Professional Documents

Culture Documents

Research Project Cybersecurity

Uploaded by

AssignmentLab.comOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Research Project Cybersecurity

Uploaded by

AssignmentLab.comCopyright:

Available Formats

1 Research Project: Cybersecurity Introduction Security industry has emerged as response to the threats of different kind that follow

humanity from its birth. The need in protection from animals and then from other tribes made first people think about their security. Through the ages, security issues started to become more and more sophisticated. Therefore, security measures changed as well. The technology era has changed everything. However, it did not change the desire of some people to get something illegally that others have. Thus, the new era of challenge between security and its counterparts has begun. Technology has brought many innovations and advances into the world of security. At first, there were code locks and highly sophisticated mechanical solutions that allowed making security breaches rather difficult. Then, different wired electronic devices provided security protectors with opportunities to have distant access to the security control systems and thus be able to control them better. Despite all these advances, their counterparts have always been close in this race. The third parties with criminal or other intent that wanted to get unauthorized access to something that was protected have always been inventive and that allowed them creating mechanisms and devices for security breaches (Guan and Huck 2012).

2 Implications of Cyber Security The advent of information technologies provided mankind with outstanding opportunities in different areas. Electronic means of communication, like wired networks, wireless, and mobile technologies have made the process of information transfer as quick and easy as never before. Such state of things required new approaches in terms of security measures because criminals have always been a threat. However, there are reasons to believe that the greatest threats to the organizations information security are constituted by employees. Why it is so? It is rather easy to explain. At first, think about the following: IT specialists, CIOs, security teams, etc. are all focused on development and implementation of the most sophisticated and advanced security measures because they do realize the significance of the consequences that security breaches might have. Then, these people within any organization oppose the other side (criminals) that play by the same rules, meaning the approaches, ideas, and concepts both side exploit. Therefore, security specialists generally know how to stop criminals, at least in theory (Benzel 2011; Kemmerer 2003). Meanwhile, employees, in most cases, have rather poor computer literacy. It means that a normal IT related individual will not write down the password from highly-secured enterprise database on the back side of keyboard. It also means that such kind of individual realizes in full that it is not appropriate to store pricy, secured, important data on mobile phone, laptop, thumb drive, or any other device, convenient to be stolen or lost. Therefore, sloppiness, foolishness, careless, and, in some cases, anger of employees are the greatest threats to the security plans and measures of any company. The greatest challenge for an IT security specialist is to try to think like regular users do and then develop such security

3 measures that would consider all imaginable actions, theoretically possible to be performed by a typical employee. Otherwise, information security is in great danger, always.

4 Limitations Unauthorized access to the protected network, such as Ministry of Interior could have, is the biggest issue today. Mobile devices are more and more popular these days so it is very important to implement protection for such devices as well. Thus, encryption and smart cards access can be useful in this matter. Protection of sensitive information has always been an issue. People have tried to protect important data for centuries and used rather different methods in order to achieve this goal. The most useful and efficient method was encryption. A sender (or keeper) altered information using a specific key. No one else was able to understand such encrypted message without having and applying the key. Therefore, the main goal to protect the data was achieved in this way. Further development of data carriers led to the sophistication of encryption methods. It was the only way to assure protection. With the advent of information technologies as we know them today, the need in protecting data grew drastically. Computers provided us with substantial computational capability that allowed developing new, more advanced and powerful encryption algorithms. Such achievement made encryption a more reliable and widespread method of data protection (Benzel 2011; Kemmerer 2003). At first, encryption was used by military in order to not allow enemies understand intercepted messages. Later, business community realized that encryption could be used for protection business secrets and internal information from the third parties. Thus, encryption tools became commonly used not only for military and business purposes but also in day-to-day life of regular people. New encryption algorithms were developed. The old ones were improved. However, the contemporary era of the Internet, smartphones, laptops, and mobile data storages required new

