Professional Documents

Culture Documents

Critism of Classical Theory

Uploaded by

georgechebo0 ratings0% found this document useful (0 votes)

130 views6 pagescritisim in clasical theory

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentcritisim in clasical theory

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

130 views6 pagesCritism of Classical Theory

Uploaded by

georgechebocritisim in clasical theory

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 6

Question 1

Criticism leveled against the foundational ideas of the of

classical theory

Keynes attacked the classical theory o the following works:

1. Keynes rejected the fundamental classical assumption of full employment equilibrium in the

economy. He considered it as unrealistic and graded full employment as a special situation. Since

the general situation inn a capitalist economy is one of unemployment. This is because the

capitalist society does not function according to says law, and supply always exceeds it demand

we find thee are many workers who are prepared to work at the current wage rate and even

zbelow it., but they do not find work. Thus the existence of involuntary unemployment in

capitalist economies proves that under employment equilibrium is a normal situation and full

employment equilibrium is abnormal ad accidental.

2. The classicist believed that savings and investments where equal at the full employment level and

in case of any divergence the equality was brought about by the mechanism of rate of interest.

Keynes held that the level of savings depended upon the level of income and not on the interest

rate. Similarly, an investment is determined not only by rate of interest but by the marginal

efficiency of capital. A low rate of interest cannot increase investments if business expectations

are low. If savings exceeds investments, it means people are spending less on consumption. As a

result, demand declines. There is overproduction and fall in investment, income and employment

and output it will lead to reduction in savings and ultimately the equality between savings and

investments will be attained at a lower level of income. Hence it is variations in income rather

than in interest rate that brings equality between savings ad investments.

3. Keynes did not agree with classical view that the Laissez- Faire policy was essential for an

automatic and self- adjusting process of full employment equilibrium. He pointed out that the

capitalist of system was not automatic a self- adjusting because of the non- egalitarian structure of

its society consumption. The poor lack money to purchase consumption goods. Thus there is a

general deficiency of aggregate demand in relation to aggregate supply which leads to

overproduction and unemployment. If the economy would have an automatic and self- adjusting

system , this would not have occurred. Keynes, therefore, advocated state interventions.

4. Keynes refuted says law of Markets, that supply always created its own not be spent in buying

products which they helped to produce the produce. A part from savings and investments are

distinct functions when all earned incomes not spent on consumption goods and a portion is not

saved. There results a deficiency of aggregate demand, thus Keynes invalidated says law by

invoking the principle that marginal propensity to consume less than one.

5. The classicist believed that money was demanded for transactions and precautionary purpose but

Keynes did not agree with the view. He emphasized the importance of speculative demand for

money which the classical economists did not recognize. He pointed out that the earning of

interest from assets meant for transactions and precautionary purposes may be very small at a low

rate of interest. But the speculative demand for money would be infinitely large at a low interest

rate of interest, thus, the rate of interest rate will not fall below a certain minimum level, and the

speculative demand for money would become perfectly interest elastic. This is ( liquidity trap)

which the classicists failed to analyze.

6. The classical economists regarded money as neutral. They excluded the theory of output,

employment and interest rate from the monetary theory. Keynes criticized the classical view that

the monetary theory was separated with values theory. He integrated monetary theory with value

theory and brought the theory interest in the demand of monetary theory.

7. The classicists believed in the long run full employment equilibrium through a self adjusting

process. Keynes had no patience to wait for the long period for he believed that in the long run,

we are all dead. Assuming consumption demand to be constant. The short period he lays

emphasis on increasing investments to remove unemployment. But the equilibrium level so

reached is one of unemployment rather than of full employment. Thus, the classical theory of

employment is unrealistic and is incapable of solving the present day economic problems f the

capitalist world.

8. Keynes did not agree with Pigou that Frictional maladjustments alone account for failure to

utilize fully our productive power. The capitalist system is such that left to itself is incapable of

using productive power fully. Therefore activity on the supplement private investment. It may

also pass legislation. Recognizing trade unions, fixing minimum wages and providing relief to

workers through social security measures. So Keynes favored state action to utilize fully the

resources of the economy for attaining full employment.

9. Keynes refuted the Pigovian formulation that a lot of money wage could achieve full employment

in the economy. Reduction in wage rate can increase employment in a industry by reducing costs

and increasing demand by the adoption of such a policy for reducing costs and increasing demand

but the adoption of such a policy for the economy leads to the reduction in employment. When

there is a general wage cut, the income of the workers is reduced. As a result, aggregate demands

fall, leading to a decline in employment.

