Professional Documents

Culture Documents

Accenture Reducing The Quantity and Cost of Customer Returns

Uploaded by

Kyriakos FarmakisOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accenture Reducing The Quantity and Cost of Customer Returns

Uploaded by

Kyriakos FarmakisCopyright:

Available Formats

A Returning Problem

Reducing the Quantity and Cost of Product

Returns in Consumer Electronics

David Douthit, Michael Flach and Vivek Agarwal

2

3

Accenture research estimates

that in 2011, US consumer

electronics (CE) manufacturers,

communication carriers and

electronics retailers will spend

an estimated $16.7 billion to

receive, assess, repair, rebox,

restock and resell returned

merchandise.

1

Put another way,

manufacturers spend about 5

percent to 6 percent of revenues

to manage all aspects of a

customer return. For retailers,

returns represent approximately

2 percent to 3 percent of sales.

This would be a gargantuan

concern in any industry. But

in a sector where margins are

thin, competition is brutal and

customer experience is a key

differentiator, high return levels

should be seen as a problem of

unsustainable magnitude.

Fortunately, the extent of the

problem is proportionate to the

size of the opportunity. There is

great potential for manufacturers

and retailers to develop formal

programs that dramatically

reduce the number and cost of

customer returns. The two groups

also have the power to design

better, more efficient ways to

process returns. Together, these

approaches could save these

companies millions of dollars and

create formidable new sources of

competitive advantage.

One reason the problemand the

opportunityare so large is that,

according to our research, more

than two thirds of costs associated

with returns can be characterized

as No Trouble Found (NTF). In

other words, the products did not

meet the customers requirements

or expectations, or the customer

believed the product had a hardware

or software failure, even though no

problem was detected when the item

was tested against specifications set

by the retailer, carrier or manufacturer.

Similarly, consumer electronics firms

could cut costs by implementing more

sophisticated approaches to returns

processing. Closer collaboration between

manufacturer and retailer is a good

starting point. Another is developing

distinctive strategies, methodologies

and tools specifically designed for the

returns supply chain. After all, returns

operations are unique; it is not effective

to position them as simple supply chain

appendages or as mirror images of

forward-focused supply chains.

This Accenture Point of View examines

the scope of the returns dilemma,

discusses recent research that frames

the problem, explains why improvement

opportunities are so vast, and presents

a variety of ways that electronics

manufacturers, communication carriers

and electronics retailers can cut costs

by reducing the quantity of returns and

improving their post-sale supply chains.

4

5

As noted previously, Accenture

research estimates that the annual

cost of consumer electronics returns

in the United States is estimated to

reach $16.7 billion in 2011. Given this

magnitude, Accenture recently set out

to understand the problem more fully

and determine what actions could be

taken in response. Approximately 100

consumer electronics manufacturer,

communication carriers and CE retail

executives responded to a subsequent

survey on trends on customer returns.

Within the scope of the research were

manufacturers and retailers of wireless

handsets, personal computers, set top

boxes, digital video recorders, high

definition televisions, game players

and software, MP3 players, computer

software, printers and peripherals,

GPS devices, home and vehicle audio

systems, CE accessories and media.

The research efforts most important

finding may be that most consumer

electronics companies do not fully

account for the cost of returnsmuch

less do everything possible to reduce

them. Consider all the costs that

go into processing a returned and

repaired/repackaged product (Figure 1).

At a typical consumer electronics firm,

only warranty costs (approximately 30

percent of the total) are identified as a

line item in cost of goods sold (COGS).

Accenture research and interviews

confirm that the remaining 70 percent

of returns costs are categorized either

as selling, general & administrative

(SG&A) or as part of operational

overhead. Yet a fundamental first step

in reducing returns and processing

them more effectively is tracking

and analyzing costs in each of the

categories shown in Figure 1 (NTF

testing, returns processing, liquidation,

and warranty reserve).

The hidden costs of customer returns

Figure 1: Breakdown of returns costs in the consumer electronics sector according to Accenture research.

0.00%

10.00%

20.00%

30.00%

40.00%

50.00%

60.00%

70.00%

80.00%

90.00%

100.00%

Warranty reserve

Liquidation - Retailer

Liquidation - OEM

Returns Processing costs

NTF costs

6

A second area of concern identified

by Accenture researchers is that the

return rate for consumer electronics

devices is between 11 percent and 20

percent and rising (Figure 2). In fact,

approximately 58 percent of consumer

electronics retailers and 43 percent

of consumer electronics OEMs are

experiencing higher return rates than

in previous years.

2

Of these returns:

68 percent are characterized as

no trouble found.

27 percent are associated with

buyers remorse.

5 percent are defective.

The bottom line is that 95 percent of

returns are ultimately unconnected to

product defects!

Ninety five percent of

returns are ultimately

unconnected to product

defects.

Clearly, there are significant benefits

associated with reducing the incidence

and impact of NTF and buyers remorse

returns (the non-defective 95

percent). For example:

Manufacturers would benefit by

reducing the far-reaching expenses

(testing, shipping, reporting,

repackaging, etc.) linked to products

that have been returned by the

consumer but operate properly when

checked.

