Professional Documents

Culture Documents

Corridor Resources Jan 2014 Investor Presentation

Uploaded by

Stan HollandCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corridor Resources Jan 2014 Investor Presentation

Uploaded by

Stan HollandCopyright:

Available Formats

UPDATE

J ANUARY 2014

Highlights - I ntroduction

Eastern Canadian E&P Company

with enormous upside potential

& sustainability

Three high-impact prospects at

various stages of maturity

McCully production generates

positive cash flow & premium

netbacks

Focused on de-risking plays,

acquiring partners for high-

impact prospects & sustainability

as we demonstrate upside

Corridor is well-positioned:

- No debt

- Working capital (J an 2014 ~ $20M)

- Catalysts for significant upside

- Quebec & New Brunswick

Governments support development

Anticosti

900,000 Net Acres

Old Harry

250,000 Net Acres

Southern New

Brunswick

225,000 Net Acres

2

I nfrastructure in Place

East Coast

3

Eastern Canada Focused

Large, relatively unexplored area

with significant potential

Commanding land position of

~1.4 million net acres in Eastern

Canada

Licenses for high-impact

prospects range from ~3-7 yrs +

Gas production from McCully

Field in N.B. provides high

netbacks and positive cash flow

4

Three High I mpact Prospects

Anticosti Macasty shale prospect

has 20 Bboe net undiscovered

resources of petroleum (best

estimate); promising results from

2012 core program

Corridors Old Harry offshore

prospect is one of the largest

identified geological structures

offshore NFLD

New Brunswick Frederick Brook

shale

- 67 TCF gross discovered resources of

shale gas (best estimate)

2014 Program at McCully

expected to increase production

and further demonstrate FB shale

potential

5

Corridor N.B. Assets

Corridors N.B. assets connected

to Boston markets and LNG

facility in N.B.

Premium Netbacks

- Q1 2013 av $7.35

- Q4 2013 av ~$5.50

Premiums in Maritimes & Boston

to remain strong through 2017

Potential for LNG Export terminal

at Repsols Canaport LNG facility

optimum East Coast LNG export

option & 10 BCF storage

Reposol feasibility studies

underway

Ability to source additional

opportunities in the region

- CNG, LNG, Storage, etc.

6

Over 225,000 net acres in N.B.

Frederick Brook shale gas:

- 67 TCF gross (59 TCF net)

discovered resources

(best estimate)

Producing up to 11 mmcf/d

gross from McCully area

- Hiram Brook gas McCully Field

94.5 BCF 2P gross reserves

- ~25 year reserve life index

(GLJ estimate)

Advancing F.B. Shale potential

through 2014 frac programs

at McCully

N.B. Government supportive:

- Oil/Gas Env Protection Plan

- New, competitive Royalty Regime

- N.B. Industrial Base

requires supply

McCully/ F.B. Shale Exploration

& Development Area

7

Frederick Brook Shale

Highlights

Proven producibility

- G-41 well IP@ 12 mmcf/d

- F-58 well producing for 5 yrs

@ low decline from small frac

Up to 1100 m in gross

thickness

Upside in overlying sands

O-59 Elgin vertical well has

min 8 frac candidates

Connected to M&NP &

LNG Terminal

J .V. Opportunity for Pilot plant

at Elgin @ $100 to $150 M to

commercialize F.B.play

8

Anticosti

Macasty Liquids-Rich Shale Highlights

Over 1.5 million gross

acres licensed (~0.9

million net acres)

Thickness of Macasty

Shale ranged from 31 to

92 metres on 3 coreholes

drilled in 2012 program

Large areas within

liquids window

20 billion bboe net

undiscovered resources

(best estimate)

Similar to Ohio

Utica shale

Depth 2300 6500 feet

9

Anticosti

900,000 Net Acres

Old Harry

250,000 Net Acres

Southern New

Brunswick

225,000 Net Acres

Anticosti

Macasty Shale Oil Large Untested

Liquids

Schlumberger analysis

indicates 6% effective

porosity with 80% S

oil

Coreholes show 4%

average TOC

Additional frac analysis

on-going to design &

optimize program

Quebec Govt support of

exploration/ development

on Anticosti

Next stage includes:

