Professional Documents

Culture Documents

Daily 26.03.2014

Uploaded by

FEPFinanceClubOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily 26.03.2014

Uploaded by

FEPFinanceClubCopyright:

Available Formats

DAILY

26th March 2014

PSI20: +0.92% DAX30: +1.18% FTSE100: +0.01% S&P500: -0.70% NIKKEI225: +0.37%

The National Stock Exchange closed higher for the second consecutive session, with the PSI20 climbing 0.92% to 7 506.72 points. PSI20 followed the trend of European indexes, as orders for durable goods in the U.S. rose more than expected, signaling some solidity in the recovery of the U.S. economy. More >>

The Portuguese Central bank revised upwards growth forecast for this year and says there are signs of a

sustainable recovery. The economy will return to growth in 2014 after three years of recession and the central bank believes that Portugal may grow at a pace close to that recorded in the euro area. More >>

European stocks rose on Wednesday as easing tensions over Ukraine and positive U.S. economic data helped the market extend the recovery rally that started in mid-March. Spanish stocks outperformed the broader market, after the Bank of Spain said the country's economic recovery was on track. More >> Italian consumer confidence rose more-than-expected last month, official data showed on Wednesday. Italian National Institute of Statistics said that Italian Consumer Confidence rose to 101.7, from 97.7 in the preceding month whose figure was revised up from 97.5. More >>

U.S. stocks slid on Wednesday, with benchmark indexes failing to maintain a second day of gains, after President Barack Obama cautioned against complacency on Russian moves in Ukraine. More >> Total durable goods orders, which include transportation items, climbed by a seasonally adjusted 2.2% last month, easily surpassing expectations for a 1% gain. More >> Orders of durable goods excluding transportation items advanced only 0.2% in February missing estimates for a 0.3% rise after recording a downwardly-revised 0.9% gain in January. More >>

Asian stocks rose after U.S. consumer confidence climbed to a six-year high, buoying investor optimism about the outlook for the worlds biggest economy. More >> Bank of China Ltd., the nations fourth -largest lender by market value, posted a higher-than-estimated 10 percent increase in quarterly profit as tighter liquidity helped improve lending margins. More >> Reserve Bank of Australia Governor said there are encouraging early signs of a handover from mining-led demand growth to domestic consumption and the economy may strengthen later this year. More >>

OIL (WTI: $100.19/bl, +0.92% ; BRENT: $106.97/bl, +0.05% ): Oil gained as inventories at Oklahoma, decreased for an eighth week and demand for gasoline reached a three-month high. More >> NATURAL GAS ($4.389/MmBtu, -0.23%): Natural gas dropped on forecasts for warmer weather that would reduce demand for the heating fuel on the heels of a snowstorm. More >> GOLD ($1305.30/oz t, -0.39%): Gold fell as signs of economic recovery in the U.S. boosted speculation the FED will further pare stimulus, curbing demand for the precious metal as a store of value. More >>

DISCLAIMER: Daily Briefs contains a summary of financial news covered on conventional news services around the world. Daily Briefs coverage of subjects is based on t whims of its volunteer contributors. FEP Finance Club is not responsible for any imprecision or error in the content of any news.

You might also like

- Daily 18.03.2014Document1 pageDaily 18.03.2014FEPFinanceClubNo ratings yet

- Daily 30.04.2014Document1 pageDaily 30.04.2014FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 19.02.2014 PDFDocument1 pageDaily 19.02.2014 PDFFEPFinanceClubNo ratings yet

- Daily 17.06.2014Document1 pageDaily 17.06.2014FEPFinanceClubNo ratings yet

- Daily 22.01.2014Document1 pageDaily 22.01.2014FEPFinanceClubNo ratings yet

- Daily 21.11.2013Document1 pageDaily 21.11.2013FEPFinanceClubNo ratings yet

- Daily 05.11.2013Document1 pageDaily 05.11.2013FEPFinanceClubNo ratings yet

- Daily 27.05.2014Document1 pageDaily 27.05.2014FEPFinanceClubNo ratings yet

- Daily 18.06.2013Document1 pageDaily 18.06.2013FEPFinanceClubNo ratings yet

- Daily 28.04.2014Document1 pageDaily 28.04.2014FEPFinanceClubNo ratings yet

- Daily 03.12.2013Document1 pageDaily 03.12.2013FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 13.05.2014Document1 pageDaily 13.05.2014FEPFinanceClubNo ratings yet

