Professional Documents

Culture Documents

2281 Nos SW 3

Uploaded by

mstudy1234560 ratings0% found this document useful (0 votes)

11 views5 pagesThe individual as producer, consumer and borrower (Unit no.3) (2281 / 0455) can be studied without any prior knowledge but does build on some of the concepts covered in Units 1 and 2. Students may already have some awareness of the causes of differences in earnings and why people choose particular occupations. This Unit links back to demand and supply and opportunity cost. It also links forward to the changing patterns and levels of employment and indicators of comparative living standards in Unit 6.

Original Description:

Original Title

2281_nos_sw_3

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe individual as producer, consumer and borrower (Unit no.3) (2281 / 0455) can be studied without any prior knowledge but does build on some of the concepts covered in Units 1 and 2. Students may already have some awareness of the causes of differences in earnings and why people choose particular occupations. This Unit links back to demand and supply and opportunity cost. It also links forward to the changing patterns and levels of employment and indicators of comparative living standards in Unit 6.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views5 pages2281 Nos SW 3

Uploaded by

mstudy123456The individual as producer, consumer and borrower (Unit no.3) (2281 / 0455) can be studied without any prior knowledge but does build on some of the concepts covered in Units 1 and 2. Students may already have some awareness of the causes of differences in earnings and why people choose particular occupations. This Unit links back to demand and supply and opportunity cost. It also links forward to the changing patterns and levels of employment and indicators of comparative living standards in Unit 6.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

(O Level/IGCSE) (Economics) (2281/0455)

(Unit no.3): (The individual as producer, consumer and borrower)

Recommended Prior Knowledge

This Unit can be studied without any prior knowledge but it does build on some of the concepts covered in Units 1 and 2. The functions of financial institutions are

influenced by the type of economic system, earnings are influenced by the demand and supply of labour and opportunity cost is relevant in analysing the different

motives for spending, saving and borrowing. Students may already have some awareness of the causes of differences in earnings and why people choose particular

occupations. They may also have some knowledge of the benefits and disadvantages of specialisation.

Context

This Unit links back to demand and supply and opportunity cost. It also links forward to the demand for factors of production in Unit 4, the changing patterns and levels

of employment and indicators of comparative living standards in Unit 6 and the benefits and disadvantages of specialisation at regional and national levels in Unit 8.

Outline

The Unit starts by examining the functions of money and the need for exchange. It then follows on to consider the functions of central banks, stock exchanges and

commercial banks. The focus then moves to the labour market with an analysis of an individuals choice of occupation, changes in earnings over time, differences in

earnings of various groups of workers and the role of trade unions. Finally the Unit explores the different motives for spending, saving and borrowing and why different

income groups have different expenditure patterns.

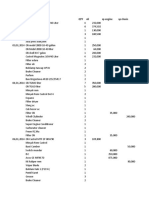

AO Learning outcomes Suggested Teaching activities Learning resources

3a Students should be able to describe

the functions of money and the need

for exchange.

You could start by asking students whether they would be prepared to

sell e.g. their mobile (cell) phones for a given number of stones. When

they say no, you can explore the characteristics money needs to

possess and the functions of money. You could also examine why

people may switch to alternative forms of money or barter during

hyperinflation. There is an interesting worksheet on the bized website

which asks students to determine, out of a group of items, which type of

money fulfils the functions of money best. Grant considers the functions,

characteristics and types of money and Moynihan and Titley also

provides a brief history of money. Dransfield, Cook and King have an

interesting case study on the Chinese currency, the yuan (page 45).

Online

http://www.bized.co.uk/virtual/bank/eco

nomics/money/worksheet.htm

Textbooks

Grant Unit 14

Moynihan and Titley Chapter 2

Dransfield, Cook and King pages 44-45

1

AO Learning outcomes Suggested Teaching activities Learning resources

3b Students should be able to describe

the functions of central banks, stock

exchanges, commercial banks

It is useful for students to examine the functions of central banks, stock

exchanges and commercial banks in a major economy and in their own

economy. Banks and stock exchanges often provide free information

about their activities.

A visit to a bank or a visiting speaker from a bank can be arranged.

Students could be asked to research what has happened to the share

prices of particular companies, why and what may be the consequences

of a fall in share prices.

Grant has a number of activities using real world examples and MCs and

Moynihan and Titley provide a range of exercises on institutions.

Dransfield, Cook and King have useful activies and questions on

commercial banks, stock exchanges and central banks (pages 46-51).

