Professional Documents

Culture Documents

AficanSun NoticetoShareholders 031013

Uploaded by

Kristi DuranCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AficanSun NoticetoShareholders 031013

Uploaded by

Kristi DuranCopyright:

Available Formats

(Incorporated in Zimbabwe on 2 July 1971 under registration number 643/1971) (African Sun or the Company)

PRESS ANNOUNCEMENT TO ALL SHAREHOLDERS

The Board wishes to advise shareholders of the disposal of 294 705 134 Linked Units in Dawn Properties Limited for a consideration of US$4,332,165 to Lengrah Investments (Private) Limited, Lengrah , a Hotel and Real Estate Investment Company incorporated in Zimbabwe. The disposal was undertaken solely for the purpose of reducing short-term debt, pursuant to the Companys strategic thrust of strengthening the Groups capital structure as communicated previously. The transaction was effected on the Zimbabwe Stock Exchange (ZSE) on 2 October 2013 at a price of US$0.0147 per Linked Unit. The Linked Units sold were acquired last year as advised in an Announcement to Shareholders published on 19 June 2012 for a consideration of US$3,710,422 (US$0.01259 per Linked Unit). The transaction price of US$0.0147 per Linked Unit represents an effective 53% premium on the 30-day Volume Weighted Average Price of Dawn Properties Linked Units as at 21 August 2013, resulting in a cash prot of US$503,862 on the original purchase price of these Linked Units. Net proceeds from the disposal will be applied entirely towards reduction of short-term debt with the following benets expected to accrue to the company: Reduction of finance costs by US$70,000 a month (US$840,000 per annum) going forward and Reduction of the companys total short-term debt by 32% from US$12,390,090 reported for the six months ended 31 March 2013. The disposal has triggered a mark down of the entire class of the Linked Units held, which could potentially result in a charge of US$8,775,097 to the Income Statement for the year ended 30 September 2013, subject to further assessment of the value-in-use of this investment. Nonetheless, it is the Boards view that the benets that will accrue from the disposal of the Linked Units far outweigh the marked down charge that will be suffered in the current nancial year. The Linked Units disposed of had a carrying amount of US$8,020,370. The Company will however remain a holder of 406,466,976 Dawn Properties Limited Linked Units, constituting 16.54% of the total issued Linked Units in Dawn Properties Limited. Below is a summary detailing the transaction:

The carrying amount of the 406,466,976 Linked Units in Dawn Properties Limited will potentially be marked down to US$5,975,065, subject to a further assessment of valuein- use at Year End F13. *The Company retains ownership of 406 466 976 Linked Units in Dawn Properties Limited after the disposal, these have been valued at the same transaction price in order to come up with an indication of the potential mark down. In terms of Section 10 of the ZSE Listing requirements, Lengrah Investments (Private) Limited is considered a related party. Accordingly and as per the requirement of the said section, full details on that relationship are provided below: Lengrah Investments is a subsidiary of Brainworks Capital Management (Private) Limited (Brainworks Capital). There are ongoing processes between Lengrah Investments and an Australian based fund and Jersey registered Investments Company ,which processes currently await the Reserve Bank of Zimbabwe exchange control approval. Brainworks Capital is a private equity investment and advisory services rm which also has a benecial shareholding in African Sun Limited through the following investment vehicles; Riustrix Investments (Private) Limited - 19.33% Ecobank Asset Management (Private) Limited - 7 .72% Cotition Investments (Private) Limited - 2.72% Criben Investments (Private) Limited - 1.53%

Dr. Shingi Munyeza, the Chief Executive Officer of African Sun Limited previously controlled the above vehicles through his family trust, Nhaka Trust, and in a recent cash and share transaction with Brainworks Capital, his family trust now owns 17 .02% of Brainworks Capital. The disclosed shareholding constitutes the full extent of the relationship with African Sun Limited as Brainworks does not yet have board representation on the African Sun Limited Board. Mr George Manyere, an appointee of African Sun Limited onto the Dawn Properties Board is a director of both Lengrah Investments and Brainworks Capital (Private) Limited. Brainworks arranged the financing used to acquire the 12% Linked Units which are the subject of this disposal. As was advised in a notice dated 19 June 2012, these shares were acquired as a pre-emptive measure to help resolve tenancy issues with Dawn Properties Limited. We are happy to inform shareholders that signicant progress has been made in this regard and a cordial business relationship now subsists between the two entities. Brainworks Capital acted as an advisor to African Sun Limited in the refinancing of short-term debt in September 2012.

