Professional Documents

Culture Documents

Investor's Perception Towards Stock Market

Uploaded by

Radha GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Investor's Perception Towards Stock Market

Uploaded by

Radha GuptaCopyright:

Available Formats

Introduction

Stock exchange:

The stock exchange is the important segment of its capital market. If the stock exchange

is well-regulated function smoothly, then it is an indicator of healthy capital market. If the state

of the stock exchange is good, the overall capital market will grow and otherwise it can suffer a

great set back which is not good for the country. The government at various stages controls the

stock market and the capitals market.

A capital market deals in financial assets, excluding coin and currency. Banking accounts

compromises the maority of financial assets. !ension and provident funds insurance policies

shares and securities.

"inancial assets are claim of holders over issuer #business firms and governments$. They

enter low different segment of financial market.

Those having short maturities that are non transferable like bank savings and current

accounts set the identification of the monetary financial assets. This market is known as money

market, %&uity, !referential shares and bonds and debentures issued by companies and securities

issued by the government constitute the financial assets, which are traded in the capital market.

Project Report on Money Market and Capital Market

Both money market and capital market constitute the financial market. 'apital market

generally known as stock exchange. This is a institution around which every activity of national

capital market revolves. Through the medium stock exchange the investor gets on impetus and

motivations to invest in securities without which they would not be able to li&uidate the

securities. If there would have been no stock exchange many of the savers would have hold their

saving either in cash i.e. idle or in bank with low interest rate or low returns. the stock exchange

provides the opportunity to investors for the continuous trading in securities. It is continuously

engaged in the capital mobili(ation process.

Another co)*%&uence of non-existence of stock exchange would have been low saving of the

community, which means low investment and lower development of the country.

* - *ecurities provide for investor.

+

T - Tax Benefits planning and exemption.

, - ,ptimum return on investment.

' - 'autious Approach.

- - -nowledge of .arket.

%x - %xchange of *ecurities Transacted.

' - 'yclopedia of /isted 'ompanies.

0 - 0igh 1ield.

A - Authentic Information

) - )ew %ntrepreneur encouraged.

2 - 2uidance of Investor 3 'ompany.

% - %&uity

History of stock exchange

The first stock exchange was established in /ondon in the year +445. 6ust after establishment

of /ondon stock exchange various countries like "rance, 2ermany and 7*A also established

their own stock exchange markets. In India, the first exchange established in Bombay in the year

+849. /ater, in year +:;8, 'alcutta stock exchange was established which was recogni(ed in the

company in +:<5. .ean which in +:<; the madras stock exchange limited in +:45. *o far the

government of India has recogni(ed << stock exchanges, which was located at maor business

centers in different parts of country.

Till the mid fifties the stock exchange was governed by their own bye laws and

regulations with very little interface by the government. In the year +:<9, the government of

Bombay promulgated an act =securities contracts and control act, +><9 for regulation and the

stock exchange. ?uring the world was second trading outside the stock exchange flourished with

adverse effect on investor@s confidence due to base A less issues and higher rate of li&uidation of

companies. In +:9>, the center government passed contracts #regulation$ act +:9>, which came

into force through out the country on <;

th

"eb. +:94.

A stock market is a market in which stocks are bought and sold. It is also called industrial

securities market, because it is the market for the trading of company stocks i.e. corporate

securitiesB both those securities listed on stock exchange as well as those only traded privately.

<

The term C*tock .arket@ is often used as synonymous to C*tock %xchange@. But there is a

difference in the two terms. *tock exchange is a corporation in the business of bringing buyers

and sellers of stocks together. It is a maor part of stock market, but not whole of it. Because a

stock market besides stock exchanges also includes the market for new issue of securities.

In financial markets, stock is the capital raised by a corporation through the issuance and

distribution of shares. A person or organisation which holds at least a partial share of stocks is

called a shareholder. The aggregate value of a corporationDs issued shares is its market

capitali(ation. In the 7nited -ingdom, *outh Africa and Australia, the term share is used the

same way, but stocks there refer to either a completely different financial instrument, the bond,

or more widely to all kinds of marketable securities.

Functions of the stock market

+. The stock market is structured to provide li&uidity and marketability to the securities

industry. It is a place where stock certificates can be turned into cash at the prevailing

price. This kind of li&uidity makes investing in stock attractive.

<. It provides linkage between the savings of household sector and investment in the

corporate sectorEeconomy.

5. It provides the market &uotation of shares. ?ebentures and bonds which is a sort of

buyers and selling in the market.

F. To ensure that the investors reap full benefit

9. To ensure recogni(ed code of conduct.

>. *tock exchange ensures fail pieces and free market

4. To provide update rates for actual and potential investors.

8. *tock exchange indirectly helps in providing employment to million of people.

5

History of stock exchanges in India

In India only registered stock exchanges can operate the stock market activities and the

recognition is governed under the provision of securities and contract #regulation$ act, +:9>.

There are <F regional stock exchanges in India. Bombay stock exchange #B*%$ and

national stock exchange #)*%$ daily turnover of all the stock exchanges is about 5;,;;; crore

daily. B*% is +<: years old, which was established in the year +849 where )*% is ust ++ year

old and was established in +::5. )*% has brought screen based trading system in India.

History of Indian capital market at a glance:

!

th

century

+8;;- Trading of shares of east India 'ompany in -olkata and .umbai

+89; A 6oint stock companies came into existence

+8>;- *peculation and feverish dealing in securities

+849- "ormation of stock exchange of .umbai

+8:F A "ormation of Ahmadabad stock exchange

"

th

century

+:;8 A "ormation of 'alcutta stock exchange

+:5: A "ormation of /ahore and madras stock exchange

+:F; - "ormation of 7.!. and ?elhi stock exchange

+:9>- *ecurities contract regulation act enacted

+:94 A *cam of 0aridas .undhra

+:88 A *ecurities and exchange board of India set up

+::+ A *cam of ms shoes

+::< A *%BI given power under *%BI act, +::<

+::5- "ormation of national stock exchange #)*%$

+::9 A 0arshad .ehta scam

+::9 A*%*A 2oa scam

+::4 A 'GB scam

+::8- B!/ and Hideocon scam

F

#$

th

century

<;;; A ?epositories came into existence #electronic form, of shares$

<;;+ A -etan !arekh scam

<;;< A *tart of rolling settlement and banning of badla trading

<;;< A Introduction t I 5 settlement in April.

<;;5- Introduction of tI< settlements in April

<;;9 A B*% sensex touches all time high of >:9F in 6anuary <;;9

9

Features or characteristics

*tock exchanges has been an association of individual members called member broker

*tock exchanges are formed for the express purpose of regulating and facilitating the

buying and selling of securities by and institution at large.

*tock exchange operate with due recognition from the govt. 7nder securities and contract

regulation act +:9>.

The member brokers are middlemen who transact on behalf of public for commission.

Board of directors@ limit given by *%BI

*%BI has been set to oversee the orderly development of stock exchange.

*tock exchange lists the companies who wish to raise the funds of capital from public.

*tock exchange facilitates trading in securities of the public sector companies as well as

govt. *ecurities.

The recognition accorded to a stock exchange is valid for period of five years subect to

satisfactory performance of stock exchange during this period.

The stock market can be divided into two constituents as followsJ -

+. !rimary .arket or )ew Issue .arket

<. *econdary .arket or *tock %xchange

>

Primary market

!rimary stock markets are also called new issue markets. A primary market is the market in

which assets are sold for the first time. In other words, it is that market in which new shares,

debentures etc are bought and sold. The essential function of the primary market is to arrange for

the raising of new capital by corporate enterprises, whether new or old. The firms raising funds

may be new companies or old companies, planning expansion. The issues of the new firms are

called =initial issuesK and those of old firms already existing are called =further issuesK. Initial

capital is raised by issuing ordinary and preference shares only, whereas further capital can be

raised by selling all three types of industrial securities. The new companies need not always be

entirely new enterprises. They may be private firms already in business, but going public to

explain their capital base.

