Professional Documents

Culture Documents

CFO SVP Vice President Finance in ST Louis MO Resume Matt Strate

Uploaded by

MattStrateOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CFO SVP Vice President Finance in ST Louis MO Resume Matt Strate

Uploaded by

MattStrateCopyright:

Available Formats

MATT STRATE, CPA

636-439-8485 (cell)

Chesterfield, MO 63005 mattstrate1@gmail.com

CFO / SVP / VP FINANCE

Controls / Treasury / Bank, Vendor & Board Relations / M&A / Integrations / Operations / HR / IT Cash Management / Cost Control / Legal / Revenue, Profit & Performance Improvement

Experience in building the infrastructures and raising the capital to support growth and change. Successful in providing the financial, operational and administrative leadership to ensure peak organizational performance. A financial executive with extensive operations management experience, my strengths include Turning around underperforming businesses, departments and personnel Finding and seizing opportunities to cut costs while boosting customer satisfaction and quality Developing and executing strategies to meet rapidly changing market, legal and competitive needs Leading new construction, upgrade (facilities, IT) and renovation projects to successful conclusion

BS in Business, major in Accounting plus AA in Computer Science both from Southeast Missouri State University. Certified Public Accountant - State of Missouri. Complete average of 40 hours of CPE per year for CPA license. A Certified Information Systems Auditor current license pending completion of CPE. Selected Accomplishments Boosted profitability. Preferred Family Healthcares (PFH) bottom line was only 1% of revenue. Re-wrote policies and procedures. Purchased new software applications. Established controls to contain costs and improve productivity. Drove bottom line to 8%. Grew equity from $5.5M to $19.5M million, as revenue grew from $23 to $42M. Orchestrated mergers, acquisitions and integrations. Worked with the CEO to identify potential mergers and acquisitions and new fields of growth. Led integrations including extensive work on the cultural differences between organizations. Unified SOPs and created a synergistic staff with high morale. Grew cash reserves. Joined PFH when there were no cash reserves and $1.5M had been drawn from the Line of Credit. Analyzed sources and uses of cash. Accelerated collections and delayed the payment of invoices until due dates. Regained a positive position in six months and built up reserves to $5M. Overcame crisis. In 2007, PFH was in default on its bank debt covenants, jeopardizing its continued existence. Met with bankers and renegotiated the covenants to eliminate the default position. Secured a six month extension of terms enabling PFH to make changes and achieve compliance. Slashed interest expense. PFH was financing its facilities through conventional bank loans. Found and seized an opportunity to refinance debt through tax-exempt bonds. Negotiated a tax-exempt bond deal to refinance facilities at an interest rate that was 65% of the conventional loan rate. Saved $175K annually in interest expense. Transformed IT failure into a triumph. Took over a failed project to install a new legacy software system. Decided to develop the system in house. Led the full life cycle of the implementation project. The system is being rolled out and has been judged by auditors, IT consultants as the best system in the industry. PFH plans to market it. Upgraded facilities. PFHs facilities were not at an acceptable level for an industry leader. Developed both short and long range plans for facilities upgrades. Created a strategy to obtain financing. Orchestrated the investment of $30M in new construction or remodeling. PFH is now considered to have the best facilities in the State. Started a new business. Delmar needed to control skyrocketing health care costs to maintain profitability. Part of the team that established a self-insured captive insurance company in the Cayman Islands. Eliminated the costs of outside insurance company's overhead and profits. Saved hundreds of thousands of dollars annually. Employment History CFO Preferred Family Healthcare, Inc. 2007 to present. Manage Operations, HR, Accounting, IT, Billing and 3rd Party Insurance. Lead a team of 100 professional and support personnel in this $42M behavioral health care organization. Guided company growth from $23M to $42M since 2007. Controller Delmar Gardens Management Services - 2000 to 2007. Responsible for month end closing procedures, P&L management and budget analysis. Also responsible for accounts payable, accounts receivable, payroll and captive insurance company based in the Cayman Islands. Delmar is a $225M health care provider. Partner Lang, Strate & Associates - 1991 to 2000. Developed and supported a multi-industry clientele (manufacturing, construction, retail, financial institutions and more). Earlier, employed in auditing and financial management positions with May Department Stores and Ernst & Young.