Online

http://www.bis.org/cbanks.htm

(gives links for central banks sites

alphabetically)

http://www.bankofengland.co.uk/

(details about the Bank of England, its

functions and its policies)

http://www.centralbanksguide.com/

(details about role of central banks and

access to a range of central banks

websites)

http://www.sbp.org.pk

(site of central bank of Pakistan:

includes strategic plans and

microfinance initiatives)

http://www.stockexchangesworld.com/

(a list of stock exchanges throughout

the world and links to their websites)

http://www.bized.co.uk/virtual/ukbank/in

dex.htm

(role of commercial banks and central

banks)

Textbooks

Grant Units 15 and 16

Moynihan and Titley Chapter 6

Dransfield, Cook and King pages 46-51

2

AO Learning outcomes Suggested Teaching activities Learning resources

3d Students should be able to describe

likely changes in earnings over time for

an individual.

Students should consider a range of factors that can cause an

individuals earnings over time including changes in qualifications, skills,

promotion and experience.

They could research e.g. how much a really qualified lawyer can earn

and how much a judge can earn and why there is a difference.

You could also ask students to match cards with occupations and

earnings. Newspaper articles can be a useful source of information on

changes in earnings.

Students could undertake the activities in Grant and/or Moynihan and

Titley (exercise 2) in groups. Dransfield, Cook and King have an activity

and a variety of questions, some of which relate to a case study

concerning J amaica (pages 54-55).

Online

Textbooks

Grant Unit 19

Moynihan and Titley Chapter 10

Dransfield, Cook and King pages 54-55

3e Students should be able to describe

the differences in earnings between

different occupational groups

(male/female; skilled/unskilled;

private/public;

agricultural/manufacturing/services)

Having considered the factors that influence wage differentials, students

could research wage differentials in their own country and another

country. For instance, they could examine the differences in pay

between bankers, nurses and top sports people, This could be followed

by a class discussion on their findings including whether they think the

differentials are likely to change in the future and whether they think they

should.

There are useful exercises in Grant and exercise 3 in Moynihan and

Titley is relevant. Dransfield, Cook and King have an activity and a

number of questions, some of which relate to a case study of the relative

earnings of doctors and hospital porters (pages 56-59).

Online

http://www.tutor2u.net/economics/conte

xt/topics/labourmarket/pay_differentials.

htm

(explains influences on wage

differentials)

Textbooks

Grant Chapter 18

Moynihan and Titley Chapter 10

Dransfield, Cook and King pages 56-59

3

AO Learning outcomes Suggested Teaching activities Learning resources

3g Students should be able to describe

the benefits and disadvantages of

specialisation for the individual.

Students might first be asked to consider the advantages and

disadvantages of teachers specialising in particular subjects. The debate

could then be widened into considering the advantages and

disadvantages of other occupations specialising including e.g. doctors,

car workers and farm workers. The concept of division of labour can

then be introduced. If possible, it would be useful for students to visit a

factory, farm or office where workers specialise and one where workers

do not. Dransfield, Cook and King have an activity and some useful

questions (pages 62-63).

Online

http://www.tutor2u.net/economics/revisi

on-notes/as-markets-specialisation-

trade.html

(covers advantages and limitations of

division of labour and comparative

advantage)

Textbooks

Grant Unit 14

Moynihan and Titley pages 19 22

Dransfield, Cook and King pages 62-63

3h Students should be able to analyse the

different motives for spending, saving

and borrowing.

You could ask students in groups to discuss whether they save and

borrow and, if so, why. There could then be a class discussion on the

motives for saving and borrowing.

Students, using an adapted version of the first website, could discuss

why Chinas saving ratio differs from that in their own country and why

they may change in the future.

There are interesting activities and questions on spending, saving and

borrowing in Grant, Moynihan and Titley and Dransfield, Cook and King.

Online

http://cesifo-

group.de/link/vs;10_roc_Hung.2.pdf

(an interesting article on why Chinas

savings ratio is high and why it may

change over time could be adapted

for student use)

http://icmrindia.org/casestudies/catalog

ue/Business%Reports/BREPO47.htm

(changes in spending patterns in India)

http://www.tutor2u.net/economics/revisi

on-notes/as-macro-consumer spending-

and-saving.html

(explains key influences on consumer

spending and saving)

Textbooks

Grant Unit 21

Moynihan and Titley Chapter 11

Dransfield, Cook and King pages 64-65

4

5

AO Learning outcomes Suggested Teaching activities Learning resources

3i Students should be able to discuss

how and why different income groups

have different expenditure patterns

(spending, saving and borrowing).

Students need to consider not only the amounts people spend, save and

borrow but also the proportion of their income that they spend, save and

borrow and what they spend their money on, where they place their

savings and who they borrow from.

