Professional Documents

Culture Documents

Risk Synopsis - Brookes Pharma (PVT) LTD

Uploaded by

Z_Z_Z_Z0 ratings0% found this document useful (0 votes)

242 views9 pagesFIRD / CBG / MFC / 149 / 2014 CUSTOMER NAME: BROOKES PHARMA (PRIVATE) LIMITED-[BPPL] DOMICILE Branch Main Branch, Karachi Profit Centre CBG (South) RISK Rating Score Rating Assigned By CBG Rating Assessed By FIRD Rating History Rating 3 Rating 3 Previous Current Score 75 Score 73 Rating 4 Rating 3 Class Good Class Good Score 68 Score 73 LARGE SCALE

Original Description:

Original Title

Risk Synopsis - Brookes Pharma (Pvt) Ltd

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFIRD / CBG / MFC / 149 / 2014 CUSTOMER NAME: BROOKES PHARMA (PRIVATE) LIMITED-[BPPL] DOMICILE Branch Main Branch, Karachi Profit Centre CBG (South) RISK Rating Score Rating Assigned By CBG Rating Assessed By FIRD Rating History Rating 3 Rating 3 Previous Current Score 75 Score 73 Rating 4 Rating 3 Class Good Class Good Score 68 Score 73 LARGE SCALE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

242 views9 pagesRisk Synopsis - Brookes Pharma (PVT) LTD

Uploaded by

Z_Z_Z_ZFIRD / CBG / MFC / 149 / 2014 CUSTOMER NAME: BROOKES PHARMA (PRIVATE) LIMITED-[BPPL] DOMICILE Branch Main Branch, Karachi Profit Centre CBG (South) RISK Rating Score Rating Assigned By CBG Rating Assessed By FIRD Rating History Rating 3 Rating 3 Previous Current Score 75 Score 73 Rating 4 Rating 3 Class Good Class Good Score 68 Score 73 LARGE SCALE

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 9

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 1 of 9

May 8, 2014

FIRD/CBG/MFC/149/2014

CUSTOMER NAME: BROOKES PHARMA (PRIVATE) LIMITED-[BPPL]

DOMICILE

Branch

Main Branch, Karachi

Profit Centre CBG (South) Customer Group Brookes Pharma

CUSTOMER CLASSIFICATION

Corporate Sector

Pharma & Healthcare

Proprietorship Public Limited Unlisted

SME Industry Pharmaceutical Partnership Public Limited Listed

Retail Category LSM Pvt. Limited Other

OBLIGOR RISK RATING SCORE

Rating Assigned By CBG Rating Assessed By FIRD Rating History

Rating 3 Rating 3 Previous Current

Score 75 Score 73 Rating 4 Rating 3

Class Good Class Good Score 68 Score 73

LARGE SCALE & RISK CONCENTRATION

BPPL At ORRS-3 Group At Weighted ORRS-3 Sector Concentration 30/04/2014 (Rs. Mn.)

Exposure Funded Max. Exposure Funded Max. Portfolio Sector

Permit 480 675 Permit 800 1,200 Limits 43,006 1,428 3.32%

Existing* 461 461 Existing 465 465 O/s 30,024 900 3.00%

Cushion 19 214 Cushion 335 735 Industry Concentration 30/04/2014

*& Proposed

Limits 1,428 O/s. 900

PROPOSAL NATURE ACCOUNT CBGs STRATEGY TERMS & CONDITIONS

Fresh Temp. Extension Grow

Terms & Conditions as mentioned in Annexure

A forms an integral part of this synopsis.

Enhancement Modification Maintain

Renewal Restructuring Exit

GROUP EXPOSURE

(PKR in Millions)

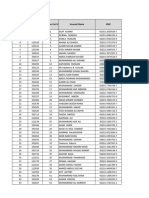

Client Name Limit Amount Outstanding Amount Risk Rating

Funded Non Funded Total

Funded Non Funded Total

Pharma Logistics

25 - 25 4 - 4 3/Good

Brookes Pharma (Pvt) Ltd

281 (90) 281 207 41 248 3/Good

Total 306 (90) 306 211 41 252

FINANCING LIMIT STRUCTURE

(PKR in Millions)

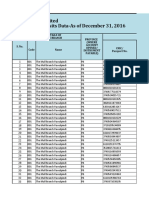

Sr.

No.

Financing Facility

Existing

Limit

O/s

Amount

Proposed

Limit

Recommen

ded

Limit

New/

Extension/

Renewal

Proposed

Profit/

Comm.

Limit

Expiry

1

DM (Sale & Purchase Back)-I

142.5 137.5 137.5 137.5 Review MK+2.1%

30-10-18

2 Murabaha (Max 120 days) 75.0 24.9 75.0 75.0 Renewal MK+2%

31-05-15

2(a) Foreign LC (Sight/U/Accp) (75.0) 30.7 (75.0) (75.0) Renewal 0.15%

31-05-15

2(b)

LG (Performance)

(15.0) 10.2 (15.0) (15.0) Renewal APSOC

31-05-15

3 DM (Fleet Financing)-I 39.5 39.5 39.5 39.5 Review 6MK+2%

04-09-16

4 DM (Fleet Financing)-II 23.5 5.4 18.9 18.9 Review 6MK+2%

04-09-16

5

DM (Sale & Purchase Back)-II

[FRESH]

- - 190.0 190.0 New MK+2.1%

6 years

Total

280.5 248.2 460.9 460.9

PURPOSE

1

Diminishing Musharika-I

[Sale & Purchase Back]

This facility is requested for review. It was earlier approved to settle principal

component of term finance facility of Pak Kuwait Investment Company (PKIC).

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 2 of 9

2

Murabaha

[Max 120 days]

This facility was allowed for retirement of import documents approved through LC

Sight & for local procurement of raw material. Raw Materials include packing

material and chemicals used in Pharma manufacturing with minimum shelf life of

one year. However, Murabaha will not be available for retirement of import

documents pertaining to machinery. Local purchases through Murabaha shall not

exceed 1/3

rd

of the approved limit i.e. Rs.25 Million.

2

(a)

Letter of Credit

[Foreign/Sight/Usance]

LC facility was granted for import of raw materials as mentioned in Murabaha

section along with machinery/equipment which shall not exceed 15% of the LC

limit at any point in time.

LC Sight can be retired through follow-on Murabaha facility; however, LC Usance

shall be retired through follow-on Acceptance with a maximum tenor of 120 days.