The volume of initial issues has mostly been smaller than that of further issuesB it has mostly

accounted for 5; to F; percent of the total issues till +:88-8:, +; to <8 percent during +::;-:4,

and one percent to F8 percent after +::8. Thus, the rang of fluctuations in the share of initial

#and, there of further$ issues in total issues has been, as in cases of other aspects of stock market

activity, very wide indeedB this share has varied between +; to >5 percent during +:94-:4. There

has been an inverse relationship between the volume of initial and further issues in most of the

years.

4

Financial Instruments in %e& Issue: ' A number of securities are issued by companies

in the new issue markets. They includeJ

()uity shares J A %&uity shares represent the ownership position in the company. The

holders of the e&uity shares are the owners of the company, and they provide permanent

capital. They have voting rights and receive dividends at discretion of the Board of

?irectors.

Preference Shares J A the holders of the preference shares have a preference over the

e&uity in the event of the li&uidation of the company. The preference dividend rate is

fixed and known. A 'ompany may issue preference with a maturity period #called

redeemable preference shares$. A preference share may also provide for the

accumulation of dividend. It is called cumulative preference share.

*e+entures J A ?ebentures represent long-term loan given by the holders of debentures to

the company. The rate of interest is specified and interest charges are treated deductible

expe)*%s in the hands of the company. ?ebentures may be issued without an interest

rate. They are called (ero-interest debentures. *uch debentures are issued at a price much

lower than their face value. Therefore, they are also called deep-discount

debenturesEbonds.

Con,erti+le Securities J A A debenture or a preference share may be issued with the

feature o of being convertible into e&uity shares after a specified period of time at a given

price.Thus a convertible debenture will have features of debenture as well as e&uity.

-arrants J A A company may issue e&uity shares or debentures attached with warrants.

Larrants entitle an investor to buy e&uity shares after a specified period at a given price.

Cumulati,e Con,erti+le Preference Shares .CCPS $J A ''!* is an instrument giving

regular returns at +;M during the gestation period from three years to five years and

e&uity benefit thereafter introduced by the 2overnment in +:8F ''!* has, however,

8

failed to catch the investor@s interest mainly because the rate of return was considered to

be too low in the initial years and the provision for conversion into e&uity was also

unattractive if the company failed to perform well.

/ero Coupon 0onds and Con,erti+le -arrants J A These are two new instruments that

have been floated by certain companies. Their overall impact and popularity will be

known only in the years ahead.

:

I1P1213s .Initial Pu+lic 2ffer4

A 'ompany proposing to raise resources by a public issue should first select the type of

securities i.e. *hare and Eor debentures to be issued by it. The decision regarding the issue of

shares to be made at par or premium should be decided keeping in view the *%BI guidelines.

The whole process of issue of shares can be divided into two partsJ

5 Pre issue acti,ities

5 Post issue acti,ities

All activities beginning with the planning of capital issues, till the opening of the subscription list

are pre issue activities, while all activities subse&uent to the opening of the subscription list may

be called post issue activities.

+;

Secondary stock markets .stock exchanges4

A stock exchange is an organi(ed market for sale and purchase of listed existing shares and other

corporate securities. It is a platform for bringing together the buyers and sellers of securities. The

securities which may be bought and sold in stock exchange generally includes shares and

debentures of public companies. These may include 2overnment securities and bonds issued by

municipalities, public corporations, utility undertakings etc. *ecurities held by the investors are

also traded on the stock exchange. ,nly listed securities are dealt in stock exchanges. The listed

securities are those securities that appear on the approved list of stock exchange.

The association or body of individuals generally organi(es it. 0ence it is defined as an

association or body of individuals established for the purpose of assisting and controlling

business buying, selling and dealing in securities.

The stock markets play an important role in the mobili(ation of financial resources for the

corporate sector. They provide an organi(ed market for transactions in shares and other

securities.

++

Products a,aila+le in the Secondary and Primary Market

%e& issue market instruments

The term initial public offering #I!,$ slipped into everyday speech during the tech bull market

of the late +::;s. Back then, it seemed you couldnDt go a day without hearing about a do(en new

dotcom millionaires in *ilicon Halley who were cashing in on their latest I!,. The phenomenon

spawned the term silicon ire, which described the dotcom entrepreneurs in their early <;s and5;s

who suddenly found themselves living large on the proceeds from their internet companiesD I!,s.

Selling Stock

An initial public offering, or I!,, is the first sale of stock by a company to the public. A

company can raise money by issuing either debtor e&uity. If the company has never issued e&uity

to the public, itDs known as an I!,. 'ompanies fall into two broad categoriesJ private and public.

A privately held company has fewer shareholders and its owners donDt have to disclose much

information about the company. Anybody can go out and incorporate a companyJ ust put in

some money, file the right legal documents and follow the reporting rules of your urisdiction.

.ost small businesses are privately held. But large companies can be private too. ?id you know

that I-%A, ?ominoDs !i((a and 0allmark 'ards are all privately heldN It usually isnDt possible to

buy shares in a private company. 1ou can approach the owners about investing, but theyDre not

obligated to sell you anything. !ublic companies, on the other hand, have sold at least a portion

of themselves to the public and trade on a stock exchange. This is why doing an I!, is also

referred to as Ogoing public.O !ublic companies have thousands of shareholders and are subect to

strict rules and regulations. They must have a board of directors and they must report financial

information every &uarter. In the 7nited *tates, public companies report to the *ecurities and

%xchange 'ommission #*%'$. In other countries, public companies are overseen by governing

bodies similar to the *%'. "rom an investorDs standpoint, the most exciting thing about a public

company is that the stock is traded in the open market, like any other commodity. If you have the

cash, you can invest. The '%, could hate your guts, but thereDs nothing he or she could do to

stop you from buying stock. 2oing public raises cash, and usually a lot of it. Being publicly

traded also opens many financial doorsJ

+<

PBecause of the increased scrutiny, public companies can usually get better rates when they issue

debt.

PAs long as there is market demand, a public company can always issue more stock. Thus,

mergers and ac&uisitions are easier to do because stock can be issued as part of the deal.

PTrading in the open markets means li&uidity. This makes it possible to implement things like

employee stock ownership plans, which help to attract top talent. Being on a maor stock

exchange carries a considerable amount of prestige. In the past, only private companies with

strong fundamentals could &ualify for an I!, and it wasnDt easy to get listed. The internet boom

changed all this. "irms no longer needed strong financials and a solid history to go public.

Instead, I!,s were done by smaller startups seeking to expand their businesses. ThereDs nothing

wrong with wanting to expand, but most of these firms had never made a profit and didnDt plan

on being profitable any time soon. "ounded on venture capital funding, they spent like Texans

trying to generate enough excitement to make it to the market before burning through all their

cash. In cases like this, companies might be suspected of doing an I!, ust to make the founders

rich. This is known as an exit strategy, implying that thereDs no desire to stick around and create

value for shareholders. The I!, then becomes the end of the road rather than the beginning.

6he 7nder&riting Process

2etting a piece of a hot I!, is very difficult, if not impossible. To understand why, we need to

know how an I!, is done, a process known as underwriting.

