Professional Documents

Culture Documents

Comparison IFRS VAS

Uploaded by

tieuquan42Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparison IFRS VAS

Uploaded by

tieuquan42Copyright:

Available Formats

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) This

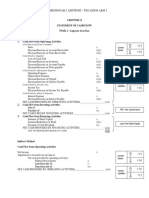

brief comparison is based on IFRS and VAS as at 24 May 2004. IFRS and VAS are both subject to chan es. IFRS Ref Framework IFRS Framework for the preparation and presentation of financial statements The Framework deals with: (a) The objective of financial statements; to provide information about the financial position, performance and changes in financial position of an enterprise that is useful to a wide range of users in making economic decisions; to show the results of the stewardship of management, or the accountability of management for the resources entrusted to it The &inistry of Finance ('&oF() issued a standard )*+ %hart of *ccounts in ,ecision --"- (dated - .ovember -//0) This has been amended by various %irculars since The most recent guidance is contained in %ircular 00 for Foreign1invested enterprises (dated 23 4une 2552), %ircular 6/ (dated / 7ctober 2552) and %ircular -50 (dated " .ovember 2558) -3 new )ietnamese *ccounting +tandards have been issued since 8- ,ecember 255- These are based on 9F:+, with certain amendments, as described in the relevant sections below )*+5- 1 Frame!or" (issued on 8- ,ecember 2552) is based on the 9*+: Frame!or" for the preparation and presentation of financia# statements. )*+5- is shorter and more simple that the 9*+ Framework, however all the key areas and concepts are covered, including: ;asic accounting principles # accruals, going concern, matching, prudence, consistency :e!uirements of *ccounting 9nformation # integrity, objectivity, completeness, timeliness, comparability <lements of financial statements # assets, liabilities, e!uity, revenues, e$penses :ecognition principles # essentially as per the 9F:+ Framework VAS

(b) The underlying assumptions: accrual basis, going concern (c) The !ualitative characteristics that determine the usefulness of information in financial statements The " principal !ualitative characteristics are: understandability, relevance, reliability and comparability (d) The definition, recognition and measurement of the elements from which financial statements are constructed # assets, liabilities, e!uity, income and e$penses (e) %oncepts of capital and capital maintenance

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ IFRS Presentation of financial statements 9*+ - is designed to improve the !uality of financial statements presented using 9nternational *ccounting +tandards by: ensuring that financial statements that state compliance with 9*+ comply with each applicable +tandard, including all disclosure re!uirements; ensuring that departures from 9*+ re!uirements are restricted to e$tremely rare cases; providing guidance on the structure of financial statements including minimum re!uirements for each primary statement, accounting policies and notes, and an illustrative appendi$; and establishing practical re!uirements on issues such as materiality, going concern, the selection of accounting policies when no +tandard e$ists, consistency and the presentation of comparative information )*+2- # $resentation of financia# statements (issued on 85 ,ecember 2558) is based on 9*+ - # $resentation of financia# statements 9t is very similar to the previous version of 9*+ -, especially the sections on Re%uirements in $reparation and $resentation of Financia# Statements, including: =oing concern *ccrual basis %onsistency of presentation %omparative information VAS

The sections in )*+2- on Information to be presented on the face of the ba#ance sheet and income statement apply the headings given in the standard )*+ Financial +tatements Format, and )*+2- also notes that the format for presenting these financial statements is prescribed in the applicable regulations This is a more prescriptive approach than 9*+ There are no illustrative financial statements in )*+2:eference needs to be made to the relevant %irculars, such as %ircular 00, for the re!uired format of financial statements The implementing guidance for )*+2- has not yet been issued, but is not e$pected to have a significant impact on the current )*+ format for financial statements .ote that )*+2- includes an analysis of changes in e!uity in the notes to the financial statements The statement of changes in e!uity is not a re!uired primary statement as in 9*+ -

Financial statements comprise a balance sheet, income statement, cash flow statement, statement of changes in e!uity, and notes to the financial statements !ote" 9*+ - was revised in ,ecember 2558, with the changes effective for accounting periods beginning on or after - 4anuary 2550 The changes include: =uidance on the meaning of 'present fairly( =ives a definition of 'material( 2

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ :evised (continued) IFRS The :evised +tandard re!uires a financial liability that is due within twelve months after the balance sheet date, or for which the entity does not have an unconditional right to defer its settlement for at least twelve months after the balance sheet date, to be classified as a current liability This classification is re!uired even if an agreement to refinance, or to reschedule payments, on a long1term basis is completed after the balance sheet date and before the financial statements are authorised for issue The :evised +tandard re!uires the following disclosures: (a) the judgements management has made in the process of applying the entity>s accounting policies that have the most significant effect on the amounts recognised in the financial statements; and (b) the key assumptions concerning the future, and other key sources of estimation uncertainty at the balance sheet date, that have a significant risk of causing a material adjustment to the carrying amounts of assets and liabilities within the ne$t financial year The following disclosures re!uired by the previous version of the +tandard have been omitted: (a) the results of operating activities, and e$traordinary items, as line items on the face of the income statement The revised +tandard prohibits disclosure of ?e$traordinary items> in financial statements; (b) the number of an entity>s employees VAS

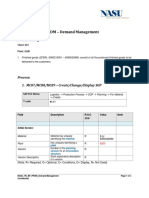

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ 2 Inventories 9nventories should be valued at lower of historical cost and net realisable value The benchmark cost formula is either F9F7 or weighted average methods @9F7 is allowed as a permitted alternative method Ahen @9F7 is used, difference between @9F7 method and benchmark treatment must be !uantified and disclosed !ote" 9*+ 2 revised in ,ecember 2558 prohibits the use of the @9F7 method This is effective for accounting periods beginning on or after - 4anuary 2550 )*+52 # In&entories was issued on 8- ,ecember 2559nventories should be valued at lower of historical cost and net realisable value F9F7, @9F7, specific identification and weighted average methods are accepted @9F7 is treated e!ually to other methods but it re!uires disclosure of the effect of using @9F7 in comparison to F9F7 or weighted average <stimations on the cost of inventories such as standard cost and the retail method are not permitted under )*+ 9*+ B Cash flow statements * cash flow statement must be included in the financial statements and should be prepared using either the direct or indirect method %ash flows should be classified into operating, investing and financing activities %ash flows arising from ac!uisitions and from disposals of subsidiaries should be presented separately )*+2" # 'ash f#o! statements was issued on 8- ,ecember 2552 )*+ presentation is very similar to 9F:+ IFRS VAS

"

