Professional Documents

Culture Documents

Walt Disney Case

Uploaded by

farhanhaseeb7Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Walt Disney Case

Uploaded by

farhanhaseeb7Copyright:

Available Formats

1

A. SUMMARY

High economic intensity, such as high unemployment, recession, the slowdown in growth and

reduced customer costumer spending contributed to a 7% drop in revenues and a 46 % drop in

Walt Disney's profitability for the first quarter of 2009. The company has been inspiring and

have captured the attention of millions of customers for more than 8 decades by offering family

entertainment, theme parks, recreations, movies TV shows. Walt Disney created the Mickey

Mouse and Donald Duck characters that took the world as sheer entertainment.

Mr. Walt Disney and his brother Roy arrived in California in the midst of 1923 to sell their

cartoon known as Alice's Wonderland. A distributor contacted them for the distribution of Alice

Comedies in October 16, 1923 and that is how Disney Brothers Cartoon Studio came into being.

They never looked back after this event by creating many popular cartoons like Oswald the

Lucky Rabbit, Snow White and the Seven Dwarfs, Pinocchio and the very popular Fantasia.

After some time they changed the name of the company to the Walt Disney Studio.

The studio started reaching its heights by making the first ever live action film Treasure Island.

Then came Disney's most successful series the Mickey Mouse Club in 1955 and cartoons like

The Shaggy Dog, Zorro, Mary Poppins and Love Bug kept coming the entertaining millions.

Big day in the history was the opening of the Walt Disney World project in Orlando, Florida and

opening of Tokyo Disneyland in 1983. Soon after leaving network television the company

started its own cable network "The Disney Channel". Meanwhile they started many theme parks

globally. Filmmaking started hitting new heights with Hollywood studios in box-office gross.

Disney's animations started reaching new heights and greater audience with The Little Mermaid,

The Beauty and the Beast and Alladin. Many other TV series like Home Improvement and

Dinosaurs expanded Disney's television base. They also moved into publishing Books for

children after starting the new Disney Press. In 1992, Disneyland Paris opened in France.

They completed many projects throughout the 1990s. From acquiring Baseball team to acquiring

Capital Cities/ABC to opening 725 Disney stores from 2000 to 2007.

Now moving towards the issues of Walt Disney, firstly the structure of Walt Disney is SBU

based with SBUs like Disney Costumer products, Studio Entertainment, Parks and Resorts,

Media Networks and Broadcasting. Disney has a very inspiring and comprehensive mission

while they do not possess a formal vision statement lacking their strategic focus on what to

2

achieve in the future. Disney's recent income statements and balance sheets indicated profit

decline from 2007 to 2008. Disney's Media Networks brings the most revenues for the company.

However, Studio Entertainment and Customer Products have experienced declining revenues.

In percentage terms the Disney revenues in 2008 could be split up in numbers like Media

Networks 43%, parks and Resorts 31%, Studio Entertainment 20% and Costumer Products 8%.

Disney owns the ABC Television Network, which includes ABC Entertainment, ABC Daytime,

ABC News, ABC Kids and many more. This segment grew probably because of the growth in

cable sector and satellite operations. Advertising on the network is another source of additional

revenue for Walt Disney. Video on Demand is a major industry expected to grow by 2010.

Disney owns and operates many parks and resorts globally. Disneyland Resort in California,

ESPN Zone facilities in many cities and 17 Hotels at the Walt Disney World Resort are a few

examples of Disney's largest network and expansion. Disney revenues increased 7% in 2008.

There was higher guest spending, theme park attendance and hotel occupancy in this sector.

Disneyland Resort Paris also experienced increased revenues due to the favorable impact of

foreign currency translation, i.e. weakening of the US$ against the Euro.

The Consumer products segment has many partners, manufacturers, publishers and retailers

worldwide who design, promote and sell a variety of products for Disney. Revenues from this

segment increased 26% also due to sales oat Disney Stores North America acquired by Walt

Disney. Disney in each segment has major competitors like Time Warner, which has five

divisions and CBS Corporation in Media Network Segment. They compete domestically and

globally. This global media industry is dominated by conglomerates of Disney and Time Warner.

