Professional Documents

Culture Documents

Financial Analysis of Furniture Company

Uploaded by

Jax TellerOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Analysis of Furniture Company

Uploaded by

Jax TellerCopyright:

Available Formats

Acco 230_Financial Statement Analysis_Ch 12 Information about past performance is helpful to assess the prior success of a business and

the effectiveness of management. Time series analysis (trend analysis) involves the comparison of information for a single company over time (two or more years). Component percentages are used to express each item on a particular financial statement as a percentage of a single base amount. The base amount on the income statement is net sales and the base amount on the BS is total assets. CLASS EXERCISE P12-1B. Horizontal and vertical analysis Net sales, net income, and total assets for Amanix Clothing Emporium for a four-year period below: (in thousands) Net sales Net income Ending Total Assets Requirements 1. Compute trend percentages for each item for 2011-2014. Use 2011 as the base year. ArmanixClothing Emporium Trend Percentages 2014 Net Sales Net Income Ending Total Assets 2013 2012 2011 2014 $386 31 196 2013 $357 26 177 2012 $324 12 170 2011 $337 22 152

2. Compute the rate of return on net sales for 2012-2014, rounding to three decimal places. In this industry, rates of 6% are average, rates above 8% are considered good, and rates above 10% are viewed as outstanding. Net income Net sales

The rate of return on net sale =

The rate of return on net sales shows the portion of each dollar of net sales that a firm is able to turn into income.

Acco 230_Financial Statement Analysis_Ch 12

(Dollar amounts in thousands) 2014 Rate of return on net sales = 2013 2012

3. How does Armanix Clothing Emporiums return on net sales compare with the industry?

Acco 230_Financial Statement Analysis_Ch 12

The component percentage is derived by dividing a statement item by the base amount from that statement. The amount is then multiplied by 100 to convert it to a percent. Component percentages appear on common-size statements. Common-size statements display important relationships and trends used in financial statement analysis. CLASS EXERCISE P12-2B. Common-size financial statements and profitability ratios Verifine Used Auto Sales asked for your help in comparing the companys profit performance and financial position with the average for the auto sales industry. The proprietor has given you the companys income statement and balance sheet as well as the average data for retailers of used autos. Verifine Used Auto Sales Income Statement Compared with Industry Average Year Ended December 31, 2014 VERIFINE $548,000 348,528 199,472 122,752 76,720 1,096 $75,624 INDUSTRY AVERAGE 100% 62.1% 37.9% 27.8% 10.1% 0.4% 9.7%

Net Sales Cost of Goods Sold Gross Profit Operating Expenses Operating Income Other Expenses Net Income

Verifine Used Auto Sales Balance Sheet Compared with Industry Average December 31, 2014 VERIFINE $229,034 50,830 8,970 10,166 $299,000 $118,105 50,830 130,065 $299,000 INDUSTRY AVERAGE 70.9% 23.6% 0.8% 4.7% 100.0% 48.1% 16.6% 35.3% 100.0%

Current Assets Plant Assets, Net Intangible Assets, Net Other Assets Total Assets Current Liabilities Long-Term Liabilities Shareholders Equity Total Liabilities and Shareholders Equity Requirements

1. Prepare a two-column, common-size income tatement and a two-column, common-size balance sheet for Verifine Used Auto Sales. The first column of each statement should present Verifine Used Auto Sales common-size statement and the second column should show the industry averages.

Acco 230_Financial Statement Analysis_Ch 12 Verifine Used Auto Sales Common-Size Income Statement Compared to Industry Average Year Ended December 31, 2014 Industry Verifine Net Sales Cost of Goods Sold Gross Profit Operating Expenses Operating Income Other Expenses Net Income Average

Acco 230_Financial Statement Analysis_Ch 12 Verifine Used Auto Sales Common-Size Balance Sheet Compared to Industry Average December 31, 2014 Industry Verifine Current Assets Plant Assets, Net Intangible Assets, Net Other Assets Total Assets Current Liabilities Long-Term Liabilities Shareholders Equity Total Liabilities and Shareholders Equity Average

2. For the profitability analysis, examine Verifine used Auto Sales (a) ratio of gross profit to net sales, (b) ratio of operating income to net sales, and (c) ratio of net income to net sales. Compare these figures with the industry averages. Is Verifine Used Auto Sales profit performance better or worse than the industry average?

