Professional Documents

Culture Documents

Financing and valuation of M&A project

Uploaded by

Muhammad BilalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financing and valuation of M&A project

Uploaded by

Muhammad BilalCopyright:

Available Formats

0

Assignment # 2

FIN 711: Mergers & Acquisitions

Submitted to

Dr. Salim Batla

Submitted by

Amber Younas

Anum Malik

Haseeb Malik

Muhammad Iqrash Awan

Raima Sabeen

Tallat Mehmood

NUST Business School

1

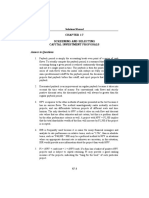

Q1: What is the value of the project assuming that the form was entirely equity financed?

What are the annual projected free cash flows? What discount rate is appropriate?

The discount rate for the firm is needed to compute the value of the firm. Since the project is all

equity financed, unlevered cost of equity is calculated using the following formula:

R

u

= R

I

u

(R

m

R

I

)

Wheie,

R

u

= 0nleveieu Cost of Equity

R

I

= Riskfiee Rate of Retuin

u

= 0nleveieu Beta

(R

m

R

]

) = 0nleveieu Cost of Equity

Inserting the values,

R

u

= S%+1.S 7.2%= 1S.8%

Thus, appropriate discount rate for the project is 15.8%.

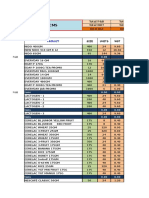

The free cash flows are calculated using the following formula:

FCF = EBIT(1 T) +Bepieciation Capital Expenuituies Change in Woiking Capital

Inserting values,

FCF

2002

= 12 +2uu Suu = $112

FCF

2003

= 81 +22S Suu = $6

FCF

2004

= 2u1 +2Su Suu = $1S1

FCF

2005

= SS9 +27S Suu = $S14

FCF

2006

= 48S +Suu Suu = $49S

Since the growth rate is constant from Year 2007 at 5% thus the horizon value is calculated

using the following formula:

Boiizon value of FCF

2006

=

49S (1 +u.uS)

(u.1S8 u.uS)

= $4812.S

2

Value of the project can now be computed as follow,

Ioluc o tc Pro]cct = 1Suu +

112

1u1S8

+

6

(1.1S8)

2

+

1S1

(1.1S8)

3

+

S14

(1.1S8)

4

+

49S +4812.S

(1.1S8)

5

Ioluc o tc Pro]cct = $1228.49

Q2: Value the project using the adjusted present value (APV) approach assuming that the

firm raise $750 thousand of debt to fund the project and keeps the level pf debt constant

in perpetuity.

We know,

API = PI o Cos Flows +PI o Iox SiclJ

We have already calculated,

PI o Cos Flows = $1228.49

Computing present value of tax shield using the following formula,

PI o Iox SiclJ =

k

d

I

k

d

= I = 7Su u.4u = $Suu

Where,

D = Debt

T = Corporate Tax Rate

Kd = Required Rate of Debt

Thus,

API = 1228.48 +Suu = $1S28.48

Q3: Value the project using the Weighted Average Cost of Capital (WACC) assuming the

firm maintains a constant 25% debt to value ratio in perpetuity?

If the firm maintains a constant debt to value ratio of 25% then WACC can be computed as

follows,

wACC = K

d

(1 t) w

d

+K

c

w

c

Since the firm is levered now thus required rate of return that is levered is now computed.

K

c

= R

+ [

c

(R

m

R

)

Where,

[

o

= [

J

w

J

+ [

c

w

c

3

[

c

=

[

o

[

J

w

J

w

c

=

1.5 (0.25 0.25)

0.75

= 1.92

Thus,

K

c

= 5%+ 1.92(7.2) = 15.12%

Pro]cct

i

s Ioluc = 1Suu +

112

1.1S12

+

6

(1.1S12)

2

+

1S1

(1.1S12)

3

+

S14

(1.1S12)

4

+

49S +S1SS.87

(1.1S12)

