Professional Documents

Culture Documents

Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To Verizon

Uploaded by

venkeeeeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Net Income Attributable To Noncontrolling Interest Net Income (Loss) Attributable To Verizon

Uploaded by

venkeeeeeCopyright:

Available Formats

Verizon Communications Inc.

Condensed Consolidated Statements of Income

(dollars in millions, except per share amounts)

Unaudited

3 Mos. Ended 12/31/09

3 Mos. Ended 12/31/08

% Change

12 Mos. Ended 12/31/09

12 Mos. Ended 12/31/08

% Change

Operating Revenues Operating Expenses Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Equity in earnings of unconsolidated businesses Other income and (expense), net Interest expense Income Before Provision for Income Taxes Income tax (provision)/benefit Net income

27,091

24,645

9.9

107,808

97,354

10.7

12,514 9,407 4,241 26,162 929 131 13 (686) 387 714 1,101 1,754 (653) 1,101

9,976 7,090 3,747 20,813 3,832 109 62 (517) 3,486 (555) 2,931 1,696 1,235 2,931

25.4 32.7 13.2 25.7 (75.8) 20.2 (79.0) 32.7 (88.9) * (62.4) 3.4 * (62.4)

44,299 32,950 16,532 93,781 14,027 553 90 (3,102) 11,568 (1,210) 10,358 6,707 3,651 10,358

39,007 26,898 14,565 80,470 16,884 567 282 (1,819) 15,914 (3,331) 12,583 6,155 6,428 12,583

13.6 22.5 13.5 16.5 (16.9) (2.5) (68.1) 70.5 (27.3) (63.7) (17.7) 9.0 (43.2) (17.7)

Net income attributable to noncontrolling interest Net income (loss) attributable to Verizon

Net Income Basic Earnings per Common Share Net income attributable to Verizon Weighted average number of common shares (in millions) Diluted Earnings per Common Share Net income attributable to Verizon

(1)

(.23) 2,841

.43 2,841

1.29 2,841

2.26 2,849

(42.9)

(.23)

.43

1.29

2.26

(42.9)

Weighted average number of common shares-assuming dilution (in millions)

2,841

2,841

2,841

2,850

Footnotes:

(1) Diluted Earnings per Share includes the dilutive effect of shares issuable under our stock-based compensation plans, which represents the only potential dilution. * Not meaningful

Verizon Communications Inc. Condensed Consolidated Statements of Income Before Special Items

(dollars in millions, except per share amounts)

Unaudited

3 Mos. Ended 12/31/09

3 Mos. Ended 12/31/08

% Change

12 Mos. Ended 12/31/09

12 Mos. Ended 12/31/08

% Change

Operating Revenues (1) Domestic Wireless Wireline Other Total Operating Revenues Operating Expenses (1) Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Operating income impact of divested operations (1) Equity in earnings of unconsolidated businesses Other income and (expense), net Interest expense Income Before Provision for Income Taxes Provision for income taxes Net Income Before Special Items

15,732 11,456 (97) 27,091

12,846 11,917 (118) 24,645

22.5 (3.9) (17.8) 9.9

62,131 46,080 (403) 107,808

49,332 48,214 (450) 97,096

25.9 (4.4) (10.4) 11.0

11,004 7,341 4,156 22,501 4,590 131 13 (686) 4,048 (712) 3,336 1,810 1,526 3,336

9,905 6,417 3,747 20,069 4,576 109 110 (517) 4,278 (855) 3,423 1,698 1,725 3,423

11.1 14.4 10.9 12.1 0.3 20.2 (88.2) 32.7 (5.4) (16.7) (2.5) 6.6 (11.5) (2.5)

42,622 29,491 16,215 88,328 19,480 553 92 (2,847) 17,278 (3,367) 13,911 7,106 6,805 13,911

38,801 25,723 14,505 79,029 18,067 44 567 330 (1,819) 17,189 (3,797) 13,392 6,157 7,235 13,392

9.8 14.6 11.8 11.8 7.8 (100.0) (2.5) (72.1) 56.5 0.5 (11.3) 3.9 15.4 (5.9) 3.9

Net income attributable to noncontrolling interest Net income attributable to Verizon

Net Income Before Special Items Basic Adjusted Earnings per Common Share Net income attributable to Verizon Weighted average number of common shares (in millions) Diluted Adjusted Earnings per Common Share Net income attributable to Verizon Weighted average number of common shares-assuming dilution (in millions)

