Professional Documents

Culture Documents

Soal Kuis UAS - AKL PDF

Uploaded by

Bastian Nugraha SiraitOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Soal Kuis UAS - AKL PDF

Uploaded by

Bastian Nugraha SiraitCopyright:

Available Formats

Kuis AKL - UAS Asistensi Kelas Bapak Mahdan Problem 1 On April 1, 2010, PT Pixel acquired 65 percent of the voting

common stock of PT Sejahtera by issuing cash for Rp 304,500,000. The excess of cost over the underlying book value of Sejahteras net assets on that date was assigned to a patent with an estimated remaining life of ten years. On December 31, 2009, PT Sejahtera reported stockholders equity balances of Rp 300,000,000 for common stock and Rp 100,000,000 for retained earnings. Income statement and dividend for PT Sejahtera for the year 2010, were as follows: Jan 1 March 31, 2010 Rp 40,000,000 Rp 10,000,000 April 1 December 31, 2010 Rp 60,000,000 Rp 20,000,000

Net Income Dividends

Required: 1. Give the entry recorded by PT Pixel during 2010 related to its investment in PT Sejahtera. 2. Give the eliminating entries to consolidate the financial statements for both companies in 2010.

Problem 2 On November 1, 2008, Monster Incorporation sold inventory costing $600,000 to a company in Scotland. The negotiated selling price was 500,000 Pounds, receivable on January 30, 2009. On the transaction date, the spot rate for Pounds was 1 Pound = $1.45. To protect itself against a weakening of the pound, Monster Incorporation entered into a forward exchange contract to deliver 500,000 Pounds to a foreign currency broker on January 30, 2009, the settlement date for the sale. The forward exchange rate specified in the contract was 1 Pound = $1.48. Exchange rates on December 31, 2008, and January 30, 2009, were as follows: Spot Rate ($/1 Pound) $ 1.50 $ 1.47 Forward Rate ($/1 Pound) $ 1.49 (30-day)

December 31, 2008 January 30, 2009

Required: Prepare all journal entries for the Monster Incorporation which pertains to the sale and the forward exchange contract. Indicate the date next to each journal entry. Assume a December 31 year-end.

Problem 3 On January 2, 2013, Nagasaki Company in Japan acquired 65% of shares ownership in PT Soetomo, a company in Indonesia, for IDR 299,743,250,-. The excess of acquisition price over book value is allocated to Plant & Equipment with economic value of 10 years. PT Soetomo declared and paid

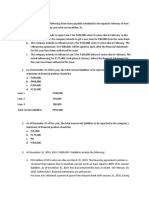

Kuis AKL - UAS Asistensi Kelas Bapak Mahdan dividend of IDR 5,200,000,- at 1 September 2013. Functional Currency PT Soetomo is Rupiah. The balance of PT Soetomo at 31 December 2008 are as follows: IDR 39,000,000 53,400,000 132,000,000 252,000,000 51,600,000 250,000,000 169,605,000 101,250,000 62,100,000 19,575,000 5,130,000 4,050,000 5,200,000

Cash Account receivable Inventory Plant & Equipment Account payable Capital stock Retained earning Sales COGS Operating expenses Depreciation expense Income tax expense Dividend

Date January 2 September 1 31 December Weighted-Average Required:

Rate 125 130 120 135

1. Determine whether the financial report is disclosed with translation or remeasurement method? Explain why! 2. Calculate the differential from the acquisition and make the amortization schedule for 2008. 3. Make the translation or remeasurement workpaper for the year 2008.

