Professional Documents

Culture Documents

Development and Assessment of An Alternative Investment Product

Uploaded by

niteshkpatelOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Development and Assessment of An Alternative Investment Product

Uploaded by

niteshkpatelCopyright:

Available Formats

Celebrity Twitter

Portfolio

Nitesh Patel

Student Number: 20008726

Module: IC311 Alternative Investments

Lecturer: Andreas Hoepner

Development and Assessment

of an Alternative Investment

Product

This study looks to present empirical analysis on a

portfolio created using a strategy of holding stocks, which

have been positively mentioned by celebrities in their

tweets.

Nitesh Patel (20008726)

2

Executive Summary

1. Research Purpose

The aim of this paper is to construct an alternative investment product based on celebrity tweets and the

subsequent assessment of its performance. Over the course of this study, I will look to answer: How does the

product perform in comparison to the benchmark and market portfolio and what conclusions can be drawn from the

evaluation.

2. Research Design

The first steps to preparing the data; I chose a sample of celebrity Twitter users. Researching and find the most

followed users; I then eliminated those whose data were unattainable, or not suitable, whilst also looking at finding

a varied sample of users who are widely followed. The celebrities Twitter history is then retrieved and filtered for the

mentioning of S&P500, FTSE350 and the Top 500 Global Brands. A portfolio is then created based upon the filtered

tweets, and the portfolio performance is assessed using simple risk and return measures, as well as advanced

relative risk measures.

3. Findings

A total of 173 different trade positions were identified and held, which consisted of 50 different companies. The

strategy is long-only, with each trade identified by the strategy, being held for 52 weeks (1 year), and then sold. The

subsequent performance assessment reveals that the product is profitable and outperforms its benchmark in many

aspects. The reward to risk relation is very positively in favour of the created portfolio.

4. Research Limitations

First of all the study carried out, is comparatively small in sample period, due to limited data availability. I can

retrieve circa 3200 tweets from any Twitter user, however if they frequently tweet this may shorten the time horizon

for that individual. Additionally the social media platform did not have widespread use until 2009/2010. The filtering

system relies on the list input, and therefore many companies will be omitted. Also the Twitter users may mis-spell

or spell differently the company which will mean their tweet doesnt pass the filter.

5. Research Implications (Theoretical & Practical)

The performance assessment of the portoflio created in this study, provides abnormal returns. This is a good starting

step, for further research, to improve the reliability and validity of the research carried out thus far. Further data can

be mined and analysed to help improve the post-execution performance evaluation.

6. Originality/Value

This paper is the first to attempt to create a trading strategy and portfolio which is based solely upon celebrities

mentioning the use of, endorsing or posting positively about a product, service or company. Previous studies have

looked at financial experts influence on Twitter, on general moods amongst the public to predict the market, or

posititvity to predict box office opening weekend outcomes, etc.

This study shows signs of positive performance using the strategy formulated. In line with many studies carried out

before, this study also shows a positive relationship between the activity on Twitter and stock returns.

Nitesh Patel (20008726)

3

Table of Contents

Executive Summary ........................................................................................................................................................... 2

1. Introduction .............................................................................................................................................................. 4

2. Study Outline ............................................................................................................................................................ 4

3. Data ........................................................................................................................................................................... 5

4. Portfolio Creation ...................................................................................................................................................... 6

5. Product Assessment .................................................................................................................................................. 7

5.1 Test for normality .............................................................................................................................................. 7

5.2. Return .................................................................................................................................................................... 8

5.3 Risk .................................................................................................................................................................... 9

5.4 Higher moments of return distribution .......................................................................................................... 10

5.5 Correlation ...................................................................................................................................................... 11

5.6. Capital Asset Pricing Model ................................................................................................................................. 12

5.7. Advanced Absolute Risk Measures ...................................................................................................................... 13

5.8. Advanced Relative Risk Measures........................................................................................................................ 14

6. Discussion and Conclusion .......................................................................................................................................... 15

Sources ............................................................................................................................................................................ 16

Appendix ......................................................................................................................................................................... 17

Tables

Table 1: Celebrities used, and their corresponding number of followers and tweets. .................................................... 5

Table 2: The final set of events which are used to create the portfolio ........................................................................... 6

Table 3: The Jarque-Bera scores for the portfolios ........................................................................................................... 8

Table 4: Standard Deviation of the Excess Return of the Portfolio. Weekly and Yearly Comparison. ............................. 9

Table 5: Portfolio skewness and kurtosis ........................................................................................................................ 10

Table 6: Advanced Absolute Risk Measures for Portfolio and MSCI World Index .......................................................... 13

Table 7: Advanced Relative Risk Measures for Portfolio and MSCI World ..................................................................... 14

Figures

Figure 1: Histograms displaying the return distribution and the corresponding skewness and kurtosis ........................ 7

Figure 2: Arithmetic Mean Excess Return of the portfolios .............................................................................................. 9

Figure 3: Arithmetic Mean Return of the portfolios ......................................................................................................... 9

Figure 4: Standard Deviation of the Excess Return from the Portfolio and the MSCI World Index ............................... 10

Figure 5: Returns of both Portfolio and MSCI World Index ............................................................................................ 11

Figure 6: Regression of Portfolio Returns using CAPM ................................................................................................... 12

Figure 7: Regression of MSCI WORLD Returns using CAPM ........................................................................................... 12

Nitesh Patel (20008726)

4

1. Introduction

Social media is a revolution, which we are currently experiencing. It has changed the way people communicate and

interact with one another, and opens up many more avenues to share news, information, and just general chit chat.