(2)

.54 2,841

.61 2,841

(11.5)

2.40 2,841

2.54 2,849

(5.5)

.54

.61

(11.5)

2.40

2.54

(5.5)

2,841

2,841

2,841

2,850

Footnotes:

(1) Reclassifications of prior period amounts have been made, where appropriate, to reflect comparable operating results for the spin-off of the wireline segment's non-strategic local exchange and related business assets in Maine, New Hampshire and Vermont in the first quarter of 2008. Reclassifications were determined using specific information where available and allocations where data is not maintained on a state-specific basis within the Company's books and records as follows: Revenues Expenses $ $ $ $ $ $ $ $ 258 214

(2) Diluted Earnings per Share includes the dilutive effect of shares issuable under our stock-based compensation plans, which represents the only potential dilution.

Verizon Communications Inc. Condensed Consolidated Statements of Income - Reconciliations

(dollars in millions, except per share amounts)

Special and Non-Recurring Items 3 Mos. Ended 12/31/09 Reported (GAAP) Merger Integration and Acquisition Costs Severance, Pension and Benefit Charges Access Line SpinOff and Other Charges 3 Mos. Ended 12/31/09 Before Special Items

Unaudited

Operating Revenues Operating Expenses Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Equity in earnings of unconsolidated businesses Other income and (expense), net Interest expense Income Before Provision for Income Taxes Income tax (provision)/benefit Net income

27,091 12,514 9,407 4,241 26,162 929 131 13 (686) 387 714 1,101

(31) (134) (85) (250) 250 -

(1,444) (1,576) (3,020) 3,020 -

(35) (356) (391) 391 -

27,091 11,004 7,341 4,156 22,501 4,590 131 13 (686) 4,048 (712) 3,336 1,810 1,526 3,336

250 (123) 127 $ 56 71 127

3,020 (1,158) 1,862 $ 1,862 1,862

391 (145) 246 $ 246 246

Net income attributable to noncontrolling interest Net income (loss) attributable to Verizon

Net income Basic Earnings per Common Share Net income attributable to Verizon

(1)

1,754 (653) 1,101 $

$

(1)

(.23) $

.02

.66

.09

.54

Diluted Earnings per Common Share Net income attributable to Verizon

(.23) $

.02

.66

.09

.54

(dollars in millions, except per share amounts)

Special and Non-Recurring Items 3 Mos. Ended 12/31/08 Reported (GAAP) Merger Integration Costs 3 Mos. Ended 12/31/08 Severance, Pension and Investment- Related Before Special Benefit Charges Charges Items

Unaudited

Operating Revenues Operating Expenses Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Equity in earnings of unconsolidated businesses Other income and (expense), net Interest expense Income Before Provision for Income Taxes Provision for income taxes Net income

24,645

24,645

9,976 7,090 3,747 20,813 3,832 109 62 (517) 3,486 (555) 2,931 $ 1,696 1,235 2,931

(6) (53) (59) 59 59 (22) 37 $ 2 35 37

(65) (620) (685) 685 685 (261) 424 $ 424 424

48 48 (17) 31 $ 31 31

9,905 6,417 3,747 20,069 4,576 109 110 (517) 4,278 (855) 3,423 1,698 1,725 3,423

Net income attributable to noncontrolling interest Net income attributable to Verizon

Net income Basic Earnings per Common Share Net income attributable to Verizon Diluted Earnings per Common Share Net income attributable to Verizon Footnote: (1) EPS totals may not add due to rounding.

Note: See www.verizon.com/investor for a reconciliation of other non-GAAP measures.

(1) (1)

.43

.01

.15

.01

.61

.43

.01

.15

.01

.61

Verizon Communications Inc. Condensed Consolidated Statements of Income - Reconciliations

(dollars in millions, except per share amounts)

Special and Non-Recurring Items 12 Mos. Ended 12/31/09 Reported (GAAP) Merger Integration Severance, Pension Access Line Spinand Acquisition and Benefit Off and Other Costs Charges Charges 12 Mos. Ended 12/31/09 Before Special Items

Unaudited

Operating Revenues Operating Expenses Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Equity in earnings of unconsolidated businesses Other income and (expense), net Interest expense Income Before Provision for Income Taxes Provision for income taxes Net income

