Professional Documents

Culture Documents

CM Assgn

Uploaded by

lionalleeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CM Assgn

Uploaded by

lionalleeCopyright:

Available Formats

Liquidity Ratio

a) Current Ratio =

b) Acid Test Ratio =

Profitability Ratio

a) Return on Equity =

b) Return on Total Assets =

c) Return on Revenue =

Operating Profitability

a) Operating Return on Assets =

b) Operating Profit Margin =

Financial Leverage Ratio

a) Debt Equity Ratio =

Performance Ratio

Earnings Per Share =

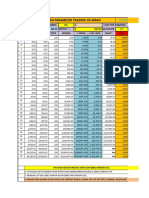

MALAYSIA BUILDING SOCIETY BHD

Analysis 2012 2011 2010 2009 2008

Current Ratio 1.167 1.205 1.131 1.206 1.074

Acid Test

Ratio

1.182 1.204 1.148 1.201 1.118

Return on

equity

0.725 0.660 1.028 0.440 0.306

Return on

Total Assets

0.042 0.044 0.034 0.027 0.022

Return on

Revenue

0.598 0.602 0.559 0.521 0.405

Operating

Return on

Assets

0.025 0.025 0.017 0.008 0.009

Operating

Profit Margin

0.358 0.337 0.272 0.171 0.158

Debt Equity

Ratio

16.452 14.028 29.196 15.040 12.661

Earnings Per

Share

9.70 8.87 4.27 (4.45) 5.58

The analysis above shows a good and consistent liquidity ratio where the liquidity of the

company is considered good as the ratio are all above 1.00. For profitability ratio, the return

on equity is considered better than return in revenue and total assets as the ratio is close to

1.00. From the ratio above also we can see that the debt to equity ratio is not consistent

over the five years. This pattern is not quite good for credit analysis.

RHB CAPITAL BHD

Analysis 2012 2011 2010 2009 2008

Current Ratio 3.495 2.844 2.588 2.723 2.985

Acid Test

Ratio

Return on

equity

0.078 0.050 0.078 0.030 0.025

Return on

Total Assets

0.056 0.033 0.048 0.019 0.017

Return on

Revenue

0.817 0.673 0.757 0.557 0.502

Operating

Return on

Assets

0.049 0.030 0.046 0.016 0.013

Operating

Profit Margin

0.726 0.613 0.724 0.477 0.399

Debt Equity

Ratio

0.401 0.542 0.629 0.580 0.504

Earnings Per

Share

79.0 77.5 66.0 55.8 48.7

The analysis above shows a good and consistent liquidity ratio where the liquidity of the

company is considered very good as the ratio are all above 1.00 and this shows that the

company can has high liquid credit. For profitability ratio, the return on equity is considered

better than return in revenue and total assets as the ratio is close to 1.00 and the operating

return on assets shows a poor ratio. From the ratio above also we can see that the debt to

equity ratio is not consistent over the five years. This pattern is not quite good for credit

analysis.

MALAYSIAN RESOURCES CORP BHD

Analysis 2012 2011 2010 2009 2008

Current Ratio 3.841 3.340 2.285 1.629 0.861

Acid Test

Ratio

3.817 3.319 2.271 1.615 0.854

Return on

equity

0.082 0.046 0.031 0.042 0.076

Return on

Total Assets

0.054 0.028 0.017 0.017 0.031

Return on

Revenue

0.472 0.211 0.115 0.061 0.111

Operating

Return on

Assets

0.038 0.024 0.021 0.024 0.033

Operating

Profit Margin

0.336 0.182 0.142 0.086 0.116

Debt Equity

Ratio

0.519 0.621 0.823 1.433 1.444

Earnings Per

Share

4.000 7.000 5.000 5.000 (6.000)

The analysis above shows a good and consistent liquidity ratio but the ratio is decreasing

over the years where the liquidity is decreasing and this is not for the company. For

profitability ratio, the return on revenue is considered better than return in equity and total

assets as the ratio is close to 1.00 and the operating return on assets shows a poor ratio.

From the ratio above also we can see that the debt to equity ratio is increasing over the

period.

