Professional Documents

Culture Documents

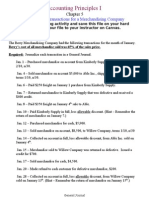

Formule Financial Management

Uploaded by

Elena NichiforOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Formule Financial Management

Uploaded by

Elena NichiforCopyright:

Available Formats

ANGLO-SAXON APPROACH

Sales revenue

- Cost of goods sold

- Selling, general and administrative expenses

= Operating Income

+ Other revenues

-Other expenses (Except Interest)

= EBIT

- Interest payment

= EBT

- Taxes

= Net Income

ROMANIAN APPROACH

Operating revenues

- Operating expenses

= Operating income

Financial revenues

- Financial expenses

= Financial income

Extraordinary revenues

- Extraordinary expenses

= Extraordinary Income

Operating Income

+ Financial Income

+ Extraordinary Income

= EBT

- Corporate Income Tax

= Net Income

Sales revenues = Total operating costs = Total variable costs + Total fixed costs

(P x Q) = TOC = (V x Q) + F

Q

OpBE

= F / (P-V)

S

OpBE

= F/ (1 -(V/P))

Net operating income (NOI = EBIT)

Degree of Operating Leverage:

1% change in Sales => x % change in EBIT

Cash Flow from Operating Activities :

Net Income

+Depreciation & Amortization

- Change in Operating Working Capital (OWC)

= Total Cash from Operations

OWC = [Current assets - Cash & Marketable

Securities] - [Current liabilities - interest

bearing current liabilities]

Cash Flow from Investing Activities :

- Acquisitions of fixed assets

+ Sales of fixed assets

- Acquisitions of financial assets

+ Sales of financial assets

= Cash Flow from Investing Activities

Cash Flow from Financing Activities :

- the amount of long-term or short-term debt

repayed.

+ the amounts of newly issued long-term or

short-term debt.

- total amount of dividends paid.

- the amount of stock repurchases.

+ the amount of new stock issues.

= Cash flow from financing activities.

x

Sales Sales

Sales

Sales

Sales

EBIT

EBIT

L

OPBE

o

=

=

A

A

=

0

0

0

0

New Working Capital (NWC) = OwnersEquity + Long Term Debt - Fixed Assets

NWC = Current Assets Current Liabilities

Inventory Conversion Period (ICP) = inventory

0

/cogs

1

x 365 days = x days

Receivables Collection Period (RCP) = acc receiv

0

/sales

1

x 365 days = x days

Payables Period (PP) = accounts payable

0

/COGS

1

x 365 days = x days

Cash conversion cycle (CCC) = ICP + RCP PP

Operating Cycle (OC) = ICP + RCP

Nominal trade credit cost formula:

period Disc. - taken Days

days 365

% Discount - 1

% Discount

k

TC

=

Net value = gross value depreciation

Current ratio = current assets / current liabilities

Quick ratio (acid test) = (cash + marketable securities + accounts receivables) / current liabilities

Cash ratio = (cash + marketable securities) / current liabilities

Acc Receiv Turnover Ratio = net credit sales / average accounts receivable

Fixed asset turnover = sales / fixed assets

Total assets turnover = Sales / Total assets

Inventory turnover = COGS / average inventory

Gross margin ratio = Gross margin/ sales

Operating margin ratio = EBIT / sales

Net profit margin = net income / sales

Cash Flow margin ratio = Cash-flow from operating activity/ sales.

ROE = net income / shareholders equity

ROA = net income / average total assets

Return on invested capital (ROIC) = (Net income + Interest)/(L-T Debt + Equity)

L-T Debt + Equity = Net Assets or Operating Capital

ROE = ROIC + [(ROIC Cost of debt)L-T Debt/Equity]

Debt-equity ratio = total debt / equity

Long-term debt ratio = long-term debt / ( long-term debt + equity)

Total debt ratio = total liabilities / total assets

Times interest earned = EBIT / interest expense

Times Cash flow coverage = (OCF + Tax + Interest Exp) / interest expense

Times burden covered = EBIT/(Interest + Principal repayment/(1-t))