107,808 44,299 32,950 16,532 93,781 14,027 553 90 (3,102)

(195) (442) (317) (954) 954 2 255

(1,444) (2,602) (4,046) 4,046 -

(38) (415) (453) 453 -

107,808 42,622 29,491 16,215 88,328 19,480 553 92 (2,847) 17,278 (3,367) 13,911 7,106 6,805 13,911

11,568 (1,210) 10,358 $ 6,707 3,651 10,358

1,211 (432) 779 $ 399 380 779

4,046 (1,559) 2,487 $ 2,487 2,487

453 (166) 287 $ 287 287

Net income attributable to noncontrolling interest Net income attributable to Verizon

Net income Basic Earnings per Common Share Net income attributable to Verizon

(1)

$

(1)

1.29

.13

.88

.10

2.40

Diluted Earnings per Common Share Net income attributable to Verizon

1.29

.13

.88

.10

2.40

(dollars in millions, except per share amounts)

Special and Non-Recurring Items 12 Mos. Ended 12/31/08 Reported (GAAP) Access Line SpinOff Related Charges Severance, Pension and Benefit Charges Impact of Divested Operations 12 Mos. Ended 12/31/08 Before Special Items

Unaudited

Merger Integration Costs

InvestmentRelated Charges

Operating Revenues Operating Expenses Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Operating income impact of divested operations Equity in earnings of unconsolidated businesses Other income and (expense), net Interest expense Income Before Provision for Income Taxes Provision for income taxes Net income

97,354 39,007 26,898 14,565 80,470 16,884 567 282 (1,819)

(24) (150) (174) 174 -

(16) (87) (103) 103 -

48 -

(65) (885) (950) 950 -

(258) $ (101) (53) (60) (214) (44) 44 -

97,096 38,801 25,723 14,505 79,029 18,067 44 567 330 (1,819) 17,189 (3,797) 13,392 6,157 7,235 13,392

15,914 (3,331) 12,583 $ 6,155 6,428 12,583

174 (65) 109 $ 2 107 109

103 (22) 81 $ 81 81

48 (17) 31 $ 31 31

950 (362) 588 $ 588 588

Net income attributable to noncontrolling interest Net income attributable to Verizon

Net income Basic Earnings per Common Share Net income attributable to Verizon

(1)

$

(1)

2.26

.03

.03

.01

.21

2.54

Diluted Earnings per Common Share Net income attributable to Verizon Footnote: (1) EPS totals may not add due to rounding.

2.26

.03

.03

.01

.21

2.54

Note: See www.verizon.com/investor for a reconciliation of other non-GAAP measures.

Verizon Communications Inc. Selected Financial and Operating Statistics

(dollars in millions, except per share amounts) Unaudited

(1)

12/31/09

12/31/08

Debt to debt and Verizon's equity ratio-end of period Book value per common share

(1)

59.9% $ 14.67 $

55.5% 14.68

Common shares outstanding (in millions) End of period Total employees

2,836 222,927

2,841 223,880

Unaudited

3 Mos. Ended 12/31/09

3 Mos. Ended 12/31/08

12 Mos. Ended 12/31/09

12 Mos. Ended 12/31/08

Capital expenditures (including capitalized software) Domestic Wireless Wireline Other Total

2,018 2,278 301 4,597

1,787 2,479 397 4,663

7,152 8,892 1,003 17,047

6,510 9,797 931 17,238

Cash dividends declared per common share

0.475

0.460

1.870

1.780

Footnote: (1) Calculations are based on the equity position attributable to Verizon, which excludes noncontrolling interests.

Verizon Communications Inc. Condensed Consolidated Balance Sheets

(dollars in millions) Unaudited

12/31/09

12/31/08

$ Change

Assets Current assets Cash and cash equivalents Short-term investments Accounts receivable, net Inventories Prepaid expenses and other Total current assets Plant, property and equipment Less accumulated depreciation Investments in unconsolidated businesses Wireless licenses Goodwill Other intangible assets, net Other investments Other assets Total Assets Liabilities and Equity Current liabilities Debt maturing within one year Accounts payable and accrued liabilities Other Total current liabilities Long-term debt Employee benefit obligations Deferred income taxes Other liabilities Equity Common stock Contributed capital Reinvested earnings Accumulated other comprehensive loss Common stock in treasury, at cost Deferred compensation - employee stock ownership plans and other Noncontrolling interest Total equity Total Liabilities and Equity