Electronics retailers and

communication carriers would be able

to lower costly customer interactions

and administrative burdens associated

with assessing, restocking and

arranging for the proper disposition of

returned merchandise.

Manufacturers, carriers and retailers

would all enjoy the benefits of increase

brand- and customer loyalty.

Figure 2: Recipients of a recent Accenture survey were asked How do your current return rates compare to the previous

three to five years?

OEMs

Retailers

Trending Higher

Trending Lower

About the Same

0% 10% 70% 60% 50% 40% 30% 20%

7

8

9

Proactive solutions

The first thing manufacturers and

retailers can do is to stop thinking

of returns as a normal cost of doing

business. After all, our research

suggests that total landed costs

associated with returns is 5 percent

to 6 percent of revenues for

manufacturers and 2 percent to 3

percent of sales for retailers. And a

(very feasible) 1 percent reduction

in the number of customer returns

translates to roughly a 4 percent

reduction in return/repair costs. This

represents about $21 million in annual

savings for a typical manufacturer and

around $16 million for a large retailer

(Figure 3). The message is clear: High

return rates should not be considered

normal; they are a problem that is

worth correcting.

High return rates should

not be considered normal;

they are a problem that is

worth correcting.

Commensurate with a change in

mindset (high returns are not normal),

manufacturers and retailers can focus

on addressing the twin challenges of 1)

reducing returns levels and 2) improving

their returnsprocessing operations.

The next sections contain a variety of

ways that both these objectives can

be reached. However, it is important

to begin with a brief discussion

about metrics, collaboration and

communication. Most companies

struggle with measurement and

analysis challenges and this hinders

their ability to gauge total landed

costs. When it comes to returns,

comprehensive measurement requires

ongoing, systematic capture and

analysis of the reasons customers

give when returning a product.

Measurement savvy not only guides

the company towards product

and service improvements, it also

provides new insights on how best

to triage returns. In addition, the

inter-organizational nature of

returns management means there

is merit in manufacturers and

retailers understanding each others

perceptions and practices. Prospects

for improvement in this area are good:

Survey input shows that, in recent

years, collaboration in the area of

returns data shared by manufacturers,

retailers and communication carriers

has increased.

To keep the ball rolling, manufacturers

need to measure more effectively

and extensively, and accept that high

NTF returns are not simply the result

of overly-permissive retail return

policies. Oftentimes, high NTF return

rates are symptomatic of problems

with a products design, manufacture,

packaging or instructions. Conversely,

communication carriers and CE retailers

should realize that, to some degree,

return problems are self-inflicted.

10

Figure 3: A 1 percent reduction in the number of open-box returns ultimately designated Not Trouble Found will reduce

return and repair costs by 4 percent for both the device manufacturer (OEM) and the retailer.

1% NTF reduction

$21 million savings for OEM

$16 million savings for Retailer/Carrier

Overall savings

$37 million

*This example assumes a $10 B CE device manufacturer with an ASP at retail of $299

CE Retailer return costs

$396 M

OEM returns processing

costs $466 M

Current

CE Retailer return costs

$380 M

OEM returns processing

costs $445 M

1. Reducing Customer

Returns

Over the past two decades, consumers

have come to expect high levels of

customer service in every segment

of commerce. This is especially

true for electronic items which,

enhanced by new technology, have

become vastly more complex and

require more and more support.

Such expectations contribute to

customer impatience with products

they cant figure out and with support

systems that are hard to access or

insufficiently helpful. Moreover,

consumers know that retailers and

manufacturers will accept returns of

merchandise that they (the customer)

find to be defective, unwanted or

(for whatever reason) unusable.

The simple reality is that most

CE manufacturers, retailers and

communication carriers have not

done enough to help consumers

understand, set up, use and optimize

the products they have purchased.

Most companies, in fact, invest

considerable sums to manage returns

and relatively little to proactively

prevent returns (Figure 4). Not unlike

health care, both CE manufacturers

and retailers need to refocus their

investment strategies on prevention.

Not unlike health care,

both CE manufacturers and

retailers need to refocus

their investment strategies

on prevention.

Improving the Stages of the

Customer Experience

In some cases, the returns issue has

a design problem at its core (basic

flaws or higher-than-necessary levels

of complexity). Quality control and

the minimization of complexity should

always be manufacturing priorities,

but in many cases, all that is needed

is to improve the customers buying,

implementation and usage experience.

Think of this experience as having

three distinct stages, with strong

potential for improvement at each:

1) point of purchase, 2) point of first

use and 3) point of need.

Point of purchase. At the point

of purchase, manufacturers must

concentrate on their ability to improve

the retail buying experience. One

way to do this is to roll out education

programs for retail sales professionals.

By expanding training focused on the

form, fit and function of a product,

manufacturers can help prepare retail

sales personnelmaking sure the

latter are well prepared to address

questions, concerns and issues that

arise during the buying process. Some

manufacturers have deployed online

learning or certification programs

that offer special rewards to sales

professionals that undergo training.

