Professional Documents

Culture Documents

GRAP Guideline 6 - Consolidated and Separate Financial Statements

Uploaded by

samaanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GRAP Guideline 6 - Consolidated and Separate Financial Statements

Uploaded by

samaanCopyright:

Available Formats

Accounting Guideline

GRAP 6

Consolidated and Separate Financial Statements

GRAP 6 Consolidated and Separate Financial Statements

Contents

1. 2. 3. 4. 4.1 4.2 5. 5.1 5.2 5.3 5.4 6. 7. 7.1 7.2 8. 8.1 8.2 8.3 8.4 INTRODUCTION ......................................................................................................... 3 SCOPE ........................................................................................................................ 5 THE BIG PICTURE ...................................................................................................... 6 IDENTIFICATION ........................................................................................................ 7 Identifying the economic entity, controlling entity and controlled entity .................... 7 Establishing control ................................................................................................. 7 CONSOLIDATED FINANCIAL STATEMENTS .......................................................... 12 Presentation of consolidated financial statements ................................................. 12 Consolidation procedures ...................................................................................... 12 Loss of control ....................................................................................................... 18 Impairment losses ................................................................................................. 21 SEPARATE FINANCIAL STATEMENTS ................................................................... 23 DISCLOSURE ........................................................................................................... 25 Consolidated financial statements ......................................................................... 25 Separate financial statements ................................................................................ 29 SUMMARY OF KEY PRINCIPLES ............................................................................ 31 Identification .......................................................................................................... 31 Consolidated financial statements ......................................................................... 31 Seperate financial statements ................................................................................ 31 Disclosure.............................................................................................................. 31

January 2014

Page 2

GRAP 6 Consolidated and Separate Financial Statements

1.

INTRODUCTION

This document provides guidance on the identification of entities that should be consolidated into consolidated financial statements, the circumstances in which consolidated and separate financial statements should be prepared and the information to be included in these financial statements. The contents should be read in conjunction with GRAP 6, which forms part of the GRAP Reporting Framework (see Directive 5 Determining the GRAP Reporting Framework, issued by the ASB). For purposes of this guide, entities refer to the following bodies to which the standards of GRAP relate to, unless specifically stated otherwise: Public entities Constitutional institutions Municipalities and all other entities under their control Parliament and the provincial legislatures Trading entities - only effective from 1 April 2013

Explanation of images used in manual:

Definition

Take note

Management process and decision making

January 2014

Page 3

GRAP 6 Consolidated and Separate Financial Statements

Example

January 2014

Page 4

GRAP 6 Consolidated and Separate Financial Statements

2.

SCOPE

GRAP 6 is applicable to all entities on the accrual basis of accounting in the preparation and presentation of consolidated financial statements of an economic entity. When an entity elects, or is required to present separate financial statements, the standard will also apply in accounting for controlled entities, jointly controlled entities and associates. Accounting for associates and jointly controlled entities are dealt with in GRAP 7 and GRAP 8 respectively.

Accounting for transfer of functions and mergers and their effects on consolidation are not dealt with in GRAP 6. An entity should refer to GRAP 105, GRAP 106 and GRAP107 on transfer of functions between entities under common control, transfer of functions between entities not under common control and mergers.

January 2014

Page 5

GRAP 6 Consolidated and Separate Financial Statements

3.

THE BIG PICTURE

Figure 1

January 2014 Page 6

GRAP 6 Consolidated and Separate Financial Statements

4.

IDENTIFICATION

4.1 Identifying the economic entity, controlling entity and controlled entity

Economic entity means a group of entities comprising a controlling entity and one or more controlled entities.

Controlling entity is an entity that has one or more controlled entities.

Controlled entity is an entity that is controlled by another entity, known as the controlling entity.

4.2 Establishing control

Control is the power to govern the financial and operating policies of another entity to benefit from its activities.

Control consists of two parts: firstly, control of the financial and operating policies is necessary (power); and secondly, benefits must be obtained from that control. Power conditions (control is presumed when at least one power condition and one benefit condition exist, unless there is clear evidence of control being held by another entity):

January 2014

The entity has, directly or indirectly through controlled entities, ownership of a majority voting interest in the other entity; or The entity has the power, either granted by or exercised within existing

Page 7

GRAP 6 Consolidated and Separate Financial Statements

legislation, to appoint or remove a majority of the members of the board of directors or equivalent governing body and control of the other entity is by that board or body; or The entity has the power to cast, or regulate the casting of, a majority of the votes that are likely to be cast at a general meeting of the other entity; or The entity has the power to cast the majority of votes at meetings of the board of directors or equivalent governing body and control of the other entity is by that board or body.

Power indicators (if one or more of the previous power conditions does not exist, the following can individually or collectively be indicative of the existence of control in combination with the benefit indicators in the following table): The entity has the ability to veto operating and capital budgets of the other entity. The entity has the ability to veto, overrule, or modify the board of directors or equivalent governing body decisions of the other entity. The entity has the ability to approve the hiring, reassignment and removal of key personnel of the other entity. The mandate of the other entity is established and limited by legislation. The entity holds a golden share (or equivalent) in the other entity that confers rights to govern the financial and operating policies of that entity. A golden share is a share with special voting rights that allow the holder to outvote other shareholders, usually in restricted circumstances. The entity has the ability to establish or amend the mission or mandate of the entity. The entity has the ability to establish borrowing or investment limits or restrict the entitys investments. The entity has the ability to restrict the revenue-generating capacity of the entity, notably the sources of revenue.

