Professional Documents

Culture Documents

ATTEMP ALL QUESTIONS: Circle Only The Correct Answer

Uploaded by

Prince Tettey NyagorteyOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ATTEMP ALL QUESTIONS: Circle Only The Correct Answer

Uploaded by

Prince Tettey NyagorteyCopyright:

Available Formats

UNIVERSITY OF PROFESSIONAL STUDIES, ACCRA L S"#$e%t& Date& LEVEL 400 Mid-Semester Exami ati!

P''F 40( ) 'a *i + , I -estme t A a./sis N!-em#er 01, 20034 Time a..!5ed& ONE 607 8!"r 30 Mi "tes

I str"%ti! & ATTEMP ALL 9UESTIONS& Cir%.e ! ./ t:e %!rre%t a s5er 1. One of the following forms may not result in credit risk a) In the case of direct lending, principal and / or interest amount may not be repaid b) In case of guarantee or letters of credit, funds may not be forthcoming from the parties upon crystallization of the liability c) In the case of securities trading, funds and securities settlement may not be effected d) None of the abo e. !. Operational risk is the risk of loss arising from arious types of a) "uman error b) #ailed systems and procedures in the bank c) $reakdown in internal controls d) Only %b) and %c) e) &ll of the abo e '. (redit risk to the bank is high from a) all customers b) )ebit holders only c) (redit holders only d) $oth %b) and %c) *. Net Interest income is a) Interest earned on ad ances b) Interest earned on in estments c) +otal interest earned on ad ances and in estment d) )ifference between interest earned and interest paid ,. & bank suffers loss due to ad erse market mo ement of a security. +he security was howe er held beyond the defeasance period. -hat is the type of the risk that the bank has suffered. a) /arket 0isk b) Operational 0isk c) /arket 1i2uidation 0isk d) (redit 0isk 3. & bank holds a security that is rated &4. +he rating of the security migrates to &. -hat is the risk that the bank has faced. a) /arket risk b) Operational risk c) /arket li2uidation risk d) (redit risk 5. Operational risk arises from which of the following. i. Inade2uate or failed internal processes ii. 6eople and systems iii. 78ternal 7 ents i . )efaults 1

a) &ll of them b) None of them c) i , ii and iii d) i , ii and i 9. Ob:ecti e of li2uidity management is to; a) 7nsure profitability b) 7nsure li2uidity c) 7ither of two d) $oth <. $anks need li2uidity to; a) /eet deposit withdrawal b) #und loan demands c) $oth of them d) None of them 1=. &de2uacy of bank>s li2uidity position depends upon a) ?ources of funds b) &nticipated future funding needs c) 6resent and future earnings capacity d) &ll of the abo e 11. &sset 1iability management is only management of maturity mismatch and has no bearing on profit augmentation. a) +rue b) #alse c) ?ometimes true and sometimes false d) )ifficult to say 1!. Net Interest /argin is also known as @?pread> a) +rue b) #alse c) Ancertain d) )ifficult to say 1'. +he risk that arises due to worsening of credit 2uality is a) Intrinsic 0isk b) (redit spread 0isk c) 6ortfolio risk d) (ounterparty risk 1*. +he bank>s liabilities are its sources of funds, which include; a) 0eser es b) $orrowings from other banks c) )eposits at other banks. d) ?ecurities and loans e) both %b) and %c)

ESSAY TYPE 9UESTION

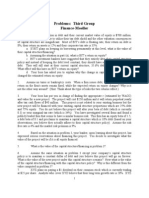

N&$ B C&D E (o, a pri ate listed bank in Fhana. +he bank was formed si8teen years ago by Cames and 7mmanuel, who as directors retain sole ownership. +he bank has returned a profit in each year of operations as shown by the following financial statements.

NA' - ;AY INCOME STATEMENT FOR T8E FINANCIAL YEAR 2000 , 2000

2002

2000

'

Interest Income Interest 78penses NET INCOME #ees and (ommissions Income #ees and (ommissions 78penses NET Fees a d C!mmissi! s Net +rading Income Other Operating Income

<8= i Mi..i! s '9,=,< %!1,5=5) 0>,3(2 3,,31 %'5,) >,0@> <,<!< 5,5 00,>@> 33,224 %!,193) 30,03@ %11,=,,) %9,=3*) %1,,9') 620,1027 00,33> B '3 1=,'5! %!,'<3) 1,?1>