11

Social media and web content are

changing the way we live, work

and communicate, and they can

also help CE companies minimize

returns. For example, well-designed

websites help people become

more informed consumers by

providing documentation, FAQs and

implementation trainingall of which

can help consumers make more-

informed purchase decisions and

subsequently reduce returns. The same

sites may also offer consumers a forum

to rate and review their purchases,

which further educates other buyers.

Similarly, social media, chat resources

and online videos that provide setup

and usage guidance can improve

the customer-training experience.

These media also build loyalty and

advocacy among a products most

knowledgeable customers.

One company that Accenture

researched was able to reduce its

return rate by half a percentage point

by offering product videos on a major

social media site. Less than 3 minutes

long, the videos demonstrate product

functionality and setup. Net effect?

Fewer returns and happier customers.

Point of first use. At the point of first

use, the key concern is ensuring the

products usability. Toward this end,

manufacturers could enhance the out-

of-the-box experience with better-

illustrated getting started guides

that help consumers set up their

devices. These should be much easier

to understand than lengthy instruction

manuals (but obviously do not replace

them). Multimedia customer-education

resources such as accompanying DVDs

and online tutorials also provide an

engaging way to help customers learn

about the product.

Less common but oftentimes effective

are priority handling policies. If a

first-time customer contacts the call

center, that call might warrant special

handling that avoids lengthy wait

times and connects customers with

personnel familiar with first timers

issues. The mission is about sales and

image building as much as support.

After all, since returns are so easy,

the product is not really sold until the

customer is contentedly using it. Call

center staff must be able to get the

customer up and running on this first

call and build excitement concerning

the products value. For example, a

first timer technician might also take

a moment to introduce shortcuts or

hidden features to the caller.

Social media, chat resources

and online videos that provide

setup and usage guidance

can improve the customer-

training experience.

Figure 4: Enhancing investments to reduce the total cost of returns.

Every manufacturers and retailers goal should be to determine the optimal (most cost effective) mix of returns prevention versus

returns processing. Our hypothesis is that if most organizations fully measure the cost of returns, they will find that their investments are

disproportionately stacked in favor of reacting to returns, rather than focusing on the prevention of returns; and that more prevention

efforts result in a lower overall cost structure.

Optimal Total Cost Position

Increasing Investment in Preventing Returns

$ Cost to Prevent Returns Cost to Process Returns

12

Developing direct communication

channels with customers can also

ensure that the product stays sold.

To engage product purchasers before

they return products, one surveyed

manufacturer deploys a set-up

concierge. Accessed via an 800

number, the program helps customers

set up smart phones to work with their

personal computers.

Point of need. At the point of need,

the challenge is to address a customers

current concerns and problems with the

product. In this context, manufacturers

could distinguish themselves by building

remote diagnostics capabilities. Such

solutions not only enable repairs to be

handled remotely but can also identify

(and head off) conflicts arising from

improper set-up or configuration of

a device.

If a customer is unable to rapidly

resolve his or her problems on-

line, an efficient contact center

experience is critical. Many device

manufacturers now include flyers

with their products that encourage

customers to call their contact center

rather than returning the device.

Accenture research shows that one

of the top factors in a compelling

customer experience is a personable

and capable agent, and a support

experience that solves the problem the

first time a customer calls. This relates

closely to the measurement issues

discussed previously: Manufacturers

should understand the relationship

between increased returns and poor

phone support or abysmally slow wait

times. Is it possible that attempting

to save money by limiting the number

of telephone support personnel is

actually costing the company money

by raising customer returns?

Is it possible that

attempting to save money

by limiting the number of

telephone support personnel

is actually costing the

company money by raising

customer returns?

Return-prevention Strategies for

CE Retailers and Communication

Carriers

When it comes to returns, retailers

and communication carriers have

more or less the same challenge as

manufacturers: create a satisfactory

user experience that helps a bought

product stay bought. However, there

are unique behaviors that retailers

and communication carriers can

exert to reduce the returns problem.

For example, many customer-facing

organizations fail to set reasonable

customer expectations or educate

the buyer properly. In addition, many

retail sales staffs are not sufficiently

knowledgeable about their products and

thus try to sidestep critical issues that

they dont fully understand. In other

cases, store advertising, signage and

literature fail to communicate a realistic

level of complexity or explain what

accessories or knowledge the customer

needs to launch and operate a device.

13

When it comes to returns,

retailers and communication

carriers have more or less

the same challenge as

manufacturers: create a

satisfactory user experience

that helps a bought product

stay bought.

Consider the following five steps that

retailers and communication carriers

could take to address the returns

problem:

Measure the impact of returns. Like

manufacturers, retailers need their

own metrics to assess the scope of the

problem and follow trends over time.

As always, it is critical to begin with

a baseline in order to benchmark the

current impact of returns. Using that

information, they can determine cost-

appropriate levels of improvement and

introduce new approaches as necessary.

For retailers, the most important

metrics are return rates by item;

item class and manufacturer; length

of time since purchase; and reason

for the return. It is nearly impossible

to determine what new approaches

might reduce return rates without this

information. One retailer Accenture

interviewed also tracks return rates

by retail sales person. NTFs are

particularly important since these are,

theoretically, 100 percent avoidable.