The success of Studio Entertainment operations totally depends upon public taste and preference.

As such, few companies dominate the industry and control the production and distribution of

most of the movies, including Warner Brothers, Walt Disney, Twentieth Century Fox, Viacom

and others. Disney is also the largest worldwide licensor of character-based merchandise and

producer/distributor of children's film related products based on retail sales. Leading competitors

in this segment are Warner Brothers, Fox, Sony, Marvel and Nickelodeon. There are also many

risks involved in such diversified business that can affect the future operational plans of Disney.

3

B. STRENGTHS-WEAKNESSES-OPPORTUNITES-THREATS (SWOT)

a) STRENGTHS

Disney Media Network with most revenue of 43% & operating income of 57%.

26% increase in revenue from consumer products.

Acquisition of Disney Stores North America.

Magic Kingdom at Disney World the most visited amusement park.

Largest Worldwide licensor of character based merchandise & product distributor of

children's film related products.

Vast & Diverse portfolio of products.

Acquisition of Pixar animation studios in 2006.

b) WEAKNESSES

No formal Vision statement.

A 5.5 % decrease in profits from 2007 to 2008.

A 26 % decrease in net income for the 3rd quarter (2009).

Movie Studio the worst performing division with $12 million losses.

Diversity in products leading to reduced strategic focus.

c) OPPORTUNITIES

Major growth potential in Video on Demand Industry up to $3.9 billion by 2010.

Transition of concept of theme parks from mass audience to more concentrated

perspective.

A 10 % increase in investment in theme parks & hotels to enhance attendance and

occupancy respectively.

Overhaul of attractions in theme parks and hotels due to increase in profits.

Can also target new consumer group.

d) THREATS

Unemployment, recession & reduced spending, contributing to 7% drop in revenue.

Threat of cannibalization of Disney's brands.

Presence of major competitors like Time Warner & CBS corporation in Media Network

industry.

Rapidly changing media & technology.

Increased difficulty in protection of intellectual property.

4

C. PROBLEM STATEMENT

The problem currently Walt Disney has to avoid is the cannibalization of its brands as it is

already expanding globally in diversified businesses that result in the lack of strategic focus.

Other issues involve the major economic slowdown, changes in technology and consumer

preference, change is travel and tourism trends and high unemployment. Their income fell 26%

in the first quarter (2009). The Major segment of Walt Disney that requires a breakthrough is the

Movie Studio unit. So, Disney requires a clear strategic plan and hard decisions to stop letting

the revenues slip.

D. EXTERNAL FACTOR EVALUATION MATRIX (EFE)

Key External Factors Weight Rating Weighted

Score

Opportunities

1. Major growth potential in Video on Demand Industry up to $3.9

billion by 2010.

0.15 4 0.60

2. Transition of concept of theme parks from mass audience to more

concentrated perspective.

0.08 3 0.24

3. A 10 % increase in investment in theme parks & hotels to enhance

attendance and occupancy respectively.

0.1 2 0.2

4. Overhaul of attractions in theme parks and hotels due to increase in

profits.

5. Can also target new consumer group.

0.09

0.1

1

3

0.09

0.3

Threats

1. Unemployment, recession & reduced spending contributing to 7%

drop in revenue.

0.15 1 0.15

2. Threat of cannibalization of Disney's brands. 0.11 2 0.22

3. Presence of major competitors like Time Warner & CBS

corporation in Media Network industry.

0.1 3 0.3

4. Rapidly changing media & technology. 0.08 3 0.24

5. Increased difficulty in protection of intellectual property. 0.04 3 0.12

Total 1.00 2.46

5

E. INTERNAL FACTOR EVALUATION MATRIX (IFE)

Key Internal Factors Weight Rating Weighted

Score

Strengths

1. Disney Media Network with most revenue of 43% & operating

income of 57%.

