Professional Documents

Culture Documents

Ratio Analysis 1

Uploaded by

Ajmal KhanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis 1

Uploaded by

Ajmal KhanCopyright:

Available Formats

Ratio Analysis

Before Chysler merged to become DaimlerChrysler AG, they were presented with a takeover bid of $55 per share by MGM billionaire irk erkorian and former Chrysler chairman !ee "acocca# irk erkorian was a stockholder in Chrysler and an e$perienced takeover financier who apparently fo%nd Chrysler to be a good b%y# Chrysler re&ected the offer, however, stating that the firm was not for sale# '%rther, many (all )treet e$perts felt that erkorian co%ld not come %p with the $*+ billion necessary to complete the deal# After Chrysler re&ected irk erkorian,s bid of $55 per share, erkorian decided to have his people repeat the analysis of the firm,s financial performance over the two most recent years to determine if he sho%ld increase his bid in this friendly takeover attempt# -o meas%re the financial performance of Chrysler over the past two years, key financial ratios will have to be comp%ted and compared with ind%stry averages# -o help in this endeavor, Chrysler,s financial statements are fo%nd on the following pages# Chrysler Corporation's Balance Sheet for the year ending December 31 (in millions)

Assets Current Assets Cash and cash equivalents Marketable securities Accounts receivable !nventories "re#aid ta$es %inance receivables &otal Current Assets "ro#ert( ) equi#*ent +ess, Accu*ulated -e#reciation .et "lant ) /qui#*ent 0ther Assets 1#ecial tools !ntan2ible assets -e3erred ta$ assets 0ther assets &otal Assets Liabilities Current +iabilities Accounts #a(able 1hort4ter* debt Accrued liabilities 0ther #a(*ents &otal Current +iabilities +on24ter* +iabilities +on24ter* debt Accrued e*#lo(ee bene3its 0ther non4current liabilities &otal +on24ter* +iabilities &otal +iabilities Stockholder's Equity "re3erred stock Co**on stock 5at $1 #ar6 Additional #aid4in ca#ital 7etained earnin2s &reasur( stock This year $ 5,543 $ 2,582 $ 2,003 $ 4,448 $ 85 $13,623 $2 ,184 $20,468 $ ',8'3 $12,5 5 $ 3,566 $ 2,082 $ 4 0 $ 5,83 $53,'56 Last year $ 5,145 $ 3,226 $ 1,6 5 $ 3,356 $ 1,330 $12,433 $2',185 $18,281 $ ',208 $11,0'3 $ 3,643 $ 2,162 $ 3 5 $ 5,081 $4 ,53

$ 8,2 0 $ 2,6'4 $ ',032 $ 1,661 $1 ,65' $ ,858 $ ,21' $ 4,065 $23,140 $42,' ' $ 0 $ 408 $ 5,506 $ 6,280 5$1,2356

$ ',826 $ 4,645 $ 5,582 $ 811 $18,864 $ ',650 $ 8,5 5 $ 3,'36 $1 , 81 $38,845 $ 2 $ 364 $ 5,536 $ 5,006 5$ 2146

&otal 1hareholder8s /quit( &otal +iabilities and 1hare9 /quit(

$10, 5 $53,'56

$10,6 4 $4 ,53

Chrysler Corporation's Income Statement for the year ending December 31 (in millions)

1ales revenue +ess, Cost o3 2oods sold :ross #ro3its +ess, 0#eratin2 e$#enses 1ellin2 ) ad*in9 $4,064 "ension $ 405 .on#ension #ost ret9 $ '58 -e#reciation $1,100 A*ort9 o3 tools $1,120 &otal o#eratin2 e$#enses 0#eratin2 #ro3its +ess, !nterest e$#enses .et #ro3it be3ore ta$es +ess, &a$es 540;6 .et #ro3it a3ter ta$es This year $53,1 5 $41,304 $11,8 1 $3, 33 $ '14 $ 834 $ 4 $ 61 Last year $52,235 $38,032 $14,203

