Professional Documents

Culture Documents

System

Uploaded by

pathanfor7860 ratings0% found this document useful (0 votes)

16 views8 pageseconomy

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documenteconomy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views8 pagesSystem

Uploaded by

pathanfor786economy

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

For release on delivery

10:00 a.m. EDT

May 7, 2014

Statement by

J anet L. Yellen

Chair

Board of Governors of the Federal Reserve System

before the

J oint Economic Committee

U.S. Congress

May 7, 2014

Chairman Brady, Vice Chair Klobuchar, and other members of the Committee, I

appreciate this opportunity to discuss the current economic situation and outlook along with

monetary policy before turning to some issues regarding financial stability.

Current Economic Situation and Outlook

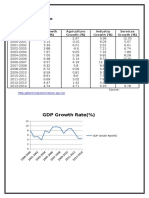

The economy has continued to recover from the steep recession of 2008 and 2009. Real

gross domestic product (GDP) growth stepped up to an average annual rate of about

3-1/4 percent over the second half of last year, a faster pace than in the first half and during the

preceding two years. Although real GDP growth is currently estimated to have paused in the

first quarter of this year, I see that pause as mostly reflecting transitory factors, including the

effects of the unusually cold and snowy winter weather. With the harsh winter behind us, many

recent indicators suggest that a rebound in spending and production is already under way, putting

the overall economy on track for solid growth in the current quarter. One cautionary note,

though, is that readings on housing activity--a sector that has been recovering since 2011--have

remained disappointing so far this year and will bear watching.

Conditions in the labor market have continued to improve. The unemployment rate was

6.3 percent in April, about 1-1/4 percentage points below where it was a year ago. Moreover,

gains in payroll employment averaged nearly 200,000 jobs per month over the past year. During

the economic recovery so far, payroll employment has increased by about 8-1/2 million jobs

since its low point, and the unemployment rate has declined about 3-3/4 percentage points since

its peak.

While conditions in the labor market have improved appreciably, they are still far from

satisfactory. Even with recent declines in the unemployment rate, it continues to be elevated.

Moreover, both the share of the labor force that has been unemployed for more than six months

- 2 -

and the number of individuals who work part time but would prefer a full-time job are at

historically high levels. In addition, most measures of labor compensation have been rising

slowly--another signal that a substantial amount of slack remains in the labor market.

Inflation has been quite low even as the economy has continued to expand. Some of the

factors contributing to the softness in inflation over the past year, such as the declines seen in

non-oil import prices, will probably be transitory. Importantly, measures of longer-run inflation

expectations have remained stable. That said, the Federal Open Market Committee (FOMC)

recognizes that inflation persistently below 2 percent--the rate that the Committee judges to be

most consistent with its dual mandate--could pose risks to economic performance, and we are

monitoring inflation developments closely.

Looking ahead, I expect that economic activity will expand at a somewhat faster pace this

year than it did last year, that the unemployment rate will continue to decline gradually, and that

inflation will begin to move up toward 2 percent. A faster rate of economic growth this year

should be supported by reduced restraint from changes in fiscal policy, gains in household net

worth from increases in home prices and equity values, a firming in foreign economic growth,

and further improvements in household and business confidence as the economy continues to

strengthen. Moreover, U.S. financial conditions remain supportive of growth in economic

activity and employment.

As always, considerable uncertainty surrounds this baseline economic outlook. At

present, one prominent risk is that adverse developments abroad, such as heightened geopolitical

tensions or an intensification of financial stresses in emerging market economies, could

undermine confidence in the global economic recovery. Another risk--domestic in origin--is that

- 3 -

the recent flattening out in housing activity could prove more protracted than currently expected

rather than resuming its earlier pace of recovery. Both of these elements of uncertainty will bear

close observation.

Monetary Policy

Turning to monetary policy, the Federal Reserve remains committed to policies designed

to restore labor market conditions and inflation to levels that the Committee judges to be

consistent with its dual mandate. As always, our policy will continue to be guided by the

evolving economic and financial situation, and we will adjust the stance of policy appropriately

to take account of changes in the economic outlook. In light of the considerable degree of slack

that remains in labor markets and the continuation of inflation below the Committees 2 percent

objective, a high degree of monetary accommodation remains warranted.