0.11 3 0.33

2. 26% increase in revenue from consumer products.

0.07 3 0.21

3. Acquisition of Disney Stores North America.

0.08 3 0.24

4. Magic Kingdom at Disney World the most visited amusement park.

0.1 4

0.4

5. Largest Worldwide licensor of character based merchandise &

product distributor of children's film related products.

0.14

4

0.56

6. Vast & Diverse portfolio of products. 0.07

3

0.21

7. Acquisition of Pixar animation studios in 2006. 0.05 3 0.15

Weaknesses

1. No formal Vision statement.

0.06 2 0.12

2. 5.5% decrease in profits from 2007 to 2008. 0.05 2 0.10

3. 26% decrease in net income for the 3rd quarter (2009).

0.1 1 0.10

4. Movie Studio the worst performing division with $12 million losses. 0.13 1 0.13

5. Diversity in products leading to reduced strategic focus. 0.04 2 0.08

Total 1.00 2.63

6

F. COMPETITIVE PROFILE MATRIX (CPM)

Walt Disney CBS Time Warner

Critical Success

Factors

Weight Rating Score Rating Score Rating Score

Advertising

0.15 4 0.6 3 0.45 3 0.45

Market Share

0.2 3 0.6 1 0.2 2 0.4

Company Image

0.11 3 0.33 3 0.33 3 0.33

Expansion

0.09 3 0.27 2 0.18 2 0.18

Diversification

0.13 4 0.52 3 0.39 3 0.39

Market Capital

0.15 4 0.6 2 0.3 3 0.45

Revenues

0.17 2 0.34 4 0.68 3 0.51

Total 1.00 3.26 2.23 2.71

7

G. STRENGTHS-WEAKNESSES-OPPORTUNITIES AND THREATS MATRIX

(SWOT)

STRENGTHS-S

1. Disney Media Network with

most revenue of 43% &

operating income of 57%.

2. 26% increase in revenue from

consumer products.

3. Acquisition of Disney Stores

North America.

4. Magic Kingdom at Disney

World the most visited

amusement park.

5. Largest Worldwide licensor of

character based merchandise &

product distributor of children's

film related products.

6. Vast & Diverse portfolio of

products.

7. Acquisition of Pixar animation

studios in 2006.

WEAKNESSES-W

1. No formal Vision statement.

2. 5.5% decrease in profits from

2007 to 2008.

3. 26% decrease in net income

for the 3rd quarter (2009).

4. Movie Studio the worst

performing division with $12

million losses.

5. Diversity in products leading

to reduced strategic focus.

OPPORTUNI TI ES-O

1. Major growth potential in

Video on Demand Industry

up to $3.9 billion by 2010.

2. Transition of concept of

theme parks from mass

audience to more

concentrated perspective.

3. 10% increase in investment

in theme parks & hotels to

enhance attendance and

occupancy respectively.

4. Overhaul of attractions in

theme parks and hotels due to

increase in profits.

5. Can also target new

consumer group.

SO STRATEGY

1. Investment to innovate attractions

in Theme Parks & Resorts.

(S4,O3)

2. Launch a new channel with

specific focus on Video On

Demand feature. (S1,O1)

WO STRATEGY

1. To create new hit movies using

the IMAX 3D latest trend

technology. (W4,O5)

8

THREATS-T

1. Unemployment, recession &

reduced spending

contributing to 7% drop in

revenue.

2. Threat of cannibalization of

Disney's brands.

3. Presence of major

competitors like Time

Warner & CBS corporation

in Media Network industry.

4. Rapidly changing media

technology.