ALLIANCE FINANCIAL GROUP BHD

Analysis 2012 2011 2010 2009 2008

Current Ratio 414.344 4.033 4.012 3.100 1.997

Acid Test

Ratio

Return on

equity

0.148 0.079 0.074 0.069 0.060

Return on

Total Assets

0.147 0.079 0.055 0.052 0.059

Return on

Revenue

20.543 7.943 7.703 28.515 10.065

Operating

Return on

Assets

0.145 0.058 0.053 0.050 0.546

Operating

Profit Margin

20.150 7.688 7.387 2.755 9.199

Debt Equity

Ratio

0.002 0.330 0.332 0.334 0.203

Earnings Per

Share

31.5 26.7 19.7 14.9 25.4

The analysis above shows a good and consistent liquidity ratio but the ratio is decreasing

over the years where the liquidity is decreasing and this is not for the company but it also

shows an issue in the year 2012 where the all the ratio is different in the year 2012. For

profitability ratio, the return on revenue is considered better than return in equity and total

assets as the ratio are all more than 1.00 and the operating return on assets shows a poor

ratio. From the ratio above also we can see that the debt to equity ratio is decreasing over

the period.

UMW HLDGS BHD

Analysis 2012 2011 2010 2009 2008

Current Ratio 1.737 1.727 1.772 2.073 1.608

Acid Test

Ratio

1.240 1.237 1.271 1.334 1.013

Return on

equity

0.298 0.225 0.229 0.158 0.233

Return on

Total Assets

0.159 0.119 0.121 0.088 0.137

Return on

Revenue

0.012 0.093 0.094 0.073 0.084

Operating

Return on

Assets

0.170 1.294 0.131 0.096 0.163

Operating

Profit Margin

0.127 0.101 0.010 0.079 0.100

Debt Equity

Ratio

0.878 0.890 0.903 0.700 0.700

Earnings Per

Share

14.53 26.11 21.17 0.74 (0.22)

The analysis above shows a good ratio but is not consistent over the years and this is not

quite good for credit analysis as it will make the party hard to predict the future financial

position. For profitability ratio, the return on equity is considered better than return in

revenue and total assets as the ratio are all close to 1.00 and the operating return on assets

shows a poor ratio. From the ratio above also we can see that the debt to equity ratio is not

consistent over the years over the period.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Option AgreementDocument6 pagesOption AgreementedallmightyNo ratings yet

- Kotler Chapter 9 MCQDocument40 pagesKotler Chapter 9 MCQAnthony Scott89% (18)

- SPACE & Rec HersheyDocument4 pagesSPACE & Rec Hersheylionallee100% (1)

- SWOT HersheyDocument4 pagesSWOT HersheylionalleeNo ratings yet

- Analyzing Hershey Company's Strategic Position Using BCG, IE, and Grand Strategy MatricesDocument2 pagesAnalyzing Hershey Company's Strategic Position Using BCG, IE, and Grand Strategy MatriceslionalleeNo ratings yet

- APC Ch9solDocument7 pagesAPC Ch9solBaymad67% (3)

- Money Management TradingDocument4 pagesMoney Management TradingBagus Krida0% (1)

- QSPM HersheyDocument3 pagesQSPM Hersheylionallee0% (1)

- External FactorDocument5 pagesExternal FactorlionalleeNo ratings yet

- Strategy ImplementationDocument11 pagesStrategy ImplementationlionalleeNo ratings yet

- External FactorDocument5 pagesExternal FactorlionalleeNo ratings yet

- Internal AssessmentDocument13 pagesInternal AssessmentlionalleeNo ratings yet

- Current RatioDocument1 pageCurrent RatiolionalleeNo ratings yet

- Goods and Services Tax in MalaysiaDocument6 pagesGoods and Services Tax in MalaysiaAzian Mohd HanipNo ratings yet

- Assignment OffshoreDocument16 pagesAssignment OffshorelionalleeNo ratings yet

- Assignment 1Document3 pagesAssignment 1lionalleeNo ratings yet

- Pa Ijebms 20130159Document8 pagesPa Ijebms 20130159lionalleeNo ratings yet

- 20Document8 pages20lionalleeNo ratings yet

- RizalDocument15 pagesRizallionalleeNo ratings yet

- Goods and Services Tax in MalaysiaDocument6 pagesGoods and Services Tax in MalaysialionalleeNo ratings yet