10. Keynes also differs with the classists that equality between savings and investments via the rate

of ineptest shifts only the investments curve and that the savings curve does not change. Keynes

view is that whenever the investments curve changes, there is a rise in income through multiplier

effect; as a result savings also increases.

Question 2

Discuss the rational expectations Theory in Macro-

Economics

The expectations theory regards future interests rate as the principal determinant of the present

structure of interest rate. The theory originated with irring fisher, was perfected by Hicks in his

value and capital, and is closely identified with lutz.

The expectation theory is based on the following assumption

1. All investors have definite expectations with respect to future short term interests rates,

and these expectations are held with complete confidence

2. The objective of investors is to maximize expected profits ad they are prepared to transfer

funds freely from one maturity to another in order to achieve this objective

3. There are no costs associated with investment and disinvestment in securities.

4. The short term and long term interest rate are adjusted for any difference due to risk and

liquidity

Given this assumptions, the theory states that long term interest rate at any point in time

represent an average of expected short term interest rates.

The expectation theory holds that differences in yields on securities of different maturities

are due to the fact that the market expects the interest rates on different securities to be the

same over an equal period of time if this is not the case the investor will buy security of one

maturity by selling security of another maturity that he expects to provide him the highest

yield

Investors generally have repressive interest rate expectations.

That is to say, at any particular time they have an opinion regarding the level of interest rates

they regard as normal, and as short- term rates rise above or fall below this level, they expect

them to regress back towards this normal level. Thus, as rates rise above normal, investors

expect them to fall and as rates fall below normal, invertors expect them to rise.

This relationship implies that:

1. When short- term rates are expected to fall, current sort term rates will be above long

term rates and the yield curve will be negatively sloped.

2. When rates are expected to rise, current short- term rates will be below long-term rates

and the yield curve will be positively sloped when the shortterm rate is at approximately

the level judged to normal and is expected neither to rise nor to fall, rate for all maturities

approximate a horizontal line.

However, the expectations theory has been criticized on several points.

1. 1

st

lenders may have expectations about long-term interest rates that may be independent

of their expectations about short-term interest rates.

2. 3nd the theory presupposes that investors can make long term expectations about short

term interest rate but it is doubtful if such predictions can be made accurate.

3. Critics doubt the efficiency of changes in the central back discount rates to influence the

long-term interest rate for instance, a reduction in the discount rate can bring a fall short-

term interest rates only if the expectations is generated that short-term interest rates will

remain law. This will prevent the discount rate being changed very often by the central

bank.

4. If open marked operations which influence the slope of the yield curve are of successful,

the expectation theory fails

You might also like

- Power of Productivity LewisDocument12 pagesPower of Productivity LewissnegcarNo ratings yet

- ECONOMICS: The Labour Market: Wages, Profits, and UnemploymentDocument11 pagesECONOMICS: The Labour Market: Wages, Profits, and UnemploymentmargaridaNo ratings yet

- Chapter 6 - Markets Allocating ResourcesDocument2 pagesChapter 6 - Markets Allocating ResourcesShayna ButtNo ratings yet

- Startup Financial ModelDocument7 pagesStartup Financial ModelSandeep JaiswalNo ratings yet

- giBriL's System Manual 1 E PDFDocument1 pagegiBriL's System Manual 1 E PDFAKIN KAYODENo ratings yet

- No Place Left To SqueezeDocument8 pagesNo Place Left To SqueezedesikanNo ratings yet

- Assignment 4 HLTH 101Document3 pagesAssignment 4 HLTH 101api-622678802No ratings yet

- ANNEX III Economic Justification GuideDocument31 pagesANNEX III Economic Justification GuideDelia Trifi RufinoNo ratings yet

- Ijma Ka Wakuh Aor HukmDocument13 pagesIjma Ka Wakuh Aor HukmMuzamil Kifayat BozdarNo ratings yet

- Compare 6 theories of international tradeDocument2 pagesCompare 6 theories of international tradeENDLESSNo ratings yet

- REVISED ADULT HEALTH ASSESSMENT FORM (2015) - GuideDocument13 pagesREVISED ADULT HEALTH ASSESSMENT FORM (2015) - GuideBianca MolinaNo ratings yet