ST STRATEGY

1. Reduce entrance fees at Theme

parks and introduce discounts on

hotels. (S4,T1)

WT STRATEGY

1. Reduce non-performing

products to reduce

cannibalization & enhance

strategic focus. (W5,T2)

9

H. STRATEGIC POSITION & ACTION EVALUATION MATRIX (SPACE)

Financial Position rating 1 (worst) to 6 (best) Ratings

1 Liquidity 4

2 Earnings per share 5

3 Working Capital 4

4 Return on Investment 5

Industry Position rating 1 (worst) to 6 (best) FP Total 18

1 Technology 5

2 Ease of Entry 5

3 Growth Potential 4

4 Financial Stability 4

Stability Position rating -1 (best) to -6 (worst) IP Total 18

1 Recession -5

2 Competitive Pressure -3

3 Price Range of Competing Products -3

4 Technological Changes -2

Competitive Position rating -1 (best) to -6 (worst) EP Total -13

1 Market Capitalization -1

2 Technological Know-How -3

3 Customer Loyalty -2

4 Competition's capacity utilization -4

CP Total -10

SP Average = -3.25, IP Average = +4.5

CP Average = -2.5, FP Average = +4.5

Directional Vector Coordinates: x-axis: -2.5+(+4.5) = +2

y-axis: -3.25+(+4.5) = +1.25

10

I. INTERNAL-EXTERNAL (IE) MATRIX

Total IFE Weighted Scores

The internal and external intersection point lies in the (V) Quadrant Cell in Average category and

the best strategies for this quadrant are "hold and maintain strategies" i.e. market penetration and

product development. So, Walt Disney in the future should hold and maintain their position

using Market Penetration and Product Development strategies if they do not want their last

quarter revenues to drop. Although the estimations are based on approximation, but are not far

from the case.

11

J. QUANTITATIVE STRATEGIC PLANNING MATRIX (QSPM)

Alternative Strategies

Key Internal Factors

Weight

Launch a new channel

with specific focus on

Video On Demand feature

Create new hit

movies using the

IMAX 3D latest

trend technology

Strengths AS TAS AS TAS

8. Disney Media Network with most

revenue of 43% & operating income of

57%.

0.11

4 0.44 4 0.44

9. 26% increase in revenue from consumer

products.

0.07

3 0.21 2 0.14

10. Acquisition of Disney Stores North

America.

0.08

- -

11. Magic Kingdom at Disney World the

most visited amusement park.

0.1

- -

12. Largest Worldwide licensor of character

based merchandise & product distributor

of children's film related products.

0.14

- 2 0.28

13. Vast & Diverse portfolio of products. 0.07

2 0.14 2 0.14

7. Acquisition of Pixar animation studios in

2006.

0.05

- 4 0.20

Weaknesses

6. No formal Vision statement. 0.06

- -

7. 5.5% decrease in profits from 2007 to

2008.

0.05

3 0.15 3 0.15

8. 26% decrease in net income for the 3rd

quarter (2009).

0.1

1 0.1 1 0.1

9. Movie Studio the worst performing

division with $12 million losses.

0.13

1 0.13

3

0.39

5. Diversity in products leading to reduced

strategic focus.

0.04

1 0.04 -

1.00

12

Alternative Strategies

Key External Factors

Weight

Launch a new channel

with specific focus on

Video On Demand feature

Create new hit

movies using the

IMAX 3D latest

trend technology

Opportunities AS TAS AS TAS

6. Major growth potential in Video on

Demand Industry up to $3.9 billion by

2010.

0.15

4 0.6 -

7. Transition of concept of theme parks from

mass audience to more concentrated

perspective.

0.08

- -

8. 10% increase in investment in theme parks

& hotels to enhance attendance and

occupancy respectively.

0.1

- -

9. Overhaul of attractions in theme parks and

hotels due to increase in profits.

0.09

- -

5. Can also target new consumer group. 0.1

3 0.3 3 0.3

Threats

5. Unemployment, recession & reduced

spending contributing to 7% drop in

revenue.

0.15

2 0.3 2 0.3

6. Threat of cannibalization of Disney's

brands.

0.11

1 0.11 -

7. Presence of major competitors like Time

Warner & CBS corporation in Media

Network industry.