With the federal funds rate, our traditional policy tool, near zero since late 2008, we have

relied on two less conventional tools to provide support for the economy: asset purchases and

forward guidance. And, because these policy tools are less familiar, we have been especially

attentive in recent years to the need to communicate to the public about how we intend to employ

our policy tools in response to changing economic circumstances.

Our current program of asset purchases began in September 2012 when the economic

recovery had weakened and progress in the labor market had slowed, and we said that our

intention was to continue the program until we saw substantial improvement in the outlook for

the labor market. By December 2013, the Committee judged that the cumulative progress in the

labor market warranted a modest reduction in the pace of asset purchases. At the first three

meetings this year, our assessment was that there was sufficient underlying strength in the

- 4 -

broader economy to support ongoing improvement in labor market conditions, so further

measured reductions in asset purchases were appropriate. I should stress that even as the

Committee reduces the pace of its purchases of longer-term securities, it is still adding to its

holdings, and those sizable holdings continue to put significant downward pressure on longer-

term interest rates, support mortgage markets, and contribute to favorable conditions in broader

financial markets.

Our other important policy tool in recent years has been forward guidance about the

likely path of the federal funds rate as the economic recovery proceeds. Beginning in December

2012, the Committee provided threshold-based guidance that turned importantly on the behavior

of the unemployment rate. As you know, at our March 2014 meeting, with the unemployment

rate nearing the threshold that had been laid out earlier, we undertook a significant review of our

forward guidance. While indicating that the new guidance did not represent a shift in the

FOMCs policy intentions, the Committee laid out a fuller description of the framework that will

guide its policy decisions going forward. Specifically, the new language explains that, as the

economy expands further, the Committee will continue to assess both the realized and expected

progress toward its objectives of maximum employment and 2 percent inflation. In assessing

that progress, we will take into account a wide range of information, including measures of labor

market conditions, indicators of inflation pressures and inflation expectations, and readings on

financial developments. In March and again last month, we stated that we anticipated the current

target range for the federal funds rate would be maintained for a considerable time after the asset

purchase program ends, especially if inflation continues to run below 2 percent, and provided

that inflation expectations remain well anchored. The new language also includes information

- 5 -

on our thinking about the likely path of the policy rate after the Committee decides to begin to

remove policy accommodation. In particular, we anticipate that even after employment and

inflation are near mandate-consistent levels, economic and financial conditions may, for some

time, warrant keeping the target federal funds rate below levels that the Committee views as

normal in the longer run.

Because the evolution of the economy is uncertain, policymakers need to carefully watch

for signs that it is diverging from the baseline outlook and respond in a systematic way to

stabilize the economy. Accordingly, for both our purchases and our forward guidance, we have

tried to communicate as clearly as possible how changes in the economic outlook will affect our

policy stance. In doing so, we will help the public to better understand how the Committee will

respond to unanticipated developments, thereby reducing uncertainty about the course of

unemployment and inflation.

Financial Stability

In addition to our monetary policy responsibilities, the Federal Reserve works to promote

financial stability, focusing on identifying and monitoring vulnerabilities in the financial system

and taking actions to reduce them. In this regard, the Committee recognizes that an extended

period of low interest rates has the potential to induce investors to reach for yield by taking on

increased leverage, duration risk, or credit risk. Some reach-for-yield behavior may be evident,

for example, in the lower-rated corporate debt markets, where issuance of syndicated leveraged

loans and high-yield bonds has continued to expand briskly, spreads have continued to narrow,

and underwriting standards have loosened further. While some financial intermediaries have

- 6 -

increased their exposure to duration and credit risk recently, these increases appear modest to

date--particularly at the largest banks and life insurers.

More generally, valuations for the equity market as a whole and other broad categories of

assets, such as residential real estate, remain within historical norms. In addition, bank holding

companies (BHCs) have improved their liquidity positions and raised capital ratios to levels

significantly higher than prior to the financial crisis. Moreover, recently concluded stress tests

mandated by the Dodd-Frank Act have provided a level of confidence in our assessment of how

financial institutions would fare in an extended period of severely adverse macroeconomic

conditions or a sharp steepening of the yield curve alongside a moderate recession. For the

financial sector more broadly, leverage remains subdued and measures of wholesale short-term

funding continue to be far below levels seen before the financial crisis.