<8= i Mi..i! s !*,'31 %1!,'53) 00,?@( *,1!1 %!*9) 3,@13 ,,3!! <33 >,(@@ 22,44> %1,3*3) 20,@00 %3,!,=) %3,55,) %1,1,3) 604,0@07 >,>0? B 15 3,3'3 %1,9<1) 4,14(

OAerati + I %!me Impairment Net OAerati + I %!me ?taff (osts &dministration and Feneral 78penses )epreciation and &mortization T!ta. OAerati + ExAe ses OAerati + Pr!Bit ?hare of 6ostBta8 6rofit of &ssociated (ompany 6rofit #rom )isposal of NonB(urrent &ssets Pr!Bit 'eB!re I %!me Tax Income +a8 78pense Pr!Bit ABter Tax Attri#"ta#.e t! EC"it/ 8!.ders !B t:e #a *

NA' - ;AY STATEMENT OF FINANCIAL POSITION AS AT 30 ;ANUARY 2000

2002

<8= i Mi..i! s ASSETS (ash and balances with $oF In estment in Fo ernment ?ecurities )ue from $anks and Other #inancial Institution 1oans and &d ances to (ustomers In estment in Other ?ecurities In estment in &ssociated (ompany In estment in ?ubsidiaries Other &ssets (urrent +a8 &ssets 6roperty and 72uipment '',!=< *',**9 *,,**= 1<=,<'9 '5= *=5 5!9 ,,,91 <'' 1*,'',

2000

<8= i Mi..i! s !=,5!9 '*,=!9 *5,1=, 11,,=3! 1,5,3 *=5 51' !,9!< 1< 11,3<9 *

Intangible &ssets T!ta. Assets LIA'ILITIES (ustomer )eposit )ue to $anks and other #inancial Institutions $orrowing &ccruals and Other 1iabilities (redit 0isk 0eser e T!ta. Lia#i.ities S8ARE8OLDERSD E9UITY ?tated (apital ?tatutory 0eser e #und (apital ?urplus Income ?urplus Other 0eser es T!ta. S:are:!.dersD EC"it/ T!ta. Lia#i.ities a d S:are:!.dersD EC"it/

!3= 33(,>4?

1!5 234,412

131,'31 1*,!'! 11,,,<! ,,<'' ',1!' 300,240

1!=,=5< ',<'5 35,'=3 1=,,1* !,!9= 204,00>

9,!5! <,*'5 *,',5 1=,,,< !,59' ',,*=9 33(,>4?

9,==9 5,**! *,''9 9,11' !,*,, '=,',3 234,412

Additional Information 1. (ash and balances with $oF should be treated as a nonBinterest earning asset interest. !. In estments in other securities are all interest earning assets. '. (onsider gross loans to include )ue to other banks and financial institutions, borrowings and customer deposits *. &ssume Net loans be all loans and ad ances to customers Note: ?tate all assumptions made and show all workings ReC"ired& (ompute and briefly comment on the following bank financial ratios a) 0eturn on &ssets g) 1oansBtoB&ssets 0atio b) 0eturn on 72uity h) 6ro ision for 1oan 1osses c) Interest 78pense i) 1oans 1oss 0eser esBtoBFross 1oans d) Interest (o er :) 1oans 1oss 0eser esBtoBNet 1oans e) Net Interest /argin k) 72uityBtoB&ssets f) Net 1oansBtoB+otal )eposit l) +otal )epositsBtoBNet 1oans One (1) marks each. Total of twenty four (12) marks are available for this question.

End of Paper.

Good Luck

MAREIN< SC8EME

A s5ers t! m".tiA.e C"esti! s 1. ) !. 7 '. ( *. ) ,. $ 3. ) ,

5. ( 9. ) <. (

1=. ) 11. $ 1!. &

1'. $ 1*. $

S"++ested A s5ers

5!r*i +s

w1) Total Interest Earnings Assets B In estment in Fo Gt ?ecurities B )ue from banks and other #I B 1oans and &d ances to (ustomers B In estment in other securities w2) Profit before Interest and ta !P"IT) B 6rofit before +a8 B Interest e8pense 1=,'5! !1,5=5 32,01? 3,3'3 1!,'53 0?,002 2012 *',**9 *,,**= 1<=,<'9 '5= 2@0,0?> 2011 '*,=!9 *5,1=, 11,,=3! 1,5,3 0?1,?(0

w#) Net $oans % &ross loan ' A(t)al $oans Ad*an(ed Fross loans B )ue to banks E other #I 1*,!'! B $orrowings 11,,,<! B (ustomer deposits 131,'31 +otal Fross 1oans 2?0,0@( 1ess 1oans E &d ances %1<=,<'9) Net loans 100+2,w,) Total deposits B (ustomer deposit 131,'31 B )ue to banks 1*,!'! B $orrowings 11,,,<! 12/+101

',<'5 35,'=3 1!=,=5< 0?0,322 %11,,=3!) -.+2.0 1!=,=5< ',<'5 35,'=3 1/1+#22

9"esti! 0

T/Ae Rati!