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ 6 IFRS Net profit or loss for the period, fundamental errors and changes in accounting policies %hanges in accounting policies or corrections of material errors should lead to a restatement of comparatives and prior year opening retained earnings The effect to current year income of changes in accounting policies should be disclosed fully *llowed alternative treatments: correction of a fundamental error can be made to the current period CD@; a change in accounting policy can be applied prospectively when the effect of the change on prior periods cannot be reasonably determined !ote" 9*+ 6 has been revised in ,ecember 2558 to: 9*+ 6, Accountin po#icies( chan es in accountin estimates and errors which is effective for accounting periods beginning on or after 4anuary 2550 *mong other changes, the :evised +tandard: eliminates the use of the above allowed alternative treatments; eliminates the concept of a fundamental error; defines material omissions or misstatements, and describes how to apply the concept of materiality when applying accounting policies and correcting errors; and re!uires, rather than encourages, disclosure of an impending change in accounting policy (and its impact) when an entity has yet to implement a new +tandard that has been issued but not yet come into effect 0 * )*+ based on 9*+ 6 has not yet been issued, so prior year adjustments are currently not permitted %hanges in accounting polices resulting from the adoption of a )*+ or &oF regulations should be accounted for in the current year with detailed disclosures made in a note to the financial statements %orrection of material or fundamental errors is recorded in the income statement of the current year VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ -5 IFRS Events after the balance sheet date %lear definition of adjusting and non1adjusting events *djusting events are events where a circumstance has arisen prior to the balance sheet date and the likelihood of a material financial impact is high &aterial non1adjusting events or contingent liabilities should be disclosed !ote" 9*+ -5 has been revised in ,ecember 2558 to clarify that if an entity declares a dividend after the balance sheet date, the dividend is not a liability at the balance sheet date This is effective for accounting periods beginning on or after - 4anuary 2550 9*+ -Construction contracts :evenue and e$penses on construction contracts should be )*+-0 # 'onstruction contracts was issued on 8- ,ecember recognised using the percentage of completion method %ontract 2552 costs should be recognised as e$penses as incurred <$pected losses should be recognised when total contract costs e$ceed This +tandard is very similar to 9F:+ total contract revenue 9*+ -2 Income taxes ,eferred ta$ should be calculated using the liability method on temporary differences between ta$ and accounting bases of assets and liabilities .o concept of deferred ta$ applied For +tate17wned <nterprises, income ta$es (business income ta$) are not taken through the income statement but treated as an appropriation from reserves .o specific +tandard or regulation on post balance sheet events VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ -" Segmental reporting :eporting formats are classified into business segments and geographical segments The dominant source and nature of the entity>s risks and returns should be used to determine whether the business or geographical segmental analysis is the ?primary reporting format> The other basis of segmentation is the ?secondary reporting format> * segment is reportable if its revenue, its result or assets are E-5F of the total base criteria The reported segments should present at least B0F of the total consolidated revenue 9*+ -0 Information reflecting the effects of changing prices %ompliance to 9*+ -0 is optional and this standard will be withdrawn with effect from - 4anuary 2550 +tate17wned <nterprises are re!uired to re1value assets and e!uity to reflect the effect of changing prices, using the rate promulgated by &oF This regulation is not applied for other enterprises .o specific +tandard or regulation on segmental reporting IFRS VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ -3 IFRS Propert , Plant and E!uipment ;enchmark treatment is to carry fi$ed assets at historical cost less depreciation and less any impairment losses *lso an allowed alternative treatment of carrying fi$ed assets at a revalued amount (less depreciation and any subse!uent impairment) !ote" 9*+ -3 has been revised in 2558 with effect for accounting periods beginning on or after - 4anuary 2550 *mong other changes, the revised +tandard specifies that: ,epreciation on CC< must be started as soon as the item is available for use and to continue to depreciate even if the item is idle The cost of an item of CC< includes the costs of its dismantlement, removal or restoration, the obligation for which an entity incurs as a conse!uence of installing the item *n entity is re!uired to determine the depreciation charge separately for each significant part of an item of property, plant and e!uipment *n entity is re!uired to derecognise the carrying amount of a part of an item of CC< if that part has been replaced and the entity has included the cost of the replacement in the carrying amount of the item )*+58 # Tan ib#e fi)ed assets was issued on 8- ,ecember 255Fi$ed assets should be carried at cost less depreciation :evaluation or write down for impairment is not allowed, unless a specific approval is received from =overnment authorities Gnder )*+, fi$ed assets may be overstated in the balance sheet, even when it is known that an impairment has occurred and the current valuation is less than the carrying amount in the accounts ,epreciation is based on management>s assessment of e$pected useful life, as per 9*+ -3 !ote" for Ta$ation purposes, depreciation on fi$ed assets is generally based on predetermined rates regulated by the &oF VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ -B "eases @eases are classified into finance leases and operating leases depending on the substance of the transaction rather than the form of the contract * finance lease is where risks and rewards are substantially transferred to the lessee 7ther leases are operating leases )*+53 # *eases was issued on 8- ,ecember 2552 This +tandard is very similar to previous 9*+ -B The section from 9*+ -B on recognition of revenue by manufacture or dealer lessors has been omitted from )*+53 IFRS VAS

!ote" 9*+ -B has been revised in 2558 with effect for * lease of @and Gse :ights is usually classified as an operating accounting periods beginning on or after - 4anuary 2550 lease, with the lease payment amortised over the lease term *mong other changes, it clarifies that when classifying a lease of land and buildings, an entity normally considers the land and buildings elements separately: the minimum lease payments are allocated between the land and buildings elements in proportion to the relative fair values of the leasehold interests in the land and buildings elements of the lease; the land element is normally classified as an operating lease unless title passes to the lessee at the end of the lease term; the buildings element is classified as an operating or finance lease by applying the classification criteria in the +tandard 9*+ -6 #evenue %onditions for recognition of revenues for sale of goods, services interest, royalties and dividends are clearly defined For sales, recognition is generally upon goods and services being / )*+-" # Re&enue and other income was issued on 8- ,ecember 255-

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref rendered to customers 9*+ -/ Emplo ee benefits 9*+ -/ re!uires an enterprise to recognise contributions to a defined contribution plan when an employee has rendered service in e$change for those contributions For defined benefit schemes, 9*+ -/ re!uires an enterprise to: determine the present value of defined benefit obligations and the fair value of any plan assets with sufficient regularity that the amounts recognised in the financial statements do not differ materially from the amounts that would be determined at the balance sheet date; use the Crojected Gnit %redit ðod to measure its obligations and costs; use unbiased and mutually compatible actuarial assumptions about demographic variables and financial variables; %ircular 00 re!uires a provision to be made for employees> entitlement to severance payments, in accordance with the current regulations of the +tate and the commitments in the employment contract 9n practice, companies make a provision of one half month>s current salary for each year of service for each employee # based on the )ietnam @abour %ode re!uirement for severance payments in the event of an employee leaving the company voluntarily or on the cessation of the company 9f the employee leaves involuntarilyHdue to redundancy, the re!uirement is for a full month>s current salary for each year of service .o other specific re!uirement for disclosure of employee benefits as a separate item in the financial statements IFRS VAS This +tandard is very similar to 9*+ -6

For +tate17wned <nterprises, employee benefits such as determine the discount rate by reference to market yields at discretionary welfare spending are normally paid from reserves the balance sheet date on high !uality corporate bonds and do not go through the income statement Termination benefits are employee benefits payable as a result of an enterprise>s decision to terminate an employee>s employment before the normal retirement date The event which gives rise to an obligation is the termination rather than employee service Therefore, an enterprise should recognise termination benefits when, and only when, the enterprise is demonstrably committed to terminate the employment of an employee

-5

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS VAS

9*+ 25

$ccounting for government grants and disclosure of government assistance =overnment grant may be of e!uity nature or of revenue nature 9n the income statement, government grants should be recognised in order to match revenue to related costs provided that the entity complies with covenants of the grant 9n the balance sheet, grants relating to fi$ed assets should be recognised as deferred income or deducted from the related assets =overnment grants are normally accounted for into the entity>s e!uity account .o specific regulations on disclosure of government grants and assistance

9*+ 2-

%he effects of changes in foreign exchange rates * transaction in a foreign currency is recorded in the reporting currency using e$change rate ruling at the date of the transaction ,istinction is made between 'foreign operation that is integral to the operations of the reporting enterprise( or 'foreign entities( For a foreign operation that is integral to the operations of the reporting enterprise, the transactions are translated as if the transactions were those of the reporting enterprise itself; For a foreign entity, the assets and liabilities are translated at balance sheet date rate and fore$ differences are carried in -)*+-5 # The effects of chan es in forei n e)chan e rates was issued on 8- ,ecember 2552 This +tandard is substantially similar to previous 9*+ 2.ote: during the construction phase of a new %ompany, e$change differences arising are retained in an e!uity account, until the time when the fi$ed assets are put into use Then they are amortised to the income statement over a ma$imum period of five years from the start of operations

