet

- The Performance of IPO of Sarawak Listed CompaniesDocument0 pagesThe Performance of IPO of Sarawak Listed CompaniesGabriel SimNo ratings yet

- Investing 101Document27 pagesInvesting 101KaramSoftNo ratings yet

- Analysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioDocument10 pagesAnalysis of IPO As An Exit Strategy For Private Equity Firms in The Present ScenarioPushpak Reddy GattupalliNo ratings yet

- Introduction To Investment and SecuritiesDocument19 pagesIntroduction To Investment and Securitiesankitb20No ratings yet

- ch15 2e Kieso TBDocument46 pagesch15 2e Kieso TBMohammed Khouli100% (3)

- CH 5Document11 pagesCH 5yebegashetNo ratings yet

- CHAPTER 12 Stock ValuationDocument36 pagesCHAPTER 12 Stock ValuationVivi CheyNo ratings yet

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 3.5 out of 5 stars3.5/5 (8)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyFrom EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyRating: 3 out of 5 stars3/5 (1)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamFrom EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamNo ratings yet

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialNo ratings yet

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- Built, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursFrom EverandBuilt, Not Born: A Self-Made Billionaire's No-Nonsense Guide for EntrepreneursRating: 5 out of 5 stars5/5 (13)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- The Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsFrom EverandThe Merger & Acquisition Leader's Playbook: A Practical Guide to Integrating Organizations, Executing Strategy, and Driving New Growth after M&A or Private Equity DealsNo ratings yet

- Product-Led Growth: How to Build a Product That Sells ItselfFrom EverandProduct-Led Growth: How to Build a Product That Sells ItselfRating: 5 out of 5 stars5/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsFrom EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsRating: 4.5 out of 5 stars4.5/5 (21)

- Value: The Four Cornerstones of Corporate FinanceFrom EverandValue: The Four Cornerstones of Corporate FinanceRating: 4.5 out of 5 stars4.5/5 (18)

- Valley Girls: Lessons From Female Founders in the Silicon Valley and BeyondFrom EverandValley Girls: Lessons From Female Founders in the Silicon Valley and BeyondNo ratings yet

- Mind over Money: The Psychology of Money and How to Use It BetterFrom EverandMind over Money: The Psychology of Money and How to Use It BetterRating: 4 out of 5 stars4/5 (24)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursFrom EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursRating: 4.5 out of 5 stars4.5/5 (8)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)From EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Rating: 4 out of 5 stars4/5 (5)

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsFrom EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsRating: 5 out of 5 stars5/5 (1)

- The Value of a Whale: On the Illusions of Green CapitalismFrom EverandThe Value of a Whale: On the Illusions of Green CapitalismRating: 5 out of 5 stars5/5 (2)