Professional Documents

Culture Documents

Capm Advantages and Disadvantages

Uploaded by

HasanovMirasovičOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capm Advantages and Disadvantages

Uploaded by

HasanovMirasovičCopyright:

Available Formats

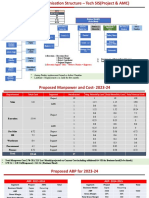

TECHNICAL

PAGE 50

STUDENT ACCOUNTANT

JUNE/JULY 2008

CAPM: THEORY,

ADVANTAGES, AND

DISADVANTAGES

THE CAPITAL ASSET PRICING MODEL

RELEVANT TO ACCA QUALIFICATION PAPER F9

CAPM FORMULA

The linear relationship between the return

required on an investment (whether in stock

market securities or in business operations)

and its systematic risk is represented by the

CAPM formula, which is given in the Paper F9

Formulae Sheet:

E(r

i

) = R

f

+

i

(E(r

m

) - R

f

)

E(r

i

) = return required on financial asset i

R

f

= risk-free rate of return

i

= beta value for financial asset i

E(r

m

) = average return on the capital market

The CAPM is an important area of financial

management. In fact, it has even been suggested

that finance only became a fully-fledged, scientific

discipline when William Sharpe published his

derivation of the CAPM in 1986

1

.

CAPM ASSUMPTIONS

The CAPM is often criticised as being unrealistic

because of the assumptions on which it is based,

so it is important to be aware of these assumptions

and the reasons why they are criticised. The

assumptions are as follows

2

:

Investors hold diversified portfolios

This assumption means that investors will only

require a return for the systematic risk of their

portfolios, since unsystematic risk has been

removed and can be ignored.

Single-period transaction horizon

A standardised holding period is assumed by the

CAPM in order to make comparable the returns on

different securities. A return over six months, for

example, cannot be compared to a return over 12

months. A holding period of one year is usually used.

Investors can borrow and lend at the risk-free rate

of return

This is an assumption made by portfolio theory,

from which the CAPM was developed, and provides

a minimum level of return required by investors.

The risk-free rate of return corresponds to the

intersection of the security market line (SML) and

the y-axis (see Figure 1). The SML is a graphical

representation of the CAPM formula.

Perfect capital market

This assumption means that all securities are

valued correctly and that their returns will plot on

to the SML. A perfect capital market requires the

following: that there are no taxes or transaction

costs; that perfect information is freely available

to all investors who, as a result, have the same

expectations; that all investors are risk averse,

rational and desire to maximise their own utility;

and that there are a large number of buyers and

sellers in the market.

FIGURE 1: THE SECURITY MARKET LINE

While the assumptions made by the CAPM allow

it to focus on the relationship between return

and systematic risk, the idealised world created

by the assumptions is not the same as the real

world in which investment decisions are made by

companies and individuals.

Section F of the Study Guide for Paper F9 contains several references to the capital asset pricing

model (CAPM). This article is the last in a series of three, and looks at the theory, advantages,

and disadvantages of the CAPM. The first article, published in the January 2008 issue of student

accountant introduced the CAPM and its components, showed how the model can be used to

estimate the cost of equity, and introduced the asset beta formula. The second article, published in

the April 2008 issue, looked at applying the CAPM to calculate a project-specific discount rate to use

in investment appraisal.

Return

E(r

i

)

R

m

R

f

SML

1

TECHNICAL

PAGE 51

This investment decision is also incorrect,

however, since project B would be rejected if

using a CAPM-derived project-specific discount

rate, because the project IRR offers insufficient

compensation for its level of systematic risk

4

.

FIGURE 2: WACC OR CAPM?

ADVANTAGES OF THE CAPM

The CAPM has several advantages over other

methods of calculating required return, explaining

why it has remained popular for more than 40 years:

It considers only systematic risk, reflecting a

reality in which most investors have diversified

portfolios from which unsystematic risk has

been essentially eliminated.