5 approaches in data protection. Business required solutions that were able to protect sensitive information from the unauthorized access. Eventually, different encryption techniques (algorithms) were developed. AES, DES, algorithms with symmetric and asymmetric keys, SSL, and many others were developed to assure that data was safe and could not be acquired by the third parties without permission. Even the full disk encryption technique was created to provide the business community with extra security measures. Modern business industry can be called customer-driven. It is rather easy to agree with this statement if we just look at the current situation on nearly any market. However, this tendency is easier to follow using the market of financial services as an example. This market grew substantially after the advent of information technologies (IT) and their rapid development. The reasons for such drastic increase were more than obvious. Banks and other financial institutions got the opportunity to provide their customers with usual services via the achievements of informational era, such as global network (the Internet), mobile terminals (smartphones and other mobile devices), smart chips in credit cards, etc. (Benzel 2011; Kemmerer 2003; El-Khatib et al. 2010; Seltsikas 2010). Along with the rapid development of financial products and services lines, oriented on the online distribution, the need in securing such kind of transactions grew as well. It was clear that people would not entrust such sensitive information as financial to the channels they were not sure about. Therefore, at the beginning of information era the number of financial services was small but they were rather secure. Credit cards, checks, other financial instruments were protected comparatively well because the customers personal financial data (personal identification numbers, for example) was not transferred via unsecured networks, including wireless ones.

6 With the advent of such technologies, as wireless networks, instant access to the Internet from mobile devices, contactless access to smart cards based on radio frequency identification (RFID), and many others, the number of opportunities to provide financial services grew substantially. However, there is an opinion that it has been done at the expense of customer security. The aim of this paper is to discuss this issue in order to understand whether it is true or not. At first, it is necessary to understand what these financial services are and what features they have. Thus, it would be easier to obtain broader view on the main issue. Online financial services are usually provided via online banking. It is also sometimes called Internet banking. Online (Internet) banking gives an opportunity to conduct various financial transactions using secured website of a bank. Most of the common operations performed via online services can be addressed to transactional and non-transactional categories, and also financial institution administration, management of numerous users that have different levels of authority, approval process of transactions. In addition, online banking could include such unique services as personal financial management support and account aggregation that would allow customers monitoring numerous personal accounts via the Internet (El-Khatib et al. 2010; Seltsikas 2010). Now, it is important to clarify the major concern of every transaction or simply action related to financial activities security. Security in such kind of transactions is issue number one beyond any doubts. Usual banking services are provided with rigid security measures, such as combination of different authentication methods, secured cards, heavily guarded safes, etc. However, in case of online banking, there are no opportunities to provide these security measures.

7 Solutions Online services provided regular people with tools that make their life easier and comfortable. Security specialists of different sectors developed various systems that should secure online transactions and make them as secure as it would be in the real bank, for example. However, considering the level of technology, it is not wise for anyone to feel entirely safe entering PIN from personal account into mobile banking application (for example). This data goes though different nodes and wireless networks so it can be intercepted, decrypted, and then used (El-Khatib et al. 2010; Seltsikas 2010). Online banking indeed provided customers with numerous services that were unreachable before. However, it lowered the overall secureness of financial transactions conducted over the Internet. It is true that customers either accept such state of thing or not. Some of them use online banking intensively, other prefer going to the nearest bank because it is more secure. In any case, it is the choice of each person whether to use online services provided by the financial institutions or not. Therefore, the implementation of online services was a very significant step. People begin entrusting their financial and other information to the Internet medium and it has its advantages and deficits. The number of services that banks can offer via online is much bigger but such freedom of choice is connected with increased risks. It could be said that such variety of services caused the overall simplification of customer security in order to provide these service to as many customers as possible. However, it cannot be said that these services were imposed. The development of the internet technologies inevitable led to the changes in many industries and the banking industry simply could not ignore it (El-Khatib et al. 2010; Seltsikas 2010).

8 Reflection In order to realize how dependent we are from the technologies, I chose morning to go without using information systems and technologies. Morning is the busiest time of the day in this matter checking the emails, news, twitts, Facebook messages, etc. so it was decided to do so to see how long my mind will be disturbed by the absence of this data. I normally use tablet and smartphone to browse the Internet and socialize, use emails and various IMs to communicate. Considering the situation, it was nearly impossible to even think that I was not able to visit Facebook there are my friends and lots of information I need to see and share from the very beginning of the day! It was obvious that communication in the old-school regime (like over the wired phone, for example or a simple meeting in a caf) could not been applied in this case. Simple process of information transfer became utterly difficult people were not nearby the phone and of course had no time for meetings. Communication this is the most difficult task to complete without IT. Based on this one-time-short experience, it is sad to conclude that we cannot live without technologies. Well, we can survive, but our life will change completely. Social connections will be either destroyed or substantially narrowed. Society will die as we know it today.