2,009 490 12,573 2,289 5,247 22,608 228,518 137,052 91,466 3,535 72,067 22,472 6,764 8,339 227,251

9,782 509 11,703 2,092 1,989 26,075 215,605 129,059 86,546 3,393 61,974 6,035 5,199 4,781 8,349 202,352

(7,773) (19) 870 197 3,258 (3,467) 12,913 7,993 4,920 142 10,093 16,437 1,565 (4,781) (10) 24,899

7,205 15,223 6,708 29,136 55,051 32,622 19,310 6,765

4,993 13,814 7,099 25,906 46,959 32,512 11,769 6,301

2,212 1,409 (391) 3,230 8,092 110 7,541 464

297 40,108 17,592 (11,479) (5,000) 88 42,761 84,367 227,251

297 40,291 19,250 (13,372) (4,839) 79 37,199 78,905 202,352

(183) (1,658) 1,893 (161) 9 5,562 5,462 24,899

The unaudited consolidated balance sheets are based on preliminary information.

Verizon Communications Inc. Condensed Consolidated Statements of Cash Flows

(dollars in millions)

Unaudited

12 Mos. Ended 12/31/09

12 Mos. Ended 12/31/08

$ Change

Cash Flows From Operating Activities Net income Adjustments to reconcile net income to net cash provided by operating activities: Depreciation and amortization expense Employee retirement benefits Deferred income taxes Provision for uncollectible accounts Equity in earnings of unconsolidated businesses, net of dividends received Changes in current assets and liabilities, net of effects from acquisition/disposition of businesses Other, net Net cash provided by operating activities Cash Flows From Investing Activities Capital expenditures (including capitalized software) Acquisitions of licenses, investments and businesses, net of cash acquired Net change in short-term investments Other, net Net cash used in investing activities Cash Flows From Financing Activities Proceeds from long-term borrowings Repayments of long-term borrowings and capital lease obligations Increase (decrease) in short-term obligations, excluding current maturities Dividends paid Proceeds from sale of common stock Purchase of common stock for treasury Other, net Net cash provided by (used in) financing activities Increase (decrease) in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, end of period

10,358

12,583

(2,225)

16,532 5,095 1,384 1,306 389 (2,511) (988) 31,565

14,565 1,955 2,183 1,085 212 (3,033) (1,993) 27,557

1,967 3,140 (799) 221 177 522 1,005 4,008

(17,047) (5,958) 84 (410) (23,331)

(17,238) (15,904) 1,677 (114) (31,579)

191 9,946 (1,593) (296) 8,248

12,040 (19,260) (1,652) (5,271) (1,864) (16,007) (7,773) 9,782 2,009

21,598 (4,146) 2,389 (4,994) 16 (1,368) (844) 12,651 8,629 1,153 9,782

(9,558) (15,114) (4,041) (277) (16) 1,368 (1,020) (28,658) (16,402) 8,629 (7,773)

Verizon Communications Inc. Verizon Wireless Selected Financial Results

(dollars in millions) Unaudited

3 Mos. Ended 12/31/09

3 Mos. Ended 12/31/08

% Change

12 Mos. Ended 12/31/09

12 Mos. Ended 12/31/08

% Change

Revenues Service revenues Equipment and other Total Revenues Operating Expenses Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Operating Income Margin

13,548 2,184 15,732

11,063 1,783 12,846

22.5 22.5 22.5

53,497 8,634 62,131

42,635 6,697 49,332

25.5 28.9 25.9

5,239 4,396 1,796 11,431 $ 4,301 27.3% $

4,153 3,467 1,416 9,036 3,810 29.7%

26.1 26.8 26.8 26.5 12.9 $

19,749 17,847 7,030 44,626 17,505 28.2% $

15,660 14,273 5,405 35,338 13,994 28.4%

26.1 25.0 30.1 26.3 25.1

Verizon Communications Inc. Verizon Wireless Selected Operating Statistics

(numbers in thousands) Unaudited

12/31/09

12/31/08

% Change

Total Customers Retail Customers

91,249 87,523

72,056 70,021

26.6 25.0

3 Mos. Ended

Unaudited

3 Mos. Ended 12/31/08 % Change

12 Mos. Ended 12/31/09

12 Mos. Ended 12/31/08 % Change

12/31/09

(1)