Return Assets

!B F!rm".a

on = et O!eratin" #ncome$ Total Assets % 1&&'

2000

'1,='9I 1==H '',,3*< G ?42(H I 1==H

2000

Remar*s FC!mme t

+he bank was able to !=,9==I 1==H generate re enue 9.95H in !'*,*5! !=1= and this increased by G @4@1H =.'9H in !=11.

I 1==H I 1==H

Return (quity #nterest (*!ense #nterest +overa"e Ratio

on = et #ncome$ sharehol)er (quity %

1&&'

= Total #nterest (*!ense $ Total #nterest (arnin" Assets % 1&&' = ,-#T or (-#T $ #nterest e*!ense . 1 = et #nterest income$ Total #nterest (arnin" Assets % 1&&' = et 0oans $ Total 1e!osits in times = 0oans to the bank $ Total Assets) % 1&&'

5,<53 ',,*=9 G 22H !1,5=5 I 1==H !9=,1<3 J 141(H '!,=<5 !1,5=5 J 044@& 0 13,',! I 1==H !9=, 1<3 J (4@4H 1==,!*5 15,,,<' J 04(1 times 1<=,<'9 I 1==H '',,3*< J (>4@@H ',1!'I 1==H 1<=,<'9 J 04>4H I 1==H ',1!' !<1,19, J 0401H ',1!' I 1==H 1==,!*5 J 3402H ',,*=9 I 1==H '',,3*< J 004((H 15,,,<'& 0 1==,!*5 J 041( & 0

*,5*, '=,',3 J0(4>3H 1!,'53 1<5,<,1 J >42(H 1<,=1! 1!,'53 J 04(4 &0 11,<9, I 1==H 1<5<,1 J >40(H 53,!3= 1!*,=13 J 04>0 times 11,,=3! I 1==H !'*,*5! J 4?401H !,!9=I 1==H 11,,=3! J 04?@H !,!9=I 1==H 1<1,'!! J 040?H !,!9=I 1==H 53,!3= J 24??H '=,',3 I 1==H !'*,*5! J 024?(H 1!*,=13& 0 53,!3= J 04>3 & 0

+his ratio indicates the return to owners of the bank. Increase by 3.'5H. +he interest e8pense increase by 1.,H. +his could be due to increase in acti ities. +he company is doing fairly well as it is able to pay its interest e8pense abo e the a erage. +his ratio indicates that interest e8pense is less than interest income. +his is a wise in estment management. +his ration indicates that the bank is not relying much on borrowed funds. +his ratio indicates the bank is assuming more risk as it may be prone to higher defaults, and its assets can pay off deposits. +his is the amt thought to be ade2uate for estimated loan losses. +he bank is keeping less of this meaning assets portfolio is 2uality. +his ratio determines how 2uality assets are. +he low ratios supposes less problems of the loans defaults. +his ratio is linked to the former ratio. 7 en though it has slightly increased, it is still generally low. +his ratio indicates the degree of e2uity le erage. Fenerally, banks are highly geared by nature of it sources of funding

+his ratios determines the deposit drains. +his ratio indicates abo e a erage funding base. ?ol ency is good

et #nterest /ar"in Net loans BtoB total deposits 0oans2to2 Assets

,rovision = 0oan loss Reserve $ for 0oan Total loans) % 1&&' 0osses 1oan loss = 0oan 0oss Reserves $ reser es BtoB 3ross 0oans avera"e % 1&&' gross loans 1oan loss reser es BtoB = 0oan loss reserves $ Net loans net loans avera"e % 1&&' (quity Assets to = 4harehol)ers (quity $ Total Assets% 1&&'

+otal )eposits BtoB = Total 1e!osits $ et Net 1oans 0oans : 1

You might also like

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsFrom EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsNo ratings yet