The disposal was conducted on terms considered arms length, at a price that was supported by valuation of the Linked Units performed by an independent nancial advisor duly registered by the Securities Exchange Commission. The Board wishes to advise that other debt reduction initiatives are being pursued, and shareholders will be advised in due course as appropriate. In terms of section 9.25-28 of the ZSE Listing requirements, a circular providing more details of this transaction will be prepared and circulated to all shareholders within 28 days of this notice. BY ORDER OF THE BOARD E T SHANGWA COMPANY SECRETARY REGISTERED OFFICE AFRICAN SUN LIMITED Ofce No. 1708, 17th Floor, Crowne Plaza Monomotapa, 54 Parklane, Harare 3 October 2013

Directors: B L Nkomo (Chairman), S A Munyeza (Group Chief Executive)*, D W Birch, E A Fundira, V W Lapham, A Makamure, N G Maphosa, N Mangwiro (Group Finance Director)*, N R Ramikosi. *Executive

You might also like

- National Budget 2017Document256 pagesNational Budget 2017Kristi DuranNo ratings yet

- Accounting Notes 2015Document7 pagesAccounting Notes 2015aspharagusNo ratings yet

- Telecom Analytics SolutionsDocument12 pagesTelecom Analytics Solutionsdivya2882No ratings yet

- Wacc DecomposedDocument1 pageWacc DecomposedKristi DuranNo ratings yet

- CFI Holdings H1 2014Document2 pagesCFI Holdings H1 2014Kristi DuranNo ratings yet

- Hippo H1 2014 ResultsDocument2 pagesHippo H1 2014 ResultsKristi DuranNo ratings yet

- 2014 Annual ReportDocument124 pages2014 Annual ReportKristi DuranNo ratings yet

- Citizens Budget 2022Document17 pagesCitizens Budget 2022Kristi DuranNo ratings yet

- BATZ FY 2015 ResultsDocument1 pageBATZ FY 2015 ResultsKristi DuranNo ratings yet

- Hippo Valley Annual Report 2014 - Final Printers' Draft PDFDocument61 pagesHippo Valley Annual Report 2014 - Final Printers' Draft PDFKristi Duran50% (2)

- CBZ Audited Financial Results Dec 2014Document16 pagesCBZ Audited Financial Results Dec 2014Kristi DuranNo ratings yet

- PCL Annual Report 2013Document116 pagesPCL Annual Report 2013Kristi DuranNo ratings yet

- Illovo Sugar Malawi LTD 2015 Annual ReportDocument60 pagesIllovo Sugar Malawi LTD 2015 Annual ReportKristi DuranNo ratings yet

- Afsun FY2014 ResultsDocument1 pageAfsun FY2014 ResultsKristi DuranNo ratings yet

- Annual Report 2011 PDFDocument69 pagesAnnual Report 2011 PDFKristi DuranNo ratings yet

- 2013 Annual ReportDocument54 pages2013 Annual ReportKristi DuranNo ratings yet

- TA Holdings Annual Report 2013Document100 pagesTA Holdings Annual Report 2013Kristi DuranNo ratings yet

- Innscor AR 2014Document98 pagesInnscor AR 2014Kristi DuranNo ratings yet

- Tariff Jul 2009Document1 pageTariff Jul 2009Kristi DuranNo ratings yet

- Unaudited Financials H1 2014Document2 pagesUnaudited Financials H1 2014Kristi DuranNo ratings yet

- Barclays Bank of Zimbabwe 2013 Annual Report HighlightsDocument74 pagesBarclays Bank of Zimbabwe 2013 Annual Report HighlightsKristi DuranNo ratings yet

- ZSE Anti Money Laundering GuidelinesDocument5 pagesZSE Anti Money Laundering GuidelinesKristi DuranNo ratings yet

- Ariston Holdings 2013 Annual Report Highlights Profit GrowthDocument57 pagesAriston Holdings 2013 Annual Report Highlights Profit GrowthKristi DuranNo ratings yet

- 2012 Blue BookDocument321 pages2012 Blue BookKristi DuranNo ratings yet

- Delta FY14 PresentationDocument18 pagesDelta FY14 PresentationKristi DuranNo ratings yet

- FMLH Fy 2013Document2 pagesFMLH Fy 2013Kristi DuranNo ratings yet

- Zimbabwe 2014 Estimates of ExpenditureDocument279 pagesZimbabwe 2014 Estimates of ExpenditureKristi DuranNo ratings yet

- Hippo Audited Results 31 March 2011Document13 pagesHippo Audited Results 31 March 2011Kristi DuranNo ratings yet