Total Customer net adds in period Retail Customer net adds in period (2) Total churn rate Retail churn rate

2,236 1,232 1.42% 1.44%

1,248 1,214 1.35% 1.34%

79.2 1.5

19,193 17,502 1.44% 1.44%

6,349 6,286 1.25% 1.24%

* *

Footnotes:

(1) Includes acquisitions and adjustments of 46, 646 and (122) customers in the second, third and fourth quarter of 2008, respectively; and 13,219, 1, 79 and 20 customers in the first, second, third and fourth quarter of 2009, respectively. (2) Includes acquisitions and adjustments of 46, 627 and (139) customers in the second, third and fourth quarter of 2008, respectively; and 12,813, 1, 81 and 20 customers in the first, second, third and fourth quarter of 2009, respectively. The segment financial results above are adjusted to exclude the effects of special and non-recurring items. The company's chief decision maker excludes these items in assessing business unit performance, primarily due to their non-operational nature. Intersegment transactions have not been eliminated. Certain reclassifications have been made, where appropriate, to reflect comparable operating results. * Not meaningful

Verizon Communications Inc. Wireline Selected Financial Results

(dollars in millions) Unaudited

3 Mos. Ended 12/31/09

3 Mos. Ended 12/31/08 % Change

12 Mos. Ended 12/31/09

12 Mos. Ended 12/31/08 % Change

Wireline Operating Revenues Mass Markets Global Enterprise Global Wholesale Other Total Operating Revenues Operating Expenses Cost of services and sales Selling, general & administrative expense Depreciation and amortization expense Total Operating Expenses Operating Income Operating Income Margin

4,925 3,744 2,413 374 11,456

4,969 3,921 2,528 499 11,917

(0.9) (4.5) (4.5) (25.1) (3.9)

19,755 14,988 9,637 1,700 46,080

19,799 15,779 10,360 2,276 48,214

(0.2) (5.0) (7.0) (25.3) (4.4)

6,094 2,726 2,345 11,165 $ 291 $ 2.5%

6,041 2,854 2,309 11,204 713 6.0%

0.9 (4.5) 1.6 (0.3) (59.2) $

24,144 10,833 9,122 44,099 1,981 4.3% $

24,274 11,047 9,031 44,352 3,862 8.0%

(0.5) (1.9) 1.0 (0.6) (48.7)

Verizon Communications Inc. Wireline Selected Operating Statistics

(numbers in thousands) Unaudited

12/31/09

12/31/08 % Change

Switched access lines in service Total Residence (includes Primary residence) Primary residence Business Public Total Broadband connections FiOS Internet Subscribers FiOS TV Subscribers

18,373 16,231 14,008 180 32,561 9,220 3,433 2,861

20,956 18,083 14,966 239 36,161 8,673 2,481 1,918

(12.3) (10.2) (6.4) (24.7) (10.0) 6.3 38.4 49.2

Footnotes:

The segment financial results above are adjusted to exclude the effects of special and non-recurring items. The company's chief decision maker excludes these items in assessing business unit performance, primarily due to their non-operational nature. Intersegment transactions have not been eliminated. Certain reclassifications have been made, where appropriate, to reflect comparable operating results.

You might also like

- Condensed Consolidated Statements of IncomeDocument7 pagesCondensed Consolidated Statements of IncomevenkeeeeeNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- 2010 Ibm StatementsDocument6 pages2010 Ibm StatementsElsa MersiniNo ratings yet

- Macys 2011 10kDocument39 pagesMacys 2011 10kapb5223No ratings yet

- Att Ar 2012 ManagementDocument35 pagesAtt Ar 2012 ManagementDevandro MahendraNo ratings yet

- Citigroup Q4 2012 Financial SupplementDocument47 pagesCitigroup Q4 2012 Financial SupplementalxcnqNo ratings yet

- 70 XTO Financial StatementsDocument5 pages70 XTO Financial Statementsredraider4404No ratings yet

- Net Sales: January 28, 2012 January 29, 2011Document9 pagesNet Sales: January 28, 2012 January 29, 2011장대헌No ratings yet

- Marchex 10Q 20121108Document60 pagesMarchex 10Q 20121108shamapant7955No ratings yet