- Chapter 7 NotesDocument17 pagesChapter 7 NotesImran GureNo ratings yet

- EarningsGuidance, WeighingThePros&Cons Survey-McKQ Mar06Document5 pagesEarningsGuidance, WeighingThePros&Cons Survey-McKQ Mar06zyz777No ratings yet

- Public Release 2017-18 041717Document3 pagesPublic Release 2017-18 041717api-265742016No ratings yet

- Public Release 2017-18 041717Document3 pagesPublic Release 2017-18 041717api-265742016No ratings yet

- NCM 114 Ethical Aspects of Care PromotionDocument2 pagesNCM 114 Ethical Aspects of Care PromotionJane DiazNo ratings yet

- ECONOMICS: Property and Power. Mutual Gains and ConflictDocument8 pagesECONOMICS: Property and Power. Mutual Gains and ConflictmargaridaNo ratings yet

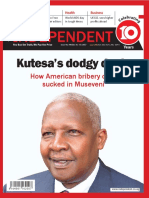

- The Independent ISSUE 498Document44 pagesThe Independent ISSUE 498The Independent MagazineNo ratings yet

- Indonesian Criminal LawDocument10 pagesIndonesian Criminal LawdeeNo ratings yet

- Kha Gādi Pañcadaśa Mālā: - October 2020Document116 pagesKha Gādi Pañcadaśa Mālā: - October 2020MarbroNo ratings yet

- LifestyleDocument37 pagesLifestyleVina Yabao LuchavezNo ratings yet

- Econ 2106 NotesDocument146 pagesEcon 2106 NotesUyen PhamNo ratings yet

- Ashoka's Catapult Program OverviewDocument7 pagesAshoka's Catapult Program OverviewAshokaCatapultNo ratings yet

- 02 MODELO ProjectFinance GenericLetterOfIntent.V.1 01052019Document9 pages02 MODELO ProjectFinance GenericLetterOfIntent.V.1 01052019tucano8997jNo ratings yet

- Alternative Measures of Well-Being: Tatistics RiefDocument8 pagesAlternative Measures of Well-Being: Tatistics RiefBunbun 221No ratings yet

- Slides Chap 04 BDocument69 pagesSlides Chap 04 BLCNo ratings yet

- Idep Finance Policy PDFDocument18 pagesIdep Finance Policy PDFLaksmiNo ratings yet

- ECO Insights 210122 Week AheadDocument2 pagesECO Insights 210122 Week Aheadamit shahNo ratings yet

- جودة الحياة الزوجية وأثرها على الأبناءDocument20 pagesجودة الحياة الزوجية وأثرها على الأبناءjihad munshiNo ratings yet

- 040 SkillFront ISO IEC 20000 IT Service Management SystemsDocument80 pages040 SkillFront ISO IEC 20000 IT Service Management SystemsAriel TatumNo ratings yet

- THE INDEPENDENT Issue 499Document44 pagesTHE INDEPENDENT Issue 499The Independent Magazine100% (1)

- Un CharterDocument6 pagesUn ChartersamiNo ratings yet

- Write Up Emerging MarketDocument9 pagesWrite Up Emerging MarketchotabawariNo ratings yet

- Dental Barotrauma in French Military Divers: Results of The POP StudyDocument5 pagesDental Barotrauma in French Military Divers: Results of The POP StudyLiga Odontopediatria RondonienseNo ratings yet

- Refugees in CanadaDocument14 pagesRefugees in Canadaapi-302159607No ratings yet

- Marketing Management - Smarwatch AssigmentDocument11 pagesMarketing Management - Smarwatch AssigmentNguyen WoabeNo ratings yet

- Abdallah Dahir - Architectural Technologist Portfolio 2022Document5 pagesAbdallah Dahir - Architectural Technologist Portfolio 2022Abdallah DahirNo ratings yet

- Schemes of AP NewDocument22 pagesSchemes of AP NewdarimaduguNo ratings yet

- InversionsDocument3 pagesInversionsGisela Martí PérezNo ratings yet

- The Purpose of International RelationsDocument65 pagesThe Purpose of International Relationsrosseventon9552100% (3)

- Abdallah Dahir - Architectural Technologist Portfolio 2022Document5 pagesAbdallah Dahir - Architectural Technologist Portfolio 2022Abdallah DahirNo ratings yet

- Chapter 3 - Opportunity CostDocument1 pageChapter 3 - Opportunity CostShayna ButtNo ratings yet