The reason for any return that is

ultimately deemed NTF should be

studied particularly closely.

Develop product-education classes

for consumers. The best example

may be Apples Genius Bar which

in addition to creating a generally

pleasurable and fruitful support

experiencehandles training programs

for groups and individuals. Better

than almost any other manufacturer/

retailer, Apple understands that

loyalty is largely forged by a

positive, personalized relationship.

Offer delivery and setup services

to consumers for highly technical

products. Accenture research reveals

that offering value-added services

can radically reduce returns, often

by as much as 20 percent, while

generating additional revenue. (Best

Buys Geek Squad is probably the best

known example.) Given the benefits

associated with reduced returns and

improved brand image, there is a

strong case to be made even without

the additional revenue.

Invest in proactive customer

service on high-cost/high-return

products. The idea here is to assist

customers before they have a chance

to become frustrated and return an

item. By demonstrating interest in the

customers success, retailers not only

head off potential implementation and

usage problems, but also strengthen

their brands image. One wireless

device manufacturer worked closely

with a wireless carrier to put in place

a proactive customer contact program

14

for complex data devices sold at the

carriers retail stores. By reaching out

in the first 24 hours, the collaboration

cut buyers remorse returns by up to

20 percent.

One wireless device

manufacturer worked closely

with a wireless carrier to

put in place a proactive

customer contact program

for complex data devices

sold at the carriers retail

stores. By reaching out

in the first 24 hours, the

collaboration cut buyers

remorse returns by up to

20 percent.

Provide multiple service options.

Customers value choice. They

have different ideas about what is

convenient, how they want to solve

problems and what is worth paying for.

Moreover, people not only have widely

differing preferences, their choices

also vary by age and gender (Figure

5).

3

Some, for example, prefer self-

help via the Web while others prefer

telephone support or exchange/repair

by mail. Another group may prefer the

face-to-face interaction and speed of

in-person support at a retail facility.

A retailer or communication carrier

that provides a choice of service and

support options is enhancing the

customers experience and potentially

reducing return rates. Because more

than two thirds of all returns are

ultimately labeled NTF, in-person

service centers can be a particularly

valuable solutionweeding out NTFs

before they become returns.

Figure 5: Percentage of survey respondents interested in having computers maintained using various methods.

Total

18-24

25-34

35-44

45-54

55-64

65+

Male

Female

Provided by

a friend or

family member

Handled in

my home by

an onsite visit

by a technician

Self directed

and guided

by training

manuals/online

forums/training

support

Provided by

technicians via

e-mail or online

chat

Provided by

technicians

through a

telephone call

center with me

on the phone

Provided

remotely by

accessing my

computer at

night or during

non-use hours

Take it into a

retail store/

computer

repair shop

51%

53%

55%

51%

47%

48%

53%

44%

58%

40%

41%

38%

41%

41%

43%

38%

36%

45%

39%

43%

47%

41%

41%

34%

27%

45%

33%

36%

30%

34%

40%

38%

38%

35%

35%

37%

36%

37%

39%

39%

36%

34%

28%

35%

37%

33%

28%

34%

36%

31%

35%

33%

32%

34%

28%

31%

31%

28%

27%

27%

26%

27%

30%

15

Accenture research on customer

returns in consumer electronics

reveals several behaviors that

can be labeled leading practice.

Simply put, manufacturers and

retailers that excel in this area...

Measure the impact of

returns. Using quantifiable

means, they have determined

the cost impact of returns and

identified the optimal mix of

investments in returns prevention

versus returns processing. Their

measurement activities involve

examinations of all costs and

processes associated with device

returns. At a minimum, they

understand what it costs to

receive, process and disposition

No Trouble Found products.

Create simpler product

designs. Leading practice

companies know that easy-

to-use products improve the

customer experience. In fact, a

survey of US consumers found

that consumers tolerance levels

for making a device work is

approximately 20 minutes.

4

After

that, they tend to give up and

return the product. Fortunately,

there are tools and strategies

that can address this challenge.

Emphasize customer

education. Industry research

suggests that a key contributor

to high return rates is

insufficient education of

the customer. One study by

the Consumer Electronics

Association found that the top

four actions companies could

take to reduce return rates are:

encourage more pre-purchase

research by the consumer;

provide better pre-sale info;

improve telephone support; and

create more informative in-

store displays.

5

Not mentioned

but also vital is creating

favorable, yet reasonable,

customer expectations.

Aggressively encourage

customer feedback to help

determine the causes of

returns.

Leading Practices in CE Product Returns

16

2. Processing

Strategies: Optimizing

the Return/Repair

Network

Many of the companies Accenture

studied have a one-size-fits-all

strategy when it comes to processing

returns. They lack the ability to quickly

and efficiently segregate NTF products

from truly defective products early

in the returns process. They may

excel at getting new products to

market swiftly, but returns pile up in

a stock room. They often are unable

to differentiate products tied to

stable demand from those with spiky

demand, which means they cant make

sensible cost decisions about whether

a repair should occur in Memphis or

Mexico. In fact, they may not be able

to determine if it is appropriate to

repair a product at all.