The Federal Reserve has also taken a number of regulatory steps--many in conjunction

with other federal agencies--to continue to improve the resiliency of the financial system. Most

recently, the Federal Reserve finalized a rule implementing section 165 of the Dodd-Frank Act to

establish enhanced prudential standards for large banking firms in the form of risk-based and

leverage capital, liquidity, and risk-management requirements. In addition, the rule requires

large foreign banking organizations to form a U.S. intermediate holding company, and it imposes

enhanced prudential requirements for these intermediate holding companies. Looking forward,

the Federal Reserve is considering whether additional measures are needed to further reduce the

risks associated with large, interconnected financial institutions.

While we have seen substantial improvements in labor market conditions and the overall

economy since the financial crisis and severe recession, we recognize that more must be

- 7 -

accomplished. Many Americans who want a job are still unemployed, inflation continues to run

below the FOMCs longer-run objective, and work remains to further strengthen our financial

system. I will continue to work closely with my colleagues and others to carry out the important

mission that the Congress has given the Federal Reserve.

Thank you. I will be pleased to take your questions.

You might also like

- Yellen TestimonyDocument7 pagesYellen TestimonyZerohedgeNo ratings yet

- US Fed FOMC Press Conference 18 September 2013 No TaperDocument26 pagesUS Fed FOMC Press Conference 18 September 2013 No TaperJhunjhunwalas Digital Finance & Business Info LibraryNo ratings yet

- Yellen HHDocument7 pagesYellen HHZerohedgeNo ratings yet

- Fomc Pres Conf 20141217Document23 pagesFomc Pres Conf 20141217JoseLastNo ratings yet

- FOMCpresconf 20230503Document25 pagesFOMCpresconf 20230503Edi SaputraNo ratings yet

- Chair Powell May 2023 Press Conference TranscriptDocument4 pagesChair Powell May 2023 Press Conference TranscriptJavierNo ratings yet

- Fomc Pres Conf 20230614Document26 pagesFomc Pres Conf 20230614LAKHAN TRIVEDINo ratings yet

- Fomc Pres Conf 20160615Document21 pagesFomc Pres Conf 20160615petere056No ratings yet

- Fomc Pres Conf 20130918Document7 pagesFomc Pres Conf 20130918helmuthNo ratings yet

- Fomc Pres Conf 20231101Document26 pagesFomc Pres Conf 20231101Quynh Le Thi NhuNo ratings yet

- Powell 20180717 ADocument6 pagesPowell 20180717 AZerohedgeNo ratings yet

- Oct FOMC RedlineDocument2 pagesOct FOMC RedlineZerohedgeNo ratings yet

- Jerome Powell's Written TestimonyDocument5 pagesJerome Powell's Written TestimonyTim MooreNo ratings yet

- FOMCpresconf 20230920Document4 pagesFOMCpresconf 20230920KHAIRULNo ratings yet

- Fed TalkDocument2 pagesFed TalkTelegraphUKNo ratings yet

- Chairman Ben S. BernankeDocument10 pagesChairman Ben S. BernankeZim VicomNo ratings yet

- Bernanke Speech 20110203Document11 pagesBernanke Speech 20110203SarweinNo ratings yet

- September FOMC RedlineDocument2 pagesSeptember FOMC RedlineZerohedgeNo ratings yet

- FOMC Word For Word Changes. 05.01.13Document2 pagesFOMC Word For Word Changes. 05.01.13Pensford FinancialNo ratings yet

- FOMCpresconf 20230614Document5 pagesFOMCpresconf 20230614Jhony SmithYTNo ratings yet

- Powell 20230621 ADocument5 pagesPowell 20230621 ADaily Caller News FoundationNo ratings yet

- Chair Powell Signals Fed Taper Coming SoonDocument26 pagesChair Powell Signals Fed Taper Coming SoonmarcoNo ratings yet

- Transcript of Chair Powell's Press Conference Opening Statement March 20, 2024Document4 pagesTranscript of Chair Powell's Press Conference Opening Statement March 20, 2024andre.torresNo ratings yet

- FOMCpresconf 20220615Document27 pagesFOMCpresconf 20220615S CNo ratings yet

- Transcript of Chair Powell's Press Conference May 4, 2022Document24 pagesTranscript of Chair Powell's Press Conference May 4, 2022Learning的生活No ratings yet