Acceptance to be retired from customers own resources.

Moreover documents for import of machinery will be retired by the customer from

their own sources.

2(b)

LG (Performance) LG facility was earlier approved for issuance of Performance Guarantee in favor of

government/semi government organizations for supply of medicines and for

various contracts.

3 &

4

DM (Fleet Financing)-I & II Facility was allowed for procurement of new, locally assembled & imported

TOYOTA/SUZUKI/HONDA cars for business use.

5

DM (Sale & Purchase

Back)-II [FRESH]

This fresh facility is requested for entire settlement of principal portion of long

term loans and leasing facilities of Pak Brunei Investment Co, Pak Gulf Leasing,

Bank of Punjab and Orix Leasing Limited.

Maximum tenor for requested DM-II facility is six year inclusive of one year grace

period. During grace period only profit will be paid on monthly basis. Principal

installments will be paid in arrears from 13

th

month in equal sixty monthly

installments.

SECURITY

1

Diminishing Musharika

[Sale & Purchase Back]

1

st

Pari Passu charge on all present and future fixed assets (land, building and plant

and machinery) with 25% risk margin amounting to Rs. 200 Million.

2

Murabaha

[Max 120 days]

1

st

Pari Passu chage over present and future stock in trade and trade debts with

25% with risk margin amounting to Rs.100 Million.

2 (a)

Letter of Credit

[Foreign]

[Sight/Usance]

a. Lien over import documents.

b. Accepted Bill of Exchange for LC Usance.

c. Security as mentioned in Murabaha section.

2

(b)

LG (Performance) a. 20% cash margin

b. Counter Guarantee of BPPL

c. Security as available under Murabaha facility.

3 & 4

DM (Fleet Financing)-I & II a) 10% & 20% equity participation for locally assembled and imported

vehicles respectively in the shape of security deposit.

b) Title over DM financed asset (vehicle) is to be registered exclusively in

favor of Burj Bank Limited in Excise & Taxation Office (ETO).

c) 06 Post Dated Cheques (PDC)

5

DM (Sale & Purchase

Back)-II [FRESH]

1

st

Pari Passu charge on all present and future fixed assets (land, building and plant

& machinery) with 25% risk margin that is, PKR 267 Million.

(The underlying DM assets are mentioned in Annexure-B with DM sharing ratio of 90:10).

Supplemental Security All the facilities (existing and proposed) are secured through Personal Guarantees

of all the directors of the company with PNWS. Directors PNW is reported at

Rs.172 Million.

Repayment Sources Primary Sources: Companys cash flows

Secondary Sources: Refinancing from other lenders

Tertiary Sources: Through sale of stocks/fixed assets and/or calling the PG of directors.

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 3 of 9

FINANCIAL HIGHLIGHTS:

AUDITED FINANCIALS M. ACC FINANCIAL PROJECTIONS

(Rs. in Millions) June 11 June 12 June 13 Dec 13 June 14 June 15

June 16 June 17 June 18

INCOME STATEMENT

Net Revenue 1,401.7 1,610.3 1,959.8 1,154.1 2,500.0 3,000.0 3,600.0 4,300.0 5,200.0

Cost of Goods Sold 855.2 973.2 1198.1 710.3 1,525.0 1,830.0 2,196.0 2,623.0 3,172.0

Gross Profit 546.3 637.1 761.6 443.7 975.0 1,170.0 1,404.0 1,677.0 2,028.0

Operating expenses 401.6 455.5 564.9 319.9 700.0 840.0 1,000.0 1,174.0 1,343.0

Operating Profit (EBIT) 144.7 181.6 196.7 123.7 295.0 330.0 404.0 538.0 684.7

Finance Cost 107.1 112.8 119.7 76.0 150.0 140.0 120.0 100.0 70.0

Profit Before Taxes 58.9 85.6 95.4 52.4 145.0 215.0 314.0 438.0 654.7

Net Income After Taxes 44.9 69.5 75.8 40.8 104.4 161.8 229.9 309.7 471.4

BALANCE SHHET

Inventory Level 292.0 305.0 327.3 395.4 395.3 465.0 550.0 645.0 755.0

Trade Receivables/ Debtors 169.5 183.7 196.1 224.5 219.5 250.0 275.0 310.0 350.0

Other Current Assets 202.1 235.6 251.1 308.8 280.4 314.7 380.0 396.5 523.3

Total Current Assets 663.6 724.3 774.5 928.7 895.2 1,029.7 1,205.0 1,351.5 1628.3

Property, Plant & Equipment 817.2 883.8 1,264.7 1,340.7 1,388.0 1400.0 1,425.0 1,470.0 1600.0

Total Non Current Assets 817.2 883.8 1,267.7

1,340.7 1,388.0 1,400.0 1,425.0 1,470.0 1,600.0

Total Assets 1,480.8 1,608.1 2,039.2

2,269.4 2,283.2 2429.7 2,630.0 2,821.5 3,228.3

Short Term Bank Borrowing 117.8 142.3 150.8 369.3 279.8 279.8 279.8 179.0 100.0

Trade Payable/ Creditors 115.1 121.9 176.3 211.9 300.0 400.0 500.0 600.0 700.0

CP of LT bank Borrowing 113.9 150.4 243.2 246.1 - - - - -

Other Current Liabilities 31.7 44.9 58.6 54.6 40.6 53.2 84.1 128.2 183.3

Total Current Liabilities 378.5 459.5 628.9 881.9 620.4 733.0 863.9 907.2 983.3

Long Term Bank Borrowing 423.0 395.1 580.7 513.0 737.0 610.1 450.6 289.5 149.3

Other Long Term Liabilities 78.3 82.9 83.3 87.3 75.0 74.0 73.0 72.5 72.0

Total Long Term Liabilities 501.3 478.0 664.0 600.3 812.0 684.1 523.6 362.0 221.3

Total Liabilities 879.8 937.5 1,292.9

1,482.2 1,432.4 1,417.1 1,387.5 1,269.2 1,204.6

Equity (Excluding RR & SL) 452.7 522.2 598.0 638.9 702.4 864.2 1,094.2 1,403.9 1,875.3