Accentures view is that companies can

realize notable gains in profitability

by bringing new levels of innovation,

agility and flexibility to their returns

processing efforts. By streamlining

and optimizing their return/repair

networksoften applying greater

levels of segmentationthey can drive

out significant costs. Following are

some specific ideas:

Work to understand the total

landed cost of returns. Accenture

recommends that retailers and

manufacturers develop a more

thorough understanding of total

landed costs for returnsaccounting

for factors such as transportation

and shipping, inventory, labor and

materials. Supply chain network

modeling tools are available to help

companies understand key tradeoffs,

such as cost to serve versus customer

service expectations.

Acknowledge that a one-size-fits-

all approach rarely works. Volume,

complexity of repair, cost of repair,

cost of product and customer

demand all must be considered when

developing a returns network. Various

combinations of these factors need

to engender different responses.

For example, it may be effective to

centralize the return/repair process

for a product with stable demand

that requires complex diagnosis and

repair by highly skilled technicians.

By contrast, a high-demand product

that requires rudimentary diagnosis by

minimally trained personnel may lend

itself to a decentralized repair network

geared to faster turnaround.

Decouple return and repair processes.

Companies may find that it is more

cost effective and expedient to

position return and repair processes

as discrete activities that can be

performed at one or more sites

17

(e.g., Triage, Level 1 repair, Level 2

repair). Decoupling these processes

can increase the responsiveness and

flexibility of return/repair networks.

One large communication carrier

reduced its repair and return cycle

from weeks to days by moving its

triage operations to its retail store and

adding Level 1 repair capabilities at its

distribution sites.

Implement strategies for quickly

identifying No Trouble Found (NTF)

items and returning them to inventory

as soon as possible.

Forecast and plan for returns and

repairs. Even the simplest repairs tap

into parts inventories, which means

that (more sophisticated) inventory

management techniques may be

needed to ensure and confirm that

necessary stocks are available to

meet service requirements. Consider

using specialized spare parts

inventory planning tools that factor

in the drivers of repairs and the

associated parts consumption (e.g.,

installed base, mean time between

failures, warranty data). From an

organizational perspective, returns

planning should have a slot on the

sales and operations planning (S&OP)

agenda, where returns metrics are

reviewed and continuous improvement

opportunities are identified.

Account for different levels of

product demand. Manufacturers and

retailers should be able to confirm

that their return/repair networks can

accommodate peak demand for a

particular product. When demand is

high, returned products need to be

rapidly processed and put back on

shelves. By contrast, products linked to

stable demand may not require rapid

re-stocking, so a different, less costly

repair approach may be preferable.

Explore creative solutions for B

stock. Many of the manufacturers

and retailers studied by Accenture

have recently expanded their online

auction activities for B product stock.

In fact, many leading retailers are

approaching the secondary market

customer with the same zeal applied

to brick and mortar customers. Theyre

moving liquidation in-house and thus

increasing profits by avoiding the

middleman.

One large communication

carrier reduced its repair

and return cycle from

weeks to days by moving

its triage operations to its

retail store and adding Level

1 repair capabilities at its

distribution sites.

18

A Returning Opportunity

Working together, CE manufacturers,

retailers and communication carriers

have a distinct and very large

opportunity to 1) reduce customer

returns and 2) make the processing

of necessary returns less arduous,

less costly and, in some cases, more

profitable. The reason for such vast

improvement potential is simple: A

great majority of returned products

are not defective, thus implying that

most returns associated with consumer

electronics devices are preventable.

95 percent of returns are ultimately

unconnected to product defects!

At the same time, smarter investments

in return and repair operations

calibrated and segmented to reflect

cost realities and market conditions

are another potential win.

The bottom line, of course, is new

potential for broad cost improvements,

greater competitive differentiation,

increased customer loyalty and

a stronger brand imageall of

which contribute mightily to higher

profitability and the attainment of

high performance.

About the authors

David Douthit

David Douthit is an executive in

Accenture Supply Chain Management

consulting where he is the Lead for

Reverse Logistics and Repair. He has

cross over experience in advising

clients on issues related to customer

support and service as it relates to

supply chain issues. He has 20+ years

domestic and international experience

in Supply Chain Management,

Supply Chain Strategy, 3rd Party

Logistics, Sourcing and Procurement,

Warehouse/Repair Operations, Service

Parts Logistics, and Electronics

Contract Manufacturing. He has deep

experience working with electronics

and high tech, communications and

product companies. Based in San

Jose, CA . David can be reached at

david.douthit@accenture.com.

Michael Flach

Michael Flach is a Manager in Accenture

Supply Chain Management consulting.

He has an extensive background in

Supply Chain Transformation, Sourcing

and Procurement, Category Review

and International Trade for a variety of

industries. Based in Pittsburgh,

he can be reached at michael.d.flach@

accenture.com.

