Professional Documents

Culture Documents

Invst in Equity

Uploaded by

Arun KumarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Invst in Equity

Uploaded by

Arun KumarCopyright:

Available Formats

INVESTMENTS IN EQUITIES

INTROUDCTION Investment management once seemed a simple process. Well-heeled investors would hold portfolios composed of stocks and bonds of blue chip industrial companies, treasury bonds, notes and bills. The choices available to less well-off investors were much more limited, confirmed primarily to passbook savings accounts. If the investment environment can be thought of as an ice cream parlor, then the customers of past decades were offered only chocolate and vanilla. Investment means the sacrifice of current rupees for future rupees. Two different attributes are involved time and risk. The sacrifice takes place in the present and is certain. The reward comes later and the magnitude is uncertain. In some cases, risk is the dominant attribute. These are two types of investments. They are: Real Investments Financial Investments

Real investments involve some kind of tangible assets such as land, machinery, factories. Financial investments involve contracts written on pieces of paper such as common stocks and bonds. Investment in securities such as shares, debentures and bonds is profitable as well as exciting, but it involves great deal of risk. Investing in financial securities is considered to be one of the best avenues for investing ones savings while it is acknowledged to be one of the most risk y avenues of investment.

PURPOSE OF THE STUDY The purpose of the study is to know about stock markets in India, how they work, fundamental requirements before entering the stock market, how to enter the stock market, market design, stock selection, when to buy or sell a stock, how to invest and knowing about market intermediaries.

OBJECTIVES OF THE STUDY The objective of the study is to look into the scientific approach for selecting a stock where Fundamental Analysis and Technical Analysis are looked into.

INVESTMENTS IN EQUITIES

For that purpose the most happening software sector was taken for study and from that sector, three stocks were picked up and analyzed. The study deals with analysis of performance of the company, share price fluctuations and comparing it with another company from same sector. The purpose of the study is to locate a stock which gives good returns with minimum risk.

LITERATURE REVIEW Investment process Investment process describes how an investor should go about making decisions. Fundamental analysis To determine the intrinsic value of an equity share Technical analysis The technical analyst assumes that it is 90 percent psychological and 10 percent logical. It doesnt evaluate a large number of fundamental factors relating to the company.

RESEARCH METHODOLOGY Project is totally based on analytical research. It is prepared on more structured way to find out problem question. The data are collected from the secondary sources. Tool: Dow Theory

EXPECTED OUTCOME Economic liberalizations acceleration in the pace of development in the securities market. The role of securities markets structural transformation with the introduction of computerized online trading and interconnected market system. Identification of profitability on investment on securities such as shares, debentures and bonds.

INVESTMENTS IN EQUITIES

BIBLIOGRAPHY: BOOKS Security Analysis and Portfolio Management, Prasanna Chandra. Investments, William, Sharpe

WEBSITES: en.wikepidia.org www.ventura1.com www.about.stocks.com www.nseindia.com www.moneycontrol.com

TIME-ACTIVITY CHART Activity Time-line

Understanding structure, culture and functioning of the organization. April 16th to 30th Preparation of research instrument for data collection Data Collection Analysis and finalization of report Submission of report May 1st to 14th May 15th to 11th June June 12th to 2nd July July 2nd to 9th

INTRODUCTION ABOUT THE SUBJECT

Finance is regarded as the lifeblood of business enterprise. This is because in the modern money oriented economy; finance is one the basic foundation of all economic activities. It is the master key, which provides access to all economic activities. A well knit financial system directly contributes to the growth of the economy. An efficient financial system calls for the effective performance of financial institution, financial instrument and financial markets. Some consider that finance is concerned with acquiring funds on reasonable terms and conditions to pay bills promptly and some other consider it as that terms which is concerned with procurement of funds.

NEED FOR FINANCE IN BUSINESS

INVESTMENTS IN EQUITIES

Finance in business is needed to meet both long term and short term objective of the organization. Following are some of the avenues where business finance is developed to meet the firms objective. Acquisition and management of current assets for managing day to day operations. Managing mergers, reorganization, expansion, and diversification. To meet expectation of stake holders. Acquisition of necessary assets for running the business. According to Guttmann and Doughall, business finance can be broadly defined as the activity concerned with planning, raising, controlling and administrating of the funds used in the business. Finance is the process of organizing the flow of funds so that a business can carry out in the most efficient manner and its obligations as they fall due.