For example, real-world capital markets are

clearly not perfect. Even though it can be argued

that well-developed stock markets do, in practice,

exhibit a high degree of efficiency, there is scope

for stock market securities to be priced incorrectly

and, as a result, for their returns not to plot on to

the SML.

The assumption of a single-period transaction

horizon appears reasonable from a real-world

perspective, because even though many investors

hold securities for much longer than one year,

returns on securities are usually quoted on an

annual basis.

The assumption that investors hold diversified

portfolios means that all investors want to hold a

portfolio that reflects the stock market as a whole.

Although it is not possible to own the market

portfolio itself, it is quite easy and inexpensive

for investors to diversify away specific or

unsystematic risk and to construct portfolios that

track the stock market. Assuming that investors

are concerned only with receiving financial

compensation for systematic risk seems therefore

to be quite reasonable.

A more serious problem is that, in reality,

it is not possible for investors to borrow at the

risk-free rate (for which the yield on short-dated

Government debt is taken as a proxy). The reason

for this is that the risk associated with individual

investors is much higher than that associated with

the Government. This inability to borrow at the

risk-free rate means that the slope of the SML is

shallower in practice than in theory.

Overall, it seems reasonable to conclude that

while the assumptions of the CAPM represent

an idealised rather than real-world view, there

is a strong possibility, in reality, of a linear

relationship existing between required return and

systematic risk.

WACC AND CAPM

The weighted average cost of capital (WACC)

can be used as the discount rate in investment

appraisal provided that a number of restrictive

assumptions are met. These assumptions

are that:

the investment project is small compared to

the investing organisation

the business activities of the investment

project are similar to the business activities

currently undertaken by the investing

organisation

the financing mix used to undertake the

investment project is similar to the current

financing mix (or capital structure) of the

investing company

existing finance providers of the investing

company do not change their required rates

of return as a result of the investment project

being undertaken.

These assumptions essentially state that WACC

can be used as the discount rate provided that

the investment project does not change either

the business risk or the financial risk of the

investing organisation.

If the business risk of the investment project is

different to that of the investing organisation, the

CAPM can be used to calculate a project-specific

discount rate. The procedure for this calculation

was covered in the second article in this series

3

.

The benefit of using a CAPM-derived

project-specific discount rate is illustrated in

Figure 2. Using the CAPM will lead to better

investment decisions than using the WACC in the

two shaded areas, which can be represented by

projects A and B.

Project A would be rejected if WACC was used

as the discount rate, because the internal rate

of return (IRR) of the project is less than that of

the WACC. This investment decision is incorrect,

however, since project A would be accepted if

a CAPM-derived project-specific discount rate

were used because the project IRR lies above the

SML. The project offers a return greater than that

needed to compensate for its level of systematic

risk, and accepting it will increase the wealth

of shareholders.

Project B would be accepted if WACC was

used as the discount rate because its IRR is

greater than the WACC.

C

R

f

0

SML

WACC

Company

A

x

B

x

R

e

q

u

i

r

e

d

r

a

t

e

o

f

r

e

t

u

r

n

%

D

LINKED PERFORMANCE OBJECTIVES

PERFORMANCE OBJECTIVES 15 AND 16 ARE RELEVANT TO PAPER F9

TECHNICAL

PAGE 52

STUDENT ACCOUNTANT

JUNE/JULY 2008

It generates a theoretically-derived relationship

between required return and systematic risk

which has been subject to frequent empirical

research and testing.

It is generally seen as a much better method of

calculating the cost of equity than the dividend

growth model (DGM) in that it explicitly takes

into account a companys level of systematic

risk relative to the stock market as a whole.

It is clearly superior to the WACC in providing

discount rates for use in investment appraisal.

DISADVANTAGES OF THE CAPM

The CAPM suffers from a number of disadvantages

and limitations that should be noted in a balanced

discussion of this important theoretical model.