5

Pro]cct

i

s Ioluc = $147u

You might also like

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Corporate Finance Basics ExplainedDocument15 pagesCorporate Finance Basics Explainedakirocks71No ratings yet

- 03 Cash Flows and Investment DecisionDocument24 pages03 Cash Flows and Investment DecisionMofdy MinaNo ratings yet

- Acf302: Corporate Finance: Capital Budgeting and Valuation With Leverage - Part IDocument43 pagesAcf302: Corporate Finance: Capital Budgeting and Valuation With Leverage - Part IXue Meng LuNo ratings yet

- Internal Rate of ReturnDocument14 pagesInternal Rate of ReturnAnshul GuptaNo ratings yet

- Sampa VideoDocument24 pagesSampa VideoDaman Pathak100% (1)

- Internal Rate of ReturnDocument7 pagesInternal Rate of ReturnDeep DebnathNo ratings yet

- FFM 9 Im 13Document15 pagesFFM 9 Im 13Ernest NyangiNo ratings yet

- 03 Handout 144Document14 pages03 Handout 144John michael ServianoNo ratings yet

- Lecture No20Document14 pagesLecture No20Ali ShamsheerNo ratings yet

- Icfai P.A. IiDocument11 pagesIcfai P.A. Iiapi-3757629No ratings yet

- Seminar 5Document6 pagesSeminar 5vofmichiganrulesNo ratings yet

- NPV AND IRR INVESTMENT VALUATION CRITERIADocument49 pagesNPV AND IRR INVESTMENT VALUATION CRITERIAMihai StoicaNo ratings yet

- Calculating Project NPV and Investment ConsiderationsDocument14 pagesCalculating Project NPV and Investment ConsiderationsMaster's FameNo ratings yet

- Welcome: Selestian AugustinoDocument24 pagesWelcome: Selestian AugustinoDane Chybo TzNo ratings yet

- Dba 302 Accounting Rate of Return, NPV and Irr PresentationsDocument12 pagesDba 302 Accounting Rate of Return, NPV and Irr Presentationsmulenga lubembaNo ratings yet

- Lecture 1 Design EconomicsDocument62 pagesLecture 1 Design Economicsaku_laNo ratings yet

- Chapter 18 - Ç Æ¡Document14 pagesChapter 18 - Ç Æ¡張閔華No ratings yet

- Chapter 6 - Review of Capital Budgeting Techniques - Part 1Document10 pagesChapter 6 - Review of Capital Budgeting Techniques - Part 1Abdelrahman Maged0% (1)

- Online Corporate Finance I Practice Exam 1 SolutionDocument14 pagesOnline Corporate Finance I Practice Exam 1 SolutionTien DuongNo ratings yet

- BCC B Capital InvestmentDocument12 pagesBCC B Capital InvestmentNguyen Thi Tam NguyenNo ratings yet

- FIN322 Chapter 18 APV and WACCDocument6 pagesFIN322 Chapter 18 APV and WACCchi_nguyen_100No ratings yet

- CAPITAL BUDGETING by AriefDocument42 pagesCAPITAL BUDGETING by AriefariefNo ratings yet

- Chapter 7: NPV and Capital Budgeting: Assigned Problems Are 3, 7, 34, 36, and 41. Read Appendix ADocument8 pagesChapter 7: NPV and Capital Budgeting: Assigned Problems Are 3, 7, 34, 36, and 41. Read Appendix AmajorkonigNo ratings yet

- Project Selection Models and TechniquesDocument50 pagesProject Selection Models and TechniquesNeway Alem100% (1)

- 4.1 Net Present Value & Profitability Index. Feb 1-5Document12 pages4.1 Net Present Value & Profitability Index. Feb 1-5John Garcia100% (1)

- Topic02A Ch18 APV FTE 1aa 20155spring 1a PRINTDocument33 pagesTopic02A Ch18 APV FTE 1aa 20155spring 1a PRINTmeftahul arnobNo ratings yet

- Advanced ValuationDocument15 pagesAdvanced Valuationgiovanni lazzeriNo ratings yet