Revaluation Reserve 148.2 148.2 148.2 148.2 148.2 148.2 148.2 148.2 148.2

Total 600.9 670.4 746.2 787.1 850.6 1,012.4 1,242.4 1,552.1 2,023.5

FINANCIAL RATIOS

EBITDA 235.1 272.2 296.1 163.7 378.2 439.0 519.5 626.2 820.7

Cash Conversion Cycle (CCC) 111 days 107 days 86 days

- 65 days 44 days 36 days 31 days 29 days

Gross Margin 39% 40% 39% 38% 39% 39% 39% 39% 39%

Operating Profit margin 10% 11% 10% 11% 12% 11% 11% 13% 13%

Net Profit Margin 3% 4% 4% 4% 4% 5% 6% 7% 9%

Current Ratio 1.7 1.6 1.2 1.0 1.4 1.4 1.3 1.5 1.6

Debt Services Coverage Ratio 1.0 1.0 0.8 0.5 2.5 3.1 4.3 6.2 11.7

Finance Cost Coverage Ratio 1.6 1.7 1.8 1.6 1.9 2.5 3.6 5.3 10.3

Bank Borrowings/Equity 1.5 1.3 1.6 1.8 1.4 1.0 0.6 0.3 0.1

Total Liab./Equity 1.9 1.8 2.1 2.3 2.0 1.6 1.2 0.9 0.6

Financial Analysis For the year ending 30

th

June 2013

Financial risk assessment of BPPL is based on audited financials (FY11 to FY13), management accounts (Dec 2013) and

projections (FY14-FY18). BPPLs financials are audited by Bilwani & Co.

Income Statement

In FY13, BPPL achieved a growth of 22% in sales volume, which is recorded at Rs.1,959.8 Million (FY12: Rs.1,610.3 Million).

This growth is even greater than that of FY12, which was 15%. Gross Profit is reported at Rs.761.6 Million with stagnant

margin of 39%. Operating expenses are registered with slight enhancement at Rs.564.9 Million (FY12: Rs.455.5 Million).

Operating profit margin remains stagnant at 10% for the period under consideration. During FY13, BPPL has earned other

income in the shape of sales of scrap sales, exchange gain and profit on deposits to the extent of Rs.18.4 Million in FY13

(FY12: Rs.16.7 Million). During FY13, BPPL has massively incurred capex through lease finances, which boosted finance cost

of the company, which is recorded at Rs.119.7 Million (FY12: Rs.112.8 Million). Growth in sales volume has impacted net

profit of the company, which is reported at Rs.75.8 Million (FY12: Rs.69.5 Million). In net margin terms, it hovers around 4%

for the period under review.

Balance Sheet

Total balance sheet size grew by 27% and stands at Rs. 2.04 Billion (FY12: Rs. 1.61 Billion). Within current assets category,

stocks level has enhanced to Rs.327.3 Million as against Rs. 305.0 Million in FY12, while trade debts have enhanced to Rs.

196.1 Million from Rs. 183.9 Million in FY12. These enhancements are justified in view of growing sales volume. Movement

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 4 of 9

in other items of current assets is only nominal. Due to capex incurred by BPPL in FY13, tangible fixed assets including

capital work in progress is recorded at Rs. 1,264.7 Million (FY12: Rs. 883.8 Million).

Current liabilities of BPPL are recorded at Rs. 628.9 Million in FY13 (FY12: Rs. 459.5 Million). BPPLs reliance on short term

bank borrowing is adequate as it experiences enhancement by 6% and booked at Rs. 150.8 Million (FY12: Rs. 142.3 Million),

which is understandable in view of growing EBITDA. Overseas creditors balance has enhanced to Rs. 149.5 Million from Rs.

95.7 Million in FY12. Long term bank borrowing level has enhanced to Rs. 580.5 Million from Rs. 395.1 Million in FY12. Net

equity of the BPPL has jumped to Rs. 598.0 Million owing to retention of net profit.

Cash Conversion Cycle (CCC) of the company has reduced to 86 days. Our analysis suggests that due to better inventory and

receivable management, inventory and receivable turnover days have reduced. Current ratio of the company has slightly

decreased. Due to increase in long term bank borrowing, leverage and debt-equity ratios have enhanced. DSCR & FCCR are

more or less stagnant at 1.0 & 1.7 respectively.

Management Accounts (1FFY14)

During six months ending in Dec 31, 2013, BPPL has achieved sales volume of Rs.1.154 Billion. Gross Profit in margin terms

has reduced to 38%. BPPL has posted profit after taxes (PAT) of Rs.40.9 Million as on Dec 31, 2014. Operating and net

profits in term of margin remained stagnant at 11% and 4% respectively. Stocks & trade debts continue to be reported at

higher levels owing to growth in sales volume. It is to be noted that short term bank borrowing level, which was earlier

reported at Rs.150.8 Million, has enhanced to Rs.369.3 Million. It appears that BBPL has used banking facilities for raw

material procurement.

Financial Projection (FY14-FY18)

CBG has provided us projections for the above mentioned period. The underlying assumptions are 20% growth in sales

volume, while gross profit margin is expected to be stagnant at its existing level of 39%. Stocks & trade debts are expected to

enhance by 17% & 13% respectively. Noncurrent assets are forecasted to be enhanced by 3-8% annually. In the projections,

Burj Banks proposed exposure is reflected with decreasing trend over the years. On the whole, financial projection appears

to be reasonable with projected growth in line with current trend of the company and Pharma industry.

Conclusion:

Overall financial position of the company appears to be adequate with respect to Burj Banks existing & proposed exposure.

It is worth noting that BPPLs requested facility wont enhance its leverage position as it is a swap case. During one year

grace period, BPPL will pay only profit, which is expected to be Rs.23.2 Million or Rs.1.9 Million per month. Keeping in view

the growing sales, profitability and EBITDA, we understand that BPPLs financial position is adequate enough.

SAFETY ASSESSMENT

Obligor Profile /

Relationship

History

Brookes Pharma (Private) Limited (BPPL) was established in 1984 and deals in manufacturing of

pharmaceutical products. BPPL specializes in antibiotics, liver products, hair, skin and

cardiovascular areas. BPPL has recently obtained manufacturing license from two multinational

pharmaceutical companies namely M/s Merz & Co & M/s Edmond Pharma to produce active

pharmaceutical ingredients and finished products. BPPL has total staff strength of over 800

persons including 500 in sales and marketing department. The product portfolio of Brookes

includes medicines under product lines of gastro-enterology, anesthesia, dermatology, cardiology,

NSAID and ant-septic drugs. Brookes is an ISO 9001, ISO 14001, SA 8000 and OHSAS 18001

certified company. It is further upgrading its operations to get one more certification of ISO 17025

during the end of the year 2012.