Vivek Agarwal

Vivek Agarwal is a Manager in

Accenture Supply Chain Management

consulting handling research and

development activities for the

global service strategy & operations

practice. He has extensive experience

in designing and implementing large

scale supply chain projects for a

variety of companies in Electronics &

High Tech sector. Based in India, he

can be reached at vivek.b.agarwal@

accenture.com

References

1

Estimate derived from Accenture

client interviews, consulting

engagements and market research.

2

Accenture Returns Management

Survey, May 2011

3

Beyond Landline: Evolving Consumer

Expectations for Technology Support:

a survey of 3,886 technology

consumers in 21 countries. 2011 by

Accenture.

4

Elke den Ouden, 2006 Thesis at the

Technical University of Eindhoven

(Netherlands).

5

Tim Hebert, 2005: A Product

Returns Odyssey, Consumer

Electronics Association Study, 2005.

19

Copyright

2011 Accenture

All rights reserved.

Accenture, its logo, and

High Performance Delivered

are trademarks of Accenture.

About Accenture

Accenture is a global management

consulting, technology services

and outsourcing company, with

more than 223,000 people serving

clients in more than 120 countries.

Combining unparalleled experience,

comprehensive capabilities across all

industries and business functions,

and extensive research on the worlds

most successful companies, Accenture

collaborates with clients to help

them become high-performance

businesses and governments. The

company generated net revenues

of US$21.6 billion for the fiscal

year ended Aug. 31, 2010. Its home

page is www.accenture.com.

11-1592_LL / 11-3653

You might also like

- Arudha PDFDocument17 pagesArudha PDFRakesh Singh100% (1)

- Marketing MetricesDocument9 pagesMarketing Metricesshaik subhaniNo ratings yet

- Customer Realtonship Management by DR Meeta NiahlaniDocument262 pagesCustomer Realtonship Management by DR Meeta Niahlanidr meetaNo ratings yet

- Marketing DefinitionsDocument18 pagesMarketing DefinitionsPramod Surya MakkenaNo ratings yet

- Nurturing-The Secret To Doubling Your Sales Conversion Rate: Helping Prospects Get Ready To BuyDocument7 pagesNurturing-The Secret To Doubling Your Sales Conversion Rate: Helping Prospects Get Ready To BuyMariano MilesNo ratings yet

- The Three D's of Costumer ExperienceDocument7 pagesThe Three D's of Costumer ExperienceJose Fernando Torres MesaNo ratings yet

- Customer ExperienceDocument18 pagesCustomer ExperienceIdayuNo ratings yet

- The Role of Artificial Intelligence in Shaping The Customer ExperienceDocument5 pagesThe Role of Artificial Intelligence in Shaping The Customer ExperienceAvik ModakNo ratings yet

- BAIN REPORT Evolving The Customer Experience in Banking PDFDocument46 pagesBAIN REPORT Evolving The Customer Experience in Banking PDFSakshi BhallaNo ratings yet

- Aashto M288-17 Product Selection GuideDocument1 pageAashto M288-17 Product Selection GuideDem DemNo ratings yet

- Strategy & Leadership: Emerald Article: Customer Experience Places: The New Offering FrontierDocument9 pagesStrategy & Leadership: Emerald Article: Customer Experience Places: The New Offering FrontierjohiiiNo ratings yet

- Artificial Intelligence EditedDocument13 pagesArtificial Intelligence EditedAjay kumarNo ratings yet

- The Importance of Customer Experience in Call CentersDocument2 pagesThe Importance of Customer Experience in Call Centersepik contactNo ratings yet

- Lecture 6 - Of&CS (Meeting Customers' Real Needs)Document28 pagesLecture 6 - Of&CS (Meeting Customers' Real Needs)Amjad AliNo ratings yet

- Positioning: by Jerry W. ThomasDocument3 pagesPositioning: by Jerry W. ThomasAkshay RaturiNo ratings yet

- Internet of Things A Survey On Enabling PDFDocument30 pagesInternet of Things A Survey On Enabling PDFKarim HashemNo ratings yet

- Internet of Things Is A Revolutionary ApproachDocument21 pagesInternet of Things Is A Revolutionary ApproachBety OvaldoNo ratings yet

- Customer MetricsDocument6 pagesCustomer MetricsswatisumankmtNo ratings yet

- Grow Revenue by Unlocking Enterprise-Wide Customer CentricityDocument14 pagesGrow Revenue by Unlocking Enterprise-Wide Customer CentricityInsight Viet NamNo ratings yet

- D14 Customer Experience FINAL As of 07.07.14Document7 pagesD14 Customer Experience FINAL As of 07.07.14chamila2345No ratings yet

- The Definition of Customer Experience ManagementDocument4 pagesThe Definition of Customer Experience ManagementGene Nix100% (1)

- A Customer Relationship Management Model To Integrate Customer Relationship Experience Quadrant and CRX Life Cycle Arpita MehtaDocument34 pagesA Customer Relationship Management Model To Integrate Customer Relationship Experience Quadrant and CRX Life Cycle Arpita MehtaAnonymous EnIdJONo ratings yet

- Grewal, Understanding Retail Experiences and Customer Journey Management, 2020Document6 pagesGrewal, Understanding Retail Experiences and Customer Journey Management, 2020Marcelo Alves Dos Santos JuniorNo ratings yet