Benefit conditions (control is presumed when at least one power condition and one benefit condition exist, unless there is clear evidence of control being held by another entity): The entity has the power to dissolve the other entity and obtain a significant level of the residual economic benefits or bear significant obligations. For example the benefit condition may be met if an entity has responsibility for the residual liabilities of another entity; or The entity has the power to extract distributions of assets from the other entity, and/or may be liable for certain obligations of the other entity.

Benefit indicators (if one or both of the previous benefit conditions does not exist, the following can individually or collectively be indicative of the existence of control in combination with the power indicators in the previous table): The entity holds direct or indirect title to the net assets of the other entity with an ongoing right to access these.

January 2014

Page 8

GRAP 6 Consolidated and Separate Financial Statements

The entity has a right to a significant level of the net assets of the other entity in the event of liquidation or in a distribution other than liquidation. The entity is able to direct the other entity to co-operate with it in achieving its objectives. The entity is exposed to the residual liabilities of the other entity. The entity has ongoing access to the assets of an entity, has the ability to direct the ongoing use of those assets, or has ongoing responsibility for deficits.

In the South African context, the government is divided into three spheres, namely the national, provincial, and local spheres of government. Although provinces and municipalities are responsible for executing its assigned functions in line with the overall policies and objectives set by the relevant national department, the autonomy of the different spheres is guaranteed in terms of the Constitution of South Africa and provinces and municipalities can therefore decide how it will achieve those objectives. The national government does not control provinces or municipalities for accounting purposes, although funding may be received from the national government. However, circumstances where one sphere of government intervenes in the administration of an entity in another sphere of government, if that entity cannot and does not fulfil its executive obligation, must be evaluated to establish whether the intervention meets the definition of control for consolidation purposes. Regulatory and purchase powers do not constitute control for the purposes of financial reporting and GRAP 6. Therefore, control does not extend to: The power of the legislature to establish the regulatory framework within which the entities operate and to impose conditions or sanctions on their operations; and Entities that are economically dependent on an entity. For example, where an entity is dependent on a department for funding. The department has some power, but not to govern the entitys financial and operating policies. Important to take note of with regards to the power to control: For an entity to have control, it does not necessarily need to hold a majority shareholding or other interest in the net assets of another entity. The power to control must be presently exercisable. The existence of the power to control another entity is not dependent upon the probability or likelihood of that power being exercised. The existence of control does not require an entity to have responsibility for the management of, or involvement in, the day-to-day operations of the other entity.

January 2014

Page 9

GRAP 6 Consolidated and Separate Financial Statements

Example 1: Presently exercisable power to control For each of the following scenarios will the power to control be presently exercisable? Scenario one: An entity will only have the power to control another entity if the agreement is renegotiated to be effective. Scenario two: An entity has the power to control another entity and it has the power to appoint and remove the majority of the members of management. However, the entity has never exercised the power to remove members of management. Answer: In the first scenario, the power to control is not presently exercisable, since it requires renegotiating the agreement in order to be effective. In the second scenario, the power to control is presently exercisable, as the existence thereof is not dependent upon the probability or likelihood of that power being exercised by the entity. An entity may have potential voting rights that, if exercised or converted, will have the potential to give the entity additional voting power or reduce another entitys voting power over the financial and operating policies of another entity. Potential voting rights can be obtained by owning share call options, debt or equity instruments, share warrants or other similar instruments that are convertible into ordinary shares. When assessing whether an entity has the power to govern the financial and operating policies of another entity, the existence, and effect of potential voting rights that are currently exercisable or convertible, including potential voting rights held by another entity, should be considered. If potential voting rights cannot be exercised or converted until a future date or until the occurrence of a future event, they are not currently exercisable or convertible, and will consequentially not be taken into account when assessing the power to control.

The entity examines all facts and circumstances (including the terms of the possible exercise or conversion of potential voting rights) that effects potential voting rights, in assessing whether such rights contribute to control. However, the intention of management and the financial ability to exercise or convert potential voting rights must not be taken into account in assessing whether the rights contribute to control.

January 2014

Page 10

GRAP 6 Consolidated and Separate Financial Statements

Example 2: Potential voting rights Entity A Entity B Entity C

40% voting power

30% voting power

30% voting power

Entity D Entity A also owns call options that are exercisable at any time at the fair value of the underlying shares and if exercised will give it an additional 20% of the voting rights in Entity D and reduce Entity B's and Entity C's interests to 20% each. If the options are exercised, Entity A will have control over more than 50% of the voting power of Entity D. The existence of the potential voting rights that can be exercised at any time gives Entity A the power to govern the financial and operating policies of Entity D. Entity A controls Entity D. The following diagram summarises the process to be followed in establishing where control of another entity exists for consolidation purposes:

N Y

N Y

Control does not appear to exist. Consider whether other entity is an associate (GRAP 7), or whether the relationship between the two entities constitutes joint control (GRAP 8).

N Y

Figure 2

January 2014 Page 11

GRAP 6 Consolidated and Separate Financial Statements

5.

CONSOLIDATED FINANCIAL STATEMENTS

5.1 Presentation of consolidated financial statements

Consolidated financial statements are those financial statements of an economic entity presented as those of a single entity.

A controlling entity should present consolidated financial statements in which it consolidates all of its controlled entities in accordance with GRAP 6. There is however an exception to the above. Only if the all of the following are met, will a controlling entity be exempt from consolidation: The controlling entity is: o Itself a wholly-owned controlled entity, and users of such financial statements are unlikely to exist or their information needs are met by its controlling entitys financial statements; or o A partially-owned controlled entity of another entity and its other owners, including those not otherwise entitled to vote, have been informed about, and do not object to, the controlling entity not presenting consolidated financial statements; The controlling entitys debt or equity instruments are not traded in a public market; The controlling entity did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organisation for the purpose of issuing any class of instruments in a public market; and The ultimate or any intermediate controlling entity produces consolidated financial statements available for public use that comply with the standards of GRAP.