- Apple 2014 Q2Document54 pagesApple 2014 Q2ikiqNo ratings yet

- Hls Fy2010 Fy Results 20110222Document14 pagesHls Fy2010 Fy Results 20110222Chin Siong GohNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- Actavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)Document3 pagesActavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)macocha1No ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Statement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesDocument5 pagesStatement of Operations For The Fiscal Year Ended January 2, 2011 RevenuesVasantha ShetkarNo ratings yet

- Att-Ar-2012-Financials Cut PDFDocument5 pagesAtt-Ar-2012-Financials Cut PDFDevandro MahendraNo ratings yet

- Cuarto Trimestre Del 2019Document17 pagesCuarto Trimestre Del 2019CINDY NAOMI APAZA LAYMENo ratings yet

- Question 31Document2 pagesQuestion 31Noopur Gandhi0% (2)

- Interest Income, Non-BankDocument206 pagesInterest Income, Non-BankArturo RiveroNo ratings yet

- Consolidated Profit & Loss Account For Continuing OperationsDocument13 pagesConsolidated Profit & Loss Account For Continuing OperationsAlok JainNo ratings yet

- Apple Inc.: September 30, 141,048 Cost of Sales Gross Margin September 24, 131,376 September 93,626Document8 pagesApple Inc.: September 30, 141,048 Cost of Sales Gross Margin September 24, 131,376 September 93,626Juan LaverdeNo ratings yet

- FSA Hw2Document13 pagesFSA Hw2Mohammad DaulehNo ratings yet

- Office MaxDocument21 pagesOffice MaxBlerta GjergjiNo ratings yet

- Bankruptcy and Restructuring at Marvel Entertainment GroupDocument12 pagesBankruptcy and Restructuring at Marvel Entertainment Groupvikaskumar_mech89200% (2)

- In Millions Assets Operations (USD $)Document41 pagesIn Millions Assets Operations (USD $)mohd_shaarNo ratings yet

- q4 Fy20 EarningsDocument20 pagesq4 Fy20 EarningsKJ HiramotoNo ratings yet

- Online Presentation 11-1-11Document18 pagesOnline Presentation 11-1-11Hari HaranNo ratings yet

- Cognizant 10qDocument53 pagesCognizant 10qhaha_1234No ratings yet

- Qfs 1q 2012 - FinalDocument40 pagesQfs 1q 2012 - Finalyandhie57No ratings yet

- Health Development Corporation Spread Sheet (Sol)Document8 pagesHealth Development Corporation Spread Sheet (Sol)Surya Kant100% (2)

- Cost Accounting EVADocument6 pagesCost Accounting EVANikhil KasatNo ratings yet

- Foreign Banks P&LDocument8 pagesForeign Banks P&LKarthik K JanardhananNo ratings yet

- Alphabet 2014 Financial ReportDocument6 pagesAlphabet 2014 Financial ReportsharatjuturNo ratings yet

- Accounting Clinic IDocument40 pagesAccounting Clinic IRitesh Batra100% (1)

- 61 JPM Financial StatementsDocument4 pages61 JPM Financial StatementsOladipupo Mayowa PaulNo ratings yet

- CH 04 Income StatementDocument6 pagesCH 04 Income Statementnreid2701No ratings yet

- 494.Hk 2011 AnnReportDocument29 pages494.Hk 2011 AnnReportHenry KwongNo ratings yet

- Life Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDocument33 pagesLife Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-Qpeterlee100No ratings yet

- Case Study - So What Is It WorthDocument7 pagesCase Study - So What Is It WorthJohn Aldridge Chew100% (1)

- Week Six ProjectDocument21 pagesWeek Six ProjectRandall PottsNo ratings yet

- Roadshow Natixis Mar09Document47 pagesRoadshow Natixis Mar09sl7789No ratings yet

- Financial Statement AnalysisDocument18 pagesFinancial Statement AnalysisSaema JessyNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Fa Submission Group 1Document14 pagesFa Submission Group 1Suresh PandaNo ratings yet

- Laporan Keuangan - Mki IchaDocument6 pagesLaporan Keuangan - Mki IchaSempaks KoyakNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- Financial ReportDocument151 pagesFinancial ReportleeeeNo ratings yet

- Dell IncDocument6 pagesDell IncMohit ChaturvediNo ratings yet

- Statement Date No. of MonthsDocument6 pagesStatement Date No. of MonthscallvkNo ratings yet