Lhen a company wants to go public, the first thing it does is hire an investment bank. A

company could theoretically sell its shares on its own, but realistically, an investment bank is

re&uired - itDs ust the way *treet works. 7nderwriting is the process of raising money by either

debt or e&uity #in this case we are referring to e&uity$. 1ou can think of under writers@ as

middlemen between companies and the investing public. The biggest underwriters are 2oldman

*achs, .errill /ynch, 'redit *uisse "irst Boston, /ehman Brothers and .organ *tanley. The

company and the investment bank will first meet to negotiate the deal. Items usually discussed

include the amount of money a company will raise, the type of securities to be issued and all the

details in the underwriting agreement. The deal can be structured in a variety of ways. "or

+5

example, in a firm commitment, the underwriter guarantees that a certain amount will be raised

by buying the entire offer and then reselling to the public. In a best efforts agreement, however,

the underwriter sells securities for the company but doesnDt guarantee the amount rose. Also,

investment banks are hesitant to shoulder all the risk of an offering. Instead, they form a

syndicate of underwriters. ,ne underwriter leads the syndicate and the others sell a part of the

issue. ,nce all sides agree to a deal, the investment bank puts together a registration statement to

be filed with the *%'. This document contains information about the offering as well

as company

info such as financial statements, management background, any legal problems, where the

money is to be used and insider holdings. The *%' then re&uires a cooling off period, in which

they investigate and make sure all material information has been disclosed. ,nce the *%'

approves the offering, a date #the effective date$ is set when the stock will be offered to

the public. ?uring the cooling off period the underwriter puts together what is known as the red

herring. This is an initial prospectus containing all the information about the company except for

the offer price and the effective date, which arenDt known at that time. Lith the red herring in

hand, the underwriter and company attempt to hype and build up interest for the issue. They go

on a road show - also known as the Odog and pony showO - where the big institutional investors

are courted. As the effective date approaches, the underwriter and company sit down and decide

on the price. This isnDt an easy decisionJ it depends on the company, the success of the road show

and, most.

+F

2rgani8ation and Structure of Stock (xchanges in India: '

The number of stock exchanges in India has increased from nine in +:4:-8; to <9 till now.

!resently, the stock market in India consists of twenty three regional stock exchanges and two

national exchanges, namely, the %ational Stock (xchange #)*%$ And 2,er the Counter

(xchange of India #,T'$

The 0om+ay Stock (xchange #B*%$ is the largest *tock %xchange, in the country, where

maximum transactions, in terms of money and shares take place. The other maor stock

exchanges are 'alcutta, .adras and ?elhi *tock %xchanges. India has now the largest number of

organi(ed and recogni(ed stock exchanges in the world. All of them are regulated by *%BI. They

are organi(ed either as voluntary, non-profit making associations #vi(., .umbai, Ahemdabad,

Indore$, or public limited companies #vi(., 'alcutta, ?elhi, Banglore $,or company limited by

guarantee#vi(. 'hennai, 0yderabad$.

9arious stock exchanges in India are as follo&s:5

%ame of Stock (xchange Incorporated 6ype of 2rgani8ation

+. Bombay *tock %xchange +849 Holuntary non profit organi(ation

<. 'alcutta *tock %xchange +:;8 !ublic /td. 'ompany

5. .adras *tock %xchange +:54 'ompany /td. By 2uarantee

F. Ahmedabad *tock %xchange +8:4 Holuntary non profit organi(ation

9. ?elhi *tock %xchange +:F4 !ublic /td. 'ompany

>. 0yderabad *tock %xchange +:F5 'ompany /td. By 2uarantee

4. .adhya !radesh *tock %xchange

#Indore$

+:5; Holuntary non profit organi(ation

8. Bangalore *tock %xchange +:94 !rivate 'onverted into !ublic /td.

'ompany

:. 'ochin *tock %xchange +:48 !ublic /td. 'ompany

+;. 7tter !radesh *tock %xchange

#-anpur$

+:8< !ublic /td. 'ompany

++. /udhiana *tock %xchange +:85 !ublic /td. 'ompany

+<. 2uahati *tock %xchange +:8F !ublic /td. 'ompany

+5. -annar *tock %xchange

#.angalore$

+:89 !ublic /td. 'ompany

+F. !une *tock %xchange +:8< 'ompany /td. By 2uarantee

+9. .agadh *tock %xchange #!atna$ +:8> 'ompany /td. By 2uarantee

+9

+>. Bhubaneshwar *tock %xchange +:8: 'ompany /td. By 2uarantee

+4. *aurashtra *tock %xchange #-utch$ +:8: 'ompany /td. By 2uarantee

+8. 6aipur *tock %xchange +:85 !ublic /td. 'ompany

+:. Hadodra *tock %xchange +::; )?

<;. 'oimbtore *tock %xchange +::> )?

<+. .eerut *tock %xchange +::+ )?

<<.)ational *tock %xchange +::F )?

<5.,ver The 'ounter %xchange +::< )?

Main stock exchanges in India

+>

B*% i.e. B,.BA1 *T,'-

%Q'0A)2%

)*% i.e. )ATI,)A/

*T,'- %Q'0A)2%

Bombay stock exchange:

The stock exchange, .umbai, which was established in +849 as =T0% )ATIH% *0AG% A)?

*T,'-BG,-%G* A**,'IATI,)K #a voluntary non-profit making association$, has

evolved over the year into its present stratus as the premier *tock %xchange in the country.

The sstock exchange .umbai #B*%$ is generally referred to as the 2ateway to capital

market in India.

It is the oldest one in Asia, even than the Tokyo stock exchange, which was established in +848.

It is a voluntary non-profit making Association of !ersons #A,!$ and is currently engaged in the

process of converting itself into demutualised and corporate entity. It has evolved over the years

into its present status as the premier *tock %xchange in the country. It is the first *tock %xchange

in the country to have obtained permanent recognition in +:9> from the 2ovt. ,f India under the

securities contracts #regulation$ act, +:9>.

+4

The exchange, while providing an efficient and transparent market for trading in securities, debt

and derivatives upholds the interest of the investors and ensures redressal of their grievances

whether against the companies or its own member-broker. It also strives to educate and enlighten

the investors by conducting investor educating programmes and making available to them

necessary informative inputs.

A 2overning Board having <; directors is the apex body, which decides the policies and

regulates the affairs of the exchange. The governing board consists of : elected directors, who

are from the broking community #one third of them retire ever year by rotation$, three *%BI

nominees, six public representatives and an %xecutive director as the chief %xecutive officer, one

chief operating officer. The executive director as the chief executive officer is responsible for the

day to day administration of the exchange and he is assisted by the chief operating officer and

other heads of departments.

The objectives of BSE

1. To safegaurd the interest of investing public having dealing on Exchange and the

members

<. To establish and promote honorable and ust practices in securities transactions.

5. To promote, develop and maintain a well- regulated marlket for dealing in securities.

F. To promote industrial developments in the country through efficient resource

mobili(ation by way of investment in corporate securities.

Stock market index

The movements of the prices in a market or section of a market are captured in price indices

called stock market indices, of which there are many, e.g., the *3!, the "T*% and the %uro next

indices. *uch indices are usually market capitali(ation #the total market value of floating capital

of the company$ weighted, with the weights reflecting the contribution of the stock to the index.

The constituents of the index are reviewed fre&uently to includeEexclude stocks in order to reflect

the changing business environment.

+8

A market index helps us evaluate the performance of a given market. "or instance if one wants to

understand how the stock market has performed over last 9,+; or +9 years, one would need to

study the performance of each of the stock listed in the stock market. It would be easier to

construct representative sample that makes it simple to understand and interpret market

performance. *uch a sample is termed as an Index.