9 Conclusion Analyzing the current paradox when the number of tools to assure cyber security grows but we are less secured in this area, it becomes clear that something should be changed on the deeper levels and in the broader scope. People should learn to accept the need in technologies in every area of day-to-day activities and that the technologies should be treated accordingly. Therefore, since we know that we must look on the road when we cross it, we must realize the problems cyber security issues can cause. It is necessary to teach young people how to assure cyber security on the most primitive level from the school desk. Organizations must accept the truth that it is important to teach employees to be cyber conscious and qualified in this area to assure the secureness of the data at every desk and workplace. Societies need to change the attitude towards cyber security, alter laws and increase the responsibility for the cyber-related crimes, pay more attention to the educational process in this area, etc.

10 References Benzel, T. 2011. The Science of Cyber Security Experimentation: The DETER Project. ACSAC 11, ACM. Orlando, Florida, USA. El-Khatib, K., Hung, P., Thorpe, J., and Rjaibi, W. 2010. Cybersecurity issues for businesses. CASCON 10, Proceedings of the 2010 Conference of the Center for Advanced Studies on Collaborative Research, 364-365. IBM Corp. Riverton, NJ, USA. Guan, J. and Huck, J. 2012. Children in the digital age: exploring issues of Cybersecurity. iConference 12, Proceedings of the 2012 iConference, ACM, 506-507. New York, NY, USA. Hoffmann, L. Risky business. Magazine Communications of the ACM, 54(11), 20-22. New York, NY, USA. Kemmerer, R. A. 2003. Cybersecurity. ICSE 03, Proceedings of the 25th International Conference on Software Engineering, IEEE, 705 715. Washington, DC, USA. Oehmen, C., Peterson, E., and Dowson, S. 2010. An Organic Model for Detecting CyberEvents. CSIIRW10, ACM. Oak Ridge, TN, USA. Seltsikas, P., Marsh, G., Frazier-McElveen, M., and Smedinghoff, T. J. 2011. Secure government in cyberspace? DG.O 11, Proceedings of the 12th Annual International Digital Government Research Conference: Digital Government Innovation in Challenging Times, ACM, 359-361. New York, NY, USA. Ten, C.-W., Liu, C.-C., and Govindarasu, M. 2008. Cyber-Vulnerability of Power Grid Monitoring and Control Systems. CSIIRW '08, Proceedings of the 4th annual workshop on Cyber security and information intelligence research: developing strategies to meet the cyber security and information intelligence challenges ahead, 43, ACM. New York, NY, USA.

You might also like

- Final Draft On: Chanakya National Law University, PatnaDocument14 pagesFinal Draft On: Chanakya National Law University, PatnaKhyati ShreeNo ratings yet

- Cyber Crime in Banking SectorDocument43 pagesCyber Crime in Banking Sectormuktesh100% (3)

- Research Paper - A Synopsis On Cyber Terrorism and Warfare by Shreedeep RayamajhiDocument27 pagesResearch Paper - A Synopsis On Cyber Terrorism and Warfare by Shreedeep RayamajhiShreedeepRayamajhi100% (5)

- E-Commerce Website Publication PaperDocument9 pagesE-Commerce Website Publication PaperSoham Shrikant manjrekarNo ratings yet

- Cyber Crime in IndiaDocument8 pagesCyber Crime in IndiaAnooja SajeevNo ratings yet

- Brazil's Critical Energy Infrastructure CybersecurityDocument63 pagesBrazil's Critical Energy Infrastructure CybersecurityGuilherme GueirosNo ratings yet

- Cyber Crime in Banking Sector - Sanchi Agrawal PDFDocument19 pagesCyber Crime in Banking Sector - Sanchi Agrawal PDFNikhil Dalvi100% (1)