- Appraisal program to

demonstrate production

$50 - $60 M

10

Old Harry Highlights

One of the largest undrilled

geological structures in Eastern

Canada (43,000 acres/67 sq miles) under

simple four-way closure

Several direct hydrocarbon indicators

identified: satellite seepage slicks,

frequency anomalies, amplitude

anomalies, and AVO anomalies

Over 1,000 km of modern 2-D

seismic available

Structures aerial extent and

potential reservoir thickness presents

huge opportunity for billion barrel oil

or multi TCF gas discovery

Basin Modeling indicates light oil (~55

API) was initially generated and could

be filling the structure

11

Anticosti

900,000 Net Acres

Old Harry

250,000 Net Acres

Southern New

Brunswick

225,000 Net Acres

Old Harry Prospect Highlights

Potential for good primary

reservoir in Bradelle Formation

Very thick secondary reservoir,

Brion Island Formation

Thick light-oil source rock

NFLD exploration well targeted for

2015/2016, pending approvals

Corridor has identified drilling

assets available in the 2015-2016

window

12

Old Harry Regulatory Summary

Corridor submitted its Old Harry Exploratory

Drilling Project Description and Environmental

Assessment (E.A.) to the C-NLOPB in February

2011

C-NLOPB & Federal Energy Dept required a

Strategic Environmental Assessment (SEA) for

NFLD side of Gulf; expected early 2014

Corridors E.A. and drilling permits can be

completed in 2014

Due to lengthy regulatory processes, Corridor has

been granted extension of drilling window (Phase I

of licence) to J an 2017 for well spud

The Quebec and Federal Governments signed an

accord in Mar 2011 to jointly regulate the offshore

on Quebecs side of the Gulf

Quebec has completed SEA and is expected to

decide on opening sections of Quebec side of the

Gulf for oil and gas activities in 2014

13

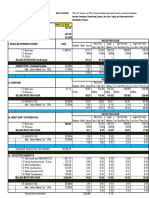

Q3 2013 YTD Netback

Q3 2013 Q3 2012

Netback ($/mscf)

Average gas price $ 6.49 $3.53

Transportation expense $ 1.27 $1.23

Royalty expense $ 0.22 $ -

Production expense $ 1.04 $0.92

Netback $ 3.96 $1.38

Production (mmscfpd) 8.2 9.0

Q1 2013 average gas price: $10.19, netback: $7.35

Forward Sale Agreements:

- Nov 13 to Mar 14 average of 3,000 mmbtupd at a price of US$9.03/mmbtu

- J an 14 Feb 14 average of 2,400 mmbtupd at a price of US$15.50/mmbtu

14

Q3 2013 YTD Financial Results

$ in thousands Q3 2013 Q3 2012

Sales $ 15,532 $ 9,833

Cash flow from operations

1

7,823 2,024

Net working capital (cash $14.2M) 16,190 9,061

Net income/(loss) 1,863 (5,866)

Net income/(loss) per share

- Basic and diluted 0.021 (0.066)

Notes: 1

Cash flow from operations is a non-IFRS measure. For a reconciliation to IFRS, see Non-IFRS Financial Measures