- Press Release: For Release at 2:00 P.M. EDTDocument2 pagesPress Release: For Release at 2:00 P.M. EDTTREND_7425No ratings yet

- FOMC Redline MarchDocument2 pagesFOMC Redline MarchZerohedgeNo ratings yet

- FOMCpresconf 20220316Document26 pagesFOMCpresconf 20220316marchmtetNo ratings yet

- Fed SideDocument1 pageFed Sideannawitkowski88No ratings yet

- Fomc StatmentDocument1 pageFomc Statmentapi-280585983No ratings yet

- March 22, 2023 - Fed Chair Prepared RemarksDocument5 pagesMarch 22, 2023 - Fed Chair Prepared RemarksRam AhluwaliaNo ratings yet

- Fed 09212011Document2 pagesFed 09212011andrewbloggerNo ratings yet

- Powell's Stanford Fireside ChatDocument6 pagesPowell's Stanford Fireside ChatTim MooreNo ratings yet

- Federal Reserve Issues FOMC Statement: ShareDocument2 pagesFederal Reserve Issues FOMC Statement: ShareTREND_7425No ratings yet

- Federal Reserve: Unconventional Monetary Policy Options: Marc LabonteDocument37 pagesFederal Reserve: Unconventional Monetary Policy Options: Marc Labonterichardck61No ratings yet

- Transcript of Chairman Bernanke's Press Conference April 25, 2012Document23 pagesTranscript of Chairman Bernanke's Press Conference April 25, 2012CoolidgeLowNo ratings yet

- FOMC Side by Side 11022011Document2 pagesFOMC Side by Side 11022011andrewbloggerNo ratings yet

- Monetary PolicyDocument18 pagesMonetary PolicyAnimNo ratings yet

- Monetary & Fiscal PolicyDocument20 pagesMonetary & Fiscal PolicyMadhupriya DugarNo ratings yet

- FOMC Word For Word Changes 03.20.13Document2 pagesFOMC Word For Word Changes 03.20.13Pensford FinancialNo ratings yet

- FOMC Rate Decision 04.25.12Document1 pageFOMC Rate Decision 04.25.12Pensford FinancialNo ratings yet

- Governor Lee's 2019 New Year Speech at Bank of KoreaDocument9 pagesGovernor Lee's 2019 New Year Speech at Bank of KoreahyNo ratings yet

- G20: ST Petersburg Action Plan Sept 2013Document11 pagesG20: ST Petersburg Action Plan Sept 2013slshaw066893No ratings yet

- American: Memorandum (SAMPLE ONLY)Document8 pagesAmerican: Memorandum (SAMPLE ONLY)testtest1No ratings yet

- December 17, 2014 Compared With October 29, 2014 Jeremie Cohen-SettonDocument3 pagesDecember 17, 2014 Compared With October 29, 2014 Jeremie Cohen-Settonapi-273992067No ratings yet

- January - March FOMC Statement ComparisonDocument1 pageJanuary - March FOMC Statement Comparisonshawn2207No ratings yet

- RBI Press Release on Second Quarter Monetary Policy ReviewDocument6 pagesRBI Press Release on Second Quarter Monetary Policy ReviewAnu AnandNo ratings yet

- Annual ReportDocument10 pagesAnnual Reportcharu555No ratings yet

- The Market's Shocking Shock at The Fed's Non-Taper Shock: Economic ResearchDocument9 pagesThe Market's Shocking Shock at The Fed's Non-Taper Shock: Economic Researchapi-227433089No ratings yet

- Ben Bernanke - Frequently Asked QuestionsDocument9 pagesBen Bernanke - Frequently Asked QuestionsJohn SutherlandNo ratings yet

- RBI Credit Policy Analysis November 2010Document8 pagesRBI Credit Policy Analysis November 2010gaurav880No ratings yet

- Christopher WallerDocument29 pagesChristopher WallerTim MooreNo ratings yet

- The World Needs Further Monetary Ease, Not An Early ExitDocument38 pagesThe World Needs Further Monetary Ease, Not An Early ExitZerohedgeNo ratings yet