Account History with Burj Bank

Burj Bank has approved DM/Murabaha/LC/LG and DM (Fleet Financing) facilities to the tune of

Rs.275 Million. Its facilities were renewed/reviewed for another year in October 2013. Overall

account history is modest with few instances of overdue up to 5-10 days. Burj Bank net earnings

from this client in FY13 are Rs.3.457 Million. It is relevant to mention that Burj Bank has also

financed BPPLs group concern i.e. Pharma Logistics to the tune of Rs.25 Million (DM Fleet), whose

o/s is reduced to Rs. 3.5 Million. Below is BPPLs import performance with Burj Bank.

Rupees in Million

FY12 FY13 FY14 (nine months)

62.89 125.42 85.02

CBG Rationale for

Enhanced Facility

CBG has requested for DM (Sales & purchase back) facility of Rs. 190 Million for swapping of

conventional banks/FIs exposure as detailed below.

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 5 of 9

Rupees in Million

Sr. No. Name of Bank/FIs Exposure Size

01 Pak Brunei Investment Company 84.0

02 Pak Gulf leasing Company 32.0

03 Bank of Punjab 30.0

04 Silk Bank Limited 16.0

05 Orix Leasing Limited 30.0

Total 192.0

Client is interested in Islamic mode of financing and is in process of converting its financing

facilities to Islamic banks. It is to be noted that fresh DM (Sale & purchase back) facility is proposed

in line with already approved facility as its tenor is 6 years inclusive of one year grace period.

Detail of underlying assets is given in attached Annexure-B.

Management

Assessment

BPPL is a private limited company having following directorship.

Sr. No. Name of Director %Shareholding

01 Abdul Haseeb Khan 13.2%

02 Nadeem Khan 12.4%

03 Waseem Khan 12.4%

04 Saleem Khan 12.4%

05 Ishrat Haseeb 12.4%

06 Farhat Nadeem 12.4%

07 Nudrat Khan 12.4%

08 Roohi Saleem 12.4%

Total 100.0%

Mr. Abdul Haseeb Khan is the President/CEO of the company. He is an electrical engineer by

profession, having 45 years of experience including 25 years in pharmaceutical sector. Mr. Nadeem

Khan, Waseem Khan and Saleem Khan are working as Executive Directors, responsible for finance,

production and marketing function. Other directors are also adequately qualified and experienced

in their respective fields. The profile of top line management team, as given by CBG, is convincing

enough. It is relevant to mention that subject client is included in PEP list. However based on

clients reputation and Burj Banks relationship with the client, we attach acceptable management

risk with this name.

Business Risk

Analysis

Brookes Pharma (Private) Limited deals in manufacturing of pharmaceutical products. Some of its

leading products are Hepa Merz, Pyodine, Dostin, Coram etc. It deals in over 77 products. It is

worth noting that product concentration of Hepa-Merz & Pyodine constitutes 44% of total revenue.

It poses product concentration risk for the company. However, since BPPL does not face any

material competition, this risk is assessed to be mitigated. BPPLs end consumers are general

masses. BPPLs products are distributed throughout Pakistan through various distributors,

hospitals, pharmacies and retailers. Some of the key institutional buyers of BPPL are Armed

Forces, Aga Khan University Hospitals, PIMS and LNH. It may be noted that 55% of BPPLs sales are

distributed through its associate concern, Pharma Logistics. As reported earlier, Burj Bank has also

financed Pharma logistics for its fleet financing requirement.

It is relevant to mention that a thorough business risk analysis was conducted at the time of

initiation of financing relationship with this name, which was found in acceptable limits. Since then

no material change is observed in its business risk parameters, hence business risk associated with

this name may be considered acceptable.

Industry / Market

Risk Analysis

Industry analysis conducted by Business Unit adequately covers the market dynamics and industry

trend. We associate acceptable industry risk with the company based on growing demand and

limited competition in the organized segment within Pharma industry.

Security Analysis Security structure of existing facilities is same as already approved earlier, which is briefly

mentioned below.

DM (Sales & Purchase back)-I: 1

st

Pari Passu charge on all Present and Future Fixed Assets (Land,

Building and Plant & Machinery) amounting to Rs.200 Million inclusive of 25% risk margin.

Following are the security structure of Murabaha/LC (Sight/Usance), LG and DM (Fleet) facilities.

1

st

Pari Passu charge over present and future stock in trade and trade debts amounting to

Rs.100 Million inclusive of 25% risk margin.

Lien over import documents/Accepted BE.

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 6 of 9

10% & 20% equity participation in the value of DM assets.

Title over DM financed asset (vehicle) & 6 Post Dated Cheques (PDC).

PG of directors.

Requested DM-II (Sales & Purchase back) of Rs. 190 Million is proposed against 1

st

PP charge on all

present and future fixed assets (land, building and plant & machinery) amounting to Rs. 267

Million inclusive of 25% risk margin. As per valuation dated July 24, 2013, following is the

valuation of fixed assets of BPPL.

Description Plot # 58, St. 15, Korangi Indus Plot # 59, St. 15, Korangi Indus

Rs. in Million

Market Value FSV Market Value FSV

Land 250.0 200.0 250.0 200.0

Building 210.8 168.7 126.3 101.0

Machineries 580.5 406.4 270.0 189.0

Total 1,041.3 775.1 646.3 490.0

Total market and FSV of fixed assets is Rs.1,687.6 Million and Rs.1,265.1 Million respectively. As

per Search Report dated 18.03.14, following banks enjoy PP over fixed assets of the company.

Rupees in Million

Sr.

No.

Banks Name Charge

Amount

O/s Amount Nature of Charge

01 Askari Bank Limited 100.0 - 1

st

EM over fixed assets

02 HMB 100.0 - 1

st

PP charge over fixed assets

03 SCB 150.0 117.0 1

st

PP charge over fixed assets

04 Pak Kuwait Inv. Co. 134.0 83.0 1

st

PP charge over fixed assets

05 Pak Brunei Inv. Co 267.0 84.0 1

st

PP charge over fixed assets

06 Silk Bank Limited 120.0 16.0 1

st

PP charge over fixed assets

07 Burj Bank Limited 200.0 137.5 1

st

PP charge over fixed assets

08 Bank of Punjab 200.0 30.0 1

st

PP charge over fixed assets

09 HBL 100.0 - 1

st

PP charge over fixed assets

Total 1,371.0 467.5

Adequate cushion is available with respect to market value of the assets & present o/s figures. CBG

has committed that after swapping of the existing facilities, charge over fixed assets of respective

banks will be vacated. Since Pak Gulf Leasing Limited and Orix Leasing Limited charges are not

reflected in the search report, BPPL will provide us an undertaking from respective FIs regarding

vacation of charge.