Social media is relatively quiet young, but is here to stay for the foreseeable future. We are now at a point where

online, we can share, read and react to lots of individual information being posted on microblogging websites, such

as Twitter, Facebook, Google+, Tumblr and more. Twitter in particular has been widely embraced

Financial theory dictates that markets are efficient, and therefore public information is already incorporated into

pricing, Fama (1970). However, we are now at a point where online, we can share, read and react to lots of

individual information being posted on microblogging websites, such as Twitter, Facebook, Google+, Tumblr and

more. This information is public, could be relevant and if not fully analysed and traded upon, could give us pricing

information not yet priced into the market.

Using empirical data, we can analyse these online messages to find relationships with relating stock prices on a

matching time scale and period. The celebrity community is sharing information and opinions on brands and

companies, continuously throughout the day on Twitter. These users have significant followings and their opinions,

endorsements and use of everyday items, can be read via tweets by millions. They have the ability to change public

opinion, and therefore followers may purchase or appreciate certain companies and brands more. Therefore they

could have a correlation with company stock. Positive tweets from celebrities regarding companies can be seen as a

vote of confidence from the celebrity world. Alternatively, if a user tweets their dislike for a product, this could be

early signs of product failure, as generally celebrities are trend setters, and can make or break product launches. This

field of research looks to filter and analyse masses of freely available data to be able to gauge positivity regarding

companies and brands from the celebrity world.

The purpose of this research is to be able to answer whether positive celebrity tweeting correlates with positive

stock gains in the following months. I will be creating a portfolio which is based on investing in companies which

receive positive tweets from celebrities in the forms of endorsement, positively talking about a company or brand, or

tweeting they use or have been using a companys product or service.

2. Study Outline

Several previous studies, which I reviewed in prior to this, found significant relationships between information

derived from tweets and different stock market characteristics. This study looks to build on the area looking at

influential Twitter users and whether, their tweets can lead to stock market gains due to their positivity to the

companys products and services. The data required initially, is compiled lists of tweets from celebrities. These are

then filtered using a list consisting of the S&P500, FTSE350 and The Top 500 Global Brands. The remaining lists of

tweets are then human-read, to be able to identify tweets which relevant. This leaves a final sample of trigger

events, which are then sorted and the portfolios are constructed accordingly. Once the portfolios are established

their performance is assessed in terms of return and risk to return measures. The findings from the analysis will be

summarised and discussed in chapter six, which will also include the limitations faced by the study, and how it could

be improved with further study and analysis.

Nitesh Patel (20008726)

5

3. Data

Celebrities due to their nature, have a high following on Twitter and therefore are a good proxy for highly influential

users. A list of celebrities is created arbitrarily but consists of those highly followed, good Twitter usage and chosen

to be a varied sample. The sample of celebrities is shown below.

Celebrity Twitter Username Followers No. of Tweets

Katy Perry @katyperry 52,491,541 5528

Justin Bieber @justinbieber 51,141,985 26,666

Barack Obama @BarackObama 42,663,795 11,630

Taylor Swift @taylorswift13 40,409,722 2,188

Justin Timberlake @jtimberlake 31,894,986 2,250

Ellen DeGeneres @TheEllenShow 28,626,945 8,758

Cristiano Ronaldo @cristiano 25,644,831 1,878

Kim Kardashian @KimKardashian 20,837,250 17,302

Harry Styles @Harry_Styles 20,242,335 4,703

Kaka @kaka 18,633,916 3,444

Niall Horan @NiallOfficial 18,056,095 9,054

Pitbull @pitbull 16,383,036 5,475

Ashton Kutcher @aplusk 15,985,311 8,333

Drizzy (Drake) @Drake 14,828,200 1,539

Emma Watson @EmWatson 12,854,363 707

Paris Hilton @parishilton 12,679,214 19,435

Stephen Fry @stephenfry 6,757,550 19,115

Jessie J @JessieJ 6,556,915 15,912

Ricky Gervais @rickygervais 5,758,776 15,258

Table 1: Celebrities used, and their corresponding number of followers and tweets. Data from: http://Twittercounter.com/pages/100

Using a python script with the use of Twitter developer access (further information in the appendix), I pull the last

3200 tweets from all the celebrities. The limitation of 3200 is due to the structure of Twitter and the maximum

historic allowance for my basic developer status. The script is a heavily edited version of other freely available scripts

on python repositories.

These tweets are exported to an excel spreadsheet, which then with the use a VBA script; I can filter using a list. The

list consists of the S&P500 company names, FTSE350 company names and the Global 500 Most Valuable Brands,

retrieved from http://brandirectory.com/league_tables/table/global-500-2014. The final outputted list of tweets are

then human read, to verify they are referring to a publicly listed company and if they are endorsing, positively talking

about or mentioning their use of a product, service or company. For example, a celebrity tweeting their positive

opinion on the new iPhone, would count as a trigger to go long Apple (APPL) stock.

The tweets which pass the filtering system are then named events, which are collated together. All the events up to

1

st

Jan 2014, are then used to create a portfolio.

The financial data for the companies is retrieved from DataStream and the data collection period is from April 2008

to the present day. The data is enough to cover a year prior to the first trigger event, which is required to create a

portfolio of the previous 12months to the trading strategy portfolio. The data is then transformed into weekly

returns for each stock between April 2008 and now.

The benchmark being used is the MSCI World Index, which the data for has also been pulled from DataStream. The

risk free data is obtained from http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html. The

market portfolio chosen is the S&P500, due to majority of my trades for the portfolio being American companies.

The S&P 500 weekly data has been obtained from http://research.stlouisfed.org/fred2/series/SP500/downloaddata.