0.1

1 0.1 -

8. Rapidly changing media & technology. 0.08

3 0.24 2 0.16

5. Increased difficulty in protection of

intellectual property.

0.04

- -

TOTAL

1.00 2.86 2.6

QSPM indicates that the first alternative strategy is the comparatively more viable to execute as

determined by the total scores. The strategy is to Launch a new channel with specific focus on

Video On Demand feature. As this industry is the most growth oriented $3.9 Billion by 2010 and

holds vital importance resulted in a higher score for this strategy.

13

K. CONCLUSION

It is quite clear from the above analysis on the Walt Disney company that they lack a strategic

focus with so many diversifications. Adapting to changing trends and continuously meeting

expectations of their consumers in various parts globally with different cultures is not a piece of

cake for any large organization of such magnitude. But for any organization that has lasted 8

decades could carry on and prevent slipping of revenues if they open themselves to change and

concentration on markets. It was apparent from the results of above analyses that ever-changing

Walt Disney has to make another change in strategy to retain its position in the global market.

L. ANNEXURE

PRO-FORMA INCOME STATEMENT:

Disney Inc. Consolidated Income Statement (in millions)

%age of Sales Increase Forecasted for

year 2009

15.00%

Income Statement & Projected Statement for the Year 2009 Tax Rate 36.00%

Cost and Expenses %age of Sales 80.00%

2006 2007 2008 2009

Sales 33,747 35,510 37,843 43,519

Cost and Expenses 28,392 28,681 30,439 34,816

Other Expenses 88 1,004 59 68

Net Interest Expenses 592 593 524 603

Equity in the income of investees 473 485 581 668

Taxable I ncome Before I ncome

Taxes and Minority I nterests

5,324 7,725 7,402 8,702

Income Taxes 1,837 2,874 2,673 3,133

Minority Interests 183 177 302 347

Net I ncome 3,374 4,687 4,427 5,222

14

ASSUMPTIONS:

The above is a pro-forma income statement projection for the year 2009. A 15 % increase in

sales is assumed to cost of goods sold to be 80% of sales and 36% tax rate. Retained earnings

and dividend ratio has not been used because no such sort of policy was discussed in the case.

Increase in sales can still render the first three quarters of declining profit to be changed into

increased profit in the last quarter of the year. Simple financial terms have been used to elucidate

that increasing net income figure. All the above figures used are in millions.

You might also like

- Walt DisneyDocument17 pagesWalt Disneyagrawalrohit_22838475% (4)

- The Walt Disney CompanyDocument8 pagesThe Walt Disney CompanyJovie Mariano Dela CruzNo ratings yet

- The Walt Disney CompanyDocument19 pagesThe Walt Disney CompanyBMX2013100% (1)

- Walt Disney Company, Nabilah (FIB 2101)Document11 pagesWalt Disney Company, Nabilah (FIB 2101)Nabilah BakarNo ratings yet

- Case 1 - Walt Disney - 2009Document13 pagesCase 1 - Walt Disney - 2009Yatiri0% (2)

- The Entertainment King: How Walt Disney and Michael Eisner Built a Global Media EmpireDocument9 pagesThe Entertainment King: How Walt Disney and Michael Eisner Built a Global Media EmpireKarun Kiran Polimetla75% (4)

- Disney AnalysisDocument5 pagesDisney AnalysisgessyghesiyahNo ratings yet

- Walt Disney - BRAMDocument3 pagesWalt Disney - BRAMBramanto Adi NegoroNo ratings yet

- Walt DisneyDocument56 pagesWalt DisneyMahrukh Khan100% (1)

- Walt Disney Case StudyDocument6 pagesWalt Disney Case StudyJMIFBNo ratings yet

- Walt Disney Case StudyDocument7 pagesWalt Disney Case StudyDeepa Justus67% (3)

- Walt Disney Case StudyDocument13 pagesWalt Disney Case StudyGeorgette Gales100% (1)