TYPES OF FINANCE Finance can be classified into two types as follows:

1. Public finance 2. Private finance Public finance deals with the requirement, receipts and disbursement of funds in the government institution like states, local self- government and central government. Private finance is concerned with requirement, receipts and disbursement of funds in case of individual, a profit seeking business organization and nonprofit organization.

FUNCTIONS OF FINANCE

Although it is difficult to separate finance functions from other functions, yet their function can be readily identified. The function of raising funds, investing them in assets and distributing returns earned from assets to

INVESTMENTS IN EQUITIES

shareholders are respectively known as financing, investment and dividend decision. While performing these functions, the firms attempt to balance cash inflow and outflow. This is called liquidity decision and it is taken as one of the most important finance functions. In short, finance is concerned with 1. Obtaining funds at the lowest cost. 2. Making the optimal use of these funds.

ISSUES IN FINANCING

Every firm has its own goals aiming at a certain extent of profit generation. It is not necessary for a firm to have the goals or profit maximization as the only objective in the short as well as long run. The management might have its own limitations of efficiency and capacity, level of satisfaction and appraisal of future, etc. The problems faced by an account dealing with finance functions are: 1. Type of expenditure to which a firm should get it involved in a commitment to spend. 2. The volume of funds that should be committed by a firm on various type of expenditure. 3. The way and means by which the existing funds committed as well as non-committed could be utilized for getting maximum benefits for the firm. 4. The course of action to be taken whenever the expectation does not materialize and a failure is to be averted.

FINANCIAL MANAGEMENT

Financial management is the operational activity of a business that is responsible for obtaining and effectively utilizing the funds necessary for efficient operation. Financial management is a subject which deals with

INVESTMENTS IN EQUITIES

the tools and techniques through which a companys balance sheet is constructed. It offers ideas to the executives in building items in liabilities and assets side of balance sheet. It clearly guides the financial manager to select both long term and short term and its allocation to capital and revenue expenditure, hence ultimately used as a communication too, to convince the investors about the performance of a corporate entity.

SPECEFIC OBJECTIVE

1. Profit maximization. 2. Wealth maximization.

OTHER OBJECTIVES

1. Balanced asset structure 2. Judicious planning of funds 3. Financial discipline 4. Liquidity 5. Efficiency

FINANCIAL ANALYSIS

Financial analysis refers to an assessment of the viability, stability and profitability of a business, sub-business or project. It is performed by professionals who prepare using ratios that make use of information taken from financial statement and other reports. These reports are usually presented to top management as one of their bases in making business decisions. Based on these reports management may: 1. Continue or discontinue its main operation or part of its business. 2. Make or purchase certain materials in the manufacture of its products; Acquire or rent/ lease certain machineries and equipments in the production of its goods. 3. Issue stocks or negotiate for bank loan to increase its working capital.

INVESTMENTS IN EQUITIES

4. Make decision regarding investing or lending capital; make other decision that allows management to make an informed selection on various alternatives in the conduct of its business.

FINANCIAL STATEMENT

The financial are composed of data which are the result of a combination of recorded facts concerning the business transaction, conventions adopted to facilitate the accounting technique, postulates or assumptions made to and personal judgment used in the application of the conventions & postulates. It is prepared for the purpose of presenting a periodical view of reports on progress by the management. Two basic financial statements prepared for the purpose of external reporting to owners, investors and creditors are Balance sheet Profit and loss account. It is the most significant financial statement. It indicates the financial conditions or the state of affairs of a business at a particular moment of time; balance sheet contains information about resources and obligations of a business entity and its owners interest in the business at a particular point of time.

FINANCIAL ANALYSIS

It refers to the process of determining financial strengths and weakness of the firm by establishing strategic relationship between the items of the balance sheet, profit and loss account and other operative data. The term financial analysis is also known as analysis and interpretation of financial statement. The purpose of financial analysis is to diagnose the information contained in the financial statement so as to judge the profitability and financial soundness of the firm.