Nitesh Patel (20008726)

6

Table 2: The final set of events which are used to create the portfolio

4. Portfolio Creation

The strategy behind creating this portfolio is to invest in those firms which are being positively mentioned via Twitter

from celebrities. In the preceding review of literature on this field, it is observed that positivity regarding certain

subjects on Twitter, can in fact predict the outcomes, such as the study to predict box office movie returns on the

basis of positivity surrounding the movie prior to the release, Asur, S. and Huberman, B. A. (2010). In this case we are

looking for abnormal stock returns after celebrities have mentioned the stock in a positive light.

The strategy is to create a long only, equally weighted portfolio, holding the corresponding stock for 12 months after

the tweet has passed the filtering system. The stock will be held for 12 months, as time needs to be allowed, the

tweet to disseminate throughout the rest of Twitter, or word of mouth, as the positivity surrounding the product or

service, will generate further rounds of positive discussion between followers.

A secondary portfolio is created with the same event dates but a portfolio of the previous 12 months. This allows for

a comparison of the returns between the portfolio, before and after the tweet from the celebrity.

Nitesh Patel (20008726)

7

1

0 0 0

4

11

24

89

84

33

5

1 1 1

0

1

-

0

.

1

7

5

7

-

0

.

1

4

9

9

-

0

.

1

2

4

1

-

0

.

0

9

8

3

-

0

.

0

7

2

5

-

0

.

0

4

6

7

-

0

.

0

2

0

9

0

.

0

0

4

9

0

.

0

3

0

7

0

.

0

5

6

5

0

.

0

8

2

3

0

.

1

0

8

1

0

.

1

3

3

9

0

.

1

5

9

7

0

.

1

8

5

5

M

o

r

e

Histogram Portfolio

Returns

1 0 0 0 0 1 2

5

9

47

133

42

12

1 1 1

-

0

.

3

6

1

2

-

0

.

3

2

2

6

4

-

0

.

2

8

4

0

8

-

0

.

2

4

5

5

2

-

0

.

2

0

6

9

6

-

0

.

1

6

8

4

-

0

.

1

2

9

8

4

-

0

.

0

9

1

2

8

-

0

.

0

5

2

7

2

-

0

.

0

1

4

1

6

0

.

0

2

4

4

0

.

0

6

2

9

6

0

.

1

0

1

5

2

0

.

1

4

0

0

8

0

.

1

7

8

6

4

M

o

r

e

Histogram Portfolio of

Previous 12 Months

1 1 2 1

3

9

20

30

47

61

40

22

12

3

1 2

-

0

.

0

8

2

7

3

4

2

6

1

-

0

.

0

7

2

2

7

7

2

1

6

-

0

.

0

6

1

8

2

0

1

7

1

-

0

.

0

5

1

3

6

3

1

2

6

-

0

.

0

4

0

9

0

6

0

8

1

-

0

.

0

3

0

4

4

9

0

3

6

-

0

.

0

1

9

9

9

1

9

9

-

0

.

0

0

9

5

3

4

9

4

5

0

.

0

0

0

9

2

2

1

0

.

0

1

1

3

7

9

1

4

5

0

.

0

2

1

8

3

6

1

9

0

.

0

3

2

2

9

3

2

3

5

0

.

0

4

2

7

5

0

2

8

0

.

0

5

3

2

0

7

3

2

5

0

.

0

6

3

6

6

4

3

7

M

o

r

e

Histogram MSCI World

Index

-

0

.

0

6

7

2

1

4

5

0

6

-

0

.

0

5

8

5

0

7

4

5

4

-

0

.

0

4

9

8

0

0

4

0

1

-

0

.

0

4

1

0

9

3

3

4

8

-

0

.

0

3

2

3

8

6

2

9

5

-

0

.

0

2

3

6

7

9

2

4

2

-

0

.

0

1

4

9

7

2

1

8

9

-

0

.

0

0

6

2

6

5

1

3

7

0

.

0

0

2

4

4

1

9

1

6

0

.

0

1

1

1

4

8

9

6

9

0

.

0

1

9

8

5

6

0

2

2

0

.

0

2

8

5

6

3

0

7

5

0

.

0

3

7

2

7

0

1

2

8

0

.

0

4

5

9

7

7

1

8

1

0

.

0

5

4

6

8

4

2

3

3

M

o

r

e

Histogram S&P500

Returns

5. Product Assessment

In this section I will assess the portfolio using several return and risk-related performance measures from the time of

the portfolios inception to the present day, the exception is the comparison portfolio created by holding each stock

for 12 months prior the execution of trading for the strategies portfolio. The portfolio returns are weekly based, as is

the data for the MSCI World Index, S&P 500. The risk-free rate which has be obtained is also the weekly rate.

Each trade is calculated to be executed on the same day each week after the tweet. Due to the financial data

retrieved, the weekly returns were based on a Wednesday to Wednesday timescale, and this is continued

throughout the analysis, to keep the structure simpler.

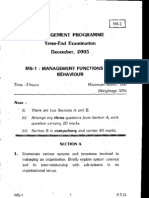

5.1 Test for normality

To assess whether skewness and kurtosis need to considered for the performance evaluation, I have created graphs

displaying the return distribution of the created strategy portfolio, the previous 12 months prior portfolio and the

MSCI World Index and S&P500.

Figure 1: Histograms displaying the return distribution and the

corresponding skewness and kurtosis

Nitesh Patel (20008726)

8

0

500

1000

1500

2000

2500

5/27/2009 5/27/2010 5/27/2011 5/27/2012 5/27/2013

Portfolio Value (Base: 1000)

Portfolio Nominal Value Benchmark Nominal Value S&P500 Nominal Value

In order to test for normality, I will test the portfolios using the Jarque-Bera test. At a confidence level of 95% a

critical value of 5.99 is derived. If the test statistic exceeds this value then the returns are not normally distributed.

The table below displays the Jarque-Bera values. Since all of the figures exceed 5.99 the returns are not normally

distributed. This finding therefore implies that skewness and kurtosis need to be considered when assessing the

performance.