Pricing Pricing of DM-II facility is proposed as per already approved DM-I facility i.e. MK+2.1%. However

pricing of Murabaha is proposed to be reduced to 1.75% from 2% over KIBOR. FIRD forward this

synopsis at already approved pricing. As per current KIBOR benchmark, Burj Banks earning from

this client in grace period and repayment tenor is expected to be Rs.23.2 Million & 66.3 Million.

ECIB Reports We have ECIB report dated April 24, 2014 of BPPL, its other group concerns and their directors, in

which exposure as on March 31, 2014 is reported. As per these reports, BPPLs funded and non

funded exposure is Rs.1,264.227 Million & Rs.348.347 Million respectively. There is no mention of

any overdue, amount under litigation or reschedule/restructured exposure. ECIB reports of its

group companies and their directors are also clean.

Risk Rating As per CBG, BPPLs risk rating is 3/good with 75 score. FIRD reassessed its rating, which yields it

same as that of CBG with 73 points. CBG agrees with FIRD working.

FRR Scorecard

Following is the FRRS of the proposed and existing facilities.

Nature of Facility Facility Score Facility Grade

DM (Sale & Purchase

back)

65 C

Murabaha Facility 71 C

DM (Fleet) 88 B

Facilities With

Other Bank/FIs

BPPL is presently availing financing facilities from following banks/FIs.

Rupees in Million

Sr. No.

Name of Bank/FIs Nature of Facility Fund Based Limit

NFB Limits Total Limits

01 Askari Bank Ltd FATR/LC 15.0 55.0 70.0

02 HMBL Short Term/LC 50.0 40.0 90.0

03 SCB

Short & Long Term

370.0 105.0 475.0

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 7 of 9

04 Silk Bank Limited

Short & Long Term

35.0 110.0 145.0

05 Pak Kuwait

Short & Long Term

164.0 - 164.0

06 Pak Brunei

Short & Long Term

200.0 - 200.0

07 Burj Bank

Short & Long Term

200.0 75.0 275.0

08 Bank of Punjab

Short & Long Term

130.0 70.0 200.0

09 HBL

Short & Long Term

50.0 100.0 150.0

10 Bank Islami Leasing 37.0 - 37.0

11 Pak Gulf Leasing 88.0 - 88.0

12

First Habib Modaraba

Leasing 30.0 - 30.0

13 Orix Leasing Leasing 68.0 - 68.0

Total 1,437.0 550.0 1,992.0

SBP PR-5 is fully complied with. After taking into consideration requested facility of Rs. 190

Million, Burj Banks proposed exposure of Rs. 461 Million will become second highest after SCB.

Further Requests

CBG has requested for gradual increase in LC/Murabaha limit corresponding to decrease in DM-I

exposure up to Rs. 125 Million. FIRD is not supportive of this arrangement in view of the fact that

such arrangement may pose monitoring repercussion, further, overall exposure over customer

shall not reduce and the payments made under the DM through cash flows may again be re-availed

under short term facility to finance working capital.

CONCLUSION/RECOMMENDATION:

Brookes Pharma (Private) Limited (BPPL) was established in 1984 and deals in manufacturing of pharmaceutical products.

BPPL specializes in antibiotics, liver products, hair, skin and cardiovascular areas.

Burj Bank has approved DM/Murabaha/LC/LG and DM (Fleet Financing) facilities to the tune of Rs. 275 Million. Its facilities

were earlier renewed/reviewed till October 2014. Overall account history is satisfactory with few isolated instances of

overdue up to 10 days. It is relevant to mention that Burj Bank has also financed its group concern i.e. Pharma Logistics to

the tune of Rs. 25 Million (DM Fleet financing). Customer has requested long term DM (Sale & Purchase back) facility of Rs.

190 Million, for swap of outstanding exposure from their conventional banks/FIs.

Based on the analysis carried out above, and due to adequate financial position and security structure, CBGs request for DM-

II (Sale & Purchase back) facility of Rs.190 Million is recommended for approval subject to compliance with all the terms and

conditions as per attached Annexure-A.

Recommended By:

______________________ ___________________________ __________________________

Financing Analyst Sr. Financing Analyst Sr. Financing Analyst

MANAGEMENT FINANCING COMMITEE

Chief Risk

Officer

Chief Financial

Officer

Group Head-

Treasury

Group Head

Corporate

Group Head-Retail

& Consumer

Approved

Not Approved

Others

Approved

Not Approved

Others

Approved

Not Approved

Other

Approved

Not Approved

Other

Approved

Not Approved

Others

Chief Executive Officer / President

Approved

Not Approved

Others

Comments:

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 8 of 9

Annexure-A

Terms & Conditions

Conditions Precedent

1. Disbursement of the facility is subject to the submission/compliance of following:

a. Personal Guarantees of directors with their itemized & detailed PNWS covering the existing and enhanced

exposure.

b. Shariah approved MO for fresh financing facility.

c. Availability of letter regarding confirmation of principal o/s of Pak Brunei Investment Company, Pak Gulf

leasing Company, Bank of Punjab, Silk Bank Limited & Orix Leasing Limited.

d. Availability of fresh dated valuation of fixed assets of BPPL.

e. Availability of financial projection (FY19-FY20).

f. Availability of undertaking from BPPL that it will adjust complete profit and partial principal (if any) of

above mentioned banks/FIs from its own sources and vacate the charge of the banks within 15 days from

the date of disbursement.

g. Disbursement must be executed after perfection of 1

st

PP charge over present and future fixed assets of

BPPL. No deferral request will be entertained in this regard.

h. Joint visit/inspection by FIAD & CBG of the underlying DM assets and BPPLs operational set up to check

operational status of the DM assets and factory.

2. Confirmation in writing as to acceptance of facilities should be obtained from customer. In case customers

acceptance is not received within 30 days of the issue date of customer advising letter, the approval terms would

stand canceled.

Further Conditions Precedent (Controlling Covenants)

1. Fresh approved DM-II (Sale & Purchase back) facility is available for swapping of principal portion of above

mentioned banks/FIs only.