Lell- known indices in the Indian e&uity market are the B*% *ensex and *3! ').Q )ifty

which reflect the movement of 5; stocks on the Bombay *tock %xchange and 9; stocks on the

)ational *tock %xchange respectively. The B*% *ensex has grown from a base of +;; in +:4:-

+:8;

0S( sensex

0ackground: "or the premier *tock %xchange that pioneered the stock broking activity in India,

+<8 years of experience seems to be a proud milestone. A lot has changed since +849 when 5+8

persons became members of what today is called OThe *tock %xchange, .umbaiO by paying a

princely amount of Ge+.

*ince then, the countryDs capital markets have passed through both good and bad periods. The

ourney in the <;th century has not been an easy one. Till the decade of eighties, there was no

scale to measure the ups and downs in the Indian stock market. The *tock %xchange, .umbai

#B*%$ in +:8> came out with a stock index that subse&uently became the barometer of the Indian

stock market.

*%)*%Q is not only scientifically designed but also based on globally accepted construction and

review methodology. "irst compiled in +:8>, *%)*%Q is a basket of 5; constituent stocks

representing a sample of large, li&uid and representative companies. The base year of *%)*%Q

is +:48-4: and the base value is +;;. The index is widely reported in both domestic and

international markets through print as well as electronic media.

The Index was initially calculated based on the O"ull .arket 'apitali(ationO methodology but

was shifted to the free-float methodology with effect from *eptember +, <;;5. The O"ree-float

.arket 'apitali(ationO methodology of index construction is regarded as an industry best

+:

practice globally. All maor index providers like .*'I, "T*%, *T,QQ, *3! and ?ow 6ones use

the "ree-float methodology.

?ue to is wide acceptance amongst the Indian investorsB *%)*%Q is regarded to be the pulse of

the Indian stock market. As the oldest index in the country, it provides the time series data over a

fairly long period of time #"rom +:4: onwards$. *mall wonder, the *%)*%Q has over the years

become one of the most prominent brands in the country.

The growth of e&uity markets in India has been phenomenal in the decade gone by. Gight from

early nineties the stock market witnessed heightened activity in terms of various bull and bear

runs. The *%)*%Q captured all these events in the most udicial manner. ,ne can identify the

booms and busts of the Indian stock market through *%)*%Q. The aB*%nce of an index number

of e&uity prices to reflect the trend of the market was felt a long time by the members of

exchange, investors and other market participants. Lith this end in view the stock exchange,

.umbai started compiling and publishing the B*%- *%)*%Q index number of e&uity prices <

nd

6anuary, +:8>.

0ase periodJ the base period of B*% *%)*%Q is +:4:-8;. The base value of B*% *%)*%Q is

+;; points.

Method of compilationJ B*% *%)*%Q is a market capitali(ation- weighted index of 5; stocks

presenting a sample of large, well established and financially sound companies. B*% *%)*%Q is

calculated using a market capitali(ation A weighted methodology. As per this methodology, the

level of index at any point of time fleet the total market capitali(ation of a company is

determined by multiplying the price of stock by the number of shares issued by the company.

*tatistician call an index of a set of combined variable # such as price and number of shares $ a

composite index.

<;

%ational stock exchange:

6he organi8ation

The national stock exchange of Indial limited has genesis the report of high powered study group

on the establishment of the new stock exchanges, which recommended promotion of a national

stock exchange by financial institutions #"is$ to provide access to investors from all across the

country on an e&ual footing. Based on the rcommendatios, )*% was promoted by leading

"inancial Institutions at the behes tof the government of India and was incorporated in november

+::< as a tax Apaying company unlike others stock exchange in the country .

,n its recognisation as a stock exchange inder the securities contracts regulation act, +:9> in

april +::5, )*% commenced operations in the wholesales debt market #L?.$

<+

*egment in une +::F the capital market #e&uities$ segment commenced operations in november

+::F and operations in derivatives segments commenced in 6une <;;;.

Features:

The national stock exchange #)*%$ is India@s leading stock exchange covering 59; cities and

towns across the country. )*% was set up by leading institutions to provide a modern, fully

automated screen based trading system with national reach. The exchange has brought about

unparalled transparency, speed and efficiency, safety and market integrity. It has set up facilities

that serve as a model for the securities industry in terms of system practices and procedures. )*%

has played a catalytic role in reforming the Indian securities market in terms of microstructure

market practices and trading volumes. The market today uses state- of art information technology

to provide an efficient and transparent trading , clearing and stRettlement mechanism and has

witnessed several innovations in products and services vi(. ?emutuali(ation and electronic

transfer of securities , securities lending and rowing , professionalisation of trading members,

fine Atuned risk manageRment systems, emergence of clearing corporations to assume counter

party risks, market of debt and derivative instruments and intensive use of information

technology.

%S( mission

)*%@s mission is setting the agenda for change in the securities market in India. The )*% was

set up with the main obectives ofJ

+. %stablishing a nation- wide trading facility for e&uities, debt instruments and hybrids

<. %nsuring e&ual access to investors all over the country through an appropriate

communication network

5. !roviding a fair , efficient and transparent securities market to investors using electronic

trading systems.

F. %nabling shorter settlement cycles and book entry settlements systems

9. .eeting the current international standards of securities markets.

<<

The standards set by )*% in terms of the market practices and technologies have

become industry benchmarks and are being emulated by other market participants. )*%@s is

more than a mere market facilitator. It@s that force which is guiding the industry towards new

hori(ons and greater opportunities.

%S(3s markets:

)*% provides a fully automated screen-based trading system with national reach in the following

maor market segmentsJ-

%&uity or capital markets S)*%Ds market share is over >9MT

"utures 3 options or derivatives market S)*%Ds market share over ::.9MT

Lholesale debt market #wdm$

.utual funds #mf$

Initial public offers

%S( group:

%SCC:

iisl

%S(1it

<5

nsdl

dotex intl1 :td1

%SCC:

6he national securities clearing corporation ltd1 .)*''/$, a wholly owned subsidiary of

)*%, was incorporated in august +::9. It was set up to bring and sustain confidence in clearing

and settlement of securitiesB to promote and maintain, short and consistent settlement cyclesB to

provide counter-party risk guarantee, and to operate a tight risk containment system. )*''/

commenced clearing operations in April +::>.

)*''/ carries out the clearing and settlement of the trades executed in the e&uities and

derivatives segments and operates subsidiary general ledger #*2/$ for settlement of trades in

government securities. It assumes the counter-party risk of each member and guarantees

financial settlement. It also undertakes settlement of transactions on other stock exchanges like,

the over the counter exchange of India.

)*''/ has successfully brought about an up-gradation of the clearing and settlement

procedures and has brought Indian financial markets in line with international markets.

It was set up with the following obectivesJ

To bring and sustain confidence in clearing and settlement of securitiesB

To promote and maintain, short and consistent settlement cyclesB

To provide counter-party risk guarantee, and

To operate a tight risk containment system.

)*''/ commenced clearing operations in April +::>. It has since completed more than +8;;

settlements #e&uities segment$ without delays or disruptions.

Clearing

'learing is the process of determination of obligations, after which the obligations are discharged

by settlement.

<F

)*''/ has two categories of clearing membersJ trading members and custodian. The trading

members can pass on its obligation to the custodians if the custodian confirms the same to

)*''/. All the trades whose obligation the trading member proposes to pass on to the custodian

are forwarded to the custodian by )*''/ for their confirmation. The custodian is re&uired to

confirm the trade on t I + days basis.

,nce, the above activities are completed, )*''/ starts its function of clearing. It uses the

concept of multi-lateral netting for determining the obligations of counter parties. Accordingly, a

clearing member would have either pay-in or pay-out obligations for funds and securities

separately. Thus, members pay-in and pay-out obligations for funds and securities are

determined latest by t I + day and are forwarded to them so that they can settle their obligations

on the settlement day #tI<$.