INVESTMENTS IN EQUITIES

DEVICES OF FINANCIAL ANALYSIS

1) COMPARATIVE STATEMENT The comparative financial statements are statements of the financial position at different periods of time. The elements of financial position are shown in a comparative form so as to give an idea of financial positions at two or more periods. Any statement prepared in a comparative form will be covered in comparative statement. Comparative balance sheet analysis is the study of the trend of the same items, groups of items and computed items in two or more balance sheets of the sane business enterprise on different dates. 2) TREND ANALYSIS The financial statements may be analyzed by computing trends of series of information. This method determines the direction upwards or downwards and involves the computation of the percentage relationship that each items bears to the same in the base year. 3) COMMON SIZE STATEMENTS The common size statements, balance sheet and income statement are shown in analytical percentages. The figures are shown as percentage of total assets, total liabilities, and total sales.

4) RATIO ANALYSIS

Ratio analysis is a technique of analysis and interpretation of financial statement. It is the process of establishing and interpreting various ratios for helping in making certain decisions.

5) FUND FLOW STATEMENT ANALYSIS

INVESTMENTS IN EQUITIES

The fund flow statement is a statement which shows the movement of funds and is a report of financial operations of the business undertakings. It indicates various means by which funds were obtained and employed during a particular year.

6) CASH FLOW STATEMENT ANALYSIS

Cash flow statement is a statement which describes the inflow (source) and outflow (uses) of cash and cash equivalents in a enterprise during a specified period of time.

Part-B GENERAL INTRODUCTION TO THE BANKING

In the past, economic advancement was unknown. Consequently the use of money for buying and selling was very much restricted. With the development of communications, economic progress and the spread of science, and the growth of economic and political institution, the use of money also expanded. Along with the use of money, the use of credit instrument also developed. The origin of modern financial institution can be traced to antiquity, where the individuals used to accept money in the form of deposits and lend it to people who needed for meeting their requirements which may be economic or social. As times advanced, the character of economic transaction also changed. Old order of borrowing and lending underwent metamorphic changes. Finance became a powerful instrument for any change. In fact, the innovations in the fields of transport and communication, development of energy and manufacturing have resulted in innovations in the sphere of banking.

ABOUT BANKING SYSTEM

INVESTMENTS IN EQUITIES

The development of Banking is evolutionary in nature. There is no single answer to the question of what is banking. Because a bank performs a multitude of functions and services which cannot be comprehended into single definition, for a common man, a bank means a storehouse of money for a business, it is an institution of finance and for a worker it may be a depository for his savings.

EVOLUTION OF BANKING

Initially, the bankers, the Jews in Lombardy carried out their business on benches in the market place resembled the banking counter. If the banker failed, his banque (bench) was broken into pieces by the people; hence the word bankrupt came into existence. In simple term bankrupt means a person who has lost all his money, wealth, or financial resources.

THE ORIGIN OF THE WORD BANK

Bank German(joint stock fund) Banco Italian (heap of money) Baucus/banque French (bench/chest a place where valuables are kept) Bank English (common meaning prevalent today)

Meaning of banking

The term banking is defined as accepting for the purpose of lending or investment of money from the public repayable on demand or otherwise and withdrawal by cheques, drafts and orders.

Importance of Banks

The importance of bank cannot be denied at all. Banks play an important and significant role in economic development of a country.

INVESTMENTS IN EQUITIES

The economic importance of bank is as follows: 1. Banks mobilizes the small scattered and idle saving of people. 2. Banks plays a vital role in development of a country. 3. Banks provides safety and security to surplus money and deposits. 4. Banks influence the rate of interest in the money market. 5. Banks direct the flow of the funds into productive channels. 6. It mobilizes funds from surplus to deficit places. 7. Banks serve as the best financial intermediary between savers and investors. 8. Banks facilitates trade and commerce, industry and agriculture by meeting their financial requirements. 9. Banks provide a convenient and economical means of payment. 10.They create credit by lending several times the cash deposits they receive. 11.Banks influence employment, income and the general price level. Banks are useful in several ways and can be concluded that a strong and sound banking system is indispensable for economic development of any country.