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref e!uity 9*+ 2:evised !ote" 9*+ 2- has been revised in ,ecember 2558 with effect for accounting periods beginning on or after - 4anuary 2550 There are significant changes The focus is on determining the 'functional currency(, which is the currency of the primary economic environment in which the entity operates The entity must determine its functional currency and measure its results and financial position in that currency The re!uirements in the previous version of 9*+ 2- for distinguishing between foreign operations that are integral to the operations of the reporting entity (referred to below as 'integral foreign operations() and foreign entities are revised The re!uirements are now among the indicators of an entity>s functional currency *s a result: there is no distinction between integral foreign operations and foreign entities :ather, an entity that was previously classified as an integral foreign operation will have the same functional currency as the reporting entity; only one translation method is used for foreign operations 1 namely that described in the previous version of 9*+ 2- as applying to foreign entities Gnder this method, assets and liabilities are translated at the closing rate, and income and e$penses are translated at the e$change rates at the dates of the transactions (or an average rate may be acceptable) Ahere an entity chooses to use a 'presentation currency( that is different from its functional currency, the entity is re!uired to translate its results and financial position from its functional currency into the presentation currency using the same method -2 IFRS VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS re!uired for translating a foreign operation for inclusion in the reporting entity>s financial statements 9*+ 22 replaced by IFRS # from 8- &arch 255" 9*+ 28 &usiness combinations +ee comments on 9F:+ 8 later in this document VAS

&orrowing Costs ;enchmark treatment is that borrowing costs should be e$pensed )*+-3 # +orro!in costs was issued on 8- ,ecember 2552 in the period in which they are incurred )*+-3 applies the 9*+ 28 alternative treatment as its re!uired *llowed alternative treatment is the capitalisation of borrowing treatment costs if they are directly attributable to the ac!uisition, construction or production of a !ualifying asset ;orrowing costs should be capitalised if they are directly attributable to the ac!uisition, construction or production of a !ualifying asset, and if it is probable that the costs will result in future economic benefits to the enterprise and the costs can be measured reliably 7ther borrowing costs should be recognised as an e$pense when incurred <$change differences in the construction period are treated as stated in )*+-5, not as an adjustment to borrowing costs as per 9*+ 28

-8

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS VAS

9*+ 2"

#elated part disclosures :elated parties are determined by the level of direct or indirect control or significant influence of one party over another, or the common control of two parties For relationships of control, disclosure is re!uired regardless of whether transactions occur !ote" 9*+ 2" has been revised in 2558 with effect for accounting periods beginning on or after - 4anuary 2550 *mong other changes: e$panded; transactions more e$tensive disclosure of related party disclosure is re!uired of compensation of key management personnel; definition of related parties has been Creviously under )*+, there had been no concept of related parties Then in 2552, %ircular 00 re!uired some disclosures for related party transactions, but did not give a definition of a related party )*+23 # Re#ated party disc#osures was issued on 85 ,ecember 2558 This is very similar to the previous version of 9*+ 2"

9*+ 23

$ccounting and reporting b retirement benefit plans :eport on retirement benefit plans includes a statement of changes in net assets available for benefits; summary of significant accounting policies; a description of the plan and the effect of any changes in the plans during the period -" .ot mentioned in )*+

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS :efer to 9*+ -/ for appropriate accounting for cost of defined benefit pension plan VAS

9*+ 2B

Consolidated financial statements and accounting for investments in subsidiaries ,efinition of subsidiary is based on voting control or dominant influence over the entity 9nvestments in subsidiaries in the parent>s separate financial statements should be accounted for using e!uity method or recorded at cost or revalued amount under the parent>s accounting policy for long term investment For consolidated financial statements, see 9F:+ 8 ;usiness %ombinations 9nvestment in subsidiaries in non1consolidated financial statements should be accounted for as if they are investments !ote" 9*+ 2B has been revised in 2558: 9*+ 2B, 'onso#idated and separate financia# statements is effective for accounting periods beginning on or after - 4anuary 2550 The :evised +tandard modifies the e$emption from preparing consolidated financial statements * parent need not present consolidated financial statements if: the parent is itself a wholly1owned subsidiary, or the parent is a partially1owned subsidiary of another entity and its other owners, including those not otherwise entitled to vote, have been informed about, and do not object to, the parent not preparing consolidated financial statements; -0 )*+20 1 'onso#idated financia# statements and accountin for in&estment in subsidiaries was issued on 85 ,ecember 2558 This is similar to the previous version of 9*+ 2B The main difference is that investments in subsidiaries in the parent>s separate financial statements can only be carried at cost The e!uity accounting method is not permitted

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS the parent>s debt or e!uity instruments are not traded in a public market; VAS

9*+ 2B :evised (continued)

the parent did not file, nor is it in the process of filing, its financial statements with a securities commission or other regulatory organisation for the purpose of issuing any class of instruments in a public market; and the ultimate or any intermediate parent of the parent produces consolidated financial statements available for public use that comply with 9nternational Financial :eporting +tandards The +tandard does not re!uire consolidation of a subsidiary ac!uired when there is evidence that control is intended to be temporary Iowever there must be evidence that the subsidiary is ac!uired with the intention to dispose of it within -2 months *n entity is not permitted to e$clude from consolidation an entity it continues to control simply because that entity is operating under severe long1term restrictions that significantly impair its ability to transfer funds to the parent %ontrol must be lost for e$clusion to occur

-3

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS VAS

9*+ 26

$ccounting for investments in associates ,efinition of associates is based on significant influence over the )*+5B 1 Accountin for in&estments in associates was issued entity on 85 ,ecember 2558 9nvestment in associates in consolidated financial statements should be accounted for by the e!uity method, e$cept when it is ac!uired with the intention to resell or it operates under long1 term restrictions 9n these cases the investment is accounted for in accordance with 9*+ 8/ 9nvestment in associates in non1consolidated financial statements should be accounted for either: at cost; using the e!uity method; or under 9*+ 8/ !ote" 9*+ 26 has been revised in 2558: 9*+ 26, In&estments in associates is effective for accounting periods beginning on or after - 4anuary 2550 *mong the changes are: the +tandard clarifies that investments in associates over which the investor has significant influence must be accounted for using the e!uity method whether or not the investor also has investments in subsidiaries and prepares consolidated financial statements Iowever, the investor does not apply the e!uity method when presenting separate financial -B This is similar to the previous version of 9*+ 26 The main difference is that investments in associates in the investor>s separate financial statements can only be carried at cost The e!uity accounting method is not permitted in the investor>s own financial statements

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS statements prepared in accordance with 9*+ 2B clarifications on the e$emptions from applying the e!uity method are as per 9*+ 2B revised 9*+ 2/ Financial reporting in h perinflationar economies :eports in the currency of a hyperinflationary economy should be restated in terms of measuring unit current at the balance sheet date =ainHloss on net monetary position should be included in the profit and loss and separately disclosed 9*+ 85 'isclosures in the financial statements of banks and similar financial institution This +tandard sets up detailed classification and disclosure re!uirements for banks and similar financial institutions The +tate ;ank of )ietnam ('+;)() is the regulator and supervisor of the banking industry in )ietnam The +;) has issued a specific accounting system for banks and financial institutions &any differences from 9*+ 85 .ot mentioned in )*+ VAS

9*+ 8-

Financial reporting of interests in (oint ventures 4oint ventures can be structured as jointly controlled operations, jointly controlled assets or jointly controlled entities For jointly controlled operationsHassets: venturer records its share of the assets, liabilities, income and e$penses For jointly controlled entities: in consolidated financial -6 )*+56 1 Financia# reportin of interests in joint &entures was issued on 85 ,ecember 2558 This is similar to the previous version of 9*+ 8- in respect of jointly controlled operationsHassets 9t includes )ietnam1specific references such as ;%%s The treatment of jointly controlled entities is different from 9*+