You might also like

- CFO Vice President Finance in United States Resume Salmon KaplanDocument3 pagesCFO Vice President Finance in United States Resume Salmon KaplanSalmon Kaplan1No ratings yet

- Director VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas KaehrDocument3 pagesDirector VP Finance Controller FP&A Auditing in Indianapolis Resume Thomas KaehrThomasKaehrNo ratings yet

- Finance Director Resume Samples: Expert Guidance for Your CareerDocument7 pagesFinance Director Resume Samples: Expert Guidance for Your CareerArojiduhu HalawaNo ratings yet

- CFO Controller Manufacturing Distribution in New Haven CT Resume Chet LatinDocument3 pagesCFO Controller Manufacturing Distribution in New Haven CT Resume Chet LatinChetLatinNo ratings yet

- CFO Senior Healthcare Executive in United States Resume Kent BrownDocument4 pagesCFO Senior Healthcare Executive in United States Resume Kent BrownKentBrown1No ratings yet

- Chief Financial Officer CFO in Boston MA Resume Lawrence SmithDocument2 pagesChief Financial Officer CFO in Boston MA Resume Lawrence SmithLawrenceSmith2No ratings yet

- CEO CFO Healthcare SEC in Tampa FL Resume Jay JarrellDocument3 pagesCEO CFO Healthcare SEC in Tampa FL Resume Jay JarrellJayJarrellNo ratings yet

- CFO Corporate Controller in Buffalo NY Resume John MarhoferDocument2 pagesCFO Corporate Controller in Buffalo NY Resume John MarhoferJohnMarhoferNo ratings yet

- Controller in Philadelphia PA Resume James MantellDocument2 pagesController in Philadelphia PA Resume James MantellJamesMantellNo ratings yet

- Corporate Controller CFO in Chicago IL Resume Jennie Shan-MartinDocument2 pagesCorporate Controller CFO in Chicago IL Resume Jennie Shan-MartinJennieShanMartinNo ratings yet

- Controller Accounting Manager CPA in Detroit MI Resume Michele MarshDocument1 pageController Accounting Manager CPA in Detroit MI Resume Michele MarshMicheleMarshNo ratings yet

- Treasurer VP Finance CFO in Nashville TN Resume Robert VottelerDocument2 pagesTreasurer VP Finance CFO in Nashville TN Resume Robert VottelerRobertVottelerNo ratings yet

- Chief Financial Officer in Toronto Canada Resume Gregory ScottDocument3 pagesChief Financial Officer in Toronto Canada Resume Gregory ScottGregoryScott1No ratings yet

- Director Finance Accounting CFO in Tampa ST Petersburg FL Resume T Harry LinnDocument2 pagesDirector Finance Accounting CFO in Tampa ST Petersburg FL Resume T Harry LinnTHarryLinnNo ratings yet

- CFO Strategic Financial Officer in Atlanta GA Resume Les FlynnDocument3 pagesCFO Strategic Financial Officer in Atlanta GA Resume Les FlynnLesFlynnNo ratings yet

- Chief Financial Officer Strategy Leader in Washington DC Resume Richard SchorrDocument3 pagesChief Financial Officer Strategy Leader in Washington DC Resume Richard SchorrRichardSchorrNo ratings yet

- Director Finance ResumeDocument2 pagesDirector Finance Resumesunny0686No ratings yet

- VP Director Human Resources in Orange County CA Resume Robert BudaDocument2 pagesVP Director Human Resources in Orange County CA Resume Robert BudaRobert BudaNo ratings yet

- Senior Financial Analyst in Philadelphia PA Resume Diego SfercoDocument2 pagesSenior Financial Analyst in Philadelphia PA Resume Diego SfercoDiegoSfercoNo ratings yet

- CEO COO VP Senior Living in USA Resume William PickhardtDocument3 pagesCEO COO VP Senior Living in USA Resume William PickhardtWilliamPickhardtNo ratings yet

