Professional Documents

Culture Documents

Monetary Policy of Bangladesh

Uploaded by

Imroz MahmudCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Monetary Policy of Bangladesh

Uploaded by

Imroz MahmudCopyright:

Available Formats

Chapter-1

Abstract This study aims to identify the influence of Monetary Policy on the performance of Capital Market of Bangladesh, DSE(Dhaka Stock Exchange) in particular. We have identified several variables that could capture the impact of the various transmission channels.. The empirical findings of this study show statistically significant correlation amongst the indicators for measuring money supply and the indicators for measuring performance of Capital Market of Bangladesh, in addition to the statistically significant influence of Monetary Policy on the performance indicators of DSE.

Introduction Capital market plays an important role in mobilizing financial resources from surplus units and transferring those to deficit and productive units of an economy. It provides an alternative source of funds for the firms for long-term investment purpose. In addition, a developed capital market also provides access to the foreign capital for domestic industries by creating a platform for foreign companies or investors to invest in domestic securities. Though the capital market of Bangladesh is one of the smallest in the world, it is the third largest in the South Asian region after India and Pakistan in terms of market capitalization1. During the last few years, stock market of Bangladesh has shown noteworthy growth in terms of almost all the indicators such as market capitalization, turnover and the price index. At the same time the market has experienced a notable volatility. Since stock prices are sensitive to economic conditions, it is crucially important for policymakers as well as investors to know the relationship between macroeconomic variables and stock price in Bangladesh. Like many other countries, maintaining low and stable inflation and fostering higher inclusive growth are two main objectives of monetary policy in Bangladesh. However, instruments of monetary policy do not influence these objectives directly and immediately. Bernanke & Kuttner (2005) argue that the most direct and immediate effects of monetary policy actions are on financial markets; by affecting asset prices and returns, policymakers try to modify economic behaviour in ways that will help to achieve their ultimate objectives. Against this backdrop, this paper explores how monetary policy and asset prices, particularly stock prices, are related in Bangladesh. Objectives of the Study The objective of the study is to identify the effect and relationship between monetary policy and stock market performance, DSE in particular. The specific objectives of the study include: To understand the Monetary Policy and its Tools. Monetary Policy of Bangladesh Bank- An Overview. Recent stock market development in Bangladesh. To identify the effect of Monetary Policy on Stock Market-DSE.

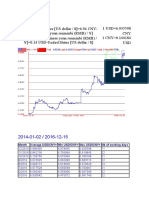

Methodology To estimate the effect of monetary policy on stock prices, we have identified several variables that could capture the impact of the various transmission channels. We took data from 1997 to 2012.Weighted average index of DSE (general) is considered .The variables are representatives of instruments of monetary policy. Where data of CPI Inflation (base year: 1995-96), Broad

Money(M2), Interest rate and Reserve money are taken. The data used in this study are collected from Bangladesh Bank, Bangladesh Bureau of Statistics and Dhaka Stock Exchange Ltd. A multiple linear regression took place. Where hypothesis were assumed and tested. Analysis of regression statistics, ANOVA, significance level, coefficients, t-test are done for analyzing statistical relationship between indicators for measuring money supply and indicators for measuring the performance of Dhaka Stock Exchange Limited.

Limitations of the Study For some variable like CPI Inflation, time factor had great impact in building relationship between DSE and monetary policy. While we took large data(1997-2012) it showed one kind of relation and when we took small data(2000-2012) it showed another kind of relation. It is assumed that the rate of change of one variable in terms of another is assumed to be constant for all values. In practice most relationships are not linear and the linear regression coefficients are not accurately descriptive of curvilinear data. Required information was not always available like - Annual DSE Index, therefore we used a weighted average figure which can reflect whole year. Time Limitation. Information Limitation

These constraints narrowed the scope of accurate analysis. If these limitations were not been there, the report would have been more useful and attractive.

Chapter-2

2.1 What Is Monetary Policy? Monetary policy is the process by which the central bank or monetary authority of a country controls the supply of money, often targeting a rate of interest. Monetary policy is usually used to attain a set of objectives oriented towards the growth and stability of the economy. These goals usually include stable prices and low unemployment. Monetary theory provides insight into how to craft optimal monetary policy. Monetary policy is referred to as either being an expansionary policy, or a contractionary policy, where an expansionary policy increases the total supply of money in the economy rapidly, and a contractionary policy decreases the total money supply or increases it only slowly. Expansionary policy is traditionally used to combat unemployment in a recession by lowering interest rates, while contractionary policy involves raising interest rates to combat inflation. Monetary policy is contrasted with fiscal policy, which refers to government borrowing, spending and taxation. An attempt to achieve broad economic goals by the regulation of the supply of money.