- SM Chapter 06Document42 pagesSM Chapter 06mfawzi010No ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Banking TermsDocument86 pagesBanking TermsumaannamalaiNo ratings yet

- Exam 1 KeyFinanceDocument7 pagesExam 1 KeyFinancepoojasoni06No ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- FM11 CH 16 Mini-Case Cap Structure DecDocument11 pagesFM11 CH 16 Mini-Case Cap Structure DecAndreea VladNo ratings yet

- Karpagam Institute of Technology Mca Continuous Assessment Internal Test-IDocument5 pagesKarpagam Institute of Technology Mca Continuous Assessment Internal Test-IanglrNo ratings yet

- Alm-Course Outlines-For Two DaysDocument40 pagesAlm-Course Outlines-For Two Daysrashed03nsuNo ratings yet

- Chapter 18 International Capital BudgetingDocument26 pagesChapter 18 International Capital BudgetingBharat NayyarNo ratings yet

- Acc 501 Midterm Solved Papers Long Questions SolvedDocument34 pagesAcc 501 Midterm Solved Papers Long Questions SolvedAbbas Jafri33% (3)

- W 10 Midterm1 SolutionDocument13 pagesW 10 Midterm1 SolutionSehoon OhNo ratings yet

- The Following Questions Are Worth 3 Points Each. Provide The Single Best ResponseDocument9 pagesThe Following Questions Are Worth 3 Points Each. Provide The Single Best ResponsePaul Anthony AspuriaNo ratings yet

- Amity AssignmentDocument16 pagesAmity AssignmentAnkita SrivastavNo ratings yet

- Solutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsDocument6 pagesSolutions Manual Chapter Twenty: Answers To Chapter 20 QuestionsBiloni KadakiaNo ratings yet

- Analysis of Financial StatementsDocument9 pagesAnalysis of Financial StatementsmuradkasassbekNo ratings yet

- BUS785 in Class Work No. 1 First Name - Last NameDocument5 pagesBUS785 in Class Work No. 1 First Name - Last Namedineshmech225No ratings yet

- Leach TB Chap09 Ed3Document8 pagesLeach TB Chap09 Ed3bia070386No ratings yet

- A Few Practice Questions From Chapters 1-5: D) Capital StructureDocument4 pagesA Few Practice Questions From Chapters 1-5: D) Capital StructureMichaelFraserNo ratings yet

- Assignment Drive Program Semester Subject Code & Name Bba203 & Financial Accounting BK Id Credit & MarksDocument4 pagesAssignment Drive Program Semester Subject Code & Name Bba203 & Financial Accounting BK Id Credit & MarksSmu DocNo ratings yet

- Utual UND: Ssignmen T ONDocument9 pagesUtual UND: Ssignmen T ONMahbubul Bari ShiblyNo ratings yet

- Problems: Third Group Finance-MoellerDocument4 pagesProblems: Third Group Finance-MoellerEvan BenedictNo ratings yet

- Knowledge Quiz: Performance ObjectiveDocument11 pagesKnowledge Quiz: Performance Objectivecseiji20% (5)

- J B Chemicals LTD - Group 14Document22 pagesJ B Chemicals LTD - Group 14xyz226422No ratings yet

- Capital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview QuestionsDocument12 pagesCapital IQ, Broadridge, Factset, Shore Infotech Etc .: Technical Interview Questionsdhsagar_381400085No ratings yet

- Chapter 14 Capital Structure and Financial Ratios: 1. ObjectivesDocument17 pagesChapter 14 Capital Structure and Financial Ratios: 1. Objectivessamuel_dwumfourNo ratings yet

- A Study On Equity AnalysisDocument61 pagesA Study On Equity AnalysisRitika KhuranaNo ratings yet

- Financial Accounting 7th EditionDocument9 pagesFinancial Accounting 7th Editiongilli1trNo ratings yet

- Sample Exam #1Document14 pagesSample Exam #1calebkinneyNo ratings yet

- Case of Cost of Capital - PrasannachandraDocument13 pagesCase of Cost of Capital - PrasannachandraJyotiGhanchiNo ratings yet

- Practice Final ExamDocument8 pagesPractice Final ExamrahulgattooNo ratings yet

- Prashant ResumeDocument7 pagesPrashant ResumePrashantAlavandiNo ratings yet

- ICF - Lecture 2 - Time Value of MoneyDocument46 pagesICF - Lecture 2 - Time Value of Moneyioana_doncaNo ratings yet