Problem 4 Vignette Corporation established a branch operation in the city of Harbor on January 1, 2011. The balance sheet for Vignette Corporation on December 31, 2010, was as follows:

Kuis AKL - UAS Asistensi Kelas Bapak Mahdan The following transactions occurred during 2011: 1. Vignette Corporation transferred $100,000 of cash and $80,000 of inventory to the new branch. The inventory cost Vignette Corporation $56,000 to produce. 2. The branch purchased $50,000 of inventory from other companies and recorded sales of $200,000 for the period. Cost of goods sold for the period consisted of $40,000 of purchases from outsiders and $60,000 of inventory transferred from the home office. A total of $170,000 was collected on account before year-end. 3. The home office purchased $300,000 of inventory and sold $320,000 of goods to external parties for $460,000. A total of $375,000 was collected on account during 2011. 4. The branch remitted $65,000 to the home office as partial payment for inventory. Vignette declared and paid a dividend of $15,000. 5. The home office recorded depreciation of $35,000 for 2011 and had other operating expenses of $55,000. The branch recorded rent expense of $36,000 for leased facilities and had other operating expenses of $40,000. Required: 1. Present the journal entries that would appear on the books of Vignettes home office and branch for 2011. Include closing entries. 2. Prepare eliminating entries for preparation of annual financial statements for Vignettes Corporation.

Problem 5 On December 31, 2012, PT Asteroid entered into a debt-restructuring agreement with PT Pinus, which was experiencing financial difficulties. PT Pinus restructured a Rp90,000,000 note receivable as follows: Reduced the principal obligation to Rp50,000,000 Forgave all Rp9,000,000 of accrued interest Extended the maturity date from December 31, 2012 to December 31, 2014 Reduced the interest rate from 10 percent to 5 percent Interest was payable annually on December 31, 2013, and 2014. In accordance with the agreement, PT Pinus made payments to PT Asteroid on December 31, 2013 and 2014. Present value factors are as follows: Present value of a single sum, two years at 5 percent 0.90703 Present value of a single sum, two years at 10 percent 0.82645 Present value of ordinary annuity of two years at 5 percent 1.85941 Present value of ordinary annuity of two years at 10 percent 1.73554 Required: Prepare journal entries on PT Cemara for December 31, 2012, December 31, 2013, December 31, 2014, that are related to the restructure debt.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Soal Asistensi AK1 Pertemuan 7Document3 pagesSoal Asistensi AK1 Pertemuan 7Afrizal WildanNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Seminar 10 PrepQDocument6 pagesSeminar 10 PrepQAlim OsmanNo ratings yet

- Seatwork #3 Solutions and Income CalculationsDocument3 pagesSeatwork #3 Solutions and Income CalculationsLemuel ReñaNo ratings yet

- Soal Asis Ak2 Pertemuan 1Document2 pagesSoal Asis Ak2 Pertemuan 1Aisya Fadhilla ShamaraNo ratings yet

- 2009-Financial Reporting Main EQP and CommentariesDocument46 pages2009-Financial Reporting Main EQP and CommentariesBryan SingNo ratings yet

- DrillDocument10 pagesDrillgnim1520No ratings yet

- Liabilities from trial balance problemsDocument3 pagesLiabilities from trial balance problemsJohn Mark PalapuzNo ratings yet

- Ifrint 2012 Dec Q PDFDocument6 pagesIfrint 2012 Dec Q PDFPiyal HossainNo ratings yet

- 240 Assignment 1 For PostingDocument4 pages240 Assignment 1 For PostingpearlydawnNo ratings yet

- 2011 NATIONAL CPA MOCK BOARD EXAMINATION PRACTICAL ACCOUNTINGDocument12 pages2011 NATIONAL CPA MOCK BOARD EXAMINATION PRACTICAL ACCOUNTINGRhea SamsonNo ratings yet

- Exam QuizbowlersDocument7 pagesExam QuizbowlersJohnAllenMarillaNo ratings yet

- EPS QuestionsDocument3 pagesEPS QuestionsAbdulwahid AbdulrahmanNo ratings yet

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKNo ratings yet

- P1 - Corporate Reporting April 11Document20 pagesP1 - Corporate Reporting April 11Abdurrazaq PanhwarNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement Analysiselsana philipNo ratings yet