IIS:

India index ser,ices ; products ltd1 #II*/$ is a oint venture between the national stock

exchange of India ltd. #)*%$ and 'GI*I/ ltd. #formerly the credit rating information services of

India limited$. Iisl has been formed with the obective of providing a variety of indices and index

related services and products for the capital markets.

II*/ has a consulting and licensing agreement with standard and poorDs #s3p$, the worldDs

leading provider of investible e&uity indices, for co-branding II*/Ds e&uity indices.

IIS: 5 products ; ser,ices

II*/ offers a wide range of products and services which are key support tools for the e&uity

markets. Le provide reliable, accurate and valuable data on indices and index related services to

cater to the needs of various segments of users. ,ur specialty is indices based on Indian e&uity

markets, which may be used for benchmarking, trading or research. 7se of II*/ data or name or

indices re&uires a lice )*% or subscription.

%S*:

In order to solve the myriad problems associated with trading in physical securities, )*% oined

hands with the industrial development bank of India #I?BI$ and the unit trust of India #7TI$ to

<9

promote demateriali(ation of securities. Together they set up national securities depository

limited .%S*:4< the first depository in India.

)*?/ commenced operations in november +::> and has since established a national

infrastructure of international standard to handle trading and settlement in dematerialised form

and thus completely eliminated the risks to investors associated with fakeEbadEstolen paper.

*otex international limited

OThe data and info-vending products of the national stock exchange are provided through a

separate company dotex international ltd., a +;;M subsidiary of )*%, which is a professional

set-up dedicated solely for this purpose.O

%S(1it ltd1

)*%.it, a +;;M subsidiary of national stock exchange of India limited #)*%$, is the

information technology arm of the largest stock exchange of the country. A leading edge

technology user, )*% houses state-of-the-art infrastructure and skills. )*%.it possesses the

wealth of expertise ac&uired in the last six years by running the trading and clearing

infrastructure of largest stock exchange of the country. )*%.it is uni&uely positioned to provide

products, services and solutions for the securities industry. There has been a long felt need for

top-of-the-line products, services and solutions in the area of trading, broker front-end and back-

office, clearing and settlement, web-based trading, risk management, treasury management, asset

liability management, banking, insurance etc. )*%.itDs expertise in these areas is the primary

focus. The company also plans to provide consultancy and implementation services in the areas

of data warehousing, business continuity plans, stratus mainframe facility management, site

maintenance and backups, real time market analysis 3 financial news over )*%-net, etc.

)*%.it is an export oriented unit with stp and plans to go global for various it services in due

course. In the near future the company plans to release new products for broker back-office

operations and enhance neatxs E neat ixs to support straight through processing on the net.

Corporate structure

<>

)*% is one of the first de-mutualised stock exchanges in the country, where the ownership and

management of the exchange is completely divorced from the right to trade on it. Though the

impetus for its establishment came from policy makers in the country, it has been set up as a

public limited company, owned by the leading institutional investors in the country. "rom day

one, )*% has adopted the form of a demutaualised exchange A the ownership, management and

trading is in the hands of three different sets of people. )*% is owned by set of leading

institutions, banks, insurance companies and other financial intermediaries and is managed by

professional, who do not directly or indirectly trade on the exchange. The )*% model however,

does not preclude, but in fact accommodates involvement, support and contribution of trading

members in a variety of ways. Its Board comprises of senior executive from promoter

institutions, eminent !rofessionals in the field of laws, economics, accountancy, finance,

taxation, etc, public representatives, nominees of *%BI and one full time executive of the

exchange.

%ifty:

The nifty is relatively a new comer in the Indian market. *3! ')Q nifty is a 9; stock index

accounting for <5 sectors of economy. It is used for purposes such as benchmarking fund

portfoliosB index based derivatives and index funds.

The base period selected for nifty is the close prices on )ovember 5, +::9, which marked the

completion of one-year of operations of )*%@s a capital market segment. The base value of

index was set at +;;;.

*3! ')Q )ifty is owned and managed by India index services and product ltd.#II*/$, which is

a oint venture between )*% and 'GI*I/. II*/ is a speciali(ed company focused upon the index

as a core product. II*/ have a consulting and licensing agreement with *tandard 3 !oor@s

#*3!$, who are world leaders in index services.

=d,antages of %S(

- -ider =ccessi+ility

<4

The )*% ensures wider accessibility through satellite linked trading facility. 'omputer terminals

and links with H*AT help the traders to contact their counterparts in other parts of the country

&uickly. The &uick trading system ensures better pricing.

- Screen 0ased 6rading

,riginally, the basic advantage of )*% is computer based trading. The back office loads have

been reduced as everything is stored in the computer. At present, B*% and many other stock

exchanges have introduced the computer based trading. The ring based trading is vanishing in

the recent days.

- %on5*isclosure of the 6rading Mem+ers Identity

Lhile placing the orders there is no need to disclose the identity of the member on the screen. It

depends upon the wish of the trading member. *o without any fear of influencing the prices, any

member can place large si(e orders.

- 6ransparent 6ransactions

The maor advantage of the )*% trading is the complete transparency. The investor can find out

the rate of the deal, the counterparty and the time of execution of the deal. The en&uiry facilities

offered in the terminals help the investor to find out the price and the depth of the market of the

particular security. The investor can have the high and low &uotations and the last traded price of

the particular security. This information enables him to make a healthy decision regarding his

investment.

- Matching of 2rders

,nce the order has been fed into the computer, the computer searches and finds out the suitable

matching order subect to the conditions placed by the investor or the trader. The conditions are

related to the price, volume and time of the trade. Lhile matching the order, priority is given on

the basis of price and time. If the matching order is found, the deal Is struck, otherwise as per the

instructions the order would be kept pending or cancelled.

- (ffecti,e Settlement of Corporate 0enefit

<8

All monetary benefits lodged, dividend, interest and redemption amount, claims on company

obections, are debitedEcredited directly in the clearing account of the clearing members. This

reduces the problems faced by the members in settlement of corporate benefits.

- 6rading in demateriali8ed Form

According to the *%BI directives, trading in the depository segment is carried out only on the

rolling #T I *$ settlement basis. This rolling settlement basis helps the traders to settle the

accounts &uickly without waiting for a fixed settlement date. The total number of compulsorily

demateriali(ed stock was 5; in 6une +::8. The demateriali(ed trading helps the institutions to

effect the transfer of shares immediately after the payment.

- S>: Facility in the *e+t Market

The *2/ #*ubsidiary 2eneral /edger$ facility provided by the )*% allows the trusts and other

retail constituents to hold and settle their trades through electronic book transfer. This speeds up

the transfer process. *ettlement of trades in 2overnment *ecurities would become paperless,

more prompt and safer. The constituents get their securities registered in their names

immediately after making payments. They would also get the interest on due dates without delay.

Speculation on the stock exchange

*tock exchange transactions are made for the purpose of investment or for the speculation.

Investment transactions are made with the intention of earning a return on the securities by

holding them gain by disposing of the securities at favourable prices.

The nature of the investment transaction and speculative transaction differs. The ionvestment

transactions re&uire the actual delivery of securities on the part of sellers and the payment of

their full price by the buyers. *peculative transactions, on the other hand, do not involve full

<:

payment for and taking delivery of the securities that the speculators have contracted to transfer.

As the speculative transactions do not call for the payment of the full price but can be made by

the deposit of a fractional part of the price , the volume of speculative transactions usually far

exceed that of the investment to ensure sufficient volume and continuity of business in the stock

exchange.

6ypes of speculation: The speculations on a stock exchange may be categorised into the

following three

+. BullJ A bull also, known as tewalla , is a speculator who buys shares in the expectation

of selling it at a higher price later

<. BearJ A bear also known as mundiwalla, who sells securities in the expectation of fall in

their prices in future

5. *tagJ A stag neither buys nor sells but applies for sibscription to the new issue expecting

that he can sell them at a premium.