3. For the analysis of financial position, examine Verifine Used Auto Sales (a) ratio of current assets to total assets and (b) ratio of shareholders equity to total assets. Compare these ratios with the industry averages. Is Verifine Used to Sales financial position better or worse than the industry average?

Acco 230_Financial Statement Analysis_Ch 12 CLASS EXERCISE P12-3B. Current ratio, debt ratio, EPS Current ratio The current ratio is the most widely used liquidity ratio. The current ratio is calculated by dividing current assets by current liabilities. A high current ratio indicates that the business has sufficient current assets to pay its current liabilities as they come due. Current ratio = Current assets Current liabilities

Debt ratio The debt ratio shows the relationship between total liabilities and total assets. In other words, it shows the proportion of assets financed with debt. Debt ratio = Total liabilities Total assets Earnings per Share (EPS) This ratio relates income to a number of shares rather than to a number of dollars. EPS is one of the most widely used ratios. Companies often release quarterly EPS information to the media. EPS must be computed for the IS. If a company has extraordinary items in deriving NI, EPS must also be computed for NI before extraordinary items. There may be many complexities when computing EPS.

EPS

Income Average # C/S shares outstanding

The average # C/S shares outstanding is based on a weighted average. Income is only the amount that relates to common shareholders. If a company has preferred shareholders, adjustments may be needed to the numerator. Common stock equivalents (convertible P/S, etc.) are factored into the computation of the denominator.

Acco 230_Financial Statement Analysis_Ch 12 Financial statement data of ABC Fencing, Inc. included the following items: Cash Short-Term Investments Accounts receivable, Net Inventory Prepaid Expenses Total Assets Short-Term Notes Payable Accounts Payable Accrued Liabilities Long-Term Notes Payable Other Long-Term Liabilities Net Income Number of Common Shares Outstanding Requirements 1. Compute ABC Fencings current ratio, debt ratio, and earnings per share. Assume that the company had no preferred shares outstanding. Round all ratios to two decimal places. (Dollar Amounts and Shares Quantities in Thousands) Current Ratio Debt Ratio Earnings per Share $21,000 25,000 102,000 121,000 15,000 660,500 45,000 106,000 44,000 160,000 37,000 77,000 37,000

Acco 230_Financial Statement Analysis_Ch 12 2. Compute each of the same three ratios after evaluating the effect of each transaction that follows: a. Purchased merchandise of $40,000 on account, debiting inventory. (Dollar Amounts and Shares Quantities in Thousands) Current Ratio Debt Ratio Earnings per Share

b. Issued 2,000 common shares, receiving cash of $78,000.

c. Borrowed $78,000 on a long-term note payable.

d. Received cash on account, $18,000.

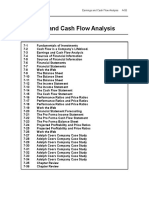

Acco 230_Financial Statement Analysis_Ch 12 CLASS EXERCISE P12-4B. Calculate various ratios for analysis Comparative financial statement data of Danfield Furniture Company below: Danfield Furniture Company Income Statement Years Ended December 31, 2014 and 2013 2014 Net Sales Cost of Goods Sold Gross Profit Operating Expenses Income from Operations Interest Expense Income Before Income Tax Income Tax Expense Net Income $483,000 244,000 239,000 145,000 94,000 14,000 80,000 28,000 $52,000 2013 $458,000 234,000 224,000 137,000 87,000 24,000 63,000 24,000 $39,000

Danfield Furniture Company Balance Sheet December 31, 2004 and 2013 (Selected 2012 amounts given for computation of ratios) 2014 Current Assets: Cash Accounts Receivable Net Inventory Prepaid Expenses Total Current Assets Property, Plant and Equipment, Net Total Assets Total Current Liabilities Long-Term Liabilities Total Liabilities Preferred Shareholders Equity 8% Common Shareholders Equity Total Liabilities and Shareholders Equity Other information follows: 1. Market price of common shares was $48.50 at December 31, 2014, and $31.75 at December 31, 2013. 2. Common shares outstanding were 17,000 during 2014 and 15,000 during 2013. 3. All sales were made on credit. 4. The full amount of preferred dividends was paid. 9 $95,000 104,000 161,000 38,000 398,000 196,000 $594,000 $212,000 129,000 341,000 99,000 154,000 $594,000 2013 $98,000 114,000 151,000 28,000 391,000 175,000 $566,000 $228,000 116,000 344,000 99,000 123,000 $566,000 2012