- 11-Rubber & PlasticsDocument48 pages11-Rubber & PlasticsJack NgNo ratings yet

- Customer Experience Management The Value of Moments of Truth Part 1 of 2Document18 pagesCustomer Experience Management The Value of Moments of Truth Part 1 of 2pammytejwani50% (2)

- Need To Use Fog Computing With IoTDocument6 pagesNeed To Use Fog Computing With IoTFiromsa Osman BuniseNo ratings yet

- 4 Brands Making Customer Loyalty Programs Work - Customer Engagement, Brand Strategy, Customer Loyalty Programs - CFO WorldDocument4 pages4 Brands Making Customer Loyalty Programs Work - Customer Engagement, Brand Strategy, Customer Loyalty Programs - CFO Worldsubashreeskm2836No ratings yet

- 5 Best Practices For Creating Unbelievable Customer Experiences 675Document13 pages5 Best Practices For Creating Unbelievable Customer Experiences 675Caron DhojuNo ratings yet

- Customer Experience 2014 Ebook by BrandloveDocument36 pagesCustomer Experience 2014 Ebook by BrandloveGavin SkullNo ratings yet

- Marketing ManagementDocument9 pagesMarketing ManagementJayant MendevellNo ratings yet

- BIZ104 - Nguyen - Q - Customer Experience ReflectionDocument10 pagesBIZ104 - Nguyen - Q - Customer Experience ReflectionQuang NguyễnNo ratings yet

- The Impact of The Chief Customer OfficerDocument5 pagesThe Impact of The Chief Customer OfficerThe Chief Customer Officer CouncilNo ratings yet

- Customer ExpirienceDocument28 pagesCustomer ExpirienceYARON11No ratings yet

- Customer Experience and Commitment in Retailing Does CustomerDocument9 pagesCustomer Experience and Commitment in Retailing Does Customerle mrNo ratings yet

- Customer Strategy ManagerDocument11 pagesCustomer Strategy ManagermatshonaNo ratings yet

- .Internet of Things-IOT Definition, Characteristics, Architecture, Enabling Technologies, Application & Future ChallengesDocument10 pages.Internet of Things-IOT Definition, Characteristics, Architecture, Enabling Technologies, Application & Future ChallengesBobby Chin SinghNo ratings yet

- A Study of Consumer Experience in Central MallDocument112 pagesA Study of Consumer Experience in Central MallNekta PinchaNo ratings yet

- Accenture Techombank CRMDocument2 pagesAccenture Techombank CRMkrovidiprasannaNo ratings yet

- Creating Compelling ExperiencesDocument2 pagesCreating Compelling ExperiencesHOyedeme KollinsNo ratings yet

- Customer Experience StrategyDocument13 pagesCustomer Experience StrategyFun Toosh345No ratings yet

- Accenture Global Megatrends Shaping Service SuccessDocument16 pagesAccenture Global Megatrends Shaping Service SuccessAtul SasaneNo ratings yet

- APPLE's Approach To Target Customers: 1. Consider The Necessity of Running AdsDocument3 pagesAPPLE's Approach To Target Customers: 1. Consider The Necessity of Running AdsDiệu Anh ChiinsNo ratings yet

- Customer Experience Management: 5 Competencies For CX SuccessDocument38 pagesCustomer Experience Management: 5 Competencies For CX SuccessAnonymous VPuGwuNo ratings yet

- Managing The Customer ExperienceDocument4 pagesManaging The Customer Experiencedadazzler82No ratings yet

- Resource Leasing Cloud Computing Model: A Win-Win Strategy For Resource Owners and Cloud Service ProvidersDocument5 pagesResource Leasing Cloud Computing Model: A Win-Win Strategy For Resource Owners and Cloud Service ProvidersJournal of ComputingNo ratings yet

- Salesforce - Mind The Customer Experience GapDocument1 pageSalesforce - Mind The Customer Experience GapBayCreativeNo ratings yet

- To Prepare For in 2019: Five Customer Experience TrendsDocument1 pageTo Prepare For in 2019: Five Customer Experience TrendstamiNo ratings yet

- Challenges Facing BrandDocument11 pagesChallenges Facing Brandrizwanashaik100% (1)

- Customer Experience Management in Retailing Understanding The Buying ProcessDocument16 pagesCustomer Experience Management in Retailing Understanding The Buying ProcessAlice Uchoa100% (9)

- Trends 2022: 7 Customer Experience Trends To Expect in 2022Document13 pagesTrends 2022: 7 Customer Experience Trends To Expect in 2022Jurn GlazenburgNo ratings yet

- KPMG 2020 Customer Experience Survey Ghana Retail Banking InsightsDocument26 pagesKPMG 2020 Customer Experience Survey Ghana Retail Banking InsightsFuaad DodooNo ratings yet

- Deck Ensuring Customer Experience CareDocument45 pagesDeck Ensuring Customer Experience Carereynald 91No ratings yet

- Watermark Customer Experience ROI StudyDocument7 pagesWatermark Customer Experience ROI StudyJuliana AssunçãoNo ratings yet