$ $ $ $ $ $

',44' 4,444 5 3,44 1,380 2,06 Last year

$ $ $ $ $ $

',436 6,'6' 3' 5,830 2,332 3,4 8

Ind!stry A"erage #inancial ratios this year and last year

Liquidity .et <orkin2 Ca#ital Current 7atio =uick 7atio 5Acid &est6 Activity !nventor( &urnover Avera2e A2e o3 !nventor( Avera2e Collection "eriod %i$ed Asset &urnover &otal Asset &urnover Debt -ebt &i*es !nterest /arned Profitability :ross "ro3it Mar2in .et "ro3it Mar2in 7eturn on &otal Assets 7eturn on /quit( This year $5,056 19'8 1955 '941 9021 2298 1954 98 '5; 694 24; 49'; 496; 209'; This year Liquidity .et <orkin2 Ca#ital Current 7atio =uick 7atio 5Acid &est6 Activity !nventor( &urnover Avera2e A2e o3 !nventor( Avera2e Collection "eriod %i$ed Asset &urnover &otal Asset &urnover Debt -ebt &i*es !nterest /arned Profitability :ross "ro3it Mar2in .et "ro3it Mar2in $5,056 19'8 1955 '941 9021 2298 1954 98 '5; 694 24; 49'; $4,8 2 196 1951 '958 9021 2394 1962 9 1 ''; '90 28; 49 ; 49'; 3398; Last year $4,8 2 196 1951 '958 9021 2394 1962 9 1 ''; '90 28; 49 ;

Ind!stry A"erage #inancial ratios this year and last year

7eturn on &otal Assets 7eturn on /quit(

496; 209';

49'; 3398;

. #Comp%te Chrysler,s financial ratios for the past two years# * #Compare these ratios to the ind%stry,s average# Comment on Chrysler,s strengths and weaknesses by ratio category#

/# )ho%ld erkorian have p%rs%ed the p%rchase of Chrysler0

1# "f erkorian did not want to takeover Chrysler, what other reasons might he have had for trying to convince other people that Chrysler was a takeover candidate0

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Prime Communications Services LTDDocument14 pagesPrime Communications Services LTDAjmal KhanNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Managing Conflicts in OrganizationsDocument309 pagesManaging Conflicts in OrganizationsRishi100% (3)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Accounting ConceptsDocument4 pagesAccounting ConceptsAjmal KhanNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Prime Communications Services LTDDocument14 pagesPrime Communications Services LTDAjmal KhanNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- DatesheetSSC (A) Exam2014Document2 pagesDatesheetSSC (A) Exam2014Ajmal KhanNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- ESED KPK Mar 2014 CDocument4 pagesESED KPK Mar 2014 CAjmal KhanNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Ma B.ed Ba Date Sheet A 2013Document4 pagesMa B.ed Ba Date Sheet A 2013Ajmal KhanNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- File 99942Document5 pagesFile 99942Ajmal KhanNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Assessment Promotion Rules (Dit)Document3 pagesAssessment Promotion Rules (Dit)Ajmal KhanNo ratings yet

- Annual 2013Document1 pageAnnual 2013Ajmal KhanNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Derivative Market: Futures Forwards OptionsDocument31 pagesDerivative Market: Futures Forwards OptionsAjmal KhanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Derivative Market: Futures Forwards OptionsDocument31 pagesDerivative Market: Futures Forwards OptionsAjmal KhanNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Idiom Is Expressive of The Living Speech of A People. It Is The Life-Blood of TheDocument6 pagesIdiom Is Expressive of The Living Speech of A People. It Is The Life-Blood of TheAjmal KhanNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- BE Punctuation OthersDocument29 pagesBE Punctuation OthersAjmal KhanNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Assessment Promotion Rules (Dit)Document3 pagesAssessment Promotion Rules (Dit)Ajmal KhanNo ratings yet

- Top Universities in 2010 FinalDocument5 pagesTop Universities in 2010 FinalAjmal KhanNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- English Jurisprudence Ba Part II OutlinesDocument2 pagesEnglish Jurisprudence Ba Part II OutlinesAjmal KhanNo ratings yet

- Dir ERD 16 May 13Document1 pageDir ERD 16 May 13Ajmal KhanNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

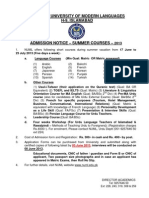

- National University of Modern Languages H-9, Islamabad: (For Foreigners)Document1 pageNational University of Modern Languages H-9, Islamabad: (For Foreigners)Ajmal KhanNo ratings yet

- Rahimgul AssigmentDocument32 pagesRahimgul AssigmentAjmal KhanNo ratings yet

- Advertizment 2013 IcpDocument2 pagesAdvertizment 2013 IcpAjmal KhanNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assessment Promotion Rules (Dit)Document3 pagesAssessment Promotion Rules (Dit)Ajmal KhanNo ratings yet

- Instructions & How To Fill Answer SheetDocument2 pagesInstructions & How To Fill Answer SheetAjmal KhanNo ratings yet