- Daily 06.02.2014Document1 pageDaily 06.02.2014FEPFinanceClubNo ratings yet

- Daily 02.04.2014Document1 pageDaily 02.04.2014FEPFinanceClubNo ratings yet

- Daily 25.03.2014Document1 pageDaily 25.03.2014FEPFinanceClubNo ratings yet

- Daily 03.04.2014Document1 pageDaily 03.04.2014FEPFinanceClubNo ratings yet

- Daily 11.03.2014 PDFDocument1 pageDaily 11.03.2014 PDFFEPFinanceClubNo ratings yet

- Daily 09.12.2013Document1 pageDaily 09.12.2013FEPFinanceClubNo ratings yet

- Daily: 4 June 2014Document1 pageDaily: 4 June 2014FEPFinanceClubNo ratings yet

- Daily 11.02.2014Document1 pageDaily 11.02.2014FEPFinanceClubNo ratings yet

- Daily 08.04.2014Document1 pageDaily 08.04.2014FEPFinanceClubNo ratings yet

- Daily 10.02.2014Document1 pageDaily 10.02.2014FEPFinanceClubNo ratings yet

- Daily 02.12.2013Document1 pageDaily 02.12.2013FEPFinanceClubNo ratings yet

- Daily 28.10.2013Document1 pageDaily 28.10.2013FEPFinanceClubNo ratings yet

- Daily 14.10.2013Document1 pageDaily 14.10.2013FEPFinanceClubNo ratings yet

- Daily 07.05.2014Document1 pageDaily 07.05.2014FEPFinanceClubNo ratings yet

- Daily 08.05.2014Document1 pageDaily 08.05.2014FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 11.11.2013Document1 pageDaily 11.11.2013FEPFinanceClubNo ratings yet

- Daily 29.10.2013Document1 pageDaily 29.10.2013FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 23.12.2013Document1 pageDaily 23.12.2013FEPFinanceClubNo ratings yet

- Daily 13.01.2014Document1 pageDaily 13.01.2014FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 21.05.2013Document1 pageDaily 21.05.2013FEPFinanceClubNo ratings yet

- Daily 10.06.2013Document1 pageDaily 10.06.2013FEPFinanceClubNo ratings yet

- Daily 17.04.2012Document1 pageDaily 17.04.2012FEPFinanceClubNo ratings yet

- Daily 13.11.2013Document1 pageDaily 13.11.2013FEPFinanceClubNo ratings yet

- Daily 17.02.2014Document1 pageDaily 17.02.2014FEPFinanceClubNo ratings yet

- Daily 31.10.2013Document1 pageDaily 31.10.2013FEPFinanceClubNo ratings yet

- Daily 27.11.2013Document1 pageDaily 27.11.2013FEPFinanceClubNo ratings yet

- Daily 29.04.2014Document1 pageDaily 29.04.2014FEPFinanceClubNo ratings yet

- Daily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225Document1 pageDaily: PSI20: DAX30: FTSE100: S&P500: NIKKEI225FEPFinanceClubNo ratings yet

- Daily 4.12.2013Document1 pageDaily 4.12.2013FEPFinanceClubNo ratings yet

- Daily 23.10.2013Document1 pageDaily 23.10.2013FEPFinanceClubNo ratings yet

- Daily: 4 June 2013Document1 pageDaily: 4 June 2013FEPFinanceClubNo ratings yet

- Daily 30.10.2013Document1 pageDaily 30.10.2013FEPFinanceClubNo ratings yet

- Daily 15.10.2013Document1 pageDaily 15.10.2013FEPFinanceClubNo ratings yet

- Daily 24.06.2014Document1 pageDaily 24.06.2014FEPFinanceClubNo ratings yet

- Daily 03.09.2013Document1 pageDaily 03.09.2013FEPFinanceClubNo ratings yet

- Daily 19.06.2013Document1 pageDaily 19.06.2013FEPFinanceClubNo ratings yet

- Daily 10.12.2013Document1 pageDaily 10.12.2013FEPFinanceClubNo ratings yet

- Daily 09.01.2014Document1 pageDaily 09.01.2014FEPFinanceClubNo ratings yet

- Daily 18.02.2014Document1 pageDaily 18.02.2014FEPFinanceClubNo ratings yet

- Daily 08.01.2014Document1 pageDaily 08.01.2014FEPFinanceClubNo ratings yet

- Daily 21.01.2013Document1 pageDaily 21.01.2013FEPFinanceClubNo ratings yet

- Daily 21.04.2014Document1 pageDaily 21.04.2014FEPFinanceClubNo ratings yet

- Equity Valuation Report - SpotifyDocument3 pagesEquity Valuation Report - SpotifyFEPFinanceClub100% (1)