- Cerritos Corporation net income and dividends 2007-2010Document4 pagesCerritos Corporation net income and dividends 2007-2010Haru Haru100% (1)

- Financial Accounting Contoh Soal Kunci JawabanDocument9 pagesFinancial Accounting Contoh Soal Kunci JawabanMega LengkongNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesmariannecarmNo ratings yet

- Audit of Shareholder's EquityDocument4 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- Investments Handouts MCDocument14 pagesInvestments Handouts MCSnow TurnerNo ratings yet

- Practical Accounting 1 2011Document17 pagesPractical Accounting 1 2011abbey89100% (2)

- 2012 2013 UAS Akuntansi Keuangan LanjutanDocument12 pages2012 2013 UAS Akuntansi Keuangan LanjutanarifahsanulNo ratings yet

- Quiz BowlDocument3 pagesQuiz BowljayrjoshuavillapandoNo ratings yet

- PrE3 Final ExamDocument16 pagesPrE3 Final ExamLyca MaeNo ratings yet

- Audit Investments, Hedging Instruments & Related RevenuesDocument7 pagesAudit Investments, Hedging Instruments & Related RevenuesJake BundokNo ratings yet

- Financial Quali - ADocument9 pagesFinancial Quali - ACarl AngeloNo ratings yet

- Quiz Audit of LiabilitiesDocument3 pagesQuiz Audit of LiabilitiesCattleyaNo ratings yet

- Ap SheDocument8 pagesAp SheMary Dale Joie BocalaNo ratings yet

- Problem 1: Comprehensive Examination Applied Auditng Name: Score: Professor: DateDocument17 pagesProblem 1: Comprehensive Examination Applied Auditng Name: Score: Professor: Dateaccounts 3 lifeNo ratings yet

- Solutions (Quiz1 &2)Document8 pagesSolutions (Quiz1 &2)Aaron Arellano50% (2)

- Soal Special Edition Akuntansi Keuangan Menengah IIDocument2 pagesSoal Special Edition Akuntansi Keuangan Menengah IIZephyra ViolettaNo ratings yet

- Re & BVDocument3 pagesRe & BV-100% (1)

- Accounting Accn3: General Certificate of Education Advanced Level Examination June 2010Document8 pagesAccounting Accn3: General Certificate of Education Advanced Level Examination June 2010Sam catlinNo ratings yet

- Ppe, Intangiblke InvestmentgfdgfdDocument12 pagesPpe, Intangiblke Investmentgfdgfdredearth2929No ratings yet

- Exam Finals 2018Document11 pagesExam Finals 2018TiffanyNo ratings yet

- 2011 NATIONAL CPA MOCK BOARD EXAMINATIONDocument7 pages2011 NATIONAL CPA MOCK BOARD EXAMINATIONkonyatanNo ratings yet

- Quiz Audit of Shareholders Equity-2Document10 pagesQuiz Audit of Shareholders Equity-2Moi Escalante100% (1)

- Asistensi Akuntansi Keuangan 2 - Basic& Diluted EPSDocument2 pagesAsistensi Akuntansi Keuangan 2 - Basic& Diluted EPSJordy TangNo ratings yet

- F2 March 2011Document20 pagesF2 March 2011Dhanushka SamNo ratings yet

- Audit of Shareholder's EquityDocument6 pagesAudit of Shareholder's EquityRosalie Colarte LangbayNo ratings yet

- P1 - Corporate Reporting April 08Document25 pagesP1 - Corporate Reporting April 08IrfanNo ratings yet

- Analyzing Trading Securities TransactionsDocument6 pagesAnalyzing Trading Securities TransactionsAna Mae Hernandez33% (3)

- Final Review ProblemsDocument17 pagesFinal Review ProblemsEvan KlineNo ratings yet