Table 3: The Jarque-Bera scores for the portfolios

5.2. Return

The main performance evaluation of the portfolio created is the return. The portfolio return is created by taking the

logarithmic returns from the portfolio. Logarithmic returns are used as they are less likely to negative skewed and

more normally distributed than using normal returns. From this, I have created a nominal chart, as seen below,

representing the value of the created portfolio, the market portfolio and the benchmark, from the point of the first

trade executed by the strategy formulated for this study. This base value is at 1000, to make them easily

comparable.

Portfolio Returns Portfolio of previous 12 months MSCI World Index S&P 500

Jarque-Bera 744.7386 3008.143 44.8931 11.93281

Figure 2: Portfolio Values Since Fund Inception

Nitesh Patel (20008726)

9

0.000%

0.100%

0.200%

0.300%

0.400%

0.500%

0.600%

Portfolio Portfolio of

Previous

12 Months

MSCI

World

Index

S&P500

Arithmetic Mean Return

-0.200%

-0.100%

0.000%

0.100%

0.200%

0.300%

0.400%

Portfolio Portfolio of

Previous

12 Months

MSCI

World

Index

S&P500

Arithmetic

Mean Excess Return

3.47%

2.25%

2.16%

Portfolio

MSCI World Index

S&P500

Excess Return StDev Weekly

As seen from the charts above, all four portfolios when unadjusted for the risk free rate have positive average

weekly return. When taking into account the risk free rate (obtained from

http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html) it is visible that the created portfolio,

benchmark and market portfolio still have positive average returns, however the portfolio of the previous 12

months, created as the comparison, has negative average returns.

The analysis shows, for nominal and real return, the portfolio created, is considered a good investment. The portfolio

is a much better investment once the tweets have been posted by celebrities, as the portfolio of stocks since the

tweet performs, much better nominally and in real returns than the portfolio if held prior to the tweet.

This return does not take into account the inherent risk attached to the portfolios and therefore the next section will

focus on introducing some risk measures.

5.3 Risk

Risk for this portfolio can be considered the possibility of a return not meeting the expected return. A simple way to

measure this risk would be to analyse the return variance and the return standard deviation of the portfolio. To

account for the risk free asset class, I will look at the excess return variance and standard deviation.

Table 4: Standard Deviation of the Excess Return

of the Portfolio. Weekly and Yearly Comparison.

Excess Return

StDev Weekly

Excess Return

StDev Yearly

Portfolio 3.47% 24.99%

MSCI World

Index

2.25% 16.23%

S&P 500 2.16% 15.56%

Figure 3: Arithmetic Mean Return of the portfolios Figure 4: Arithmetic Mean Excess Return of the portfolios

Nitesh Patel (20008726)

10

Figure 3: Standard Deviation of the Excess Return from the Portfolio and the MSCI World Index

Both charts show that the portfolio created, exceeds the MSCI World Index, in terms of absolute risk. This is to be

expected, as the returns are higher for the portfolio than the benchmark. Therefore, the added risk of the portfolio is

compensated by additional return over the benchmark. To be able to compare the risk-return ratios, we need to

analyse this further using applicable risk to performance measures, these will be discussed later alongside other

advanced risk measures.

5.4 Higher moments of return distribution

The return distribution from the created portfolios, of the strategy portfolio, the comparison portfolio of the

previous 12 months prior to execution and the benchmark, can be described using skewness and kurtosis. The

following table displays the empirical values for skewness and kurtosis for the portfolios constructed, including the

benchmark being used.

Portfolio Portfolio of the previous 12

months

MSCI World

Index

S&P 500

Skewness 0.41679 -1.780550168 -0.49720721 -0.37941

Kurtosis 11.31411 18.37102221 4.794399124 3.736823

Table 5: Portfolio skewness and kurtosis

The created portfolio has a positive skew, whilst the benchmark , market and comparison portfolios are all

negatively skewed. This means that the created portfolio using the portfolio strategy will experience positive

deviations from the expected return. In respect to performance, this shows that the created portfolio is more

beneficial than benchmark and market, and shows improvement after the tweet event by being much higher skewed

than the comparison previous 12 month portfolio.

All of the kurtoses display a heavy positive excess kurtosis, except for the market portfolio. This is interesting as only

the market portfolio is similar to a normal distribution, being only 0.73 in excess kurtosis. All of the distributions are

leptokurtic, showing they have higher peaks than a normal distribution which can result in larger fluctuations in the

fatter tails. This can therefore impact the reliability of Value at Risk tests when assuming normal distribution, as

there extremities can vary a lot more relative to a normal distribution due to fatter tails.

Nitesh Patel (20008726)

11

5.5 Correlation

To be able to examine the relative movement of the created portfolio and the chosen market portfolio and

benchmark the MSCI World Index, we need to use a covariance and correlation. This will show us the diversification

in the portfolio and how the portfolio returns relative to the market returns.

Figure 4: Returns of both Portfolio and MSCI World Index

In the above chart, I have used a two period moving average line, to be able to show the correlation, a little easier,

due to the many weekly periods assessed in this study. The correlation between the two return sets, is 0.53, this

shows they are moderately correlated. The positive correlation shows they tend to increase and decrease together.

-0.15

-0.05

0.05

0.15

Returns of the Portolfio and MSCI World Index (2

Week Moving Average)

Portolfio Returns (LN) MSCI WORLD LN Returns

2 per. Mov. Avg. (Portolfio Returns (LN)) 2 per. Mov. Avg. (MSCI WORLD LN Returns)

Nitesh Patel (20008726)

12

5.6. Capital Asset Pricing Model

Another performance evaluation method is to apply the capital asset pricing model to the returns. Using CAPM, we

can regress the two sets of data, the portfolio and the market adjusted for the risk free rate. The slope will be the

beta value between the two return sets and the y intercept displaying Jensens Alpha. This is because:

Return(Portfolio/Benchmark) Risk Free = Jensens Alpha + Beta(Portfolio,Market) x [Return(Market) Risk Free] +

Residual Error Term.