- Kaplan AssignmentDocument7 pagesKaplan AssignmentAli100% (1)

- Walt Disney Case AnalysisDocument13 pagesWalt Disney Case AnalysisVenkataramanan VaidyanathanNo ratings yet

- Disney Case Study Organizational StructuresDocument22 pagesDisney Case Study Organizational StructuresAvinash SinghNo ratings yet

- DISNEY Strategic PlanDocument18 pagesDISNEY Strategic PlanRao P Satyanarayana100% (1)

- Euro DisneylandDocument13 pagesEuro DisneylandSoumabrata GangulyNo ratings yet

- The Walt Disney CompanyDocument6 pagesThe Walt Disney Companybpowell2No ratings yet

- Disney Apr 1Document31 pagesDisney Apr 1hoangbaotranbaotay25% (4)

- Group 4 Strategy Case 'Disney' V 1.4Document10 pagesGroup 4 Strategy Case 'Disney' V 1.4Stijn Lfb50% (2)

- Walt Disney Case AnalysisDocument8 pagesWalt Disney Case AnalysisPauline Beatrice Sombillo100% (2)

- Disney ReportDocument12 pagesDisney Reportalhumdulilah100% (1)

- Disney+case FinalDocument9 pagesDisney+case FinalmskrierNo ratings yet

- Disney CaseDocument49 pagesDisney CaseGrace MasdoNo ratings yet

- Euro Disney Case Study PDFDocument2 pagesEuro Disney Case Study PDFLinda0% (1)

- Strategic Plan Walt DisneyDocument2 pagesStrategic Plan Walt DisneyRhea CastilloNo ratings yet

- Walt Disney Case AnalysisDocument9 pagesWalt Disney Case AnalysisHassam BalouchNo ratings yet

- Walt Disney Company CaseDocument12 pagesWalt Disney Company Caserobertatoscano7450% (2)

- Disney Company Analysis ReportDocument16 pagesDisney Company Analysis ReportSanjay BijaraniaNo ratings yet

- Case 1 Strategic Management For Walt DisneyDocument15 pagesCase 1 Strategic Management For Walt DisneyAnn GonzalesNo ratings yet

- Case Analysis Disney3Document8 pagesCase Analysis Disney3visvisnuvNo ratings yet

- Disney Case StudyDocument17 pagesDisney Case StudyNahid HawkNo ratings yet

- Euro Disney CaseDocument8 pagesEuro Disney CaseBulla Suunil KumaarNo ratings yet

- Disney's Keys to Entertainment SuccessDocument14 pagesDisney's Keys to Entertainment Successprsnt100% (1)

- Walt DisneyDocument11 pagesWalt Disneydeeptithakur98_69910No ratings yet

- Disney Five ForcesDocument11 pagesDisney Five ForcesRick RamseyNo ratings yet

- Walt Disney ReportDocument21 pagesWalt Disney ReportAli Husanen80% (5)

- WALT DISNEY CaseDocument5 pagesWALT DISNEY CaseAmro RazigNo ratings yet

- ch15 Special Topics Euro Disney SolutionDocument6 pagesch15 Special Topics Euro Disney Solutionmohammad audiNo ratings yet

- Case Study - DisneyDocument5 pagesCase Study - Disneyxuqiuche100% (1)

- Disney Acquires Marvel in $4.24B Landmark DealDocument15 pagesDisney Acquires Marvel in $4.24B Landmark DealPatrick FlynnNo ratings yet

- Case Study - DisneyDocument25 pagesCase Study - Disneymathew00796% (28)

- The Walt Disney ComapanyDocument22 pagesThe Walt Disney ComapanyScarlet100% (4)

- Disney Company AnalysisDocument29 pagesDisney Company AnalysisGuenazNo ratings yet

- The Walt Disney Company CaseDocument2 pagesThe Walt Disney Company CaseAlexandra Marcelle80% (10)