- WACC NTDocument40 pagesWACC NTHamid S. ParwaniNo ratings yet

- 5.1 Basic Methods For Eng'g Eco StudyDocument16 pages5.1 Basic Methods For Eng'g Eco StudyVinceNo ratings yet

- Business Finance Solutions WebVDocument10 pagesBusiness Finance Solutions WebVJosh LebetkinNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate Financelefteris82No ratings yet

- CHAPTER 17 - AnswerDocument7 pagesCHAPTER 17 - AnswerKlare HayeNo ratings yet

- CB and Cash Flow (FM Keown10e Chap10Document70 pagesCB and Cash Flow (FM Keown10e Chap10Hasrul HashomNo ratings yet

- Solutions: First Group Moeller-Corporate FinanceDocument13 pagesSolutions: First Group Moeller-Corporate FinancejwbkunNo ratings yet

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Document10 pagesCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashNo ratings yet

- 4 Internal Rate of ReturnDocument25 pages4 Internal Rate of ReturnAngel NaldoNo ratings yet

- Rate of ReturnDocument38 pagesRate of ReturnPraz AarashNo ratings yet

- CF2 - Chapter 3 Capital Budgeting - SVDocument26 pagesCF2 - Chapter 3 Capital Budgeting - SVleducNo ratings yet

- Kalyani Government Engineering CollegeDocument4 pagesKalyani Government Engineering CollegeArpan AdakNo ratings yet

- CH19Document8 pagesCH19Lyana Del Arroyo OliveraNo ratings yet

- Economics AssmDocument4 pagesEconomics AssmArpan AdakNo ratings yet

- Corporate Finance PDFDocument56 pagesCorporate Finance PDFdevNo ratings yet

- Module 6 IRR and Payback PeriodDocument13 pagesModule 6 IRR and Payback PeriodRhonita Dea AndariniNo ratings yet

- Investment CriteriaDocument27 pagesInvestment CriteriaCharu ModiNo ratings yet

- Extra Practice Exam 2 SolutionsDocument9 pagesExtra Practice Exam 2 SolutionsSteve SmithNo ratings yet

- Practical Task 3 PROBLEM SOLUTIONDocument7 pagesPractical Task 3 PROBLEM SOLUTIONTanya PribylevaNo ratings yet

- Project Management Assignment: Analyzing Software ProjectsDocument9 pagesProject Management Assignment: Analyzing Software ProjectssizzlacalunjiNo ratings yet

- Investment Analysis & Lockheed Case StudyDocument34 pagesInvestment Analysis & Lockheed Case StudyKshitij GuptaNo ratings yet

- APV Method FrameworkDocument17 pagesAPV Method FrameworkssinhNo ratings yet

- Cash Flows and Other Topics in Capital Budgeting Chap 10Document25 pagesCash Flows and Other Topics in Capital Budgeting Chap 10Allison EvangelistaNo ratings yet

- Capital BudgetingDocument5 pagesCapital Budgetingshafiqul84No ratings yet

- Step - Term AssignmentDocument8 pagesStep - Term Assignmentfarah tahirNo ratings yet

- Chapter # 07: Long Term Investment and Capital BudgetingDocument73 pagesChapter # 07: Long Term Investment and Capital BudgetingshakilhmNo ratings yet

- Financial Management Capital Budgeting Methods NPV IRR PaybackDocument46 pagesFinancial Management Capital Budgeting Methods NPV IRR Paybackj787No ratings yet

- Capital Budgeting Decisions: Key Terms and Concepts To KnowDocument17 pagesCapital Budgeting Decisions: Key Terms and Concepts To Knownisarg_No ratings yet

- UAS Menkeu Lanjutan - Michael Krisnaputra Sondakh - 205020200111045Document25 pagesUAS Menkeu Lanjutan - Michael Krisnaputra Sondakh - 205020200111045Michael SondakhNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Honda Case StudyDocument18 pagesHonda Case Studygouatm_infy100% (10)

- Walmart China CaseDocument4 pagesWalmart China CaseMuhammad Bilal100% (4)