Figure 5: Regression of Portolfio Returns using CAPM

Figure 6: Regression of MSCI WORLD Returns using CAPM

As the Figure 6 above shows, the Beta is -0.23 and this shows it offers a lower risk to the market portfolio as it is less

volatile than the S&P 500. It is almost 80% less volatile over the period of analysis for this created portfolio. This beta

also backs up the previous correlation statistics, showing there is a negative relationship between the S&P 500 and

the portfolio created. The y-intercept or Jensens Alpha of 0.004 represents the portfolios systemic return when the

y = -0.2318x + 0.004

R = 0.021

-0.2

-0.15

-0.1

-0.05

0

0.05

0.1

0.15

0.2

0.25

-0.08 -0.06 -0.04 -0.02 0 0.02 0.04 0.06 0.08

Regression of Portolfio Returns using

CAPM

y = 0.526x + 1E-04

R = 0.2538

-0.1000

-0.0800

-0.0600

-0.0400

-0.0200

0.0000

0.0200

0.0400

0.0600

0.0800

0.1000

-0.08 -0.06 -0.04 -0.02 0 0.02 0.04 0.06 0.08

Regression of MSCI WORLD Returns

using CAPM

Nitesh Patel (20008726)

13

market return is zero or the level of return from the created portfolio over the market for any given level of

systematic risk.

The R squared value of 2%, shows that 2% of the variance in this model, is explained by the data.

Unsurprisingly the MSCI World Index and S&P500, has a beta of 0.5, which shows there is a positively relationship,

however the MSCI World Index is less volatile, as to be expected by the nature of being more geographically

diversified portfolio.

5.7. Advanced Absolute Risk Measures

For a holistic approach to assessing the performance of the portfolio, we need to analyse the return with regards to

the risks associated, and whether the performance is good enough to justify the additional risk for the return over

the risk free rate.

Portfolio Returns

(LN)

MSCI WORLD LN

Returns

VaR 0.0535 0.0362

Expected

Shortfall

-0.0592 -0.0424

Drawdown -0.3002 -0.1575

LPM(rp) 0.0006 0.0003

SSD(rxp) 0.0241 0.0169

Shortfall Risk 0.4724 0.4764

Table 6: Advanced Absolute Risk Measures for Portfolio and MSCI World Index

The first measure of risk, which is commonly user, is Value at Risk. This is down by ranking the returns from the

lowest to highest and identifying the 5% cumulative figure. This gives us the expected loss not to exceed the VaR

with a probability of 95%. As shown in the table, the VaR level for the created portfolio is much higher than the

benchmark. This means on any given day there is a probability of 5%, that the created portfolio will incur losses of

5.35% or more, whilst the benchmark would lose 3.62% or more.

Another measure expected shortfall, can be used to analyse further the tails in the VaR measure. The expected

shortfall is the average loss experienced on the occasions that the portfolio or benchmark has exceeded the VaR

level. The VaR level is the minimum loss on any given day with a 5% probability, but the average loss deviates further

from the minimum loss in the benchmark compared to the created portfolio.

Drawdown is another risk measure that tells us the maximum decline in portfolio value before any recovery. The

created portfolio suffers a drop in 30% of the total value without any recovery, at some stage during the life of the

portfolio. A loss of almost a third of the portfolio value without seeing any positive gains on the weekly time period

is not good. The drawdown on the benchmark is not as harsh, at only 15.7%.

Lower Partial Moment is a measure of only downside risk. Standard deviation is commonly used, however it also

considers the uncertainty of the upside chances as well as the downside risk. In our test of the portfolio and the

benchmark, the portfolio has the higher downside risk.

Semi-standard deviation is another measure, which follows on from LPM. SSD is the square root of the LPM, which

means the squares deviations from the mean excess return. The portfolios SSD is valued at 2.4%, whilst the

benchmark registers 1.7%, overall the downside risk is lower for the benchmark than the portfolio.

Nitesh Patel (20008726)

14

Shortfall risk is another measure which can be derived from the LPM. By taking the LPM to the power 0, you can

calculate the probability of a return falling below the minimal acceptable level, in this case falling below the mean

excess return of the market portoflio, S&P 500. The values are very similar for the portfolio and benchmark, at 47.2%

and 47.6% respectively.

5.8. Advanced Relative Risk Measures

Following on from the absolute risk measures, we can compute relative risk indicators, as shown in the table below.

Portlfio Returns

(LN)

MSCI WORLD LN

Returns

Sharpe Ratio 0.1005 0.0382

RAPA 0.002169728 0.000823608

Treynor 0.0151 0.0016

Sortina 6.53066648 2.906925796

RoPS 0.007386009 0.00180046

Table 7: Advanced Relative Risk Measures for Portfolio and MSCI World

The most common risk measure used is the sharpe ratio, it is the ratio of the excess mean return of the portfolio

over the risk of the portfolio, valued as the standard deviation of the excess returns. As shown in the table, the

excess return per unit of deviation is higher for the portfolio than the benchmark. For this simple measure the risk-

adjusted returns are far superior for the portfolio relatively.

The treynor ratio is similar to the sharpe ratio, but differs slightly in that is accounts for only the systemic risk of the

portfolio rather than taking the total risk of the portfolio. Therefore the ratio is the excess mean return of the

portfolio over the beta of the portfolio. The beta is taken from the regressions done earlier, of the portfolio against

the market portfolio, the S&P500. Again the portfolio performs very well and far better than the benchmark.