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS statements of the venturer, proportionate consolidation is the benchmark treatment and e!uity method is an allowed alternative treatment There is no specific guidance on accounting treatment in the venturer>s separate (non1 consolidated) financial statements 9*+ 8:evised !ote" 9*+ 8- has been revised in 2558: 9*+ 8-, Interests in joint &entures is effective for accounting periods beginning on or after - 4anuary 2550 The changes include the same clarifications on e$emptions from applying proportionate consolidation or the e!uity method as per 9*+ 2B and 9*+ 26 9t also specifies that the re!uirements for the preparation of the investor>s separate financial statements are as per 9*+ 2B Financial instruments) 'isclosure and presentation Crescribes certain re!uirements for presentation of on1balance1 sheet financial instruments and identifies the information that should be disclosed about both on1balance1sheet (recognised) and off1balance1sheet (unrecognised) financial instruments The presentation standards deal with the classification of financial instruments between liabilities and e!uity, the classification of related interest, dividends, losses and gains, and the circumstances in which financial assets and financial liabilities should be offset The disclosure standards deal with information about factors that affect the amount, timing and certainty of an enterprise>s future cash flows relating to financial instruments and the accounting policies applied to the instruments -/ For foreign1invested enterprises, %ircular 00 of the &oF states that disclosure of financial instruments is re!uired Iowever, there are no details of the disclosure re!uirements VAS 8- Ahen a venturer prepares consolidated financial statements, it accounts for its interest in the joint venture using the e!uity method # not proportionate consolidation The venturer accounts for its interest in the joint venture in its separate financial statements at cost

9*+ 82

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS 9n addition, the +tandard encourages disclosure of information about the nature and e$tent of an enterprise>s use of financial instruments, the business purposes that they serve, the risks associated with them and management>s policies for controlling those risks 9*+ 82 :evised !ote" 9*+ 82 was revised in ,ecember 2558, the changes are effective for accounting periods beginning on or after - 4anuary 2550 and include the following: Ahen an issuer determines whether a financial instrument is a financial liability or an e!uity instrument, the instrument is an e!uity instrument if, and only if, both conditions (a) and (b) are met (a) The instrument includes no contractual obligation to deliver cash or another financial asset to another entity; or to e$change financial assets or financial liabilities with another entity under conditions that are potentially unfavourable to the issuer (b) 9f the instrument will or may be settled in the issuer>s own e!uity instruments, it is: (i) a non1derivative that includes no contractual obligation for the issuer to deliver a variable number of its own e!uity instruments; or (ii) a derivative that will be settled by the issuer e$changing a fi$ed amount of cash or another financial asset for a fi$ed number of its own e!uity instruments The definitions of a financial asset and a financial liability, and the description of an e!uity instrument, are amended consistently 25 VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref with this principle The re!uirements for separating the liability and e!uity components of a compound financial instrument are conformed to both the definition of an e!uity instrument as a residual and the measurement re!uirements in 9*+ 8/ 9*+ 88 Earnings per share .umerator in basic earnings per share ('<C+() calculation is the net profit or loss (less preference dividends) attributable to ordinary shareholders ,enominator is the weighted average number of ordinary share outstanding during the period ;asic and diluted <C+ should be disclosed in the financial statements !ote" 9*+ 88 was revised in ,ecember 2558, the changes are effective for accounting periods beginning on or after - 4anuary 2550 This is a limited revision to provide additional guidance and illustrative e$amples on selected comple$ matters, such as the effects of contingently issuable shares; potential ordinary shares of subsidiaries, joint ventures or associates; participating e!uity instruments; written put options; purchased put and call options; and mandatorily convertible instruments 9*+ 8" Interim financial reporting *ccounting policies applied in the previous annual financial statements should be adopted for the interim financial report unless there is a change of policy, which is to be reflected in the 2.ot specifically mentioned in )*+ +tate17wned <nterprises, which are re!uired to issue interim .o mention of <C+ disclosures IFRS VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS ne$t annual financial statements .o re!uirement to publish interim financial report VAS financial reports, should follow )*+ in these reports

9*+ 80

'iscontinued operations +pecific disclosure is re!uired for sale or abandonment that represents a separate, major line of business of an entity and of which the assets, net profit or loss and activities can be distinguished physically or operationally !ote" 9F:+ 0, ,on-current assets he#d for sa#e and discontinued operations was issued on 8- &arch 255" and is effective for accounting periods beginning on or after - 4anuary 2550 9F:+ 0 supersedes 9*+ 80 this document +ee comments on 9F:+ 0 later in .ot specifically mentioned under )*+ 9n practice, the &oF re!uires disclosure on the closing down of an entity>s operations For companies that are being wound up, financial statements are prepared under the same accounting basis as they were when fully operational Therefore, the historical cost convention is still applied to companies which are being wound up, which may lead to assets being stated at the report>s date in e$cess of the amount at which they are subse!uently realised

9*+ 83 :evised 8- &arch 255"

Impairment of assets The revised 9*+ 83 applies to goodwill or intangible assets ac!uired in an ac!uisition after 8- &arch 255", and for all other assets for accounting periods beginning on or after 8- &arch 255" 9*+ 83 has been revised as part of the project on ;usiness %ombinations that has seen the release of 9F:+ 8 )*+ does recognise diminution in value of certain current assets =enerally, impairment of tangibleHintangible fi$ed assets is not permitted

22

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS The previous version of 9*+ 83 re!uired the recoverable amount of an asset to be measured whenever there is an indication that the asset may be impaired This re!uirement is included in the :evised +tandard Iowever, the :evised +tandard also re!uires: VAS

9*+ 83 :evised (continued)

the recoverable amount of an intangible asset with an indefinite useful life to be measured annually, irrespective of whether there is any indication that it may be impaired The most recent detailed calculation of recoverable amount made in a preceding period may be used in the impairment test for that asset in the current period, provided specified criteria are met the recoverable amount of an intangible asset not yet available for use to be measured annually, irrespective of whether there is any indication that it may be impaired goodwill ac!uired in a business combination to be tested for impairment annually

The :evised +tandard gives guidance on calculation of an asset>s value in use and guidance on using reasonable cash flow projections for this calculation .ew guidance is given on allocating goodwill to cash1generating units as part of impairment testing the cash1generating unit(s) to which it relates *lso new guidance on timing of the annual impairment tests for goodwill 28

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS The :evised +tandard prohibits the recognition of reversals of impairment losses for goodwill VAS

9*+ 8B

Provisions, contingent liabilities and contingent assets 9*+ 8B defines provisions as liabilities of uncertain timing or amount * provision should be recognised when, and only when: an enterprise has a present obligation (legal or constructive) as a result of a past event; it is probable (i e more likely than not) that an outflow of resources embodying economic benefits will be re!uired to settle the obligation; and a reliable estimate can be made of the amount of the obligation The +tandard notes that it is only in e$tremely rare cases that a reliable estimate will not be possible .o +tandard has been issued on provisions and contingencies The re!uirement to make provisions is described in certain regulations, for e$ample: %ircular 00 mentions provision for accrued retirement benefits %ontingencies are mentioned in )*+2-, $resentation of financia# statements, but no specific accounting guidance has been issued

The amount recognised as a provision should be the best estimate of the e$penditure re!uired to settle the present obligation at the balance sheet date 9*+ 8B e$plains how the general recognition and measurement re!uirements for provisions should be applied in three specific cases: future operating losses; onerous contracts; and restructurings Crovisions should not be recognised for future operating 2"