The controlling entity, or is controlled entity, may be an investor in an associate or a venture in a jointly controlled entity. In these cases, the entity should follow the requirements in GRAP 7 and GRAP 8 respectively.

5.2 Consolidation procedures

A controlling entity should combine the controlled entitys financial information (100%) on a line-by-line basis by adding assets, liabilities, net assets, revenue and expenses. The following steps are then taken: 1) The carrying value of the controlling entitys investment in each controlled entity and the controlling entitys portion of the controlled entitys net assets are eliminated. The difference between the consideration paid (if any) and the assets acquired or liabilities assumed as of acquisition date is recognised in surplus or deficit (in accordance with GRAP 106 - Transfer of Functions between Entities Not under Common Control) or in accumulated surplus or deficit (under GRAP 105 - Transfer of Functions between

Page 12

January 2014

GRAP 6 Consolidated and Separate Financial Statements

Entities under Common Control) (refer to accounting guideline GRAP 105 and 106 for detail). 2) 3) Non-controlling interest in the surplus or deficit of the controlled entity is identified. Non-controlling interest in the net assets of the controlled entity is identified, which consists of: o The amount of non-controlling interest at the date of the original transfer of functions calculated in accordance with GRAP 105 or 106 Transfer of functions between entities under/not under common control (refer to accounting guideline GRAP 105 and 106 for detail). o The amount of non-controlling interest in changes in net assets since initial transfer of functions date. Non-controlling interest is the interest in the net assets in a controlled entity not attributable, directly or indirectly, to a controlling entity.

Consolidation is applied based on the controlling entitys current voting rights and does not take into account any potential voting rights.

The following are some of the detailed requirements for consolidating controlled entities: Balances, transactions, revenues and expenses between group entities should be eliminated in full. Consolidated financial statements should be prepared using the same reporting date across all entities. When a controlled entity has a reporting date different from that of the controlling entity then appropriate adjustments should be made for the effect of significant transactions between that date and the reporting date of the controlling entity. Consolidated financial statements should be prepared using the same accounting policies for similar transactions and other events across all entities. If the controlled entity uses different accounting policies than those adopted for the consolidated financial statements then appropriate adjustments should be made to its financial statements for consolidation purposes. Non-controlling interest should be presented separately from controlling interest in the consolidated statement of financial position.

January 2014

Page 13

GRAP 6 Consolidated and Separate Financial Statements

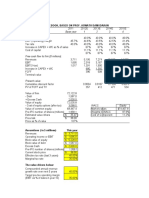

Non-controlling interests share in surplus or deficit should be disclosed separately from the controlling interests share in the surplus or deficit in the consolidated statement of financial performance. Example 3: Consolidation procedures Entity A acquired a 60% shareholding in Entity B on 1 April 2010 for R50,000. Assume that Entity A accounts for the investment in controlled entity at cost and that the year-end of both Entity A and Entity B is 31 March. Further, assume that Entity B has not issued any further shares. Assume that Entity A and Entity B are not under common control. The summarised statements of financial performance for Entity A and Entity B for the period ended 31 March 2011 are as follows: Entity A R Revenue Other income Expenditure Surplus 450,000 20,000 (300,000) 170,000 Entity B R 150,000 45,000 (120,000) 75,000

Entity B has declared and paid a dividend of R5,000 on 31 March 2011 to all owners. Although Entity A has already received its share of the dividend, it has not yet recorded the transaction as it is unsure how to do so. The summarised statements of financial position for Entity A and Entity B for the period ended 31 March 2011 are as follows: Entity A R Assets Property, plant and equipment Investment in Entity B Current assets Total assets Liabilities and net assets Current liabilities Ordinary shares Accumulated surplus Total liabilities and net assets

January 2014

Entity B R 50,000 0 51,000 101,000

200,000 50,000 50,000 300,000

100,000 1,000 199,000 300,000

20,000 1,000 80,000 101,000

Page 14

GRAP 6 Consolidated and Separate Financial Statements

Calculations: Firstly, Entity A has to account for the dividend received from Entity B in its separate financial statements. The following journal entry will be made: 1. 31 March 2011 Current assets (R5,000 x 60%) Dividends received (income) Account for share of dividend received Debit R 3,000 3,000 Credit R

Secondly, Entity As portion of the net assets of Entity B as at acquisition date needs to be calculated. Net assets of Entity B as at 1 April 2010: Share capital Accumulated surplus as at 31 March 2011 Less surplus for the period Add back dividend paid Net assets as at 1 April 2010 R1,000 R80,000 (R75,000) R5,000 R11,000

Now the difference between the consideration paid, assets acquired, and liabilities assumed (net assets) and the non-controlling interest at the date of acquisition can be calculated. Difference between consideration paid and net assets: Consideration paid Share of net assets as at 1 April 2010 Difference - recognised in surplus or deficit Non-controlling interest at the date of acquisition: Net assets as at 1 April 2010 Non-controlling interests share in net assets R11,000 R4,400 (R11,000 x 40%)) R50,000 R6,600 (R11,000 x 60%) R43,400

The next step is to calculate the non-controlling interest in surplus or deficit. Non-controlling interest in surplus for the period: Surplus for the period

January 2014

R75,000

Page 15

GRAP 6 Consolidated and Separate Financial Statements

Non-controlling interests share in surplus

R30,000 (R75,000 x 40%)

Journal entries: Remember that these consolidation journals are not processed in the actual records of Entity A or Entity B; they are only processed on the consolidated financial statements each year and rolled forward. Following the steps as provided above, the following journal entries will be made: 2. 31 March 2011 Revenue Other income Expenditure Property, plant and equipment Current assets Current liabilities Share capital Accumulated surplus (R80,000 - R75,000) 120,000 50,000 51,000 20,000 1,000 5,000 Debit R Credit R 150,000 45,000

Combine Entity Bs financial information (100%) on a line-by-line basis by adding assets, liabilities, net assets, revenue and expenses to Entity A

3.