The sortina ratio is the relative risk measuring following on from the Lower Partial Moment. This measure computes

the return on semi-standard deviation. As for the results of 6.5 and 2.9 for the portfolio and benchmark respectively,

this shows, that whilst the return for the portfolio is better, it is also has a much better return for the level of risk

(semi-standard deviation) when compared to the benchmark.

The last measured used is the Return on Probability of Shortfall. RoPS measures the return over the probability that

the return fails to exceed the mean excess return of the market portfolio. This follows on from the Shortfall

calculation in the previous section. The RoPS is far superior for the portfolio over the benchmark, and this means for

investors, the risk of shortfall is much greater compared to the level of return when investing in the benchmark, and

should invest in the portfolio created.

A have used no relative risk measures involving drawdown, as the nature of my portfolio, is a fixed 12 month hold

period, and therefore any drawdown suffered, I would not be able to react and cut my losses. These risk measures

would offer no value as they are more suited to higher frequency trading, where the aim is to allow profits to run

and cut losses. In my case the strategy is for the trade to run regardless of the market movement.

The relative measures used, all agree that the portfolio created by the strategy outlined in this study, has a much

better level of return per unit risk. When comparing this to the previous section, it shows compared to the

benchmark, the portfolio created, has a higher potential for losses, due to increased volatility, but with the returns it

generates for investors, it has a better risk-reward relationship.

Nitesh Patel (20008726)

15

6. Discussion and Conclusion

The preceding study is carried out using a strategy formulated using messages posted to Twitter from celebrities.

The strategy after all of the assessment done, looks to have found a positive relationship between the messages

regarding companies and the corresponding stocks return over the following 12 months.

Over the course of the portfolio, using the 173 trade executions, spanning 50 different companies, and each stock

being held for 12 months, we have beaten the benchmark, MSCI World Index, on several measures. The created

portfolio outperforms in the market portfolio and the benchmarks return over the life of the portfolio to date, but

also the relative risk associated it also outperforms the benchmark, showing a very positive reward to risk

relationship. The portfolio has a higher return, but suffers from a high value at risk, but due to having great relative

risk measure, you can see the portfolio rewards the investor much better per unit of risk taken relative to the

benchmark. However, the portfolio constituents and study all together, could be increased and improved.

The direct comparison between the before tweet event portfolio and the post tweet event portfolio shows a heavy

performance improvement after the tweet. At this point without further research and widening the data set, it is

possible to conclude, that there is a relationship between celebrities tweeting and stock prices for the following 12

months. This could be improved with another study to find the degree of effect on stock price improvement

dependant on the weighting of the number of followers and quantifying the positivity of the tweets.

The CAPM regression used could have been replaced with a Fama French three factor model or Cahart model to test

the drivers in the portfolio returns, to a much more detailed level. A further question to the validity of the portfolio

created, is the relatively short observation period. This would need to analysed in the forthcoming years, as Twitter

itself is a relatively new platform for sharing this public information, and therefore we can not just extend our data

back further. A vital assumption for many of the risk measures is normal distribution. As we saw the Jarque Bera test

was very high, showing the distribution is far form being normal, and therefore this could improved with a further

data in the datasets, that should lower the JB score, and help improve the reliability of the measures used.

The portfolio created, could be expanded to data mine more celebrities, and potentially move onto all public Twitter

users whose messages are then retweeted. This would increase the reliability, and help the portfolio become more

diversified, as more tweets would be passing through the filter system created. Additionally, I could add more public

companies into the filtering list, and a wholescale upgrade in the filtering system could be employed, as the python

and VBA scripting employed in this study, could be deemed relatively simplistic. I was limited by the computing

power available and the limited developer license issued by Twitter.

Nitesh Patel (20008726)

16

Sources

Andreas Hoepner (2014). TRADING ON BRAND EVALUATIONS: Corporate Reputation Total Return Fund:

Development and Assessment of an Alternative Investment Product. Alternative Investments - Investment Product

Carolin.

Asur, S. and Huberman, B. A. (2010). Predicting the future with social media. Proceeding WI-IAT '10 Proceedings of

the 2010 IEEE/WIC/ACM International Conference on Web Intelligence and Intelligent Agent Technology 1 pp. 492--

499.

Bodie, Kane and Marcus (2009): Investments, 8. Edition, Irvin: McGraw-Hill.

Datastream 2014, Weekly stock data 2008-2014, Weekly MSCI World Index data 2008-2014. Available from:

Datastream.

Fama/French Factors [Weekly]. Available from:

http://mba.tuck.dartmouth.edu/pages/faculty/ken.french/data_library.html.

Global 500 Brands 2014, Brand Finance. Available from: http://brandirectory.com/league_Tables/table/global-500-

2014.

Hoepner, A., Rammal, H. and Rezec, M. (2011). Islamic mutual funds financial performance and international

investment style: evidence from 20 countries. The European Journal of Finance, 17(9-10), pp.829--850.

Kempf, A. and Osthoff, P. (2007). The effect of socially responsible investing on portfolio performance. European

Financial Management, 13(5), pp.908--922.

Malkiel, B. G. and Fama, E. F. (1970). Efficient capital markets: A review of theory and empirical work*. The journal of

Finance, 25 (2), pp. 383--417.

Twitter Statistics, Twitter Counter. Available from: http://twittercounter.com/pages/100.