- Target Corporation Reports Third Quarter EarningsDocument12 pagesTarget Corporation Reports Third Quarter EarningsRafael BorgesNo ratings yet

- Financial Statement Fy 14 Q 3Document46 pagesFinancial Statement Fy 14 Q 3crtc2688No ratings yet

- United States Securities and Exchange Commission FORM 10-QDocument71 pagesUnited States Securities and Exchange Commission FORM 10-QWai LonnNo ratings yet

- Case SolutionsDocument106 pagesCase SolutionsRichard Henry100% (5)

- Financial ReportDocument35 pagesFinancial ReportDaniela Denisse Anthawer LunaNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- Arp 4Document1 pageArp 4Ega N WidjajaNo ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Non-GAAP Financial MeasuresDocument1 pageNon-GAAP Financial MeasuresAlok ChitnisNo ratings yet

- Discover Annual Report1Document208 pagesDiscover Annual Report1venkeeeeeNo ratings yet

- HcacjoDocument1 pageHcacjovenkeeeeeNo ratings yet

- Annual Report 2013Document145 pagesAnnual Report 2013venkeeeeeNo ratings yet

- Atos 2014 Financial ReportDocument99 pagesAtos 2014 Financial ReportvenkeeeeeNo ratings yet

- VTSP Foundation (2015) - VCenter OverviewDocument6 pagesVTSP Foundation (2015) - VCenter OverviewvenkeeeeeNo ratings yet

- Placement Report Class 2014Document17 pagesPlacement Report Class 2014Mudassir KhanNo ratings yet

- 2013 Annual Report FinalDocument64 pages2013 Annual Report FinalvenkeeeeeNo ratings yet

- AkzoNobel Report Report 2013 0414 Tcm9-84856Document218 pagesAkzoNobel Report Report 2013 0414 Tcm9-84856venkeeeeeNo ratings yet

- Ch07 SSolDocument7 pagesCh07 SSolvenkeeeee100% (1)

- Fund 4e Chap07 PbmsDocument14 pagesFund 4e Chap07 PbmsChu Minh LanNo ratings yet

- FMCG Employer Profiles: (And Graduate Assessment Process)Document26 pagesFMCG Employer Profiles: (And Graduate Assessment Process)nareshsbcNo ratings yet

- ACCT303 Chapter 9 Teaching PPDocument115 pagesACCT303 Chapter 9 Teaching PPvenkeeeeeNo ratings yet

- AkzoNobel Report 2014 en Tcm9-90769Document258 pagesAkzoNobel Report 2014 en Tcm9-90769venkeeeeeNo ratings yet

- Aifs Case - Fin 411Document2 pagesAifs Case - Fin 411Tanmay MehtaNo ratings yet

- Grennel LDocument3 pagesGrennel LvenkeeeeeNo ratings yet

- Discover Annual Report1Document208 pagesDiscover Annual Report1venkeeeeeNo ratings yet

- Wksheet 05Document18 pagesWksheet 05venkeeeeeNo ratings yet

- Walgreen 09Document16 pagesWalgreen 09venkeeeeeNo ratings yet

- 2011 q4 Foi Xls v2Document21 pages2011 q4 Foi Xls v2venkeeeeeNo ratings yet

- UhuahulhDocument1 pageUhuahulhvenkeeeeeNo ratings yet

- 311 Session3Document39 pages311 Session3venkeeeeeNo ratings yet

- CH 13Document76 pagesCH 131asdfghjkl3No ratings yet

- Z-Score Review: - To Translate A Raw Score Into A Z ScoreDocument5 pagesZ-Score Review: - To Translate A Raw Score Into A Z ScorevenkeeeeeNo ratings yet

- 2012 Annual ReportDocument60 pages2012 Annual ReportvenkeeeeeNo ratings yet

- Top 25 Summer InternshipsDocument13 pagesTop 25 Summer InternshipsGaurav ThaparNo ratings yet

- ACCT303 Chapter 1 Teaching PPDocument61 pagesACCT303 Chapter 1 Teaching PPvenkeeeeeNo ratings yet

- Z-Score Review: - To Translate A Raw Score Into A Z ScoreDocument5 pagesZ-Score Review: - To Translate A Raw Score Into A Z ScorevenkeeeeeNo ratings yet