31 March 2011 Loss on acquisition of controlling entity (surplus or deficit) Investment in Entity B Non-controlling interest (accumulated surplus) (R1,000 x 40%) Non-controlling interest (accumulated surplus) (R10,000 x 40%)

Debit R 43,400

Credit R

50,000 400 4,000

Eliminating the investment in Entity B and Entity As portion of the net assets of Entity B as at date of acquisition

4.

31 March 2011

Debit R

Credit R

Page 16

January 2014

GRAP 6 Consolidated and Separate Financial Statements

Non-controlling interest (surplus) Non-controlling interest (accumulated surplus) Account for non-controlling interest in surplus for 2011

30,000 30,000

Lastly, all transactions and balances between Entity A and Entity B need to be eliminated in full. The only inter-group transaction which occurred was the dividend paid to Entity A. 5. 31 March 2011 Dividend received (income) Non-controlling interest (accumulated surplus) Dividend paid (accumulated surplus) Eliminate inter-group transactions Debit R 3,000 2,000 5,000 Credit R

The summarised consolidated statement of financial performance for the period ended 31 March 2011 will look as follows: Entity A R Revenue (R450,000 + R150,000) Other income (R20,000 + R45,000 + R3,000 - R3,000) Expenditure (R300,000 + R120,000) Deficit on acquisition of controlled entity Surplus Attributable to: Owners of controlled entity Non-controlling interest 171,600 30,000 600,000 65,000 (420,000) (43,400) 201,600

The summarised consolidated statement of financial position for the period ended 31 March 2011 will look as follows: Entity A R Assets Property, plant and equipment (R200,000 + R50,000) Investment in Entity B (R50,000 - R50,000) Current assets (R50,000 + R51,000 + R3,000) 250,000 0 104,000

January 2014

Page 17

GRAP 6 Consolidated and Separate Financial Statements

Total assets Liabilities and net assets Current liabilities (R100,000 + R20,000) Ordinary shares (R1,000 + R1,000 - R1,000) Accumulated surplus (R199,000 + R80,000 + R3,000 R10,000 - R43,400 - R30,000 - R3,000 + R5,000) Non-controlling interest (R4,400 + R30,000 - R2,000) Total liabilities and net assets

354,000

120,000 1,000 200,600 32,400 354,000

5.3 Loss of control

Loss of control of a controlled entity can happen with or without a change in the ownership levels. For example, when the controlled entity becomes subject to control by another sphere of government or by another entity. It could also occur because of a binding arrangement. If a controlling entity loses control of a controlled entity, it should follow the steps below: 1) 2) 3) Derecognise the assets and liabilities of the controlled entity at their carrying amounts at the date when control is lost. Derecognise the carrying amount of any non-controlling interest at the date when control is lost. Recognise: o The fair value of the consideration received (if any), for the loss of control. o The distribution, if the transaction that resulted in the loss of control, involves a distribution of residual interests of the controlled entity to owners. 4) 5) Recognise any investment retained at its fair value at the date when control is lost. Reclassify amounts to surplus or deficit (as a reclassification adjustment). Therefore, any gains or losses will be reclassified from net assets to surplus and deficit, if the gains and losses previously recognised in net assets is required to be reclassified to surplus or deficit on the disposal of assets and liabilities. Transfer amounts directly to accumulated surplus or deficit. Therefore, any reserves will be transferred directly to accumulated surplus or deficit, if the reserves previously recognised in net assets are required to be transferred directly to accumulated surplus or deficit on the disposal of the asset. For example, a revaluation surplus will be transferred directly to accumulated surplus or deficit and not to surplus or deficit as in the previous step. Recognise any resulting difference as a gain or loss in surplus or deficit (in accordance with GRAP 106 - Transfer of Functions between Entities Not under Common Control) or in accumulated surplus or deficit (under GRAP 105 - Transfer of Functions between

Page 18

6)

7)

January 2014

GRAP 6 Consolidated and Separate Financial Statements

Entities under Common Control) attributable to the controlling entity (refer to accounting guideline GRAP 105 and 106 for detail). Changes in ownership interest in a controlled entity that does not result in a loss of control should be accounted for as transactions that affect net assets; therefore the controlling interest and the non-controlling interest will be adjusted to reflect the changes in their relative interests. The difference between the amounts by which the non-controlling interest is adjusted and the fair value of the consideration paid or received should be recognised directly in net assets and attributed to the owner(s) of the controlling entity. Example 4: Change in ownership that does not result in loss of control Entity A has a 100% shareholding in Entity B. In the current year, the entity disposed of 30% of its interest to other investors (non-controlling interest) for R60,000. As at date of disposal, Entity Bs net assets amounted to R180,000. Entity A will retain control over Entity B after the disposal. According to GRAP 6, the difference between the amount by which the noncontrolling interest is adjusted and the fair value of the consideration paid or received should be recognised directly in net assets and attributed to the owner(s) of the controlling entity. The controlling interest and the non-controlling interest should be adjusted to reflect the changes in their relative interests. Calculations: Fair value of consideration received Net assets attributable to non-controlling interest Difference attributable to controlling entity R60,000 R54,000 (R180,000 x 30%) R6,000

Journal entries: The following journal entry will be made: 6. On disposal date Bank (cash) Accumulated surplus (controlling entity interest) Accumulated surplus (non-controlling interest) Account for change in interest Debit R 60,000 6,000 54,000 Credit R

In the following year, Entity A reacquired 20% of its interest disposed of in the previous year for R40,000. Therefore, its interest in Entity B is now 90% (70% last year + 20% acquired).