- Equity Valuation Report - LVMHDocument3 pagesEquity Valuation Report - LVMHFEPFinanceClubNo ratings yet

- Equity Valuation Report - Corticeira AmorimDocument3 pagesEquity Valuation Report - Corticeira AmorimFEPFinanceClubNo ratings yet

- Equity Valuation Report - TwitterDocument3 pagesEquity Valuation Report - TwitterFEPFinanceClubNo ratings yet

- Equity Valuation Report - AppleDocument3 pagesEquity Valuation Report - AppleFEPFinanceClubNo ratings yet

- Monthly FX Report MayDocument3 pagesMonthly FX Report MayFEPFinanceClub100% (1)

- FX Monthly Report - FEP Finance ClubDocument3 pagesFX Monthly Report - FEP Finance ClubFEPFinanceClubNo ratings yet

- Equity Valuation Report - InditexDocument3 pagesEquity Valuation Report - InditexFEPFinanceClubNo ratings yet

- Equity Valuation Report - AppleDocument3 pagesEquity Valuation Report - AppleFEPFinanceClubNo ratings yet

- Monthly FX Report - October 2017Document3 pagesMonthly FX Report - October 2017FEPFinanceClubNo ratings yet

- Equity Valuation Report - AdidasDocument3 pagesEquity Valuation Report - AdidasFEPFinanceClubNo ratings yet

- Equity Valuation Report - Snap Inc.Document3 pagesEquity Valuation Report - Snap Inc.FEPFinanceClubNo ratings yet

- Monthly FX Report AprilDocument3 pagesMonthly FX Report AprilFEPFinanceClubNo ratings yet

- Equity Valuation Report - Sumol + CompalDocument3 pagesEquity Valuation Report - Sumol + CompalFEPFinanceClubNo ratings yet

- Monthly FX Report JanuaryDocument3 pagesMonthly FX Report JanuaryFEPFinanceClubNo ratings yet

- Monthly FX Report FebruaryDocument3 pagesMonthly FX Report FebruaryFEPFinanceClubNo ratings yet

- Monthly FX Report NovemberDocument3 pagesMonthly FX Report NovemberFEPFinanceClubNo ratings yet

- Monthly FX Report MarchDocument3 pagesMonthly FX Report MarchFEPFinanceClubNo ratings yet

- Monthly FX Report OctoberDocument3 pagesMonthly FX Report OctoberFEPFinanceClubNo ratings yet

- Equity Valuation Report - TOTAL, GALPDocument10 pagesEquity Valuation Report - TOTAL, GALPFEPFinanceClubNo ratings yet

- Media Market PDFDocument10 pagesMedia Market PDFFEPFinanceClubNo ratings yet

- Equity Valuation Report - TOTAL, GALPDocument10 pagesEquity Valuation Report - TOTAL, GALPFEPFinanceClubNo ratings yet

- Monthly FX Report - November 15Document3 pagesMonthly FX Report - November 15FEPFinanceClubNo ratings yet

- Monthly FX Report January 2016Document3 pagesMonthly FX Report January 2016FEPFinanceClubNo ratings yet

- Advertising MarketDocument11 pagesAdvertising MarketFEPFinanceClubNo ratings yet

- Equity Valuation Report - Jerónimo MArtinsDocument2 pagesEquity Valuation Report - Jerónimo MArtinsFEPFinanceClub100% (1)

- Media Market PDFDocument10 pagesMedia Market PDFFEPFinanceClubNo ratings yet

- Monthly FX Report December 2015Document3 pagesMonthly FX Report December 2015FEPFinanceClubNo ratings yet

- Equity Valuation Report - RENDocument2 pagesEquity Valuation Report - RENFEPFinanceClubNo ratings yet

- Monthly FX Report - January 15Document3 pagesMonthly FX Report - January 15FEPFinanceClubNo ratings yet

- AEI 2015 Annual ReportDocument40 pagesAEI 2015 Annual ReportmoneyminderNo ratings yet

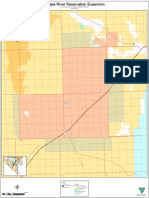

- Moapa Reservation ExpansionDocument1 pageMoapa Reservation ExpansionLas Vegas Review-JournalNo ratings yet

- Week 7) Kevin G. CaiDocument43 pagesWeek 7) Kevin G. CaiAditya Rahman FadlyNo ratings yet