- Walt Disney Financial Statement AnalysisDocument37 pagesWalt Disney Financial Statement AnalysisVishnu Sajit100% (1)

- Euro DisneylandDocument27 pagesEuro DisneylandRishabh GoelNo ratings yet

- Awa Traore Benih Hartanti Irwan Arfandi B. Master of Management Gadjah Mada UniversityDocument29 pagesAwa Traore Benih Hartanti Irwan Arfandi B. Master of Management Gadjah Mada UniversityErdiliaNo ratings yet

- EURO DISNEYLAND: AN ANALYSIS OF CULTURAL MISSTEPSDocument11 pagesEURO DISNEYLAND: AN ANALYSIS OF CULTURAL MISSTEPSSurbhi Rastogi100% (1)

- Walt Disney Case StudyDocument14 pagesWalt Disney Case StudyMelkior SangmaNo ratings yet

- Walt Disney's Euro Disneyland Venture: A Study in Corporate Foreign ExpansionDocument16 pagesWalt Disney's Euro Disneyland Venture: A Study in Corporate Foreign ExpansionPardeep VirvaniNo ratings yet

- Disney Theme Park Case Study QuestionsDocument4 pagesDisney Theme Park Case Study Questionstouseef1234100% (1)

- Walt DisneyDocument56 pagesWalt DisneyPulkit Gupta100% (2)

- Porter's Five ForcesDocument17 pagesPorter's Five ForcesTe TeeNo ratings yet

- Disney CaseDocument11 pagesDisney CaseKevin WangNo ratings yet

- Zauderer Paper1Document10 pagesZauderer Paper1api-498321643No ratings yet

- Disney Vs TimeWarner Financial RatioDocument19 pagesDisney Vs TimeWarner Financial RatiopatternprojectNo ratings yet

- The Walt Disney Company For PrintDocument12 pagesThe Walt Disney Company For PrintSwakiya Shrestha0% (1)

- FIN202 Indi PDF (Corporate Finance)Document58 pagesFIN202 Indi PDF (Corporate Finance)Huynh Minh Tien (K16HCM)No ratings yet

- Blockbusters: Hit-making, Risk-taking, and the Big Business of EntertainmentFrom EverandBlockbusters: Hit-making, Risk-taking, and the Big Business of EntertainmentRating: 4 out of 5 stars4/5 (33)

- JetBlue CaseDocument14 pagesJetBlue Casefarhanhaseeb7100% (1)

- What Do We Mean by Corporate Social Responsibility-2001Document20 pagesWhat Do We Mean by Corporate Social Responsibility-2001Madan MaddyNo ratings yet

- Jetblue Case StudyDocument1 pageJetblue Case StudyiitebaNo ratings yet

- PTCLDocument31 pagesPTCLfarhanhaseeb7No ratings yet

- EEODocument5 pagesEEOfarhanhaseeb7No ratings yet

- ChartDocument18 pagesChartfarhanhaseeb7No ratings yet

- Cemento ArgosCaseStudy1Document3 pagesCemento ArgosCaseStudy1farhanhaseeb7No ratings yet

- JFE 95 38 2-4 Executive Compensation Structure, Ownership, and Firm PerformanceDocument22 pagesJFE 95 38 2-4 Executive Compensation Structure, Ownership, and Firm Performancefarhanhaseeb7No ratings yet

- Baring BankDocument4 pagesBaring Bankfarhanhaseeb7No ratings yet

- Introduction Summary - Innovation - Target Market (Hafeez CentreDocument4 pagesIntroduction Summary - Innovation - Target Market (Hafeez Centrefarhanhaseeb7No ratings yet

- Business CommunicationDocument6 pagesBusiness Communicationfarhanhaseeb7No ratings yet

- QuestionnaireDocument6 pagesQuestionnairefarhanhaseeb7No ratings yet

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivDocument2 pagesDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryNo ratings yet

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDocument24 pagesAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNo ratings yet