- VP Finance CFO Controller in Los Angeles CA Resume Mark RussellDocument3 pagesVP Finance CFO Controller in Los Angeles CA Resume Mark RussellMark RussellNo ratings yet

- MITU SHARMA: 15+ Years Finance LeaderDocument4 pagesMITU SHARMA: 15+ Years Finance LeaderNiveditha RajNo ratings yet

- CFO Finance Management Accounting in New York City Resume Edward GlasserDocument2 pagesCFO Finance Management Accounting in New York City Resume Edward GlasserEdwardGlasserNo ratings yet

- Vice President Managed Care in Sacramento CA Resume Jeffrey BaumeisterDocument3 pagesVice President Managed Care in Sacramento CA Resume Jeffrey BaumeisterJeffreyBaumeisterNo ratings yet

- Chief Operating Officer CEO CFO Consultant in Austin TX Resume Charlie CooperDocument4 pagesChief Operating Officer CEO CFO Consultant in Austin TX Resume Charlie CooperCharlieCooper3No ratings yet

- CEO COO CFO Consultant in Austin TX Resume Charlie CooperDocument4 pagesCEO COO CFO Consultant in Austin TX Resume Charlie CooperCharlieCooper3No ratings yet

- COO CEO CFO Consultant in Austin TX Resume Charlie CooperDocument4 pagesCOO CEO CFO Consultant in Austin TX Resume Charlie CooperCharlieCooper2No ratings yet

- Breaking The Glass CeilingDocument8 pagesBreaking The Glass CeilingInnocent HarryNo ratings yet

- Position Announcement Vice President of Finance (Cfo)Document5 pagesPosition Announcement Vice President of Finance (Cfo)api-47732589No ratings yet

- CFO/ControllerDocument3 pagesCFO/Controllerapi-78754416No ratings yet

- COO CEO CFO Consultant in Los Angeles CA Resume Charlie CooperDocument4 pagesCOO CEO CFO Consultant in Los Angeles CA Resume Charlie CooperCharlieCooperNo ratings yet

- Vice President Finance in Los Angeles Ventura County CA Resume Andrew LandisDocument2 pagesVice President Finance in Los Angeles Ventura County CA Resume Andrew LandisAndrewLandisNo ratings yet

- Finance Controller General Manager in Chicago IL Resume Jerry WellerDocument2 pagesFinance Controller General Manager in Chicago IL Resume Jerry WellerJerryWellerNo ratings yet

- Financial Management FundamentalsDocument6 pagesFinancial Management FundamentalsElrose Saballero KimNo ratings yet

- CFO Finance VP in Orange County CA Resume Peter HernandezDocument2 pagesCFO Finance VP in Orange County CA Resume Peter HernandezPeterHernandezNo ratings yet

- Polytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaDocument11 pagesPolytechnic University of The Philippines Office of The Pup Graduate School Dean G/F M.H. Delpilar Campus Sta. Mesa, ManilaJennybabe SantosNo ratings yet

- Director HR Employee Benefits in Richmond VA Resume Karen SumnerDocument2 pagesDirector HR Employee Benefits in Richmond VA Resume Karen SumnerKarenSumnerNo ratings yet

- Finance Manager in Atlanta GA Resume Benjamin HughesDocument3 pagesFinance Manager in Atlanta GA Resume Benjamin HughesBenjaminHughesNo ratings yet

- Healthcare Finance Director in Raleigh NC Resume Marcus WilsonDocument3 pagesHealthcare Finance Director in Raleigh NC Resume Marcus WilsonMarcusWilsonNo ratings yet

- Collections Credit Manager Director in Los Angeles CA Resume Cheryl RubinDocument2 pagesCollections Credit Manager Director in Los Angeles CA Resume Cheryl RubinCheryl RubinNo ratings yet

- Gary Richardson ResumeDocument2 pagesGary Richardson ResumesarahwolfrumNo ratings yet