There are a number of topics they could research including the growth of

microfinance, how young people could be encouraged to save and why

some people get into unmanageable debt. Dransfield, Cook and King

have some questions which relate to a case study on rising consumption

in China (pages 66-67).

To recap this Unit, students could undertake the activities in Section 3 of

Grant workbook and at the end of the Section in Grant.. Dransfield, Cook

and King also have questions at the end of the Unit (pages 68-70).

Online

http://www.sarpa.org.za/documents/d00

03023/index.php

(useful information on changes in

consumer expenditure by income

groups, population groups and areas in

South Africa)

http://www.statistics.gov.uk/statbase/Pr

oduct.asp?vink=361&More=N

(gives access to details of the UK

Family Expenditure Survey)

Textbooks

Grant Unit 22

Grant Workbook Section 3

Moynihan and Titley Chapter 11

Dransfield, Cook and King pages 66-67

You might also like

- Frequently Asked Questions: A/AS Level Sociology (9699)Document1 pageFrequently Asked Questions: A/AS Level Sociology (9699)mstudy123456No ratings yet

- 0547 s06 TN 3Document20 pages0547 s06 TN 3mstudy123456No ratings yet

- 0486 w09 QP 4Document36 pages0486 w09 QP 4mstudy123456No ratings yet

- 0654 w04 Ms 6Document6 pages0654 w04 Ms 6mstudy123456No ratings yet

- Literature (English) : International General Certificate of Secondary EducationDocument1 pageLiterature (English) : International General Certificate of Secondary Educationmstudy123456No ratings yet

- 9697 w11 QP 41Document2 pages9697 w11 QP 41mstudy123456No ratings yet

- 9701 s06 Ms 4Document5 pages9701 s06 Ms 4Kenzy99No ratings yet

- 0445 s13 ErDocument37 pages0445 s13 Ermstudy123456No ratings yet

- 0420-Nos As 1Document24 pages0420-Nos As 1Ali HassamNo ratings yet

- University of Cambridge International Examinations General Certificate of Education Advanced LevelDocument2 pagesUniversity of Cambridge International Examinations General Certificate of Education Advanced Levelmstudy123456No ratings yet

- 9697 s12 QP 53Document4 pages9697 s12 QP 53mstudy123456No ratings yet

- 9697 s12 QP 33Document4 pages9697 s12 QP 33mstudy123456No ratings yet

- 9695 s05 QP 4Document12 pages9695 s05 QP 4mstudy123456No ratings yet

- 9694 w10 QP 23Document8 pages9694 w10 QP 23mstudy123456No ratings yet

- 9693 s12 QP 2Document12 pages9693 s12 QP 2mstudy123456No ratings yet

- 9694 s11 QP 21Document8 pages9694 s11 QP 21mstudy123456No ratings yet

- 9689 w05 ErDocument4 pages9689 w05 Ermstudy123456No ratings yet

- 8683 w12 Ms 1Document4 pages8683 w12 Ms 1mstudy123456No ratings yet

- 9274 w12 ErDocument21 pages9274 w12 Ermstudy123456No ratings yet

- 8780 w12 QP 1Document16 pages8780 w12 QP 1mstudy123456No ratings yet

- 9084 s10 Ms 31Document7 pages9084 s10 Ms 31olamideNo ratings yet

- 9706 s11 Ms 41Document5 pages9706 s11 Ms 41HAHA_123No ratings yet

- English Language: PAPER 1 Passages For CommentDocument8 pagesEnglish Language: PAPER 1 Passages For Commentmstudy123456No ratings yet

- 8695 s13 Ms 21Document6 pages8695 s13 Ms 21mstudy123456No ratings yet

- 9719 SPANISH 8685 Spanish Language: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of TeachersDocument3 pages9719 SPANISH 8685 Spanish Language: MARK SCHEME For The May/June 2009 Question Paper For The Guidance of Teachersmstudy123456No ratings yet

- 8004 General Paper: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of TeachersDocument12 pages8004 General Paper: MARK SCHEME For The May/June 2011 Question Paper For The Guidance of Teachersmrustudy12345678No ratings yet

- 8693 English Language: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument4 pages8693 English Language: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of Teachersmstudy123456No ratings yet

- 8679 w04 ErDocument4 pages8679 w04 Ermstudy123456No ratings yet

- First Language Spanish: Paper 8665/22 Reading and WritingDocument6 pagesFirst Language Spanish: Paper 8665/22 Reading and Writingmstudy123456No ratings yet

