Professional Documents

Culture Documents

What Determines Investor Risk Behavior in Pakistan

Uploaded by

Mushtaq Hussain Khan0 ratings0% found this document useful (0 votes)

28 views3 pagesv

Original Title

New Topicv

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views3 pagesWhat Determines Investor Risk Behavior in Pakistan

Uploaded by

Mushtaq Hussain Khanv

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

What Determines the Investor Risk Behavior?

Evidence from Pakistani Stock Market

There is a plethora of research literature available on determinants of investor risk behavior in

context of Western countries. Most of scholars who have studied individuals risky decisions

making behavior found contradictory results. Negatively framed situation leads to risk seeking or

taking behavior due to gambler fallacy while positively framed situation leads to risk aversion

due to protecting prior gains (Kahneman & Tversky, 1979). However, several studies have

contradiction with these results. The outcomes of an individuals prior risk seeking behavior

leads to future risk behavior (Osborn & Jackson, 1988); (Thaler & Johnson, 1990). When

individuals are threatened by losses (Negatively Framed Situation) then they become risk-averse

(Staw, Sandelands & Dutton, 1981).

Furthermore, it is also clear that Western context is different from Asian context. Asian cultures

tend to based on collectivist paradigm and collectivity is characterized by values that reflect a

tendency to prefer certain states of affairs over others (Hofstede, 1980). Tendencies to prefer

certainty versus uncertainty and risk seeking versus risk avoidance may be cultural risk values

(Douglas & Wildavsky, 1982). Literature has focused on nine key determinants of individuals

risk behavior; characteristics of individual decision maker, characteristics of organizational

context and characteristics of problem itself (Sitkin & Pablo, 1992). In this study one

characteristic related to individual decision maker (Risk Perception) and one characteristic

related to problem itself (Problem Framing) and last but not the least social influence are taken

into consideration. Furthermore risk perception has mediating role while problem framing and

social influence acting as independent variables.

Problem framing means influencing humans judgments about a problem by framing it into

positive or a negative ways or in terms of gains or losses. The usage of positive or negative

framing has a considerable influence on information processing and how information is

perceived and understood (Morris, Sheldon, Ames & Young, 2005). In context of Prospect

Theory, Tversky and Kahneman (1986) documented that framing same information in positive or

negative ways, may systematically affect the action of decision maker. The same finding in this

line of research literature that an object is assessed more favorably when it is presented in a

positive frame rather a negative frame in context of consumer research. For example, consumers

assessments are more favorable towards a beef product labeled 75% lean rather one labeled

25% fat (Levin & Gaeth, 1988). Similar findings in this line of research in context of

marketing, for example the use of pleasant music in a commercial can lead to a favorable image

of product, although the music is irrelevant to the merits of the product (Gorn, 1982).

This study attempts to address, unexplored area of Pakistan where investors risky decision

making behavior is different from Western countries. The reason for this difference could be

high gambler fallacy and behavioral biases in collectivist societies of Asian countries,

particularly Pakistan. It has been said that collectivist societies cause individuals to be trapped

more by behavioral biases (Kim & Nofsinger, 2008). People raised in Asian cultures trapped by

behavioral biases more, than people raised in Western cultures (Yates et al. 1989). To authors

best knowledge, despite interest of researchers on investors risk behavior in context of stock

markets, the majority of studies conducted in Western countries, is limited in regions such as

Pakistan. So it should be considered that how investor making risky decisions in collectivist

societies particularly in Pakistan.

The author of the view that study of investors risky decision making is important because, it

helps in understanding how individual investor decisions making varies in different societies and

what happens in financial markets. The importance of current study is encouraged by the

statement of De Bondt , Mayoral and Vallelado (2013), who were of the view that behavioral

biases (behavioral biases influence risk-seeking and risk-taking behavior) and social influence

have received a great deal of attention and are extremely relevant topics to figure out what

happens in financial markets. Furthermore, studies conducted in Western and some Asian

countries cannot be generalized and may not necessarily have any application in context of

Pakistan because of the difference in contextual paradigm (i.e. individualist v/s collectivist).

Hence, an attempt is being made to find out the determinants and their influence on risky

decision making behavior of investors regarding stock market in context of collectivist society of

Pakistan.