Traditional services of banks The Goldsmith:

The goldsmiths by virtue of dealing in gold facilitates for the safe keeping of valuables. A person largely because of the danger of theft started to leave their precious bullion and coin in the custody of goldsmith. Goldsmith began imposing charges for safe keeping.

The moneylender:

INVESTMENTS IN EQUITIES

The moneylenders were men of means and reputations. They used to lend their surplus funds to the needy at high rates of interest and earned large income. The moneylenders borrowed money at lower rates of interest and lent it to the needy at higher rate of interest. The difference between the two interests constituted the profits.

The merchant bankers:

These people are originally traders in commodities. They were engaged in trade, internal as well as external. In course of time besides trading, they undertook the financing trade, especially the foreign. Thus the merchant who started as traders in goods slowly developed as financier of foreign trade or banker. It is clear that merchant bankers, money lenders and goldsmith were largely responsible for the development of modern banks.

Modern banks possess the characteristics of all these ancestors like the merchant bankers, modern banks finance foreign trade and use bills of exchange in their financing of foreign trade. Like the money lenders, modern banks accept deposits from those who have surplus money to spare and lend the same to the needy for productive purposes. Like the goldsmiths modern banks provide to the depositors and a convenient means of payment in the form of cheques and create money.

History of banking in India:

Banking was existence in India from very early times. The writing Manu and Kautilya contained references to banking. But, banking on western lines started in India only from the beginning of the 19th century. The Indian commercial banking system had to pass through a series of financial crisis and reforms; its growth was slow during the first half of the 20th

INVESTMENTS IN EQUITIES

century. Further many banks during this period went through a series financial crisis. It is only after independence the Indian banking system has made a rapid progress. Today, the Indian banking system is one the sophisticated and well developed commercial banking systems in the world.

Meaning of the term Bank:

The term BANK is derived from the German word PACKS which means joint stock fund or a common fund that is a Heap of money raised from a large number of the public. They contended that the early European bankers raised a common fund or heap of money from the public for the purpose of financing the need as, banks deal in common funds or heaps of money raised from the public.

Definition of the term Bank:

The Indian Banking Companies Act of 1949 defines the term Banking Company as any company which transacts the business of banking in India, as accepting foe the purpose of lending or investment of deposits of money from the public repayable on demand or otherwise and withdraw able by cheques, draft order or otherwise.

Classification of banks

Banks are classified into several types based on the functions they perform. Generally banks are classified into: Commercial banks Investment banks (or) Industrial banks Exchange banks Land mortgage bank Central bank Co- operative banks Commercial banks:

INVESTMENTS IN EQUITIES

Commercial banks perform all the business transaction of a typical bank. They accept three types of deposits viz current deposit, fixed deposits, saving deposits which are re payable on demand. Since commercial banks are expected to meet immediate requirements of depositors, they cannot invest credit overdrafts. They provide cheque facility and bank draft for transfer of funds, safeguarding the valuables, discounting the bills of exchange, collecting customers stocks and shares etc. Investment / Industrial banks Investment banks are those banks which are mainly concerned with underwriting new securities. They underwrite new issued shares and debentures of industrial companies and also purchase entire issue of new securities and later sell it to the public at higher price. Industrial banks are those banks which are socialized in providing long term loans to industries with a view to buy plant and machinery and other capital assets that require huge capital outlay. These banks play major role in economic development of a country.

Exchange bank: Exchange banks are known as foreign banks or foreign exchange banks, which provide foreign exchange for import trade. Their main function is to make international payment through the purchase and sales of exchange bills. They convert home currency into foreign currency and vice versa. They discount foreign exchange bills, which are used in foreign trade. These banks function like commercial banks accepting deposits and lending funds for investment.