- Fourth Quarter Items For Consideration: Global Monetary Policy EffectivenessDocument9 pagesFourth Quarter Items For Consideration: Global Monetary Policy EffectivenessClay Ulman, CFP®No ratings yet

- JPM Market ReportDocument3 pagesJPM Market ReportDennis OhlssonNo ratings yet

- Monthly Economic Outlook 06082011Document6 pagesMonthly Economic Outlook 06082011jws_listNo ratings yet

- First Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoDocument5 pagesFirst Quarter Review of Monetary Policy 2012-13 Press Statement by Dr. D. SubbaraoUttam AuddyNo ratings yet

- Fed Keeps Rates Near Zero, Sees Slower RecoveryDocument2 pagesFed Keeps Rates Near Zero, Sees Slower RecoveryEduardo VinanteNo ratings yet

- Hidden Spending: The Politics of Federal Credit ProgramsFrom EverandHidden Spending: The Politics of Federal Credit ProgramsNo ratings yet

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentFrom EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentRating: 1 out of 5 stars1/5 (1)

- WoodDocument1 pageWoodpathanfor786No ratings yet

- Performance 2014: Global Stock Markets: Yardeni Research, IncDocument8 pagesPerformance 2014: Global Stock Markets: Yardeni Research, Incpathanfor786No ratings yet

- Track & Field Championships: May 30, 2014 at San Jose City College Presented byDocument11 pagesTrack & Field Championships: May 30, 2014 at San Jose City College Presented bypathanfor786No ratings yet

- RetireDocument1 pageRetirepathanfor786No ratings yet

- GEF Bulletin: A Daily Report of The 5th GEF AssemblyDocument6 pagesGEF Bulletin: A Daily Report of The 5th GEF Assemblypathanfor786No ratings yet

- Mistrial in Crane Case: Report Urges Caution in Projecting Casino RevenueDocument1 pageMistrial in Crane Case: Report Urges Caution in Projecting Casino Revenuepathanfor786No ratings yet

- UCO Bank: Performance HighlightsDocument12 pagesUCO Bank: Performance Highlightspathanfor786No ratings yet

- SharpDocument6 pagesSharppathanfor786No ratings yet

- A Higher Minimum Wage - at What Cost?: EditorialDocument1 pageA Higher Minimum Wage - at What Cost?: Editorialpathanfor786No ratings yet

- WeatherDocument1 pageWeatherpathanfor786No ratings yet

- PublicDocument2 pagesPublicpathanfor786No ratings yet

- Asia Pacific Economic Outlook: Australia China Japan South KoreaDocument20 pagesAsia Pacific Economic Outlook: Australia China Japan South Koreapathanfor786No ratings yet

- OECD Obesity Update 2014Document8 pagesOECD Obesity Update 2014Jesse FerrerasNo ratings yet

- Weekly Market Brief: ECB Moves Centre StageDocument2 pagesWeekly Market Brief: ECB Moves Centre Stagepathanfor786No ratings yet

- Fear of Economic Blow As Births Drop Around World: Page 1/7Document7 pagesFear of Economic Blow As Births Drop Around World: Page 1/7pathanfor786No ratings yet

- Weekly Market Brief: ECB Moves Centre StageDocument2 pagesWeekly Market Brief: ECB Moves Centre Stagepathanfor786No ratings yet

- PoliticalDocument6 pagesPoliticalpathanfor786No ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- Northeastern Agricultural and Resource Economics Association Meetings, June 1-3, 2014Document5 pagesNortheastern Agricultural and Resource Economics Association Meetings, June 1-3, 2014pathanfor786No ratings yet

- SpiceDocument4 pagesSpicepathanfor786No ratings yet

- Danske Daily: Market Movers TodayDocument6 pagesDanske Daily: Market Movers Todaypathanfor786No ratings yet

- BriefDocument3 pagesBriefpathanfor786No ratings yet

- Daily FX Update: Usd Looks To Chair YellenDocument3 pagesDaily FX Update: Usd Looks To Chair Yellenpathanfor786No ratings yet

- Global Markets Research Daily AlertDocument7 pagesGlobal Markets Research Daily Alertpathanfor786No ratings yet

- SystemDocument8 pagesSystempathanfor786No ratings yet

- European Economic Outlook: No Room For Optimism: June2014 1Document2 pagesEuropean Economic Outlook: No Room For Optimism: June2014 1pathanfor786No ratings yet