$107,000 193,000

97,000

Acco 230_Financial Statement Analysis_Ch 12 Requirements 1. Compute the following ratios for 2014 and 2013: a. Current ratio (Dollar Amounts and Shares Quantities in Thousands) 2014 Current ratio: 2013

b. Inventory turnover The inventory turnover measures the number of times a company sells its average level of inventory during a year. A high rate o turnover indicates ease in selling inventory; a lower rate indicates difficulty. Inventory turnover = Cost of goods sold Average inventory

Inventory turnover:

c. Accounts receivable turnover The accounts receivable turnover measures the ability to collect cash from credit customers. The higher the ratio, the faster the company collects cash. However, a receivable turnover ratio that is too high may indicate that credit is too tight. Account receivable turnover = Net credit sales Average net accounts receivable

Accounts Receivable turnover:

10

Acco 230_Financial Statement Analysis_Ch 12 d. Times-interest-earned ratio The times-interest-earned ratio indicates a companys ability to continue to service its debe. It measures the number of times operating income can cover (pay) interest expense. A high ratio means that a company is able to meet its interest obligations because earnings are significantly greater than annual interest obligations. A low ratio indicates that a company may encounter difficulty meeting its obligations. Times-interest-earned ratio = Operating income Interest expense

Times-interestearned ratio:

e. Return on common shareholders equity. The rate of return on common shareholders equity shows the amount of net income returned as a percentage of common shareholders equity. Rate of return on common shareholders equity = Net income-preferred dividends Average common shareholders equity

Rate of return on common sharesholders' equity: f. Earnings per share of common shares Earnings per common share = Net income-preferred dividends Number of common shares outstanding

Earnings per share of common shares:

11

Acco 230_Financial Statement Analysis_Ch 12 g. Price/earnings ratio The price/earnings ratio is the ratio of the market price of a common share to the companys earnings per share. This ratio shows how much investors are willing to pay per dollar of earnings. Price/earnings ratio = Market price per share Earnings per share

Price/earnings ratio: 2. Decide (a) whether Danfield Furniture Companys financial position improved or deteriorated during 2014 and (b) whether the investment attractiveness of its common shares appears to have increased or decreased.

3. How will what you learned in this problem help you evaluate an investment?

12

Acco 230_Financial Statement Analysis_Ch 12 CLASS ECERCISE P12-5B. Calculate various ratios for analysis Assume you are purchasing an investment and decide to invest in a company in the home remodeling business. You narrow the choice to Bobs Home Repair, Inc. or Stellar Stability, Corp. You assemble the following selected data: Net Sales ( all on credit) Cost of Goods Sold Income from Operations Interest Expense Net Income Bobs Home Repair, Inc. $282,000 158,000 88,000 15,000 44,000 Stellar Stability, Corp. $226,000 129,000 48,000 24,00

Selected balance sheet and market price data at the end of the current year follow: Bobs Home Repair, Inc. Current Assets: Cash Short-Term Investments Accounts Receivable, Net Inventory Prepaid Expenses Total Current Assets Total Assets Total Current Liabilities Total Liabilities Preferred Shares, 5%, 180 shares Common Shares, 7,000 Shares 4,000 Shares Total Shareholders Equity Market price per common share Stellar Stability, Corp. $14,000 15,000 25,000 50,000 4,000 108,000 166,000 68,000 71,000 7,000 10,000 121,000 $43,12 95,000 $30.87

$13,000 12,000 30,000 69,000 5,000 129,000 201,000 54,000 80,000 18,000

Selected balance sheet data at the beginning of the current year follow: Accounts Receivable, Net Inventory Total Assets Preferred Shares, 5% (180 shares) Common Shares, 7,000 Shares 4,000 Shares Total Shareholders Equity Bobs Home Repair, Inc. $29,000 52,000 162,000 18,000 10,000 77,000 Stellar Stability, Corp $26,000 62,000 157,000 7,000 72,000

Your investment strategy is to purchase the shares of the company that has a low price/earnings ratio but appears to be in good shape financially. Assume that you analyzed all other factors and your decision depends on the results of the ratio analysis to be performed.