- Revision 4 - Business Finance: Topic List 1. Internal Sources of Finance Exam Question ReferenceDocument33 pagesRevision 4 - Business Finance: Topic List 1. Internal Sources of Finance Exam Question Referencesamuel_dwumfourNo ratings yet

- Chapter 20: Managing Credit Risk On The Balance SheetDocument17 pagesChapter 20: Managing Credit Risk On The Balance SheetAmmar Ali AyubNo ratings yet

- MCQ On Banking, Finance and Economy - Test - IDocument7 pagesMCQ On Banking, Finance and Economy - Test - IAnubrata KarmakarNo ratings yet

- Partnership Accounting Sample QuestionsDocument15 pagesPartnership Accounting Sample Questionspaul ndhlovuNo ratings yet

- Practice Qns - Cap StructureDocument8 pagesPractice Qns - Cap StructureSadi0% (1)

- Answer All: TEST 2 FIN 542 International Financial Management 2012Document5 pagesAnswer All: TEST 2 FIN 542 International Financial Management 2012Janeahmadzack100% (1)

- Solution Financial Management Strategy May 2009Document7 pagesSolution Financial Management Strategy May 2009samuel_dwumfourNo ratings yet

- Liquidity Ratio 001Document4 pagesLiquidity Ratio 001Anurag SahrawatNo ratings yet

- NBG Format-20.11.13Document6 pagesNBG Format-20.11.13Srinivas MaheshwariNo ratings yet

- Balance Sheet and Income StatementDocument11 pagesBalance Sheet and Income StatementAmelia Butan50% (2)

- Security Analysis and Portfolio ManagementDocument11 pagesSecurity Analysis and Portfolio ManagementAhasan HabibNo ratings yet

- Review Notes Mid1Document8 pagesReview Notes Mid1dadahahaNo ratings yet

- Management Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Document4 pagesManagement Accounting PMA1A - Need Solution - Ur Call Away - 9582940966Ambrish (gYpr.in)No ratings yet

- Introduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Document3 pagesIntroduction: This Memorandum Sets Out Our Proposed Strategy For Auditing The Karnataka State Khadi and Village Industries Board (KVIB) For The Year Ended 31 March 2006Rachyl SacramedNo ratings yet

- Financial Statements, Cash Flows, and Taxes: Homework ForDocument9 pagesFinancial Statements, Cash Flows, and Taxes: Homework Foradarshdk1No ratings yet

- Order in The Matter of Weird Industries LimitedDocument18 pagesOrder in The Matter of Weird Industries LimitedShyam SunderNo ratings yet

- FIN515 Week 2 Homework AssignmentDocument6 pagesFIN515 Week 2 Homework AssignmentNatasha DeclanNo ratings yet

- D & G Case StudyDocument10 pagesD & G Case StudyVrusti RaoNo ratings yet

- Sample Final Exam, FinalDocument11 pagesSample Final Exam, Finaldennis.matienzo29No ratings yet

- Business Finance ExamDocument8 pagesBusiness Finance Examapi-342895963100% (3)

- Financial Risk and Financial Performance of Commercial Banks in Rwanda A Case of Equity Bank RwandaDocument8 pagesFinancial Risk and Financial Performance of Commercial Banks in Rwanda A Case of Equity Bank RwandaSolomon MainaNo ratings yet

- Ratio Analysis On Dhaka BankDocument8 pagesRatio Analysis On Dhaka Banktoxictouch100% (1)

- Sample Midterm 2Document9 pagesSample Midterm 2hjgNo ratings yet

- Financial Analysis 105-115Document10 pagesFinancial Analysis 105-115deshpandep33No ratings yet

- Accounting For Business II PM Xii Chapter4Document6 pagesAccounting For Business II PM Xii Chapter4akbar2jNo ratings yet

- Revision 2 - Investment Appraisal: Topics ListDocument35 pagesRevision 2 - Investment Appraisal: Topics ListKashif MehmoodNo ratings yet

- Multiple Choice - MarketingDocument6 pagesMultiple Choice - MarketingRobinHoodCookiesNo ratings yet

- ENTREPDocument275 pagesENTREPmylykhan LucasNo ratings yet

- How The NSSF Has Grown Its Asset Base To Shs6 TrillionDocument2 pagesHow The NSSF Has Grown Its Asset Base To Shs6 TrillionjadwongscribdNo ratings yet