You might also like

- My PaperDocument10 pagesMy PaperAtique Arif KhanNo ratings yet

- Individual Investors Herding BehaviorDocument20 pagesIndividual Investors Herding BehaviorHina MasoodNo ratings yet

- Personality Type Investment IntentionDocument18 pagesPersonality Type Investment Intentionrashid awanNo ratings yet

- The Impact of Behavioural Factors on Investment DecisionsDocument4 pagesThe Impact of Behavioural Factors on Investment DecisionsAbdul LathifNo ratings yet

- Behavioral Biases Influenced by Demographics and Personality TraitsDocument17 pagesBehavioral Biases Influenced by Demographics and Personality TraitsRenuka SharmaNo ratings yet

- Chapter 1Document15 pagesChapter 1Saurav KumarNo ratings yet

- bernaola2020Document21 pagesbernaola2020Thanh Trúc Nguyễn ThịNo ratings yet

- Assistant Professor, Maharaja Prithvi Engineering College, Tiruchirappalli, Tamilnadu, IndiaDocument33 pagesAssistant Professor, Maharaja Prithvi Engineering College, Tiruchirappalli, Tamilnadu, IndiaAbdul LathifNo ratings yet

- International Institution For Special Education Lucknow: CaseletDocument9 pagesInternational Institution For Special Education Lucknow: Caseletsaurabh dixitNo ratings yet

- Imran ResearchDocument20 pagesImran Researchwaheed mohmandNo ratings yet

- (2019) Gambetti & Giusberti - Personality, Decision-Making Styles and InvestmentsDocument11 pages(2019) Gambetti & Giusberti - Personality, Decision-Making Styles and InvestmentsGabriela De Abreu PassosNo ratings yet

- Assessment of Investors' Investment Behaviour: Mediating Effect of Risk Tolerance: A Case of Pakistan Stock ExchangeDocument11 pagesAssessment of Investors' Investment Behaviour: Mediating Effect of Risk Tolerance: A Case of Pakistan Stock ExchangeanuNo ratings yet

- SSRN-id2727890Document20 pagesSSRN-id2727890amirhayat15No ratings yet

- Impact of Financial Literacy, Financial Knowledge, Moderating Role of Risk Perception On Investment DecisionDocument20 pagesImpact of Financial Literacy, Financial Knowledge, Moderating Role of Risk Perception On Investment Decisiondahiman khan100% (1)

- (Group 7) Risk Aversion and Personality Type PDFDocument12 pages(Group 7) Risk Aversion and Personality Type PDFmeidaNo ratings yet

- Influence of Individual InvestorDocument9 pagesInfluence of Individual InvestorashNo ratings yet

- MPRA Paper 53849Document8 pagesMPRA Paper 53849Vipul GhoghariNo ratings yet

- Personality Traits Impact Risk Taking Behavior of Pakistani Youth InvestorsDocument14 pagesPersonality Traits Impact Risk Taking Behavior of Pakistani Youth InvestorsNouman MujahidNo ratings yet

- 13-Paper Rafay's Paper DR Shafiqurrehman Required Final Paper - Revised 137-162Document26 pages13-Paper Rafay's Paper DR Shafiqurrehman Required Final Paper - Revised 137-162anuNo ratings yet

- Overconfidence and Investment Decisions in Nepalese Stock MarketDocument10 pagesOverconfidence and Investment Decisions in Nepalese Stock MarketMgc RyustailbNo ratings yet

- An Analysis of Decision Making in The Stock Investment: AbstractDocument8 pagesAn Analysis of Decision Making in The Stock Investment: AbstractReni NilasariNo ratings yet

- A Study On Factors Influencing Buying Behavior of Securities in Indian Stock MarketsDocument9 pagesA Study On Factors Influencing Buying Behavior of Securities in Indian Stock MarketsShivam Singh RajputNo ratings yet

- Factors Affecting The Individual Decision Making ADocument17 pagesFactors Affecting The Individual Decision Making AChosen RamosNo ratings yet

- B FinanceDocument14 pagesB Financehinabatool777_651379No ratings yet

- Impact of Behavioral Biases On Investment Decisions Moderating Role of Financial LiteracyDocument16 pagesImpact of Behavioral Biases On Investment Decisions Moderating Role of Financial LiteracywaqasNo ratings yet

- Heuristic Bias, Risk Perception and Investment DecisionsDocument4 pagesHeuristic Bias, Risk Perception and Investment DecisionsMKashifKhurshidNo ratings yet

- An Empirical Research On Investor Biases in Financial Decision-Making, Financial Risk Tolerance and Financial PersonalityDocument12 pagesAn Empirical Research On Investor Biases in Financial Decision-Making, Financial Risk Tolerance and Financial PersonalityrajaniNo ratings yet

- Investors Decision Making: The Interaction of Environmental and Individual FactorsDocument10 pagesInvestors Decision Making: The Interaction of Environmental and Individual FactorsrulekhalsaNo ratings yet