Assigning values to CAPM variables

In order to use the CAPM, values need to be

assigned to the risk-free rate of return, the return

on the market, or the equity risk premium (ERP),

and the equity beta.

The yield on short-term Government debt,

which is used as a substitute for the risk-free rate

of return, is not fixed but changes on a daily basis

according to economic circumstances. A short-term

average value can be used in order to smooth out

this volatility.

Finding a value for the ERP is more difficult.

The return on a stock market is the sum of the

average capital gain and the average dividend yield.

In the short term, a stock market can provide a

negative rather than a positive return if the effect of

falling share prices outweighs the dividend yield. It

is therefore usual to use a long-term average value

for the ERP, taken from empirical research, but it

has been found that the ERP is not stable over time.

In the UK, an ERP value of between 2% and 5% is

currently seen as reasonable. However, uncertainty

about the exact ERP value introduces uncertainty

into the calculated value for the required return.

Beta values are now calculated and published

regularly for all stock exchange-listed companies.

The problem here is that uncertainty arises in the

value of the expected return because the value of

beta is not constant, but changes over time.

Using the CAPM in investment appraisal

Problems can arise when using the CAPM to

calculate a project-specific discount rate. For

example, one common difficulty is finding suitable

proxy betas, since proxy companies very rarely

undertake only one business activity. The proxy

beta for a proposed investment project must be

disentangled from the companys equity beta. One

way to do this is to treat the equity beta as an

average of the betas of several different areas of

proxy company activity, weighted by the relative

share of the proxy company market value arising

from each activity. However, information about

relative shares of proxy company market value may

be quite difficult to obtain.

A similar difficulty is that the ungearing

of proxy company betas uses capital structure

information that may not be readily available.

Some companies have complex capital structures

with many different sources of finance. Other

companies may have debt that is not traded, or

use complex sources of finance such as convertible

bonds. The simplifying assumption that the

beta of debt is zero will also lead to inaccuracy

in the calculated value of the project-specific

discount rate.

One disadvantage in using the CAPM in

investment appraisal is that the assumption of

a single-period time horizon is at odds with the

multi-period nature of investment appraisal. While

CAPM variables can be assumed constant in

successive future periods, experience indicates that

this is not true in reality.

CONCLUSION

Research has shown the CAPM to stand up well

to criticism, although attacks against it have been

increasing in recent years. Until something better

presents itself, however, the CAPM remains a very

useful item in the financial management toolkit.

REFERENCES

1 Megginson W L, Corporate Finance Theory,

Addison-Wesley, p10, 1996.

2 Watson D and Head A, 2007, Corporate

Finance: Principles and Practice, 4th edition,

FT Prentice Hall, pp2223.

3 Project-specific discount rates, student

accountant, April 2008.

4 Watson and Head, pp2523.

Tony Head is examiner for Paper F9

You might also like

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Risk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveFrom EverandRisk Premium & Management - an Asian Direct Real Estate (Dre) PerspectiveNo ratings yet

- Advantages and Disadvantages of Capital ASset Pricing ModelDocument3 pagesAdvantages and Disadvantages of Capital ASset Pricing Modelkvj292001100% (1)

- E4 CAPM Theory Advantages and DisadvantagesDocument6 pagesE4 CAPM Theory Advantages and DisadvantagesTENGKU ANIS TENGKU YUSMANo ratings yet

- CAPM: Theory, Advantages, and DisadvantagesDocument9 pagesCAPM: Theory, Advantages, and DisadvantagesMuhammad YahyaNo ratings yet

- Capital Asset Pricing ModelDocument8 pagesCapital Asset Pricing Modelمحمد حمزہ اسلمNo ratings yet

- Cost of Capital & CAPM - CMA & ACCADocument13 pagesCost of Capital & CAPM - CMA & ACCAMahesh SadhNo ratings yet