- "Cyber Crime in India": Poornima Institute of Engineering & Technology, JaipurDocument27 pages"Cyber Crime in India": Poornima Institute of Engineering & Technology, JaipurRishabh AgarwalNo ratings yet

- Digital India's Cyber Security NeedsDocument14 pagesDigital India's Cyber Security NeedsRurban Jashpur100% (1)

- Cyber Crime and Security - A Study On Awareness Among Young Netizens of Anand Gujarat State India Ijariie3502Document9 pagesCyber Crime and Security - A Study On Awareness Among Young Netizens of Anand Gujarat State India Ijariie3502icNo ratings yet

- CYB1: Introduction to Cyber Crimes & Banking SecurityDocument37 pagesCYB1: Introduction to Cyber Crimes & Banking Securityanand guptaNo ratings yet

- Future of ComputersDocument2 pagesFuture of ComputersArim ArimNo ratings yet

- Competition Mapping - Different Antivirus SoftwaresDocument58 pagesCompetition Mapping - Different Antivirus SoftwaresRoyal ProjectsNo ratings yet

- Internet of Things (Iot) : Mohan Kumar GDocument35 pagesInternet of Things (Iot) : Mohan Kumar GkamenRider AgitoNo ratings yet

- Step-by-step guide to customizing ProDiscover for incident response investigationsDocument13 pagesStep-by-step guide to customizing ProDiscover for incident response investigationsgkpalok100% (1)

- Cyber Crime, Cyber Security and Right To PrivacyDocument88 pagesCyber Crime, Cyber Security and Right To PrivacyCheriNo ratings yet

- Impact of Cyber Crime On Banking Sector in IndiaDocument55 pagesImpact of Cyber Crime On Banking Sector in Indiaanita mauryaNo ratings yet

- Cybercrime in Banking Sector Project for Mumbai UniversityDocument44 pagesCybercrime in Banking Sector Project for Mumbai UniversityPranav ViraNo ratings yet

- Introduction To Cyber Security Chapter 4Document4 pagesIntroduction To Cyber Security Chapter 4Pinoy Ako EntertainmentNo ratings yet

- .Cybercrimes An Indian PerspectiveDocument8 pages.Cybercrimes An Indian PerspectiveIELTSNo ratings yet

- Cyber SecurityDocument29 pagesCyber SecurityJaasindah Mir80% (5)

- The Misuse of Mobile PhoneDocument3 pagesThe Misuse of Mobile Phoneyisethe melisa erira menesesNo ratings yet

- Project Report On Cyber Security and Cyber Crime Involving Estonia Case, Homeland Security and Athens AffairDocument41 pagesProject Report On Cyber Security and Cyber Crime Involving Estonia Case, Homeland Security and Athens AffairSameer R. Khan40% (5)

- E-Authentication System Using QR Code and Otp: Bachelor of Technology Computer Science & EngineeringDocument7 pagesE-Authentication System Using QR Code and Otp: Bachelor of Technology Computer Science & EngineeringShobhit GoswamiNo ratings yet

- Cyber Law: Submitted By: M.Swarna Geetham H13103 Iv-Ba BL (Hons) - B Sec SoelDocument13 pagesCyber Law: Submitted By: M.Swarna Geetham H13103 Iv-Ba BL (Hons) - B Sec SoelPranav Gupta0% (1)

- Cyber Crime in IndiaDocument26 pagesCyber Crime in Indiariteshjain07100% (1)

- Project Report Titles For MBA in Information TechnologyDocument5 pagesProject Report Titles For MBA in Information Technologyebrandingindia1No ratings yet

- Artificial Intelligence in Cyber SecuritDocument5 pagesArtificial Intelligence in Cyber SecuritPiyush KunwarNo ratings yet

- Internet of Things IOTDocument6 pagesInternet of Things IOTArjan SinghNo ratings yet

- Cyber Security ReportDocument24 pagesCyber Security ReportAakash Jain100% (1)

- Cybersecurity Challenges in Developing NationsDocument158 pagesCybersecurity Challenges in Developing Nationsdd1335100% (1)

- Cyber Crime in Banking Sector - Sanchi AgrawalDocument50 pagesCyber Crime in Banking Sector - Sanchi AgrawalmukteshNo ratings yet