- BetsDocument2 pagesBetspathanfor786No ratings yet

- Can Quantum Key Distribution Be SecureDocument14 pagesCan Quantum Key Distribution Be Securepathanfor786No ratings yet

- Platform Specialty Products Corporation Announces First Quarter 2014 Financial ResultsDocument8 pagesPlatform Specialty Products Corporation Announces First Quarter 2014 Financial Resultspathanfor786No ratings yet

- Tax 1Document43 pagesTax 1opep77No ratings yet

- Transfer Taxes and Wealth PlanningDocument26 pagesTransfer Taxes and Wealth PlanningMo ZhuNo ratings yet

- India Korea Write UpDocument5 pagesIndia Korea Write UpshahipiyushNo ratings yet

- Something For Nothing Understanding TIFDocument8 pagesSomething For Nothing Understanding TIFSandra FlorezNo ratings yet

- International Finance Multiple Choice ExamplesDocument6 pagesInternational Finance Multiple Choice ExamplesRəşad SəttarlıNo ratings yet

- 1-Part 1-6 Phase of BudgetDocument11 pages1-Part 1-6 Phase of Budgetchartoolanman67% (3)

- Structure of International BankingDocument1 pageStructure of International BankingAnkur Saxena0% (1)

- Bonded Warehouses PDFDocument5 pagesBonded Warehouses PDFDaisy Anita SusiloNo ratings yet

- Microeconomics and Macroeconomics Concepts ExplainedDocument7 pagesMicroeconomics and Macroeconomics Concepts ExplainedChirag HablaniNo ratings yet

- Factors affecting demand for money in IndiaDocument26 pagesFactors affecting demand for money in IndiaNidhi AroraNo ratings yet

- Chapter 9 IBT SUMMARYDocument2 pagesChapter 9 IBT SUMMARYHazraphine LinsoNo ratings yet

- Economics As An Applied ScienceDocument3 pagesEconomics As An Applied ScienceJims PotterNo ratings yet

- The Contemporary WorldDocument10 pagesThe Contemporary WorldGian Joshua Dayrit100% (1)

- Fifth National Development Plan 2006 - 10Document397 pagesFifth National Development Plan 2006 - 10Chola MukangaNo ratings yet

- Chapter 8 Savings and Invest (New)Document20 pagesChapter 8 Savings and Invest (New)Laiba KhanNo ratings yet

- The Political Economy of International TradeDocument47 pagesThe Political Economy of International Tradecherryking267100% (3)

- Hall 1993 Policy ParadigmsDocument23 pagesHall 1993 Policy ParadigmsJennifer RockettNo ratings yet

- Money Banking Group AssignmentDocument33 pagesMoney Banking Group AssignmentnanaNo ratings yet

- Fundamental Analysis of INFOSYSDocument25 pagesFundamental Analysis of INFOSYSsohelrangrej21No ratings yet

- Balibago WaterDocument9 pagesBalibago WaterJeffrey MacalinoNo ratings yet

- Implementation of GST in MalaysiaDocument2 pagesImplementation of GST in MalaysiashanursofNo ratings yet

- CSC 110: Where's The Money AssignmentDocument4 pagesCSC 110: Where's The Money AssignmentMadison C BarnettNo ratings yet

- Money's Functions and Economic EfficiencyDocument47 pagesMoney's Functions and Economic EfficiencyلبليايلاNo ratings yet

- Nafta Vs UeDocument10 pagesNafta Vs UenicoletaNo ratings yet

- ECS229 RevisionDocument11 pagesECS229 RevisionRemi KolaNo ratings yet

- Tax Deductions, Brackets, and EquityDocument3 pagesTax Deductions, Brackets, and Equitycollegegirl69No ratings yet

- India and NeighboursDocument20 pagesIndia and NeighboursRiya SinghNo ratings yet

- Charles Dallara Speech To The Hellenic Bank AssociationDocument11 pagesCharles Dallara Speech To The Hellenic Bank AssociationCEInquiryNo ratings yet

- Budget AnalysisDocument13 pagesBudget AnalysisRamneet ParmarNo ratings yet

- Functions of Monetary PolicyDocument7 pagesFunctions of Monetary PolicyBecks AliNo ratings yet