You might also like

- Financial Statement AnalysisDocument96 pagesFinancial Statement AnalysisArun Kumar100% (1)

- FRS Unit 3Document6 pagesFRS Unit 3Sushma KambleNo ratings yet

- RAKSHITHADocument83 pagesRAKSHITHAajaytilak999No ratings yet

- Vivek ProjectDocument93 pagesVivek ProjectMohmmedKhayyumNo ratings yet

- Business Finance ReviewerDocument4 pagesBusiness Finance ReviewerDubu GloryNo ratings yet

- Importance of Finance:-: Chapter - 1Document102 pagesImportance of Finance:-: Chapter - 1VidyaNo ratings yet

- FINANCIAL MANAGEMENT Study PaperDocument102 pagesFINANCIAL MANAGEMENT Study PaperPriyank TripathyNo ratings yet

- Introduction To Finance and AccountingDocument38 pagesIntroduction To Finance and AccountingDr.Ashok Kumar PanigrahiNo ratings yet

- Chapter 3Document26 pagesChapter 3Siddhesh TamhanekarNo ratings yet

- Financial Analysis ProjectDocument60 pagesFinancial Analysis ProjectSree GaneshNo ratings yet

- Kevin Project - OushadhiDocument88 pagesKevin Project - OushadhiRojith Abraham CheruvazhakunnelNo ratings yet

- Chapter-4 Specialization - Ii FinanceDocument15 pagesChapter-4 Specialization - Ii FinanceRahul ThakurNo ratings yet

- Introduction to Financial Statement AnalysisDocument83 pagesIntroduction to Financial Statement AnalysisNaresh KumarNo ratings yet

- Financial Ratio Interpretation (ITC)Document12 pagesFinancial Ratio Interpretation (ITC)Gorantla SindhujaNo ratings yet

- Approach To The Study: CHAPTER-IDocument10 pagesApproach To The Study: CHAPTER-Igovi93No ratings yet

- Finance, ITS DEFINITION, IMPORTANCE AND FUNCTIONDocument20 pagesFinance, ITS DEFINITION, IMPORTANCE AND FUNCTIONJhon GonzalesNo ratings yet

- Chapter 2: Introduction to Financial StatementsDocument18 pagesChapter 2: Introduction to Financial StatementsNabila Afrin RiyaNo ratings yet

- BCH-503-SM03 FM IntroDocument28 pagesBCH-503-SM03 FM Introsugandh bajajNo ratings yet

- Ratio AnalysisDocument21 pagesRatio AnalysisNitin MagarNo ratings yet

- Unit - 5 NotesDocument11 pagesUnit - 5 Notesdilipkumar.1267No ratings yet

- Day 1 - BFDocument59 pagesDay 1 - BFPhill SamonteNo ratings yet

- MCO 106 UNIT-1 Business Finance 2023Document14 pagesMCO 106 UNIT-1 Business Finance 2023daogafugNo ratings yet

- 804 I.A Ahmadu Bello UniversityDocument5 pages804 I.A Ahmadu Bello Universityayo kunleNo ratings yet

- Capital Budgeting Is Finance Terminology For The Process of Deciding Whether or Not To Undertake An Investment Project.Document14 pagesCapital Budgeting Is Finance Terminology For The Process of Deciding Whether or Not To Undertake An Investment Project.Utkarsh BajpaiNo ratings yet

- Financial Performance Analysis of India CementsDocument74 pagesFinancial Performance Analysis of India CementsKarthikeyan ThangarajNo ratings yet

- Fundamentals of Finance and Financial ManagementDocument4 pagesFundamentals of Finance and Financial ManagementCrisha Diane GalvezNo ratings yet

- Unit 1 Introduction To Financial ManagementDocument12 pagesUnit 1 Introduction To Financial ManagementPRIYA KUMARINo ratings yet

- Investment Decision Analysis at ICICI BankDocument11 pagesInvestment Decision Analysis at ICICI BankKhaisarKhaisarNo ratings yet

- Bba 301Document10 pagesBba 301rohanNo ratings yet

- Business Finance - Introduction To Financial ManagementDocument23 pagesBusiness Finance - Introduction To Financial ManagementAranda, Irian D.No ratings yet

- MBA Accounting Project, A STUDY ON FINANCIAL PERFORMANCE OF SARAVANA STORES FOODS PRIVATE LIMITED., CHENNAI.Document52 pagesMBA Accounting Project, A STUDY ON FINANCIAL PERFORMANCE OF SARAVANA STORES FOODS PRIVATE LIMITED., CHENNAI.AbishRaghulGaneshRL100% (2)