- A Minor Project Report On Cyber CrimeDocument53 pagesA Minor Project Report On Cyber CrimeDarvesh SinghNo ratings yet

- A Seminar Report: Visvesvaraya Technological UniversityDocument24 pagesA Seminar Report: Visvesvaraya Technological Universitynabin mahatoNo ratings yet

- A Study of Cybercrimes in India Using Digital ForensicsDocument15 pagesA Study of Cybercrimes in India Using Digital ForensicsIJRASETPublicationsNo ratings yet

- Cyber Crime in IndiaDocument8 pagesCyber Crime in IndiaAnooja Sajeev100% (1)

- Cosmos Bank Cyber Theft: Understanding the AttackDocument11 pagesCosmos Bank Cyber Theft: Understanding the AttackTofayel Haque SagorNo ratings yet

- Final Year Project Report 2Document96 pagesFinal Year Project Report 2nurun nufusNo ratings yet

- The Impact of Artificial Intelligence On CyberspaceDocument6 pagesThe Impact of Artificial Intelligence On Cyberspacesly westNo ratings yet

- E - Commerce in IndiaDocument8 pagesE - Commerce in IndiaAnonymous CwJeBCAXpNo ratings yet

- Cyber Security Seminar ReportDocument19 pagesCyber Security Seminar ReportManik SharmaNo ratings yet

- Case Study of Cyber Attack On Cosmos BankDocument1 pageCase Study of Cyber Attack On Cosmos BankanimeshNo ratings yet

- Cybercrime in Banking SectorDocument10 pagesCybercrime in Banking SectorHala GharibNo ratings yet

- Government Loan Schemes for Small Scale Businesses ExplainedDocument5 pagesGovernment Loan Schemes for Small Scale Businesses ExplainedKunal HarinkhedeNo ratings yet

- Cloud Storage Seminar Report SummaryDocument27 pagesCloud Storage Seminar Report SummaryGaurav BhattalNo ratings yet

- Cyber and Information TechnologyDocument12 pagesCyber and Information TechnologyAlfedNo ratings yet

- Chapter 1 Fundamentals of Cyber LawDocument24 pagesChapter 1 Fundamentals of Cyber LawVaiJai VaiJai50% (2)

- Role of Cyber Law in Cyber Security in IndiaDocument4 pagesRole of Cyber Law in Cyber Security in IndiaHJ ManviNo ratings yet

- E-Commerce Guide: Introduction, Types, Examples & FutureDocument8 pagesE-Commerce Guide: Introduction, Types, Examples & FutureUtpal KantNo ratings yet

- Edge Computing SeminarDocument24 pagesEdge Computing SeminarNitin RanjanNo ratings yet

- Cyber Threats and SecurityDocument17 pagesCyber Threats and Securityno OneNo ratings yet

- Security Considerations in e BankingDocument29 pagesSecurity Considerations in e Bankingsakshivam100% (1)

- Cyber Crime in Banking SectorDocument78 pagesCyber Crime in Banking Sectorajay mauryaNo ratings yet

- Application of E-Commerce in BankingDocument14 pagesApplication of E-Commerce in Bankingswetanim86% (7)

- Cyber SecurityDocument55 pagesCyber SecurityAshish SuryaNo ratings yet

- Advantages of Cyber LawsDocument9 pagesAdvantages of Cyber LawsAvneetPalSinghNo ratings yet

- Cyber Security For Our Digital LifeDocument7 pagesCyber Security For Our Digital LifeKhalifa MoizNo ratings yet

- DatasecuritylawsDocument9 pagesDatasecuritylawsinkandparchmentwsNo ratings yet

- Reserach Paper On Cyber SecurityDocument8 pagesReserach Paper On Cyber SecurityAnjali VashishthaNo ratings yet

- The Pursuit of HappinessDocument4 pagesThe Pursuit of HappinessAssignmentLab.comNo ratings yet

- The Promise by C. Wright MillsDocument4 pagesThe Promise by C. Wright MillsAssignmentLab.comNo ratings yet

- The Problem of Consequences and ForgivenessDocument4 pagesThe Problem of Consequences and ForgivenessAssignmentLab.comNo ratings yet