S&P 500 Weekly Data, FRED Economic Data. Available from:

http://research.stlouisfed.org/fred2/series/SP500/downloaddata

Nitesh Patel (20008726)

17

Appendix

Front end python code used to execute tweet download and create arrays for excel output. Tweepy and xlsxwriter

are modules which are available to be installed to run the background processes using additional functions. This

code is available online, and has been edited by myself to function in a way I could use it for this study.

consumer_key = "2US2nBhbbSR3f8lN72PHb2Isd"

consumer_secret = "uCAvXL1NY2IZgRTHbYFnIcTkGwEuh7jS1J35X6EcXGnnNHZSFn"

access_key = "2310455635-RTYxmilTEuhYdzrOJdV6tsCo5cfjd77yG1e0oT7"

access_secret = "iWb4q2SgSVDsuGXgtLnLQ17yKvZE0gPCmiirQbBOOrlcK"

def get_all_tweets(screen_name):

auth = tweepy.OAuthHandler(consumer_key, consumer_secret)

auth.set_access_token(access_key, access_secret)

api = tweepy.API(auth)

alltweets = []

new_tweets = []

outtweets = []

new_tweets = api.user_timeline(screen_name = screen_name,count=200)

alltweets.extend(new_tweets)

#save the id of the oldest tweet less one

oldest = alltweets[-1].id - 1

#keep grabbing tweets until there are no tweets left to grab

while len(new_tweets) > 0:

print "getting tweets before %s" % (oldest)

#all subsiquent requests use the max_id param to prevent duplicates

new_tweets = api.user_timeline(screen_name = screen_name,count=200,max_id=oldest)

#save most recent tweets

alltweets.extend(new_tweets)

#update the id of the oldest tweet less one

oldest = alltweets[-1].id - 1

print "...%s tweets downloaded so far" % (len(alltweets))

#transform the tweepy tweets into a 2D array

outtweets = [[tweet.id_str, tweet.created_at,

tweet.coordinates,tweet.geo,tweet.source,tweet.text] for tweet in alltweets]

return outtweets

def write_worksheet(twitter_name):

#formating for excel

format01 = workbook.add_format()

format02 = workbook.add_format()

format03 = workbook.add_format()

format04 = workbook.add_format()

format01.set_align('center')

format01.set_align('vcenter')

format02.set_align('center')

format02.set_align('vcenter')

format03.set_align('center')

format03.set_align('vcenter')

format03.set_bold()

format04.set_align('vcenter')

format04.set_text_wrap()

out1 = []

header = ["id","created_at","coordinates-x","coordinates-y","source","text"]

Nitesh Patel (20008726)

18

worksheet = workbook.add_worksheet(twitter_name)

out1 = get_all_tweets(twitter_name)

row = 0

col = 0

worksheet.set_column('A:A', 20)

worksheet.set_column('B:B', 18)

worksheet.set_column('C:C', 13)

worksheet.set_column('D:D', 13)

worksheet.set_column('E:E', 20)

worksheet.set_column('F:F', 120)

for h_item in header:

worksheet.write(row, col, h_item, format03)

col = col + 1

row += 1

col = 0

for o_item in out1:

write = []

cord1 = 0

cord2 = 0

write = [o_item[0], o_item[1], o_item[4], o_item[5]]

if o_item[2]:

cord1 = o_item[2]['coordinates'][0]

cord2 = o_item[2]['coordinates'][1]

else:

cord1 = ""

cord2 = ""

format01.set_num_format('yyyy/mm/dd hh:mm:ss')

worksheet.write(row, 0, write[0], format02)

worksheet.write(row, 1, write[1], format01)

worksheet.write(row, 2, cord1, format02)

worksheet.write(row, 3, cord2, format02)

worksheet.write(row, 4, write[2], format02)

worksheet.write(row, 5, write[3], format04)

row += 1

col = 0

workbook = xlsxwriter.Workbook('Twitter_timelineX.xlsx')

write_worksheet('katyperry')

write_worksheet('BarackObama')

workbook.close()

This VBA code is used within Excel, to filter the list of tweets produced by the script above. This script creates a

temporary array in column Z of the list file Filtering List and uses it for an advanced filter of the column of tweets, it

will then output in another column, all tweets which have at least one word matching the list.

Sub Filtr()

Dim c00 As Variant

Dim mText As Variant

Dim Sentences As Range

Dim mCriteria As Range

Dim mAddy As String

Const mTextFile As String = "C:\Python27\Filtering List.txt"

mText =

Split(CreateObject("scripting.filesystemobject").getfile(mTextFile).openastextstream.re

adall, vbCrLf)

Nitesh Patel (20008726)

19

If Len(mText(UBound(mText))) = 0 Then ReDim Preserve mText(UBound(mText) - 1)

Set Sentences = Range("F1:F" & Range("F" & Rows.Count).End(xlUp).Row)

Range("Z1") = Range("F1")

mAddy = Range("Z2").Resize(UBound(mText) + 1).Address

Range(mAddy) = Application.Transpose(mText)

c00 = Evaluate(Chr$(34) & "* " & Chr$(34) & "&" & mAddy & "&" & Chr$(34) & " *" &

Chr$(34))

Range(mAddy) = c00

Set mCriteria = Range("Z1:Z" & Range("Z" & Rows.Count).End(xlUp).Row)

Sentences.AdvancedFilter xlFilterCopy, mCriteria, Range("H1"), False

With Range("G2:G" & Range("H" & Rows.Count).End(xlUp).Row)

.Formula = "=INDEX(B:B, MATCH($H2, F:F, 0))"

.Value = .Value

.NumberFormat = "YYYY/MM/DD HH:MM:SS"

End With

Set mCriteria = Range("Z2:Z" & Range("Z" & Rows.Count).End(xlUp).Row)

mCriteria.Replace "~* ", "", xlPart

mCriteria.Replace "~ *", "", xlPart

Call Rto

End Sub

Sub Rto()