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref losses 9f an enterprise has a contract that is onerous, the present obligation under the contract should be recognised and measured as a provision * provision for restructuring costs is recognised only when the general criteria for provisions are met IFRS VAS

9*+ 8B (continued)

* contingent liability is defined as: a possible obligation that arises from past events and whose e$istence will be confirmed only by the occurrence or non1 occurrence of one or more uncertain future events not wholly within the control of the enterprise; or a present obligation that arises from past events but is not recognised because: (i) it is not probable that an outflow of resources embodying economic benefits will be re!uired to settle the obligation; or (ii) the amount of the obligation cannot be measured with sufficient reliability *n enterprise should not recognise a contingent liability *n enterprise should disclose a contingent liability, unless the possibility of an outflow of resources embodying economic benefits is remote * contingent asset is defined as a possible asset that arises from past events and whose e$istence will be confirmed only by the occurrence or non1occurrence of one or more uncertain future 20

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS events not wholly within the control of the enterprise *n enterprise should not recognise a contingent asset * contingent asset should be disclosed where an inflow of economic benefits is probable VAS

9*+ 86 :evised 8- &arch 255"

Intangible assets The revised 9*+ 86 applies to intangible assets ac!uired in an ac!uisition after 8- &arch 255", and for all other assets for accounting periods beginning on or after 8- &arch 255" The previous version of 9*+ 86 defined an intangible asset as an identifiable non1monetary asset without physical substance held for use in the production or supply of goods or services, for rental to others, or for administrative purposes The re!uirement for the asset to be held for use in the production or supply of goods or services, for rental to others, or for administrative purposes has now been removed from the definition of an intangible asset The previous version of 9*+ 86 did not define 'identifiability(, but stated that an intangible asset could be distinguished clearly from goodwill if the asset was separable, but that separability was not a necessary condition for identifiability The :evised +tandard states that an asset meets the identifiability criterion in the definition of an intangible asset when it: (a) is separable, ie capable of being separated or divided from the entity and sold, transferred, licensed, rented or 23 )*+5" # Intan ib#e fi)ed assets was issued on 8- ,ecember 255This +tandard is substantially similar to the previous version of 9*+ 86, so there are now significant differences between the revised 9*+ 86 and )*+5" 9f the definition of an asset met, intangible assets must be amortised over useful life, which should be no longer than 25 years, unless there is persuasive evidence that a life over 25 years is appropriate :evaluation or write down for impairment is not allowed Gnder )*+, intangible fi$ed assets may be overstated in the balance sheet, even when it is known that an impairment has occurred and the current valuation is less than the carrying amount in the accounts %ertain pre1operating costs, in relation to an entity>s establishment, training, advertisement activities, research and relocation of a business are allowed to be deferred and charged

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS e$changed, either individually or together with a related contract, asset or liability; or (b) arises from contractual or other legal rights, regardless of whether those rights are transferable or separable from the entity or from other rights and obligations over 8 years VAS

9*+ 86 :evised (continued)

The previous version of 9*+ 86 re!uired an intangible asset to be recognised if, and only if, it was probable that the e$pected future economic benefits attributable to the asset would flow to the entity, and its cost could be measured reliably These recognition criteria have been included in the :evised +tandard Iowever, additional guidance has been included to clarify that: (a) the probability recognition criterion is always considered to be satisfied for intangible assets that are ac!uired separately or in a business combination (b) the fair value of an intangible asset ac!uired in a business combination can normally be measured with sufficient reliability to be recognised separately from goodwill 9f an intangible asset ac!uired in a business combination has a finite useful life, there is a rebuttable presumption that its fair value can be measured reliably The previous version of 9*+ 86 was based on the assumption that the useful life of an intangible asset is always finite, and included a rebuttable presumption that the useful life cannot e$ceed twenty years from the date the asset is available for use That rebuttable presumption has been removed The :evised +tandard re!uires an intangible asset to be regarded as having an indefinite useful life when, based on an analysis of all of the 2B

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS relevant factors, there is no foreseeable limit to the period over which the asset is e$pected to generate net cash inflows for the entity VAS

The :evised +tandard re!uires that: 9*+ 86 :evised (continued) (a) an intangible asset with an indefinite useful life should not be amortised (b) the useful life of such an asset should be reviewed each reporting period to determine whether events and circumstances continue to support an indefinite useful life assessment for that asset 9f they do not, the change in the useful life assessment from indefinite to finite should be accounted for as a change in an accounting estimate The previous version of 9*+ 86 re!uired the recoverable amount of an intangible asset that was amortised over a period e$ceeding twenty years from the date it was available for use to be estimated at least at each financial year1end, even if there was no indication that the asset was impaired This re!uirement has been removed Therefore, an entity needs to determine the recoverable amount of an intangible asset with a finite useful life that is amortised over a period e$ceeding twenty years from the date it is available for use only when, in accordance with 9*+ 83, there is an indication that the asset may be impaired

26

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS VAS

9*+ 8/

Financial instruments) recognition and measurement @iabilities versus e!uity: the classification between liabilities and e!uity depends on whether the issuer has a contractual obligation to deliver cash or another financial asset to the holder of the instrument, regardless of its legal form ,erivatives: all derivatives must be carried at fair value =ains or losses on all derivatives are recorded in income unless they !ualify for cash flow hedge accounting when such gains or losses are deferred in e!uity Financial assets: should be initially measured at cost, being the fair value of the consideration given, including transaction costs There are only four categories of financial assets under 9*+ 8/: held for trading, held to maturity, originated by the enterprise and available for sale Financial liabilities: should be initially measured at cost, being the fair value of the consideration received, including transaction costs *ll financial liabilities e$cept for held for trading and derivatives that are liabilities should be carried at amortised cost @iabilities held for trading and derivatives that are liabilities should be measured at fair value 2/ .o specific rules on financial instruments )*+-5 # The effects of chan es in forei n e)chan e rates and %ircular 00 both include a statement that where financial instruments are used to hedge against foreign e$change risk, the foreign currency loanHliability should not be retranslated The meaning of this statement is not clear, and has not been tested in practice

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS 7ffsetting: the ability to offset financial assets and liabilities is severely restricted VAS

9*+ 8/ (continued)

Iedge accounting: may be used only if the hedge relationship meets !ualifying criteria of documentation and hedge effectiveness There must be a one1on1one hedging relationship; hedge accounting may not be used for overall balance sheet positions =ains or losses on instruments !ualifying as cash flow hedges should be included in e!uity and recycled to the income statement when the hedged transaction or balance effects the income statement, or is used to adjust the carrying amount of an asset or liability at ac!uisition ,erecognition: a financial asset should be derecognised when the enterprise realises the rights to benefits specified in the contract, the rights e$pire, or the enterprise loses control of the contractual rights * financial liability should only be removed from the balance sheet when the obligation specified in the contract is discharged, cancelled, e$pires, or the primary responsibility for the liability is transferred to another party !ote" 9*+ 8/ was revised in ,ecember 2558, the changes are effective for accounting periods beginning on or after - 4anuary 2550 and include the following: The definition of 'originated loans and receivables( is amended to become 'loans and receivables( Gnder the revised definition, 85