- Capm + AptDocument10 pagesCapm + AptharoonkhanNo ratings yet

- Introduction To International CAPMDocument7 pagesIntroduction To International CAPMselozok1100% (1)

- E2 The Capital Asset Pricing Model Part 1Document6 pagesE2 The Capital Asset Pricing Model Part 1TENGKU ANIS TENGKU YUSMANo ratings yet

- The Capital Asset Pricing ModelDocument43 pagesThe Capital Asset Pricing ModelTajendra ChughNo ratings yet

- Capital Asset Pricing ModelDocument17 pagesCapital Asset Pricing ModelChrisna Joyce MisaNo ratings yet

- Capital Asset Pricing ModelDocument4 pagesCapital Asset Pricing ModelGeorge Ayesa Sembereka Jr.No ratings yet

- Saim Unit 3 & Unit 4 NotesDocument9 pagesSaim Unit 3 & Unit 4 NotesSantosh MaheshwariNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelRajvi SampatNo ratings yet

- Chapter 8Document10 pagesChapter 8adafgsdfgNo ratings yet

- Corporate Finance Individual AssignmentDocument9 pagesCorporate Finance Individual AssignmentchabeNo ratings yet

- CAPM Approach To Estimating The Cost of Capital - 2023 VersionDocument11 pagesCAPM Approach To Estimating The Cost of Capital - 2023 VersionJeremiah KhongNo ratings yet

- Capm Ta 1Document6 pagesCapm Ta 1Olivier MNo ratings yet

- Capital Asset Pricing ModelDocument13 pagesCapital Asset Pricing ModelkamransNo ratings yet

- Capital Asset Pricing ModelDocument5 pagesCapital Asset Pricing ModelVrinda TayadeNo ratings yet

- Ameri TradeDocument7 pagesAmeri TradexenabNo ratings yet

- CH 9-The Cost of Capital by IM PandeyDocument36 pagesCH 9-The Cost of Capital by IM PandeyJyoti Bansal89% (9)

- 06 Cost of CapitalDocument13 pages06 Cost of Capitallawrence.dururuNo ratings yet

- SAPM Unit-3Document18 pagesSAPM Unit-3Badrinath BhardwajNo ratings yet

- Assignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelDocument6 pagesAssignment of Security Analysis & Portfolio Management On Capital Asset Pricing ModelShubhamNo ratings yet

- Zephyr Concepts - Black-LittermanDocument4 pagesZephyr Concepts - Black-LittermanGautam PraveenNo ratings yet

- 8524 UniqueDocument20 pages8524 UniqueMs AimaNo ratings yet

- Chapte 10 Capital MarketDocument5 pagesChapte 10 Capital MarketRonaliza MallariNo ratings yet

- Theory CoC and WACCDocument9 pagesTheory CoC and WACCMisky1673No ratings yet

- Notes MBADocument46 pagesNotes MBAAghora Siva100% (3)

- Article Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingDocument8 pagesArticle Review Report On Revised Capital Assets Pricing Model An Improved Model For ForecastingWorash EngidawNo ratings yet

- Derivatives Hedging, Capital and LeverageDocument19 pagesDerivatives Hedging, Capital and LeverageWayneNo ratings yet

- Term Paper On The Use of WACC and CAPM FinalDocument19 pagesTerm Paper On The Use of WACC and CAPM FinalJudith AniNo ratings yet

- Disadvantage 0f CAPMDocument4 pagesDisadvantage 0f CAPMromanaNo ratings yet

- Solution Manual For Essentials of Investments 11th by BodieDocument5 pagesSolution Manual For Essentials of Investments 11th by BodieAlisonHillqczf100% (37)

- 08 Risk and ReturnDocument11 pages08 Risk and Returnddrechsler9No ratings yet

- The CostDocument25 pagesThe CostRomeo Torreta JrNo ratings yet

- CAPMDocument40 pagesCAPMkrishnendu maji100% (2)