P/E Ratio = ratio of market price per share to earnings per share

Market/Book Ratio = Market price per share / Book value per share

Price/Cash Flow

Dividend yield = Dividend per share of common stock Market price per share of common stock

Compund interest: FV = PV + (PV x Interest)

Future Value: FV

1

= PV (1+k)

n

FV = future value

PV = present value or principle

k = rate of interest per compounding period

n = number of compounding periods

Frequency of comp: FV

n

= PV

0

(1 + [k/m])

mn

n: Number of Years

m: Compounding Periods per Year

k: Annual Interest Rate

FV

n,m

: FV at the end of Year n

PV

0

: PV of the Cash Flow today

FV = PV(1 + k)

t

=> PV = FV / (1 + k)

t

1 -

m

k

+ 1 = EAR

m

SIMPLE

|

.

|

\

|

n m

SIMPLE

n

m

k

+ 1 PV = FV

|

.

|

\

|

(

+

=

(

+ =

=

k

1 k) (1

PMT k) (1 PMT FVA

n 1 n

0 t

t

n

(

(

=

(

+

=

+

=

k

- 1

PMT

k) (1

1

PMT PVA

n

k) (1

1

n

1 t

t n

g k

PMT

PVA

n

=

1

PVA

n

= PMT/k

NPV = - I

0

EXPECTED PROJECT RETURN = r

f

+ b

project

(r

m

- r

f

)

Profitability index

Internal rate of return (IRR)

X (1+0,01)

60

+ X (1+0,01)

59

+ . X (1+0,01) = 100.000

X (1+0,01) ((1+0,01)

59

+ 1+0,01)

58

+ . + 1) = 100.000

(geometric progression)

Ration q = (1+0,01)

S = a

1

x (q

n+1

1)/q-1

S= 1 x (1+0,01)

60

1/ (1+0,01) 1

WACC = K

e

* OE/K

inv

+ K

d

* (1- tau) * LTD/ K

inv

K

inv

= OE + LTD

OE/K

inv

+ LTD/ K

inv

= 1

n 2

) (1 ) (1 ) (1

.......

k

TV FCFF

k

FCFF

k

FCFF n n 2 1

+ + +

+

+ + +

rate inflation + 1

rate interest nominal + 1

= rate interest real 1 +

( ) ( )

0

1

1 1

I

k

TV

k

CF

NPV

n t

t

n

t

+

+

+

=

=

0

) (

I

CF PV

PI =

( ) ( )

n t

t

n

t

IRR

TV

IRR

CF

I

+

+

+

=

=

1 1

1

0

factor annuity

costs of lue present va

= cost annual Equivalent

You might also like

- Daily Market Outlook ReiffeisenDocument6 pagesDaily Market Outlook ReiffeisenElena NichiforNo ratings yet

- Project Online Business ProjectDocument6 pagesProject Online Business ProjectElena NichiforNo ratings yet

- Risk Analysis Risk RaiffeisenDocument5 pagesRisk Analysis Risk RaiffeisenElena NichiforNo ratings yet

- Chapter 6: RisksDocument10 pagesChapter 6: RisksElena NichiforNo ratings yet

- Review Chapter 2 Thomas S KuhnDocument3 pagesReview Chapter 2 Thomas S KuhnElena NichiforNo ratings yet

- The Academy of Economic Studies Entrepreneurship and Business Administration - English TeachingDocument32 pagesThe Academy of Economic Studies Entrepreneurship and Business Administration - English TeachingElena Nichifor33% (3)

- Project Online Business ProjectDocument6 pagesProject Online Business ProjectElena NichiforNo ratings yet

- Review Chapter 3 Karl PopperDocument3 pagesReview Chapter 3 Karl PopperElena NichiforNo ratings yet

- Marketing Project Google ProjectionsDocument5 pagesMarketing Project Google ProjectionsElena NichiforNo ratings yet

- About The Product: CRM Software in A Hosted Model - There Is No Option For An On-Premise ImplementationDocument4 pagesAbout The Product: CRM Software in A Hosted Model - There Is No Option For An On-Premise ImplementationElena NichiforNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Retailing Management Chapter 6Document28 pagesRetailing Management Chapter 6Ahmed EhtishamNo ratings yet