2.2 Objectives of Monetary Policy The objectives are to maintain price stability and ensure adequate flow of credit to the productive sectors of the economy. Stability for the national currency (after looking at prevailing economic conditions), growth in employment and income are also looked into. The monetary policy affects the real sector through long and variable periods while the financial markets are also impacted through short-term implications. There are four main 'channels' which the Central Bank looks at:

Quantum channel: money supply and credit (affects real output and price level through changes in reserves money, money supply and credit aggregates). Interest rate channel. Exchange rate channel (linked to the currency). Asset price. Monetary decisions today take into account a wider range of factors, such as:

Short term interest rates; Long term interest rates; Velocity of money through the economy; Exchange rate Credit quality Bonds and equities (corporate ownership and debt) Government versus private sector spending/savings

International capital flow of money on large scales Financial derivatives such as options, swaps and future contracts etc. 2.3 Types of Monetary Policy Monetary policy affects a nations monetary supply and the direction of its economy. Central banks, such as Bangladesh Bank, Bank of Japan, U.S. Federal Reserve, are responsible for enacting monetary policy. Central bankers have different types of policy actions at their disposal, and they can use these in an expansionary or contractionary manner, economic conditions. The four main types of monetary policies are: 1. Bank Reserve Requirements

Through reserve requirements, the central bank requires and other depository institutions to hold a certain amount of funds in reserve to meet outflows of money, such as customer withdrawals. Banks may hold these reserves as cash in their vaults, as deposits with the central bank or as a combination of the two. When a central banks policy-making body wants to expand the money supply, it can lower reserve requirements. This puts more money into circulation by freeing banks to engage in more lending. Raising reserve requirements, in contrast, lowers the money supply by requiring banks to hold more money in reserve, making less available for lending. 2. Open Market Operations

An important type of monetary policy tool, open market operations involve the purchase and sale of government securities on the open market by central banks. In the United States, the Federal Reserve Bank of New York conducts open market operations. When the central bank wants to expand the money supply, it purchases securities from a bank, increasing that banks reserves as payment. This gives that bank more reserves than it wants, freeing it to lend the funds. To reduce the money supply, the Federal Reserve sells government securities to banks and receives reserves as payment, which lowers those banks supply of reserves. 3. Federal Funds Rate

The federal funds rate is an interest rate that banks charge each other for short-term loans. Federal Reserve policy makers adjust this interest rate in response to economic conditions. When inflationary pressures appear in the economy, the Federal Reserve often increases the federal funds rate, making it more expensive to borrow reserves and thus reducing the money supply. Lowering the federal funds rate expands the money supply. 4. Discount Rate

The discount rate is the interest rate that the Federal Reserve and other countries central banking authorities charge banks and other depository institutions for borrowing reserves. The discount rate is typically higher than the federal funds rate, to discourage banks from turning to this lending source before other alternatives. Central banks can lower the discount rate, to expand the money supply, or raise the rate to reduce it.