- Financial Manager's Role in OrganizationsDocument10 pagesFinancial Manager's Role in OrganizationsZeleine Raine Del RosarioNo ratings yet

- Financial Management SourcesDocument21 pagesFinancial Management Sourcesvignesh sivakumarNo ratings yet

- Chapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductionDocument10 pagesChapter One: Investments and Capital Allocation Framework 1.1. The Investment Environment-An IntroductiontemedebereNo ratings yet

- Financial Analysis and PerformanceDocument13 pagesFinancial Analysis and PerformanceSiddhesh TamhanekarNo ratings yet

- Malvik ProjectDocument95 pagesMalvik ProjectKamal ShahNo ratings yet

- Cash Flow Final PrintDocument61 pagesCash Flow Final PrintGeddada DineshNo ratings yet

- 210 - F - ZuariDocument72 pages210 - F - ZuariPeacock Live ProjectsNo ratings yet

- Gikondo Rusizi - Ur - Cbe Managerial Finance Notes April 2023 April 2023Document324 pagesGikondo Rusizi - Ur - Cbe Managerial Finance Notes April 2023 April 2023Cyiza Ben RubenNo ratings yet

- Topic 5Document5 pagesTopic 5Kary EscobarNo ratings yet

- Corporate Finance Class NotesDocument80 pagesCorporate Finance Class NotesAnmol Srivastava100% (1)

- Module 1Document30 pagesModule 1Erika PiapiNo ratings yet

- Finance Is The Lifeline of Any BusinessDocument22 pagesFinance Is The Lifeline of Any BusinessmeseretNo ratings yet

- PT FinanceDocument4 pagesPT FinanceDarlianne Klyne BayerNo ratings yet

- Corrected BrandDocument63 pagesCorrected BrandRajesh KhannaNo ratings yet

- Overview of Finance and Business EthicsDocument22 pagesOverview of Finance and Business EthicsRACHEL RIANNE ANTONENo ratings yet

- Financial ManagementDocument11 pagesFinancial ManagementWaseem KhanNo ratings yet

- Business Finance ABM StrandDocument107 pagesBusiness Finance ABM StrandMiss Anonymous23No ratings yet

- Natinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section RegularDocument18 pagesNatinal Aviation College: Financial Management Finalexamination Name Solomon Abera Id Gblr/049/12 Section Regularcn comNo ratings yet

- FinanceDocument10 pagesFinanceswati_rathourNo ratings yet

- Babu KPCL Final ProjectDocument95 pagesBabu KPCL Final ProjectLucky Yadav100% (1)

- Evolution of Financial ManagementDocument4 pagesEvolution of Financial ManagementAshis karmakar100% (3)

- Module 1 FM NotesDocument18 pagesModule 1 FM NotesDachu DarshanNo ratings yet

- Chapter - I 1.1 Introduction To The StudyDocument91 pagesChapter - I 1.1 Introduction To The StudyNaresh KumarNo ratings yet

- "Working Capital and Funds Efficiency": BBM" by Chandan. T.LDocument36 pages"Working Capital and Funds Efficiency": BBM" by Chandan. T.LmechanicalmadhuNo ratings yet

- minor project on financial performace analysis on the basis of annual reprotsDocument31 pagesminor project on financial performace analysis on the basis of annual reprotsatishay jainNo ratings yet

- Introduction To Financial ManagementDocument24 pagesIntroduction To Financial ManagementPasa YanNo ratings yet

- Principle of Finance Chapter - I: DR S.M.Tariq ZafarDocument25 pagesPrinciple of Finance Chapter - I: DR S.M.Tariq ZafarSúprítí RóyNo ratings yet

- PG - No 1. Chapter-IDocument91 pagesPG - No 1. Chapter-ImasthanshaNo ratings yet

- Financial Intelligence: Mastering the Numbers for Business SuccessFrom EverandFinancial Intelligence: Mastering the Numbers for Business SuccessNo ratings yet

- Customer-centric policies guide service excellenceDocument121 pagesCustomer-centric policies guide service excellenceElena Diana100% (1)