2. BPPL would route its business cash commensurate to the size of the financing accommodations with Burj Bank

during the currency of the facilities.

3. BPPL would route its import business equivalent to twice of its approved limits with Burj Bank.

4. The DM financed assets/fixed assets of BPPL must be kept fully insured for full market value at all times against

pertinent risks by any of the Insurance/ Takaful companies on the approved panel of Burj Bank.

5. The facility will be available for first utilization till July 31, 2014 i.e. if utilization is not made within stipulated

period, the facility would be considered withdrawn/cancelled. Full utilization is to be made within August 30, 2014.

6. Overall accommodation of BPPL shall remain restricted at Rs. 460.9 Million. Moreover, DM is non-revolving limit

and no disbursement should be allowed subsequent to full utilization of limit.

7. It must be ensured that total accommodation of BPPL should stand complied with the prescribed benchmarks

mentioned in the Prudential Regulations No. R-5 at all times during the currency of the approved limit.

8. All Insurance/ Takaful policies along with premium paid receipt must be held by the bank. All charges, insurance to

be recovered from customer upfront.

9. Customer must submit financial accounts within six months of the close of each financial year.

10. SBP Prudential Regulations and financing restrictions along with Banks financing policy, as advised by Burj Banks

Head Office from time to time and the instructions of approved product policy manuals, must be complied with at all

times.

11. During the tenancy of Burj Banks exposure, any change in directorship will require prior consent, in writing, from

the Bank. In the event of non-compliance with this condition Burj Bank will have the right to immediately recall the

facilities/ exposure arrangements.

12. Burj Bank reserves the right, acting on its own discretion, to cancel financing facilities approved by virtue of this

Approval anytime without assigning reason.

13. The bank shall have the bankers lien and right-off set-off on all deposits, accounts, properties & securities available

with Burj Bank.

14. The Bank reserves the right to recall all financing facilities at any time if the same are utilized for:

any purpose other than for which the facility was originally extended or

purposes detrimental to public interest or

Purposes against Shariah or the Law of the Land.

Note:

1. Review/renewal date of the facilities shall be May 31, 2015. CBG must submit its renewal/review proposal two month prior to

its due date.

2. CBG would ensure to review appropriateness of customers rating on a continuous basis, preferably on quarterly basis, and

submit downgrading / upgrading of account to FIRD in light of any material change in information.

3. All other terms and conditions as per earlier approvals will remain applicable and effective.

FINANCING PROPOSAL SYNOPSIS

Financing & Investment Risk Department

Page 9 of 9

Annexure-B

Detail of underlying DM assets

Rupees in Million

Sr. No. Nature of Assets Amount

01 Building Plot # 59 126.0

02 Inspection Machine 39.0

03 Dry Head Sterilizer 15.0

04 BQS Bilster Mac 12.0

05 Tablets & Capsules cartooning machine 11.5

06 Emulsifying Mixer & Storage Tank 9.0

Total 212.5

You might also like

- KarachiDocument86 pagesKarachiABDQ0% (1)

- 5th Merit List LLB MorningDocument2 pages5th Merit List LLB MorningZuhaib Ali SoomroNo ratings yet

- DOWN48Document41 pagesDOWN48Yasir Altaf100% (1)

- FTS PST Female ListDocument88 pagesFTS PST Female Listhassan kkNo ratings yet

- Index PDFDocument68 pagesIndex PDFShaheen FalconNo ratings yet

- List of Open Branches: Branch Code Branch Name Branch Address CityDocument50 pagesList of Open Branches: Branch Code Branch Name Branch Address CityAli MalikNo ratings yet

- MeezanDocument695 pagesMeezanMuhammad Arslan0% (1)

- List of Open Branches: Branch Code Branch Name Branch Address CityDocument38 pagesList of Open Branches: Branch Code Branch Name Branch Address CityHussain HakimuddinNo ratings yet

- GLI ListDocument101 pagesGLI ListSaad MasoodNo ratings yet

- Dealer Search DataDocument14 pagesDealer Search DataSairamTirumalaiGovindarajuNo ratings yet

- Tefal Clipso Jamie Oliver Manual enDocument18 pagesTefal Clipso Jamie Oliver Manual enJimmy ZettenbergNo ratings yet

- PakistanDocument120 pagesPakistanAli RazaNo ratings yet

- PHL Metrobank Enrollment InstructionsDocument2 pagesPHL Metrobank Enrollment InstructionsJames Patrick MilanaNo ratings yet

- Finallllllllll Report BBA MCB ADocument55 pagesFinallllllllll Report BBA MCB AMahrukh WaheedNo ratings yet

- Js BankDocument17 pagesJs BankAtia KhalidNo ratings yet

- Internship Report On State Bank of PakistanDocument59 pagesInternship Report On State Bank of PakistanHaseeb AhmadNo ratings yet

- Final PTB Pakistan Studies 10 EM Prepress 08-02-2020 - 0Document128 pagesFinal PTB Pakistan Studies 10 EM Prepress 08-02-2020 - 0SAQIB ALINo ratings yet

- RMC No. 4-2021 Annex A - Steps in Paying Taxes OnlineDocument2 pagesRMC No. 4-2021 Annex A - Steps in Paying Taxes OnlineToti PatrimonioNo ratings yet

- 10000016084Document150 pages10000016084Chapter 11 DocketsNo ratings yet

- Beware of Scam in Emails about Money TransferDocument4 pagesBeware of Scam in Emails about Money TransferMarcos Paulo Do NascimentoNo ratings yet

- Google Adsens BillDocument1 pageGoogle Adsens BillImraan IqbalNo ratings yet

- Pakistan Studied 2059/01 Topic: Foreign Policy and Foreign Relations of PakistanDocument14 pagesPakistan Studied 2059/01 Topic: Foreign Policy and Foreign Relations of PakistanTaha SiddiquiNo ratings yet

- Destroying Pakistan by DesignDocument22 pagesDestroying Pakistan by DesignShahzad ShameemNo ratings yet

- HR Practices at Askari BankDocument12 pagesHR Practices at Askari BankSyed Osama AliNo ratings yet

- Pakistan PM RoleDocument21 pagesPakistan PM RoledawoodNo ratings yet

- Contact details for IT companiesDocument1 pageContact details for IT companiesSanjay ShelarNo ratings yet

