Professional Documents

Culture Documents

Leasing Questions

Uploaded by

Aarti GuptaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Leasing Questions

Uploaded by

Aarti GuptaCopyright:

Available Formats

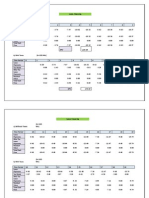

Beginning LOAN PAYMENT SCHEDULE 800 658.08 507.6448 348.183488 179.

1544973

Instalment 189.92 189.92 189.92 189.92 189.92

Principal

Interest End 141.92 48 658.08 150.4352 39.4848 507.6448 159.461312 30.45869 348.1835 169.0289907 20.89101 179.1545 179.1707302 10.74927 0

Lease Tax After Tax Lease LEASE COST

1 237.4 113.952 123.448 Rs. 467.97 1 189.92 -21.6 -90 78.32 Rs. 316.33 200 Rs. 516.33

2 237.4 113.952 123.448

3 237.4 113.952 123.448

4 237.4 113.952 123.448

5 237.4 113.952 123.448

INSTALMENT TAX ADVTG ON INT. TAX ADVTG ON DEP. NET CF

2 189.92 -17.76816 -90 82.15184

3 4 5 189.92 189.92 189.92 -13.7064096 -9.40095 -4.83717 -90 -90 -90 86.2135904 90.51905 95.08283

Kd 3.3

Ke 11

K 14.3

to be checked

cost of mc revenue op expense dep. after tax cf add dep net cf npv

0 -6000

1 4000 -1000 -1800 1200 840 1800 2640

2 4000 -1000 -1800 1200 840 1800 2640

3 4000 -1000 -1800 1200 840 600 1800 3240

-6000 Rs. 7,016.08 1016.07814 leasing 1

2 4000 -2500 -800 700 490

3 4000 -2500 -800 700 490

revenue lease payment op expense after tax cf net cf

4000 -2500 -800 700 490 Rs. 1,176.90

490 1.12 1 437.5 490

490 1.2544 1.12 390.625 437.5 490 1.404928 1.2544 348.7723 390.625

NAL Beneits from Leasing Benefits Investment cost Tax shield on lease payment NPV Tax shield on operating cost NPV op cost under buy NPV Sum NPV Cost of Leasing lease rentals NPV dep shield NPV salvage NPV pv of tax shiels operating cost under buy NPV op cost NPV Sum( 2500 $6,004.58 540 $1,342.90 600 $545.45 300 $746.06 800 $1,921.47 $10,560.45 800 800 300 300 540 540 2500 2500 (revenue cancels from both side) 0 6000 $1,801.37 240 $576.44 1000 $2,486.85 10865 1000 1000 240 240 1 750 2 750 3 750

Net advantage

304.211543511095

Operating 0 Net Operating cash Lease Payment Net Profit Tax Profit after tax NPV Buy Total loan amount Loan Payment schedule Beginning Instalment Principal Interest End 15000 3750 2550 1200 12450 12450 3771 2775 996 9675 9675 3749 2975 774 6700 6700 3736 3200 536 3500 3500 3780 3500 280 0 0 Net operating cash Depreciation Interest Salvage profit PBT Tax PAT Depreciation addback Principal repaid final sum NPV 1 5000 3000 1200 800 320 480 3000 2550 930 $3,386.82 2 5000 3000 996 1004 401.6 602.4 3000 2775 827.4 3 5000 3000 774 1226 490.4 735.6 3000 2975 760.6 4 5000 3000 536 1464 585.6 878.4 3000 3200 678.4 5 5000 3000 280 2100 3820 1528 2292 3000 3500 1792 1 5000 4200 800 320 480 2 5000 4200 800 320 480 3 5000 4200 800 320 480 4 5000 4200 800 320 480 5 5000 4200 800 320 480

$1,688.27

6750

LOAN PAYMENT SCHEDULE

1200

15000

5000

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Managerial Economics: An Analysis of Business IssuesDocument23 pagesManagerial Economics: An Analysis of Business IssuesAarti GuptaNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Assignment SPM Case1Document5 pagesAssignment SPM Case1Aarti GuptaNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sales Promotion Management-Course Outline July 2013Document2 pagesSales Promotion Management-Course Outline July 2013Aarti GuptaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Corp Comm & Crisis Mgmt. 7cs General Comm Letters/ Reports/ Messages Cross Cultural Comm Oral CommDocument1 pageCorp Comm & Crisis Mgmt. 7cs General Comm Letters/ Reports/ Messages Cross Cultural Comm Oral CommAarti GuptaNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- National Railroad Passenger CorporationDocument10 pagesNational Railroad Passenger CorporationAarti GuptaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Economies of Scale & Scope: A Comprehensive AnalysisDocument5 pagesEconomies of Scale & Scope: A Comprehensive AnalysisAarti GuptaNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- ReferencesDocument1 pageReferencesAarti GuptaNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Inside The House of MoneyDocument3 pagesInside The House of Moneyvlx82No ratings yet