- C5. Financial Statements of Banks and Their Principal CompetitorsDocument1 pageC5. Financial Statements of Banks and Their Principal CompetitorsNguyen Hoai HuongNo ratings yet

- Co Act On Loans Accepted & GivenDocument43 pagesCo Act On Loans Accepted & GivendkdineshNo ratings yet

- English For OfficeDocument79 pagesEnglish For OfficeSegaf Sang PengelanaNo ratings yet

- Sbi P&SDocument2 pagesSbi P&SvmktptNo ratings yet

- Republic v. CTA - CIR GR No. GR 62554-55Document9 pagesRepublic v. CTA - CIR GR No. GR 62554-55Darrel John SombilonNo ratings yet

- Concept of MoneyDocument12 pagesConcept of MoneyHamidi HamidNo ratings yet

- Finan StatDocument11 pagesFinan StatMd. Abu Yousuf NoshedNo ratings yet

- Vision: Vision Statement Mission StatementDocument7 pagesVision: Vision Statement Mission StatementALINo ratings yet

- A Research Project UrmilaDocument50 pagesA Research Project UrmilamanuNo ratings yet

- KCB Kenya Tariff Guide 2019Document1 pageKCB Kenya Tariff Guide 2019clement muriithiNo ratings yet

- The Banking Companies Ordinance, 1962 (LVII of 1962) Part - I Preliminary Sections: PagesDocument201 pagesThe Banking Companies Ordinance, 1962 (LVII of 1962) Part - I Preliminary Sections: PagesAlinizambdoNo ratings yet

- Ratio Analysis of Nepal Investment Bank LimitedDocument9 pagesRatio Analysis of Nepal Investment Bank LimitedKrishant KCNo ratings yet

- RDocument2 pagesRMukesh ManwaniNo ratings yet

- Bloomberg Bna Transfer Pricing Report Negative Interest Rates A Transfer Pricing PerspectiveDocument5 pagesBloomberg Bna Transfer Pricing Report Negative Interest Rates A Transfer Pricing PerspectiverajuNo ratings yet

- CARO 2020 Question BankDocument9 pagesCARO 2020 Question BankRitikaNo ratings yet

- Banker S Right of Set Off - Explained - BankExamsTodayDocument4 pagesBanker S Right of Set Off - Explained - BankExamsTodayHimanshu Panchpal100% (3)

- Mavic Enterprises Post-Closing Trial BalanceDocument2 pagesMavic Enterprises Post-Closing Trial BalanceAlexidaniel Labasbas100% (1)

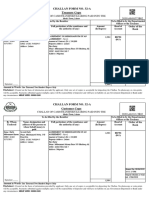

- Challan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheDocument1 pageChallan Form No. 32-A Treasury Copy: Challan of Cash/Transfer/Clearing Paid Into TheHafiz ImranNo ratings yet

- Study of Deposit Schemes of Bank of IndiaDocument69 pagesStudy of Deposit Schemes of Bank of IndiaMegha JerathNo ratings yet

- G.R. No. 123498 PDFDocument7 pagesG.R. No. 123498 PDFRuth TenajerosNo ratings yet

- Internship ReporDocument39 pagesInternship ReporconXn Communication & Cyber100% (1)

- PSB Tk.2 d3 Pajak 2018Document93 pagesPSB Tk.2 d3 Pajak 2018Ardi PribadiNo ratings yet

- Checkbook RegisterDocument10 pagesCheckbook RegisterTechto solveNo ratings yet

- Vouching ControlDocument42 pagesVouching ControlSundayNo ratings yet

- Central Bank Balance Sheet Money SupplyDocument37 pagesCentral Bank Balance Sheet Money SupplyIzzy Cohn0% (1)

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsJennifer EcleNo ratings yet

- Sap Fi Accounts ReceivableDocument66 pagesSap Fi Accounts ReceivableNikola100% (1)

- Net Open PositionDocument8 pagesNet Open Positionshehzeds100% (1)

- Assignment On Chapter 5 Cash Ad ReceivablesDocument3 pagesAssignment On Chapter 5 Cash Ad Receivablesdameregasa08No ratings yet