- HRM Function of BopDocument25 pagesHRM Function of BopVirtual Help CenterNo ratings yet

- Cash Management EssentialsDocument60 pagesCash Management EssentialsNagireddy KalluriNo ratings yet

- List of Additional RT-PCR Negative Result - (49,814) As of 18 1900h Oct 2020 Series 05-2020 - Lab IdDocument320 pagesList of Additional RT-PCR Negative Result - (49,814) As of 18 1900h Oct 2020 Series 05-2020 - Lab Idbhing del rosario sabucoNo ratings yet

- MCB Bank Vendor Panel Enlistment ApplicationDocument3 pagesMCB Bank Vendor Panel Enlistment ApplicationAhmad Bilal0% (1)

- Project On State Bank of PakistanDocument41 pagesProject On State Bank of PakistanSaimSafdarNo ratings yet

- HeroDocument101 pagesHeroAnkitSinghNo ratings yet

- Cat-I (H, I-TYPES GWL) PDFDocument3 pagesCat-I (H, I-TYPES GWL) PDFShahid MalikNo ratings yet

- Details of Compliances and NoticesDocument8 pagesDetails of Compliances and NoticesMuhammad SufyanNo ratings yet

- Swot Analysis of BOKDocument3 pagesSwot Analysis of BOKamreenaNo ratings yet

- Introduction Pakistan Kaisay Bana All VolumesDocument64 pagesIntroduction Pakistan Kaisay Bana All VolumesTehqeeq0% (1)

- E-Purse enDocument39 pagesE-Purse enTayran PrashadNo ratings yet

- JS Bank of Pakistan Internship ReportDocument59 pagesJS Bank of Pakistan Internship Reportbbaahmad89100% (2)

- MCB Bank Internship Report 2012Document58 pagesMCB Bank Internship Report 2012Vegabond Nwaar100% (1)

- AskariBank-2015 Unclaimed DepositsDocument3,591 pagesAskariBank-2015 Unclaimed DepositsSmith Ben100% (1)

- Payment Details 1 (1) .5Document4 pagesPayment Details 1 (1) .5David533No ratings yet

- Dha Plots For Sale Application Form PDFDocument2 pagesDha Plots For Sale Application Form PDFJohson Mandela100% (1)

- Provisional Voter List of PRGMEA (NZ) Sialkot1Document6 pagesProvisional Voter List of PRGMEA (NZ) Sialkot1Farhan Ashraf100% (1)

- Western Union Analyse For TunisiaDocument179 pagesWestern Union Analyse For TunisiaAlina BlagaNo ratings yet

- AskariDocument145 pagesAskariAmina100% (1)

- Template SRSDocument30 pagesTemplate SRSMinh Bảo VũNo ratings yet

- Application FormDocument5 pagesApplication Formankit singhNo ratings yet

- Customs AgentsDocument17 pagesCustoms AgentsmfaizanzahidNo ratings yet

- Introduction To Punjab Government Rules of BusinessDocument26 pagesIntroduction To Punjab Government Rules of Businesskhanlala1No ratings yet

- Unclaimed Deposit For Year 2016Document3,430 pagesUnclaimed Deposit For Year 2016Ali SyedNo ratings yet

- Measuring Customer SatisfactionDocument55 pagesMeasuring Customer SatisfactionNaveen KNo ratings yet

- Rashed CVDocument3 pagesRashed CVRasedul BariNo ratings yet

- Internship Report On MCB Bank LimitedDocument42 pagesInternship Report On MCB Bank Limitedbbaahmad89No ratings yet

- Financial Markets and Their RolesDocument4 pagesFinancial Markets and Their RolesAbdul BasitNo ratings yet

- Internship Report (Rida)Document46 pagesInternship Report (Rida)Tania AliNo ratings yet

- DirectoryDocument92 pagesDirectoryAlejandro VelazquezNo ratings yet

- Apna Rozgar Scheme - 2014 Winner List: Sargodha DivisionDocument124 pagesApna Rozgar Scheme - 2014 Winner List: Sargodha Divisionshafi ullah khanNo ratings yet

- RMC Minutes November 13, 2023 - DraftDocument30 pagesRMC Minutes November 13, 2023 - Draftranuagrawal2023No ratings yet

- Sintex NBG FinalDocument8 pagesSintex NBG FinallittlemissperfecttNo ratings yet

- Atr Cars - SBH S FormatDocument71 pagesAtr Cars - SBH S FormatPraneeth CheruvupalliNo ratings yet

- Sgrep Adapt Part2b EngDocument18 pagesSgrep Adapt Part2b EngthisiscolmNo ratings yet

- Panel 1 What Have We Learned About Improving School ParticipationDocument46 pagesPanel 1 What Have We Learned About Improving School ParticipationZ_Z_Z_ZNo ratings yet

- Formative Cerid4ebcd23cf1303Document80 pagesFormative Cerid4ebcd23cf1303Z_Z_Z_ZNo ratings yet

- Cherat Packaging Seeks PKR 200M Financing for Imports and Working CapitalDocument14 pagesCherat Packaging Seeks PKR 200M Financing for Imports and Working CapitalZ_Z_Z_ZNo ratings yet

- Ece 411Document9 pagesEce 411Z_Z_Z_ZNo ratings yet

- Final Government Schemes For School EducationDocument16 pagesFinal Government Schemes For School EducationSathyanarayanan Mysore RanganathanNo ratings yet

- 5 Education in PakistanDocument9 pages5 Education in PakistanwaqariccaNo ratings yet

- 6 Baluch Lahore Edu StudyDocument40 pages6 Baluch Lahore Edu StudyZ_Z_Z_ZNo ratings yet

- African Development Bank: Economic Research Working Paper SeriesDocument30 pagesAfrican Development Bank: Economic Research Working Paper SeriesZ_Z_Z_ZNo ratings yet

- The Determinants of Primary School Enrollment and Household Schooling Expenditures in Kenya: Do They Vary by Income?Document22 pagesThe Determinants of Primary School Enrollment and Household Schooling Expenditures in Kenya: Do They Vary by Income?Z_Z_Z_ZNo ratings yet

- 02 Prob Qs MEEDocument12 pages02 Prob Qs MEEZ_Z_Z_ZNo ratings yet

- OBS Pakistan - General RemarksDocument14 pagesOBS Pakistan - General RemarksZ_Z_Z_ZNo ratings yet