- Engro ChemicalsDocument5 pagesEngro ChemicalsMuhammad BilalNo ratings yet

- TTS WorkingDocument4 pagesTTS WorkingMuhammad BilalNo ratings yet

- Why Cdos Failed:: Role of Credit Rating AgenciesDocument3 pagesWhy Cdos Failed:: Role of Credit Rating AgenciesMuhammad BilalNo ratings yet

- Sony (Regeneration)Document5 pagesSony (Regeneration)Muhammad BilalNo ratings yet

- Product: Total F&B Total F&B Total NUT Total NUT Total BIZ Total BIZDocument15 pagesProduct: Total F&B Total F&B Total NUT Total NUT Total BIZ Total BIZMuhammad BilalNo ratings yet

- Corporate Finance Chapter8Document32 pagesCorporate Finance Chapter8AmnyCruzadoTorresNo ratings yet

- TWS 1Document582 pagesTWS 1Muhammad BilalNo ratings yet

- 6/20/2015 Brand Mop in Lit/Kg Rs Per Lit/Kg Total Budget Sale Milkpak 100,000 1.4 Nesvita NFV NesfrutaDocument4 pages6/20/2015 Brand Mop in Lit/Kg Rs Per Lit/Kg Total Budget Sale Milkpak 100,000 1.4 Nesvita NFV NesfrutaMuhammad BilalNo ratings yet

- Wumart Stores - China's Response To Wal-MartDocument1 pageWumart Stores - China's Response To Wal-MartMuhammad Bilal0% (1)

- Risk and ContingenciesDocument4 pagesRisk and ContingenciesMuhammad BilalNo ratings yet

- National University of Sciences and Technology NUST Business SchoolDocument1 pageNational University of Sciences and Technology NUST Business SchoolMuhammad BilalNo ratings yet

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87No ratings yet

- Michelin in The Land of The MaharajasDocument4 pagesMichelin in The Land of The MaharajasMuhammad BilalNo ratings yet

- Problems CH 2 (B) MuhammadBilalDocument20 pagesProblems CH 2 (B) MuhammadBilalMuhammad BilalNo ratings yet

- Why Cdos Failed:: Role of Credit Rating AgenciesDocument3 pagesWhy Cdos Failed:: Role of Credit Rating AgenciesMuhammad BilalNo ratings yet

- Critical Chain Project Management Techniques ExplainedDocument33 pagesCritical Chain Project Management Techniques ExplainedMuhammad BilalNo ratings yet

- Lecture 5Document25 pagesLecture 5Muhammad BilalNo ratings yet

- Critical ChainDocument16 pagesCritical ChainMuhammad BilalNo ratings yet

- Sampa Video: Project ValuationDocument18 pagesSampa Video: Project Valuationkrissh_87No ratings yet

- Compiled - Critical ChainDocument21 pagesCompiled - Critical ChainMuhammad BilalNo ratings yet

- Assignment 1Document9 pagesAssignment 1Muhammad BilalNo ratings yet

- 29 Oct SolutionDocument9 pages29 Oct SolutionMuhammad BilalNo ratings yet

- Otd Term ProjectDocument10 pagesOtd Term ProjectMuhammad BilalNo ratings yet

- Car Loan Analysis Worksheet: Purchase PriceDocument2 pagesCar Loan Analysis Worksheet: Purchase PriceMuhammad BilalNo ratings yet

- OTDDocument7 pagesOTDMuhammad BilalNo ratings yet

- Productivity ExercisesDocument1 pageProductivity ExercisesMuhammad BilalNo ratings yet

- WSJ Story - Nokia's Supply Chain ShockDocument6 pagesWSJ Story - Nokia's Supply Chain ShockMuhammad BilalNo ratings yet

- Financial Management NotesDocument48 pagesFinancial Management NotesnajibMahmudNo ratings yet

- ASEAN Integration and Federalism AdvantagesDocument7 pagesASEAN Integration and Federalism AdvantagesJuan de GuiaNo ratings yet

- Macroeconomic Analysis For DenmarkDocument8 pagesMacroeconomic Analysis For DenmarkBozinoskaSNo ratings yet