in Corridors Q3 2013 MD&A

15

Strategic Priorities

Advance three high impact prospects by sourcing J .V. arrangements

& with CDH working capital

Implement 2014 program for additional production at McCully from both

Hiram Brook and F.B. Shale

Maximize cash flow and ensure we optimize value of McCully assets

Maintain licenses for Corridors high impact prospects

Promote export potential for LNG from Atlantic Canada using existing

infrastructure and location advantages as well as other opportunities such

as CNG that will promote commercialization of F.B. Shale

Continue to advance regulatory approvals and social licenses for Corridor

prospects in various appropriate jurisdictions

16

North East Gas Prices

Anticipate elevated premium to Henry Hub for next several years

Anticipate supply short fall for market in Maritimes served by MNP

CNG & demand growth in Maritimes & NE pushing up supply shortfall

Forward Prices based in Platts Gas Daily, J anuary 24, 2014

17

CDH 2-Yr Performance

18

Shares outstanding ~ 88 mm

Options outstanding ~ 3.5 mm

Cash position (12/2013) $ 16 M

Market Cap $120 M

Summary & Catalysts

Corridor has excellent upside potential combined with sustainability

Focus on de-risking high-impact prospects & maintaining cash flow from

McCully assets

Corridor is well positioned to capitalize on its potential catalysts, including:

- Advancing J .V. arrangements on high-impact prospects

- Implementation of 2014 McCully program to increase production; further

demonstrating deliverability of Frederick Brook Shale

- Continued recognition of strong pricing signals for Corridor production

sold into Boston market

- Progress on LNG export facilities located in N.B. and N.S.

- Advancing regulatory permitting process for Corridors prospects

19

Disclaimer

Forward Looking Information Disclosure

This presentation contains certain forward-looking statements and forward-looking information (collectively referred to herein as "forward-looking statements") within the meaning of

Canadian securities laws. All statements other than statements of historical fact are forward-looking statements. Forward-looking information typically contains statements with words

such as "anticipate", "believe", "plan", "continuous", "estimate", "expect", "may", "will", "project", "should", or similar words suggesting future outcomes. In particular, this

presentation contains forward-looking statements pertaining to the following: the potential and characteristics of its properties; business plans and strategies; increased production

and results from the 2014 program at McCully; potential for LNG export; ability to source additional opportunities; the quantity of natural gas, oil and natural gas liquids reserves and

resources; support and treatment under governmental regulatory regimes; exploration and development plans and the cost of such plans; estimates of production, revenues, average

gas price; and projected elevated premiums.

Undue reliance should not be placed on forward-looking statements, which are inherently uncertain, are based on estimates and assumptions, and are subject to known and unknown

risks and uncertainties (both general and specific) that contribute to the possibility that the future events or circumstances contemplated by the forward-looking statements will not

occur. There can be no assurance that the plans, intentions or expectations upon which forward-looking statements are based will in fact be realized. Actual results will differ, and the

difference may be material and adverse to the Company and its shareholders. Forward-looking statements are based on the Company's current beliefs as well as assumptions made

by, and information currently available to, the Company including information concerning anticipated financial performance, business prospects, strategies, regulatory developments,

future natural gas and oil commodity prices, exchange rates, future natural gas production levels, the ability to obtain equipment in a timely manner to carry out development

activities, the ability to market natural gas successfully to current and new customers, the impact of increasing competition, the ability to obtain financing on acceptable terms, the

ability to add production and reserves through development and exploration activities and the terms of agreements with third parties. Although management considers these

assumptions to be reasonable based on information currently available to it, they may prove to be incorrect. Unknown risks and uncertainties include, but are not limited to: risks

associated with oil and gas exploration, substantial capital requirements and financing, prices, markets and marketing, government regulation, third party risk, environmental,

hydraulic fracturing, dependence on key personnel, co-existence with mining operations, availability of drilling equipment and access, risks may not be insurable, variations in

exchange rates, expiration of licenses and leases, reserves and resources estimates, development and/or acquisition of oil and natural gas properties, trading of common shares,

seasonality, competition, management of growth, conflicts of interest, issuance of debt, title to properties and hedging. Further information regarding these factors and additional

factors may be found under the heading "Risk Factors" in the Annual Information Form for the year ended December 31, 2012. Readers are cautioned that the foregoing list of factors

that may affect future results is not exhaustive.