- Chap 012Document26 pagesChap 012venkeeeeeNo ratings yet

- Accounting CH 26Document34 pagesAccounting CH 26venkeeeee100% (1)

- Applied EconomicsDocument9 pagesApplied EconomicsJanisha RadazaNo ratings yet

- Case Analysis I American Chemical CorporationDocument13 pagesCase Analysis I American Chemical CorporationamuakaNo ratings yet

- Foreign Exchange MarketsDocument19 pagesForeign Exchange MarketsniggerNo ratings yet

- CalPERS Pension & Health Benefits Committee Agenda Item 4Document7 pagesCalPERS Pension & Health Benefits Committee Agenda Item 4jon_ortizNo ratings yet

- Intraday Trading Strategy FINALDocument59 pagesIntraday Trading Strategy FINALJeniffer Rayen100% (1)

- KPMG Flash News Hitesh Satishchandra DoshiDocument7 pagesKPMG Flash News Hitesh Satishchandra DoshiHimanshuNo ratings yet

- MT103 Saud Arabia 3,8MDocument2 pagesMT103 Saud Arabia 3,8Mterihinch87No ratings yet

- AC517Document11 pagesAC517Inaia ScottNo ratings yet

- Nit11 PDFDocument239 pagesNit11 PDFexecutive engineerNo ratings yet

- Bank Reconciliation Statement 70Document6 pagesBank Reconciliation Statement 70xyzNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Credit Counseling For Responsible Retail BankingDocument12 pagesCredit Counseling For Responsible Retail BankingSubhanan SahooNo ratings yet

- Suggested Solutions To Chapter 8 Problems: NswerDocument5 pagesSuggested Solutions To Chapter 8 Problems: NsweremilyNo ratings yet

- Digitization of Indian Economy (Power Point Presentation)Document9 pagesDigitization of Indian Economy (Power Point Presentation)Gursparsh MakkerNo ratings yet

- Awb 6014931576Document1 pageAwb 6014931576SA ControlNo ratings yet

- Federal Ex Vs Antonio DIgestDocument4 pagesFederal Ex Vs Antonio DIgestgrurocketNo ratings yet

- Mgt101-5 - Ledger - Books of Secondary Entries and Trial BalanceDocument69 pagesMgt101-5 - Ledger - Books of Secondary Entries and Trial BalanceSaqib MalghaniNo ratings yet

- REDD - The Leading Provider of Emerging Market Event Driven IntelligenceDocument1 pageREDD - The Leading Provider of Emerging Market Event Driven IntelligenceArtem RozhokNo ratings yet

- Challan UpdatedDocument1 pageChallan UpdatedSonali KumariNo ratings yet

- Bank Treasury Management Lecture 2Document25 pagesBank Treasury Management Lecture 2Golam RamijNo ratings yet

- DT Tax Laws 2021Document1,060 pagesDT Tax Laws 2021Aluma MuzamilNo ratings yet

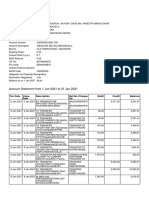

- Sbi Account Jan 2021Document2 pagesSbi Account Jan 2021Manoj GaurNo ratings yet

- BackOffice ManualDocument141 pagesBackOffice ManualJAGM1505100% (1)

- Case Study 1 Case Study 2Document3 pagesCase Study 1 Case Study 2MoatasemMadianNo ratings yet

- Basel-III Norms and Indian Financial SystemDocument3 pagesBasel-III Norms and Indian Financial SystemNavneet MayankNo ratings yet

- FM102 Financial ManagementDocument2 pagesFM102 Financial ManagementmusuotaNo ratings yet

- Solution: P R (1 - (1+r/m) : Period Periodic Payment Interest Payment Principal Repayment Outstanding PrincipalDocument3 pagesSolution: P R (1 - (1+r/m) : Period Periodic Payment Interest Payment Principal Repayment Outstanding PrincipalJohn Mark Arnoco BostrilloNo ratings yet

- Case Study of The Banking Sector in The UK - HSBC & BarclaysDocument50 pagesCase Study of The Banking Sector in The UK - HSBC & BarclaysMuhammad Salman Khan67% (3)

- Dispute Claim Form: Personal InformationDocument1 pageDispute Claim Form: Personal InformationOptimiNo ratings yet

- Functions of RBIDocument3 pagesFunctions of RBITarun BhatejaNo ratings yet