- Moving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingDocument1 pageMoving To Portugal, Buy Property, Portugal, d7 Visa, RelocatingAshraful IslamNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Saptagiri Grameena Bank:: Head Office:: Chittoor Saptagiri Grameena Bank:: Head Office:: ChittoorDocument10 pagesSaptagiri Grameena Bank:: Head Office:: Chittoor Saptagiri Grameena Bank:: Head Office:: ChittoornanubalajagadeeshNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Macro Curriculum Changes 2023 Part 2Document6 pagesMacro Curriculum Changes 2023 Part 2Al VelNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Axiss BankDocument10 pagesAxiss BankMoghAKaranNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Interest Rate Swap DiagramDocument1 pageInterest Rate Swap DiagramTheGreatDealerNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Amalgamation of Global Trust Bank With UTI and Oriental Bank of CommerceDocument16 pagesAmalgamation of Global Trust Bank With UTI and Oriental Bank of CommerceGunjan DhingraNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- DownloadDocument9 pagesDownloadKamran RahimiNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Lesson 1: Concept and Functions of MoneyDocument31 pagesLesson 1: Concept and Functions of MoneyFind DeviceNo ratings yet

- Tutorial 5Document1 pageTutorial 5easoncho29No ratings yet

- MCQ - Negotiable Instruments PDFDocument9 pagesMCQ - Negotiable Instruments PDFErika LanezNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Balance Sheet Items For CIBDocument1 pageThe Balance Sheet Items For CIBKhalid Al SanabaniNo ratings yet

- Private Placement Trade Programs ExplainedDocument18 pagesPrivate Placement Trade Programs ExplainedMike Weiner100% (6)

- Home Office and Branch Accounting Special ProceduresDocument17 pagesHome Office and Branch Accounting Special ProceduresOrnica BalesNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Ummati White PaperDocument13 pagesUmmati White PaperIbrahim Abu SammyNo ratings yet

- WaerDocument13 pagesWaerdasmaguero4lgNo ratings yet

- Pioneer Invest Corp - Harshit TaunkDocument40 pagesPioneer Invest Corp - Harshit Taunkrjain_112No ratings yet

- Globalinvestmentfunds Annualreport 706Document368 pagesGlobalinvestmentfunds Annualreport 706xuhaibimNo ratings yet

- Risk Management Solution Chapters Seven-EightDocument9 pagesRisk Management Solution Chapters Seven-EightBombitaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- 2012-06 CFA L2 100 ForecastDocument236 pages2012-06 CFA L2 100 ForecastAfaque Mehmood Memon100% (3)

- Mathematics 8300/2F: Foundation Tier Paper 2 CalculatorDocument31 pagesMathematics 8300/2F: Foundation Tier Paper 2 CalculatorT SolomonNo ratings yet

- In This Report, We Discuss Recent Changes in The Credit Quality ofDocument15 pagesIn This Report, We Discuss Recent Changes in The Credit Quality ofbekarareNo ratings yet

- MS Excel Cheat SheetDocument1,023 pagesMS Excel Cheat SheetxdoubledutchessNo ratings yet

- PNB v. Natl City Bank of NYDocument19 pagesPNB v. Natl City Bank of NYAndrea RioNo ratings yet

- MBL922N 2013 6 E 1 - TestDocument16 pagesMBL922N 2013 6 E 1 - Testeugene123100% (1)

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- Chapter - 1: 1.1 OverviewDocument33 pagesChapter - 1: 1.1 OverviewAshish KotianNo ratings yet

- FX Markets Weekly: The Upcoming Presidential Election in France (Raphael Brun-Aguerre)Document44 pagesFX Markets Weekly: The Upcoming Presidential Election in France (Raphael Brun-Aguerre)nosternosterNo ratings yet

- Knowledge Is Power - Finacle Knowledge To Bankers PDFDocument6 pagesKnowledge Is Power - Finacle Knowledge To Bankers PDFRajendraYadavNo ratings yet

- Bofa Approval LetterDocument3 pagesBofa Approval LetterSteve Mun GroupNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)