Certain of the forward-looking statements in this presentation may constitute "financial outlooks" as contemplated by National I nstrument 51-102 Disclosure Obligations, including

information related to the Henry Hub forward price and forecast average premium of Corridor , under the heading North East Gas Prices on Silde #17, which is provided for the

purpose of estimating Corridors future revenues and cash flow for 2014 and 2015. Please be advised that the financial outlook in this presentation may not be appropriate for

purposes other than the one stated above.

The forward-looking statements contained in this presentation are made as of the date hereof and the Company does not undertake any obligation to update publicly or to revise any

of the included forward-looking statements, except as required by applicable law. The forward-looking statements contained herein are expressly qualified by this cautionary

statement.

Oil and Gas Disclosure

The term "boe" refers to barrels of oil equivalent. All calculations converting natural gas to crude oil equivalent have been made using a ratio of six mscf of natural gas to one barrel

of crude equivalent. Boes may be misleading, particularly if used in isolation. A boe conversion ratio of six mscf of natural gas to one barrel of crude oil equivalent is based on an

energy equivalency conversion method primarily applicable at the burner tip and does not represent a value equivalency at the wellhead.

20

Disclaimer, (contd)

Resources Disclosure

"discovered resources" is that quantity of petroleum that is estimated, as of a given date, to be contained in known accumulations prior to production. The recoverable portion of

discovered petroleum initially-in-place includes production, reserves, and contingent resources; the remainder is unrecoverable.

"undiscovered resources" refers to those quantities of petroleum that are estimated, on a given date, to be contained in accumulations yet to be discovered. The recoverable portion

of undiscovered petroleum initially-in-place is referred to as prospective resources, the remainder as unrecoverable. Undiscovered resources carry discovery risk. There is no certainty

that any portion of these resources will be discovered. If discovered, there is no certainty that it will be commercially viable to produce any portion of the resources. A recovery

project cannot be defined for this volume of undiscovered petroleum initially-in-place at this time.

Resources do not constitute, and should not be confused with, reserves. Actual reserves and resources will vary from the reserve and resource estimates, and those variations could

be material. There is no certainty that it will be economically viable to produce any portion of the resources.

The resources assessment referred to in Slides #5 & #7 was completed by GLJ Petroleum Consultants Ltd. effective J une 1, 2009 setting forth certain information regarding

discovered resources of Corridor's interests in the Frederick Brook shale formation. The best estimate is the value that best represents the expected outcome with no optimism or

conservatism , GLJ subsequently reviewed the pertinent data collected between J une 1, 2009 and December 31, 2012 in the upper part of the Frederick Brook formation, and made

no changes to the original estimates as at December 31, 2012. There is no certainty that it will be commercially viable to produce any portion of these discovered

resources.

The reserves estimates referred to in Slide #7 was prepared by GLJ dated February 28 2013 with an effective date of December 31, 2012 and a preparation date of February 28,

2013 setting forth certain information relating to certain natural gas, crude oil and natural gas liquids reserves of Corridor properties, specifically the McCully Field and the Caledonia

Field, and the net present value of the estimated future net reserves associated with such reserves.

The resources assessment, referred to in Slides #5 and #9 was prepared by Sproule Associates Limited effective J une 1, 2011 setting forth certain information regarding total

petroleum initially-in-place of Corridors interests in the Macasty shale formation on Anticosti Island. The best estimate reflects the probability that the quantity actually in place is

equal to or greater than the estimate is 50%. Sproule subsequently reviewed the pertinent data collected between J une 1, 2011 and December 31, 2012, and has made no changes

to the original resource estimates provided in the Sproule Anticosti Reserves Report. These resources are reported as Bboe to reflect uncertainty of hydrocarbon type across the

island. A recovery project cannot be defined for this volume or undiscovered resources. There is no certainty that any portion of these resources will be discovered. If

discovered, there is no certainty that it will be commercially viable to produce any of these resources.

For further information on Corridor's resources and reserves, see the Annual Information Form for the year ended December 31, 2012.