- Financial Wellness and LiteracyDocument28 pagesFinancial Wellness and LiteracyRio AlbaricoNo ratings yet

- Chapter 20 - The Exchange Rate System and The Balance of Payments (Part 2)Document8 pagesChapter 20 - The Exchange Rate System and The Balance of Payments (Part 2)ohyeajcrocksNo ratings yet

- Chapter 10 Question 1 and 2Document7 pagesChapter 10 Question 1 and 2Francien BaileyNo ratings yet

- The Basic New Keynesian Model - Drago BergholtDocument136 pagesThe Basic New Keynesian Model - Drago BergholtplxnospamNo ratings yet

- 2013 Review & 2014 OutlookDocument21 pages2013 Review & 2014 OutlookJohn CuthbertNo ratings yet

- DATA INTERPRETATION - OdtDocument6 pagesDATA INTERPRETATION - OdtAbhay DabhadeNo ratings yet

- Nafta Vs UeDocument10 pagesNafta Vs UenicoletaNo ratings yet

- 2016 No Bull Review AP Econ (Published)Document196 pages2016 No Bull Review AP Econ (Published)ManasNo ratings yet

- Italian Purchase VAT RegisterDocument9 pagesItalian Purchase VAT RegisterArcotsinghNo ratings yet

- Calculation MacroDocument19 pagesCalculation Macromolla mengeshaNo ratings yet

- Demo Quiz - Key Macroeconomic ConceptsDocument10 pagesDemo Quiz - Key Macroeconomic ConceptsRohit GuptaNo ratings yet

- Y V Reddy: Indian Economy - Current Status and Select IssuesDocument3 pagesY V Reddy: Indian Economy - Current Status and Select IssuesSreekanth ReddyNo ratings yet

- Sample Test For Chapter 1Document40 pagesSample Test For Chapter 1Ha KimNo ratings yet

- Free Trade Vs Protection EconomicsDocument40 pagesFree Trade Vs Protection EconomicsRehan MistryNo ratings yet

- What Is Suppressed InflationDocument4 pagesWhat Is Suppressed InflationDrRishikesh KumarNo ratings yet

- Principles of Macroeconomics Practice AssignmentDocument4 pagesPrinciples of Macroeconomics Practice AssignmentAnonymous xUb9GnoFNo ratings yet

- Globalization and Its DiscontentsDocument6 pagesGlobalization and Its DiscontentsNazish SohailNo ratings yet

- International Marketing (TYBMS - Sem 6) : For Private Circulation OnlyDocument20 pagesInternational Marketing (TYBMS - Sem 6) : For Private Circulation OnlyPriteshPanchal100% (1)

- Ito Na Talaga Totoo Pramis Teksman Mamatay Man-2Document11 pagesIto Na Talaga Totoo Pramis Teksman Mamatay Man-2ReveRieNo ratings yet

- W16 ADMS 4562 Assignment 2Document6 pagesW16 ADMS 4562 Assignment 2vyaskush100% (1)

- Understanding Unemployment in PakistanDocument9 pagesUnderstanding Unemployment in Pakistanareesha farooqiNo ratings yet

- End of BipolarityDocument2 pagesEnd of Bipolarityashish aroraNo ratings yet

- International Monetary Fund: Articles of Agreement, and Began Operations On March 1, 1947. (Note: There Are 184 MemberDocument6 pagesInternational Monetary Fund: Articles of Agreement, and Began Operations On March 1, 1947. (Note: There Are 184 MemberSohaib AshfaqNo ratings yet

- Notes On WTO (World Trade Organization)Document3 pagesNotes On WTO (World Trade Organization)Anand Verma0% (1)

- The Nazi Blueprint for a United Europe: The 1942 Seminars on the European Economic CommunityDocument122 pagesThe Nazi Blueprint for a United Europe: The 1942 Seminars on the European Economic CommunityAlex Diam100% (1)

- Security Rmc39 07Document2 pagesSecurity Rmc39 07Printet08No ratings yet

- Broadway Motors Vs NLRCDocument1 pageBroadway Motors Vs NLRCida_chua8023No ratings yet