- DocumentDocument1 pageDocumentAjmal KhanNo ratings yet

- Rahimgul AssigmentDocument32 pagesRahimgul AssigmentAjmal KhanNo ratings yet

- Loan Approval BacatanDocument2 pagesLoan Approval BacatanMario BacatanNo ratings yet

- Form 3 - DKMDocument4 pagesForm 3 - DKMJATIN KAPADIANo ratings yet

- Use The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseDocument33 pagesUse The Following Information For Items 1 To 5:: Chapter 5 - Problem 1: True or FalseAlarich Catayoc80% (5)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Venture Debt Presentation BLOG v2Document25 pagesVenture Debt Presentation BLOG v2tavel3900100% (11)

- LFIS Exam Sample PaperDocument14 pagesLFIS Exam Sample Paper李姈潓No ratings yet

- Bankruptcy Problems MirzaDocument3 pagesBankruptcy Problems MirzaKesarapu Venkata ApparaoNo ratings yet

- Paying For Higher Education Reinforcement Sheet 2Document2 pagesPaying For Higher Education Reinforcement Sheet 2api-442132286No ratings yet

- My Car Loan PDF WorksheetDocument5 pagesMy Car Loan PDF Worksheetapi-62785081No ratings yet

- Business Mathematics For UiTMDocument19 pagesBusiness Mathematics For UiTMSara LazimNo ratings yet

- Commercial Law OutlineDocument46 pagesCommercial Law Outlinejustgottabezen100% (3)

- Quiz 4 - Extinguishment of Obligations - OBLICONDocument8 pagesQuiz 4 - Extinguishment of Obligations - OBLICONmhikeedelantar100% (2)

- 476 - 1 - English File. Intermediate. Student's Book - 2019, 4-Ed, 168pDocument169 pages476 - 1 - English File. Intermediate. Student's Book - 2019, 4-Ed, 168paylen barujNo ratings yet

- ObliCon Written ReportDocument7 pagesObliCon Written Reportmaxinejanellalee100% (1)

- Simple InterestDocument27 pagesSimple Interestleslie0% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- CHAPTER 8 Interest Rates and Bond Valuation - TB SolutionsDocument2 pagesCHAPTER 8 Interest Rates and Bond Valuation - TB SolutionsVangara Harish100% (1)

- Bhopal: National Law Institute UnversityDocument13 pagesBhopal: National Law Institute Unversityvijendra sableNo ratings yet

- 4 - Home Loan TerminolgyDocument210 pages4 - Home Loan Terminolgypurit83No ratings yet

- Salary LoanDocument11 pagesSalary LoanJanessa EstayoNo ratings yet

- Abdul Qadir Khan (Fixed Income Assignement No.5)Document10 pagesAbdul Qadir Khan (Fixed Income Assignement No.5)muhammadvaqasNo ratings yet

- Macroeconomics Canadian 4th Edition Williamson Solutions Manual Full Chapter PDFDocument31 pagesMacroeconomics Canadian 4th Edition Williamson Solutions Manual Full Chapter PDFqueeningalgatestrq0100% (12)

- Prudential Bank Vs AlviarDocument3 pagesPrudential Bank Vs Alviarcmv mendozaNo ratings yet

- Fin Mar 2.1 Determinants of Int RatesDocument3 pagesFin Mar 2.1 Determinants of Int RatesMadelyn EspirituNo ratings yet

- KFI Appendix 2 Section RulesDocument4 pagesKFI Appendix 2 Section Rulesapi-3771474No ratings yet

- Basics IBC PDFDocument17 pagesBasics IBC PDFArsh SinghNo ratings yet

- Bond MarketDocument22 pagesBond MarketSumonaminur100% (1)

- Chapter 1 ReviewDocument6 pagesChapter 1 ReviewSolyKalNo ratings yet

- Complete Mcqs For Oblicon Complete Mcqs For ObliconDocument41 pagesComplete Mcqs For Oblicon Complete Mcqs For ObliconMama AnjongNo ratings yet

- Accounting EquationDocument31 pagesAccounting EquationgganyanNo ratings yet

- Study of Debt MarketDocument199 pagesStudy of Debt Marketbhar4tp0% (1)

- 1.PDF Insolvency Law 10th EditionDocument733 pages1.PDF Insolvency Law 10th Editionliam.dalwai100% (1)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNFrom Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNRating: 4.5 out of 5 stars4.5/5 (3)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialFrom EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialRating: 4.5 out of 5 stars4.5/5 (32)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthFrom EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthRating: 4 out of 5 stars4/5 (20)