- How ToDocument19 pagesHow TolionalleeNo ratings yet

- GB31303 Group Assignment - Evaluation FormDocument1 pageGB31303 Group Assignment - Evaluation FormlionalleeNo ratings yet

- Assessment Tasks Jan 5 and 7 2022 InocencioDocument8 pagesAssessment Tasks Jan 5 and 7 2022 Inocencioalianna johnNo ratings yet

- Online TradingDocument50 pagesOnline TradingKeleti SanthoshNo ratings yet

- Meaning:: Difference Between Equity Shares and Preference SharesDocument7 pagesMeaning:: Difference Between Equity Shares and Preference SharesAnkita ModiNo ratings yet

- CAN SLIM คัดหุ้นชั้นยอด ด้วยระบบชั้นเยี่ยม (ORC)Document505 pagesCAN SLIM คัดหุ้นชั้นยอด ด้วยระบบชั้นเยี่ยม (ORC)eosxudlbrvedaiwpyjNo ratings yet

- Chapter 7 Exercise Stock ValuationDocument3 pagesChapter 7 Exercise Stock ValuationShaheera Suhaimi100% (3)

- Multibagger Stock Ideas2Document16 pagesMultibagger Stock Ideas2KannanNo ratings yet

- Listing and Delisting of SecuritiesDocument11 pagesListing and Delisting of SecuritiesSaksham GoelNo ratings yet

- DividendsDocument3 pagesDividendsjano_art2125% (8)

- FIN 623 Final Exam Practice QuestionsDocument8 pagesFIN 623 Final Exam Practice QuestionsChivajeetNo ratings yet

- Adjudication Order Against 18 Entities in The Matter of Goldstone Technologies Ltd.Document34 pagesAdjudication Order Against 18 Entities in The Matter of Goldstone Technologies Ltd.Shyam SunderNo ratings yet

- Answer: Uestion XAM OV Old Syllabus MarksDocument7 pagesAnswer: Uestion XAM OV Old Syllabus MarksSiva Kumar ReddyNo ratings yet

- Bond Stock ValuationDocument38 pagesBond Stock ValuationRichard Artajo RoxasNo ratings yet

- FM11 CH 07 Mini CaseDocument12 pagesFM11 CH 07 Mini CaseMariam Sharif100% (2)

- Arcimoto Bankruptcy WarningDocument32 pagesArcimoto Bankruptcy WarningMaria MeranoNo ratings yet

- Difference Between IPO OFS FPODocument2 pagesDifference Between IPO OFS FPOGanesh ShevadeNo ratings yet

- S&P500 Complete List PDFDocument3,401 pagesS&P500 Complete List PDFMacera FelipeNo ratings yet

- DRV Bank&VSD Messages V1.1Document249 pagesDRV Bank&VSD Messages V1.1Trang Phùng MinhNo ratings yet

- Accounting 113 - Audit 2 ProblemsDocument4 pagesAccounting 113 - Audit 2 ProblemsAnna Carlaine PosadasNo ratings yet

- Pre-Issue Processof IpoDocument28 pagesPre-Issue Processof Ipo2005ravi100% (1)

- mc30 Mutual Funds PDFDocument3 pagesmc30 Mutual Funds PDFAnkur ShahNo ratings yet

- En 07 MemberDocument9 pagesEn 07 MemberDouggie YuNo ratings yet

- B.COM DEGREE CBCS PRIVATE EXAMINATION FINANCIAL MARKETS EXAMDocument8 pagesB.COM DEGREE CBCS PRIVATE EXAMINATION FINANCIAL MARKETS EXAMVictor VargheseNo ratings yet

- Chapter - 6 - Common Stock - GitmanDocument42 pagesChapter - 6 - Common Stock - GitmanJessica Charoline PangkeyNo ratings yet

- An Introduction To The Indian Stock MarketDocument7 pagesAn Introduction To The Indian Stock MarketsandystaysNo ratings yet

- Equity Investment 2 - ValuationDocument34 pagesEquity Investment 2 - Valuationnur syahirah bt ab.rahmanNo ratings yet

- Financial Markets and Institutions 5th Edition Saunders Test BankDocument40 pagesFinancial Markets and Institutions 5th Edition Saunders Test Bankodiledominicmyfmf100% (31)

- Topic Wise Test Investment AccountsDocument2 pagesTopic Wise Test Investment AccountsChinmay GokhaleNo ratings yet