2.4 Limitations of Monetary Policy Monetary policy is not the only force acting on output, employment, and prices. Many other factors affect aggregate demand and aggregate supply and, consequently, the economic position of households and businesses. Some of these factors can be anticipated and built into spending and other economic decisions, and some come as a surprise. On the demand side, the government influences the economy through changes in taxes and spending programs, which typically receive a lot of public attention and are therefore anticipated. For example, the effect of a tax cut may precede its actual implementation as businesses and households alter their spending in anticipation of the lower taxes. Also, forward-looking financial markets may build such fiscal events into the level and structure of interest rates, so that a simulative measure, such as a tax cut, would tend to raise the level of interest rates even before the tax cut becomes effective, which will have a restraining effect on demand and the economy before the fiscal stimulus is actually applied. Other changes in aggregate demand and supply can be totally unpredictable and influence the economy in unforeseen ways. Examples of such shocks on the demand side are shifts in consumer and business confidence, and changes in the lending posture of commercial banks and other creditors. Lessened confidence regarding the outlook for the economy and labor market or more restrictive lending conditions tend to curb business and household spending. On the supply side, natural disasters, disruptions in the oil market that reduce supply, agricultural losses, and slowdowns in productivity growth are examples of adverse supply shocks. Such shocks tend to raise prices and reduce output. Monetary policy can attempt to counter the loss of output or the higher prices but cannot fully offset both. In practice, as previously noted, monetary policy makers do not have up-to-the-minute information on the state of the economy and prices. Useful information is limited not only by lags in the construction and availability of key data but also by later revisions, which can alter the picture considerably. Therefore, although monetary policy makers will eventually be able to offset the effects that adverse demand shocks have on the economy, it will be some time before the shock is fully recognized and given the lag between a policy action and the effect of the action on aggregate demandan even longer time before it is countered. Add to this the uncertainty about how the economy will respond to an easing or tightening of policy of a given magnitude, and it is not hard to see how the economy and prices can depart from a desired path for a period of time. The statutory goals of maximum employment and stable prices are easier to achieve if the public understands those goals and believes that the Central Bank will take effective measures to achieve them. For example, if the Bangladesh Bank responds to a negative demand shock to the economy with an aggressive and transparent easing of policy, businesses and consumers may believe that these actions will restore the economy to full employment; consequently, they may be less inclined to pull back on spending because of concern that demand may not be strong enough to warrant new business investment or that their job prospects may not warrant the purchase of big-ticket household goods. Similarly, a credible anti-inflation policy will lead businesses and households to expect less wage and price inflation; workers then will not feel the same need to protect themselves by demanding large wage increases, and businesses will be less aggressive in raising their prices, for fear of losing sales and profits. As a result, inflation will come down more rapidly, in keeping with the policy-related slowing in growth of aggregate demand, and will give rise to less slack in product and resource markets than if workers and businesses continued to act as if inflation were not going to slow.

Chapter-3

3.1 Stock Market of Bangladesh

Capital market plays an important role in mobilizing financial resources from surplus units to deficit and productive units of an economy. It provides an alternative source of fund for organizations or businesses who wants to capitalize by investing in long-term instruments. In addition, a developed capital market also provides access to the foreign capital for domestic industries by creating a platform for foreign companies or investors to invest in domestic securities. During last few years, stock market of Bangladesh has shown noteworthy growth in terms of almost all the indicators such as market capitalization, turnover and the price index. At the same time the market has experienced a notable volatility. If we consider the Stock Market Debacle in 2010 and consider the role of Central Bank, almost all policies to minimize the exposure of banks were taken in the second half of 2010, when the stock index had reached an alarming level. For example, the situation worsened when it was made mandatory for all banks to maintain their investment in the stock market equivalent to 10 percent of their total deposit and to comply by December, 2010, when in reality, the ratio was much higher than this level. Some argue in favor of the view that central banks should burst bubbles. But, in their view, monetary policy should respond to asset bubbles in a cautious and moderate manner in order to avoid economic distortions. Some others argue against the role of central bank in bursting bubbles. They say bubbles generally arise out of some combination of irrational exuberance, jumps forward in technology and financial deregulation, for which the connection between monetary conditions and the rise of bubbles is tenuous. However, the central bank is at the central point in this debate. The recent crash in the stock market in Bangladesh is also associated with some policies of the central bank. The controlling question raised regarding following two aspects: 1) whether the monetary policy response was appropriate to the rise and the recent collapse of the bubble, and 2) whether the behavior of financial institutions was optimal to the policy response. Commercial banks have been involved heavily in the stock market business in the last few years. Allowing merchant banking has exaggerated the situation. They become the key player in the stock market. Undoubtedly, any policies to control banks exposure to the stock market could have significant impact on the capital market. Monetary easing during last two or more years (money supply was more than 22 percent during the period) could have helped stock market remain buoyant during these days. Perhaps, Bangladesh Bank (BB) was not much aware about banks exposure to the stock market. Because, surprisingly, banks profit from share business seemed to be negligible according to their income statement or balance sheet although there is a wide perception that banks are making handsome profits from investing in shares and debentures. Proper date on their exposure to the capital market remained unknown, which we think is a failure from the part of the central bank as a supervisory agency.