21

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Far East Bank & Trust Co. v. Gold Palace Jewelry Co DIGESTDocument3 pagesFar East Bank & Trust Co. v. Gold Palace Jewelry Co DIGESTAprilNo ratings yet

- Pioneering Portfolio ManagementDocument6 pagesPioneering Portfolio ManagementGeorge KyriakoulisNo ratings yet

- Iffco-Tokio General Insurance Co - LTD: Servicing OfficeDocument3 pagesIffco-Tokio General Insurance Co - LTD: Servicing Officevijay_sudha50% (2)

- DeGolyer & MacNaughton Reserve Report For Polvo FieldDocument47 pagesDeGolyer & MacNaughton Reserve Report For Polvo FieldStan HollandNo ratings yet

- HDFC StatementDocument8 pagesHDFC StatementAnonymous 3Mycs5No ratings yet

- Arbitration ClausesDocument14 pagesArbitration Clausesramkannan18No ratings yet

- Del Monte Philippines, Inc. vs. AragoneDocument1 pageDel Monte Philippines, Inc. vs. AragoneLeizle Funa-FernandezNo ratings yet

- Linc Energy Prospectus Volume 1Document207 pagesLinc Energy Prospectus Volume 1Stan HollandNo ratings yet

- Bot ContractDocument18 pagesBot ContractideyNo ratings yet

- Canadian Oil Sands 12-Jan-2015 PresentationDocument32 pagesCanadian Oil Sands 12-Jan-2015 PresentationStan HollandNo ratings yet

- HHC Todd Sullivan Harbor Conf 2-12-15Document44 pagesHHC Todd Sullivan Harbor Conf 2-12-15CanadianValue0% (1)

- FX Energy 2013 Reserve Report For PolandDocument105 pagesFX Energy 2013 Reserve Report For PolandStan HollandNo ratings yet

- AGM2014 Corridor ResourcesDocument23 pagesAGM2014 Corridor ResourcesStan HollandNo ratings yet

- Corridor Resources 2012 Reserve ReportDocument17 pagesCorridor Resources 2012 Reserve ReportStan HollandNo ratings yet

- Corridor Resources 2011 Reserve ReportDocument102 pagesCorridor Resources 2011 Reserve ReportStan HollandNo ratings yet

- Corridor Resources YE 2013 ReservesDocument44 pagesCorridor Resources YE 2013 ReservesStan HollandNo ratings yet

- VAALCO 26-November-2013 PresentationDocument22 pagesVAALCO 26-November-2013 PresentationStan HollandNo ratings yet

- DeGolyer&MacNaughton's Prospective Resources Report For HRT's Namibian AcreageDocument56 pagesDeGolyer&MacNaughton's Prospective Resources Report For HRT's Namibian AcreageStan HollandNo ratings yet

- VAALCO Capital One Presentation 12-13-2013 FinalDocument21 pagesVAALCO Capital One Presentation 12-13-2013 FinalStan HollandNo ratings yet

- Old Harry 8 Apr 2011Document46 pagesOld Harry 8 Apr 2011Stan HollandNo ratings yet

- Corridor Resources 2013 AGM SlidesDocument22 pagesCorridor Resources 2013 AGM SlidesStan HollandNo ratings yet

- FX Energy - ReserveReport2012Document95 pagesFX Energy - ReserveReport2012Stan HollandNo ratings yet

- VAALCO+Company+Update+-+RBC June 2013 FinalDocument23 pagesVAALCO+Company+Update+-+RBC June 2013 FinalStan HollandNo ratings yet

- Corridor Resources 2011 Reserve ReportDocument102 pagesCorridor Resources 2011 Reserve ReportStan HollandNo ratings yet

- Corridor Resources - 2010 Year End Investor PresentationDocument21 pagesCorridor Resources - 2010 Year End Investor PresentationStan HollandNo ratings yet

- Corridor Resources - 13-June-2012 PresentationDocument21 pagesCorridor Resources - 13-June-2012 PresentationStan HollandNo ratings yet