- COO Call Center or Director Call Center or COODocument3 pagesCOO Call Center or Director Call Center or COOapi-78359692No ratings yet

- CFO Finance Director Controller in Los Angeles CA Resume Keith RowlandDocument2 pagesCFO Finance Director Controller in Los Angeles CA Resume Keith RowlandKeithRowlandNo ratings yet

- Controller Director Finance in New York City Resume Ronald SchulmanDocument2 pagesController Director Finance in New York City Resume Ronald SchulmanRonaldSchulmanNo ratings yet

- Chief Financial Officer CFO in Midwest USA Resume David LindstaedtDocument4 pagesChief Financial Officer CFO in Midwest USA Resume David LindstaedtDavidLindstaedtNo ratings yet

- John G. Barone: Christ Hospital, Jersey City, NJDocument4 pagesJohn G. Barone: Christ Hospital, Jersey City, NJjohngbarone100% (3)

- CFO Chief Financial Officer in New York NY Resume David RaineyDocument4 pagesCFO Chief Financial Officer in New York NY Resume David RaineyDavid RaineyNo ratings yet

- President CEO Multi-Family Property Management in Dallas TX Resume Jeffrey CarpenterDocument5 pagesPresident CEO Multi-Family Property Management in Dallas TX Resume Jeffrey CarpenterJeffreyCarpenterNo ratings yet

- CFO VP Finance Technology in Denver CO Resume Craig RutherfordDocument2 pagesCFO VP Finance Technology in Denver CO Resume Craig RutherfordCraigRutherfordNo ratings yet

- VP Finance Director CFO in Philadelphia PA Resume Thomas Della-FrancoDocument3 pagesVP Finance Director CFO in Philadelphia PA Resume Thomas Della-FrancoThomasDellaFranco2No ratings yet

- CEO COO Executive Director in Salt Lake City UT Resume Glen ZauggDocument2 pagesCEO COO Executive Director in Salt Lake City UT Resume Glen ZauggGlenZauggNo ratings yet

- Financial ObjectivesDocument11 pagesFinancial ObjectivesLinda ZyongweNo ratings yet

- CFO Chief Financial Officer in Southern CA Resume Richard DrinkwardDocument3 pagesCFO Chief Financial Officer in Southern CA Resume Richard DrinkwardRichardDrinkwardNo ratings yet

- Human Resource Specialist Benefits Payroll in San Diego CA Resume Lisa CoffeyDocument2 pagesHuman Resource Specialist Benefits Payroll in San Diego CA Resume Lisa CoffeylisacoffeyNo ratings yet

- Senior Human Resources Director Attorney in Milwaukee WI Resume Christiane StandleeDocument3 pagesSenior Human Resources Director Attorney in Milwaukee WI Resume Christiane StandleeChristianeStandlee2No ratings yet

- Workers Compensation Risk Manager in Pittsburgh PA Resume Seon PierceDocument3 pagesWorkers Compensation Risk Manager in Pittsburgh PA Resume Seon PierceSeon PierceNo ratings yet

- Senior HR Director Attorney in Milwaukee WI Resume Christiane StandleeDocument3 pagesSenior HR Director Attorney in Milwaukee WI Resume Christiane StandleeChristianeStandleeNo ratings yet

- CFO Controller Director Finance in Miami FT Lauderdale FL Resume Paul SuidDocument3 pagesCFO Controller Director Finance in Miami FT Lauderdale FL Resume Paul SuidPaulSuidNo ratings yet

- Balance Sheet Formats For BangladeshDocument23 pagesBalance Sheet Formats For Bangladeshsaurabh240386No ratings yet

- Estas Questões São Independentes Do Texto Apresentado Na PARTE IDocument11 pagesEstas Questões São Independentes Do Texto Apresentado Na PARTE Ijanastarr99No ratings yet

- IIM Udaipur M&A Course Covers Mergers, AcquisitionsDocument5 pagesIIM Udaipur M&A Course Covers Mergers, AcquisitionsVinay KumarNo ratings yet