3.2 Dhaka Stock Exchange (DSE) Dhaka Stock Exchange is the first & biggest stock exchange of the country. The operation of Dhaka Stock Exchange started on May 14, 1964 after renaming East Pakistan Stock Exchange Limited. Dhaka Stock Exchange (DSE) is registered as a Public Limited Company and its activities are regulated by its Articles of Association rules & regulations and bye-laws along with the Securities and Exchange Ordinance - 1969, Companies Act - 1994 & Securities& Exchange Commission Act - 1993. There are 238 members and total 507 listed securities in Dhaka Stock Exchange. The working days of DSE is 5 days in a week without Saturday, Sunday public holidays & other government

holidays. The trading time is from 11:00 am to 15:00 pm (local time). Investment options for an investor in this market are ordinary share, Debenture, Bond & Mutual funds. In the beginning DSE had only one index. However, now there are DSEX, DS30, DSES index in DSE. Two types of markets as like other stock exchange are there in DSE. These are Primary Market through which Initial Public Offerings (IPOs), New Share issuance of a company comes to market. Companies can issue new securities after getting permission from the market regulators. Secondary Market: deals with existing securities or previously issued securities. Securities can be sold or bought from this market. In a stock exchange most of the trading figures comes from the secondary market. This market is also divided according to its different trading characteristics. i) Public Market: Instruments are traded on this market in normal volume which is called lot share. ii) Spot Market: Trading is done in normal volume under corporate actions and must be settled in 24 hours. iii) Block Market: In this market bulk volume of instruments are trades through pick & fill basis. iv) Odd Lot Market: Odd lot refers to a quantity of shares that is less than market lot. Odd lots of all instruments are traded through pick & fills in this market.

Majors Functions of Dhaka Stock Exchange

Listing of Companies (As per Listing Regulations). Providing the screen based automated trading of listed Securities. Settlement of trading (As per Settlement of Transaction Regulations). Gifting of share / granting approval to the transaction/transfer of share outside the trading system of the exchange (As per Listing Regulations 42). Market Administration & Control. Market Surveillance. Publication of Monthly Review. Monitoring the activities of listed companies (As per Listing Regulations). Investors grievance Cell (Disposal of complaint bye laws 1997). Investors Protection Fund (As per investor protection fund Regulations 1999). Announcement of Price sensitive or other information about listed companies through online.

3.3 Chittagong Stock Exchange(CSE)

The Chittagong Stock Exchange (CSE) began its journey in 10th October of 1995 from Chittagong City

through the cry-out trading system with the promise to create a state-of-the art bourse in the country. Founder members of the proposed Chittagong Stock Exchange approached the Bangladesh Government in January 1995 and obtained the permission of the Securities and Exchange Commission on February 12, 1995 for establishing the country's second stock exchange. The Exchange comprised of twelve Board members, presided by Mr. Amir Khosru Mahmud Chowdhury (MP) and run by an independent secretariat from the very first day of its inception. CSE was formally opened by then Hon'ble Prime Minister of Bangladesh on November 4, 1995. 3.4 Bangladesh Bank (BB) Bangladesh Bank is the Central bank of Bangladesh and is a member of the Asian Clearing Union. The bank is active in developing green banking and financial inclusion policy and is an important member of the Inclusion. Bangladesh Financial Intelligence Unit (BFIU), a department of Bangladesh Bank, has got the membership of Egmont Group. Bangladesh Bank, the central bank and apex regulatory body for the country's monetary and financial system. Like other central banks, Bangladesh Bank performs all the core functions of a typical monetary and financial sector regulator, and a number of other non core functions. Its primary function is to provide the nation's money supply in addition to control interest rates, acting as a lender of last resort to the banking sector during times of financial crisis, supervisory role to prevent banks and other financial institutions from reckless or fraudulent behavior. Like all other central banks across the globe, Bangladesh Bank is both the Governments banker and the bankers bank, a Lender of the Last Resort. Bangladesh Bank, like most of the central banks of different countries, exercises monopoly over the issue of currency and the banknotes. Except for the 1 and 2 taka notes, it issues all other denominations of Bangladeshi Taka. Credit control, Clearing House, Control Money Market, Job creation, Agricultural development, SME development, Industrial development, and Natural resources development are also the functions of Bangladesh Bank. History of Bangladesh Bank After the liberation war, and the eventual independence of Bangladesh, the Government of Bangladesh reorganized the Dhaka branch of the State Bank of Pakistan as the central bank of the country, and named it Bangladesh Bank. This reorganization was done pursuant to Bangladesh Bank Order, 1972, and the Bangladesh Bank came into existence with retrospective effect from 16th December, 1971. The highest official in the bank is the Governor. The Governor chairs the Board of Director. The Executive Staff, also headed by the Governor, are responsible for the day to day affairs. Objectives of Bangladesh Bank As the central Bank of Bangladesh, the broad objectives of the Bank are: To regulate currency issuance and to keep foreign exchange reserves; To manage the monetary and credit system of Bangladesh with a view to stabilizing domestic monetary value; To preserve the par value of the Bangladesh Taka;