13

Acco 230_Financial Statement Analysis_Ch 12 Requirement 1. Compute the following ratio for both companies for the current year and decide which companys shares better fit your investment strategy. (Dollar Amounts and Shares Quantities in Thousands) a. Quick ratio The quick ratio tells us whether the entity could pay all its current amiabilities if they came due immediately. Inventory and prepaid expenses are not included in the acid-test ratio because they are not available to pay current liabilities. Quick ratio = Cash + short-term investments + net current receivable Current liabilities

(Dollar Amounts and Shares Quantities in Thousands) Bobs Home Repair Quick ratio: Stellar Stability

b. Inventory turnover Cost of goods sold Average inventory

Inventory turnover =

Inventory turnover:

c. Days sales in receivables .The days sales in receivables also measures the ability to collect receivables. Days sales in receivables tell us how many days sales remain in Accounts Receivable.

Days sales in receivables=

365 Accounts receivable turnover

14

Acco 230_Financial Statement Analysis_Ch 12 Days sales in receivables:

d. Debt ratio Debt ratio = Total liabilities Total assets

Debt ratio:

e. Earnings per share of common shares Earnings per common share = Net income-preferred dividends Number of common shares outstanding

Earnings per share of common shares:

f.

Price/earnings ratio Price/earnings ratio = Market price per share Earnings per share

Price/earnings ratio:

15

Acco 230_Financial Statement Analysis_Ch 12 CLASS ECERCISE P12-6B. Financial statement ratio analysis You have been hired as an investment analyst at Harriet Winston Company. It is your job to recommend investments for your client. The only information you have are the following ratio values for two companies in the video game industry. Ratio Days to collect receivables Inventory turnover Gross profit percentage Net income as a percentage of sales Time-interest-earned ratio Return on equity Return on assets Requirement 1. Write a memo to your client recommending the company you believe to be a more attractive investment. Explain the reasons for your recommendation. Mario and Luco, Co. 60 10 69% 17% 14 37% 15% Witches and Warlocks, Inc. 54 8 75% 11% 18 45% 13%

16

You might also like

- Business Metrics and Tools; Reference for Professionals and StudentsFrom EverandBusiness Metrics and Tools; Reference for Professionals and StudentsNo ratings yet

- Tutorial 12Document72 pagesTutorial 12Irene WongNo ratings yet

- Acmngt. 211 Quiz1 Analysis of Financial Statement Questionnaire2Document7 pagesAcmngt. 211 Quiz1 Analysis of Financial Statement Questionnaire2Secret-uploaderNo ratings yet

- ACCT 102 Lecture Notes Chapter 13 SPR 2018Document5 pagesACCT 102 Lecture Notes Chapter 13 SPR 2018Sophia Varias CruzNo ratings yet

- Ch17 ProblemsDocument30 pagesCh17 ProblemsWed CornelNo ratings yet

- Financial Statements & AnalysisDocument36 pagesFinancial Statements & AnalysisMahiNo ratings yet

- 03 CH03Document41 pages03 CH03Walid Mohamed AnwarNo ratings yet

- Financial Statement Analysis and Ratio CalculationsDocument33 pagesFinancial Statement Analysis and Ratio CalculationsKamrul HasanNo ratings yet

- The CommonDocument5 pagesThe CommonDarshan SawantNo ratings yet

- Analysis of Financial Statements: QuestionsDocument44 pagesAnalysis of Financial Statements: QuestionsgeubrinariaNo ratings yet

- 05-Financial Stratement AnalysisDocument8 pages05-Financial Stratement AnalysisPratheep GsNo ratings yet

- Financial Statement Analysis RatiosDocument7 pagesFinancial Statement Analysis RatiosMarry Rose FranciscoNo ratings yet

- Financial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Document24 pagesFinancial Management (Chapter 4: Financial Analysis-Sizing Up Firm Performance)Steven consueloNo ratings yet

- Financial Statements and Ratio AnalysisDocument9 pagesFinancial Statements and Ratio AnalysisRabie HarounNo ratings yet