Shareholder

A shareholder #or stockholder$ is an individual or company #including a corporation$ that

legally owns one or more shares of stock in a oint stock company. 'ompanies listed at the stock

market strive to enhance shareholder value.*hareholders are granted special privileges depending

on the class of stock, including the right to vote #usually one vote per share owned$ on matters

such as elections to the board of directors, the right to share in distributions of the companyDs

income, the right to purchase new shares issued by the company, and the right to a companyDs

assets during a li&uidation of the company. 0owever, shareholderDs rights to a companyDs assets

are subordinate to the rights of the companyDs creditors. This means that shareholders typically

receive nothing if a company is li&uidated after bankruptcy #if the company had had enough to

pay its creditors, it would not have entered bankruptcy$, although a stock may have value after a

bankruptcy if there is the possibility that the debts of the company will be restructured.

*hareholders are considered by some to be a partial suB*%t of stakeholders, which may include

anyone who has a direct or indirect e&uity interest in the business entity or someone with even a

non-pecuniary interest in a non-profit organi(ation. Thus it might be common to call volunteer

5;

contributors to an association stakeholders, even though they are not shareholders.Although

directors and officers of a company are bound by fiduciary duties to act in the best interest of the

shareholders, the shareholders themselves normally do not have such duties towards each other.

Function and purpose

The stock market is one of the most important sources for companies to raise money. This

allows businesses to go public, or raise additional capital for expansion. The li&uidity that an

exchange provides affords investors the ability to &uickly and easily sell securities. This is an

attractive feature of investing in stocks, compared to other less li&uid investments such as real

estate.

0istory has shown that the price of shares and other assets is an important part of the dynamics

of economic activity, and can influence or be an indicator of social mood. Gising share prices,

for instance, tend to be associated with increased business investment and vice versa. *hare

prices also affect the wealth of households and their consumption. Therefore, central banks tend

to keep an eye on the control and behavior of the stock market and, in general, on the smooth

operation of financial system functions. "inancial stability is the raison dDUtre of central banks.

%xchanges also act as the clearinghouse for each transaction, meaning that they collect and

deliver the shares, and guarantee payment to the seller of a security. This eliminates the risk to an

individual buyer or seller that the counterparty could default on the transaction.

The smooth functioning of all these activities facilitates economic growth in that lower costs and

enterprise risks promote the production of goods and services as well as employment. In this way

the financial system contributes to increased prosperity.

*efinition of stockJ A stock #also known as e&uity or a share$ is a portion of the ownership of a

corporation. A share in a corporation gives the owner of the stock a stake in the company and its

profits. If a corporation has issued +;; stocks in total, then each stock represents a +M ownership

in the company.

5+

*tock is ownership of the company, with each share of stock representing a tiny piece of

ownership. The more shares you own, the more of the company you own. The more shares you

own, the more dividends you earn when company makes a profit. In the financial world,

ownership is called e&uity.

There are two primary classes of stock. The one you choose depends on what you want from a

stock. !referred stock typically pays regular dividends and is favored by investors who want

income offer more rights and privileges than preferred stock.

Investors may purchase stock on the primary or secondary market. A company sells its stocks to

the public on the primary market through its initial public offering. Investors may sell their

shares through brokers to other investors on the secondary market. The secondary market can be

structured as a auction market, like the other exchanges, or a dealer market, like the )A*?AV.

*tock prices can be found #&uotes$ in newspapers, on television and the internet.

:e,eraged strategies

*tock that a trader does not actually own may be traded using short sellingB margin buying may

be used to purchase stock with borrowed fundsB or, derivatives may be used to control large

blocks of stocks for a much smaller amount of money than would be re&uired by outright

purchase or sale.

Short selling

In short selling, the trader borrows stock #usually from his brokerage which holds its clientsD

shares or its own shares on account to lend to short sellers$ then sells it on the market, hoping for

the price to fall. The trader eventually buys back the stock, making money if the price fell in the

meantime or losing money if it rose. %xiting a short position by buying back the stock is called

Ocovering a short position.O This strategy may also be used by unscrupulous traders to artificially

lower the price of a stock. 0ence most markets either prevent short selling or place restrictions

5<

on when and how a short sale can occur. The practice of naked shorting is illegal in most #but not

all$ stock markets.

In,estment strategies

,ne of the many things people always want to know about the stock market is, O0ow do I make

money investingNO There are many different approachesB two basic methods are classified as

either fundamental analysis or technical analysis. "undamental analysis refers to analy(ing

companies by their financial statements found in *%' "ilings, business trends, general economic

conditions, etc. Technical analysis studies price actions in markets through the use of charts and

&uantitative techni&ues to attempt to forecast price trends regardless of the companyDs financial

prospects. ,ne example of a technical strategy is the Trend following method, used by 6ohn L.

0enry and %d *eykota, which uses price patterns, utili(es strict money management and is also

rooted in risk control and diversification.

Additionally, many choose to invest via the index method. In this method, one holds a weighted

or unweighted portfolio consisting of the entire stock market or some segment of the stock

market #such as the *3! 9;; or Lilshire 9;;;$. The principal aim of this strategy is to maximi(e

diversification, minimi(e taxes from too fre&uent trading, and ride the general trend of the stock

market ."inally, one may trade based on inside information, which is known as insider trading.

0owever, this is illegal in most urisdictions #i.e., in most developed world stock markets$.

0lue chip

A nationally recogni(ed, well-established and financially sound company. Blue chips generally

sell high-&uality, widely accepted products and services. Blue-chip companies are known to

weather downturns and operate profitably in the face of adverse economic conditions, which help

to contribute to their long record of stable and reliable growth. The name Oblue chipO came about

because in the game of poker the blue chips have the highest value. Blue-chip stock is seen as

55

a less volatile investment than owning shares in companies without blue-chip status because blue

chips have an institutional status in the economy. The stock price of a blue chip usually closely

follows the *3! 9;;.. *tock of a well-established and financially sound company that has

demonstrated its ability to pay dividends in both good and bad times. These stocks are usually

less risky than other stocks. The stock price of a blue chip usually closely follows the *3! 9;;.

:arge cap

'ompanies with a market capitali(ation between W+; billion and W<;; billion. These are the big

kahunas of the financial world. %xamples include Lal-.art, .icrosoft and 2eneral %lectric.

0owever, these stocks are sometimes called Omega capsO.

-eep in mind that classifications such as Olarge capO or Osmall capO are only approximations that

change over time. Also, the exact definition can vary between brokerage houses.

Mid cap

'ompanies having a market capitali(ation between W< billion and W+; billion. *hortened form of

Omiddle capO.As the name implies, mid-cap companies are in the middle of the pack. .id caps

arenDt too big, but they have a respectably si(ed market cap.

-eep in mind that classifications such as Olarge capO or Osmall capO are only approximations that

change over time. Also, the exact definition of these terms can vary between brokerage houses.

Market capitali8ation

It is a measure of a companyDs total value. It is estimated by determining the cost of buying an

entire business in its current state. ,ften referred to as Omarket capO, it is the total dollar value of

all outstanding shares. It is calculated by multiplying the number of shares outstanding by the

current market price of one share.

5F

Brokerages vary on their exact definitions, but the current approximate classes of market

capitali(ation areJ

.ega 'apJ .arket cap of W<;; billion and greater

BigE/arge 'apJ W+; billion to W<;; billion

.id 'apJ W< billion to W+; billion

*mall 'apJ W5;; million to W< billion

.icro 'apJ W9; million to W5;; million

)ano 'apJ 7nder W9; million

If a business has 9; shares, each with a market value of W+;, the businessDs market capitali(ation

is W9;; #9; shares x W+;E share$.