- Corridor Resources - 22-Jun-2010 Investor Day PresentationDocument52 pagesCorridor Resources - 22-Jun-2010 Investor Day PresentationStan HollandNo ratings yet

- Corridor Resources - 2012 AGM SlidesDocument21 pagesCorridor Resources - 2012 AGM SlidesStan HollandNo ratings yet

- Du Tran New Partner - Press ReleaseDocument1 pageDu Tran New Partner - Press ReleaseTranDuVanNo ratings yet

- Fresher Finance Resume Format - 4Document2 pagesFresher Finance Resume Format - 4Dhananjay KulkarniNo ratings yet

- PSP Study Guide 224 Q & A Revision Answers OlnyDocument214 pagesPSP Study Guide 224 Q & A Revision Answers OlnyMohyuddin A Maroof100% (1)

- Innovative Business Models in The Era of Ubiquitous NetworksDocument13 pagesInnovative Business Models in The Era of Ubiquitous NetworksWan Sek ChoonNo ratings yet

- Sylvania Outdoor Lighting Equipment Ordering Guide & Price Schedule 10-65Document32 pagesSylvania Outdoor Lighting Equipment Ordering Guide & Price Schedule 10-65Alan MastersNo ratings yet

- 10 Types of Entrepreneurial BMsDocument36 pages10 Types of Entrepreneurial BMsroshnisoni_sNo ratings yet

- Security agency cost report for NCRDocument25 pagesSecurity agency cost report for NCRRicardo DelacruzNo ratings yet

- Universidad de Lima Study Session 5 Questions and AnswersDocument36 pagesUniversidad de Lima Study Session 5 Questions and Answersjzedano95No ratings yet

- Invoice: Telecom Equipment Pte LTDDocument1 pageInvoice: Telecom Equipment Pte LTDRiff MarshalNo ratings yet

- Reeengineering MethodologyDocument87 pagesReeengineering MethodologyMumbi NjorogeNo ratings yet

- RAM Guide 080305Document266 pagesRAM Guide 080305Ned H. CriscimagnaNo ratings yet

- Aparna Singh 19021141023Document2 pagesAparna Singh 19021141023Aparna SinghNo ratings yet

- The Meatpacking Factory: Dardenbusinesspublishing:228401Document2 pagesThe Meatpacking Factory: Dardenbusinesspublishing:228401354Prakriti SharmaNo ratings yet

- Hill and Jones Chapter 4 SlidesDocument32 pagesHill and Jones Chapter 4 Slidesshameless101No ratings yet

- Dominos PizzaDocument14 pagesDominos PizzahemantNo ratings yet

- CH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third EditionDocument15 pagesCH 02 Project Life Cycle and Organization: A Guide To The Project Management Body of Knowledge Third Editionapi-3699912No ratings yet

- Managing With Agile - Peer-Review Rubric (Coursera)Document8 pagesManaging With Agile - Peer-Review Rubric (Coursera)awasNo ratings yet

- Cheyne Capital ManagementDocument2 pagesCheyne Capital ManagementCheyne CapitalNo ratings yet

- Project Feasibility Study and Evaluation .Best Ce Ra Ceramic Company. Mae Fah Luang University (MFU) 2010.Document155 pagesProject Feasibility Study and Evaluation .Best Ce Ra Ceramic Company. Mae Fah Luang University (MFU) 2010.xingrong100% (4)

- Project Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering ScienceDocument19 pagesProject Proposal: ESC472 - Electrical and Computer Capstone Design Division of Engineering Scienceapi-140137201No ratings yet

- Kalyan Pharma Ltd.Document33 pagesKalyan Pharma Ltd.Parth V. PurohitNo ratings yet

- Case Review (Chwee Kin Keong & Statoil)Document9 pagesCase Review (Chwee Kin Keong & Statoil)AFIQQIWA93No ratings yet

- Customer Service ExcellenceDocument19 pagesCustomer Service ExcellenceAnh ThưNo ratings yet