- Ratio Analysis (Buet)Document13 pagesRatio Analysis (Buet)Tahsinul Haque TasifNo ratings yet

- BUSINESS-FINANCE-MODULE 3Document8 pagesBUSINESS-FINANCE-MODULE 3Giezell BabiaNo ratings yet

- Chapter 4Document40 pagesChapter 4Ayesha DilawarNo ratings yet

- 4.analysis and InterpretationDocument55 pages4.analysis and InterpretationRocky BassigNo ratings yet

- Financial Statement Analysis Ratios GuideDocument55 pagesFinancial Statement Analysis Ratios GuideRocky Bassig100% (1)

- Chapter 5Document59 pagesChapter 5mokeNo ratings yet

- Chapter 5 ExercisesDocument7 pagesChapter 5 ExercisesTrang TranNo ratings yet

- ACCT 504 Final Exam AnswersDocument5 pagesACCT 504 Final Exam Answerssusanperry50% (2)

- Aviation Industry: Financial Statement AnalysisDocument62 pagesAviation Industry: Financial Statement AnalysisParul BhusriNo ratings yet

- Andi Nur Indah Mentari - Mid Exam SheetsDocument8 pagesAndi Nur Indah Mentari - Mid Exam SheetsAríesNo ratings yet

- STR 581 Final Exam Capstone Part 2 Week 4Document9 pagesSTR 581 Final Exam Capstone Part 2 Week 4Mike Russell100% (3)

- FIN621 Final solved MCQs under 40 charsDocument23 pagesFIN621 Final solved MCQs under 40 charshaider_shah882267No ratings yet

- Ratio Analysis Excel Case StudyDocument17 pagesRatio Analysis Excel Case StudyPuran SinghNo ratings yet

- Financial Analysis FundamentalsDocument12 pagesFinancial Analysis FundamentalsAni Dwi Rahmanti RNo ratings yet

- Credit Evaluation Process AnalysisDocument73 pagesCredit Evaluation Process AnalysisNeeRaz Kunwar100% (2)

- Calculations and Interpretations of 14 Key Financial RatiosDocument6 pagesCalculations and Interpretations of 14 Key Financial RatioswarishaaNo ratings yet

- Financial Management I: 2. Financial Analyses and PlanningDocument8 pagesFinancial Management I: 2. Financial Analyses and PlanningBenol MekonnenNo ratings yet

- 4b - Chapter 4 Financial Management-OkDocument49 pages4b - Chapter 4 Financial Management-OkIni IchiiiNo ratings yet

- Financial Statement AnalysisDocument42 pagesFinancial Statement AnalysisSwarna RoyNo ratings yet

- Financial Statement Analysis True/FalseDocument30 pagesFinancial Statement Analysis True/FalseAhmed HusseinNo ratings yet

- AnswerDocument8 pagesAnswerShamik SenghaniNo ratings yet

- Commerce and Accountancy Mcqs-3: Ans. (B) ExplanationDocument4 pagesCommerce and Accountancy Mcqs-3: Ans. (B) ExplanationGaurav Chandra DasNo ratings yet

- CAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuDocument12 pagesCAHPTER 3. Analisis Keuangan (Analysis of Financial Statements) MankeuKezia NatashaNo ratings yet

- Earnings and Cash Flow Analysis: SlidesDocument6 pagesEarnings and Cash Flow Analysis: Slidestahera aqeelNo ratings yet

- CH 4Document20 pagesCH 4Waheed Zafar100% (1)

- BBC406 Fundamentals of Finance: Week 5 Analysis of Financial StatementsDocument53 pagesBBC406 Fundamentals of Finance: Week 5 Analysis of Financial StatementsZhaslan HamzinNo ratings yet

- Fs AnalysisDocument34 pagesFs Analysisbawangb21No ratings yet

- Financial Statement AnalysisDocument51 pagesFinancial Statement AnalysisNasim RosinNo ratings yet

- Analysis of Key Financial RatiosDocument31 pagesAnalysis of Key Financial RatiosMaxhar AbbaxNo ratings yet

- Create Financial Plans Fast with Ratio Analysis & Break-Even CalculationsDocument29 pagesCreate Financial Plans Fast with Ratio Analysis & Break-Even CalculationsNaveed Mughal AcmaNo ratings yet