- Roger Sherman CaveatDocument52 pagesRoger Sherman CaveatTheOdyssey100% (1)

- CSBS Spring Meeting Remarks - Superintendent Maria T. VulloDocument11 pagesCSBS Spring Meeting Remarks - Superintendent Maria T. VulloThe Capitol PressroomNo ratings yet

- Fishery in India 2001 PDFDocument185 pagesFishery in India 2001 PDFsanjnuNo ratings yet

- Reconstruction Study Guide: (Answer Key)Document3 pagesReconstruction Study Guide: (Answer Key)api-509646550No ratings yet

- Executive Order 14607-Digital-CurrencyDocument10 pagesExecutive Order 14607-Digital-CurrencyBob JohnsonNo ratings yet

- Current CVDocument6 pagesCurrent CVPaul MusgraveNo ratings yet

- United States ConstitutionDocument20 pagesUnited States ConstitutionMuayad HussainNo ratings yet

- Turner PDFDocument9 pagesTurner PDFSagar SinghNo ratings yet

- Employment Eligibility Verification: U.S. Citizenship and Immigration ServicesDocument3 pagesEmployment Eligibility Verification: U.S. Citizenship and Immigration ServicessjfdajoNo ratings yet

- Axis of Evil: Wrong Kind of Green Avaaz Ceres PurposeDocument5 pagesAxis of Evil: Wrong Kind of Green Avaaz Ceres PurposeJay Thomas TaberNo ratings yet

- Sample Fee Schedule Notice For Protection Against Corporate AbuseDocument2 pagesSample Fee Schedule Notice For Protection Against Corporate AbuseVen Geancia100% (24)

- Dueño de La Móvil de CG Televisión Asegura Que Tiene Permisos para Rodar en ColombiaDocument231 pagesDueño de La Móvil de CG Televisión Asegura Que Tiene Permisos para Rodar en ColombiaW Radio ColombiaNo ratings yet

- Market Leader Inter Exit TestDocument5 pagesMarket Leader Inter Exit TestBreggae71% (7)

- The International Legal OrderDocument30 pagesThe International Legal OrderBerna GündüzNo ratings yet

- Unit 1 Understanding Globalisation and Its RamificationDocument17 pagesUnit 1 Understanding Globalisation and Its RamificationakurilNo ratings yet

- SIGNED AWAY How Exxon's Exploitative Deal Deprived Guyana of Up To US$55 Billion - A Report by Global WitnessDocument28 pagesSIGNED AWAY How Exxon's Exploitative Deal Deprived Guyana of Up To US$55 Billion - A Report by Global WitnessPeople's Progressive Party100% (1)

- ZIP Codes Are Applicable To Federal Territories and Enclaves Located Within The 50 States of The Union PDFDocument2 pagesZIP Codes Are Applicable To Federal Territories and Enclaves Located Within The 50 States of The Union PDFnujahm1639100% (1)

- Meat Market Review Fao 2020Document15 pagesMeat Market Review Fao 2020Robinson Alexander Timana ArevaloNo ratings yet

- Chapter 13 West TestDocument14 pagesChapter 13 West Testkevinkatovich1No ratings yet

- Middle EastDocument45 pagesMiddle Eastswetaagarwal2706100% (1)

- Sovereign King Bey 10 Form - COLDocument1 pageSovereign King Bey 10 Form - COLSovereign_King_3095100% (2)

- Anholt City Brands Index, How The World Sees The World's CitiesDocument14 pagesAnholt City Brands Index, How The World Sees The World's CitiesGrace Yang100% (3)

- 8 Grade - United States History Midterm Exam Study Guide: CCPS Skills and Processes QuestionsDocument4 pages8 Grade - United States History Midterm Exam Study Guide: CCPS Skills and Processes Questionsdevinpage1No ratings yet

- Handbook of Revolutionary Warfare Kwame Nkrumah PDFDocument145 pagesHandbook of Revolutionary Warfare Kwame Nkrumah PDFDinesh100% (4)

- Leopold Ice Foia Black Lives Matter Protests UnredactedDocument8 pagesLeopold Ice Foia Black Lives Matter Protests UnredactedPaul WallNo ratings yet

- How Slavery and Freedom Developed in Early VirginiaDocument3 pagesHow Slavery and Freedom Developed in Early VirginiaCarl Churchill100% (1)

- American Mayors SurveyDocument22 pagesAmerican Mayors SurveyepraetorianNo ratings yet