January 2014

Page 19

GRAP 6 Consolidated and Separate Financial Statements

At the date of acquisition, Entity Bs net assets amounted to R230,000. According to GRAP 6, the difference between the amount by which the noncontrolling interest is adjusted and the fair value of the consideration paid or received should be recognised directly in net assets and attributed to the owner(s) of the controlling entity. The controlling interest and the non-controlling interest should be adjusted to reflect the changes in their relative interests. Calculations: Fair value of consideration paid Net assets attributable to non-controlling interest Difference attributable to controlling entity R40,000 R23,000 (R230,000 x 10%) R17,000

Journal entries: The following journal entry will be made: 7. On disposal date Bank (cash) Accumulated surplus (controlling entity interest) Accumulated surplus (non-controlling interest) Account for change in interest Any investment retained in the formed controlled entity should be recognised at its fair value at the date when control is lost (refer to step 4 above). This fair value will be regarded as the fair value on initial recognition of a financial asset in accordance with GRAP 104 or, when appropriate, the cost on initial recognition of an investment in an associate (refer to accounting guideline GRAP 7 for detail) or jointly controlled entity (refer to accounting guideline GRAP 8 for detail). Example 5: Calculating the gain or loss in change in ownership that does result in loss of control Entity A has a 100% shareholding in Entity B. In the current year, the entity disposed of 75% of its interest to other investors (non-controlling interest) for R130,000. As at date of disposal, Entity Bs net assets amounted to R180,000. Entity A will account for the remaining 25% interest as an associate in accordance with GRAP 7. The fair value of the investment amounts to R48,000. Assume that Entity A and Entity B are not under common control. Calculations: 17,000 23,000 Debit R Credit R 40,000

January 2014

Page 20

GRAP 6 Consolidated and Separate Financial Statements

The gain or loss on disposal of investment should be calculated. Fair value of consideration received Fair value of residual interest Less net assets derecognised Loss on disposal of interest in controlled entity (recognised in surplus or deficit) R130,000 R48,000 R180,000 R2,000

The fair value of R48,000 will be regarded as the cost on initial recognition of the investment in an associate in accordance with GRAP 7. Refer to accounting guideline GRAP 7 for details on how to account for interests in associates. Journal entries: The following journal entry in the records of Entity A will be made: 8. On disposal date Bank (cash) Accumulated surplus (controlling entity interest) Investment in Entity B (associate) Loss on disposal of interest in controlled entity (surplus or deficit) 48,000 2,000 Debit R 130,000 180,000 Credit R

Recognise the disposal of 75% interest in Entity B and recognise the residual interest retained at fair value

5.4 Impairment losses

How the impairment of an investment in a controlled entity in the separate financial statements is determined, depends on how it was initially recognised and measured. To assess whether an investment in a controlled entity that is accounted for in the separate financial statements at cost is impaired, the controlling entity determines the recoverable amount of the asset in accordance with GRAP 26 - Impairment of Cash-generating Assets. In determining value in use, the controlling entity estimates future cash flows from the asset on the basis of continuing use of the asset and its ultimate disposal by the controlling entity. To assess whether an investment in a controlled entity that is accounted for in the separate financial statements at fair value is impaired, the controlling entity determines the impairment loss of the asset in accordance with GRAP 104 - Financial Instruments. In determining the amount, the controlling entity estimates future cash flows (excluding future credit losses that have not been incurred) from the asset discounted at the assets original effective interest rate.

January 2014

Page 21

GRAP 6 Consolidated and Separate Financial Statements

Example 6: Impairment loss Entity A has an investment in a controlled entity, whereby it acquired a 70% interest in Entity B at 1 April 2010 at a cost of R180,000. No changes occurred in the investment since acquisition date. At that date, the net assets of Entity B amounted to R300,000. Entity A accounts for the investment at cost in its separate financial statements. Entity A accounts for impairment of its assets in accordance with GRAP 26 Impairment of Cash-generating Assets. In 2012, a significant decrease in the surplus for the period occurred because of a crash in the market - i.e. indication of impairment. Entity A consequently needs to test the investment for impairment by calculating the recoverable amount of the asset. Since the investment is carried at cost, the recoverable amount should be determined in accordance with GRAP 26. The recoverable amount of an investment will be the higher of: Value in use: The controlling entitys share of the present value of the estimated future cash flows expected to be generated by the controlled entity, including the cash flows from the operations of the controlled entity and the proceeds on the ultimate disposal of the investment; and Fair value less costs to sell. Entity A calculates the present value of the future cash flows to R150,000. Assume that the fair value less costs to sell is lower. The recoverable amount is less than the carrying amount, therefore an impairment loss will be recognised in the statement of financial performance amounting to R30,000 (R180,000 - R150,000). The impairment loss will be recorded in the separate financial statements and group financial statements. Journal entries: The following journal entry in the records of Entity A will be made: 1. On disposal date Impairment loss Investment in Entity B Recognise the impairment loss on investment in controlled entity Debit R 30,000 30,000 Credit R

January 2014

Page 22

GRAP 6 Consolidated and Separate Financial Statements

6.