Market ,alue

+. The current &uoted price at which investors buy or sell a share of common stock or a bond at

a given time. Also known as Omarket priceO.

<. The market capitali(ation plus the market value of debt. *ometimes referred to as Ototal

market value. In the context of securities, market value is often different from book value

because the market takes into account future growth potential. .ost investors who use

fundamental analysis to picks stocks look at a companyDs market value and then determine

whether or not the market value is ade&uate or if itDs undervalued in comparison to itDs book

value, net assets or some other measure

Fair market ,alue:

The price that a given property or asset would fetch in the marketplace, subect to the following

conditionsJ

59

+. !rospective buyers and sellers are reasonably knowledgeable about the assetB they are

behaving in their own best interests and are free of undue pressure to trade.

<. A reasonable time period is given for the transaction to be completed.

2iven these conditions, an assetDs fair market value should represent an accurate valuation or

assessment of its worth. "air market values are widely used across many areas of commerce. "or

example, municipal property taxes are often assessed based on the fair market value of the

ownerDs property. ?epending upon how many years the owner has owned the home, the

difference between the purchase price and the residenceDs fair market value can be substantial.

"air market values are often used in the insurance industry as well. "or example, when an

insurance claim is made as a result of a car accident, the insurance company covering the

damage to the ownerDs vehicle will usually cover damages up to the fair market value of the

automobile.

S(0I .Securities and (xchange 0oard of India4

In +::8, the *%BI was established by the 2overnment of India through an executive resolution,

and was subse&uently upgraded as a fully autonomous body #a statutory board$ in the year +::<

5>

with the passing of the *%BI act on 5;th 6an +::<. In place of 2overnment control statutory and

autonomous regulatory boards with defined responsibilities, to cover both development and

regulation of the market, and independent powers have been set up. !aradoxically this is a

positive outcome of the securities scam of +::;-:+.

6he +asic o+jecti,es of the +oard &ere identified as:

P To promote the interests of investors in securities.

P To promote the development of securities market.

P To regulate the securities market and

P "or matters connected there with or incidental there (to.

*ince its inception *%BI has been working targeting the securities and is attending to the

fulfillment of its obectives with commendable (eal and dexterity. The improvements in the

securities markets like capitali(ations re&uirements, margining, establishments of clearing

corporation etc. reduced the risk of credit and also reduced the market.

*%BI has introduced the comprehensive regulatory measures prescribed norms, the eligibility

criteria, the code of obligations and the code of conduct for different intermediaries like, bankers

to issue, merchant bankers, brokers and sub-brokers, registrars, portfolio managers, credit rating

agencies, underwriters and others. It has framed by-laws, risk identification and risk management

systems for clearing houses of stock exchanges, surveillance system etc. which has made dealing

in securities both safe And transparent to the end investors.

Another significant event is the approval of trading in stock indices #like *3! ')Q )ifty and

*ensex$ in <;;;. A market index is a convenient and effective product because of the following

reasonsJ

P It acts as a barometer for market behavior.

P It is used to benchmark portfolio performance.

P It is used in derivative instrument like index futures and index options.

P It can be used for passive fund management as in case if index funds.

54

Two board approaches of *%BI is to integrate the securities market at the national level, and also

to diversify the trading products, so that there is an increase in number of traders including

banks, financial institutions, insurance companies, mutual funds, primary dealers etc. to transact

through the exchanges. In this context the introduction of derivatives trading through Indian

stock exchanges permitted by *%BI in <;;; A? is a real landmark.

*%BI appointed the /.'. 2upta 'ommittee in +::8 to recommend the regulatory frameworks for

derivatives trading and suggest by-laws for regulation and control of trading and settlement of

derivatives contracts. The board of *%BI in its meeting held on .ay ++, ++:8 accepted the

recommendations of the committee and approved the phased introduction of derivatives trading

in India beginning with stock index futures. The board also approved the =*uggestive by-lawsK

as recommended by the ?r. /.'. 2upta 'ommittee for regulation and control of trading and

settlement of derivatives contracts.

*%BI then appointed the 6. G. Herma 'ommittee to recommend Gisk 'ontainment .easures

#G'.$ in the Indian stock index futures market. The report was submitted in )ovember +::8.

0owever the *ecurities 'ontracts #Gegulation$ act, +:9> #*'GA$ re&uired amendment to include

=derivativesK in the definitions of securities to enable *%BI to introduce trading in derivatives.

The necessary amendment was then carried out by the 2overnment in +:::. The *ecurities law

#Amendment$ bill, +::: was introduced. In ?ecember +::: the new framework was approved.

?erivatives have been accorded the status of C*ecurities@. The ban imposed on trading in

derivatives in +:>: under a notification issued by the central government was revoked.

Thereafter *%BI formulated the necessary regulations and intimated the stock exchanges in the

year <;;;. The derivatives trading started in India at )*% in <;;; and B*% started trading in the

year <;;+.

Stock +rokers

*%BI registered stock - brokers interested in providing internet based trading services

will be re&uired to apply to the respective stock exchange for a formal permission. The stock

58

exchange should grant approval or reect the application as the case may be, and communicate its

decision to the member within thirty calendar days of the date of completed application

submitted to the exchange.

The exchange closely monitors outstanding position of top buying member-brokers and

top selling member-brokers on a daily basis. "or this purpose, it has developed various market

monitoring reports based on certain pre-set parameters. These reports are scrutini(ed by officials

of the surveillance dept. To ascertain whether a member-broker has built up excessive purchase

or sale position compared to his normal level of business. "urther, it is examined whether

purchases or sales are concentrated in one or more scripts, whether the margin cover is ade&uate,

whether transactions have been entered into on behalf of institutional clients and even the &uality

of scripts, i.e., li&uid or illi&uid is looked into in order to assess the &uality of exposure. The

exchange also scrutini(es the pay-in position of the member-brokers and the member-brokers

having larger funds pay-in positions are at times, at the discretion of the exchange, re&uired to

make advance pay-in on tI+ day instead of on tI< day.

0asic re)uirements for stock +rokers

Trading will be on existing stock exchanges through order routing system for execution

of trades. Therefore, stockbrokers are to comply with the following before the start of trade on

internet.

+. The broker must have a net worth of Gs. 9; lakh if he wants to avail the facility of

internet for his own.

<. !rovision for maintenance of ade&uate back up system.

5. The software system to be used by him should be secured and reliable.

F. To employ the &ualified staff for this purpose.

9. To send orderEtrade confirmation to the client also through e-mail.

>. The contract notes must be issued to the clients as per existing regulation within <F hours

of the execution of trades.

4. The broker and his client should use authentication technologies.

The above are some of the important pre-re&uisites for the stockbroker should intend to take

benefits of trading on internet. 0owever, detailed guidelines issued by the sebi for the stock

exchange

5:

?ind of stock +rokers

+. Commission +roker

)ear about all the brokers buy and sell securities for earning a commission for investor point of

view he is the most important person and responsibility is to buy and sell stoke for his customer.

It means that he acts as an agent of investor and earns commission for his services rendered. The

broker is also an independent dealer in securities. 0e purchases and sell securities in his own

name but he is not allowed to deal with non-member.

<. @o++er

0e is an professional speculator who works for a profit called Cturn@ he makes a continuous

auction in the market in the stoke in which he speciali(ed. 0e trades in the market evens for

small difference in the prices and helps to maintain li&uidity in the stoke exchange.

5. Floor +roker

The floor broker buys and sells shares for the other broker on the floor of the exchange. 0e is an

individual member owns his seat and receives his own commission on the orders he execute. 0e

helps other brokers when they are buying and as compensation receives a portion the broker.