- Understanding consumer perception, brand loyalty & promotionDocument8 pagesUnderstanding consumer perception, brand loyalty & promotionSaranya SaranNo ratings yet

- AMUL Market AnalysisDocument59 pagesAMUL Market AnalysisHacking Master NeerajNo ratings yet

- The Theory of Interest Second EditionDocument43 pagesThe Theory of Interest Second EditionVineet GuptaNo ratings yet

- MphasisDocument2 pagesMphasisMohamed IbrahimNo ratings yet

- HESCO Quality Plan for TDC Flap Gate Valves and Stoplogs ProjectDocument50 pagesHESCO Quality Plan for TDC Flap Gate Valves and Stoplogs ProjectAyman AlkwaifiNo ratings yet

- Figure 26.1 The Directional Policy Matrix (DPM)Document2 pagesFigure 26.1 The Directional Policy Matrix (DPM)Abdela TuleNo ratings yet

- Sample Income StatementDocument1 pageSample Income StatementJason100% (34)

- American Medical Assn. v. United States, 317 U.S. 519 (1943)Document9 pagesAmerican Medical Assn. v. United States, 317 U.S. 519 (1943)Scribd Government DocsNo ratings yet

- Westpac Case Study Ed 3 PDFDocument2 pagesWestpac Case Study Ed 3 PDFAhmedHawcharNo ratings yet

- Franchised Stores of New York, Inc. and Thomas Carvel v. Martin Winter, 394 F.2d 664, 2d Cir. (1968)Document8 pagesFranchised Stores of New York, Inc. and Thomas Carvel v. Martin Winter, 394 F.2d 664, 2d Cir. (1968)Scribd Government DocsNo ratings yet

- Case Study: When in RomaniaDocument3 pagesCase Study: When in RomaniaAle IvanovNo ratings yet

- Human Resourse Management 1Document41 pagesHuman Resourse Management 1Shakti Awasthi100% (1)

- PWC High Frequency Trading Dark PoolsDocument12 pagesPWC High Frequency Trading Dark PoolsAnish TimsinaNo ratings yet

- Global Marketing Test Bank ReviewDocument31 pagesGlobal Marketing Test Bank ReviewbabykintexNo ratings yet

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDocument2 pagesGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNo ratings yet

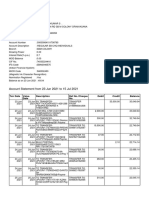

- Account Statement From 23 Jun 2021 To 15 Jul 2021Document8 pagesAccount Statement From 23 Jun 2021 To 15 Jul 2021R S enterpriseNo ratings yet

- Econ 201 MicroeconomicsDocument19 pagesEcon 201 MicroeconomicsSam Yang SunNo ratings yet

- 3m Fence DUPADocument4 pages3m Fence DUPAxipotNo ratings yet

- 09 - Chapter 2 PDFDocument40 pages09 - Chapter 2 PDFKiran PatelNo ratings yet

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Analisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Document25 pagesAnalisis Cost Volume Profit Sebagai Alat Perencanaan Laba (Studi Kasus Pada Umkm Dendeng Sapi Di Banda Aceh)Fauzan C LahNo ratings yet

- 1 MDL299356Document4 pages1 MDL299356Humayun NawazNo ratings yet

- SHELF CORP SECRETS 3 FLIPPING CORPORATIONSDocument24 pagesSHELF CORP SECRETS 3 FLIPPING CORPORATIONSRamon RogersNo ratings yet

- Contract CoffeeDocument5 pagesContract CoffeeNguyễn Huyền43% (7)

- Model LOC Model LOC: CeltronDocument3 pagesModel LOC Model LOC: CeltronmhemaraNo ratings yet

- HR ManagementDocument7 pagesHR ManagementAravind 9901366442 - 9902787224No ratings yet

- 0 AngelList LA ReportDocument18 pages0 AngelList LA ReportAndrés Mora PrinceNo ratings yet

- Balance ScorecardDocument11 pagesBalance ScorecardParandeep ChawlaNo ratings yet