- SpanishDocument2 pagesSpanishmstudy123456No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 3 0 Visual Weld InspectorDocument74 pages3 0 Visual Weld InspectorVincent Sofia RaphaelNo ratings yet

- The Study of Accounting Information SystemsDocument44 pagesThe Study of Accounting Information SystemsCelso Jr. AleyaNo ratings yet

- WPB Pitch DeckDocument20 pagesWPB Pitch Deckapi-102659575No ratings yet

- Proprietar Utilizator Nr. Crt. Numar Inmatriculare Functie Utilizator Categorie AutovehiculDocument3 pagesProprietar Utilizator Nr. Crt. Numar Inmatriculare Functie Utilizator Categorie Autovehicultranspol2023No ratings yet

- 702190-Free PowerPoint Template AmazonDocument1 page702190-Free PowerPoint Template AmazonnazNo ratings yet

- PDF Problemas Ishikawa - Free Download PDF - Reporte PDFDocument2 pagesPDF Problemas Ishikawa - Free Download PDF - Reporte PDFNewtoniXNo ratings yet

- 16 BPI V FernandezDocument1 page16 BPI V FernandezAngelica Joyce BelenNo ratings yet

- Organization Structure GuideDocument6 pagesOrganization Structure GuideJobeth BedayoNo ratings yet

- Perbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraDocument9 pagesPerbandingan Sistem Pemerintahan Dalam Hal Pemilihan Kepala Negara Di Indonesia Dan SingapuraRendy SuryaNo ratings yet

- 1 N 2Document327 pages1 N 2Muhammad MunifNo ratings yet

- Guardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicDocument110 pagesGuardplc Certified Function Blocks - Basic Suite: Catalog Number 1753-CfbbasicTarun BharadwajNo ratings yet

- Localization Strategy in Vietnamese Market: The Cases ofDocument25 pagesLocalization Strategy in Vietnamese Market: The Cases ofHồng Thy NguyễnNo ratings yet

- How To: Create A Clickable Table of Contents (TOC)Document10 pagesHow To: Create A Clickable Table of Contents (TOC)Xuan Mai Nguyen ThiNo ratings yet

- Upgrade DB 10.2.0.4 12.1.0Document15 pagesUpgrade DB 10.2.0.4 12.1.0abhishekNo ratings yet

- I-Parcel User GuideDocument57 pagesI-Parcel User GuideBrian GrayNo ratings yet

- Automatizari Complexe - Laborator Nr. 4: Wind (M/S)Document1 pageAutomatizari Complexe - Laborator Nr. 4: Wind (M/S)Alexandru AichimoaieNo ratings yet

- Javascript: What You Should Already KnowDocument6 pagesJavascript: What You Should Already KnowKannan ParthasarathiNo ratings yet

- Java MCQ questions and answersDocument65 pagesJava MCQ questions and answersShermin FatmaNo ratings yet

- Acceptance and Presentment For AcceptanceDocument27 pagesAcceptance and Presentment For AcceptanceAndrei ArkovNo ratings yet

- City Gas Distribution ReportDocument22 pagesCity Gas Distribution Reportdimple1101100% (9)

- Structures Module 3 Notes FullDocument273 pagesStructures Module 3 Notes Fulljohnmunjuga50No ratings yet

- Method Statement of Static Equipment ErectionDocument20 pagesMethod Statement of Static Equipment Erectionsarsan nedumkuzhi mani100% (4)

- FC Bayern Munich Marketing PlanDocument12 pagesFC Bayern Munich Marketing PlanMateo Herrera VanegasNo ratings yet

- A - Bahasa Inggris-DikonversiDocument96 pagesA - Bahasa Inggris-DikonversiArie PurnamaNo ratings yet

- Funded African Tech Startups 2020Document13 pagesFunded African Tech Startups 2020LoNo ratings yet

- Entrepreneurship and EconomicDocument2 pagesEntrepreneurship and EconomicSukruti BajajNo ratings yet

- Maximizing Revenue of IT Project DevelopmentDocument4 pagesMaximizing Revenue of IT Project DevelopmentJulius Mark CerrudoNo ratings yet

- DSP Lab Record Convolution ExperimentsDocument25 pagesDSP Lab Record Convolution ExperimentsVishwanand ThombareNo ratings yet

- Forms of Business Organization: Sole Proprietorship, Partnership, Corporation, CooperativesDocument17 pagesForms of Business Organization: Sole Proprietorship, Partnership, Corporation, CooperativesSanti BuliachNo ratings yet

- HandoverDocument2 pagesHandoverKumaresh Shanmuga Sundaram100% (1)