Dim c00 As Variant

Dim Filters As Variant

Dim iRow As Long

Dim iC As Long

Dim findME As Integer

' sentences

iRow = Range("H" & Rows.Count).End(xlUp).Row

c00 = Range("H2:H" & iRow).Value

c00 = addS(c00)

Range("Z1:Z" & Range("Z" & Rows.Count).End(xlUp).Row).RemoveDuplicates 1, xlYes

Filters = Range("Z2:Z" & Range("Z" & Rows.Count).End(xlUp).Row)

For iRow = LBound(c00, 1) To UBound(c00, 1)

For iC = LBound(Filters, 1) To UBound(Filters, 1)

findME = InStr(1, c00(iRow, 1), Chr$(32) & Filters(iC, 1) & Chr$(32),

vbTextCompare)

If findME > 0 Then

With Range("H" & iRow + 1).Characters(findME, Len(Filters(iC, 1))).Font

.ColorIndex = 3

.Bold = True

End With

End If

Next

Next

Nitesh Patel (20008726)

20

End Sub

Private Function addS(V As Variant) As Variant

Dim i As Long

For i = LBound(V, 1) To UBound(V, 1)

V(i, 1) = Chr$(32) & V(i, 1) & Chr$(32)

Next

addS = V

End Function

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Intangibles PDFDocument5 pagesIntangibles PDFJer RamaNo ratings yet

- Project: "Sui Northern Gas Pipelines Limited (SNGPL) "Document29 pagesProject: "Sui Northern Gas Pipelines Limited (SNGPL) "fariaNo ratings yet

- WSJ 2808Document30 pagesWSJ 2808NOROKNo ratings yet

- NISM-Series-VIII Equity Derivatives Solved Exam QuestionsDocument21 pagesNISM-Series-VIII Equity Derivatives Solved Exam QuestionsHitisha agrawalNo ratings yet

- Questionnaire: Respected Sir/MadamDocument4 pagesQuestionnaire: Respected Sir/MadamhunnyNo ratings yet

- Inventment in Security and Portfolio TheoryDocument10 pagesInventment in Security and Portfolio Theorytmpvd6gw8fNo ratings yet

- 4th Complt Ist Fed PT 1Document40 pages4th Complt Ist Fed PT 1piratetwinsNo ratings yet

- Experienced CS Rohit Tyagi Seeks Finance RoleDocument3 pagesExperienced CS Rohit Tyagi Seeks Finance RoleroseNo ratings yet

- Tata Steel Recapitalizes to Pay Special DividendDocument8 pagesTata Steel Recapitalizes to Pay Special DividendKshitishNo ratings yet

- Jay Abraham P.E.Q. TranscriptDocument608 pagesJay Abraham P.E.Q. Transcriptmichael3laterza100% (3)

- PI Final CombineDocument46 pagesPI Final CombineMonique LimNo ratings yet

- Capital StructuringDocument6 pagesCapital StructuringLourene Jauod- GuanzonNo ratings yet

- Intermediate Accounting 5EDocument44 pagesIntermediate Accounting 5Ejahanzeb90100% (1)

- 2 Taxation of International TransactionsDocument7 pages2 Taxation of International TransactionssumanmehtaNo ratings yet

- India's Hotel Industry Booming Growth Despite ChallengesDocument12 pagesIndia's Hotel Industry Booming Growth Despite ChallengesJitendra GuptaNo ratings yet

- MANAGEMENT CASE STUDIES AND HUMAN RESOURCES ISSUESDocument336 pagesMANAGEMENT CASE STUDIES AND HUMAN RESOURCES ISSUESsamuraioo7No ratings yet

- Business Plan For Establishment of Liquid Detergent PlantDocument22 pagesBusiness Plan For Establishment of Liquid Detergent PlantYoseph Melesse89% (38)

- The World 07232014Document36 pagesThe World 07232014The WorldNo ratings yet

- 3 - Gordon Scott - Technical Analysis Modern Perspectives PDFDocument45 pages3 - Gordon Scott - Technical Analysis Modern Perspectives PDFrfernandezNo ratings yet

- Group 6 HRM Eyes of Janus Evaluating L-D TMLDocument17 pagesGroup 6 HRM Eyes of Janus Evaluating L-D TMLRaghavendra Naduvinamani100% (4)

- Trade War Between US and ChinaDocument1 pageTrade War Between US and ChinaRajarshi MaityNo ratings yet

- Question Bank-Ch 6 - QUANTATIVE EVALUATION OF MUTUAL FUND SCHEMEDocument2 pagesQuestion Bank-Ch 6 - QUANTATIVE EVALUATION OF MUTUAL FUND SCHEMEteerthlumbhani6No ratings yet

- AccountingDocument57 pagesAccountingSyed ImranNo ratings yet

- Hull: Fundamentals of Futures and Options Markets, Ninth Edition Chapter 1: Introduction Multiple Choice Test BankDocument5 pagesHull: Fundamentals of Futures and Options Markets, Ninth Edition Chapter 1: Introduction Multiple Choice Test BankfdvdfvNo ratings yet

- Business ValuationDocument5 pagesBusiness ValuationAppraiser PhilippinesNo ratings yet

- Brown-Forman Corporation Business Transformation StudyDocument2 pagesBrown-Forman Corporation Business Transformation StudyAvinash MalladhiNo ratings yet

- Money, Measures of Money Supply, and Quantity Theory of MoneyDocument8 pagesMoney, Measures of Money Supply, and Quantity Theory of MoneyMayank AroraNo ratings yet

- Manufacturing sector's Nifty weighting up in 2022Document49 pagesManufacturing sector's Nifty weighting up in 2022lovishNo ratings yet

- Partnership Agreement SummaryDocument2 pagesPartnership Agreement SummaryJohn EfendiNo ratings yet

- CSR E-BookDocument153 pagesCSR E-BookMilan Malik100% (2)