- TerrorismDocument23 pagesTerrorismZ_Z_Z_ZNo ratings yet

- 11Document4 pages11Z_Z_Z_ZNo ratings yet

- Writing Student Learning OutcomesDocument10 pagesWriting Student Learning OutcomesGabriel Dan BărbulețNo ratings yet

- Love and LogicDocument2 pagesLove and LogicZ_Z_Z_ZNo ratings yet

- Curriculum Is A Long-Term, Written Plan That Guides The Content and Skills Specific For Each Class in A ProgramDocument1 pageCurriculum Is A Long-Term, Written Plan That Guides The Content and Skills Specific For Each Class in A ProgramZ_Z_Z_ZNo ratings yet

- What Is The Curriculum Development ProcessDocument3 pagesWhat Is The Curriculum Development ProcessZ_Z_Z_ZNo ratings yet

- Sensitive Periods ChartDocument1 pageSensitive Periods ChartZ_Z_Z_Z0% (1)

- CMPDocument10 pagesCMPZ_Z_Z_ZNo ratings yet

- NCERT Pakistan Paper BRJDocument27 pagesNCERT Pakistan Paper BRJZ_Z_Z_ZNo ratings yet

- LearningObjectivesArreola PDFDocument6 pagesLearningObjectivesArreola PDFrinkuNo ratings yet

- Ndre PPKDocument4 pagesNdre PPKSajid AwanNo ratings yet

- Conducting WorkshopsDocument12 pagesConducting WorkshopsZ_Z_Z_ZNo ratings yet

- 4 Planes of DevelopmentDocument35 pages4 Planes of DevelopmentRb GutierrezNo ratings yet

- Problems and Prospects of Higher Education in PakistanDocument325 pagesProblems and Prospects of Higher Education in Pakistankahani20099731No ratings yet

- E Educa Ation N: Chapte Er No. 10Document14 pagesE Educa Ation N: Chapte Er No. 10Z_Z_Z_ZNo ratings yet

- EmotionalpositioningDocument6 pagesEmotionalpositioningZ_Z_Z_ZNo ratings yet

- Subject: - Valuation Certificate: Daman Kumar Shrestha (Engineering Consultant)Document6 pagesSubject: - Valuation Certificate: Daman Kumar Shrestha (Engineering Consultant)Abhishek ShresthaNo ratings yet

- Statement 605009 42691257 17 08 2022 16 09 2022Document3 pagesStatement 605009 42691257 17 08 2022 16 09 2022taslimaakther1989No ratings yet

- Cse 50 Index ListDocument2 pagesCse 50 Index ListConnorLokmanNo ratings yet

- 319 - Schenzen Stock ExchangeDocument2 pages319 - Schenzen Stock Exchangemajumdar.sayanNo ratings yet

- Kishinchand Chellaram College Insurance OverviewDocument41 pagesKishinchand Chellaram College Insurance OverviewNiket Dattani100% (2)

- Account Statement From 1 Jan 2020 To 31 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Jan 2020 To 31 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRama Mohan GhantasalaNo ratings yet

- Statement JUN2019 073481524-Unlocked PDFDocument16 pagesStatement JUN2019 073481524-Unlocked PDFKumar Shashi50% (2)

- Steps in Registering Your Business in The PhilippinesDocument7 pagesSteps in Registering Your Business in The PhilippinesJonas Celiz DatorNo ratings yet

- In Savings Account SoscDocument9 pagesIn Savings Account SoscAbhishek MitraNo ratings yet

- Cashlite TNC Oct2018 EnbmDocument15 pagesCashlite TNC Oct2018 EnbmPokya SgNo ratings yet

- Amazon Settlement ReportDocument77 pagesAmazon Settlement ReportHarsh PatelNo ratings yet

- Nepal Standard On Auditing 600Document11 pagesNepal Standard On Auditing 600Ankit Jung RayamajhiNo ratings yet

- Banking Awareness IBPS Guide PDFDocument41 pagesBanking Awareness IBPS Guide PDFsanthana lakshmiNo ratings yet

- Cash Flow 101Document3 pagesCash Flow 101ricchiute100% (3)

- Presentation On Women Empowerment in Banking SectorDocument18 pagesPresentation On Women Empowerment in Banking SectorAj100% (1)

- Use Cases For Example ATM SystemDocument54 pagesUse Cases For Example ATM SystemGayatri SharmaNo ratings yet

- Gramin BankDocument8 pagesGramin BankSayan SahaNo ratings yet

- India Post OfficeDocument20 pagesIndia Post Officetiwari jiNo ratings yet

- PayPal Transaction History Feb-Mar 2015Document1 pagePayPal Transaction History Feb-Mar 2015dnbinhNo ratings yet

- External Distribution Channel EDC Agent Guide PDFDocument183 pagesExternal Distribution Channel EDC Agent Guide PDFCamilaOsorioNo ratings yet

- View Statement ImageDocument3 pagesView Statement ImageJackson340No ratings yet

- Airtel Broadband Bill - DecDocument1 pageAirtel Broadband Bill - DecSubhani NaniNo ratings yet

- Public Notice02082018Document1 pagePublic Notice02082018Anonymous FnM14a0No ratings yet

- Comp ProjectDocument28 pagesComp Projectavram johnNo ratings yet

- Format .Hum - Role of Self Help Groups in Social Development of Tamil Nadu in The 20th Century A Case Study With Reference To The Fishing Community - 1 - 2 - 1Document8 pagesFormat .Hum - Role of Self Help Groups in Social Development of Tamil Nadu in The 20th Century A Case Study With Reference To The Fishing Community - 1 - 2 - 1Impact JournalsNo ratings yet

- Challan 431798 02052018 112519 PDFDocument1 pageChallan 431798 02052018 112519 PDFchandrikaNo ratings yet

- MSU-IIT Cooperative ArticlesDocument5 pagesMSU-IIT Cooperative ArticlesMariver LlorenteNo ratings yet

- List of All CompaniesDocument86 pagesList of All CompaniesRaj Sa100% (2)

- San Fernando Rural Bank, Inc. V. Pampanga Omnibus Development Corporation and Dominic G. Aquino FactsDocument2 pagesSan Fernando Rural Bank, Inc. V. Pampanga Omnibus Development Corporation and Dominic G. Aquino FactsRamon Khalil Erum IVNo ratings yet

- Super Care Pharma Bank Statement-July-2021Document4 pagesSuper Care Pharma Bank Statement-July-2021AKM Anwar SadatNo ratings yet