- Financial Analysis Through RatiosDocument8 pagesFinancial Analysis Through RatiosChandramouli KolavasiNo ratings yet

- ACF 361 4 To 6Document157 pagesACF 361 4 To 6edithyemehNo ratings yet

- Financial Statements & AnalysisDocument14 pagesFinancial Statements & AnalysisMuntasir SizanNo ratings yet

- CH 014Document26 pagesCH 014thenikkitrNo ratings yet

- Project Accounting & FM ch5Document74 pagesProject Accounting & FM ch5Nesri YayaNo ratings yet

- Analyzing Financial Ratios to Evaluate a CompanyDocument38 pagesAnalyzing Financial Ratios to Evaluate a Companymuzaire solomon100% (1)

- Chapter - 3Document58 pagesChapter - 3habtamuNo ratings yet

- Financial Statement Analysis Word FileDocument25 pagesFinancial Statement Analysis Word FileolmezestNo ratings yet

- FM II - Chapter 03, Financial Planning & ForecastingDocument28 pagesFM II - Chapter 03, Financial Planning & ForecastingHace Adis100% (1)

- Financial Ratios Guide for Customer AnalysisDocument11 pagesFinancial Ratios Guide for Customer AnalysisPrince Kumar100% (1)

- Ratio AnalysisDocument25 pagesRatio Analysisdeba1644No ratings yet

- FinMan Report On FS Analysis RATIODocument31 pagesFinMan Report On FS Analysis RATIOMara LacsamanaNo ratings yet

- STR 581 Capstone Final Examination, Part Two - Transweb E TutorsDocument10 pagesSTR 581 Capstone Final Examination, Part Two - Transweb E Tutorstranswebetutors3No ratings yet

- Libby Financial Accounting Chapter14Document7 pagesLibby Financial Accounting Chapter14Jie Bo TiNo ratings yet

- Chapter 5 Solutions To PostDocument43 pagesChapter 5 Solutions To PostJax TellerNo ratings yet

- Presentation TipsDocument1 pagePresentation TipsJax TellerNo ratings yet

- Chapter 4Document50 pagesChapter 4Jax TellerNo ratings yet

- Acco 420 Final Coursepack CoursepacAplusDocument51 pagesAcco 420 Final Coursepack CoursepacAplusJax TellerNo ratings yet

- Presentation TipsDocument1 pagePresentation TipsJax TellerNo ratings yet

- 1 - Blank Business Plan TemplateDocument11 pages1 - Blank Business Plan TemplateJax TellerNo ratings yet

- An Overview of IFRS 6 Exploration For and Evaluation of Mineral Resources PDFDocument22 pagesAn Overview of IFRS 6 Exploration For and Evaluation of Mineral Resources PDFJax TellerNo ratings yet

- 20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Document4 pages20 Marks 2019 Adjustments To Net Income: Consolidated Income Statement 2019Jax TellerNo ratings yet

- 1 - Blank Financial AppendixDocument57 pages1 - Blank Financial AppendixJax TellerNo ratings yet

- Acco 440 Cribsheet Fall 2016Document1 pageAcco 440 Cribsheet Fall 2016Jax TellerNo ratings yet

- Course Out Acco440 Winter 2017Document6 pagesCourse Out Acco440 Winter 2017Jax TellerNo ratings yet

- Production Report: Physical Units Direct Materials Conversion Costs TotalDocument1 pageProduction Report: Physical Units Direct Materials Conversion Costs TotalJax TellerNo ratings yet

- Chapter 1Document13 pagesChapter 1Jax TellerNo ratings yet

- Earnings ManagementDocument13 pagesEarnings ManagementJax Teller100% (1)

- Acco 450 Solutions Fall 2016Document21 pagesAcco 450 Solutions Fall 2016Jax TellerNo ratings yet

- Winter 2016 PDFDocument15 pagesWinter 2016 PDFJax Teller100% (1)