To promote and maintain a high level of production, employment and real income in Bangladesh; and to foster growth and development of the country's productive resources. Monetary Policy of Bangladesh Bank The Monetary Policy undertaken by Bangladesh Bank in general pursues dual objectives of maintaining price stability and supporting faster economic growth of the country. It tries to influences real sector price levels via financial sector prices by intervening policy interest rate (repo, reverse repo rate) as well as seeks to influence real sector prices via quantity theory based money stock targeting; monetary programs chalk out target growth paths for broad money (M2) and its sub aggregates, implemented by day to day management of growth path of reserve money (RM), currency in issue and balances of banks/financial institutions with the Bangladesh Bank. It may be noted that the main monetary policy instruments available to the Bangladesh Bank are open market operations, bank reserve requirements, interest rate policy, re-lending and re-discount (including using the term repurchase market), and credit policy (often coordinated with trade policy).

You might also like

- Hallmark SonaliDocument4 pagesHallmark SonaliMilon SultanNo ratings yet

- Solutions Chapter 13Document4 pagesSolutions Chapter 13Imroz MahmudNo ratings yet

- Effect of Dividend Announcement On Shareholders' Value Evidence From Dhaka Stock ExchangeDocument17 pagesEffect of Dividend Announcement On Shareholders' Value Evidence From Dhaka Stock ExchangeMD. REZAYA RABBINo ratings yet

- Current Affairs BCS SpecialDocument240 pagesCurrent Affairs BCS SpecialImroz MahmudNo ratings yet

- Chapter 07 Solutions ManualDocument12 pagesChapter 07 Solutions ManualImroz MahmudNo ratings yet

- Research TypesDocument8 pagesResearch TypesImroz MahmudNo ratings yet

- Criteria of A Good ResearchDocument2 pagesCriteria of A Good ResearchImroz Mahmud67% (9)

- IpoDocument5 pagesIpoImroz MahmudNo ratings yet

- Research ProblemDocument4 pagesResearch ProblemImroz MahmudNo ratings yet

- Measuring Exposure To Exchange Rate FluctuationsDocument38 pagesMeasuring Exposure To Exchange Rate FluctuationsImroz MahmudNo ratings yet

- Multinational Capital BudgetingDocument17 pagesMultinational Capital BudgetingImroz MahmudNo ratings yet

- Country Risk AnalysisDocument32 pagesCountry Risk AnalysisImroz MahmudNo ratings yet

- Global Financial Crisis and Its Impact On Bangladesh's EconomyDocument55 pagesGlobal Financial Crisis and Its Impact On Bangladesh's EconomyImroz Mahmud0% (1)

- Time Value of MoneyDocument36 pagesTime Value of MoneyImroz MahmudNo ratings yet

- Business Plan of A Theme ParkDocument73 pagesBusiness Plan of A Theme ParkImroz Mahmud60% (5)

- Stock Market of BangladeshDocument31 pagesStock Market of BangladeshImroz Mahmud88% (8)

- Beta Calculation & Analysis of Bangladesh Leather IndustryDocument22 pagesBeta Calculation & Analysis of Bangladesh Leather IndustryImroz Mahmud100% (1)

- The 14th Dhaka International Trade FairDocument5 pagesThe 14th Dhaka International Trade FairImroz MahmudNo ratings yet

- TitanDocument52 pagesTitanImroz MahmudNo ratings yet

- E-Commerce:: E-Business Is The Use of The Internet and Other Networks andDocument13 pagesE-Commerce:: E-Business Is The Use of The Internet and Other Networks andImroz MahmudNo ratings yet

- Problem & Solutions of Toyota Motor CorporationDocument5 pagesProblem & Solutions of Toyota Motor CorporationImroz Mahmud73% (15)