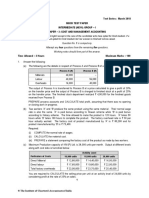

- Sample Test Paper 2015Document4 pagesSample Test Paper 2015jeankoplerNo ratings yet

- 09-PCSO2019 Part2-Observations and RecommDocument40 pages09-PCSO2019 Part2-Observations and RecommdemosreaNo ratings yet

- Auditing Harold) PDFDocument251 pagesAuditing Harold) PDFSuada Bőw Wéěžý100% (1)

- Chapter 01 Solutions PalepuDocument3 pagesChapter 01 Solutions Palepuilhamuh67% (6)

- ALCO and Operational Risk Management at CITI Bank: Name Student ID Instructor DateDocument16 pagesALCO and Operational Risk Management at CITI Bank: Name Student ID Instructor DateAbrarNo ratings yet

- ABC Latest Theory and Practice Questions PDFDocument18 pagesABC Latest Theory and Practice Questions PDFTaha MadniNo ratings yet

- IUC University Portsmouth Accounting Books CatalogDocument3 pagesIUC University Portsmouth Accounting Books Cataloghinsermu100% (1)

- Salary Structure Local Companies Associate/Staf Non-CPADocument2 pagesSalary Structure Local Companies Associate/Staf Non-CPAEmmanuel C. DumayasNo ratings yet

- Sop PurchasingDocument5 pagesSop PurchasingSteven TanNo ratings yet

- LK Myoh 2013Document132 pagesLK Myoh 2013Arief KurniawanNo ratings yet

- Skema Audit InternalDocument4 pagesSkema Audit InternaligoeneezmNo ratings yet

- UIU 03 - Audit OverviewDocument3 pagesUIU 03 - Audit Overviewmanhesh012No ratings yet

- ZION Corporate Management & Consultanc yDocument26 pagesZION Corporate Management & Consultanc yGetnat Bahiru100% (3)

- Department of Humanities and Social Sciences SyllabusDocument60 pagesDepartment of Humanities and Social Sciences SyllabusRajput RishavNo ratings yet

- QAP ReferenceDocument60 pagesQAP Referencegreenicez10No ratings yet

- Nonconformity and Corrective Action: PurposeDocument8 pagesNonconformity and Corrective Action: PurposeVelraj ParthibanNo ratings yet

- Bank reconciliation statement for Priva Enterprise (31 December 2016Document2 pagesBank reconciliation statement for Priva Enterprise (31 December 2016Nor AmalinaNo ratings yet

- APM Terminals customs charges and proceduresDocument133 pagesAPM Terminals customs charges and proceduressaurabhNo ratings yet

- 01 ABM Financial Accounting Session1Document36 pages01 ABM Financial Accounting Session1DentatusNo ratings yet

- MLF Presentation To SEBI Mahalingam Committee 13 May 2022Document13 pagesMLF Presentation To SEBI Mahalingam Committee 13 May 2022Moneylife FoundationNo ratings yet

- Consolidated Rules of Bursa Malaysia Securities BHDDocument323 pagesConsolidated Rules of Bursa Malaysia Securities BHDjerlson83No ratings yet

- Maths Project: Planning A Home BudgetDocument10 pagesMaths Project: Planning A Home Budgetadil rizviNo ratings yet

- 7 Annual Report: L & T Metro Rail (Hyderabad) LimitedDocument80 pages7 Annual Report: L & T Metro Rail (Hyderabad) LimitedPriyanshu DoshiNo ratings yet

- PEFA ReportDocument238 pagesPEFA ReportDaisy Anita SusiloNo ratings yet

- Considerations of Internal Control Psa-Based QuestionsDocument28 pagesConsiderations of Internal Control Psa-Based QuestionsNoro75% (4)

- FINANCIAL ANALYSIS of AMUL - 122742796 PDFDocument7 pagesFINANCIAL ANALYSIS of AMUL - 122742796 PDFbhavin rathodNo ratings yet

- Paper 3 Cost and Management Accounting PDFDocument6 pagesPaper 3 Cost and Management Accounting PDFMEGHANANo ratings yet