- Literature Review On Capm ModelDocument5 pagesLiterature Review On Capm Modelaflshtabj100% (1)

- CapmDocument43 pagesCapmVaidyanathan RavichandranNo ratings yet

- Capital Market Theory and CAPMDocument10 pagesCapital Market Theory and CAPMIsma NizamNo ratings yet

- Capital Asset Pricing Model (CAPM)Document25 pagesCapital Asset Pricing Model (CAPM)ktkalai selviNo ratings yet

- 13 Understanding-The-Capital-Asset-Pricing-ModelDocument14 pages13 Understanding-The-Capital-Asset-Pricing-ModelAk ShashwatNo ratings yet

- Assignment 1 Fin 430Document12 pagesAssignment 1 Fin 430Luqmanulhakim JohariNo ratings yet

- Valuation of Securities Including Capital Asset ModelDocument11 pagesValuation of Securities Including Capital Asset Modelmayaverma123pNo ratings yet

- CAPMDocument8 pagesCAPMshadehdavNo ratings yet

- Investment and Portfolio ManagementDocument16 pagesInvestment and Portfolio ManagementmudeyNo ratings yet

- What Is The Capital Asset Pricing ModelDocument10 pagesWhat Is The Capital Asset Pricing ModelshlakaNo ratings yet

- SHARPE SINGLE INDEX MODEL - HarryDocument12 pagesSHARPE SINGLE INDEX MODEL - HarryEguanuku Harry EfeNo ratings yet

- A Literature Study On The Capital Asset Pricing MoDocument5 pagesA Literature Study On The Capital Asset Pricing Momarcel XNo ratings yet

- CAPMDocument36 pagesCAPMnlamsaNo ratings yet

- DlerDocument7 pagesDlerRose DallyNo ratings yet

- Capital Asset Pricing Model - CAPMDocument2 pagesCapital Asset Pricing Model - CAPMSylvia ShirapovaNo ratings yet

- SIM - ACC 212 - Week 8-9 - ULOb CAPMDocument16 pagesSIM - ACC 212 - Week 8-9 - ULOb CAPMDaisy GuiralNo ratings yet

- Corporate Finance AssignmentDocument5 pagesCorporate Finance AssignmentInam SwatiNo ratings yet

- The Capital Asset Pricing Model - : The Cost of EquityDocument8 pagesThe Capital Asset Pricing Model - : The Cost of EquityMuhammad YahyaNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Creating Shareholder Value: A Guide For Managers And InvestorsFrom EverandCreating Shareholder Value: A Guide For Managers And InvestorsRating: 4.5 out of 5 stars4.5/5 (8)

- Carroll 1979 3 Dimensional Model of Corporate Social Performance PDFDocument10 pagesCarroll 1979 3 Dimensional Model of Corporate Social Performance PDFHasanovMirasovičNo ratings yet

- Harvard Referencing 2013Document51 pagesHarvard Referencing 2013Georgiana ModoranNo ratings yet

- Academic Writing and Research Skills 2013Document38 pagesAcademic Writing and Research Skills 2013HasanovMirasovičNo ratings yet

- The Impact of Liquidity Asset On Iranian BankDocument5 pagesThe Impact of Liquidity Asset On Iranian BankHasanovMirasovičNo ratings yet

- NCFM Module - 1 Financial Markets: A Beginner's Module by Wahid311Document93 pagesNCFM Module - 1 Financial Markets: A Beginner's Module by Wahid311Abdul Wahid KhanNo ratings yet

- Dr. Mehmet AsutayDocument17 pagesDr. Mehmet AsutayHasanovMirasovičNo ratings yet

- B3.4 Development Economics Lessons That Remain To Be LearnedDocument12 pagesB3.4 Development Economics Lessons That Remain To Be Learnedadrhm100% (2)