SEPARATE FINANCIAL STATEMENTS

Separate financial statements are those presented by a controlling entity, an investor in an associate or a venture in a jointly controlled entity, in which the investment is accounted for on the basis of the direct interest in the net assets rather than on the basis of the reported results and net assets of the investee.

Separate financial statements should be presented in addition to consolidated financial statements (refer to the previous section). Where a controlling entity is exempted from presenting consolidated financial statements (refer to section 5.1 above), it may present separate financial statements as its only financial statements. Investments in controlled entities, associates and jointly controlled entities can be accounted for in the following two manners, for each category of investments, in the separate financial statements of the controlling entity: Cost; or In accordance with GRAP 104 - Financial Instruments. Note that above is an accounting policy choice in terms of GRAP 3 and an entity should apply the same accounting policy for each category of investments.

Where investments are accounted for at cost, the entity should follow the provisions of GRAP 100 when they are classified as held for sale (or included in a disposal group that is classified as held for sale). Investments in controlled entities that are accounted for in terms of GRAP 104 are not changed in such circumstances. Dividends, or other similar distributions, are recorded in surplus or deficit, in terms of GRAP 9, when the investors right to receive the dividends, or other similar distribution, is established. Investments in controlled entities that are accounted for in terms of GRAP 104 in the consolidated financial statements need to be accounted for in the same way in the investors separate financial statements.

January 2014

Page 23

GRAP 6 Consolidated and Separate Financial Statements

Example 7: Recognising the investment in the separate financial statements Scenario one: Entity A has an investment in Entity B amounting to R250,000. It decides to account for the investment in its separate financial statements at cost. The investment will be recognised at R250,000 and only adjusted for any impairment losses recognised. Scenario two: Entity A has an investment in Entity B amounting to R250,000. It decides to account for the investment in its separate financial statements in accordance with GRAP 104. In accordance with GRAP 104, an investment in the residual interest of another entity should be accounted for at fair value, unless the fair value cannot be reliably determined. Investments at fair value will be recognised and measured under the financial assets at fair value category. The investment will be recognised at R250,000 and adjusted subsequently for any changes in fair value or impairment losses. An investment where the fair value cannot be reliably determined will be recognised and measured under the financial assets at cost category. The investment will be recognised at R250,000 and only adjusted for any impairment losses recognised. Refer to accounting guideline GRAP 104 for detail.

January 2014

Page 24

GRAP 6 Consolidated and Separate Financial Statements

7.

7.1

DISCLOSURE

Consolidated financial statements

Illustrative example on what should be disclosed, as a minimum, in the consolidated financial statements of the controlling entity (refer to the standard for detail): Accounting policies 1.5 Investments in controlled entities The consolidated annual financial statements include those of the controlling entity and its controlled entities. The results of the controlled entities are included from the effective date of acquisition or transfer of functions.

January 2014

Page 25

GRAP 6 Consolidated and Separate Financial Statements

Extract from the Consolidated Statement of Financial Position Entity Consolidated Annual Financial Statements for the period ended ... Statement of Financial Position Note 20x1 R Assets Non-current assets Property, plant and equipment ..... XX XX 20x0 R

Current assets Trade and other receivables ..... XX XX

Total assets

XXX

XXX

Liabilities Non-current liabilities Financial liabilities ..... XX XX

Current liabilities Trade and other payables ..... XX XX

Total liabilities Total net assets

XXX XXX

XXX XXX

Net assets Share capital Accumulated suplus/(deficit) Non-controlling interest XX XX XX XX XX XX

January 2014

Page 26

GRAP 6 Consolidated and Separate Financial Statements

Extract from the Consolidated Statement of Financial Performance Entity Consolidated Annual Financial Statements for the period ended ... Statement of Financial Performance Notes 20x1 R Revenue List all material classes of revenue Other income Total revenue x x XX XX XXX XX XX XXX 20x0 R

Expenditure List all material classes of expenditure (e.g. employee related cost, repairs and maintenance etc.) General expenses Finance cost Deficit on acquisition of controlled entity Total expenses x XX XX

x x x

XX XX XX XXX

XX XX XX XXX

Surplus/(deficit) for the period Attributable to: Owners of the controlling entity Non-controlling interest

XXX

XXX

XX XX

XX XX

January 2014

Page 27

GRAP 6 Consolidated and Separate Financial Statements

Extract from the Consolidated Statement of Changes in Net Assets Entity Consolidated Annual Financial Statements for the period ended ... Statement of Changes in Net Assets Notes Accumulated surplus Total attributable to owners of the controlling entity R Noncontrolling interest Total net assets

R 20x0 Balance as at 31 March 20x0 Surplus/(deficit) for the period XXX XX

XXX XX

XXX XX

XXX XX

20x1 Balance as at 31 March 20x1 Surplus/(deficit) for the period Balance as at 31 March 20x1 XXX XX XXX XXX XX XXX XXX XX XXX XXX XX XXX

Other important disclosures to be made in the consolidated financial statements include, but are not limited to: The nature of the relationship between the controlling entity and the controlled entity when the controlling entity does not own more than half of the voting power; The name of the controlled entity and the reasons why the ownership of more than half of the voting power does not constitute control; The nature and extent of any significant restrictions on the ability of the controlled entity to transfer funds to the controlling entity in the form of cash dividends or similar distributions or to repay loans or advances; Fees charged for administration of the controlled entity.