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS an entity is permitted to classify as loans and receivables purchased loans that are not !uoted in an active market The :evised +tandard clarifies that the evaluation of the transfer of risks and rewards of ownership precedes the evaluation of the transfer of control for all derecognition transactions &ore guidance is given on derecognition of financial assets 9*+ 8/ :evised (continued) The :evised +tandard introduces the notion of a 'transfer( of a financial asset and gives rules to define when a transfer has occurred 9t also provides guidance on how to apply the concepts of risks and rewards and of control The option previously contained in 9*+ 8/ to recognise in profit or loss gains and losses on available1for1sale financial assets has been eliminated +uch an option is no longer necessary because under the amendments to 9*+ 8/ an entity is now permitted by designation to measure any financial asset or financial liability at fair value with gains and losses recognised in profit or loss The :evised +tandard provides additional guidance about how to evaluate impairment that is inherent in a group of loans, receivables or held1to1maturity investments, but cannot yet be identified with any individual financial asset in the group Iedges of firm commitments are now treated as fair value hedges rather than cash flow hedges Iowever, the :evised +tandard clarifies that a hedge of the foreign currency risk of a firm commitment can be treated as either a cash flow hedge or a fair value hedge The :evised +tandard re!uires that when a hedged forecast transaction occurs and results in the recognition of a financia# asset or a financia# liability, the gain or loss deferred in e!uity 8VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS does not adjust the initial carrying amount of the asset or liability (ie basis adjustment is prohibited), but remains in e!uity and is recognised in profit or loss consistently with the recognition of gains and losses on the asset or liability VAS

9*+ 8/ :evised (continued)

For hedges of forecast transactions that result in the recognition of a non-financia# asset or a non-financia# liability, the entity has a choice of whether to apply basis adjustment or retain the hedging gain or loss in e!uity and report it in profit or loss when the asset or liability affects profit or loss The disclosure re!uirements previously in 9*+ 8/ have been moved to 9*+ 82

9*+ "5

Investment propert 9nvestment property is defined as property (land or a building 1 or part of a building 1 or both) held (by the owner or by the lessee under a finance lease) to earn rentals or for capital appreciation or both, rather than for: (a) use in the production or supply of goods or services or for administrative purposes; or (b) sale in the ordinary course of business 9*+ "5 permits enterprises to choose either: (a) a fair value model: investment property should be measured at fair value and changes in fair value should be recognised 82 )*+50 1 In&estment property( was issued on 85 ,ecember 2558 The +tandard is based on the structure of 9*+ "5, but has the fundamental difference that investment property can only be measured at depreciated historical cost &easurement at fair value is not permitted

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS in the income statement; or (b) a cost model The cost model is the benchmark treatment in 9*+ -3 $roperty( $#ant and .%uipment: investment property should be measured at depreciated cost (less any accumulated impairment losses) *n enterprise that chooses the cost model should disclose the fair value of its investment property 9*+ "5 (continued) Gnder the fair value model, all changes in fair value are recognised in the income statement 9f there is clear evidence when an enterprise first ac!uires an investment property that the fair value of the property will not be able to be reliably measured on a continuing basis, then that investment property is measured using the depreciated cost model under 9*+ -3 until it is disposed of !ote" 9*+ "5 was revised in ,ecember 2558, the changes are effective for accounting periods beginning on or after - 4anuary 2550 This is a limited revision that includes the following: * property interest that is held by a lessee under an operating lease may be classified and accounted for as investment property provided that: (a) the rest of the definition of investment property is met; (b) the operating lease is accounted for as if it were a finance lease in accordance with 9*+ -B *eases; and (c) the lessee uses the fair value model set out in 9*+ "5 for the asset recognised VAS

88

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS The :evised +tandard re!uires an entity to disclose: (a) whether it applies the fair value model or the cost model; and (b) if it applies the fair value model, whether, and in what circumstances, property interests held under operating leases are classified and accounted for as investment property 9*+ "5 :evised (continued) VAS

Ahen a valuation obtained for investment property is adjusted significantly for the purpose of the financial statements, a reconciliation is re!uired between the valuation obtained and the valuation included in the financial statements 7ther changes have been incorporated into the :evised 9*+ "5 as a result of amendments to 9*+ -3: $roperty( $#ant and .%uipment.

8"

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref 9*+ "$griculture 9*+ "- deals with accounting for agricultural activity This is defined as the managed biological transformation of biological assets (living animals and plants) for sale, into agricultural produce (harvested product of biological assets) or into additional biological assets *ll biological assets should be measured at fair value less estimated point1of1sale costs, with the change in the carrying amount reported as part of profit or loss from operating activities *gricultural produce harvested from an enterprise>s biological assets should be measured at fair value less estimated point1of1sale costs at the point of harvest The fair value is the !uoted price in any available market .ot specifically mentioned under )*+ IFRS VAS

9F:+ <ffective from - 4anuary 255"

First*time adoption of International Financial #eporting Standards 9F:+ - applies when an entity adopts 9F:+s for the first time by an e$plicit and unreserved statement of compliance with 9F:+s 9n general, the 9F:+ re!uires an entity to comply with each 9F:+ effective at the reporting date for its first 9F:+ financial statements 9n particular, the 9F:+ re!uires an entity to do the 80 .ot applicable to )*+

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS following in the opening 9F:+ balance sheet that it prepares as a starting point for its accounting under 9F:+s: (a) recognise all assets and liabilities whose recognition is re!uired by 9F:+s; (b) not recognise items as assets or liabilities if 9F:+s do not permit such recognition; (c) reclassify items that it recognised under previous =**C as one type of asset, liability or component of e!uity, but are a different type of asset, liability or component of e!uity under 9F:+s; and (d) apply 9F:+s in measuring all recognised assets and liabilities 9F:+ - grants limited e$emptions from these re!uirements in specified areas where the cost of complying with them would be likely to e$ceed the benefits to users of financial statements; including e$emption from restating business combinations, taking fair value as deemed cost for fi$ed assets, and e$emption from calculating cumulative translation differences VAS

9F:+ (continued)

9F:+ - also prohibits retrospective application of 9F:+s in some areas; including where retrospective application would re!uire judgements by management about past conditions after the outcome of a particular transaction is already known, derecognition of financial assets and financial liabilities, and hedge accounting 9F:+ - re!uires disclosures that e$plain how the transition from previous =**C to 9F:+s affected the entity>s reported financial 83

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS position, financial performance and cash flows *n entity is re!uired to apply the 9F:+ if its first 9F:+ financial statements are for a period beginning on or after - 4anuary 255" <arlier application is encouraged 9F:+ 2 <ffective from - 4anuary 2550 Share*based pa ments 9F:+ 2 re!uires an entity to recognise share1based payment transactions in its financial statements, including transactions with employees or other parties to be settled in cash, other assets, or e!uity instruments of the entity &easurement principles and specific re!uirements for three types of share1based payment transactions are set1out: (a) e!uity1settled share1based payment transactions, in which the entity receives goods or services as consideration for e!uity instruments of the entity (including shares or share options); (b) cash1settled share1based payment transactions, in which the entity ac!uires goods or services by incurring liabilities to the supplier of those goods or services for amounts that are 9F:+ 2 (continued) based on the price (or value) of the entity>s shares or other e!uity instruments of the entity; and (c) transactions in which the entity receives or ac!uires goods or services and the terms of the arrangement provide either the entity or the supplier of those goods or services with a choice of whether the entity settles the transaction in cash or by issuing e!uity instruments 8B .o related guidance under )*+ VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS For e!uity1settled share1based payment transactions, an entity measures the goods or services received, and the corresponding increase in e!uity, directly, at the fair value of the goods or services received, unless that fair value cannot be estimated reliably For cash1settled share1based payment transactions, an entity measures the goods or services ac!uired and the liability incurred at the fair value of the liability Gntil the liability is settled, the entity is re!uired to remeasure the fair value of the liability at each reporting date and at the date of settlement, with any changes in value recognised in profit or loss for the period For share1based payment transactions in which the terms of the arrangement provide either the entity or the supplier of goods or services with a choice of whether the entity settles the transaction in cash or by issuing e!uity instruments, the entity is re!uired to account for that transaction, or the components of that transaction, as a cash1settled share1based payment transaction if, and to the e$tent that, the entity has incurred a liability to settle in cash (or other assets), or as an e!uity1settled share1based payment transaction if, and to the e$tent that, no such liability has been incurred VAS