- FQ UNIT1 MetodocientDocument5 pagesFQ UNIT1 MetodocientAlandahen AliveiNo ratings yet

- Cool I NG Ti L e - Sol Ar Ref L Ect I Ve Ti L e - Heat Resi ST Ant Ti L - eDocument1 pageCool I NG Ti L e - Sol Ar Ref L Ect I Ve Ti L e - Heat Resi ST Ant Ti L - eBharathidasan rajuNo ratings yet

- General OrientationDocument7 pagesGeneral OrientationStacey SalvillaNo ratings yet

- Latihan Essay Hari Ke 4 - MEMPROSES ENTRY JURNALDocument8 pagesLatihan Essay Hari Ke 4 - MEMPROSES ENTRY JURNALDenisa Nur HandayaniNo ratings yet

- Abdallah Dahir - Architectural Technologist Portfolio 2021Document5 pagesAbdallah Dahir - Architectural Technologist Portfolio 2021Abdallah DahirNo ratings yet

- Lab Homeostasis ExerciseDocument4 pagesLab Homeostasis Exerciseapi-259776843No ratings yet

- Gastrointestinal System Notes - 3rd EdDocument174 pagesGastrointestinal System Notes - 3rd EdDaniela CovashNo ratings yet

- Housing Studio 3 Module 03Document8 pagesHousing Studio 3 Module 03Peter DavidNo ratings yet

- MicroeconomicsDocument18 pagesMicroeconomicssaumyaNo ratings yet

- Complete Set of Notes CompressedDocument76 pagesComplete Set of Notes CompressedsaumyaNo ratings yet

- Microeconomics: Basic Concept of DemandDocument6 pagesMicroeconomics: Basic Concept of Demandtabassum manzoorshahNo ratings yet

- Chapter 5 - Micro MacroDocument1 pageChapter 5 - Micro MacroShayna ButtNo ratings yet

- Resume 2021 RevisedDocument1 pageResume 2021 Revisedapi-521051373No ratings yet

- MKR Creative Studio Portfolio - Colab - 11252021Document9 pagesMKR Creative Studio Portfolio - Colab - 11252021Matt RumboldtNo ratings yet

- Marketing Fiche 1Document7 pagesMarketing Fiche 1CarlinNo ratings yet

- (Individu) - Tugas SJODocument3 pages(Individu) - Tugas SJOeobikaskusNo ratings yet

- Test 1Document1 pageTest 1georgecheboNo ratings yet

- Promoting HIV Antiretroviral TherapyDocument92 pagesPromoting HIV Antiretroviral TherapygeorgecheboNo ratings yet

- Major Plant RenovationDocument1 pageMajor Plant RenovationgeorgecheboNo ratings yet

- Characteristics of HostelDocument1 pageCharacteristics of HostelgeorgecheboNo ratings yet

- Astronomy AssignmentsDocument5 pagesAstronomy AssignmentsgeorgecheboNo ratings yet

- Bank Sector in DetailDocument44 pagesBank Sector in DetailgeorgecheboNo ratings yet

- Economic Empowerment of Women An Impact Study of Micro-Enterprises in Nuwakot District Babita Adhikari PDFDocument23 pagesEconomic Empowerment of Women An Impact Study of Micro-Enterprises in Nuwakot District Babita Adhikari PDFgeorgecheboNo ratings yet

- Economic Empowerment of Women An Impact Study of Micro-Enterprises in Nuwakot District Babita Adhikari PDFDocument23 pagesEconomic Empowerment of Women An Impact Study of Micro-Enterprises in Nuwakot District Babita Adhikari PDFgeorgecheboNo ratings yet

- Promoting HIV Antiretroviral TherapyDocument92 pagesPromoting HIV Antiretroviral TherapygeorgecheboNo ratings yet

- An Investigation On The Effects of Product and Service Delivery On Customer Satisfaction in Banks Within Nakuru CountyDocument32 pagesAn Investigation On The Effects of Product and Service Delivery On Customer Satisfaction in Banks Within Nakuru CountygeorgecheboNo ratings yet

- A) Explain Three Different Types of InterviewsDocument13 pagesA) Explain Three Different Types of InterviewsgeorgecheboNo ratings yet

- Huawei Modem DetailsDocument1 pageHuawei Modem DetailsgeorgecheboNo ratings yet