- Impact of Risk Tolerance and Demographic Factors On Financial Investment Decision Mitali Baruah, Abhishek Kiritkumar ParikhDocument13 pagesImpact of Risk Tolerance and Demographic Factors On Financial Investment Decision Mitali Baruah, Abhishek Kiritkumar ParikhsitiNo ratings yet

- Jurnal FramingDocument16 pagesJurnal FramingLita RianNo ratings yet

- Role of Psychological Factors in Individuals Investment Decisions (#352310) - 363199Document9 pagesRole of Psychological Factors in Individuals Investment Decisions (#352310) - 363199ADINo ratings yet

- Influence of Behavioual Bias On Investment Decisions of Individual Investors in Delhi NCRDocument11 pagesInfluence of Behavioual Bias On Investment Decisions of Individual Investors in Delhi NCRDS ReishenNo ratings yet

- An Investigation of The Impact of Financial Literacy, Risk Attitude, and Saving Motives On The Attenuation of Mutual Fund Investors' Disposition BiasDocument17 pagesAn Investigation of The Impact of Financial Literacy, Risk Attitude, and Saving Motives On The Attenuation of Mutual Fund Investors' Disposition Biasachmad.zulfikarNo ratings yet

- Real-Estate Investor's Psychology: Heuristics and Prospect FactorsDocument6 pagesReal-Estate Investor's Psychology: Heuristics and Prospect Factors03217925346No ratings yet

- Financial literacy paperDocument33 pagesFinancial literacy papersufaid aliNo ratings yet

- Adam SzyszkaDocument16 pagesAdam SzyszkaBatool HuzaifahNo ratings yet

- Impact of Personality Traits On InvestmeDocument19 pagesImpact of Personality Traits On InvestmefirdauskennyNo ratings yet

- Real-Estate Investor's Psychology: Heuristics and Prospect FactorsDocument7 pagesReal-Estate Investor's Psychology: Heuristics and Prospect FactorsKomkor GuyNo ratings yet

- 10 1108 - Imefm 12 2017 0333Document26 pages10 1108 - Imefm 12 2017 0333ANKIT RAINo ratings yet

- Intro N Literature Review FinalDocument23 pagesIntro N Literature Review FinalHasnain SialNo ratings yet

- Exploring Behavioural Biases among Indian InvestorsDocument12 pagesExploring Behavioural Biases among Indian Investorsmoinahmed99No ratings yet

- 17 (Adil Mehraj)Document8 pages17 (Adil Mehraj)Sakshi AgarwalNo ratings yet

- SSRN Id2727890Document20 pagesSSRN Id2727890Hoang OanhNo ratings yet

- Financial Literacy Risk Perception and IDocument9 pagesFinancial Literacy Risk Perception and IK61 ĐẶNG TRI THỨCNo ratings yet

- Analyzing Corporate Finance Decisions During Unstable Stock MarketsDocument16 pagesAnalyzing Corporate Finance Decisions During Unstable Stock MarketsDhrumil ShahNo ratings yet

- Kudryavtsev (2013)Document23 pagesKudryavtsev (2013)Janayna FreireNo ratings yet

- I JB Mer 2010010103Document12 pagesI JB Mer 2010010103sanskritiNo ratings yet

- Hayat 2016 Invesment DecisionDocument14 pagesHayat 2016 Invesment DecisionNyoman RiyoNo ratings yet

- Assignment - 05Document10 pagesAssignment - 05Tarteel 20No ratings yet

- The Behavior of Taiwanese Investors in Asset Allocation: Apjba 3,1Document13 pagesThe Behavior of Taiwanese Investors in Asset Allocation: Apjba 3,1clarinsdNo ratings yet

- Comparing Decision Styles of American, Japanese, and Chinese Business LeadersDocument10 pagesComparing Decision Styles of American, Japanese, and Chinese Business LeadersCristhian CamargoNo ratings yet

- Review of LiteratureDocument6 pagesReview of LiteratureAkhil AnilkumarNo ratings yet

- An Analysis of Behavioral Biases in Investment Decision-MakingDocument13 pagesAn Analysis of Behavioral Biases in Investment Decision-MakingZubaria BashirNo ratings yet

- The Financial Behavior of Major Players: Part TwoDocument21 pagesThe Financial Behavior of Major Players: Part TwoEvhil's Lucia Kaito-Kid 洋一No ratings yet

- Understanding Cultural InfluenceDocument15 pagesUnderstanding Cultural InfluenceAi VaNo ratings yet

- 8bhattacharjee 033121Document20 pages8bhattacharjee 033121Om PatelNo ratings yet

- 1684-Article Text-6733-1-10-20220416Document12 pages1684-Article Text-6733-1-10-20220416Salman KhanNo ratings yet