9F:+ 8 <ffective from 8- &arch 255"

&usiness combinations 9F:+ 8 re!uires all business combinations to be accounted for by +ome guidance for accounting for business combinations applying the purchase method &erger accounting is not adopting the purchase method of accounting, but not permitted comprehensive *n ac!uirer must be identified for every business combination *c!uirer measures the cost of a business combination as the 86 Cositive goodwill is recognised as an asset and amortised to the income statement over its useful life .egative goodwill is

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS aggregate of: the fair values, at the date of e$change, of assets given, liabilities incurred or assumed, and e!uity instruments issued by the ac!uirer, in e$change for control of the ac!uiree; plus any costs directly attributable to the combination *c!uirer recognises separately, at the ac!uisition date, the ac!uiree>s identifiable assets, liabilities and contingent liabilities that satisfy the following recognition criteria at that date, regardless of whether they had been previously recognised in the ac!uiree>s financial statements: (i) in the case of an asset other than an intangible asset, it is probable that any associated future economic benefits will flow to the ac!uirer, and its fair value can be measured reliably; (ii) in the case of a liability other than a contingent liability, it is probable that an outflow of resources embodying economic benefits will be re!uired to settle the obligation, and its fair value can be measured reliably; and (iii) in the case of an intangible asset or a contingent liability, its fair value can be measured reliably The identifiable assets, liabilities and contingent liabilities that satisfy the above recognition criteria are measured initially by the ac!uirer at their fair values at the ac!uisition date, irrespective of the e$tent of any minority interest =oodwill ac!uired in a business combination is recognised by the ac!uirer as an asset from the ac!uisition date, initially measured as the e$cess of the cost of the business combination over the ac!uirer>s interest in the net fair value of the ac!uiree>s 8/ VAS recognised as a deferred revenue and amortised to the income statement over its useful life

9F:+ 8 (continued)

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS identifiable assets, liabilities and contingent liabilities =oodwill is not amortised 9t is tested for impairment at least annually, or more fre!uently if events indicate that the asset might be impaired 9F:+ " <ffective from - 4anuary 2550 Insurance contracts 9F:+ " applies to all insurance contracts (including reinsurance contracts) that an entity issues and to reinsurance contracts that it holds, e$cept for specified contracts covered by other 9F:+s 9t does not apply to other assets and liabilities of an insurer, such as financial assets and financial liabilities within the scope of 9*+ 8/ 9F:+ " e$empts an insurer temporarily from some re!uirements of other 9F:+s, including the re!uirement to consider the Frame!or" in selecting accounting policies for insurance contracts Iowever, the 9F:+: (a) prohibits provisions for possible claims under contracts that are not in e$istence at the reporting date (such as catastrophe and e!ualisation provisions); 9F:+ " (continued) (b) re!uires a test for the ade!uacy of recognised insurance liabilities and an impairment test for reinsurance assets; (c) re!uires an insurer to keep insurance liabilities in its balance sheet until they are discharged or cancelled, or e$pire, and to present insurance liabilities without offsetting them against related reinsurance assets The &inistry of Finance ('&oF() is the regulator and supervisor of the insurance industry in )ietnam The &oF has issued a specific accounting system for insurance companies &any differences from 9F:+ " The insurer registers its formula for calculation of insurance liabilities for each insurance product with the &oF 9f approved by the &oF, this formula is applied in calculating the insurance liability, unless an application for variance in the formula is approved at a later date There is no test for ade!uacy of recognised insurance liabilities or for impairment of reinsurance assets VAS

"5

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS *n insurer is permitted to change its accounting policies for insurance contracts only if, as a result, its financial statements present information that is more relevant and no less reliable, or more reliable and no less relevant 9n particular, an insurer cannot introduce any of the following practices, although it may continue using accounting policies that involve them: (a) measuring insurance liabilities on an undiscounted basis (b) measuring contractual rights to future investment management fees at an amount that e$ceeds their fair value as implied by a comparison with current fees charged by other market participants for similar services (c) using non1uniform accounting policies for the insurance liabilities of subsidiaries 9F:+ " permits the introduction of an accounting policy that involves remeasuring designated insurance liabilities consistently in each period to reflect current market interest rates (and, if the insurer so elects, other current estimates and assumptions) Aithout this permission, an insurer would have been re!uired to apply the change in accounting policies consistently to all similar liabilities 9F:+ " (continued) 9F:+ ": (a) clarifies that an insurer need not account for an embedded derivative separately at fair value if the embedded derivative meets the definition of an insurance contract (b) re!uires an insurer to unbundle deposit components of some insurance contracts, to avoid the omission of assets and liabilities from its balance sheet "VAS

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS (c) clarifies the applicability of the practice sometimes known as 'shadow accounting( (d) permits an e$panded presentation for insurance contracts ac!uired in a business combination or portfolio transfer (e) addresses limited aspects of discretionary participation features contained in insurance contracts or financial instruments 9F:+ " re!uires disclosure to help users understand: (a) the amounts in the insurer>s financial statements that arise from insurance contracts (b) the amount, timing and uncertainty of future cash flows from insurance contracts VAS

9F:+ 0 <ffective from - 4anuary 2550

Non*current assets held for sale and discontinued operations 9F:+ 0 adopts the classification 'held for sale( and introduces the concept of a disposal group, being a group of assets to be disposed of, by sale or otherwise, together as a group in a single transaction, and liabilities directly associated with those assets that will be transferred in the transaction .ot specifically mentioned under )*+ 9n practice, the &oF re!uires disclosure on the closing down of an entity>s operations For companies that are being wound up, financial statements are prepared under the same accounting basis as they were when fully operational Therefore, the

"2

Summary of differences between International Financial Reporting Standards (IFRS) and the Vietnamese Accounting System (VAS) IFRS Ref IFRS *ssets or disposal groups that are classified as held for sale are carried at the lower of carrying amount and fair value less costs to sell *n asset classified as held for sale, or included within a disposal group that is classified as held for sale, is not depreciated *n asset classified as held for sale, and the assets and liabilities included within a disposal group classified as held for sale, are presented separately on the face of the balance sheet VAS historical cost convention is still applied to companies which are being wound up, which may lead to assets being stated at the report>s date in e$cess of the amount at which they are subse!uently realised

*n operation is classified as discontinued at the date the operation meets the criteria to be classified as held for sale or when the entity has disposed of the operation :esults of discontinued operations are to be shown separately on the face of the income statement :etroactive classification of an operation as discontinued is not permitted, when the criteria for that classification are not met until after the balance sheet date

"8

You might also like

- Define Your Project Goals and Success CriteriaDocument3 pagesDefine Your Project Goals and Success CriteriaFaizan AhmadNo ratings yet

- Module 2 - Topic 3 - Lecture SlidesDocument27 pagesModule 2 - Topic 3 - Lecture SlidesJesta ZillaNo ratings yet

- Materi Chapter 23 Cash FlowDocument2 pagesMateri Chapter 23 Cash FlowM Reza andriantoNo ratings yet

- Project Charter Form InstructionsDocument11 pagesProject Charter Form Instructionsnsadnan100% (4)

- Key Questions For SAP Post Imp ReviewDocument1 pageKey Questions For SAP Post Imp ReviewManu ManuNo ratings yet

- IFRS vs VN GAAP Financial Reporting GuideDocument99 pagesIFRS vs VN GAAP Financial Reporting GuideminhNo ratings yet

- FICO Interview QuestionsDocument177 pagesFICO Interview QuestionsNagaratna ReddyNo ratings yet