- Using Receivables Credit To CashDocument598 pagesUsing Receivables Credit To CashKumar MNo ratings yet

- Naveen Syllabus SheetDocument54 pagesNaveen Syllabus SheetRajesh khannaNo ratings yet

- Tesfaye Beyene GCDocument126 pagesTesfaye Beyene GCMegersa TadeleNo ratings yet

- Departmental accounts solutionsDocument10 pagesDepartmental accounts solutionsMINTU SARAFNo ratings yet

- Crystec - Presentation - 2021 - Oct 1500 (19652)Document18 pagesCrystec - Presentation - 2021 - Oct 1500 (19652)Edward WilsonNo ratings yet

- Accountant Job DiscriptionDocument2 pagesAccountant Job DiscriptionmohandNo ratings yet

- Financial Administration in Local GovernmentDocument21 pagesFinancial Administration in Local GovernmentNizam Saiful50% (2)

- Vakrangee Clarification - The Ken Article PDFDocument12 pagesVakrangee Clarification - The Ken Article PDFDewang ShahNo ratings yet

- Comprehensive Exam ADocument12 pagesComprehensive Exam Ajdiaz_646247100% (2)

- Edlyn Valmai Devina - 29117056 - PT Holcim IndonesiaDocument50 pagesEdlyn Valmai Devina - 29117056 - PT Holcim IndonesiaEdlyn Valmai Devina SNo ratings yet

- VWDocument19 pagesVWAbdul QayumNo ratings yet

- Vietnam Steel Industry: Presenter: Huynh Thanh LyDocument46 pagesVietnam Steel Industry: Presenter: Huynh Thanh LyDương NguyễnNo ratings yet

- TaxAtion CasesDocument103 pagesTaxAtion CasesYen PolsNo ratings yet

- XML and Excel financial ratios made easy with SEO-optimized titlesDocument60 pagesXML and Excel financial ratios made easy with SEO-optimized titlesNikita SharmaNo ratings yet

- VKCC Tenaga Nasional Berhad TNB Proposal MeetingDocument4 pagesVKCC Tenaga Nasional Berhad TNB Proposal MeetingQissyHalimyNo ratings yet

- AccountingDocument3 pagesAccountingLouie CraneNo ratings yet

- AON - Week 1 - New England Trust - Group 6Document15 pagesAON - Week 1 - New England Trust - Group 6rizkiNo ratings yet

- Oromia Pipe Factory PLC Business Valuation ReportDocument122 pagesOromia Pipe Factory PLC Business Valuation ReportKokand100% (1)

- Business Plan for GEOScales TradingDocument11 pagesBusiness Plan for GEOScales TradingNichol CorderoNo ratings yet

- Form No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarDocument9 pagesForm No. Aoc-4: Form For Filing Financial Statement and Other Documents With The RegistrarHardik KalariaNo ratings yet

- Financial Statement Analysis - Dabur India LTDDocument17 pagesFinancial Statement Analysis - Dabur India LTDVishranth Chandrashekar100% (1)

- Questions & Solutions ACCTDocument246 pagesQuestions & Solutions ACCTMel Lissa33% (3)

- Pos Malaysia Berhad Swot Analysis BacDocument7 pagesPos Malaysia Berhad Swot Analysis BacNour Ly100% (1)

- Paper 5 Revised PDFDocument576 pagesPaper 5 Revised PDFameydoshiNo ratings yet

- Nusantara Infrastructure TBK.: Company Report: January 2018 As of 31 January 2018Document3 pagesNusantara Infrastructure TBK.: Company Report: January 2018 As of 31 January 2018Gaztin Tri SetyaningsihNo ratings yet

- Shareholders' Agreement Defines Company OwnershipDocument13 pagesShareholders' Agreement Defines Company OwnershipAbhishek BiswalNo ratings yet

- IDBI Federal Financial AnalysisDocument44 pagesIDBI Federal Financial AnalysisGarima BhattNo ratings yet

- PRELEC1 Final ExamDocument4 pagesPRELEC1 Final ExamAramina Cabigting BocNo ratings yet