- Zimbabwwe CensusDocument173 pagesZimbabwwe CensusKristi DuranNo ratings yet

- Dawn Overview Mar 2010Document3 pagesDawn Overview Mar 2010Kristi DuranNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Document 5Document23 pagesDocument 5Chi ChengNo ratings yet

- Investment in Associate ExercisesDocument7 pagesInvestment in Associate ExercisesJo KeNo ratings yet

- Accounting Chap 10 - Sheet1Document2 pagesAccounting Chap 10 - Sheet1Nguyễn Ngọc Mai100% (1)

- Trailhead Virtual Bootcamp For Platform Developer Slide DeckDocument111 pagesTrailhead Virtual Bootcamp For Platform Developer Slide DeckBrenda Paiva100% (1)

- Karachi Meezan 30-Index overviewDocument27 pagesKarachi Meezan 30-Index overviewFaraz Ul Haq KhanNo ratings yet

- Ankur Introduction WofDocument12 pagesAnkur Introduction WofKNo ratings yet

- Analytical Research in AccountingDocument12 pagesAnalytical Research in AccountingBhupendra RaiNo ratings yet

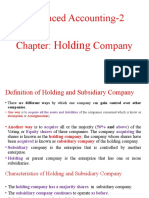

- Advanced Accounting-2 Company: HoldingDocument20 pagesAdvanced Accounting-2 Company: HoldingTB AhmedNo ratings yet

- Script - How To Survive RecessionDocument5 pagesScript - How To Survive RecessionMayumi AmponNo ratings yet

- Pondicherry University MBA Paper on Investment and Portfolio ManagementDocument285 pagesPondicherry University MBA Paper on Investment and Portfolio ManagementYonas Tsegaye HaileNo ratings yet

- Case 31 An Introduction To Debt Policy and ValueDocument8 pagesCase 31 An Introduction To Debt Policy and ValueChittisa CharoenpanichNo ratings yet

- Chapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)Document35 pagesChapter 10 Lessons From Market History: Corporate Finance, 12e (Ross)EnciciNo ratings yet

- in Rs. Cr. - Balance Sheet of Infibeam AvenuesDocument5 pagesin Rs. Cr. - Balance Sheet of Infibeam AvenuesAmir khanNo ratings yet

- Long-Term Liabilities: QuestionsDocument74 pagesLong-Term Liabilities: QuestionsChu Thị ThủyNo ratings yet

- Analisis de Cuentas HQCDocument14 pagesAnalisis de Cuentas HQCAlejandro MartínezNo ratings yet

- A Comparative Study on Financial Performance of SBI and PNBDocument84 pagesA Comparative Study on Financial Performance of SBI and PNBshalini TripathiNo ratings yet

- Structured Credit and Equity Product PDFDocument480 pagesStructured Credit and Equity Product PDFRach3ch100% (1)

- June 2021Document21 pagesJune 2021Anjana TimalsinaNo ratings yet

- JAWABAN CHAPTER 17 - INVESTMENTS (Revisi)Document3 pagesJAWABAN CHAPTER 17 - INVESTMENTS (Revisi)CaratmelonaNo ratings yet

- MCQS Chapter 6 Company Law 2017Document8 pagesMCQS Chapter 6 Company Law 2017BablooNo ratings yet

- Assignment 2Document19 pagesAssignment 2KSNo ratings yet

- SDD b2b Contract 49mDocument21 pagesSDD b2b Contract 49mCammissa Khoi Services and Trading0% (1)

- Geographical Pricing Strategy FinalDocument10 pagesGeographical Pricing Strategy FinalSeif ElkhoulyNo ratings yet

- II-ResearchTemplatev1 20Document301 pagesII-ResearchTemplatev1 20'Izzad AfifNo ratings yet

- Barrick Gold 2009 Annual ReportDocument170 pagesBarrick Gold 2009 Annual ReportBarrickGoldNo ratings yet

- A Study On Financial Performance of Multipurpose Cooperative Unions of Tigrai Region EthiopiaDocument12 pagesA Study On Financial Performance of Multipurpose Cooperative Unions of Tigrai Region EthiopiaMJ Yacon100% (2)

- Financial System NoteDocument5 pagesFinancial System NoteVaibhav PriyeshNo ratings yet

- 5 EMA 13 EMA Fibonacci Forex Trading SystemDocument7 pages5 EMA 13 EMA Fibonacci Forex Trading SystemantoniusNo ratings yet

- Unit Iii Business Plan Preparation Entrepreneurship DevelopmentDocument10 pagesUnit Iii Business Plan Preparation Entrepreneurship DevelopmentKaarletNo ratings yet

- Pairs Trading G GRDocument31 pagesPairs Trading G GRSrinu BonuNo ratings yet