January 2014

Page 28

GRAP 6 Consolidated and Separate Financial Statements

7.2

Separate financial statements

Illustrative example on what should be disclosed, as a minimum, in the separate financial statements of the controlling entity (refer to the standard for detail): Accounting policies 1.5 Investments in controlled entities Investments in controlled entities are carried at cost. The cost of an investment is the aggregate of: The fair value of, at the date of acquisition or transfer of functions, of assets given, liabilities incurred or assumed, and equity instruments issued by the entity; and Any costs directly attributable to the purchase of the controlled entity.

Extract from the Statement of Financial Position Entity Annual Financial Statements for the period ended ... Statement of Financial Position Note 20x1 R Assets Non-current assets Property, plant and equipment Investments in controlled entities ..... x XX XX XX XX 20x0 R

Current assets Trade and other receivables Loans to controlled entities ..... x XX XX XX XX

Total assets

XXX

XXX

Liabilities Non-current liabilities Loans from controlled entities .....

January 2014 Page 29

XX

XX

GRAP 6 Consolidated and Separate Financial Statements

Current liabilities Trade and other payables ..... XX XX

Total liabilities Total net assets

XXX XXX

XXX XXX

Net assets Share capital Accumulated suplus/(deficit) Extract from the Notes to the Financial Statements Entity Annual Financial Statements for the period ended ... Notes to the Annual Financial Statements Notes 7. Investments in controlled entities Name Nature of activities Country of incorporation South Africa Ownership interest 100% If voting power is different than ownership interest, this must also be disclosed. 20x1 20x0 XX XX XX XX

Entity A Provider of xxx

Investment in Entity A - carrying amount

XX

XX

January 2014

Page 30

GRAP 6 Consolidated and Separate Financial Statements

8.

SUMMARY OF KEY PRINCIPLES

GRAP 6 sets out the principles on the identification of entities that should be consolidated into consolidated financial statements and the circumstances in which consolidated and separate financial statements should be prepared and the information to be included in these financial statements.

8.1

Identification

A controlled entity is an entity that is controlled by another entity, known as the controlling entity. Control is established if the entity has the power to govern the financial and operating policies of another entity to benefit from its activities. Regulatory and purchase powers do not constitute control for the purposes of financial reporting and GRAP.

8.2

Consolidated financial statements

A controlling entity with its controlled entities, known as the economic entity, should prepare consolidated financial statements, unless it qualifies for exemption. A controlling entity should combine the controlled entitys financial information on a line-byline basis by adding assets, liabilities, net assets, revenue and expenses. The investment in the controlled entity and any inter-group transactions should be eliminated upon consolidation. Non-controlling interest should be separately presented from controlling interest in the consolidated financial statements. The accounting treatment differs for a change in ownership interest which does not result in a loss of control from where a change in ownership interest does result in a loss of control.

8.3

Seperate financial statements

Investments in controlled entities can be accounted for in the following two manners, for each category of investments, in the separate financial statements of the controlling entity: Cost; or In accordance with GRAP 104.

8.4

Disclosure

Specific disclosures are required in the consolidated financial statements and the separate financial statements.

January 2014

Page 31

You might also like

- AnathapindikaAndSangnajaneeyaSuthraya - Daham VilaDocument18 pagesAnathapindikaAndSangnajaneeyaSuthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- Anapanasathi Suthraya and Maha Rahulowada Suthraya - Daham VilaDocument21 pagesAnapanasathi Suthraya and Maha Rahulowada Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- Udai Suthraya and Puththamansa Suthraya - Daham VilaDocument18 pagesUdai Suthraya and Puththamansa Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- Waththupama Suthraya and Aggee Suthraya - Daham VilaDocument16 pagesWaththupama Suthraya and Aggee Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- Sona Suthraya and Pariyaya Suthraya - Daham VilaDocument20 pagesSona Suthraya and Pariyaya Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- The Thuparama Temple at AnuradhapuraDocument5 pagesThe Thuparama Temple at AnuradhapurasamaanNo ratings yet

- Sona Suthraya and Pariyaya Suthraya - Daham VilaDocument20 pagesSona Suthraya and Pariyaya Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- Exploring the Life and Works of F.N. de SilvaDocument18 pagesExploring the Life and Works of F.N. de SilvaSamitha SandanuwanNo ratings yet

- Aditta Pariyaya and Kummopama Suthra - Daham VilaDocument18 pagesAditta Pariyaya and Kummopama Suthra - Daham VilaDaham Vila BlogspotNo ratings yet

- Udai Suthraya and Puththamansa Suthraya - Daham VilaDocument18 pagesUdai Suthraya and Puththamansa Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- Wakkalee and Sakkayadittippahana Suthraya PDFDocument22 pagesWakkalee and Sakkayadittippahana Suthraya PDFvasanthapradeepNo ratings yet

- Upasena Suthraya and Awassutha Pariyaya Suthraya - Daham VilaDocument17 pagesUpasena Suthraya and Awassutha Pariyaya Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- StelazineDocument3 pagesStelazinesamaanNo ratings yet

- Waththupama Suthraya and Aggee Suthraya - Daham VilaDocument16 pagesWaththupama Suthraya and Aggee Suthraya - Daham VilaDaham Vila BlogspotNo ratings yet

- 380.760: Corporate Finance: Payout PolicyDocument17 pages380.760: Corporate Finance: Payout PolicysamaanNo ratings yet