- The One Minute ManagerDocument2 pagesThe One Minute ManagerAssignmentLab.comNo ratings yet

- The Most Dangerous Moment Comes With VictoryDocument3 pagesThe Most Dangerous Moment Comes With VictoryAssignmentLab.comNo ratings yet

- The Principle of AutonomyDocument2 pagesThe Principle of AutonomyAssignmentLab.comNo ratings yet

- The Principal-Agent ProblemDocument9 pagesThe Principal-Agent ProblemAssignmentLab.comNo ratings yet

- The Opinion Essay On The Short Story "Seventh Grade" by Gary SotoDocument2 pagesThe Opinion Essay On The Short Story "Seventh Grade" by Gary SotoAssignmentLab.comNo ratings yet

- The Polygraph and Lie DetectionDocument4 pagesThe Polygraph and Lie DetectionAssignmentLab.comNo ratings yet

- The Place of Endangered Languages in A Global SocietyDocument3 pagesThe Place of Endangered Languages in A Global SocietyAssignmentLab.comNo ratings yet

- The Origin of My NameDocument4 pagesThe Origin of My NameAssignmentLab.comNo ratings yet

- The Old Testament Law and Its Fulfillment in ChristDocument7 pagesThe Old Testament Law and Its Fulfillment in ChristAssignmentLab.comNo ratings yet

- The Media and The GovernmentDocument4 pagesThe Media and The GovernmentAssignmentLab.comNo ratings yet

- The Mini Mental Status ExaminationDocument4 pagesThe Mini Mental Status ExaminationAssignmentLab.comNo ratings yet

- The Obscurities of Blue Collar Jobs and Sociological Factors Affecting Blue CollarDocument7 pagesThe Obscurities of Blue Collar Jobs and Sociological Factors Affecting Blue CollarAssignmentLab.comNo ratings yet

- The Implications On Mobile Commerce in The International Marketing CommunicationDocument2 pagesThe Implications On Mobile Commerce in The International Marketing CommunicationAssignmentLab.comNo ratings yet

- The Models of Church "As A Communion" and "As A Political Society" TheDocument7 pagesThe Models of Church "As A Communion" and "As A Political Society" TheAssignmentLab.comNo ratings yet

- The Microsoft CaseDocument3 pagesThe Microsoft CaseAssignmentLab.comNo ratings yet

- The Issues Surrounding The Coding of SoftwareDocument10 pagesThe Issues Surrounding The Coding of SoftwareAssignmentLab.comNo ratings yet

- The Merchant of VeniceDocument5 pagesThe Merchant of VeniceAssignmentLab.comNo ratings yet

- The Marketing Mix 2 Promotion and Price CS3Document5 pagesThe Marketing Mix 2 Promotion and Price CS3AssignmentLab.comNo ratings yet

- The MetamorphosisDocument4 pagesThe MetamorphosisAssignmentLab.comNo ratings yet

- The Lorax On Easter IslandDocument4 pagesThe Lorax On Easter IslandAssignmentLab.comNo ratings yet

- The Influence of Families On Children's SchoolDocument8 pagesThe Influence of Families On Children's SchoolAssignmentLab.comNo ratings yet

- The Life StyleDocument3 pagesThe Life StyleAssignmentLab.comNo ratings yet

- The Impact of Media On Illicit Drug UseDocument6 pagesThe Impact of Media On Illicit Drug UseAssignmentLab.comNo ratings yet

- The LawDocument4 pagesThe LawAssignmentLab.comNo ratings yet

- The Identity of Christianity Given by Early ArtDocument6 pagesThe Identity of Christianity Given by Early ArtAssignmentLab.comNo ratings yet

- The Impact of The Depression of The 1890s On Political Tensions of The TimeDocument3 pagesThe Impact of The Depression of The 1890s On Political Tensions of The TimeAssignmentLab.com100% (1)

- The Human Hand in Global WarmingDocument10 pagesThe Human Hand in Global WarmingAssignmentLab.comNo ratings yet

- Value Chain Engineering Assignemnt IIDocument22 pagesValue Chain Engineering Assignemnt IImaria50% (2)

- AbaqusCAE FSI Module Users GuideDocument21 pagesAbaqusCAE FSI Module Users GuideZenghu Han100% (1)