- An Investigation On The Effects of Product and Service Delivery On Customer Satisfaction in Banks Within Nakuru CountyDocument32 pagesAn Investigation On The Effects of Product and Service Delivery On Customer Satisfaction in Banks Within Nakuru CountygeorgecheboNo ratings yet

- Grandview Morning PressDocument13 pagesGrandview Morning PressJane Claire Escala0% (1)

- 3Document36 pages3api-505638589No ratings yet

- Measuring National IncomeDocument7 pagesMeasuring National Incomeanora7No ratings yet

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet

- Conceptual Framework for Financial ReportingDocument49 pagesConceptual Framework for Financial ReportingRifky ApriandiNo ratings yet

- Investment Process - Private EquityDocument32 pagesInvestment Process - Private Equitykunal_desai7447No ratings yet

- Money, Its Meaning...and Everything You Need to KnowDocument19 pagesMoney, Its Meaning...and Everything You Need to KnowJayson GambaNo ratings yet

- KB 3 Model QuestionDocument3 pagesKB 3 Model QuestionVinthuja Murukes100% (1)

- Explain The Major Indicators of DevelopmentDocument2 pagesExplain The Major Indicators of DevelopmentTrust ChiradzaNo ratings yet

- Fcffsimpleginzu 2014Document54 pagesFcffsimpleginzu 2014Pro Resources100% (1)

- Ford Strategic AnalysisDocument32 pagesFord Strategic AnalysisFahad100% (5)

- Principles of Managerial Finance: Fifteenth Edition, Global EditionDocument85 pagesPrinciples of Managerial Finance: Fifteenth Edition, Global EditionAlbertus GaniNo ratings yet

- CJH Development Corporation Vs Bureau of Internal Revenue Et AlDocument6 pagesCJH Development Corporation Vs Bureau of Internal Revenue Et AlThe ChogsNo ratings yet

- CF Micro8 Tif02Document61 pagesCF Micro8 Tif02هناءالحلوNo ratings yet

- Battle of The Exes: Understanding The Effect of The Ex Ante and Ex Post Approaches On Damage CalculationsDocument3 pagesBattle of The Exes: Understanding The Effect of The Ex Ante and Ex Post Approaches On Damage CalculationsVeris Consulting, Inc.No ratings yet

- Krispy Kreme - PaperDocument6 pagesKrispy Kreme - PaperLitz4660% (1)

- Boiler MaintenanceDocument6 pagesBoiler MaintenanceRamalingam PrabhakaranNo ratings yet

- Top Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersDocument8 pagesTop Activist Stories - 5 - A Review of Financial Activism by Geneva PartnersBassignotNo ratings yet

- Case 21 Aurora Textile Company - My VersionDocument31 pagesCase 21 Aurora Textile Company - My VersionSajjad Ahmad0% (2)

- State & Local Finance Lecture OverviewDocument48 pagesState & Local Finance Lecture OverviewAnisha Charisma PermatasariNo ratings yet

- Uniform CPA Examination May 1981-May 1985 Selected Questions &Document647 pagesUniform CPA Examination May 1981-May 1985 Selected Questions &Abdelmadjid djibrineNo ratings yet

- A Future For Mobile Operators The Keys To Successful ReinventionDocument8 pagesA Future For Mobile Operators The Keys To Successful ReinventionJunaid NaeemNo ratings yet

- AFAR MOD 4 HO Branch PDFDocument5 pagesAFAR MOD 4 HO Branch PDFelaine piliNo ratings yet

- Annual Report 2016 17Document308 pagesAnnual Report 2016 17poonam anchheraNo ratings yet

- Risk CabreraDocument54 pagesRisk CabreraJohn Rey Enriquez100% (2)

- Cash and Receivables: True-FalseDocument44 pagesCash and Receivables: True-FalseIzzy B100% (2)

- Balance Sheet of Reliance IndustriesDocument5 pagesBalance Sheet of Reliance IndustriesMukesh bariNo ratings yet

- Introduction To International Financial Management: Powerpoint® Lecture PresentationDocument34 pagesIntroduction To International Financial Management: Powerpoint® Lecture PresentationRafiqul Islam100% (2)

- Funds Flow AnalysisDocument54 pagesFunds Flow AnalysisSriram DivyaNo ratings yet

- EbitdaDocument4 pagesEbitdaVenugopal Balakrishnan NairNo ratings yet