F. 2dd lit dealer

"or trading in stock exchange there a certain number of share a fixed to be transacted in a lot,

this is known as round lat which is usually a, +;; share a. Any thing less than the round lot are

add lot. If a person is in possession of add lot of share i.e. +;, <;, 5;, F; etc. They he will has to

look for the add lot dealer.

9. 0udli&ala

F;

0e is the person who finance or provide credit facilities to the market for this service he charges

a fees called contango or backwardation charges. The budliwala gives a fully secured loan for

period of < to 5 weeks.

>. =r+itrageur

A person who is specialist in dealing with securities in different stoke exchange centers at the

same time. 0e makes a profit by the difference in the piece prevailing in different centers of the

market activity. "or example the rte of a certain scrip is higher in some stoke exchange than

other on. In this case the broker will buy the scrip from the marked lower price and will sell the

scrip in the market at higher price. The profit of the arbitrageur depends on the ability to get the

prices from different centers before trading in other stoke exchanges.

F+

2+jecti,es

F<

2+jecti,es

,bectives of this research areJ-

To study investor@s perceptions about stock market

To study the factor@s influencing their decision for choosing a particular share.

F5

Research methodology

FF

Research methodology

Gesearch is an art of scientific investigation. As per the advanced learner@s dictionary of current

%nglish, =Gesearch is a careful investigation or e&uity especially through search for new facts in

any brand of knowledgeK, thus research is the pursuit of truth with the help of study, observation,

comparison, and experiments

Methodology: Sur,ey method &as adopted for the study1 Sur,ey &ork &ith a structured

)uestionnaire &as administered to collect primary data1 6his study is totally +ased on

Primary data collected from the respondent.

The purpose of research methodology section is to describe the procedure for conducting the

study. It includes Research design< Sample unit< Sample si8e< Sampling techni)ue< 6ools for

data collection< Statistical tools< sources of data ; Procedure of analysis of research

instrument.

Research design: The research design indicates a plan of action to be carried out in connection

with a proposed research work. It provides only a guideline for the research to enable him to

keep that he is moving in the right direction in order to enable his goals.

In this research the research design was be the descripti,e research design.

*ata collection: A structured )uestionnaire was used to collect the primary data from

respondents at different locations randomly.

F9

Statistical toolsJ

"or the representation of the data various statistical tools like Column *iagrams

have been used. These statistical tools have really provided great help to understand the results of

the analysis.

Sources of data:

Primary dataJ *tructured Vuestionnaire

Secondary dataJ )ewspapers, Television, Internet, 6ournals 3 .aga(ines

Sampling design: *ampling is one of the most fundamental concepts underlying any research work.

.ost research studies attempt to make generali(ation or draw inferences regarding the population,

based on their study of a part of the population that is the sample. The sample data enables the

researcher to correctly estimate the population parameters.

There are two method of sampling methodsJ

+. !robability .ethod

<. )on A !robability .ethod

As far as study is concerned, I have used )on- !robability sampling as well as *nowball

*ampling. Basically my *ample consists of Getail investors as well as corporate investors.

,n the basis of this sampling, I have made my proect and finally come on the findings and

conclusion.

(lement: The element of the research were the investors

Sampling unit: The data was collected from various locations of :7*HI=%=

(xtent: The extent was the scope or the area of the research

F>

6ime: The duration of this research was six months.

Sampling planJ Random Sampling was carried out to identify the respondents from the

different areas at different timesB the data is collected from various locations so there are very

less chances of duplication of data

Sampling frame: The list of the respondents is called the sampling frame. In this research the

list of the respondents can be those persons who have their ?-mat accounts in different banks.

There are two types of the sampling one is proportional sampling and other is the disproportional

sampling. The proportional sampling is that sampling in which the researcher can cover all the

respondents in the sampling frame and the disproportional sampling is that sampling in which the

researcher cannot cover all the respondents of his sampling frame. This research is

disproportional research.

Sampling techni)ue: The sampling techni&ue is of two types of sampling techni&ue. ,ne is

probability sampling techni&ue and other is non probability sampling techni&ue

As far as *ampling Techni&ue is concerned, a nicely prepared Vuestionnaire has been filed by

the Investors at the time of handling their &ueries. As we know most of the corporate investors

don@t have sufficient time to fill up the form so it was found convenient to fill the information at

the time of handling &ueries.

F4

=nalysis and

interpretation

F8

=nalysis and interpretation

This chapter analy(es the investors@ perceptions about stock market.

This chapter therefore deals with analysis and discussions of the proect.

A: Profession of in,estor

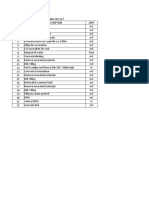

2P6I2%S %21 2F R(SP2%*(%6S

B7*I)%**.A) <;

*%GHI'%.A) +9

*T7?%)T* 8

,T0%G* 4

Table1 showing occupation of people

Graph1 showing occupation of people

=nalysis:5

This diagram shows that F;M respondents are businessman, 5;M are serviceman, +>M are

students and +FM are other respondents.

F:

0

2

4

6

8

10

12

14

16

18

20

Column2

A#: 9arious alternati,es for in,esting moneyB

2P6I2%S %212F R(SP2%*(%6S

BA)-* +9

G%A/ %*TAT% +,

*0AG%* +<

I)*7GA)'% 8

.7T7A/ "7)?* 9

Table 2 showing alternatives for investing money

Graph 2 showing alternatives for investing money

=nalysis:5

This diagram shows that 5;M respondents said that they are investing their savings in banks,

<FM respondents

Are investing in shares, <;M respondents investing in real estate, +>M respondents investing in

insurance and other

+;M respondents are investing in mutual funds.

9;

0

10

20

30

40

50

60

70

COMMODITIES DERIVATIVES EQUITY

P

e

r

c

e

n

t

a

g

e

AC: 9arious options for in,estment

Table 3 showing the investment of investors in the share market

Graph 3 showing the investment of the investors in the share market

=nalysis:5

),. ,"

G%*!,?%)T*

!%G*%)TA2%

',..,?ITI%* 55 +:

?%GIHATIH%* 59 <;

%V7IT1 +;; 9:

9+

"rom the above table and graph we can interpret that all the respondents are investing in the

e&uity shares along with e&uity shares there are +:M respondents who are investing in the

commodities and there are <;M investors who are investing in derivatives also.

AD: 6he type of shares for in,estment

Table 4 showing the types of shares in which investors are investing

39%

32%

23%

6%

Mid cap Sma cap !a"#$ cap M$#a cap

Graph 4 showing the types of shares in which investors are investing

Gesponses !ercentage

.id cap 5: 5:

*mall cap 5< 5<

/arge cap <5 <5

.ega cap > >

9<

59%

35%

6%

0 %& 25%

26 %& 50%

51 %& 75%

=nalysis:5

"rom the above table and graph we can interpret that most of the investors prefers mid cap and

small cap for their investments. /arge cap is preferred by very less investors. .ega cap is the

least preferred by the investors. There are 5:M of investors who prefers mid cap companies for

their investments and there are 5<M of the investors who prefers small cap companies for their

investments. /arge cap companies are prefers by <5M investors only. It is very less preferred

companies. The least preferred is mega cap companies@ shares. There are only >M investors who

prefers mega cap companies@ shares.

A1E4 =,erage Fage of in,estorGs total income contri+uted to shares trading

Gesponses !ercentage

; to <9M 9> 9:

<> to 9;M 5F 59

9+ to 49M > >

4> to +;;M ; ;

Table 5 showing the total income contribution to the shares trading

Graph 5 showing the total income contribution to the shares trading

=nalysis:5

95