- Atmos GIGA N 32-160Document1 pageAtmos GIGA N 32-160Efril dilen franciscoNo ratings yet

- Avinash Excat Full ProjectDocument87 pagesAvinash Excat Full ProjectNaguSwamyNo ratings yet

- Spokane County Sheriff's Internal Communication PlanDocument11 pagesSpokane County Sheriff's Internal Communication Planjmcgrath208100% (1)

- Automated Car Parking System DocumentationDocument5 pagesAutomated Car Parking System DocumentationVamsiVaddadiNo ratings yet

- Action Stories Lesson 2Document2 pagesAction Stories Lesson 2api-296427690No ratings yet

- L-990 Sensor Tap: Codes Power Supply Temperature Control WeightDocument3 pagesL-990 Sensor Tap: Codes Power Supply Temperature Control WeightNguyên Trịnh CaoNo ratings yet

- Effect of CSR on Corporate Reputation and PerformanceDocument13 pagesEffect of CSR on Corporate Reputation and PerformanceAnthon AqNo ratings yet

- MS 1472-2017Document65 pagesMS 1472-2017Thinagaran100% (2)

- Form-HSE-TMR-006 Compressor, Genzet, Water Jet InspectionDocument2 pagesForm-HSE-TMR-006 Compressor, Genzet, Water Jet Inspectionkenia infoNo ratings yet

- Track The 5 Most Important Call Center MetricsDocument3 pagesTrack The 5 Most Important Call Center Metricssalesforce.comNo ratings yet

- Perencanaan Produksi Dan Kebutuhan Material: Modul 4Document48 pagesPerencanaan Produksi Dan Kebutuhan Material: Modul 4Ivanca Earltina Miranda SimanungkalitNo ratings yet

- School Paper Management: Dennis M. VidarDocument36 pagesSchool Paper Management: Dennis M. VidarMary Ann AysonNo ratings yet

- ISN SM 50 ManualDocument8 pagesISN SM 50 Manualsinggih bramantyoNo ratings yet

- PACK PAR BoilersDocument31 pagesPACK PAR BoilersJosé MacedoNo ratings yet

- ADL 01 Assignment ADocument5 pagesADL 01 Assignment Aversha2950% (2)

- NATO Tactical Nuclear Weapons in EuropeDocument35 pagesNATO Tactical Nuclear Weapons in EuropeMaria Mont' SerratNo ratings yet

- Spare Parts List: Hydraulic Breakers RX6Document16 pagesSpare Parts List: Hydraulic Breakers RX6Sales AydinkayaNo ratings yet

- ParkerOriga PDFDocument338 pagesParkerOriga PDFilyesNo ratings yet

- R Programming CheatsheetDocument6 pagesR Programming CheatsheetAnand PrasadNo ratings yet

- SAIC-A-2009 Rev 2Document5 pagesSAIC-A-2009 Rev 2ரமேஷ் பாலக்காடுNo ratings yet

- Syabas Water ApplicationDocument7 pagesSyabas Water ApplicationKen Chia0% (1)

- Right ShipDocument25 pagesRight ShipEmmNo ratings yet

- Bugcrowd Vulnerability Rating Taxonomy 1.7Document13 pagesBugcrowd Vulnerability Rating Taxonomy 1.7junior108No ratings yet

- NVF5Document16 pagesNVF5Juan LobosNo ratings yet

- 9303 Part 1 Vol 1 PDFDocument99 pages9303 Part 1 Vol 1 PDFrexthrottleNo ratings yet

- Fiat 4061 PDFDocument6 pagesFiat 4061 PDFSamir YehyaNo ratings yet

- DELL XPS 11 VAZ90 LA-A161P Rev 1.0 (A00) 20130814Document49 pagesDELL XPS 11 VAZ90 LA-A161P Rev 1.0 (A00) 20130814Sonel SmithNo ratings yet

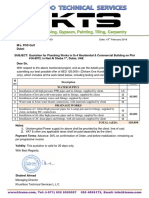

- KTS Quotation Meidan Building Plumbing Works PDFDocument1 pageKTS Quotation Meidan Building Plumbing Works PDFShakeel Ahmad100% (1)