- H1 ReviewFinancialStatementsDocument2 pagesH1 ReviewFinancialStatementsLim Kuan YiouNo ratings yet

- Soal GSLC-13 Advanced AccountingDocument7 pagesSoal GSLC-13 Advanced AccountingEunice ShevlinNo ratings yet

- Chapter 27 Earnings and Book Value Per ShareDocument19 pagesChapter 27 Earnings and Book Value Per ShareNhel AlvaroNo ratings yet

- Part IIDocument11 pagesPart IINCTNo ratings yet

- AFA IIPl III Question Dec 2016Document4 pagesAFA IIPl III Question Dec 2016HossainNo ratings yet

- Prob Basic AcctDocument3 pagesProb Basic AcctSamuel Ferolino50% (2)

- FAC3702 MayJun2011 SolutionsDocument20 pagesFAC3702 MayJun2011 SolutionsItumeleng KekanaNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1jhefster_81No ratings yet

- Buy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsFrom EverandBuy and Hold is Still Dead (Again): The Case for Active Portfolio Management in Dangerous MarketsNo ratings yet

- ASEAN+3 Information on Transaction Flows and Settlement InfrastructuresFrom EverandASEAN+3 Information on Transaction Flows and Settlement InfrastructuresNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- SEC 12SmartphoneRiATechReDocument14 pagesSEC 12SmartphoneRiATechReBastian Nugraha SiraitNo ratings yet

- ASEAN Youth Exchange ProgramDocument9 pagesASEAN Youth Exchange ProgramBastian Nugraha SiraitNo ratings yet

- XXXDocument24 pagesXXXBastian Nugraha SiraitNo ratings yet

- P A R T 1: Introduction: Markets and PricesDocument1 pageP A R T 1: Introduction: Markets and PricesBastian Nugraha SiraitNo ratings yet

- Kuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerDocument4 pagesKuis 2 AK 2 GNP 1314 - Leasing Tax - RegulerBastian Nugraha SiraitNo ratings yet

- Market Value AnalysisDocument3 pagesMarket Value AnalysisBastian Nugraha SiraitNo ratings yet

- Case 04 (Old) - Can One Size Fit All - SolutiondsfsdDocument4 pagesCase 04 (Old) - Can One Size Fit All - SolutiondsfsdFitria Hasanah100% (4)

- 11Document4 pages11Bastian Nugraha SiraitNo ratings yet

- Instructor's Manual Duncan M. Holthausen: MicroeconomicsDocument3 pagesInstructor's Manual Duncan M. Holthausen: MicroeconomicsBastian Nugraha SiraitNo ratings yet

- What is RFID? Definition and ExampleDocument4 pagesWhat is RFID? Definition and ExampleBastian Nugraha SiraitNo ratings yet

- Soal Kuis Uas - AklDocument3 pagesSoal Kuis Uas - AklBastian Nugraha SiraitNo ratings yet

- Mojakoe UAS AMDocument11 pagesMojakoe UAS AMBastian Nugraha SiraitNo ratings yet

- Zimbabwe Mict Strategic Plan2010-2014 PDFDocument54 pagesZimbabwe Mict Strategic Plan2010-2014 PDFSamuel ChariNo ratings yet

- Inst of Directors-WCFCG Global Covention-Paper Prof J P Sharma-What Went Wrong With Satyam NewDocument19 pagesInst of Directors-WCFCG Global Covention-Paper Prof J P Sharma-What Went Wrong With Satyam NewBastian Nugraha SiraitNo ratings yet

- Southeast Asia: The Role of Foreign Direct Investment Policies in DevelopmentDocument33 pagesSoutheast Asia: The Role of Foreign Direct Investment Policies in DevelopmentNguyễn Thu HuyềnNo ratings yet

- 1-Carr - 2003 - IT Doesn - T MatterDocument9 pages1-Carr - 2003 - IT Doesn - T MatterBastian Nugraha SiraitNo ratings yet