- Advanced Audit & Assurance: Revision Mock Examination December 2019 Answer GuideDocument21 pagesAdvanced Audit & Assurance: Revision Mock Examination December 2019 Answer GuidecryoffalconNo ratings yet

- Template 1 Project Proposal TemplateDocument8 pagesTemplate 1 Project Proposal TemplateLaurence HabanNo ratings yet

- Fairchild SA statement of cash flows 2019Document3 pagesFairchild SA statement of cash flows 2019ulil alfarisyNo ratings yet

- SAP FICO - Accounting Transactions ListDocument18 pagesSAP FICO - Accounting Transactions ListSudhakar PotnuruNo ratings yet

- Questionnaire Split Valuation en No ScenariosDocument15 pagesQuestionnaire Split Valuation en No ScenariosPrasanna Kumar SethiNo ratings yet

- Vendor Portal SolutionDocument11 pagesVendor Portal SolutionAnishNo ratings yet

- Organization Structure in SAP Project NOVUSDocument46 pagesOrganization Structure in SAP Project NOVUSVikram BhandeNo ratings yet

- SAP FICO Analyst in Wilmington NC Resume Jonathan WaltersDocument5 pagesSAP FICO Analyst in Wilmington NC Resume Jonathan WaltersJonathanWaltersNo ratings yet

- Imprest Funds & ReplenishmentsDocument38 pagesImprest Funds & ReplenishmentsraghavNo ratings yet

- Sap Guide How To Approve Petty CashDocument2 pagesSap Guide How To Approve Petty CashasphaltjpNo ratings yet

- BlueprinttestDocument68 pagesBlueprinttestVeera Mani100% (1)

- EHP7 Issues After Upgrade: Resolving MIRO Small Difference Rounding ErrorDocument11 pagesEHP7 Issues After Upgrade: Resolving MIRO Small Difference Rounding Errorsawantamit777No ratings yet

- F Validation Master TemplateDocument5 pagesF Validation Master TemplateGuiss LemaNo ratings yet

- Truebell - Fin - Ap - Config - Account PayableDocument49 pagesTruebell - Fin - Ap - Config - Account PayableRajesh ChowdaryNo ratings yet

- Implementing Activity Based CostingDocument36 pagesImplementing Activity Based CostingLintang UtomoNo ratings yet

- 03-Payment and Revenue Account Reconciliation-V6.0-16July2021Document31 pages03-Payment and Revenue Account Reconciliation-V6.0-16July2021Birtukan AberaNo ratings yet

- Asap MethodologyDocument3 pagesAsap MethodologyJay KoshtiNo ratings yet

- 02 - Financial Accounting - Accounts Receivable ReportsDocument28 pages02 - Financial Accounting - Accounts Receivable ReportsjohnNo ratings yet

- Month End and Year End ActivitiesDocument6 pagesMonth End and Year End ActivitiesAnonymous ldfiOk97uNo ratings yet

- Reckon One - ProjectsDocument27 pagesReckon One - ProjectsSameerbaskarNo ratings yet

- Sap Fico TcodesDocument24 pagesSap Fico TcodesFelipeJonasNo ratings yet

- Pantaloon Retail LTDDocument2 pagesPantaloon Retail LTDKer ShniNo ratings yet

- Financial Accounting and Taxation Using TallyDocument7 pagesFinancial Accounting and Taxation Using TallySanjay KumarNo ratings yet

- 7717 - Manual Cash Management PDFDocument70 pages7717 - Manual Cash Management PDFkoos_engelbrechtNo ratings yet

- Configure AP Accounts and Vendor Master DataDocument10 pagesConfigure AP Accounts and Vendor Master DatasowmyanavalNo ratings yet

- SAP HANA and Real Time Analytics - BIDocument8 pagesSAP HANA and Real Time Analytics - BIaslamharysNo ratings yet

- Fi Overview 3Document87 pagesFi Overview 3Sushil KumarNo ratings yet

- Sap Accounting EntriesDocument5 pagesSap Accounting EntriesonionheadmonsterNo ratings yet

- Controlling ConfigurationDocument58 pagesControlling ConfigurationHridya Prasad100% (1)

- Business Requirement Document - CRF# 1905 - LATAM AMEX - CONCUR Posting V4Document19 pagesBusiness Requirement Document - CRF# 1905 - LATAM AMEX - CONCUR Posting V4KolluriRajubhaiChowdaryNo ratings yet

- Addon Integration ModuleDocument19 pagesAddon Integration ModuleRajib Bose100% (1)

- Tailieumienphi - VN Lecture Logistics Theory Lecture 16 Material Requirements PlanningDocument21 pagesTailieumienphi - VN Lecture Logistics Theory Lecture 16 Material Requirements PlanningBong ThoNo ratings yet

- Functional Requirement SpecificationDocument7 pagesFunctional Requirement SpecificationGanesh KumarNo ratings yet

- Transaction Based Pricing - Nirvana For FAODocument0 pagesTransaction Based Pricing - Nirvana For FAOvijayhegdeNo ratings yet

- FICO TcodesDocument6 pagesFICO TcodesShakeel AhmedNo ratings yet

- Ec&o RoadmapDocument63 pagesEc&o Roadmapmdhinesh100% (1)

- Sap BudgetDocument4 pagesSap BudgetRajuSPallapuNo ratings yet

- Compliance Risk Management BFR V6.0-18July2021Document29 pagesCompliance Risk Management BFR V6.0-18July2021Birtukan AberaNo ratings yet

- Assign Business Area to ConsolidationDocument5 pagesAssign Business Area to ConsolidationaravindNo ratings yet

- Sap Fi GlossaryDocument5 pagesSap Fi GlossarydbedadaNo ratings yet

- Account Receivable NotesDocument28 pagesAccount Receivable Noteskeeru_bioNo ratings yet

- SAP Standard Reports - ERP Operations - SCN WikiDocument9 pagesSAP Standard Reports - ERP Operations - SCN Wikisurendra devathiNo ratings yet

- Tfin50 Exam Questions1Document9 pagesTfin50 Exam Questions1Hanry KumalaNo ratings yet

- Process Improvement Manager Analyst in Portsmouth New Hampshire Resume William HartinDocument2 pagesProcess Improvement Manager Analyst in Portsmouth New Hampshire Resume William HartinWilliam HartinNo ratings yet

- SAP Modules T-CodesListDocument10 pagesSAP Modules T-CodesListvs9192631770No ratings yet

- Chapter - Strategy Implementation MCQDocument11 pagesChapter - Strategy Implementation MCQgamergeeeNo ratings yet

- Final Vaccination List - Per LocationDocument99 pagesFinal Vaccination List - Per LocationRodmark EsparteroNo ratings yet

- SAP FICO Certification Test 6Document18 pagesSAP FICO Certification Test 6arfaaNo ratings yet

- FBL3N Account Line Item AnalysisDocument5 pagesFBL3N Account Line Item AnalysisDinesh KumarNo ratings yet

- Substitution in FIDocument3 pagesSubstitution in FIraghav108No ratings yet

- Company Code PlaybookDocument12 pagesCompany Code Playbookrohitsawarkar28No ratings yet

- Product Cost Controlling Cost Center Accounting: Transaction CodeDocument14 pagesProduct Cost Controlling Cost Center Accounting: Transaction CodeOshinfowokan OloladeNo ratings yet

- CertificateOfCompletion - Having Career Conversations With Your TeamDocument1 pageCertificateOfCompletion - Having Career Conversations With Your Teamtieuquan42No ratings yet

- CertificateOfCompletion - Having Career Conversations With Your TeamDocument1 pageCertificateOfCompletion - Having Career Conversations With Your Teamtieuquan42No ratings yet