- Accouting 101Document2 pagesAccouting 101Jax TellerNo ratings yet

- Accouting 101Document2 pagesAccouting 101Jax TellerNo ratings yet

- History of MonkDocument1 pageHistory of MonkJax TellerNo ratings yet

- Bluetooth TutorialDocument349 pagesBluetooth Tutorialjohn bougsNo ratings yet

- Propiedades Grado 50 A572Document2 pagesPropiedades Grado 50 A572daniel moreno jassoNo ratings yet

- SCA ALKO Case Study ReportDocument4 pagesSCA ALKO Case Study ReportRavidas KRNo ratings yet

- Sri S T Kalairaj, Chairman: Income Tax TaxesDocument3 pagesSri S T Kalairaj, Chairman: Income Tax TaxesvikramkkNo ratings yet

- Family Service and Progress Record: Daughter SeptemberDocument29 pagesFamily Service and Progress Record: Daughter SeptemberKathleen Kae Carmona TanNo ratings yet

- Tech Data: Vultrex Production & Drilling CompoundsDocument2 pagesTech Data: Vultrex Production & Drilling CompoundsJeremias UtreraNo ratings yet

- Case 5Document1 pageCase 5Czan ShakyaNo ratings yet

- Coffee Table Book Design With Community ParticipationDocument12 pagesCoffee Table Book Design With Community ParticipationAJHSSR JournalNo ratings yet

- FR Post-10Document25 pagesFR Post-10kulich545No ratings yet

- Case Study Hotel The OrchidDocument5 pagesCase Study Hotel The Orchidkkarankapoor100% (4)

- ISO 9001:2015 Explained, Fourth Edition GuideDocument3 pagesISO 9001:2015 Explained, Fourth Edition GuideiresendizNo ratings yet

- Yellowstone Food WebDocument4 pagesYellowstone Food WebAmsyidi AsmidaNo ratings yet

- PandPofCC (8th Edition)Document629 pagesPandPofCC (8th Edition)Carlos Alberto CaicedoNo ratings yet

- GlastonburyDocument4 pagesGlastonburyfatimazahrarahmani02No ratings yet

- Iq TestDocument9 pagesIq TestAbu-Abdullah SameerNo ratings yet

- DLL - The Firm and Its EnvironmentDocument5 pagesDLL - The Firm and Its Environmentfrances_peña_7100% (2)

- Final Thesis Report YacobDocument114 pagesFinal Thesis Report YacobAddis GetahunNo ratings yet

- DLP in Health 4Document15 pagesDLP in Health 4Nina Claire Bustamante100% (1)

- 15 - 5 - IoT Based Smart HomeDocument6 pages15 - 5 - IoT Based Smart HomeBhaskar Rao PNo ratings yet

- ITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFDocument280 pagesITU SURVEY ON RADIO SPECTRUM MANAGEMENT 17 01 07 Final PDFMohamed AliNo ratings yet

- Numerical Methods Chapter 10 SummaryDocument8 pagesNumerical Methods Chapter 10 SummarynedumpillilNo ratings yet

- C6 RS6 Engine Wiring DiagramsDocument30 pagesC6 RS6 Engine Wiring DiagramsArtur Arturowski100% (3)

- Rounded Scoodie Bobwilson123 PDFDocument3 pagesRounded Scoodie Bobwilson123 PDFStefania MoldoveanuNo ratings yet

- Survey Course OverviewDocument3 pagesSurvey Course OverviewAnil MarsaniNo ratings yet

- ESA Knowlage Sharing - Update (Autosaved)Document20 pagesESA Knowlage Sharing - Update (Autosaved)yared BerhanuNo ratings yet

- Chapter 3 of David CrystalDocument3 pagesChapter 3 of David CrystalKritika RamchurnNo ratings yet

- Thin Film Deposition TechniquesDocument20 pagesThin Film Deposition TechniquesShayan Ahmad Khattak, BS Physics Student, UoPNo ratings yet

- PROF ED 10-ACTIVITY #1 (Chapter 1)Document4 pagesPROF ED 10-ACTIVITY #1 (Chapter 1)Nizelle Arevalo100% (1)

- Mazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedDocument5 pagesMazda Fn4A-El 4 Speed Ford 4F27E 4 Speed Fnr5 5 SpeedAnderson LodiNo ratings yet

- Requesting A Query in Zemanta Using PHPDocument10 pagesRequesting A Query in Zemanta Using PHPAther SajjadNo ratings yet