- SugarcaneDocument37 pagesSugarcaneImroz MahmudNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 39 1 Vijay KelkarDocument14 pages39 1 Vijay Kelkargrooveit_adiNo ratings yet

- Mock Meeting Perhentian Kecil IslandDocument3 pagesMock Meeting Perhentian Kecil IslandMezz ShiemaNo ratings yet

- Anser Key For Class 8 Social Science SA 2 PDFDocument5 pagesAnser Key For Class 8 Social Science SA 2 PDFSoumitraBagNo ratings yet

- Full Download Business in Action 6th Edition Bovee Solutions ManualDocument35 pagesFull Download Business in Action 6th Edition Bovee Solutions Manuallincolnpatuc8100% (32)

- 64 Development of Power Operated WeederDocument128 pages64 Development of Power Operated Weedervinay muleyNo ratings yet

- Veit Tunel 1Document7 pagesVeit Tunel 1Bladimir SolizNo ratings yet

- Portfolio October To December 2011Document89 pagesPortfolio October To December 2011rishad30No ratings yet

- Sustainability in The Built Environment Factors AnDocument7 pagesSustainability in The Built Environment Factors AnGeorges DoungalaNo ratings yet

- Filetype PDF Journal of Real Estate Finance and EconomicsDocument2 pagesFiletype PDF Journal of Real Estate Finance and EconomicsJennaNo ratings yet

- Salary Slip Template V12Document5 pagesSalary Slip Template V12Matthew NiñoNo ratings yet

- Od124222428139339000 4Document2 pagesOd124222428139339000 4biren shahNo ratings yet

- 6 The Neoclassical Summary Free Trade As Economic GoalDocument4 pages6 The Neoclassical Summary Free Trade As Economic GoalOlga LiNo ratings yet

- N 1415 Iso - CD - 3408-5 - (E) - 2003 - 08Document16 pagesN 1415 Iso - CD - 3408-5 - (E) - 2003 - 08brunoagandraNo ratings yet

- SMR0275 Four Horsemen of The American Apocalypse ReportDocument44 pagesSMR0275 Four Horsemen of The American Apocalypse Reportmaat3x3No ratings yet

- New Economic Policy of IndiaDocument23 pagesNew Economic Policy of IndiaAbhishek Singh Rathor100% (1)

- Booking Invoice M06ai23i01024843Document2 pagesBooking Invoice M06ai23i01024843AkshayMilmileNo ratings yet

- IELTS Writing Task 1 Sample - Bar Chart - ZIMDocument28 pagesIELTS Writing Task 1 Sample - Bar Chart - ZIMPhương Thư Nguyễn HoàngNo ratings yet

- Udai Pareek Scal For SES RuralDocument3 pagesUdai Pareek Scal For SES Ruralopyadav544100% (1)

- Pasamuros PTD 308 - PentairDocument5 pagesPasamuros PTD 308 - PentairJ Gabriel GomezNo ratings yet

- Clean Wash EN 2Document2 pagesClean Wash EN 2Sean HongNo ratings yet

- Superstocks Final Advance Reviewer'sDocument250 pagesSuperstocks Final Advance Reviewer'sbanman8796% (24)

- Womens Hostel in BombayDocument5 pagesWomens Hostel in BombayAngel PanjwaniNo ratings yet

- Partnership Dissolution Lecture NotesDocument7 pagesPartnership Dissolution Lecture NotesGene Marie PotencianoNo ratings yet

- Advantages and Disadvantages of Shares and DebentureDocument9 pagesAdvantages and Disadvantages of Shares and Debenturekomal komal100% (1)

- Attacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep DevkarDocument14 pagesAttacking and Defending Through Operations - Fedex: Assignment Submitted By: Pradeep Devkarsim4misNo ratings yet

- Dennis Redmond Adorno MicrologiesDocument14 pagesDennis Redmond Adorno MicrologiespatriceframbosaNo ratings yet

- Bill 1.1Document2 pagesBill 1.1Александр ТимофеевNo ratings yet

- Report Sugar MillDocument51 pagesReport Sugar MillMuhammadAyyazIqbal100% (1)

- Month Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysDocument3 pagesMonth Average USD/CNY Min USD/CNY Max USD/CNY NB of Working DaysZahid RizvyNo ratings yet

- ChartsDocument4 pagesChartsMyriam GGoNo ratings yet