- Behavioral Biases Across The Stock Market Investors: Evidence From PakistanDocument25 pagesBehavioral Biases Across The Stock Market Investors: Evidence From PakistanPeterNo ratings yet

- Dospert AdultDocument15 pagesDospert AdultAnusha KunduNo ratings yet

- Speculation by Commodity Index Funds: The Impact on Food and Energy PricesFrom EverandSpeculation by Commodity Index Funds: The Impact on Food and Energy PricesNo ratings yet

- Entrepreneurship & Small Business: Lecture No. 02Document20 pagesEntrepreneurship & Small Business: Lecture No. 02Mushtaq Hussain KhanNo ratings yet

- Hong Kong PHD Fellowship Scheme - Research Grants CouncilDocument5 pagesHong Kong PHD Fellowship Scheme - Research Grants CouncilMushtaq Hussain KhanNo ratings yet

- 1 - Modelling COVID-19 As Black SwanDocument20 pages1 - Modelling COVID-19 As Black SwanMushtaq Hussain KhanNo ratings yet

- Literature NEWDocument1 pageLiterature NEWMushtaq Hussain KhanNo ratings yet

- Ibrahim 2017Document32 pagesIbrahim 2017Mushtaq Hussain KhanNo ratings yet

- LaevenDocument1 pageLaevenMushtaq Hussain KhanNo ratings yet

- Steckel2016 (Hamayun SB)Document8 pagesSteckel2016 (Hamayun SB)Mushtaq Hussain KhanNo ratings yet

- Guidance NoteDocument5 pagesGuidance NoteDawod AbdieNo ratings yet

- My Application For CouncilDocument2 pagesMy Application For CouncilMushtaq Hussain KhanNo ratings yet

- Natural Disaster - Klomp2014Document36 pagesNatural Disaster - Klomp2014Mushtaq Hussain KhanNo ratings yet

- Mushtaq Hussain Khan: Mushtaq - Hussain@ajku - Edu.pk Skype Sex - Date of Birth - NationalityDocument3 pagesMushtaq Hussain Khan: Mushtaq - Hussain@ajku - Edu.pk Skype Sex - Date of Birth - NationalityMushtaq Hussain KhanNo ratings yet

- Financing Entrepreneurship in Times of Crisis: Exploring The Impact of COVID-19 On The Market For Entrepreneurial Finance in The United KingdomDocument11 pagesFinancing Entrepreneurship in Times of Crisis: Exploring The Impact of COVID-19 On The Market For Entrepreneurial Finance in The United KingdomGianmarco David Turpo MarónNo ratings yet

- Analysis 00Document325 pagesAnalysis 00Mushtaq Hussain KhanNo ratings yet

- Literature NEWDocument1 pageLiterature NEWMushtaq Hussain KhanNo ratings yet

- Q 1..Document4 pagesQ 1..Mushtaq Hussain KhanNo ratings yet

- Q2Document4 pagesQ2Mushtaq Hussain KhanNo ratings yet

- Formula For Panel in ExcelDocument28 pagesFormula For Panel in ExcelMushtaq Hussain KhanNo ratings yet

- CV - Pejman AbedifarDocument2 pagesCV - Pejman AbedifarMushtaq Hussain KhanNo ratings yet

- Foreign Supervisor PerformaDocument2 pagesForeign Supervisor PerformaMushtaq Hussain Khan100% (3)

- Dear SirDocument3 pagesDear SirMushtaq Hussain KhanNo ratings yet

- Tables ModifiedDocument10 pagesTables ModifiedMushtaq Hussain KhanNo ratings yet

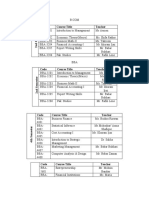

- List of Courses New Sem 2020Document3 pagesList of Courses New Sem 2020Mushtaq Hussain KhanNo ratings yet

- SERIAL KeyDocument1 pageSERIAL KeyMushtaq Hussain KhanNo ratings yet

- Dear SirDocument3 pagesDear SirMushtaq Hussain KhanNo ratings yet

- KhanDocument60 pagesKhanMushtaq Hussain KhanNo ratings yet

- Request For Acceptance LetterDocument1 pageRequest For Acceptance LetterMushtaq Hussain KhanNo ratings yet

- Dear SirDocument3 pagesDear SirMushtaq Hussain KhanNo ratings yet

- Table 4Document1 pageTable 4Mushtaq Hussain KhanNo ratings yet

- Gadzo 2019Document16 pagesGadzo 2019Mushtaq Hussain KhanNo ratings yet

- ManDocument1 pageManMushtaq Hussain KhanNo ratings yet

- Mosek UserguideDocument81 pagesMosek UserguideadethroNo ratings yet

- Páginas Desdeingles - Sep2008Document1 pagePáginas Desdeingles - Sep2008anayourteacher100% (1)