- 380.760: Corporate Finance: Payout PolicyDocument17 pages380.760: Corporate Finance: Payout PolicysamaanNo ratings yet

- Eval Food CostDocument7 pagesEval Food CostsamaanNo ratings yet

- Finance Lecture 9Document15 pagesFinance Lecture 9samaanNo ratings yet

- Ethics Hotel ManagerDocument2 pagesEthics Hotel ManagersamaanNo ratings yet

- 380.760: Corporate Finance: Financing ProjectsDocument19 pages380.760: Corporate Finance: Financing Projectsssregens82No ratings yet

- Finance Lecture 3Document21 pagesFinance Lecture 3samaanNo ratings yet

- 380.760: Corporate FinanceDocument17 pages380.760: Corporate Financessregens82No ratings yet

- Lect 1Document22 pagesLect 1ssregens82No ratings yet

- Lect 5Document21 pagesLect 5ssregens82No ratings yet

- Finance Lecture 3Document21 pagesFinance Lecture 3samaanNo ratings yet

- Law On Foreign Investments in The Republic of MaldivesDocument3 pagesLaw On Foreign Investments in The Republic of MaldivessamaanNo ratings yet

- Lect 4Document23 pagesLect 4ssregens82No ratings yet

- Lect 2Document23 pagesLect 2ssregens82No ratings yet

- Class Note On Valuing Swaps: Corporate Finance Professor Gordon BodnarDocument7 pagesClass Note On Valuing Swaps: Corporate Finance Professor Gordon Bodnarssregens82No ratings yet

- Lect 1Document22 pagesLect 1ssregens82No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- LHAG Brochure 3Document3 pagesLHAG Brochure 3pohlevoonNo ratings yet

- Accounting ExamDocument14 pagesAccounting Examronzeus67% (6)

- MBA 3rd Semester Investment Analysis Case StudiesDocument5 pagesMBA 3rd Semester Investment Analysis Case StudiesChandru ChanduNo ratings yet

- Sub-Prime CrisisDocument18 pagesSub-Prime Crisissurajvsakpal100% (2)

- DBA Weights-PowerShares ETFsDocument7 pagesDBA Weights-PowerShares ETFsfredtag4393No ratings yet

- Bhanu Chaitanya Kumar (11) : Presented byDocument16 pagesBhanu Chaitanya Kumar (11) : Presented bySriramya PediredlaNo ratings yet

- R42 Derivatives Strategies IFT Notes PDFDocument24 pagesR42 Derivatives Strategies IFT Notes PDFZidane KhanNo ratings yet

- Index Models and Portfolio OptimizationDocument14 pagesIndex Models and Portfolio OptimizationdomazzzNo ratings yet

- Anne Chwat BioDocument3 pagesAnne Chwat Biomaxmueller15No ratings yet

- Investment in Equity - MCDocument5 pagesInvestment in Equity - MCLeisleiRago100% (1)

- SynopsisFormat Antra PitchDocument2 pagesSynopsisFormat Antra PitchKavit ThakkarNo ratings yet

- DCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranDocument12 pagesDCF Base Year 1 2 3 4 Assumptions:: Valuation of Facebook, Based On Prof. Aswath DamodaranSahaana VijayNo ratings yet

- Financial StatementsDocument31 pagesFinancial StatementsJeahMaureenDominguez100% (2)

- Morgan Stanley: About The CompanyDocument1 pageMorgan Stanley: About The Companyaakash urangapuliNo ratings yet

- Valuation Methods Guide: How to Value a Private CompanyDocument20 pagesValuation Methods Guide: How to Value a Private CompanyopopppoNo ratings yet

- Knowledge Management On Company Performance With Risk Management Analysis - Evidence From Financial Sector in ThailandDocument9 pagesKnowledge Management On Company Performance With Risk Management Analysis - Evidence From Financial Sector in ThailandAlexander DeckerNo ratings yet

- Investment Alternatives & Investments AttributesDocument22 pagesInvestment Alternatives & Investments Attributespranab_nandaNo ratings yet

- A Study On Performance of Equity Linked Savings SchemesDocument136 pagesA Study On Performance of Equity Linked Savings Schemeslovineaso83% (6)

- Technical Analysis: Presented by Anita Singhal 1Document41 pagesTechnical Analysis: Presented by Anita Singhal 1anita singhalNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Examples WACC Project RiskDocument4 pagesExamples WACC Project Risk979044775No ratings yet

- Afm - Ratio Analysis TheoryDocument12 pagesAfm - Ratio Analysis TheoryMr. N. KARTHIKEYAN Asst Prof MBANo ratings yet

- FMI Long Questions EditedDocument7 pagesFMI Long Questions EditedChanna KeshavaNo ratings yet

- Ch05 Quiz Solution 052416Document5 pagesCh05 Quiz Solution 052416sum pradhanNo ratings yet

- Warren Buffett Stock Picks ValuationDocument11 pagesWarren Buffett Stock Picks ValuationOld School Value75% (4)

- Debtors Turnover RatioDocument7 pagesDebtors Turnover RatiorachitdedhiaNo ratings yet

- ICICI SecuritiesDocument14 pagesICICI SecuritiesBrad johnsonNo ratings yet

- Black-Derman-Toy Model ConstructionDocument4 pagesBlack-Derman-Toy Model ConstructionLore-Anne A. CadsawanNo ratings yet

- Icici PruDocument14 pagesIcici PruMubeenNo ratings yet

- Stock Exchange: by Huda A.S. QureshiDocument27 pagesStock Exchange: by Huda A.S. Qureshistd_10225No ratings yet