- IKEA and ACME Case StudyDocument24 pagesIKEA and ACME Case StudyGuma BashirNo ratings yet

- ACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDDocument17 pagesACCA Paper F2 ACCA Paper F2 Management Accounting: Saa Global Education Centre Pte LTDEjaz KhanNo ratings yet

- Test Bank For Financial Management Theory and Practice 3rd Canadian Edition Eugene F Brigham Michael C Ehrhardt Jerome Gessaroli Richard R NasonDocument21 pagesTest Bank For Financial Management Theory and Practice 3rd Canadian Edition Eugene F Brigham Michael C Ehrhardt Jerome Gessaroli Richard R Nasongisellesamvb3100% (24)

- An Introduction To New Product Development (NPD)Document20 pagesAn Introduction To New Product Development (NPD)binder8640No ratings yet

- BBVA Compass: Marketing Resource Allocation: Ho Kim, Ph.D. Assistant Professor of MarketingDocument27 pagesBBVA Compass: Marketing Resource Allocation: Ho Kim, Ph.D. Assistant Professor of MarketingJoaquín Norambuena Escalona100% (1)

- Problems in Estimating Production Function Empirically For A Ceramic Tile Manufacture in Sri LankaDocument15 pagesProblems in Estimating Production Function Empirically For A Ceramic Tile Manufacture in Sri LankaRavinath NiroshanaNo ratings yet

- Online Accrual - A White PaperDocument50 pagesOnline Accrual - A White PaperManisekaran SeetharamanNo ratings yet

- ch08 SolDocument18 pagesch08 SolJohn Nigz Payee50% (2)

- Internship ReportDocument37 pagesInternship ReportMicky Gautam100% (1)

- Concept and Accounting of Depreciation: Learning OutcomesDocument30 pagesConcept and Accounting of Depreciation: Learning OutcomesCA Kranthi Kiran100% (1)

- Nobles Finman6e SMQ CH23Document77 pagesNobles Finman6e SMQ CH23Ryan Nguyen100% (2)

- Cooperative AssignmentDocument2 pagesCooperative AssignmentWhite WhiteyNo ratings yet

- The Relationship Between Psychological PDocument17 pagesThe Relationship Between Psychological PGeet YadavNo ratings yet

- 4O00156Document573 pages4O00156Ketan GuhagarkarNo ratings yet

- A Simple Correction of The WACC Discount Rate For Default Risk and Bankruptcy CostsDocument15 pagesA Simple Correction of The WACC Discount Rate For Default Risk and Bankruptcy CostsMustika DewiNo ratings yet

- Scorecard Valuation Methodology Jan111Document7 pagesScorecard Valuation Methodology Jan111Franch Maverick Arellano LorillaNo ratings yet

- PR 424 - Case StudyDocument5 pagesPR 424 - Case Studyapi-455029395No ratings yet

- AP 2003 (Inventories)Document4 pagesAP 2003 (Inventories)Ram PinedaNo ratings yet

- Business Plan of Fella Incorporation: Maysan RD., Valenzuela City, Metro ManilaDocument38 pagesBusiness Plan of Fella Incorporation: Maysan RD., Valenzuela City, Metro ManilaVincent OntalNo ratings yet

- Bonds Payable & Other ConceptsDocument7 pagesBonds Payable & Other ConceptsChristine Jean MajestradoNo ratings yet

- PQM Consultants Compro 2019 - R4Document23 pagesPQM Consultants Compro 2019 - R4Emad HamdiNo ratings yet

- Chap 5 HomeworkDocument2 pagesChap 5 HomeworkTaghi MammadovNo ratings yet

- Puja Rahangdale HR 16Document2 pagesPuja Rahangdale HR 16Luis VivasNo ratings yet

- Final GE 408Document76 pagesFinal GE 408Mohammed BabkirNo ratings yet

- Sales Promotion and Direct Marketing Chapter 11Document41 pagesSales Promotion and Direct Marketing Chapter 11Aisha FarooqNo ratings yet

- Introduction and Axioms of Urban Economics: Mcgraw-Hill/Irwin ©2009 The Mcgraw-Hill Companies, All Rights ReservedDocument23 pagesIntroduction and Axioms of Urban Economics: Mcgraw-Hill/Irwin ©2009 The Mcgraw-Hill Companies, All Rights ReservedSixd WaznineNo ratings yet

- Chapter-1: Background of The StudyDocument32 pagesChapter-1: Background of The StudyPHANTOM 017No ratings yet