- Manzano's and Kendall Taxonomy of Cognitive ProcessesDocument5 pagesManzano's and Kendall Taxonomy of Cognitive ProcessesSheena BarulanNo ratings yet

- Excellence Range DatasheetDocument2 pagesExcellence Range DatasheetMohamedYaser100% (1)

- Sample Statement of Purpose.42120706Document8 pagesSample Statement of Purpose.42120706Ata Ullah Mukhlis0% (2)

- The Stolen Bacillus - HG WellsDocument6 pagesThe Stolen Bacillus - HG Wells1mad.cheshire.cat1No ratings yet

- Roman Questions II PDFDocument738 pagesRoman Questions II PDFjlinderski100% (3)

- Finger Relaxation Technique Reduces Post-Appendectomy PainDocument13 pagesFinger Relaxation Technique Reduces Post-Appendectomy PainIan ClaxNo ratings yet

- DELA PENA - Transcultural Nursing Title ProposalDocument20 pagesDELA PENA - Transcultural Nursing Title Proposalrnrmmanphd0% (1)

- Manual For The MCPL Programming LanguageDocument74 pagesManual For The MCPL Programming Languagechri1753No ratings yet

- RAGHAV Sound DesignDocument16 pagesRAGHAV Sound DesignRaghav ChaudhariNo ratings yet

- ATP Draw TutorialDocument55 pagesATP Draw TutorialMuhammad Majid Altaf100% (3)

- Barriers To Lifelong LearningDocument4 pagesBarriers To Lifelong LearningVicneswari Uma SuppiahNo ratings yet

- Honey Commission InternationalDocument62 pagesHoney Commission Internationallevsoy672173No ratings yet

- Remapping The Small Things PDFDocument101 pagesRemapping The Small Things PDFAme RaNo ratings yet

- HAU Theology 103 Group Goal Commitment ReportDocument6 pagesHAU Theology 103 Group Goal Commitment ReportEM SagunNo ratings yet

- MC145031 Encoder Manchester PDFDocument10 pagesMC145031 Encoder Manchester PDFson_gotenNo ratings yet

- Countable and Uncountable Nouns Lesson PlanDocument7 pagesCountable and Uncountable Nouns Lesson PlanAndrea Tamas100% (2)

- 10 1016@j Ultras 2016 09 002Document11 pages10 1016@j Ultras 2016 09 002Ismahene SmahenoNo ratings yet

- Radical Candor: Fully Revised and Updated Edition: How To Get What You Want by Saying What You Mean - Kim ScottDocument5 pagesRadical Candor: Fully Revised and Updated Edition: How To Get What You Want by Saying What You Mean - Kim Scottzafytuwa17% (12)

- Companies DatabaseDocument2 pagesCompanies DatabaseNIRAJ KUMARNo ratings yet

- NAVMC 3500.35A (Food Services)Document88 pagesNAVMC 3500.35A (Food Services)Alexander HawkNo ratings yet

- Topic 4 Petrophysics - Part 4Document32 pagesTopic 4 Petrophysics - Part 4Aneesch PreethaNo ratings yet

- Risk Assessment For Modification of Phase 1 Existing Building GPR TankDocument15 pagesRisk Assessment For Modification of Phase 1 Existing Building GPR TankAnandu Ashokan100% (1)

- ArrayList QuestionsDocument3 pagesArrayList QuestionsHUCHU PUCHUNo ratings yet

- Shailesh Sharma HoroscopeDocument46 pagesShailesh Sharma Horoscopeapi-3818255No ratings yet

- HTTP - WWW - Aphref.aph - Gov.au - House - Committee - Pjcis - nsl2012 - Additional - Discussion Paper PDFDocument61 pagesHTTP - WWW - Aphref.aph - Gov.au - House - Committee - Pjcis - nsl2012 - Additional - Discussion Paper PDFZainul Fikri ZulfikarNo ratings yet

- IS BIOCLIMATIC ARCHITECTURE A NEW STYLE OF DESIGNDocument5 pagesIS BIOCLIMATIC ARCHITECTURE A NEW STYLE OF DESIGNJorge DávilaNo ratings yet

- Capitalism Communism Socialism DebateDocument28 pagesCapitalism Communism Socialism DebateMr. Graham Long100% (1)

- Science 10 3.1 The CrustDocument14 pagesScience 10 3.1 The CrustマシロIzykNo ratings yet