- Bisi 2018Document96 pagesBisi 2018Akun NuyulNo ratings yet

- Full Compilation Qawaid FiqhiyyahDocument215 pagesFull Compilation Qawaid Fiqhiyyahanis suraya mohamed said95% (20)

- Name: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Document4 pagesName: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Eigha apriliaNo ratings yet

- Duty Drawback, Refund and Abatement, and Return of Cash Deposits Held in TrustDocument14 pagesDuty Drawback, Refund and Abatement, and Return of Cash Deposits Held in TrustPortCalls100% (2)

- AS310 Midterm Test Sep Dec2021 PDFDocument1 pageAS310 Midterm Test Sep Dec2021 PDFGhetu MbiseNo ratings yet

- Libya Discredited - 16 - Feb - 2021Document38 pagesLibya Discredited - 16 - Feb - 2021Thomas CrealNo ratings yet

- Financial Report of Nepal Bank Limited (NBL)Document17 pagesFinancial Report of Nepal Bank Limited (NBL)Sarose ThapaNo ratings yet

- Aaa Erori ManagementDocument33 pagesAaa Erori ManagementAndrei IoanNo ratings yet

- Pitchbook: The Private Equity 2Q 2012 BreakdownDocument14 pagesPitchbook: The Private Equity 2Q 2012 BreakdownpedguerraNo ratings yet

- Mock Exam 2 - ACC102Document16 pagesMock Exam 2 - ACC102Cundangan, Denzel Erick S.No ratings yet

- United States v. Smith, 1st Cir. (1995)Document67 pagesUnited States v. Smith, 1st Cir. (1995)Scribd Government DocsNo ratings yet

- GAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsDocument1 pageGAAP: Understanding It and The 10 Key Principles: U.S. Public Companies Must Follow GAAP For Their Financial StatementsThuraNo ratings yet

- Application Form 2018Document2 pagesApplication Form 2018Mohammad Arafat YusophNo ratings yet

- ChamberDocument5 pagesChamberFaisal OmarNo ratings yet

- Main Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementDocument22 pagesMain Report - Study of Risk Perception of Equity Investors and Potrfolio ManagementSnehaVohra100% (1)

- Ppe 2016Document40 pagesPpe 2016Benny Wee0% (1)

- Materiality Matrix BCADocument1 pageMateriality Matrix BCAGalla GirlNo ratings yet

- Axis Bank - Home-Loan-Dynamic-AgreementDocument21 pagesAxis Bank - Home-Loan-Dynamic-Agreementmadhukar sahayNo ratings yet

- Form For Filing FDCPA Law SuitDocument18 pagesForm For Filing FDCPA Law Suitnutech18100% (2)

- SEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponDocument10 pagesSEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponJoy Navaja DominguezNo ratings yet

- Orbit 1Document2 pagesOrbit 1Pranav MishraNo ratings yet

- Lectures - Acct 555Document64 pagesLectures - Acct 555PetraNo ratings yet

- International Financial Management: Jeff Madura 7 EditionDocument38 pagesInternational Financial Management: Jeff Madura 7 EditionBilal sattiNo ratings yet

- HDFC BankDocument78 pagesHDFC Bankinfo.rkvkjalNo ratings yet

- Proposed Org Chart - Tech SIS.Document5 pagesProposed Org Chart - Tech SIS.Santosh KumarNo ratings yet

- 5 - Allied Thread v. City of Manila G.R. No. L-40296 November 21, 1984Document1 page5 - Allied Thread v. City of Manila G.R. No. L-40296 November 21, 1984Pam Otic-ReyesNo ratings yet

- Budget PlannerDocument9 pagesBudget PlannerKarl HitchensNo ratings yet

- Module 3.2 Ordinary and Exact InterestsDocument20 pagesModule 3.2 Ordinary and Exact InterestsvanNo ratings yet

- Lot Sizes Vs Risk in Forex SimplifiedDocument14 pagesLot Sizes Vs Risk in Forex SimplifiedTeju OniNo ratings yet