- Accenture Customer 2020 Future Ready Reliving PastDocument8 pagesAccenture Customer 2020 Future Ready Reliving Pastishaan90No ratings yet

- Customer Journey Framework: Adam Wills - GSMA, Mobile For Development Impact September 2015Document27 pagesCustomer Journey Framework: Adam Wills - GSMA, Mobile For Development Impact September 2015NeilFaverNo ratings yet

- A Framework For Successful CRM Implementation: Mohammad AlmotairiDocument14 pagesA Framework For Successful CRM Implementation: Mohammad AlmotairiMarina MatijaševićNo ratings yet

- Customer Relationship Management Course Outline Semester II 20092010Document6 pagesCustomer Relationship Management Course Outline Semester II 20092010Sohan SharmaNo ratings yet

- Share of Wallet in Retailing The Effects of Customer SatisfactionDocument10 pagesShare of Wallet in Retailing The Effects of Customer SatisfactionFrank XieNo ratings yet

- Customer Relationship ManagementDocument5 pagesCustomer Relationship Managementbharathshire701No ratings yet

- Machine Learning For Revenue Management A Complete Guide - 2020 EditionFrom EverandMachine Learning For Revenue Management A Complete Guide - 2020 EditionNo ratings yet

- 2.a.1.f v2 Active Matrix (AM) DTMC (Display Technology Milestone Chart)Document1 page2.a.1.f v2 Active Matrix (AM) DTMC (Display Technology Milestone Chart)matwan29No ratings yet

- Point and Figure ChartsDocument5 pagesPoint and Figure ChartsShakti ShivaNo ratings yet

- Philo Q2 Lesson 5Document4 pagesPhilo Q2 Lesson 5Julliana Patrice Angeles STEM 11 RUBYNo ratings yet

- Importance of Porosity - Permeability Relationship in Sandstone Petrophysical PropertiesDocument61 pagesImportance of Porosity - Permeability Relationship in Sandstone Petrophysical PropertiesjrtnNo ratings yet

- FIR FliterDocument10 pagesFIR FliterasfsfsafsafasNo ratings yet

- Cap1 - Engineering in TimeDocument12 pagesCap1 - Engineering in TimeHair Lopez100% (1)

- CM2192 - High Performance Liquid Chromatography For Rapid Separation and Analysis of A Vitamin C TabletDocument2 pagesCM2192 - High Performance Liquid Chromatography For Rapid Separation and Analysis of A Vitamin C TabletJames HookNo ratings yet

- A Short Survey On Memory Based RLDocument18 pagesA Short Survey On Memory Based RLcnt dvsNo ratings yet

- Poster-Shading PaperDocument1 pagePoster-Shading PaperOsama AljenabiNo ratings yet

- How Transformers WorkDocument15 pagesHow Transformers Worktim schroderNo ratings yet

- Documentation Report On School's Direction SettingDocument24 pagesDocumentation Report On School's Direction SettingSheila May FielNo ratings yet

- 123Document3 pages123Phoebe AradoNo ratings yet

- Rankine-Froude Model: Blade Element Momentum Theory Is A Theory That Combines BothDocument111 pagesRankine-Froude Model: Blade Element Momentum Theory Is A Theory That Combines BothphysicsNo ratings yet

- Daftar ObatDocument18 pagesDaftar Obatyuyun hanakoNo ratings yet

- TTDM - JithinDocument24 pagesTTDM - JithinAditya jainNo ratings yet

- Amity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorDocument23 pagesAmity School of Business:, Semester IV Research Methodology and Report Preparation Dr. Deepa KapoorMayank TayalNo ratings yet

- Bridge Over BrahmaputraDocument38 pagesBridge Over BrahmaputraRahul DevNo ratings yet

- Transfert de Chaleur AngDocument10 pagesTransfert de Chaleur Angsouhir gritliNo ratings yet

- Ultra Electronics Gunfire LocatorDocument10 pagesUltra Electronics Gunfire LocatorPredatorBDU.comNo ratings yet

- CHAPTER 2 Part2 csc159Document26 pagesCHAPTER 2 Part2 csc159Wan Syazwan ImanNo ratings yet

- CPD - SampleDocument3 pagesCPD - SampleLe Anh DungNo ratings yet

- DTR Testastretta Valve Adjustment ProcedureDocument10 pagesDTR Testastretta Valve Adjustment ProcedureTony LamprechtNo ratings yet

- MATM1534 Main Exam 2022 PDFDocument7 pagesMATM1534 Main Exam 2022 PDFGiftNo ratings yet

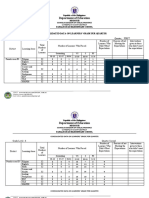

- Department of Education: Consolidated Data On Learners' Grade Per QuarterDocument4 pagesDepartment of Education: Consolidated Data On Learners' Grade Per QuarterUsagi HamadaNo ratings yet

- Chapter 01 What Is Statistics?Document18 pagesChapter 01 What Is Statistics?windyuriNo ratings yet

- G.Devendiran: Career ObjectiveDocument2 pagesG.Devendiran: Career ObjectiveSadha SivamNo ratings yet